Deck 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/170

Play

Full screen (f)

Deck 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis

1

To motivate engineers to design simpler products, costs for production, distribution, and customer service may be included in product-cost estimates.

True

2

One of the purposes of allocating direct costs is to justify costs or compute reimbursement amounts.

True

3

An electronics manufacturer is trying to encourage its engineers to design simpler products so that overall costs are reduced.

Required:

Which of the value-chain function costs (R&D, design, production, marketing, distribution, customer service)should be included in product-cost estimates to achieve the above purpose? Why?

Required:

Which of the value-chain function costs (R&D, design, production, marketing, distribution, customer service)should be included in product-cost estimates to achieve the above purpose? Why?

All costs that are affected by the design should be included in the product cost estimate. These costs include the cost of design, production, distribution, and customer service.

4

Which purpose of cost allocation is used to cost products at a "fair" price?

A)to provide information for economic decisions

B)to motivate managers and other employees

C)to justify costs or compute reimbursement

D)to measure income and assets for reporting to external parties

A)to provide information for economic decisions

B)to motivate managers and other employees

C)to justify costs or compute reimbursement

D)to measure income and assets for reporting to external parties

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

5

To allocate a cost, it is only necessary to satisfy one of the purposes for which costs are allocated.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

6

R&D costs are used for which purpose of cost allocation?

A)to provide information for economic decisions

B)to report to external parties when using generally accepted accounting principles

C)to calculate costs of a government contract

D)All of these answers are correct.

A)to provide information for economic decisions

B)to report to external parties when using generally accepted accounting principles

C)to calculate costs of a government contract

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

7

Which purpose of cost allocation is used to encourage sales representatives to push high-margin products or services?

A)to provide information for economic decisions

B)to motivate managers and other employees

C)to justify costs or compute reimbursement

D)to measure income and assets for reporting to external parties

A)to provide information for economic decisions

B)to motivate managers and other employees

C)to justify costs or compute reimbursement

D)to measure income and assets for reporting to external parties

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

8

For each item listed select the appropriate purpose of cost allocation from the list below. A purpose may be used more than once.

1. To cost a product at a fair price for government contracts

2. To encourage simpler product design

3. To decide on an appropriate selling price for a special-order product

4. To cost inventories for reporting on a company's tax return

5. To encourage the sales department to focus on high-margin products

6. To evaluate a make or buy decision

7. To cost inventories for the balance sheet

8. To decide whether to add or delete a product line

Purposes of cost allocation:

a. To provide information for economic decisions

b. To motivate managers and other employees

c. To justify costs or compute reimbursement amounts

d. To measure income and assets

1. To cost a product at a fair price for government contracts

2. To encourage simpler product design

3. To decide on an appropriate selling price for a special-order product

4. To cost inventories for reporting on a company's tax return

5. To encourage the sales department to focus on high-margin products

6. To evaluate a make or buy decision

7. To cost inventories for the balance sheet

8. To decide whether to add or delete a product line

Purposes of cost allocation:

a. To provide information for economic decisions

b. To motivate managers and other employees

c. To justify costs or compute reimbursement amounts

d. To measure income and assets

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

9

A company might choose to allocate corporate costs to various divisions within the company for what four purposes? Give an example of each.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

10

Briefly describe the four criteria used to guide cost-allocation decisions.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

11

Which purpose of cost allocation is used to decide on the selling price for a customized product or service?

A)to provide information for economic decisions

B)to motivate managers and other employees

C)to justify costs or compute reimbursement

D)to measure income and assets for reporting to external parties

A)to provide information for economic decisions

B)to motivate managers and other employees

C)to justify costs or compute reimbursement

D)to measure income and assets for reporting to external parties

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

12

Any item for which a separate measurement of cost is desired is known as:

A)cost allocation

B)a cost object

C)a direct cost

D)an indirect cost

A)cost allocation

B)a cost object

C)a direct cost

D)an indirect cost

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

13

Indirect costs are costs that CANNOT be traced to cost objects in an economically feasible way.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

14

For external reporting, inventoriable costs under GAAP sometimes include R&D costs.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

15

The costs of all six value-chain functions should be included when determining:

A)whether to add a new product line

B)the selling price of a service

C)whether to make or buy a component part from another manufacturer

D)All of these answers are correct.

A)whether to add a new product line

B)the selling price of a service

C)whether to make or buy a component part from another manufacturer

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following illustrates a purpose for allocating costs to cost objects?

A)to motivate managers and employees

B)to provide information to customers

C)to determine a selling price the market will bear

D)to measure liabilities

A)to motivate managers and employees

B)to provide information to customers

C)to determine a selling price the market will bear

D)to measure liabilities

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

17

All of the following illustrate purposes for allocating costs to cost objects EXCEPT to:

A)provide information for economic decisions

B)motivate managers and employees

C)determine a selling price the market will bear

D)measure income and assets for reporting to external parties

A)provide information for economic decisions

B)motivate managers and employees

C)determine a selling price the market will bear

D)measure income and assets for reporting to external parties

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

18

Costs which are NOT economically feasible to trace but which are related to a cost object are known as:

A)fixed costs

B)direct costs

C)indirect costs

D)variable costs

A)fixed costs

B)direct costs

C)indirect costs

D)variable costs

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

19

Indirect costs:

A)often comprise a large percentage of overall costs assigned to a cost object

B)specifically exclude marketing costs

C)cannot be used for external reporting

D)are treated as period costs and not as product costs

A)often comprise a large percentage of overall costs assigned to a cost object

B)specifically exclude marketing costs

C)cannot be used for external reporting

D)are treated as period costs and not as product costs

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

20

Which purpose of cost allocation is used to cost inventories for reporting to tax authorities?

A)to provide information for economic decisions

B)to motivate managers and other employees

C)to justify costs or compute reimbursement

D)to measure income and assets for reporting to external parties

A)to provide information for economic decisions

B)to motivate managers and other employees

C)to justify costs or compute reimbursement

D)to measure income and assets for reporting to external parties

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

21

Some companies only allocate corporate costs to divisions that are:

A)planned and under the control of division managers

B)output unit-level costs

C)perceived as causally related to division activities

D)direct costs

A)planned and under the control of division managers

B)output unit-level costs

C)perceived as causally related to division activities

D)direct costs

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

22

Corporate overhead costs can be allocated:

A)using a single cost pool

B)to divisions using one cost pool and then reallocating costs to products using multiple cost pools

C)using numerous individual corporate cost pools

D)All of these answers are correct.

A)using a single cost pool

B)to divisions using one cost pool and then reallocating costs to products using multiple cost pools

C)using numerous individual corporate cost pools

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

23

Under the fairness criterion, cost allocation is NOT viewed as a reasonable means of establishing a selling price.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

24

To guide cost allocation decisions, the fairness or equity criterion is:

A)the criterion often cited in government contracts

B)superior when the purpose of cost allocation is for economic decisions

C)used more frequently than the other criteria

D)the primary criterion used in activity-based costing

A)the criterion often cited in government contracts

B)superior when the purpose of cost allocation is for economic decisions

C)used more frequently than the other criteria

D)the primary criterion used in activity-based costing

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

25

Using the fairness criterion, the costs are allocated among the beneficiaries in proportion to the benefits each receives.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

26

A challenge to using cost-benefit criteria for allocating costs is that:

A)the costs of designing and implementing complex cost allocations are not readily apparent

B)the benefits of making better-informed pricing decisions are difficult to measure

C)cost systems are being simplified and fewer multiple cost-allocation bases are being used

D)the costs of collecting and processing information keep spiraling upward

A)the costs of designing and implementing complex cost allocations are not readily apparent

B)the benefits of making better-informed pricing decisions are difficult to measure

C)cost systems are being simplified and fewer multiple cost-allocation bases are being used

D)the costs of collecting and processing information keep spiraling upward

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

27

To guide cost allocation decisions, the cause-and-effect criterion:

A)is used less frequently than the other criteria

B)is the primary criterion used in activity-based costing

C)is a difficult criterion on which to obtain agreement

D)may allocate corporate salaries to divisions based on profits

A)is used less frequently than the other criteria

B)is the primary criterion used in activity-based costing

C)is a difficult criterion on which to obtain agreement

D)may allocate corporate salaries to divisions based on profits

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

28

The most likely reason for allocating all corporate costs to divisions include that:

A)division managers make decisions that ultimately control corporate costs

B)divisions receive benefits from all corporate costs

C)the hierarchy of costs promotes cost management

D)it is best to use multiple cost objects

A)division managers make decisions that ultimately control corporate costs

B)divisions receive benefits from all corporate costs

C)the hierarchy of costs promotes cost management

D)it is best to use multiple cost objects

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

29

Which is the preferred allocation method for performance evaluation?

A)allocating all corporate costs

B)allocating only human resource cost

C)allocating controllable costs

D)allocating uncontrollable costs

A)allocating all corporate costs

B)allocating only human resource cost

C)allocating controllable costs

D)allocating uncontrollable costs

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

30

NOT allocating some corporate costs to divisions and products results in:

A)an increase in overall corporate profitability

B)the sum of individual product profitability being less than overall company profitability

C)the sum of individual product profitability being greater than overall company profitability

D)a decrease in overall corporate profitability

A)an increase in overall corporate profitability

B)the sum of individual product profitability being less than overall company profitability

C)the sum of individual product profitability being greater than overall company profitability

D)a decrease in overall corporate profitability

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

31

Which cost-allocation criterion is most likely to subsidize poor performers at the expense of the best performers?

A)the fairness or equity criterion

B)the benefits-received criterion

C)the ability to bear criterion

D)the cause-and-effect criterion

A)the fairness or equity criterion

B)the benefits-received criterion

C)the ability to bear criterion

D)the cause-and-effect criterion

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

32

The benefits of implementing a more-complex cost allocation system are relatively easy to quantify for application of the cost-benefit approach.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

33

To guide cost allocation decisions, the ability to bear criterion:

A)is likely to be the most credible to operating personnel

B)allocates costs in proportion to the benefits received

C)results in subsidizing products that are not profitable

D)is the criterion often cited in government contracts

A)is likely to be the most credible to operating personnel

B)allocates costs in proportion to the benefits received

C)results in subsidizing products that are not profitable

D)is the criterion often cited in government contracts

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

34

When the purpose of cost allocation is to provide information for economic decisions or to motivate managers and employees, the best criteria are:

A)the cause-and-effect and the ability-to bear criteria

B)the cause-and-effect and the benefits-received criteria

C)the benefits-received and the fairness criteria

D)the fairness and the ability-to-bear criteria

A)the cause-and-effect and the ability-to bear criteria

B)the cause-and-effect and the benefits-received criteria

C)the benefits-received and the fairness criteria

D)the fairness and the ability-to-bear criteria

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

35

The ability-to-bear criterion is considered superior when the purpose of cost allocation is motivation.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

36

Today, companies are simplifying their cost systems and moving toward less-detailed and less-complex cost allocation bases.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

37

The most likely reason for NOT allocating corporate costs to divisions include that:

A)these costs are not controllable by division managers

B)these costs are incurred to support division activities, not corporate activities

C)division resources are already used to attain corporate goals

D)divisions receive no benefits from corporate costs

A)these costs are not controllable by division managers

B)these costs are incurred to support division activities, not corporate activities

C)division resources are already used to attain corporate goals

D)divisions receive no benefits from corporate costs

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

38

To guide cost allocation decisions, the benefits-received criterion:

A)generally uses the cost driver as the cost allocation base

B)results in subsidizing products that are not profitable

C)is the primarily used criterion in activity-based costing

D)may use an allocation base of division revenues to allocate advertising costs

A)generally uses the cost driver as the cost allocation base

B)results in subsidizing products that are not profitable

C)is the primarily used criterion in activity-based costing

D)may use an allocation base of division revenues to allocate advertising costs

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

39

When using the cause-and-effect criterion, cost drivers are selected as the cost allocation bases.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

40

Which cost-allocation criterion is appropriate when making an economic decision?

A)the fairness or equity criterion

B)the ability to bear criterion

C)the cause-and-effect criterion

D)All of these answers are correct.

A)the fairness or equity criterion

B)the ability to bear criterion

C)the cause-and-effect criterion

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

41

The three major corporate cost categories are treasury, human resource management, and corporate administration costs.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

42

Answer the following questions using the information below:

The Hassan Corporation has an Electric Mixer Division and an Electric Lamp Division. Of a $10,000,000 bond issuance, the Electric Mixer Division used $7,000,000 and the Electric Lamp Division used $3,000,000 for expansion. Interest costs on the bond totaled $750,000 for the year.

The above interest costs would be considered a(n):

A)output unit-level cost

B)facility-sustaining cost

C)product-sustaining cost

D)batch-level cost

The Hassan Corporation has an Electric Mixer Division and an Electric Lamp Division. Of a $10,000,000 bond issuance, the Electric Mixer Division used $7,000,000 and the Electric Lamp Division used $3,000,000 for expansion. Interest costs on the bond totaled $750,000 for the year.

The above interest costs would be considered a(n):

A)output unit-level cost

B)facility-sustaining cost

C)product-sustaining cost

D)batch-level cost

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

43

Identifying homogeneous cost pools:

A)requires judgment and should be reevaluated on a regular basis

B)should include the input of management

C)should include a cost-benefit analysis

D)All of these answers are correct.

A)requires judgment and should be reevaluated on a regular basis

B)should include the input of management

C)should include a cost-benefit analysis

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

44

Allocating all corporate costs motivates division managers to examine how corporate costs are planned and controlled.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

45

If a cost pool is homogeneous, the cost allocations using that pool will be the same as they would be if costs of each individual activity in that pool were allocated separately.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

46

Once a cost pool has been established, it should NOT need to be revisited or revised.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

47

An individual cost item can be simultaneously a direct cost of one cost object and an indirect cost of another cost object.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

48

Corporate administrative costs allocated to a division cost pool are most likely to be:

A)output unit-level costs

B)facility-sustaining costs

C)product-sustaining costs

D)batch-level costs

A)output unit-level costs

B)facility-sustaining costs

C)product-sustaining costs

D)batch-level costs

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

49

Costs in a homogeneous cost pools have the same or a similar cause-and-effect or benefits-received relationship with the cost-allocation base.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

50

Answer the following questions using the information below:

The Hassan Corporation has an Electric Mixer Division and an Electric Lamp Division. Of a $10,000,000 bond issuance, the Electric Mixer Division used $7,000,000 and the Electric Lamp Division used $3,000,000 for expansion. Interest costs on the bond totaled $750,000 for the year.

What amount of interest costs should be allocated to the Electric Lamp Division?

A)$225,000

B)$525,,000

C)$2,100,000

D)$3,000,000

The Hassan Corporation has an Electric Mixer Division and an Electric Lamp Division. Of a $10,000,000 bond issuance, the Electric Mixer Division used $7,000,000 and the Electric Lamp Division used $3,000,000 for expansion. Interest costs on the bond totaled $750,000 for the year.

What amount of interest costs should be allocated to the Electric Lamp Division?

A)$225,000

B)$525,,000

C)$2,100,000

D)$3,000,000

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

51

Answer the following questions using the information below:

The Hassan Corporation has an Electric Mixer Division and an Electric Lamp Division. Of a $10,000,000 bond issuance, the Electric Mixer Division used $7,000,000 and the Electric Lamp Division used $3,000,000 for expansion. Interest costs on the bond totaled $750,000 for the year.

What amount of interest costs should be allocated to the Electric Mixer Division?

A)$225,000

B)$525,000

C)$2,100,000

D)$7,000,000

The Hassan Corporation has an Electric Mixer Division and an Electric Lamp Division. Of a $10,000,000 bond issuance, the Electric Mixer Division used $7,000,000 and the Electric Lamp Division used $3,000,000 for expansion. Interest costs on the bond totaled $750,000 for the year.

What amount of interest costs should be allocated to the Electric Mixer Division?

A)$225,000

B)$525,000

C)$2,100,000

D)$7,000,000

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

52

Homogeneous cost pools lead to:

A)more accurate costs of a given cost object

B)more resources being assigned to that cost object

C)the need for more cost drivers

D)Both A and C are correct.

A)more accurate costs of a given cost object

B)more resources being assigned to that cost object

C)the need for more cost drivers

D)Both A and C are correct.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

53

To allocate corporate costs to divisions, the allocation base used should:

A)be an output unit-level base

B)have the best cause-and-effect relationship with the costs

C)combine administrative costs and human resource management costs

D)allocate the full costs

A)be an output unit-level base

B)have the best cause-and-effect relationship with the costs

C)combine administrative costs and human resource management costs

D)allocate the full costs

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

54

When there is a lesser degree of homogeneity, fewer cost pools are required to accurately explain the use of company resources.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

55

The greater the degree of homogeneity, the:

A)greater the number of needed cost pools

B)fewer the number of needed cost pools

C)less accurate the costs of a particular cost object

D)greater the variety of cause-and-effect relationships with the cost driver

A)greater the number of needed cost pools

B)fewer the number of needed cost pools

C)less accurate the costs of a particular cost object

D)greater the variety of cause-and-effect relationships with the cost driver

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

56

To manage setup costs, a corporation might focus on the:

A)number of setup-hours

B)number of units included in each production run

C)batch-level costs incurred per setup-hour

D)Both A and C are correct.

A)number of setup-hours

B)number of units included in each production run

C)batch-level costs incurred per setup-hour

D)Both A and C are correct.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

57

Companies that want to calculate the full cost of products must allocate all corporate costs to indirect-cost pools of divisions.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

58

When individual activities within a cost pool have a similar relationship with the cost driver, those costs:

A)need to be reallocated

B)need multiple cost drivers

C)are considered a homogeneous cost pool

D)are considered an allocated cost pool

A)need to be reallocated

B)need multiple cost drivers

C)are considered a homogeneous cost pool

D)are considered an allocated cost pool

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

59

Answer the following questions using the information below:

The Hassan Corporation has an Electric Mixer Division and an Electric Lamp Division. Of a $10,000,000 bond issuance, the Electric Mixer Division used $7,000,000 and the Electric Lamp Division used $3,000,000 for expansion. Interest costs on the bond totaled $750,000 for the year.

Which corporate costs should be allocated to divisions?

A)fixed costs only

B)variable costs only

C)neither fixed nor variable costs

D)both fixed and variable costs

The Hassan Corporation has an Electric Mixer Division and an Electric Lamp Division. Of a $10,000,000 bond issuance, the Electric Mixer Division used $7,000,000 and the Electric Lamp Division used $3,000,000 for expansion. Interest costs on the bond totaled $750,000 for the year.

Which corporate costs should be allocated to divisions?

A)fixed costs only

B)variable costs only

C)neither fixed nor variable costs

D)both fixed and variable costs

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

60

Advances in information-gathering technology make it more likely that multiple cost-pool systems will pass the cost-benefit test.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

61

Corporate-sustaining costs are costs of activities to support individual customers, regardless of the number of units or batches of product delivered to the customer.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

62

Price discounts must be uniform among all customers.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

63

Should a company allocate its corporate costs to divisions?

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

64

Customers making large contributions to the profitability of the company should:

A)be treated the same as other customers because all customers are important

B)receive a higher level of attention from the company than less profitable customers

C)be charged higher prices for the same products than less profitable customers

D)not be offered the volume-based price discounts offered to less profitable customers

A)be treated the same as other customers because all customers are important

B)receive a higher level of attention from the company than less profitable customers

C)be charged higher prices for the same products than less profitable customers

D)not be offered the volume-based price discounts offered to less profitable customers

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

65

In general, distribution-channel costs are more easily influenced by customer actions than customer batch-level costs.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

66

Customer revenues and ________ are the determinants of customer profitability

A)customer profile

B)customer costs

C)customer location

D)customer industry

A)customer profile

B)customer costs

C)customer location

D)customer industry

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

67

To improve customer profitability, companies should track:

A)only the final invoice price of a sale

B)the volume of the products purchased by each customer

C)discounts taken by each customer

D)Both B and C are correct.

A)only the final invoice price of a sale

B)the volume of the products purchased by each customer

C)discounts taken by each customer

D)Both B and C are correct.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

68

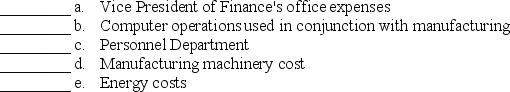

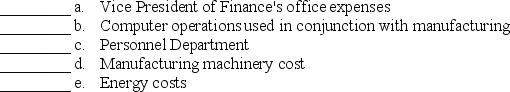

For each cost pool listed select an appropriate allocation base from the list below. An allocation base may be used only once. Assume a manufacturing company.

Allocation bases for which the information system can provide data:

1. Number of employees per department

2. Employee wages and salaries per department

3. Production facility square footage

4. Hours of operation of each production department

5. Machine hours by department

6. Operations costs of each department

7. Hours of computer use per month per department

8. Indirect labor-hours per department

Cost pools:

Allocation bases for which the information system can provide data:

1. Number of employees per department

2. Employee wages and salaries per department

3. Production facility square footage

4. Hours of operation of each production department

5. Machine hours by department

6. Operations costs of each department

7. Hours of computer use per month per department

8. Indirect labor-hours per department

Cost pools:

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

69

An activity-based costing system may focus on customers rather than products.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

70

All customers are equally important to a company and should receive equal levels of attention.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

71

A customer cost hierarchy categorizes costs related to customers into different cost pools on the basis of using only one cost driver.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

72

Price discounts should NEVER be viewed as:

A)price discrimination

B)predatory pricing

C)unethical

D)All of the above are correct.

A)price discrimination

B)predatory pricing

C)unethical

D)All of the above are correct.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

73

If one of five distribution channels is discontinued, corporate-sustaining costs such as general administration costs will most likely be reduced by 20%.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

74

Customer-profitability analysis is the reporting and assessment of revenues earned from customers and the costs incurred to earn those revenues.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

75

A customer cost hierarchy may include distribution-channel costs.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

76

Price discounts are influenced by:

A)the volume of product purchased

B)a desire to sell to a customer in an area with high-growth potential

C)negotiating skills of the sales person

D)All of these answers are correct.

A)the volume of product purchased

B)a desire to sell to a customer in an area with high-growth potential

C)negotiating skills of the sales person

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

77

A customer cost hierarchy may include customer-sustaining costs.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

78

Companies that only record the invoice price can usually track the magnitude of price discounting.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

79

To improve customer profitability, companies should:

A)strictly enforce their volume-based price discounting policy

B)track discounts by customer

C)track discounts by sales person

D)Both B and C are correct.

A)strictly enforce their volume-based price discounting policy

B)track discounts by customer

C)track discounts by sales person

D)Both B and C are correct.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

80

There are two elements that influence customer profitability revenues and costs.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck