Deck 3: Cost-Volume-Profit Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/207

Play

Full screen (f)

Deck 3: Cost-Volume-Profit Analysis

1

A revenue driver is defined as:

A)any factor that affects costs and revenues

B)any factor that affects revenues

C)only factors that can influence a change in selling price

D)only factors that can influence a change in demand

A)any factor that affects costs and revenues

B)any factor that affects revenues

C)only factors that can influence a change in selling price

D)only factors that can influence a change in demand

B

2

Which of the following items is NOT an assumption of CVP analysis?

A)Costs may be separated into separate fixed and variable components.

B)Total revenues and total costs are linear in relation to output units.

C)Unit selling price, unit variable costs, and unit fixed costs are known and remain constant.

D)Proportion of different products will remain constant when multiple products are sold.

A)Costs may be separated into separate fixed and variable components.

B)Total revenues and total costs are linear in relation to output units.

C)Unit selling price, unit variable costs, and unit fixed costs are known and remain constant.

D)Proportion of different products will remain constant when multiple products are sold.

C

3

Answer the following questions using the information below:

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

The contribution income statement highlights:

A)gross margin

B)products costs and period costs

C)different product lines

D)variable and fixed costs

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

The contribution income statement highlights:

A)gross margin

B)products costs and period costs

C)different product lines

D)variable and fixed costs

D

4

Answer the following questions using the information below:

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

Fixed costs equal $12,000, unit contribution margin equals $20, and the number of units sold equal 1,600. Operating income is:

A)$12,000

B)$20,000

C)$32,000

D)$40,000

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

Fixed costs equal $12,000, unit contribution margin equals $20, and the number of units sold equal 1,600. Operating income is:

A)$12,000

B)$20,000

C)$32,000

D)$40,000

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

5

Cost-volume-profit analysis assumes all of the following EXCEPT:

A)all costs are variable or fixed

B)units manufactured equal units sold

C)total variable costs remain the same over the relevant range

D)total fixed costs remain the same over the relevant range

A)all costs are variable or fixed

B)units manufactured equal units sold

C)total variable costs remain the same over the relevant range

D)total fixed costs remain the same over the relevant range

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

6

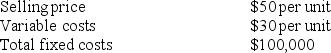

Answer the following questions using the information below:

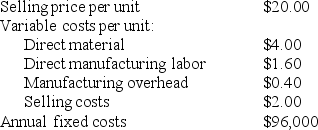

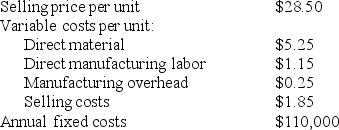

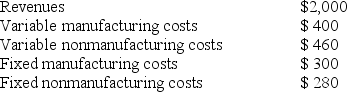

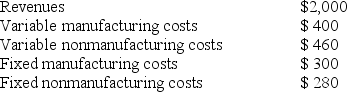

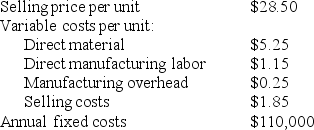

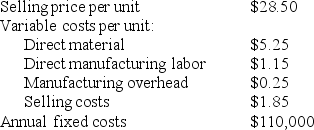

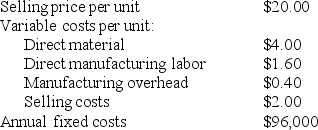

Northenscold Company sells several products. Information of average revenue and costs is as follows:

The contribution margin per unit is:

A)$6

B)$8

C)$12

D)$14

Northenscold Company sells several products. Information of average revenue and costs is as follows:

The contribution margin per unit is:

A)$6

B)$8

C)$12

D)$14

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

7

Answer the following questions using the information below:

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

Kenefic Company sells its only product for $9 per unit, variable production costs are $3 per unit, and selling and administrative costs are $1.50 per unit. Fixed costs for 10,000 units are $5,000. The contribution margin is:

A)$6 per unit

B)$4.50 per unit

C)$5.50 per unit

D)$4 per unit

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

Kenefic Company sells its only product for $9 per unit, variable production costs are $3 per unit, and selling and administrative costs are $1.50 per unit. Fixed costs for 10,000 units are $5,000. The contribution margin is:

A)$6 per unit

B)$4.50 per unit

C)$5.50 per unit

D)$4 per unit

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

8

Answer the following questions using the information below:

Sherry's Custom Jewelry sells a single product. 700 units were sold resulting in $7,000 of sales revenue, $2,800 of variable costs, and $1,200 of fixed costs.

If sales increase by $25,000, operating income will increase by:

A)$10,000

B)$15,000

C)$22,200

D)None of these answers are correct.

Sherry's Custom Jewelry sells a single product. 700 units were sold resulting in $7,000 of sales revenue, $2,800 of variable costs, and $1,200 of fixed costs.

If sales increase by $25,000, operating income will increase by:

A)$10,000

B)$15,000

C)$22,200

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

9

Answer the following questions using the information below:

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

If selling price per unit is $30, variable costs per unit are $20, total fixed costs are $10,000, the tax rate is 30%, and the company sells 5,000 units, net income is:

A)$12,000

B)$14,000

C)$28,000

D)$40,000

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

If selling price per unit is $30, variable costs per unit are $20, total fixed costs are $10,000, the tax rate is 30%, and the company sells 5,000 units, net income is:

A)$12,000

B)$14,000

C)$28,000

D)$40,000

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

10

One of the first steps to take when using CVP analysis to help make decisions is:

A)finding out where the total costs line intersects with the total revenues line on a graph.

B)identifying which costs are variable and which costs are fixed.

C)calculation of the degree of operating leverage for the company.

D)estimating how many products will have to be sold to make a decent profit.

A)finding out where the total costs line intersects with the total revenues line on a graph.

B)identifying which costs are variable and which costs are fixed.

C)calculation of the degree of operating leverage for the company.

D)estimating how many products will have to be sold to make a decent profit.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

11

The contribution income statement:

A)reports gross margin

B)is allowed for external reporting to shareholders

C)categorizes costs as either direct or indirect

D)can be used to predict future profits at different levels of activity

A)reports gross margin

B)is allowed for external reporting to shareholders

C)categorizes costs as either direct or indirect

D)can be used to predict future profits at different levels of activity

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following items is NOT an assumption of CVP analysis?

A)Total costs can be divided into a fixed component and a component that is variable with respect to the level of output.

B)When graphed, total costs curve upward.

C)The unit-selling price is known and constant.

D)All revenues and costs can be added and compared without taking into account the time value of money.

A)Total costs can be divided into a fixed component and a component that is variable with respect to the level of output.

B)When graphed, total costs curve upward.

C)The unit-selling price is known and constant.

D)All revenues and costs can be added and compared without taking into account the time value of money.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

13

Contribution margin equals:

A)revenues minus period costs

B)revenues minus product costs

C)revenues minus variable costs

D)revenues minus fixed costs

A)revenues minus period costs

B)revenues minus product costs

C)revenues minus variable costs

D)revenues minus fixed costs

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is true about the assumptions underlying basic CVP analysis?

A)Only selling price is known and constant.

B)Only selling price and variable cost per unit are known and constant.

C)Only selling price, variable cost per unit, and total fixed costs are known and constant.

D)Selling price, variable cost per unit, fixed cost per unit, and total fixed costs are known and constant.

A)Only selling price is known and constant.

B)Only selling price and variable cost per unit are known and constant.

C)Only selling price, variable cost per unit, and total fixed costs are known and constant.

D)Selling price, variable cost per unit, fixed cost per unit, and total fixed costs are known and constant.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

15

Answer the following questions using the information below:

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

If sales increase by $40,000, operating income will increase by:

A)$10,000

B)$20,000

C)$30,000

D)None of these answers are correct.

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

If sales increase by $40,000, operating income will increase by:

A)$10,000

B)$20,000

C)$30,000

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

16

Cost-volume-profit analysis is used primarily by management:

A)as a planning tool

B)for control purposes

C)to prepare external financial statements

D)to attain accurate financial results

A)as a planning tool

B)for control purposes

C)to prepare external financial statements

D)to attain accurate financial results

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

17

Answer the following questions using the information below:

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

Contribution margin per ham is:

A)$5.00

B)$15.00

C)$20.00

D)None of these answers are correct.

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

Contribution margin per ham is:

A)$5.00

B)$15.00

C)$20.00

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

18

Answer the following questions using the information below:

Sherry's Custom Jewelry sells a single product. 700 units were sold resulting in $7,000 of sales revenue, $2,800 of variable costs, and $1,200 of fixed costs.

Contribution margin per unit is:

A)$4.00

B)$4.29

C)$6.00

D)None of these answers are correct.

Sherry's Custom Jewelry sells a single product. 700 units were sold resulting in $7,000 of sales revenue, $2,800 of variable costs, and $1,200 of fixed costs.

Contribution margin per unit is:

A)$4.00

B)$4.29

C)$6.00

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements about net income (NI)is true?

A)NI = operating income plus nonoperating revenue.

B)NI = operating income plus operating costs.

C)NI = operating income less income taxes.

D)NI = operating income less cost of goods sold.

A)NI = operating income plus nonoperating revenue.

B)NI = operating income plus operating costs.

C)NI = operating income less income taxes.

D)NI = operating income less cost of goods sold.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

20

Operating income calculations use:

A)net income

B)income tax expense

C)cost of goods sold and operating costs

D)nonoperating revenues and nonoperating expenses

A)net income

B)income tax expense

C)cost of goods sold and operating costs

D)nonoperating revenues and nonoperating expenses

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

21

Many companies find even the simplest CVP analysis helps with strategic and long-range planning.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

22

In CVP analysis, an assumption is made that the total revenues are linear with respect to output units, but that total costs are non-linear with respect to output units.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

23

Answer the following questions using the information below:

Northenscold Company sells several products. Information of average revenue and costs is as follows:

All of the following are assumed in the above analysis EXCEPT:

A)a constant product mix

B)fixed costs increase when activity increases

C)cost and revenue relationships are reflected accurately

D)all costs can be classified as either fixed or variable

Northenscold Company sells several products. Information of average revenue and costs is as follows:

All of the following are assumed in the above analysis EXCEPT:

A)a constant product mix

B)fixed costs increase when activity increases

C)cost and revenue relationships are reflected accurately

D)all costs can be classified as either fixed or variable

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

24

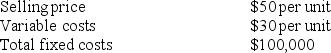

Answer the following questions using the information below:

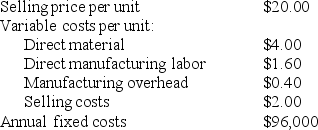

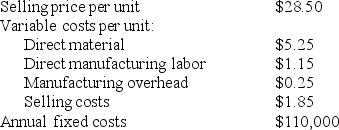

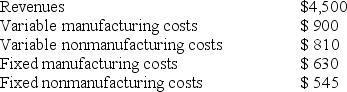

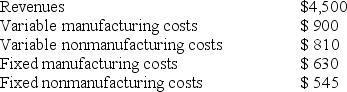

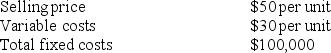

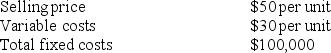

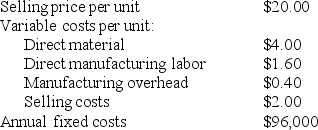

Franscioso Company sells several products. Information of average revenue and costs is as follows:

All of the following are assumed in the above analysis EXCEPT:

A)a constant product mix

B)all costs can be classified as either fixed or variable

C)cost and revenue relationships are reflected accurately

D)per unit variable costs increase when activity increases

Franscioso Company sells several products. Information of average revenue and costs is as follows:

All of the following are assumed in the above analysis EXCEPT:

A)a constant product mix

B)all costs can be classified as either fixed or variable

C)cost and revenue relationships are reflected accurately

D)per unit variable costs increase when activity increases

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

25

Answer the following questions using the information below:

Franscioso Company sells several products. Information of average revenue and costs is as follows:

The contribution margin per unit is:

A)$15

B)$20

C)$22

D)$125

Franscioso Company sells several products. Information of average revenue and costs is as follows:

The contribution margin per unit is:

A)$15

B)$20

C)$22

D)$125

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

26

Answer the following questions using the information below:

Dr. Charles Hunter, MD, performs a certain outpatient procedure for $1,000. His fixed costs are $20,000, while his variable costs are $500 per procedure. Dr. Hunter currently plans to perform 200 procedures this month.

What is the budgeted operating income for the month assuming that Dr. Hunter plans to perform the procedure 200 times?

A)$200,000

B)$100,000

C)$80,000

D)$40,000

Dr. Charles Hunter, MD, performs a certain outpatient procedure for $1,000. His fixed costs are $20,000, while his variable costs are $500 per procedure. Dr. Hunter currently plans to perform 200 procedures this month.

What is the budgeted operating income for the month assuming that Dr. Hunter plans to perform the procedure 200 times?

A)$200,000

B)$100,000

C)$80,000

D)$40,000

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

27

Answer the following questions using the information below:

Nancy's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

To determine contribution margin use:

A)only variable manufacturing costs

B)only fixed manufacturing costs

C)both variable and fixed manufacturing costs

D)both variable manufacturing costs and variable nonmanufacturing costs

Nancy's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

To determine contribution margin use:

A)only variable manufacturing costs

B)only fixed manufacturing costs

C)both variable and fixed manufacturing costs

D)both variable manufacturing costs and variable nonmanufacturing costs

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

28

Contribution margin = Contribution margin percentage * Revenues (in dollars)

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

29

In CVP analysis, the number of output units is the only revenue driver.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

30

Answer the following questions using the information below:

Nancy's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

In the merchandising sector:

A)only variable costs are subtracted to determine gross margin

B)fixed overhead costs are subtracted to determine gross margin

C)fixed overhead costs are subtracted to determine contribution margin

D)all operating costs are subtracted to determine contribution margin

Nancy's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

In the merchandising sector:

A)only variable costs are subtracted to determine gross margin

B)fixed overhead costs are subtracted to determine gross margin

C)fixed overhead costs are subtracted to determine contribution margin

D)all operating costs are subtracted to determine contribution margin

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

31

Answer the following questions using the information below:

Dr. Charles Hunter, MD, performs a certain outpatient procedure for $1,000. His fixed costs are $20,000, while his variable costs are $500 per procedure. Dr. Hunter currently plans to perform 200 procedures this month.

What is the budgeted revenue for the month assuming that Dr. Hunter plans to perform this procedure 200 times?

A)$100,000

B)$200,000

C)$300,000

D)$400,000

Dr. Charles Hunter, MD, performs a certain outpatient procedure for $1,000. His fixed costs are $20,000, while his variable costs are $500 per procedure. Dr. Hunter currently plans to perform 200 procedures this month.

What is the budgeted revenue for the month assuming that Dr. Hunter plans to perform this procedure 200 times?

A)$100,000

B)$200,000

C)$300,000

D)$400,000

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

32

In CVP analysis, variable costs include direct variable costs, but do NOT include indirect variable costs.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

33

It is assumed in CVP analysis that the unit selling price, unit variable costs, and unit fixed costs are known and constant.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

34

A revenue driver is defined as a variable that causes changes in prices.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

35

Answer the following questions using the information below:

Nancy's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

To achieve $100,000 in operating income, sales must total:

A)$440,000

B)$160,000

C)$130,000

D)None of these answers are correct.

Nancy's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

To achieve $100,000 in operating income, sales must total:

A)$440,000

B)$160,000

C)$130,000

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

36

The difference between total revenues and total variable costs is called contribution margin.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

37

To perform cost-volume-profit analysis, a company must be able to separate costs into fixed and variable components.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

38

Answer the following questions using the information below:

Nancy's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

In the manufacturing sector:

A)only variable costs are subtracted to determine gross margin

B)fixed overhead costs are subtracted to determine gross margin

C)fixed overhead costs are subtracted to determine contribution margin

D)all operating costs are subtracted to determine contribution margin

Nancy's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

In the manufacturing sector:

A)only variable costs are subtracted to determine gross margin

B)fixed overhead costs are subtracted to determine gross margin

C)fixed overhead costs are subtracted to determine contribution margin

D)all operating costs are subtracted to determine contribution margin

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

39

Answer the following questions using the information below:

Nancy's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

The contribution margin percentage is:

A)12.5%

B)25.0%

C)37.5%

D)75.0%

Nancy's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

The contribution margin percentage is:

A)12.5%

B)25.0%

C)37.5%

D)75.0%

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

40

Answer the following questions using the information below:

Nancy's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

Gross margin is:

A)sales revenue less variable costs

B)sales revenue less cost of goods sold

C)contribution margin less fixed costs

D)contribution margin less variable costs

Nancy's Niche sells a single product. 8,000 units were sold resulting in $80,000 of sales revenue, $20,000 of variable costs, and $10,000 of fixed costs.

Gross margin is:

A)sales revenue less variable costs

B)sales revenue less cost of goods sold

C)contribution margin less fixed costs

D)contribution margin less variable costs

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

41

The breakeven point is the activity level where:

A)revenues equal fixed costs

B)revenues equal variable costs

C)contribution margin equals variable costs

D)revenues equal the sum of variable and fixed costs

A)revenues equal fixed costs

B)revenues equal variable costs

C)contribution margin equals variable costs

D)revenues equal the sum of variable and fixed costs

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

42

Sales total $200,000 when variable costs total $150,000 and fixed costs total $30,000. The breakeven point in sales dollars is:

A)$200,000

B)$120,000

C)$ 40,000

D)$ 30,000

A)$200,000

B)$120,000

C)$ 40,000

D)$ 30,000

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

43

Jennifer's Stuffed Animals reported the following:

Required:

Required:

a. Compute contribution margin.

b. Compute gross margin.

c. Compute operating income.

Required:

Required:a. Compute contribution margin.

b. Compute gross margin.

c. Compute operating income.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

44

For merchandising firms, contribution margin will always be a lesser amount than gross margin.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

45

Answer the following questions using the information below:

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

The number of hams that must be sold to achieve $75,000 of operating income is:

A)6,600 hams

B)7,500 hams

C)8,400 hams

D)None of these answers are correct.

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

The number of hams that must be sold to achieve $75,000 of operating income is:

A)6,600 hams

B)7,500 hams

C)8,400 hams

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

46

Arthur's Plumbing reported the following:

Required:

Required:

a. Compute contribution margin.

b. Compute contribution margin percentage.

c. Compute gross margin.

d. Compute gross margin percentage.

e. Compute operating income.

Required:

Required:a. Compute contribution margin.

b. Compute contribution margin percentage.

c. Compute gross margin.

d. Compute gross margin percentage.

e. Compute operating income.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

47

Service sector companies will never report gross margin on an income statement.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

48

If the selling price per unit is $50 and the contribution margin percentage is 40%, then the variable cost per unit must be $20.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

49

Breakeven point is:

A)total costs divided by variable costs per unit

B)contribution margin per unit divided by revenue per unit

C)fixed costs divided by contribution margin per unit

D)the sum of fixed and variable costs divided by contribution margin per unit

A)total costs divided by variable costs per unit

B)contribution margin per unit divided by revenue per unit

C)fixed costs divided by contribution margin per unit

D)the sum of fixed and variable costs divided by contribution margin per unit

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

50

Contribution margin and gross margin are terms that can be used interchangeably.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

51

Answer the following questions using the information below:

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

Breakeven point in units is:

A)1,000 hams

B)1,200 hams

C)1,600 hams

D)None of these answers are correct.

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

Breakeven point in units is:

A)1,000 hams

B)1,200 hams

C)1,600 hams

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

52

Jacob's Manufacturing sales is equal to production. If Jacob's Manufacturing presented a Financial Accounting Income Statement emphasizing gross margin showing operating income of $180,000, a Contribution Income Statement emphasizing contribution margin would show a different operating income.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

53

Answer the following questions using the information below:

Sherry's Custom Jewelry sells a single product. 700 units were sold resulting in $7,000 of sales revenue, $2,800 of variable costs, and $1,200 of fixed costs.

The number of units that must be sold to achieve $6,000 of operating income is:

A)1,000 units

B)1,166 units

C)1,200 units

D)None of these answers are correct.

Sherry's Custom Jewelry sells a single product. 700 units were sold resulting in $7,000 of sales revenue, $2,800 of variable costs, and $1,200 of fixed costs.

The number of units that must be sold to achieve $6,000 of operating income is:

A)1,000 units

B)1,166 units

C)1,200 units

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

54

Answer the following questions using the information below:

Sherry's Custom Jewelry sells a single product. 700 units were sold resulting in $7,000 of sales revenue, $2,800 of variable costs, and $1,200 of fixed costs.

Breakeven point in units is:

A)200 units

B)300 units

C)500 units

D)None of these answers are correct.

Sherry's Custom Jewelry sells a single product. 700 units were sold resulting in $7,000 of sales revenue, $2,800 of variable costs, and $1,200 of fixed costs.

Breakeven point in units is:

A)200 units

B)300 units

C)500 units

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

55

If the selling price per unit of a product is $30, variable costs per unit are $20, and total fixed costs are $10,000 and a company sells 5,000 units, operating income would be $40,000.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

56

Answer the following questions using the information below:

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

At the breakeven point of 2,000 units, variable costs total $4,000 and fixed costs total $6,000. The 2,001st unit sold will contribute ________ to profits.

A)$1

B)$2

C)$3

D)$5

Holly's Ham, Inc. sells hams during the major holiday seasons. During the current year 11,000 hams were sold resulting in $220,000 of sales revenue, $55,000 of variable costs, and $24,000 of fixed costs.

At the breakeven point of 2,000 units, variable costs total $4,000 and fixed costs total $6,000. The 2,001st unit sold will contribute ________ to profits.

A)$1

B)$2

C)$3

D)$5

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

57

Total revenues less total fixed costs equal the contribution margin.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

58

Gross margin is reported on the contribution income statement.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

59

The selling price per unit less the variable cost per unit is the:

A)fixed cost per unit

B)gross margin

C)margin of safety

D)contribution margin per unit

A)fixed cost per unit

B)gross margin

C)margin of safety

D)contribution margin per unit

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

60

Gross Margin will always be greater than contribution margin.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

61

Answer the following questions using the information below:

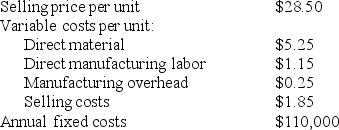

Franscioso Company sells several products. Information of average revenue and costs is as follows:

The number of units that Franscioso must sell each year to break even is:

A)1,000 units

B)4,000 units

C)5,500 units

D)indeterminable

Franscioso Company sells several products. Information of average revenue and costs is as follows:

The number of units that Franscioso must sell each year to break even is:

A)1,000 units

B)4,000 units

C)5,500 units

D)indeterminable

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

62

What is the breakeven point in units, assuming a product's selling price is $100, fixed costs are $8,000, unit variable costs are $20, and operating income is $3,200?

A)100 units

B)300 units

C)400 units

D)500 units

A)100 units

B)300 units

C)400 units

D)500 units

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

63

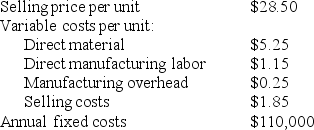

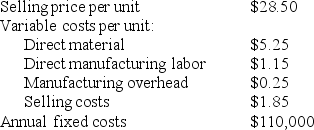

Answer the following questions using the information below:

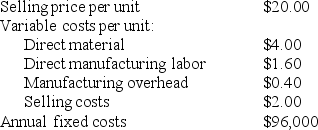

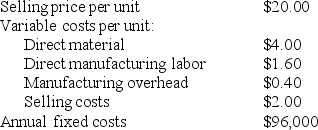

The following information is for Nichols Company:

The number of units that Nichols Company must sell to reach targeted operating income of $30,000 is:

A)5,000 units

B)6,500 units

C)3,334 units

D)4,334 units

The following information is for Nichols Company:

The number of units that Nichols Company must sell to reach targeted operating income of $30,000 is:

A)5,000 units

B)6,500 units

C)3,334 units

D)4,334 units

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

64

Answer the following questions using the information below:

The following information is for Nichols Company:

If targeted operating income is $40,000, then targeted sales revenue is:

A)$350,000

B)$233,333

C)$166,667

D)$250,000

The following information is for Nichols Company:

If targeted operating income is $40,000, then targeted sales revenue is:

A)$350,000

B)$233,333

C)$166,667

D)$250,000

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

65

If unit outputs exceed the breakeven point:

A)there is a loss

B)total sales revenue exceeds total costs

C)there is a profit

D)Both total sales revenue exceeds total costs and there is a profit.

A)there is a loss

B)total sales revenue exceeds total costs

C)there is a profit

D)Both total sales revenue exceeds total costs and there is a profit.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

66

Answer the following questions using the information below:

Stephanie's Bridal Shoppe sells wedding dresses. The average selling price of each dress is $1,000, variable costs are $400, and fixed costs are $90,000.

How many dresses are sold when operating income is zero?

A)225 dresses

B)150 dresses

C)100 dresses

D)90 dresses

Stephanie's Bridal Shoppe sells wedding dresses. The average selling price of each dress is $1,000, variable costs are $400, and fixed costs are $90,000.

How many dresses are sold when operating income is zero?

A)225 dresses

B)150 dresses

C)100 dresses

D)90 dresses

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

67

Answer the following questions using the information below:

Ruben intends to sell his customers a special round-trip airline ticket package. He is able to purchase the package from the airline carrier for $150 each. The round-trip tickets will be sold for $200 each and the airline intends to reimburse Ruben for any unsold ticket packages. Fixed costs include $5,000 in advertising costs.

How many ticket packages will Ruben need to sell to break even?

A)34 packages

B)50 packages

C)100 packages

D)150 packages

Ruben intends to sell his customers a special round-trip airline ticket package. He is able to purchase the package from the airline carrier for $150 each. The round-trip tickets will be sold for $200 each and the airline intends to reimburse Ruben for any unsold ticket packages. Fixed costs include $5,000 in advertising costs.

How many ticket packages will Ruben need to sell to break even?

A)34 packages

B)50 packages

C)100 packages

D)150 packages

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

68

Answer the following questions using the information below:

Ruben intends to sell his customers a special round-trip airline ticket package. He is able to purchase the package from the airline carrier for $150 each. The round-trip tickets will be sold for $200 each and the airline intends to reimburse Ruben for any unsold ticket packages. Fixed costs include $5,000 in advertising costs.

For every $25,000 of ticket packages sold, operating income will increase by:

A)$6,250

B)$12,500

C)$18,750

D)an indeterminable amount

Ruben intends to sell his customers a special round-trip airline ticket package. He is able to purchase the package from the airline carrier for $150 each. The round-trip tickets will be sold for $200 each and the airline intends to reimburse Ruben for any unsold ticket packages. Fixed costs include $5,000 in advertising costs.

For every $25,000 of ticket packages sold, operating income will increase by:

A)$6,250

B)$12,500

C)$18,750

D)an indeterminable amount

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

69

Answer the following questions using the information below:

Ruben intends to sell his customers a special round-trip airline ticket package. He is able to purchase the package from the airline carrier for $150 each. The round-trip tickets will be sold for $200 each and the airline intends to reimburse Ruben for any unsold ticket packages. Fixed costs include $5,000 in advertising costs.

How many ticket packages will Ruben need to sell in order to achieve $60,000 of operating income?

A)367 packages

B)434 packages

C)1,100 packages

D)1,300 packages

Ruben intends to sell his customers a special round-trip airline ticket package. He is able to purchase the package from the airline carrier for $150 each. The round-trip tickets will be sold for $200 each and the airline intends to reimburse Ruben for any unsold ticket packages. Fixed costs include $5,000 in advertising costs.

How many ticket packages will Ruben need to sell in order to achieve $60,000 of operating income?

A)367 packages

B)434 packages

C)1,100 packages

D)1,300 packages

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

70

When fixed costs are $40,000 and variable costs are 20% of the selling price, then breakeven sales are:

A)$40,000

B)$50,000

C)$200,000

D)indeterminable

A)$40,000

B)$50,000

C)$200,000

D)indeterminable

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

71

The breakeven point in CVP analysis is defined as:

A)when fixed costs equal total revenues

B)fixed costs divided by the contribution margin per unit

C)revenues less variable costs equal operating income

D)when the contribution margin percentage equals total revenues divided by variable costs

A)when fixed costs equal total revenues

B)fixed costs divided by the contribution margin per unit

C)revenues less variable costs equal operating income

D)when the contribution margin percentage equals total revenues divided by variable costs

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

72

Answer the following questions using the information below:

Ruben intends to sell his customers a special round-trip airline ticket package. He is able to purchase the package from the airline carrier for $150 each. The round-trip tickets will be sold for $200 each and the airline intends to reimburse Ruben for any unsold ticket packages. Fixed costs include $5,000 in advertising costs.

What is the contribution margin per ticket package?

A)$50

B)$100

C)$150

D)$200

Ruben intends to sell his customers a special round-trip airline ticket package. He is able to purchase the package from the airline carrier for $150 each. The round-trip tickets will be sold for $200 each and the airline intends to reimburse Ruben for any unsold ticket packages. Fixed costs include $5,000 in advertising costs.

What is the contribution margin per ticket package?

A)$50

B)$100

C)$150

D)$200

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

73

If the breakeven point is 1,000 units and each unit sells for $50, then:

A)selling 1,250 units will result in a profit

B)sales of $40,000 will result in a loss

C)sales of $50,000 will result in zero profit

D)All of these answers are correct.

A)selling 1,250 units will result in a profit

B)sales of $40,000 will result in a loss

C)sales of $50,000 will result in zero profit

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

74

How many units would have to be sold to yield a target operating income of $22,000, assuming variable costs are $15 per unit, total fixed costs are $2,000, and the unit selling price is $20?

A)4,800 units

B)4,400 units

C)4,000 units

D)3,600 units

A)4,800 units

B)4,400 units

C)4,000 units

D)3,600 units

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

75

Answer the following questions using the information below:

Franscioso Company sells several products. Information of average revenue and costs is as follows:

The number of units that Franscioso must sell annually to make a profit of $90,000 is:

A)10,000 units

B)12,000 units

C)15,000 units

D)20,000 units

Franscioso Company sells several products. Information of average revenue and costs is as follows:

The number of units that Franscioso must sell annually to make a profit of $90,000 is:

A)10,000 units

B)12,000 units

C)15,000 units

D)20,000 units

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

76

If breakeven point is 1,000 units, each unit sells for $30, and fixed costs are $10,000, then on a graph the:

A)total revenue line and the total cost line will intersect at $30,000 of revenue

B)total cost line will be zero at zero units sold

C)revenue line will start at $10,000

D)All of these answers are correct.

A)total revenue line and the total cost line will intersect at $30,000 of revenue

B)total cost line will be zero at zero units sold

C)revenue line will start at $10,000

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

77

Answer the following questions using the information below:

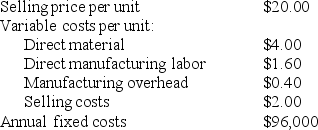

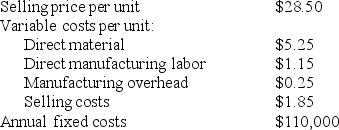

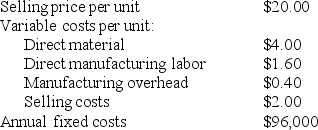

Northenscold Company sells several products. Information of average revenue and costs is as follows:

The number of units that Northenscold's must sell each year to break even is:

A)8,000 units

B)12,000 units

C)16,000 units

D)indeterminable

Northenscold Company sells several products. Information of average revenue and costs is as follows:

The number of units that Northenscold's must sell each year to break even is:

A)8,000 units

B)12,000 units

C)16,000 units

D)indeterminable

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

78

Answer the following questions using the information below:

Stephanie's Bridal Shoppe sells wedding dresses. The average selling price of each dress is $1,000, variable costs are $400, and fixed costs are $90,000.

What is the Bridal Shoppe's operating income when 200 dresses are sold?

A)$30,000

B)$80,000

C)$200,000

D)$100,000

Stephanie's Bridal Shoppe sells wedding dresses. The average selling price of each dress is $1,000, variable costs are $400, and fixed costs are $90,000.

What is the Bridal Shoppe's operating income when 200 dresses are sold?

A)$30,000

B)$80,000

C)$200,000

D)$100,000

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements about determining the breakeven point is FALSE?

A)Operating income is equal to zero.

B)Contribution margin - fixed costs is equal to zero.

C)Revenues equal fixed costs plus variable costs.

D)Breakeven revenues equal fixed costs divided by the variable cost per unit.

A)Operating income is equal to zero.

B)Contribution margin - fixed costs is equal to zero.

C)Revenues equal fixed costs plus variable costs.

D)Breakeven revenues equal fixed costs divided by the variable cost per unit.

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck

80

Answer the following questions using the information below:

Northenscold Company sells several products. Information of average revenue and costs is as follows:

The number of units that Northenscold's must sell annually to make a profit of $144,000 is:

A)12,000 units

B)18,000 units

C)20,000 units

D)30,000 units

Northenscold Company sells several products. Information of average revenue and costs is as follows:

The number of units that Northenscold's must sell annually to make a profit of $144,000 is:

A)12,000 units

B)18,000 units

C)20,000 units

D)30,000 units

Unlock Deck

Unlock for access to all 207 flashcards in this deck.

Unlock Deck

k this deck