Deck 6: Inventories

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/205

Play

Full screen (f)

Deck 6: Inventories

1

Inventory controls start when the merchandise is shelved in the store area.

False

2

Safeguarding inventory and proper reporting of the inventory in the financial statements are the reasons for controlling the inventory.

True

3

Under the LIFO inventory costing method, the most recent costs are assigned to ending inventory.

False

4

When using the FIFO inventory costing method, the most recent costs are assigned to the cost of goods sold.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

5

During periods of increasing costs, the use of the FIFO method of costing inventory will yield an inventory amount for the balance sheet that is higher than LIFO would produce.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

6

One of the two internal control procedures over inventory is to properly report inventory on the financial statements.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

7

A perpetual inventory system is an effective means of control over inventory.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

8

The choice of an inventory costing method has no significant impact on the financial statements.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

9

The weighted average cost method will always yield results between FIFO and LIFO.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

10

FIFO is the inventory costing method that follows the physical flow of the goods.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

11

A purchase order establishes an initial record of the receipt of the inventory.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

12

A physical inventory should be taken at the end of every month.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

13

The specific identification inventory method should be used when the inventory consists of identical, low-cost units that are purchased and sold frequently.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

14

Of the three widely used inventory costing methods (FIFO, LIFO, and average cost), the LIFO method of costing inventory assumes costs are charged based on the most recent purchases first.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

15

Under the periodic inventory system, the inventory account continuously discloses the amount of inventory on hand.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

16

A subsidiary inventory ledger can be an aid in maintaining inventory levels at their proper levels.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

17

Under the periodic inventory system, a physical inventory is taken to determine the cost of the inventory on hand and the cost of the goods sold.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

18

The three inventory costing methods will normally each yield different amounts of net income.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

19

During periods of increasing costs, the use of the FIFO method of costing inventory will result in a greater amount of net income than would result from the use of the LIFO cost method.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

20

If the perpetual inventory system is used, the inventory account is debited for purchases of merchandise.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

21

Generally, the lower the number of days' sales in inventory, the better.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

22

The use of the lower-of-cost-or-market method of inventory valuation increases net income for the period in which the inventory replacement price declined.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

23

During periods of decreasing costs, the use of the LIFO method of costing inventory will result in a lower amount of net income than would result from the use of the FIFO method.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

24

During periods of increasing costs, an advantage of the LIFO inventory cost method is that it matches more recent costs against current revenues.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

25

The lower-of-cost-or-market method of determining the value of ending inventory can be applied on an item by item, by major classification of inventory, or by the total inventory.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

26

Average inventory is computed by adding the inventory at the beginning of the period to the inventory at the end of the period and dividing by two.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

27

A consignor who has goods out on consignment with an agent should include the goods in ending inventory even though they are not in the possession of the consignor.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

28

During periods of rapidly rising costs, the use of the LIFO method results in illusory or inventory profits.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

29

If ending inventory for the year is overstated, stockholders' equity reported on the balance sheet at the end of the year is understated.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

30

The lower of cost or market is a method of inventory valuation.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

31

One negative effect of carrying too much inventory is risk that customers will change their buying habits.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

32

Inventory errors, if not discovered, will self-correct within two years.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

33

Inventory turnover measures the length of time it takes to acquire, sell, and replace the inventory.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

34

It's not unusual for large companies to use different inventory costing methods for different segments of its inventory.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

35

If ending inventory for the year is understated, net income for the year is overstated.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

36

Unsold consigned merchandise should be included in the consignee's inventory.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

37

In valuing merchandise for inventory purposes, net realizable value is the estimated selling price less any direct costs of disposal.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

38

"Market" as used in the phrase "lower of cost or market" for valuing inventory, refers to the price at which the inventory is being offered for sale by the company.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

39

Direct disposal costs do not include special advertising or sales commissions.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

40

When inventory is shown on the balance sheet, both the method of determining the cost of the inventory and the method of valuing the inventory should be shown.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

41

Control of inventory should begin as soon as the inventory is received. Which of the following internal control steps is not done to meet this goal?

A) check the invoice to the receiving report

B) check the invoice to the purchase order

C) check the invoice with the person who specifically purchased the item

D) check the invoice extensions and totals

A) check the invoice to the receiving report

B) check the invoice to the purchase order

C) check the invoice with the person who specifically purchased the item

D) check the invoice extensions and totals

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

42

Use of the retail inventory method requires taking a physical count of inventory.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

43

The inventory method that assigns the most recent costs to cost of goods sold is

A) FIFO

B) LIFO

C) weighted average

D) specific identification

A) FIFO

B) LIFO

C) weighted average

D) specific identification

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is not an example for safeguarding inventory?

A) Storing inventory in restricted areas.

B) Physical devices such as two-way mirrors, cameras, and alarms.

C) Matching receiving documents, purchase orders, and vendor's invoice.

D) Returning inventory that is defective or broken.

A) Storing inventory in restricted areas.

B) Physical devices such as two-way mirrors, cameras, and alarms.

C) Matching receiving documents, purchase orders, and vendor's invoice.

D) Returning inventory that is defective or broken.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

45

Cost flow is in the order in which costs were incurred when using

A) average cost

B) last-in, first-out

C) first-in, first-out

D) weighted average

A) average cost

B) last-in, first-out

C) first-in, first-out

D) weighted average

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

46

Taking a physical count of inventory

A) is not necessary when a periodic inventory system is used

B) should be done near year-end

C) has no internal control relevance

D) is not necessary when a perpetual inventory system is used

A) is not necessary when a periodic inventory system is used

B) should be done near year-end

C) has no internal control relevance

D) is not necessary when a perpetual inventory system is used

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

47

Which document establishes an initial record of the receipt of the inventory?

A) receiving report

B) vendor's invoice

C) purchase order

D) petty cash voucher

A) receiving report

B) vendor's invoice

C) purchase order

D) petty cash voucher

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

48

When merchandise sold is assumed to be in the order in which the purchases were made, the company is using

A) first-in, last-out

B) last-in, first-out

C) first-in, first-out

D) average cost

A) first-in, last-out

B) last-in, first-out

C) first-in, first-out

D) average cost

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

49

Cost flow is in the reverse order in which costs were incurred when using

A) weighted average

B) last-in, first-out

C) first-in, first-out

D) average cost

A) weighted average

B) last-in, first-out

C) first-in, first-out

D) average cost

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

50

The inventory costing method that reports the earliest costs in ending inventory is

A) FIFO

B) LIFO

C) weighted average

D) specific identification

A) FIFO

B) LIFO

C) weighted average

D) specific identification

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following methods is appropriate for a business whose inventory consists of a relatively small number of unique, high-cost items?

A) FIFO

B) LIFO

C) average

D) specific identification

A) FIFO

B) LIFO

C) average

D) specific identification

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

52

Which document authorizes the purchase of the inventory from an approved vendor?

A) the purchase order

B) the petty cash voucher

C) the receiving report

D) the vendor's invoice

A) the purchase order

B) the petty cash voucher

C) the receiving report

D) the vendor's invoice

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

53

The inventory costing method that reports the most current prices in ending inventory is

A) FIFO

B) specific identification

C) LIFO

D) average cost

A) FIFO

B) specific identification

C) LIFO

D) average cost

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

54

Under a perpetual inventory system, the amount of each type of merchandise on hand is available in the

A) customer's ledger

B) creditor's ledger

C) inventory ledger

D) purchase ledger

A) customer's ledger

B) creditor's ledger

C) inventory ledger

D) purchase ledger

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

55

If a company uses a periodic inventory system, the gross profit method can be used to estimate inventory for monthly or quarterly statements.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

56

All of the following are documents used for inventory control except

A) a petty cash voucher

B) a vendor's invoice

C) a receiving report

D) a purchase order

A) a petty cash voucher

B) a vendor's invoice

C) a receiving report

D) a purchase order

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

57

In the retail inventory method, the cost to retail ratio is equal to the cost of goods sold divided by the retail price of the goods sold.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

58

The primary objectives of control over inventory are

A) safeguarding the inventory from damage and maintaining constant observation of the inventory

B) reporting inventory in the financial statements

C) maintaining constant observation of the inventory and reporting inventory in the financial statements

D) safeguarding inventory from damage and reporting inventory in the financial statements

A) safeguarding the inventory from damage and maintaining constant observation of the inventory

B) reporting inventory in the financial statements

C) maintaining constant observation of the inventory and reporting inventory in the financial statements

D) safeguarding inventory from damage and reporting inventory in the financial statements

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

59

If a fire destroys the inventory, the gross profit method can be used to estimate the cost of merchandise destroyed.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

60

Ending inventory is made up of the oldest purchases when a company uses

A) first-in, first-out

B) last-in, first-out

C) average cost

D) retail method

A) first-in, first-out

B) last-in, first-out

C) average cost

D) retail method

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

61

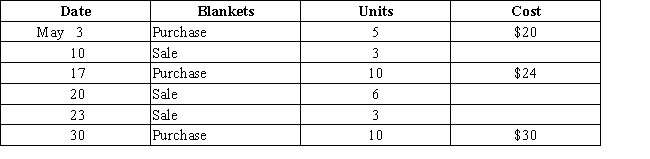

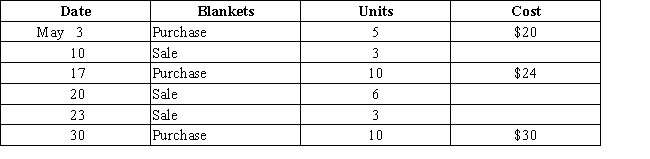

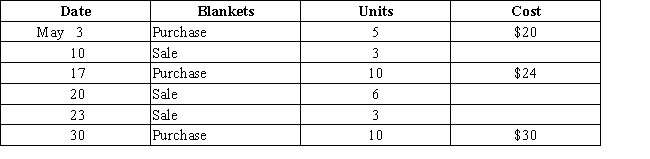

Use the information below to answer the following questions.

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

?

?

?

-Assuming that the company uses the perpetual inventory system, determine the May 31 inventory balance using the FIFO inventory cost method.

A) $364

B) $372

C) $324

D) $320

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

?

??

-Assuming that the company uses the perpetual inventory system, determine the May 31 inventory balance using the FIFO inventory cost method.

A) $364

B) $372

C) $324

D) $320

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

62

When using a perpetual inventory system, the journal entry to record the cost of goods sold is:

A) debit Cost of Goods Sold; credit Sales

B) debit Cost of Goods Sold; credit Inventory

C) debit Inventory; credit Cost of Goods Sold

D) No journal entry is made to record the cost of goods sold.

A) debit Cost of Goods Sold; credit Sales

B) debit Cost of Goods Sold; credit Inventory

C) debit Inventory; credit Cost of Goods Sold

D) No journal entry is made to record the cost of goods sold.

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

63

The inventory data for an item for November are: Using a perpetual system, what is the cost of the goods sold for November if the company uses LIFO?

A) $610

B) $600

C) $590

D) $580

A) $610

B) $600

C) $590

D) $580

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

64

The following lots of Commodity Z were available for sale during the year. Use this information to answer the questions that follow.

?

?

-The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year. What is the ending inventory balance at the end of the year rounded to nearest dollar according to the average cost method?

A) $655

B) $620

C) $690

D) $659

?

?

-The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year. What is the ending inventory balance at the end of the year rounded to nearest dollar according to the average cost method?

A) $655

B) $620

C) $690

D) $659

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

65

The following lots of Commodity Z were available for sale during the year. Use this information to answer the questions that follow.

?

?

-The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year. What is the ending inventory balance at the end of the year according to the LIFO method?

A) $655

B) $620

C) $690

D) $659

?

?

-The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year. What is the ending inventory balance at the end of the year according to the LIFO method?

A) $655

B) $620

C) $690

D) $659

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

66

If Addison uses FIFO, the September 30 inventory is

A) $800

B) $650

C) $750

D) $700

A) $800

B) $650

C) $750

D) $700

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following companies would be more likely to use the specific identification inventory costing method?

A) Gordon's Jewelers

B) Lowe's

C) Best Buy

D) Walmart

A) Gordon's Jewelers

B) Lowe's

C) Best Buy

D) Walmart

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

68

If Addison uses LIFO, the September 30 inventory balance is

A) $800

B) $650

C) $750

D) $700

A) $800

B) $650

C) $750

D) $700

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

69

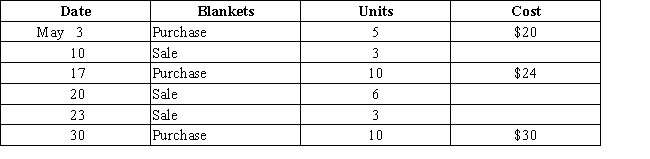

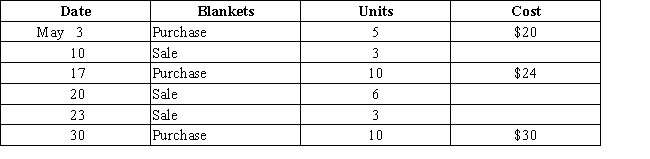

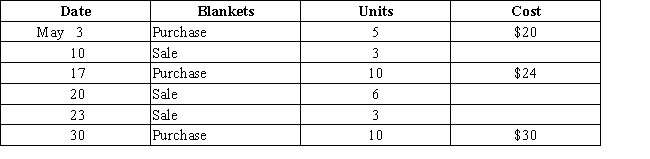

Use the information below to answer the following questions.

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

?

?

?

-Assuming that the company uses the perpetual inventory system, determine the gross profit for the month of May using the LIFO cost method.

A) $348

B) $452

C) $444

D) $356

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

?

??

-Assuming that the company uses the perpetual inventory system, determine the gross profit for the month of May using the LIFO cost method.

A) $348

B) $452

C) $444

D) $356

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

70

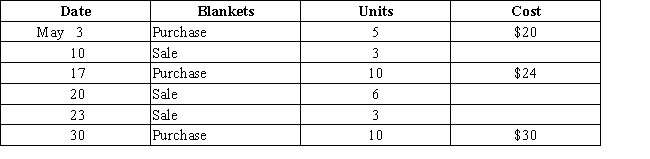

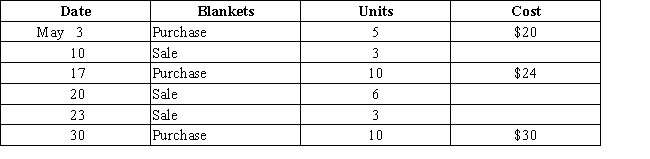

Use the information below to answer the following questions.

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

?

?

?

-Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the FIFO inventory cost method.

A) $120

B) $180

C) $136

D) $144

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

?

??

-Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the FIFO inventory cost method.

A) $120

B) $180

C) $136

D) $144

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

71

The inventory data for an item for November are: Using a perpetual system, what is the cost of the goods sold for November if the company uses FIFO?

A) $610

B) $600

C) $590

D) $580

A) $610

B) $600

C) $590

D) $580

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

72

The following units of an inventory item were available for sale during the year. Use this information to answer the following questions.

The firm uses the periodic inventory system. During the year, 60 units of the item were sold.

?

-The ending inventory cost using FIFO is

A) $1,250

B) $1,350

C) $1,375

D) $1,150

The firm uses the periodic inventory system. During the year, 60 units of the item were sold.

?

-The ending inventory cost using FIFO is

A) $1,250

B) $1,350

C) $1,375

D) $1,150

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

73

The following units of an inventory item were available for sale during the year. Use this information to answer the following questions.

The firm uses the periodic inventory system. During the year, 60 units of the item were sold.

?

-The ending inventory cost rounded to nearest dollar using average cost is:

A) $1,353

B) $1,263

C) $1,375

D) $1,150

The firm uses the periodic inventory system. During the year, 60 units of the item were sold.

?

-The ending inventory cost rounded to nearest dollar using average cost is:

A) $1,353

B) $1,263

C) $1,375

D) $1,150

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

74

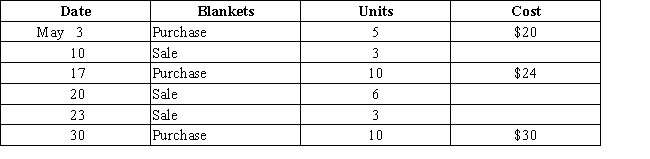

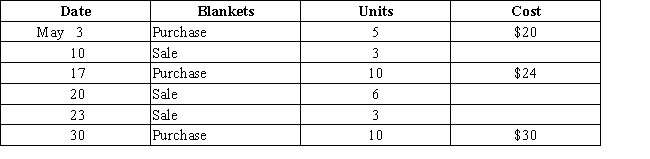

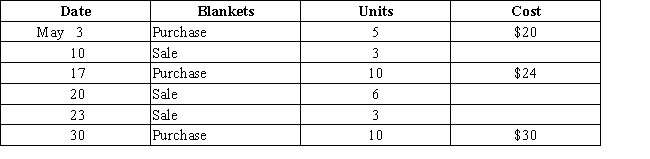

Use the information below to answer the following questions.

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

?

?

?

-Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the LIFO inventory cost method.

A) $136

B) $144

C) $180

D) $120

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

?

??

-Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the LIFO inventory cost method.

A) $136

B) $144

C) $180

D) $120

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

75

Use the information below to answer the following questions.

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

?

?

?

-Assuming that the company uses the perpetual inventory system, determine the gross profit for the sale of May 23 using the FIFO inventory cost method.

A) $108

B) $120

C) $72

D) $180

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

?

??

-Assuming that the company uses the perpetual inventory system, determine the gross profit for the sale of May 23 using the FIFO inventory cost method.

A) $108

B) $120

C) $72

D) $180

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

76

The following lots of Commodity Z were available for sale during the year. Use this information to answer the questions that follow.

?

?

-The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year. What is the ending inventory balance at the end of the year according to the FIFO method?

A) $655

B) $620

C) $690

D) $659

?

?

-The firm uses the periodic system, and there are 20 units of the commodity on hand at the end of the year. What is the ending inventory balance at the end of the year according to the FIFO method?

A) $655

B) $620

C) $690

D) $659

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

77

Under the _____ inventory method, accounting records maintain a continuously updated inventory value.

A) retail

B) periodic

C) physical

D) perpetual

A) retail

B) periodic

C) physical

D) perpetual

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

78

What is the amount of cost of goods sold for the year according to the average cost method?

A) $1,380

B) $1,375

C) $1,510

D) $1,250

A) $1,380

B) $1,375

C) $1,510

D) $1,250

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

79

The following units of an inventory item were available for sale during the year. Use this information to answer the following questions.

The firm uses the periodic inventory system. During the year, 60 units of the item were sold.

?

-The ending inventory cost using LIFO is

A) $1,250

B) $1,350

C) $1,375

D) $1,150

The firm uses the periodic inventory system. During the year, 60 units of the item were sold.

?

-The ending inventory cost using LIFO is

A) $1,250

B) $1,350

C) $1,375

D) $1,150

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck

80

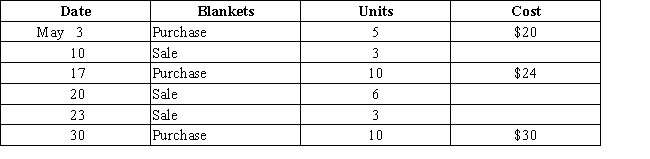

Use the information below to answer the following questions.

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

?

?

?

-Assuming that the company uses the perpetual inventory system, determine the May 31 inventory balance using the LIFO inventory cost method.

A) $324

B) $372

C) $320

D) $364

The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

?

??

-Assuming that the company uses the perpetual inventory system, determine the May 31 inventory balance using the LIFO inventory cost method.

A) $324

B) $372

C) $320

D) $364

Unlock Deck

Unlock for access to all 205 flashcards in this deck.

Unlock Deck

k this deck