Deck 22: Management Control Systems, Transfer Pricing, and Multinational Considerations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

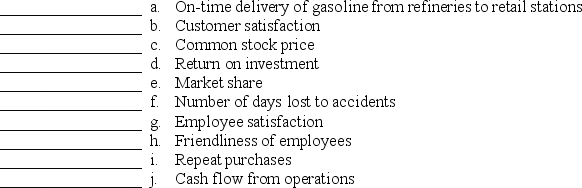

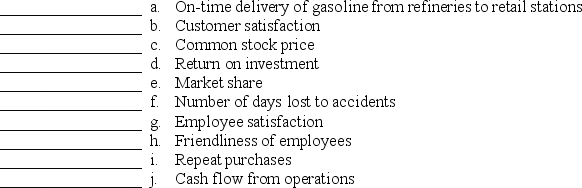

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

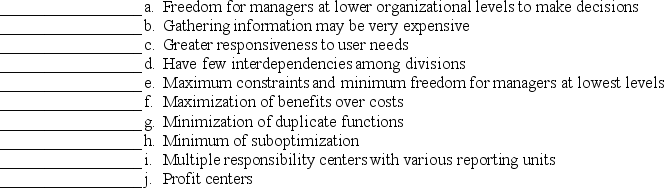

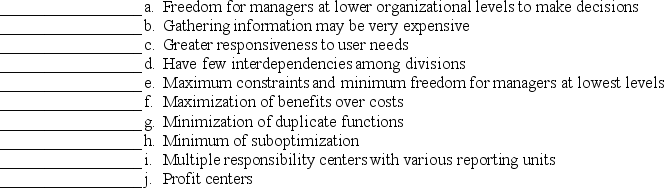

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

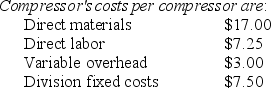

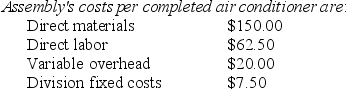

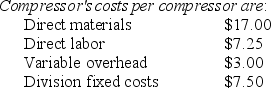

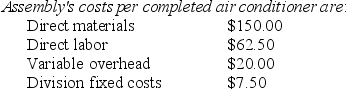

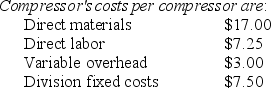

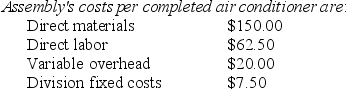

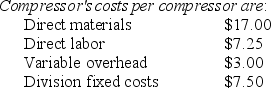

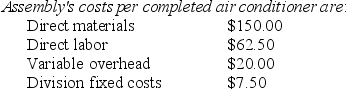

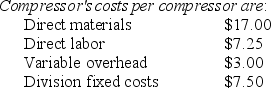

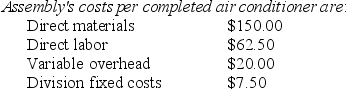

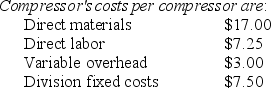

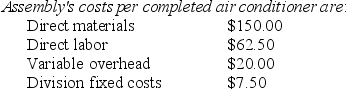

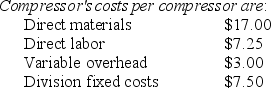

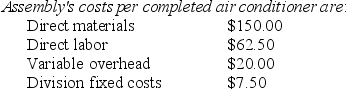

Question

Question

Question

Question

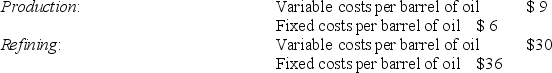

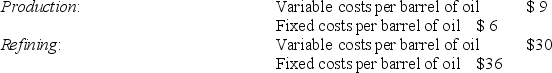

Question

Question

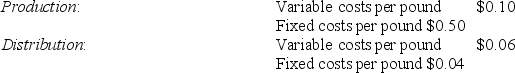

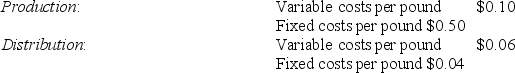

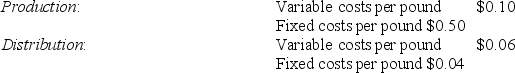

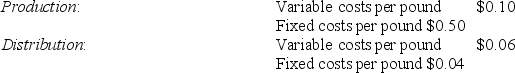

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

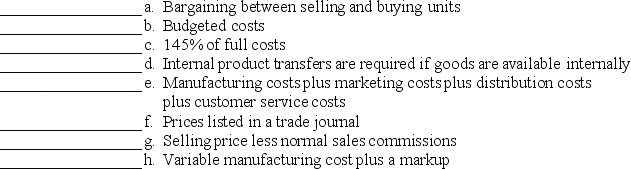

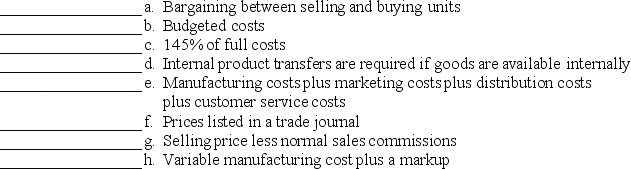

Question

Question

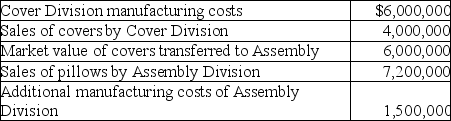

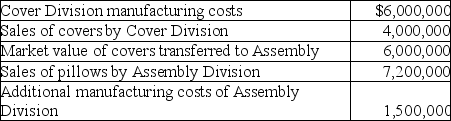

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/123

Play

Full screen (f)

Deck 22: Management Control Systems, Transfer Pricing, and Multinational Considerations

1

The formal management control system includes:

A)performance measures

B)mutual commitments

C)incentive plans

D)Both A and C are correct.

A)performance measures

B)mutual commitments

C)incentive plans

D)Both A and C are correct.

D

2

The formal management control system includes shared values, loyalties, and mutual commitments among members of the company, company culture, and norms about acceptable behavior for managers and other employees.

False

3

The goal of a management control system is to improve the collective decisions in an organization in an economically feasible way.

True

4

Management control systems reflect only financial data.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

5

If a computer manufacturer used its common stock price as a Balanced Scorecard control measure, it would represent the ________ perspective.

A)financial

B)customer

C)internal business process

D)learning and growth

A)financial

B)customer

C)internal business process

D)learning and growth

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

6

If an oil refinery used refinery down-time as a Balanced Scorecard control measure, it would represent the ________ perspective.

A)financial

B)customer

C)internal business process

D)learning and growth

A)financial

B)customer

C)internal business process

D)learning and growth

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

7

Effort is defined as achievement of a goal.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

8

Discuss the possible problems a corporation might have if its operations are totally decentralized.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

9

Motivation is the desire to attain a selected goal combined with the resulting drive or pursuit toward that goal.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

10

Management control systems motivate managers and other employees to exert effort through a variety of rewards tied to the achievement of goals.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

11

Exertion towards a goal is:

A)motivation

B)effort

C)goal congruence

D)incentive

A)motivation

B)effort

C)goal congruence

D)incentive

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

12

Effort in terms of management control systems is defined in terms of physical exertion such as a worker producing at a faster rate.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

13

Of the four perspectives of the balanced scorecard the customer perspective refers to employee satisfaction, absenteeism, information systems capabilities, and number of processes with real-time feedback.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

14

Goal congruence exists when individuals work toward achieving one goal, and groups work toward achieving a different goal.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

15

For each of the following Balanced Scorecard measures, identify which of the four perspectives (Financial, Customer, Internal Business Process, or Learning and Growth)the measure best represents.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

16

The degree of freedom to make decisions is:

A)decentralization

B)autonomy

C)centralization

D)motivation

A)decentralization

B)autonomy

C)centralization

D)motivation

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

17

The essence of decentralization is the freedom for managers at lower levels of the organization to make decisions.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

18

A well-designed management control system obtains all of its information from within the company.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

19

Number of processes with real time feedback would be an example of a Balanced Scorecard control measure from a customer perspective.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is NOT a characteristic of a management control system?

A)It aids and coordinates the process of making decisions.

B)It encourages short-term profitability.

C)It motivates individuals throughout the organization to act in concert.

D)It coordinates forecasting sales and cost-driver activities, budgeting, and measuring and evaluating performance.

A)It aids and coordinates the process of making decisions.

B)It encourages short-term profitability.

C)It motivates individuals throughout the organization to act in concert.

D)It coordinates forecasting sales and cost-driver activities, budgeting, and measuring and evaluating performance.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

21

In a profit center, the manager is accountable for investments, revenues, and costs.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

22

Transfer prices should be judged by whether they promote:

A)goal congruence.

B)the balanced scorecard method.

C)a high level of subunit autonomy in decision making.

D)Both A and C are correct.

A)goal congruence.

B)the balanced scorecard method.

C)a high level of subunit autonomy in decision making.

D)Both A and C are correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

23

A DISADVANTAGE of decentralization is that it:

A)creates greater responsiveness to local needs

B)focuses manager's attention on the organization as a whole

C)does not result in a duplication of activities

D)encourages suboptimal decision making

A)creates greater responsiveness to local needs

B)focuses manager's attention on the organization as a whole

C)does not result in a duplication of activities

D)encourages suboptimal decision making

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

24

The president of Silicon Company has just returned from a week of professional development courses and is very excited that she will not have to change the organization from a centralized structure to a decentralized structure just to have responsibility centers. However, she is somewhat confused about how responsibility centers relate to centralized organizations where a few managers have most of the authority.

Required:

Explain how a centralized organization might allow for responsibility centers.

Required:

Explain how a centralized organization might allow for responsibility centers.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

25

Surveys indicate that decisions made most frequently at the corporate level are related to sources of supplies and products to manufacture.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

26

Autonomy is the freedom for managers at lower levels of the organization to make decisions.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

27

Decentralizaion can sometimes lead to suboptimal decisions.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

28

The benefits of a decentralized organization are greater when a company:

A)is large and unregulated

B)is facing great uncertainties in their environment

C)has few interdependencies among division

D)All of these answers are correct.

A)is large and unregulated

B)is facing great uncertainties in their environment

C)has few interdependencies among division

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

29

Area(s)which is/are usually appropriate for decentralized decision making is(are):

A)sources of supplies and materials

B)long-term financing

C)product advertising

D)Both A and C are correct.

A)sources of supplies and materials

B)long-term financing

C)product advertising

D)Both A and C are correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

30

For each of the following activities, characteristics, and applications, identify whether they can be found in a centralized organization, a decentralized organization, or both types of organizations.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

31

An advantage of decentralization is that it:

A)creates greater responsiveness to local needs

B)focuses manager's attention on the organization as a whole

C)does not result in a duplication of activities

D)reduces the cost of gathering information

A)creates greater responsiveness to local needs

B)focuses manager's attention on the organization as a whole

C)does not result in a duplication of activities

D)reduces the cost of gathering information

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

32

Suboptimal decision making is also called congruent decision making.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

33

A transfer-pricing method leads to goal congruence when managers:

A)always act in their own best interest

B)act in their own best interest and the decision is in the long-term best interest of the manager's subunit

C)act in their own best interest and the decision is in the long-term best interest of the company

D)act in their own best interest and the decision is in the short-term best interest of the company

A)always act in their own best interest

B)act in their own best interest and the decision is in the long-term best interest of the manager's subunit

C)act in their own best interest and the decision is in the long-term best interest of the company

D)act in their own best interest and the decision is in the short-term best interest of the company

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

34

What is the term used to describe the situation when a manager's decision, which benefits one subunit, is more than offset by the costs to the organization as a whole?

A)suboptimal decision making

B)dysfunctional decision making

C)congruent decision making

D)Both A and B are correct.

A)suboptimal decision making

B)dysfunctional decision making

C)congruent decision making

D)Both A and B are correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

35

All of the following are benefits of decentralization EXCEPT that it:

A)creates greater responsiveness to local needs

B)decreases management and worker morale

C)leads to quicker decision making

D)sharpens the focus of managers

A)creates greater responsiveness to local needs

B)decreases management and worker morale

C)leads to quicker decision making

D)sharpens the focus of managers

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

36

A product may be passed from one subunit to another subunit in the same organization. The product is known as a(n):

A)interdepartmental product

B)intermediate product

C)subunit product

D)transfer product

A)interdepartmental product

B)intermediate product

C)subunit product

D)transfer product

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

37

An important advantage of decentralized operations is that it improves corporate control.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

38

A benefit of decentralization is that it creates better responsiveness to local needs.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements is FALSE?

A)A centralized structure does not empower employees to handle customer complaints directly.

B)A decentralized structure forces top management to lose some control over the organization.

C)Decentralization slows responsiveness to local needs for decision making.

D)The extent to which decisions are pushed downward, and the types of decisions that are pushed down, provide a measure of the level of centralization/decentralization in an organization.

A)A centralized structure does not empower employees to handle customer complaints directly.

B)A decentralized structure forces top management to lose some control over the organization.

C)Decentralization slows responsiveness to local needs for decision making.

D)The extent to which decisions are pushed downward, and the types of decisions that are pushed down, provide a measure of the level of centralization/decentralization in an organization.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

40

________ means minimum constraints and maximum freedom for managers at the lowest levels of an organization to make decisions and to take actions.

A)Total centralization

B)Use of market-based transfer pricing

C)Total decentralization

D)Use of negotiated transfer pricing

A)Total centralization

B)Use of market-based transfer pricing

C)Total decentralization

D)Use of negotiated transfer pricing

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

41

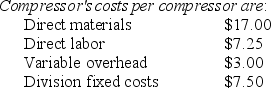

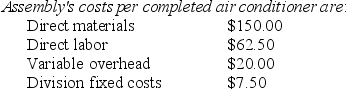

Answer the following questions using the information below:

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.)The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

Assume the transfer price for a compressor is 150% of total costs of the Compressor Division and 1,000 of the compressors are produced and transferred to the Assembly Division. The Compressor Division's operating income is:

A)$15,875

B)$16,375

C)$17,375

D)$18,250

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.)The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

Assume the transfer price for a compressor is 150% of total costs of the Compressor Division and 1,000 of the compressors are produced and transferred to the Assembly Division. The Compressor Division's operating income is:

A)$15,875

B)$16,375

C)$17,375

D)$18,250

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

42

Answer the following questions using the information below:

Division A sells ground veal internally to Division B, which in turn, produces veal burgers that sell for $10 per pound. Division A incurs costs of $1.50 per pound while Division B incurs additional costs of $5.00 per pound.

What is Division A's operating income per pound, assuming the transfer price of the ground veal is set at $2.50 per pound?

A)$1.00

B)$1.75

C)$2.50

D)$3.25

Division A sells ground veal internally to Division B, which in turn, produces veal burgers that sell for $10 per pound. Division A incurs costs of $1.50 per pound while Division B incurs additional costs of $5.00 per pound.

What is Division A's operating income per pound, assuming the transfer price of the ground veal is set at $2.50 per pound?

A)$1.00

B)$1.75

C)$2.50

D)$3.25

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

43

The costs used in cost-based transfer prices:

A)are actual costs

B)are budgeted costs

C)can either be actual or budgeted costs

D)are lower than the market-based transfer prices

A)are actual costs

B)are budgeted costs

C)can either be actual or budgeted costs

D)are lower than the market-based transfer prices

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

44

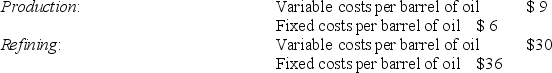

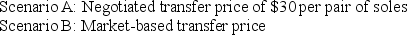

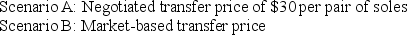

Answer the following questions using the information below:

Calculate the Division operating income for the AlphaShoe Company which manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $40. (Ignore changes in inventory.)The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $14 per pair at 100,000 units.

What is the market-based transfer price per pair of soles from the Sole Division to the Assembly Division?

A)$20

B)$32

C)$40

D)$52

Calculate the Division operating income for the AlphaShoe Company which manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $40. (Ignore changes in inventory.)The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $14 per pair at 100,000 units.

What is the market-based transfer price per pair of soles from the Sole Division to the Assembly Division?

A)$20

B)$32

C)$40

D)$52

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

45

Answer the following questions using the information below:

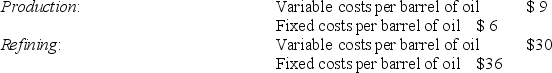

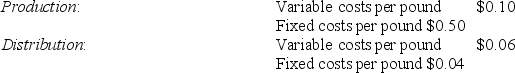

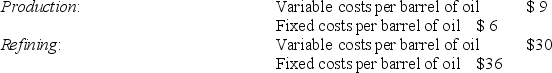

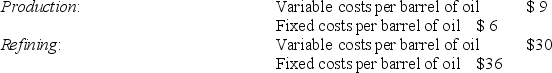

Penn Oil Corporation has two divisions, Refining and Production. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

What is the transfer price per barrel from the Production Division to the Refining Division, assuming the method used to place a value on each barrel of oil is 180% of variable costs?

A)$16.20

B)$27.00

C)$54.00

D)$70.20

Penn Oil Corporation has two divisions, Refining and Production. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.What is the transfer price per barrel from the Production Division to the Refining Division, assuming the method used to place a value on each barrel of oil is 180% of variable costs?

A)$16.20

B)$27.00

C)$54.00

D)$70.20

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

46

Answer the following questions using the information below:

Calculate the Division operating income for the AlphaShoe Company which manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $40. (Ignore changes in inventory.)The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $14 per pair at 100,000 units.

What is the transfer price per pair of shoes from the Sole Division to the Assembly Division per pair of soles if the transfer price per pair of soles is 125% of full costs?

A)$20

B)$25

C)$26

D)$30

Calculate the Division operating income for the AlphaShoe Company which manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $40. (Ignore changes in inventory.)The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $14 per pair at 100,000 units.

What is the transfer price per pair of shoes from the Sole Division to the Assembly Division per pair of soles if the transfer price per pair of soles is 125% of full costs?

A)$20

B)$25

C)$26

D)$30

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

47

Answer the following questions using the information below:

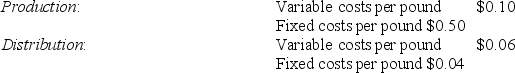

Greenlawn Corporation has two divisions, Distribution and Production. The company's primary product is fertilizer. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.

Assume 100,000 pounds are transferred from the Production Division to the Distribution Division for a transfer price of $0.80 per pound. The Distribution Division sells the 100,000 pounds at a price of $1.10 each to customers. What is the operating income of both divisions together?

A)$20,000

B)$30,000

C)$40,000

D)$50,000

Greenlawn Corporation has two divisions, Distribution and Production. The company's primary product is fertilizer. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.Assume 100,000 pounds are transferred from the Production Division to the Distribution Division for a transfer price of $0.80 per pound. The Distribution Division sells the 100,000 pounds at a price of $1.10 each to customers. What is the operating income of both divisions together?

A)$20,000

B)$30,000

C)$40,000

D)$50,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

48

Answer the following questions using the information below:

Penn Oil Corporation has two divisions, Refining and Production. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

Assume 200 barrels are transferred from the Production Division to the Refining Division for a transfer price of $18 per barrel. The Refining Division sells the 200 barrels at a price of $120 each to customers. What is the operating income of both divisions together?

A)$7,200

B)$7,800

C)$10,800

D)$20,400

Penn Oil Corporation has two divisions, Refining and Production. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.Assume 200 barrels are transferred from the Production Division to the Refining Division for a transfer price of $18 per barrel. The Refining Division sells the 200 barrels at a price of $120 each to customers. What is the operating income of both divisions together?

A)$7,200

B)$7,800

C)$10,800

D)$20,400

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

49

Answer the following questions using the information below:

Calculate the Division operating income for the AlphaShoe Company which manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $40. (Ignore changes in inventory.)The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $14 per pair at 100,000 units.

Calculate and compare the difference in overall corporate net income between Scenario A and Scenario B if the Assembly Division sells 100,000 pairs of shoes for $120 per pair to customers.

A)$1,000,000 more net income under Scenario A

B)$1,000,000 of net income using Scenario B

C)$200,000 of net income using Scenario A.

D)None of these answers is correct.

Calculate the Division operating income for the AlphaShoe Company which manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $40. (Ignore changes in inventory.)The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $14 per pair at 100,000 units.

Calculate and compare the difference in overall corporate net income between Scenario A and Scenario B if the Assembly Division sells 100,000 pairs of shoes for $120 per pair to customers.

A)$1,000,000 more net income under Scenario A

B)$1,000,000 of net income using Scenario B

C)$200,000 of net income using Scenario A.

D)None of these answers is correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

50

Answer the following questions using the information below:

Greenlawn Corporation has two divisions, Distribution and Production. The company's primary product is fertilizer. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.

What is the transfer price per barrel from the Production Division to the Distribution Division, assuming the method used to place a value on each pound of fertilizer is 120% of full costs?

A)$0.60

B)$0.72

C)$0.90

D)$1.10

Greenlawn Corporation has two divisions, Distribution and Production. The company's primary product is fertilizer. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.What is the transfer price per barrel from the Production Division to the Distribution Division, assuming the method used to place a value on each pound of fertilizer is 120% of full costs?

A)$0.60

B)$0.72

C)$0.90

D)$1.10

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

51

Answer the following questions using the information below:

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.)The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

What is the market-based transfer price per compressor from the Compressor Division to the Assembly Division?

A)$17.00

B)$27.25

C)$34.75

D)$38.50

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.)The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

What is the market-based transfer price per compressor from the Compressor Division to the Assembly Division?

A)$17.00

B)$27.25

C)$34.75

D)$38.50

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

52

Answer the following questions using the information below:

Calculate the Division operating income for the AlphaShoe Company which manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $40. (Ignore changes in inventory.)The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $14 per pair at 100,000 units.

What is the transfer price per pair of soles from the Sole Division to the Assembly Division if the method used to place a value on each pair of soles is 180% of variable costs?

A)$28.80

B)$25.20

C)$32.40

D)$57.60

Calculate the Division operating income for the AlphaShoe Company which manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $40. (Ignore changes in inventory.)The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $14 per pair at 100,000 units.

What is the transfer price per pair of soles from the Sole Division to the Assembly Division if the method used to place a value on each pair of soles is 180% of variable costs?

A)$28.80

B)$25.20

C)$32.40

D)$57.60

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

53

Answer the following questions using the information below:

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.)The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

What is the transfer price per compressor from the Compressor Division to the Assembly Division if the transfer price per compressor is 110% of full costs?

A)$42.35

B)$40.00

C)$38.23

D)none of the items

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.)The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

What is the transfer price per compressor from the Compressor Division to the Assembly Division if the transfer price per compressor is 110% of full costs?

A)$42.35

B)$40.00

C)$38.23

D)none of the items

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

54

Answer the following questions using the information below:

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.)The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

What is the transfer price per compressor from the Compressor Division to the Assembly Division if the method used to place a value on each compressor is 150% of variable costs?

A)$40.88

B)$38.50

C)$4.50

D)$36.38

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.)The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

What is the transfer price per compressor from the Compressor Division to the Assembly Division if the method used to place a value on each compressor is 150% of variable costs?

A)$40.88

B)$38.50

C)$4.50

D)$36.38

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

55

Negotiated transfer prices are often employed when:

A)market prices are stable

B)market prices are volatile

C)market prices change by a regular percentage each year

D)goal congruence is not a major objective

A)market prices are stable

B)market prices are volatile

C)market prices change by a regular percentage each year

D)goal congruence is not a major objective

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

56

Answer the following questions using the information below:

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.)The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

If the Assembly Division sells 1,000 air conditioners at a price of $375.00 per air conditioner to customers, what is the operating income of both divisions together?

A)$100,250

B)$103,500

C)$97,000

D)$82,875

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.)The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

If the Assembly Division sells 1,000 air conditioners at a price of $375.00 per air conditioner to customers, what is the operating income of both divisions together?

A)$100,250

B)$103,500

C)$97,000

D)$82,875

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

57

Answer the following questions using the information below:

Greenlawn Corporation has two divisions, Distribution and Production. The company's primary product is fertilizer. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.

What is the transfer price per barrel from the Production Division to the Distribution Division, assuming the method used to place a value on each pound of fertilizer is 160% of variable costs?

A)$0.10

B)$0.22

C)$0.16

D)$0.80

Greenlawn Corporation has two divisions, Distribution and Production. The company's primary product is fertilizer. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.

The Distribution Division has been operating at a capacity of 4,000,000 pounds a week and usually purchases 2,000,000 pounds from the Production Division and 2,000,000 pounds from other suppliers at $0.90 per pound.What is the transfer price per barrel from the Production Division to the Distribution Division, assuming the method used to place a value on each pound of fertilizer is 160% of variable costs?

A)$0.10

B)$0.22

C)$0.16

D)$0.80

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

58

Answer the following questions using the information below:

Calculate the Division operating income for the AlphaShoe Company which manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $40. (Ignore changes in inventory.)The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $14 per pair at 100,000 units.

Assume the transfer price for a pair of soles is 180% of total costs of the Sole Division and 40,000 of soles are produced and transferred to the Assembly Division. The Sole Division's operating income is:

A)$640,000

B)$720,000

C)$800,000

D)$880,000

Calculate the Division operating income for the AlphaShoe Company which manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $40. (Ignore changes in inventory.)The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $14 per pair at 100,000 units.

Assume the transfer price for a pair of soles is 180% of total costs of the Sole Division and 40,000 of soles are produced and transferred to the Assembly Division. The Sole Division's operating income is:

A)$640,000

B)$720,000

C)$800,000

D)$880,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

59

Answer the following questions using the information below:

Calculate the Division operating income for the AlphaShoe Company which manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $40. (Ignore changes in inventory.)The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $14 per pair at 100,000 units.

If the Assembly Division sells 100,000 pairs of shoes at a price of $120 a pair to customers, what is the operating income of both divisions together?

A)$8,800,000

B)$6,800,000

C)$6,000,000

D)$5,200,000

Calculate the Division operating income for the AlphaShoe Company which manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $40. (Ignore changes in inventory.)The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $14 per pair at 100,000 units.

If the Assembly Division sells 100,000 pairs of shoes at a price of $120 a pair to customers, what is the operating income of both divisions together?

A)$8,800,000

B)$6,800,000

C)$6,000,000

D)$5,200,000

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

60

Answer the following questions using the information below:

Penn Oil Corporation has two divisions, Refining and Production. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

What is the transfer price per barrel from the Production Division to the Refining Division, assuming the method used to place a value on each barrel of oil is 110% of full costs?

A)$16.50

B)$66.00

C)$72.60

D)$89.10

Penn Oil Corporation has two divisions, Refining and Production. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Production Division and 15,000 barrels from other suppliers at $60 per barrel.What is the transfer price per barrel from the Production Division to the Refining Division, assuming the method used to place a value on each barrel of oil is 110% of full costs?

A)$16.50

B)$66.00

C)$72.60

D)$89.10

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

61

When an industry has excess capacity, market prices may drop well below their historical average. If this drop is temporary, it is called:

A)distress prices

B)dropped prices

C)low-average prices

D)substitute prices

A)distress prices

B)dropped prices

C)low-average prices

D)substitute prices

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

62

DesMoines Valley Company has two divisions, Computer Services and Management Advisory Services. In addition to their external customers, each division performs work for the other division. The external fees earned by each division in 20X5 were $200,000 for Computer Services and $350,000 for Management Advisory Services. Computer Services worked 3,000 hours for Management Advisory Services, who, in turn, worked 1,200 hours for Computer Services. The total costs of external services performed by Computer Services were $110,000 and $240,000 by Management Advisory Services.

Required:

a. Determine the operating income for each division and for the company as a whole if the transfer price from Computer Services to Management Advisory Services is $15 per hour and the transfer price from Management Advisory Services to Computer Services is $12.50 per hour.

b. Determine the operating income for each division and for the company as a whole if the transfer price between divisions is $15 per hour.

c. What are the operating income results for each division and for the company as a whole if the two divisions net the hours worked for each other and charge $12.50 per hour for the one with the excess? Which division manager prefers this arrangement?

Required:

a. Determine the operating income for each division and for the company as a whole if the transfer price from Computer Services to Management Advisory Services is $15 per hour and the transfer price from Management Advisory Services to Computer Services is $12.50 per hour.

b. Determine the operating income for each division and for the company as a whole if the transfer price between divisions is $15 per hour.

c. What are the operating income results for each division and for the company as a whole if the two divisions net the hours worked for each other and charge $12.50 per hour for the one with the excess? Which division manager prefers this arrangement?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

63

A perfectly competitive market exists when there is a homogeneous product with buying prices equal to selling prices and no individual buyers or sellers can affect those prices by their own actions.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

64

Explain what transfer prices are, and what are the four criteria used to evaluate them?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

65

Answer the following questions using the information below:

Division A sells ground veal internally to Division B, which in turn, produces veal burgers that sell for $10 per pound. Division A incurs costs of $1.50 per pound while Division B incurs additional costs of $5.00 per pound.

Which of the following formulas correctly reflects the company's operating income per pound?

A)$10.00 - ($1.50 + $5.00)= $3.50

B)$10.00 - ($2.50 + $5.00)= $2.50

C)$10.00 - ($1.50 + $7.50)= $1.00

D)$10.00 - ($0.50 + $2.50 + $7.00)= 0

Division A sells ground veal internally to Division B, which in turn, produces veal burgers that sell for $10 per pound. Division A incurs costs of $1.50 per pound while Division B incurs additional costs of $5.00 per pound.

Which of the following formulas correctly reflects the company's operating income per pound?

A)$10.00 - ($1.50 + $5.00)= $3.50

B)$10.00 - ($2.50 + $5.00)= $2.50

C)$10.00 - ($1.50 + $7.50)= $1.00

D)$10.00 - ($0.50 + $2.50 + $7.00)= 0

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

66

Transferring products or services at market prices generally leads to optimal decisions when:

A)the market for the intermediate product is perfectly competitive

B)the interdependencies of the subunits are minimal

C)there are no additional costs or benefits to the company in buying or selling in the external market

D)All of these answers are correct.

A)the market for the intermediate product is perfectly competitive

B)the interdependencies of the subunits are minimal

C)there are no additional costs or benefits to the company in buying or selling in the external market

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

67

The costs used in cost-based transfer prices can only be budgeted costs.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

68

Sandra's Sheet Metal Company has two divisions. The Raw Material Division prepares sheet metal at its warehouse facility. The Fabrication Division prepares the cut sheet metal into finished products for the air conditioning industry. No inventories exist in either division at the beginning of 20X8. During the year, the Raw Material Division prepared 450,000 square feet of sheet metal at a cost of $1,800,000. All the sheet metal was transferred to the Fabrication Division, where additional operating costs of $1.50 per square foot were incurred. The 450,000 square feet of finished fabricated sheet metal products were sold for $3,875,000.

Required:

a. Determine the operating income for each division if the transfer price from Raw Material to Fabrication is at a cost of $4 per square foot.

b. Determine the operating income for each division if the transfer price is $5 per square foot.

c. Since the Raw Materials Division sells all of its sheet metal internally to the Fabrication Division, does the Raw Materials manager care what price is selected? Why? Should the Raw Materials Division be a cost center or a profit center under the circumstances?

Required:

a. Determine the operating income for each division if the transfer price from Raw Material to Fabrication is at a cost of $4 per square foot.

b. Determine the operating income for each division if the transfer price is $5 per square foot.

c. Since the Raw Materials Division sells all of its sheet metal internally to the Fabrication Division, does the Raw Materials manager care what price is selected? Why? Should the Raw Materials Division be a cost center or a profit center under the circumstances?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

69

A benefit of using a market-based transfer price is the:

A)profits of the transferring division are sacrificed for the overall good of the corporation

B)profits of the division receiving the products are sacrificed for the overall good of the corporation

C)economic viability and profitability of each division can be evaluated individually

D)None of these answers is correct.

A)profits of the transferring division are sacrificed for the overall good of the corporation

B)profits of the division receiving the products are sacrificed for the overall good of the corporation

C)economic viability and profitability of each division can be evaluated individually

D)None of these answers is correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

70

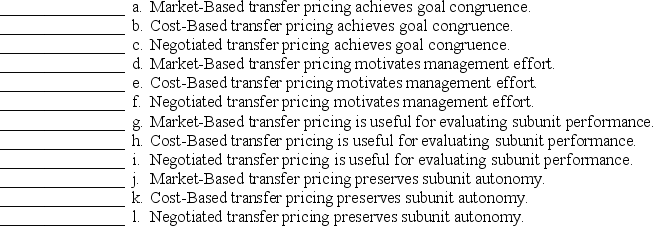

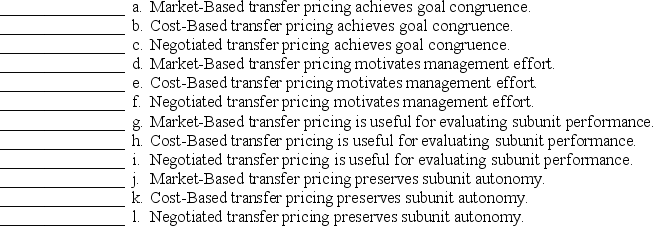

For each of the following statements regarding the satisfaction of transfer pricing criteria, identify whether you would expect the transfer pricing method to meet the criteria. Provide a yes, no, or sometimes for each situation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

71

A transfer price is the price one subunit charges for a product or service supplied to another subunit of the same organization.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

72

The choice of a transfer-pricing method has minimal effect on the allocation of company-wide operating income among divisions.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

73

For each of the following, identify whether it BEST relates to market-based, cost-based, negotiated, or all types of transfer pricing.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

74

Cost-based transfer prices are helpful when:

A)a market exists for the product

B)a price is easy to obtain

C)the product is unique

D)All of these answers are correct.

A)a market exists for the product

B)a price is easy to obtain

C)the product is unique

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

75

Bedtime Bedding Company manufactures pillows. The Cover Division makes covers and the Assembly Division makes the finished products. The covers can be sold separately for $5.00. The pillows sell for $6.00. The information related to manufacturing for the most recent year is as follows:

Required:

Required:

Compute the operating income for each division and the company as a whole. Use market value as the transfer price. Are all managers happy with this concept? Explain.

Required:

Required:Compute the operating income for each division and the company as a whole. Use market value as the transfer price. Are all managers happy with this concept? Explain.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

76

Briefly describe the conditions that should be met for market-based transfer pricing to lead to optimal decision making among subunits of a large organization.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

77

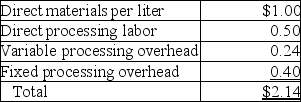

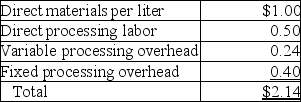

Better Food Company recently acquired an olive oil processing company that has an annual capacity of 2,000,000 liters and that processed and sold 1,400,000 liters last year at a market price of $4 per liter. The purpose of the acquisition was to furnish oil for the Cooking Division. The Cooking Division needs 800,000 liters of oil per year. It has been purchasing oil from suppliers at the market price. Production costs at capacity of the olive oil company, now a division, are as follows:

Management is trying to decide what transfer price to use for sales from the newly acquired company to the Cooking Division. The manager of the Olive Oil Division argues that $4, the market price, is appropriate. The manager of the Cooking Division argues that the cost of $2.14 should be used, or perhaps a lower price, since fixed overhead cost should be recomputed with the larger volume. Any output of the Olive Oil Division not sold to the Cooking Division can be sold to outsiders for $4 per liter.

Management is trying to decide what transfer price to use for sales from the newly acquired company to the Cooking Division. The manager of the Olive Oil Division argues that $4, the market price, is appropriate. The manager of the Cooking Division argues that the cost of $2.14 should be used, or perhaps a lower price, since fixed overhead cost should be recomputed with the larger volume. Any output of the Olive Oil Division not sold to the Cooking Division can be sold to outsiders for $4 per liter.

Required:

a. Compute the operating income for the Olive Oil Division using a transfer price of $4.

b. Compute the operating income for the Olive Oil Division using a transfer price of $2.14.

c. What transfer price(s)do you recommend? Compute the operating income for the Olive Oil Division using your recommendation.

Management is trying to decide what transfer price to use for sales from the newly acquired company to the Cooking Division. The manager of the Olive Oil Division argues that $4, the market price, is appropriate. The manager of the Cooking Division argues that the cost of $2.14 should be used, or perhaps a lower price, since fixed overhead cost should be recomputed with the larger volume. Any output of the Olive Oil Division not sold to the Cooking Division can be sold to outsiders for $4 per liter.

Management is trying to decide what transfer price to use for sales from the newly acquired company to the Cooking Division. The manager of the Olive Oil Division argues that $4, the market price, is appropriate. The manager of the Cooking Division argues that the cost of $2.14 should be used, or perhaps a lower price, since fixed overhead cost should be recomputed with the larger volume. Any output of the Olive Oil Division not sold to the Cooking Division can be sold to outsiders for $4 per liter.Required:

a. Compute the operating income for the Olive Oil Division using a transfer price of $4.

b. Compute the operating income for the Olive Oil Division using a transfer price of $2.14.

c. What transfer price(s)do you recommend? Compute the operating income for the Olive Oil Division using your recommendation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

78

Briefly explain each of the three methods used to determine a transfer price.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

79

The Mill Flow Company has two divisions. The Cutting Division prepares timber at its sawmills. The Assembly Division prepares the cut lumber into finished wood for the furniture industry. No inventories exist in either division at the beginning of 20X5. During the year, the Cutting Division prepared 60,000 cords of wood at a cost of $660,000. All the lumber was transferred to the Assembly Division, where additional operating costs of $6 per cord were incurred. The 600,000 boardfeet of finished wood were sold for $2,500,000.

Required:

a. Determine the operating income for each division if the transfer price from Cutting to Assembly is at cost - $11 a cord.

b. Determine the operating income for each division if the transfer price is $9 per cord.

c. Since the Cutting Division sells all of its wood internally to the Assembly Division, does the manager care what price is selected? Why? Should the Cutting Division be a cost center or a profit center under the circumstances?

Required:

a. Determine the operating income for each division if the transfer price from Cutting to Assembly is at cost - $11 a cord.

b. Determine the operating income for each division if the transfer price is $9 per cord.

c. Since the Cutting Division sells all of its wood internally to the Assembly Division, does the manager care what price is selected? Why? Should the Cutting Division be a cost center or a profit center under the circumstances?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

80

No matter how low the transfer price, the manager of the selling division should sell the division's product to other company divisions in the interests of overall company profitability.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck