Deck 23: Performance Measurement, Compensation, and Multinational Considerations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

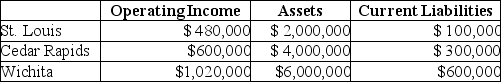

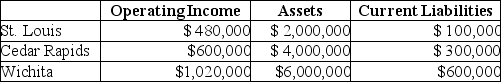

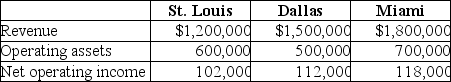

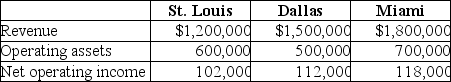

Question

Question

Question

Question

Question

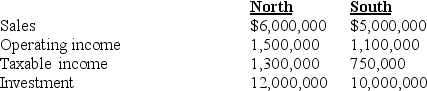

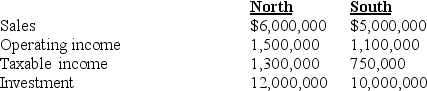

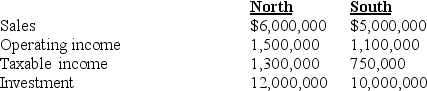

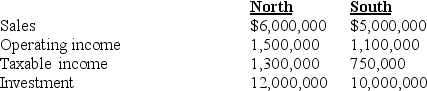

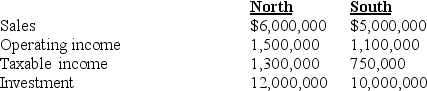

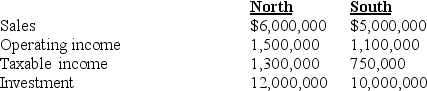

Question

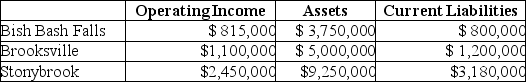

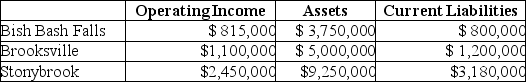

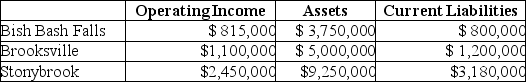

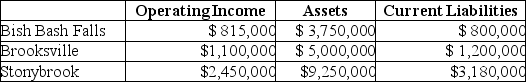

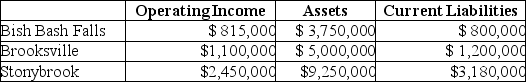

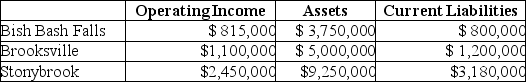

Question

Question

Question

Question

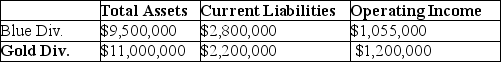

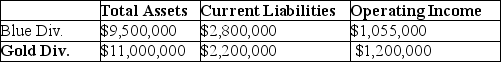

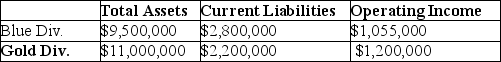

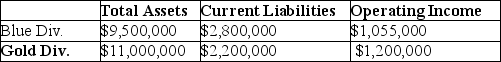

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

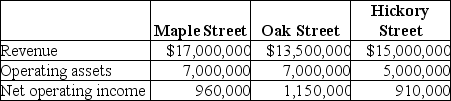

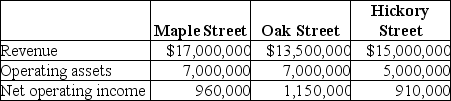

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/139

Play

Full screen (f)

Deck 23: Performance Measurement, Compensation, and Multinational Considerations

1

Many common performance measures, such as customer satisfaction, rely on internal financial accounting information.

False

2

During the past twelve months, the Aaron Corporation had a net income of $25,000. What is the amount of the investment if the return on investment is 20%?

A)$50,000

B)$100,000

C)$125,000

D)$250,000

A)$50,000

B)$100,000

C)$125,000

D)$250,000

C

3

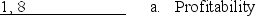

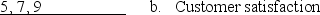

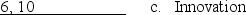

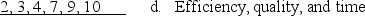

Assume you are evaluating a manufacturing company. Match the various organizational activities and concepts with the performance measures listed. Some items may have more than one match.

Activities:

1. Change in revenues

2. Cycle time

3. Economic order quantity

4. Manufacturing defects

5. Market share

6. New products

7. On-time delivery

8. Operating income

9. Product reliability

10. Time-to-market

Performance measure:

Activities:

1. Change in revenues

2. Cycle time

3. Economic order quantity

4. Manufacturing defects

5. Market share

6. New products

7. On-time delivery

8. Operating income

9. Product reliability

10. Time-to-market

Performance measure:

4

The executive vice president of Wicker Pen Company wants to establish an accounting-based performance measurement system for the company's new plant. The company has an accounting information system sufficient to support a fairly sophisticated performance measurement system. The new plant is going to be considered an investment center since its products will be markedly different from others the company currently sells. The new plant will have no internal dealings with other plants within the company.

Required:

What are some of the key steps that should be undertaken in the establishment of an accounting-based performance measurement system?

Required:

What are some of the key steps that should be undertaken in the establishment of an accounting-based performance measurement system?

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

5

Designing an accounting based performance measure requires six steps. List each step. For three of the steps, describe a question that must be resolved as part of the implementation process.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

6

A report that measures financial and nonfinancial performance measures for various organization units in a single report is called a(n):

A)balanced scorecard

B)financial report scorecard

C)imbalanced scorecard

D)unbalanced scorecard

A)balanced scorecard

B)financial report scorecard

C)imbalanced scorecard

D)unbalanced scorecard

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

7

Customer-satisfaction measures are an example of the:

A)goal-congruence approach

B)balanced scorecard approach

C)financial report scorecard approach

D)investment success approach

A)goal-congruence approach

B)balanced scorecard approach

C)financial report scorecard approach

D)investment success approach

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

8

The return on investment is usually considered the most popular approach to incorporating the investment base into a performance measure because:

A)it blends all the ingredients of profitability into a single percentage

B)once determined, there is no need to use it with other measures of performance

C)it is similar to the company's price earnings ratio because a corporation's return on investment appears every day in The Wall Street Journal

D)Both A and C are correct.

A)it blends all the ingredients of profitability into a single percentage

B)once determined, there is no need to use it with other measures of performance

C)it is similar to the company's price earnings ratio because a corporation's return on investment appears every day in The Wall Street Journal

D)Both A and C are correct.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

9

Some companies present financial and nonfinancial performance measures for various organization units in a single report called the "balanced scorecard."

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

10

The ________ method of profitability analysis recognizes the two basic ingredients in profit-making: increasing income per dollar of revenues and using assets to generate more revenues.

A)Balanced Scorecard

B)Residual-Income

C)Dupont

D)Economic Value Added

A)Balanced Scorecard

B)Residual-Income

C)Dupont

D)Economic Value Added

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

11

The "balanced scorecard" in most organizations is broken down into the following categories: financial perspective, customer perspective, internal business-process perspective, and productivity perspective.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

12

Return on investment can be increased by:

A)increasing operating assets

B)decreasing operating assets

C)decreasing revenues

D)Both B and C are correct.

A)increasing operating assets

B)decreasing operating assets

C)decreasing revenues

D)Both B and C are correct.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

13

An example of a performance measure with a long-run time horizon is:

A)direct materials efficiency variances

B)overhead spending variances

C)number of new patents developed

D)All of these answers are correct.

A)direct materials efficiency variances

B)overhead spending variances

C)number of new patents developed

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

14

Does operating income best measure a subunit's financial performance? This question is considered part of which step in designing an accounting-based performance measure?

A)Choose performance measures that align with top management's financial goals.

B)Choose the time horizon of each performance measure.

C)Choose a definition for each performance measure.

D)Choose a measurement alternative for each performance measure.

A)Choose performance measures that align with top management's financial goals.

B)Choose the time horizon of each performance measure.

C)Choose a definition for each performance measure.

D)Choose a measurement alternative for each performance measure.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

15

The first step in designing accounting based performance measures is to choose a target level of performance and feedback mechanism.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

16

Companies are increasingly using nonfinancial measures to evaluate performance. Why? Since these numbers do not come from the company's financial records, why are they used?

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

17

Should assets be measured at historical cost or current cost? This question is considered part of which step in designing an accounting-based performance measure?

A)Choose performance measures that align with top management's financial goals.

B)Choose the time horizon of each performance measure.

C)Choose a definition for each performance measure.

D)Choose a measurement alternative for each performance measure.

A)Choose performance measures that align with top management's financial goals.

B)Choose the time horizon of each performance measure.

C)Choose a definition for each performance measure.

D)Choose a measurement alternative for each performance measure.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

18

Should assets be defined as total assets or net assets? This question is considered part of which step in designing an accounting-based performance measure?

A)Choose performance measures that align with top management's financial goals.

B)Choose the time horizon of each performance measure.

C)Choose a definition for each performance measure.

D)Choose a measurement alternative for each performance measure.

A)Choose performance measures that align with top management's financial goals.

B)Choose the time horizon of each performance measure.

C)Choose a definition for each performance measure.

D)Choose a measurement alternative for each performance measure.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements about designing an accounting-based performance measure is FALSE?

A)The steps may be followed in a random order.

B)The issues considered in each step are independent.

C)Management's beliefs are present during the analyses.

D)Behavioral criteria are important when evaluating the steps.

A)The steps may be followed in a random order.

B)The issues considered in each step are independent.

C)Management's beliefs are present during the analyses.

D)Behavioral criteria are important when evaluating the steps.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

20

Managers usually use the term return on investment to evaluate:

A)the performance of a subdivision

B)a potential project

C)the performance of a subunit

D)Both A and C are correct.

A)the performance of a subdivision

B)a potential project

C)the performance of a subunit

D)Both A and C are correct.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

21

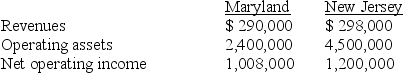

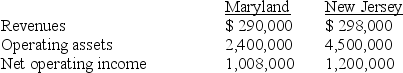

Thacker Company has two regional offices. The data for each are as follows:  What is the return on investment for the New Jersey Division?

What is the return on investment for the New Jersey Division?

A)0.21

B)0.27

C)0.48

D)2.06

What is the return on investment for the New Jersey Division?

What is the return on investment for the New Jersey Division?A)0.21

B)0.27

C)0.48

D)2.06

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

22

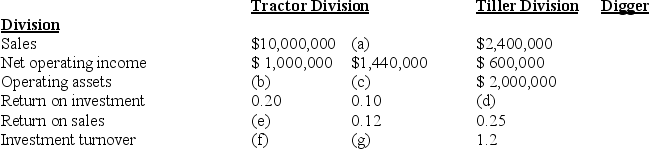

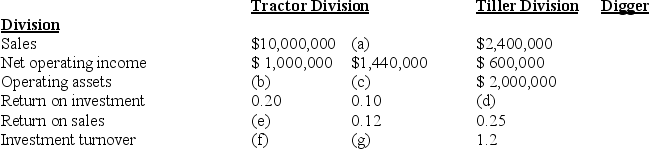

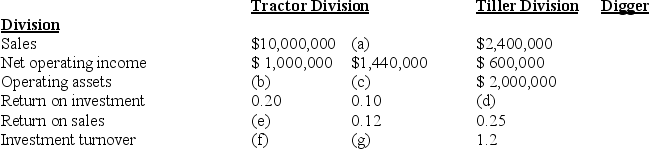

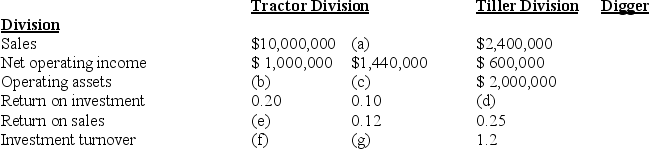

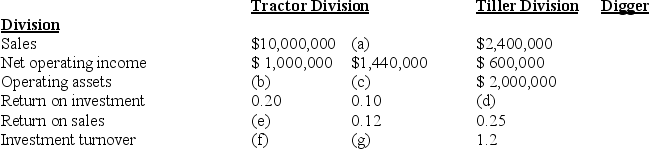

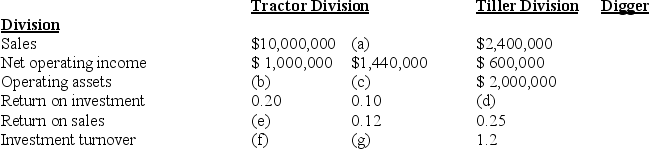

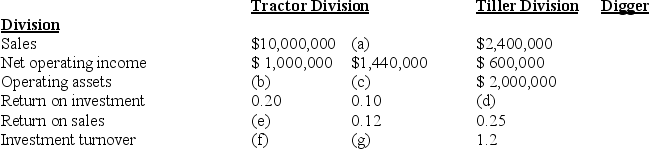

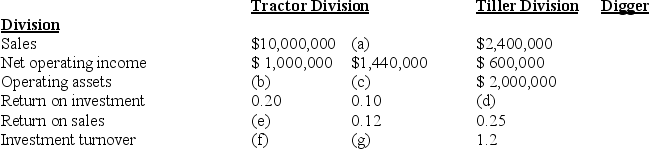

Answer the following questions using the information below:

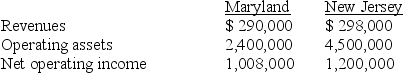

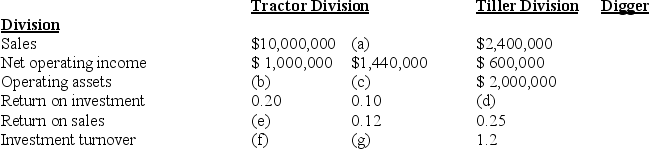

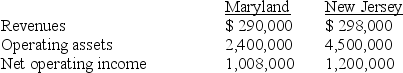

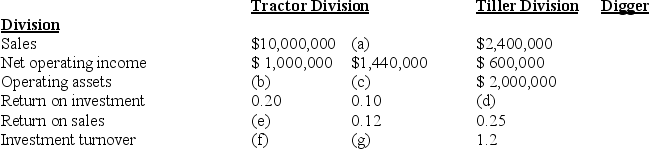

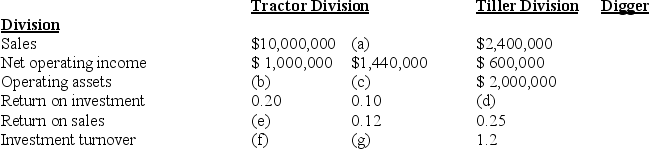

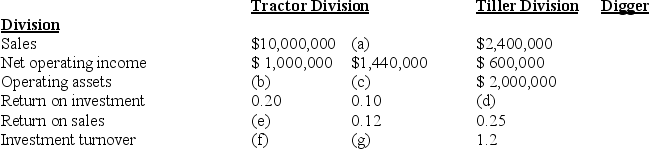

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the operating assets belonging to the Tiller Division?

A)$10,000,000

B)$ 12,000,000

C)$ 14,400,000

D)$ 15,000,000

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the operating assets belonging to the Tiller Division?

A)$10,000,000

B)$ 12,000,000

C)$ 14,400,000

D)$ 15,000,000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

23

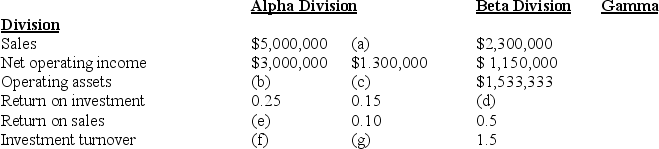

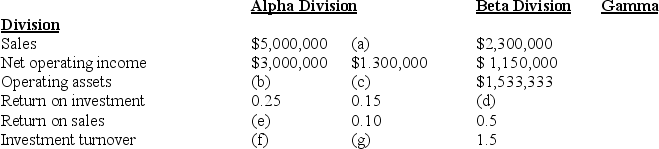

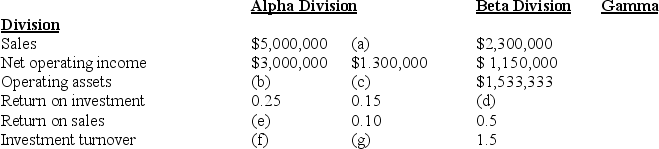

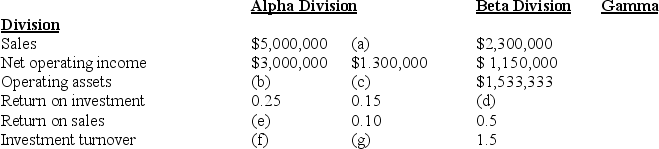

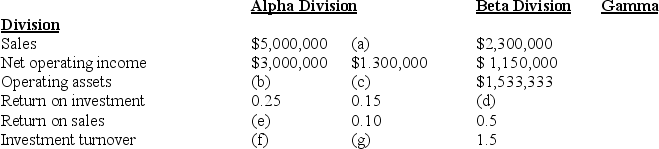

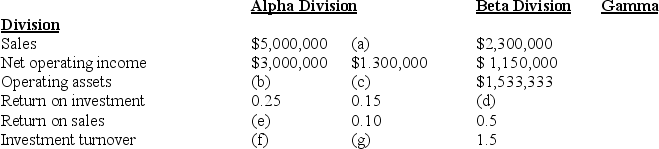

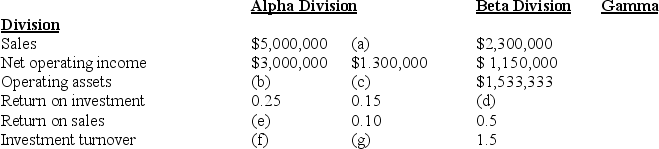

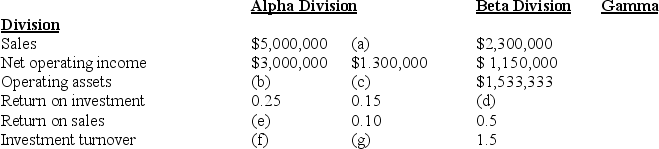

Answer the following questions using the information below:

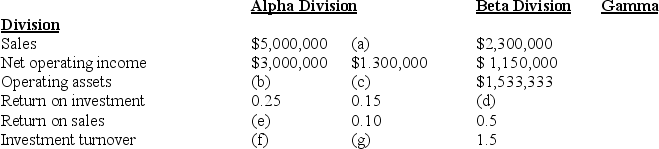

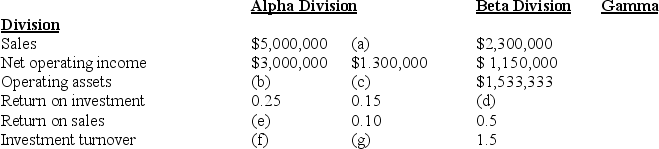

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Alpha Division's return on sales?

A)0.25

B)0.42

C)0.60

D)0.75

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Alpha Division's return on sales?

A)0.25

B)0.42

C)0.60

D)0.75

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

24

Answer the following questions using the information below:

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the operating assets belonging to the Alpha Division?

A)$8,666,667

B)$12,000,000

C)$13,000,000

D)$14,303,600

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the operating assets belonging to the Alpha Division?

A)$8,666,667

B)$12,000,000

C)$13,000,000

D)$14,303,600

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

25

Answer the following questions using the information below:

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Digger Division's return on investment?

A).25

B).30

C).45

D).60

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Digger Division's return on investment?

A).25

B).30

C).45

D).60

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

26

Answer the following questions using the information below:

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Tiller Division's investment turnover?

B).833

C)1.2

D)1.5

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Tiller Division's investment turnover?

B).833

C)1.2

D)1.5

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

27

Wacker Company has two regional offices. The data for each are as follows:  What is the Maryland Division's return on investment?

What is the Maryland Division's return on investment?

A)0.42

B)0.54

C)0.96

D)4.12

What is the Maryland Division's return on investment?

What is the Maryland Division's return on investment?A)0.42

B)0.54

C)0.96

D)4.12

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

28

Answer the following questions using the information below:

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Tractor Division's investment turnover?

A).50

B)1.0

C)2.0

D)2.5

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Tractor Division's investment turnover?

A).50

B)1.0

C)2.0

D)2.5

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

29

Answer the following questions using the information below:

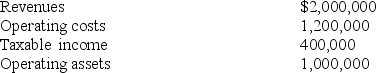

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

Income is defined as operating income.

What is the Cyclotron Division's return on investment?

A)0.2

B)0.4

C)0.5

D)0.8

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

Income is defined as operating income.What is the Cyclotron Division's return on investment?

A)0.2

B)0.4

C)0.5

D)0.8

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

30

Answer the following questions using the information below:

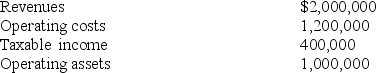

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

Income is defined as operating income.

What is the Cyclotron Division's return on sales?

A)0.20

B)0.40

C)0.50

D)0.60

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

Income is defined as operating income.What is the Cyclotron Division's return on sales?

A)0.20

B)0.40

C)0.50

D)0.60

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

31

Answer the following questions using the information below:

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the operating assets belonging to the Beta Division?

A)$8,666,667

B)$11,904,760

C)$13,000,000

D)$14,303,600

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the operating assets belonging to the Beta Division?

A)$8,666,667

B)$11,904,760

C)$13,000,000

D)$14,303,600

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

32

Costs recognized in particular situations that are NOT recognized by accrual accounting procedures are:

A)opportunity costs

B)imputed costs

C)cash accounting costs

D)None of these answers is correct.

A)opportunity costs

B)imputed costs

C)cash accounting costs

D)None of these answers is correct.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

33

Answer the following questions using the information below:

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What were the sales for the Tiller Division?

A)$9,600,000

B)$12,000,000

C)$15,000,000

D)$15,500,000

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What were the sales for the Tiller Division?

A)$9,600,000

B)$12,000,000

C)$15,000,000

D)$15,500,000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

34

Answer the following questions using the information below:

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Tractor Division's return on sales?

A)0.10

B)0.12

C)0.15

D)0.20

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Tractor Division's return on sales?

A)0.10

B)0.12

C)0.15

D)0.20

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

35

Answer the following questions using the information below:

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What were the sales for the Beta Division?

A)$8,666,667

B)$11,904,760

C)$13,000,000

D)$14,303,600

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What were the sales for the Beta Division?

A)$8,666,667

B)$11,904,760

C)$13,000,000

D)$14,303,600

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

36

Answer the following questions using the information below:

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the operating assets belonging to the Tractor Division?

A)$ 3,500,000

B)$4,000,000

C)$4,500,000

D)$5,000,000

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the operating assets belonging to the Tractor Division?

A)$ 3,500,000

B)$4,000,000

C)$4,500,000

D)$5,000,000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

37

Answer the following questions using the information below:

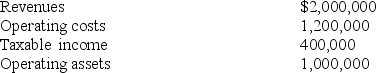

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

Income is defined as operating income.

What is the Cyclotron Division's investment turnover ratio?

A)2.00

B)3.33

C)2.50

D)0.80

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

Income is defined as operating income.What is the Cyclotron Division's investment turnover ratio?

A)2.00

B)3.33

C)2.50

D)0.80

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

38

During the past twelve months, the Zenith Corporation had a net income of $78,400 What is the return on investment if the amount of the investment is $560,000?

A)10%

B)12%

C)14%

D)16%

A)10%

B)12%

C)14%

D)16%

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

39

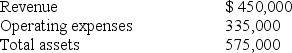

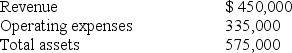

The Alpha Beta Corporation had the following information for 20X5:  What is the return on investment?

What is the return on investment?

A)10%

B)20%

C)25%

D)78.2%

What is the return on investment?

What is the return on investment?A)10%

B)20%

C)25%

D)78.2%

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

40

Answer the following questions using the information below:

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Gamma Division's return on investment?

A)0.25

B)0.42

C)0.60

D)0.75

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Gamma Division's return on investment?

A)0.25

B)0.42

C)0.60

D)0.75

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

41

A negative feature of defining investment by EXCLUDING the portion of total assets employed that are financed by short-term creditors is that:

A)current liabilities are sometimes difficult to define

B)short-term debt is always more expensive to finance than long-term debt

C)this method encourages managers to use an excessive amount of short-term debt

D)this method encourages managers to use an excessive amount of long-term debt

A)current liabilities are sometimes difficult to define

B)short-term debt is always more expensive to finance than long-term debt

C)this method encourages managers to use an excessive amount of short-term debt

D)this method encourages managers to use an excessive amount of long-term debt

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

42

Answer the following questions using the information below:

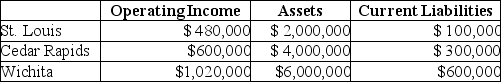

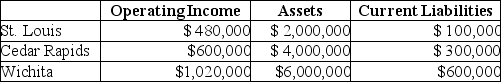

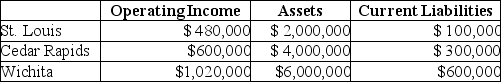

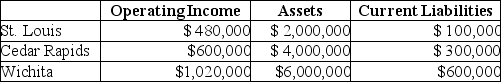

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

What is the EVA® for St. Louis?

A)$127,870

B)$163,730

C)$196,270

D)$360,000

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

What is the EVA® for St. Louis?

A)$127,870

B)$163,730

C)$196,270

D)$360,000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

43

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield's after-tax cost of debt is:

A).0320

B).0480

C).0800

D).0912

A).0320

B).0480

C).0800

D).0912

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

44

After-tax operating income minus the after-tax weighted-average cost of capital multiplied by total assets minus current liabilities equals:

A)return on investment

B)residual income

C)economic value added

D)weighted-average cost of capital

A)return on investment

B)residual income

C)economic value added

D)weighted-average cost of capital

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

45

Answer the following questions using the information below:

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

What is the EVA® for Cedar Rapids?

A)$67,790

B)$110,000

C)$117,000

D)$152,500

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

What is the EVA® for Cedar Rapids?

A)$67,790

B)$110,000

C)$117,000

D)$152,500

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

46

A problem with using residual income is that a corporation with a:

A)high investment turnover ratio always has a higher residual income than a corporation with a smaller investment turnover ratio

B)high return on sales always has a higher residual income than a corporation with a smaller return on sales

C)larger dollar amount of assets is likely to have a higher residual income than a corporation with a smaller dollar amount of assets

D)None of these answers is correct.

A)high investment turnover ratio always has a higher residual income than a corporation with a smaller investment turnover ratio

B)high return on sales always has a higher residual income than a corporation with a smaller return on sales

C)larger dollar amount of assets is likely to have a higher residual income than a corporation with a smaller dollar amount of assets

D)None of these answers is correct.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

47

Answer the following questions using the information below:

The Bandage Medical Supply Company has two divisions that operate independently of one another. The financial data for the year 2012 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

The company's desired rate of return is 10%. Income is defined as operating income.

Which division has the best return on investment and which division has the best residual income figure, respectively?

A)North, North

B)South, South

C)North, South

D)South, North

The Bandage Medical Supply Company has two divisions that operate independently of one another. The financial data for the year 2012 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

The company's desired rate of return is 10%. Income is defined as operating income.Which division has the best return on investment and which division has the best residual income figure, respectively?

A)North, North

B)South, South

C)North, South

D)South, North

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

48

Answer the following questions using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

What is the EVA® for Brooksville?

A)$476,250

B)$428,000

C)$415,525

D)$390,000

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

What is the EVA® for Brooksville?

A)$476,250

B)$428,000

C)$415,525

D)$390,000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

49

A company which favors the residual income approach wants managers to:

A)concentrate on maximizing an absolute amount of dollars

B)concentrate on maximizing a percentage return

C)maximize the investment turnover ratio

D)maximize return on sales

A)concentrate on maximizing an absolute amount of dollars

B)concentrate on maximizing a percentage return

C)maximize the investment turnover ratio

D)maximize return on sales

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

50

The after-tax average cost of all the long-term funds used by a corporation equals:

A)economic value added

B)return on investment

C)return on equity

D)weighted-average cost of capital

A)economic value added

B)return on investment

C)return on equity

D)weighted-average cost of capital

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

51

Answer the following questions using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

What is the EVA® for Bish Bash Falls?

A)$338,563

B)$305,000

C)$275,500

D)$255,500

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

What is the EVA® for Bish Bash Falls?

A)$338,563

B)$305,000

C)$275,500

D)$255,500

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

52

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:  What is Economic Value Added (EVA®)for the Blue Division?

What is Economic Value Added (EVA®)for the Blue Division?

A)-$233,400

B)$21,960

C)$188,600

D)$433,960

What is Economic Value Added (EVA®)for the Blue Division?

What is Economic Value Added (EVA®)for the Blue Division?A)-$233,400

B)$21,960

C)$188,600

D)$433,960

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is the correct formula for return on sales?

A)Income / Investment

B)Investment / Income

C)Income / Revenue

D)Revenue / Investment

A)Income / Investment

B)Investment / Income

C)Income / Revenue

D)Revenue / Investment

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

54

Using residual income as a measure of performance rather than return on investment promotes goal congruence because residual income:

A)places importance on the reduction of underperforming assets

B)calculates a percentage return rather than an absolute return

C)concentrates on maximizing an absolute amount of dollars

D)concentrates on maximizing the return on sales

A)places importance on the reduction of underperforming assets

B)calculates a percentage return rather than an absolute return

C)concentrates on maximizing an absolute amount of dollars

D)concentrates on maximizing the return on sales

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

55

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. What is Springfield's weighted average cost of capital (WACC)?

A).0480

B).0800

C).0912

D).1000

A).0480

B).0800

C).0912

D).1000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

56

Answer the following questions using the information below:

The Bandage Medical Supply Company has two divisions that operate independently of one another. The financial data for the year 2012 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

The company's desired rate of return is 10%. Income is defined as operating income.

What are the respective residual incomes for the North and South Divisions?

A)$60,000 and $100,000

B)$300,000 and $60,000

C)$300,000 and $100,000

D)$100,000 and a negative $300,000

The Bandage Medical Supply Company has two divisions that operate independently of one another. The financial data for the year 2012 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

The company's desired rate of return is 10%. Income is defined as operating income.What are the respective residual incomes for the North and South Divisions?

A)$60,000 and $100,000

B)$300,000 and $60,000

C)$300,000 and $100,000

D)$100,000 and a negative $300,000

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

57

Answer the following questions using the information below:

The Bandage Medical Supply Company has two divisions that operate independently of one another. The financial data for the year 2012 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

The company's desired rate of return is 10%. Income is defined as operating income.

What are the respective return-on-investment ratios for the North and South Divisions?

A)0.110 and 0.125

B)0.108 and 0.075

C)0.125 and 0.110

D)0.125 and 0.150

The Bandage Medical Supply Company has two divisions that operate independently of one another. The financial data for the year 2012 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

The company's desired rate of return is 10%. Income is defined as operating income.What are the respective return-on-investment ratios for the North and South Divisions?

A)0.110 and 0.125

B)0.108 and 0.075

C)0.125 and 0.110

D)0.125 and 0.150

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

58

Another name for return on investment is the:

A)net present value

B)accounting rate of return

C)residual income

D)internal rate of return

A)net present value

B)accounting rate of return

C)residual income

D)internal rate of return

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

59

Answer the following questions using the information below:

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

What is the EVA® for Wichita?

A)$225,000

B)$765,000

C)$207,180

D)$557,820

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5 million issued at an interest rate of 12%, and equity capital that has a market value of $4 million (book value of $2 million). Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 25%.

What is the EVA® for Wichita?

A)$225,000

B)$765,000

C)$207,180

D)$557,820

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

60

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:  Calculate EVA® for the Gold Division.

Calculate EVA® for the Gold Division.

A)($283,200)

B)($82,560)

C)$196,800

D)$397,440

Calculate EVA® for the Gold Division.

Calculate EVA® for the Gold Division.A)($283,200)

B)($82,560)

C)$196,800

D)$397,440

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

61

Investment turnover is calculated as revenue divided by investment.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

62

Answer the following questions using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

What is the EVA® for Stonybrook?

A)$1,108,000

B)$ 1,168,700

C)$ 1,315,063

D)$1,403,063

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

What is the EVA® for Stonybrook?

A)$1,108,000

B)$ 1,168,700

C)$ 1,315,063

D)$1,403,063

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

63

Companies that adopt the Economic Value Added concept define investment as total assets employed minus current liabilities.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

64

Goal congruence is more likely to be promoted by using return on investment rather than residual income as a measure of a subunit's managerial performance.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

65

In an Economic Value Added calculation, the measure of the invested capital for a division would be that division's assets minus that division's liabilities.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

66

Consolidated Gas Supply Corporation uses the investment center concept for the gasoline stations that it manages in the city. Consolidated has a 15% required rate of return on investment in order for a branch station to be viable. Select operating data for three of its stations for 200X are as follows:

Required:

Required:

a. Compute the return on investment for each station.

b. Which station manager is doing best based only on ROI? Why?

c. Are any of the stations in danger of being closed due to lack of performance?

d. What other factors should be included when evaluating the managers?

Required:

Required:a. Compute the return on investment for each station.

b. Which station manager is doing best based only on ROI? Why?

c. Are any of the stations in danger of being closed due to lack of performance?

d. What other factors should be included when evaluating the managers?

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

67

In an Economic Added Value calculation, the corporate charge for a division's investment is based on a weighted average of the after-tax interest rate on the firm's debt and the cost of the firm's equity.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

68

The three alternatives for increasing return on investment include increasing assets such as receivables, increasing revenues, and decreasing costs. (In all cases assume that all other items stay the same.)

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

69

Economic value added, unlike residual income, charges managers for the costs of their investments in long-term assets and working capital.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

70

Imputed costs are costs recognized in particular situations that are NOT usually recognized by accrual accounting procedures.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

71

In an Economic Value Added calculation, the appropriate measure of a division's profit would be that division's pre-tax operating income.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

72

Museum Corporation uses the investment center concept for the museums that it manages. Select operating data for three of its museums for 2012 are as follows:

Required:

Required:

a. Compute the return on investment for each division.

b. Which museum manager is doing best based only on ROI? Why?

c. What other factors should be included when evaluating the managers?

Required:

Required:a. Compute the return on investment for each division.

b. Which museum manager is doing best based only on ROI? Why?

c. What other factors should be included when evaluating the managers?

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

73

The objective of maximizing return on investment may induce managers of highly profitable divisions to reject projects that from the viewpoint of the overall organization should be accepted.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

74

Return on sales is calculated by dividing revenues by income.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

75

To evaluate overall aggregate performance, return on investment and residual income measures are more appropriate than return on sales.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

76

The residual income method is the most popular performance measure when measuring performance in an investment center.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

77

Return on investment is also called the accrual accounting rate of return.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

78

A major weakness of comparing two companies using only operating incomes as the basis of comparison is this method ignores differences in the size of the investment required to earn the operating income.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

79

Required rate of return multiplied by the investment is the imputed cost of the investment.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck

80

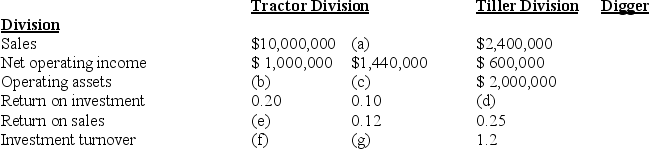

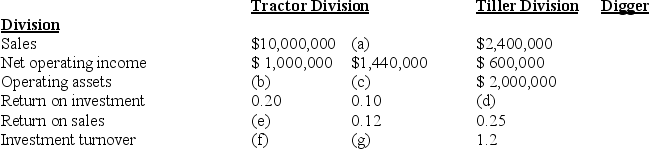

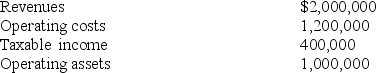

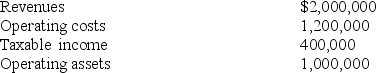

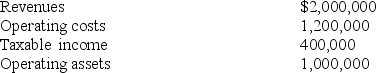

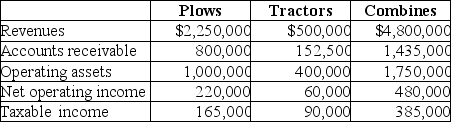

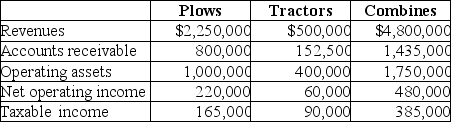

Kase Tractor Company allows its divisions to operate as autonomous units. The operating data for 20X5 follow:

Required:

Required:

a. Compute the investment turnover for each division.

b. Compute the return on sales for each division.

c. Compute the return on investment for each division.

d. Which division manager is doing best? Why?

e. What other factors should be included when evaluating the managers?

For parts (b)and (c)income is defined as operating income.

Required:

Required:a. Compute the investment turnover for each division.

b. Compute the return on sales for each division.

c. Compute the return on investment for each division.

d. Which division manager is doing best? Why?

e. What other factors should be included when evaluating the managers?

For parts (b)and (c)income is defined as operating income.

Unlock Deck

Unlock for access to all 139 flashcards in this deck.

Unlock Deck

k this deck