Deck 22: Capital Budgeting: a Closer Look

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

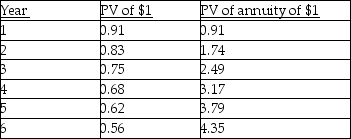

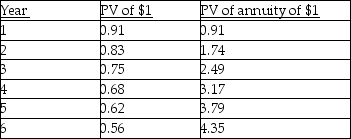

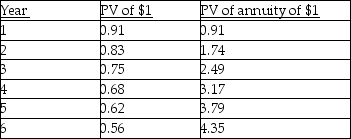

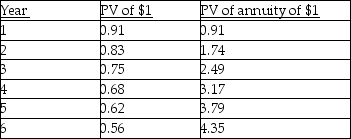

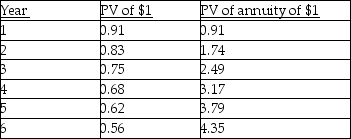

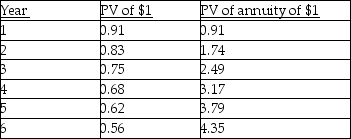

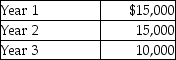

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/120

Play

Full screen (f)

Deck 22: Capital Budgeting: a Closer Look

1

A decrease in the tax rate will decrease the net present value (NPV) for a given capital budgeting project.

False

2

A capital proposal is projected to result in annual savings of $25,000. What is the after-tax cash flow if the tax rate is 35%?

A) $25,000

B) $16,250

C) $8,750

D) $7,500

E) $5,000

A) $25,000

B) $16,250

C) $8,750

D) $7,500

E) $5,000

B

3

The tax effects are significant in capital budgeting decisions.

True

4

The half-year rule assumes that all net additions are purchased in the middle of the year, and thus only one-half of the stated CCA rate is allowed in the first year.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

5

The use of an accelerated method of depreciation for tax purposes would usually increase the present value of the investment.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

6

In case of a sale or trade of a capital asset for another capital asset, the net tax book value of the asset can be ignored for capital budgeting purposes.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

7

Businesses may opt not to claim the full amount of available capital cost allowance.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

8

Capital Cost Allowance (CCA) is a cash flow.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

9

In the net present value (NPV) method, after-tax cash flows should be used instead of pre-tax cash flows when taxes are a consideration.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

10

When considering the net cash inflows resulting from a capital-budgeting decision, taxes will

A) reduce the amount of the cash savings by the tax rate.

B) increase the amount of the cash savings by the tax rate.

C) increase the amount of the cash savings by (1 - tax rate).

D) reduce the amount of the cash savings by (1 - tax rate).

E) increase the amount of the cash savings by (1 + tax rate).

A) reduce the amount of the cash savings by the tax rate.

B) increase the amount of the cash savings by the tax rate.

C) increase the amount of the cash savings by (1 - tax rate).

D) reduce the amount of the cash savings by (1 - tax rate).

E) increase the amount of the cash savings by (1 + tax rate).

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

11

Capital cost allowance is the income tax version of financial reporting depreciation.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

12

The disposal of a machine (or any depreciable asset) results in a lost tax shield.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

13

The acquisition cost of the assets in a class, minus the CCA claimed to date for that class, is referred to as the UCC of a particular class.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

14

The Income Tax Act does not permit a company to deduct depreciation in the calculation of taxable income.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

15

A Canadian corporation can deduct a full year's worth of CCA on any asset acquired in the year.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

16

The Income Tax Act classifies every amortizable asset into one of several classes.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

17

CCA reduces taxable income, and therefore reduces tax payments and increases the firm's cash flow.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

18

After-tax cash-operating flows are equal to

A) (one minus the tax rate) times (net income).

B) (one minus the tax rate) times (operating income) plus CCA.

C) (one minus the tax rate) times (sales less costs excluding CCA).

D) sales less (one minus the tax rate) times (cash costs).

E) (one minus the tax rate) times (sales less costs including CCA).

A) (one minus the tax rate) times (net income).

B) (one minus the tax rate) times (operating income) plus CCA.

C) (one minus the tax rate) times (sales less costs excluding CCA).

D) sales less (one minus the tax rate) times (cash costs).

E) (one minus the tax rate) times (sales less costs including CCA).

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

19

After-tax savings from an operating cash outflow are calculated by multiplying the cash flow by (1 - t), where t = the tax rate.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

20

Depreciation tax deductions result in tax savings that partially offset the cost of acquiring the capital asset.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

21

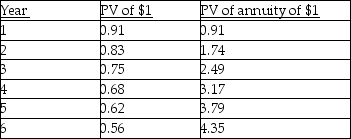

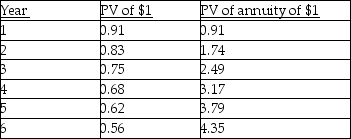

For Years 1 through 6 Better Products Ltd. had annual net income of $20,000, CCA of $40,000 each year, a 40 percent tax rate, a discount rate of 10 percent and annual cash sales of $200,000. The depreciable assets of Better Products belong in several different classes under the Income tax Act, have a salvage value of zero at the end of six years, and were all bought new at the beginning of Year 1. The present value factors, in simplified form, for 10 percent are:

Biermann Equipment is a publicly held corporation required to pay income taxes. For the current year it had revenues of $5,000,000 and cash expenses of $3,000,000, and claimed CCA of $200,000. The company has a 30 percent tax rate. What would be the net cash flow for the current year if all revenues were received in cash?

A) $600,000

B) $1,260,000

C) $1,460,000

D) $1,800,000

E) $2,000,000

Biermann Equipment is a publicly held corporation required to pay income taxes. For the current year it had revenues of $5,000,000 and cash expenses of $3,000,000, and claimed CCA of $200,000. The company has a 30 percent tax rate. What would be the net cash flow for the current year if all revenues were received in cash?

A) $600,000

B) $1,260,000

C) $1,460,000

D) $1,800,000

E) $2,000,000

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

22

A company purchased a class 8 asset (there were no disposals). If the asset cost $20,000, had an estimated salvage value of $5,000, using the declining balance method with an allowable rate of 20%, the allowable CCA in the first and second years would be, respectively,

A) $1,500 and $2,700.

B) $2,000 and $3,600.

C) $3,000 and $2,400.

D) $3,000 and $1,200.

E) $4,000 and $3,200.

A) $1,500 and $2,700.

B) $2,000 and $3,600.

C) $3,000 and $2,400.

D) $3,000 and $1,200.

E) $4,000 and $3,200.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

23

What is the balance in the Class 8 pool after the addition of the new equipment?

A) $350,000

B) $410,000

C) $450,000

D) $430,000

E) $460,000

A) $350,000

B) $410,000

C) $450,000

D) $430,000

E) $460,000

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

24

Canada, like most taxing authorities, uses different methods for calculating depreciation for tax purposes. The Income Tax Act uses which of the following methods?

A) accelerated amortization

B) straight-line and accelerated amortization

C) straight-line, double declining balance, and accelerated amortization

D) straight-line and declining balance

E) double declining balance and accelerated amortization only

A) accelerated amortization

B) straight-line and accelerated amortization

C) straight-line, double declining balance, and accelerated amortization

D) straight-line and declining balance

E) double declining balance and accelerated amortization only

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is not a relevant cash flow in capital budgeting?

A) after-tax cash flow from current disposal of old asset

B) after-tax cash flow from future disposal of asset at life's end

C) after-tax cash flow from accumulated depreciation

D) initial asset investment of the replacement machine

E) after-tax annual cash flows relating to the new asset

A) after-tax cash flow from current disposal of old asset

B) after-tax cash flow from future disposal of asset at life's end

C) after-tax cash flow from accumulated depreciation

D) initial asset investment of the replacement machine

E) after-tax annual cash flows relating to the new asset

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

26

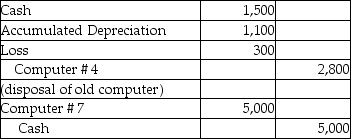

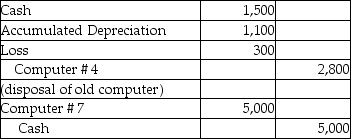

A company purchased computer equipment that is Class 10 for Income Tax purposes (Class 10 is declining balance, but with a 30% rate). The company made the following two journal entries:  How is the $300 loss treated in discounted cash flow analysis?

How is the $300 loss treated in discounted cash flow analysis?

A) It reduces the net additions to class 10 for calculating CCA.

B) The loss times the tax rate is an after-tax cash flow.

C) The loss plus the accumulated amortization are disposals for class 10.

D) It reduces the net additions to class 10 for calculating CCA, and (the loss) times (the tax rate) is an after-tax cash flow.

E) It is ignored.

How is the $300 loss treated in discounted cash flow analysis?

How is the $300 loss treated in discounted cash flow analysis?A) It reduces the net additions to class 10 for calculating CCA.

B) The loss times the tax rate is an after-tax cash flow.

C) The loss plus the accumulated amortization are disposals for class 10.

D) It reduces the net additions to class 10 for calculating CCA, and (the loss) times (the tax rate) is an after-tax cash flow.

E) It is ignored.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

27

For Years 1 through 6 Better Products Ltd. had annual net income of $20,000, CCA of $40,000 each year, a 40 percent tax rate, a discount rate of 10 percent and annual cash sales of $200,000. The depreciable assets of Better Products belong in several different classes under the Income tax Act, have a salvage value of zero at the end of six years, and were all bought new at the beginning of Year 1. The present value factors, in simplified form, for 10 percent are:

If the appropriate tax rate is 35%, the after-tax effect of a single CCA deduction of $60,000 is

A) $39,000 net after-tax cash outflow.

B) $39,000 net after-tax cash inflow.

C) $21,000 net after-tax cash outflow.

D) $21,000 net after-tax cash inflow.

E) $24,000 net after-tax cash inflow.

If the appropriate tax rate is 35%, the after-tax effect of a single CCA deduction of $60,000 is

A) $39,000 net after-tax cash outflow.

B) $39,000 net after-tax cash inflow.

C) $21,000 net after-tax cash outflow.

D) $21,000 net after-tax cash inflow.

E) $24,000 net after-tax cash inflow.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

28

The income tax depreciation method referred to as CCA

A) allows a corporation some flexibility in choosing the class an asset is assigned to.

B) ignores estimated salvage value.

C) only applies to businesses organized as corporations.

D) provides an organization some flexibility in choosing a method of amortization.

E) allows amortization over the asset's useful life as determined by management.

A) allows a corporation some flexibility in choosing the class an asset is assigned to.

B) ignores estimated salvage value.

C) only applies to businesses organized as corporations.

D) provides an organization some flexibility in choosing a method of amortization.

E) allows amortization over the asset's useful life as determined by management.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

29

What is the CCA claim in year 1?

A) $3,500

B) $7,000

C) $8,000

D) $16,000

E) $18,400

A) $3,500

B) $7,000

C) $8,000

D) $16,000

E) $18,400

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

30

A project's net present value is increased if

A) the CCA rate is decreased.

B) the discount rate is increased.

C) the CCA rate is increased.

D) the company's net income is negative during the life of the project.

E) the rate of inflation rises.

A) the CCA rate is decreased.

B) the discount rate is increased.

C) the CCA rate is increased.

D) the company's net income is negative during the life of the project.

E) the rate of inflation rises.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

31

Wilf Company acquired an additional Class 10 (30% declining balance) asset for $60,000. The UCC at the beginning of the year was $100,000. CCA in the current year is

A) $48,000.

B) $24,000.

C) $45,000.

D) $37,500.

E) $39,000.

A) $48,000.

B) $24,000.

C) $45,000.

D) $37,500.

E) $39,000.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

32

A new machine will cost $500,000. It is in a CCA class pool that uses a declining balance rate of 30%. The company's tax rate is 40% and it requires a 15% rate of return on investments. Calculate the cash savings from the tax shield the first year assuming the savings occur at year end.

A) $126,998.42

B) $78,214.34

C) $132,445.53

D) $119,765.22

E) $26,086.96

A) $126,998.42

B) $78,214.34

C) $132,445.53

D) $119,765.22

E) $26,086.96

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

33

When calculating the lost tax shield concerning the terminal disposition of an asset four years from now,

A) the amount calculated by the Tax Shield formula must also be discounted for the four years by the relevant discount factor.

B) the discount is already included in the formula.

C) we discount the Lost Tax Shield amount by the tax rate.

D) we discount the Lost Tax Shield amount by (1 - tax rate).

E) we discount the Lost Tax Shield amount by (1 + tax rate).

A) the amount calculated by the Tax Shield formula must also be discounted for the four years by the relevant discount factor.

B) the discount is already included in the formula.

C) we discount the Lost Tax Shield amount by the tax rate.

D) we discount the Lost Tax Shield amount by (1 - tax rate).

E) we discount the Lost Tax Shield amount by (1 + tax rate).

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

34

The three factors that generally influence depreciation for tax purposes are: amount allowable for depreciation, allowable life of asset, and allowable methods of depreciation. In Canada, for tax purposes,

A) the amount allowable for CCA is the cost of the asset, and, the allowable life of asset and the amount of salvage value are determined by its Class under the Income Tax Act.

B) the amount allowable for CCA is the cost of the asset; the tax-based depreciation rate is determined by the Class of the asset under the Income Tax Act, and neither the estimated life of asset nor the amount of estimated salvage value are relevant in calculating the CCA claim.

C) the allowable depreciation for tax purposes (CCA) is increased for the first year only.

D) depreciable assets are placed in various classes by the Income Tax Act, based on their estimated salvage value.

E) in the year of acquisition of new assets into an existing pool the allowable CCA claim is based on 50% of all the assets in the pool.

A) the amount allowable for CCA is the cost of the asset, and, the allowable life of asset and the amount of salvage value are determined by its Class under the Income Tax Act.

B) the amount allowable for CCA is the cost of the asset; the tax-based depreciation rate is determined by the Class of the asset under the Income Tax Act, and neither the estimated life of asset nor the amount of estimated salvage value are relevant in calculating the CCA claim.

C) the allowable depreciation for tax purposes (CCA) is increased for the first year only.

D) depreciable assets are placed in various classes by the Income Tax Act, based on their estimated salvage value.

E) in the year of acquisition of new assets into an existing pool the allowable CCA claim is based on 50% of all the assets in the pool.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements is true?

A) The accounting book value for all assets in a class equals the UCC for that class.

B) The CCA claimed does not affect cash outflows.

C) The total CCA available over the life of the asset depends on the method of depreciation used.

D) Since CCA does not involve a cash expenditure, it can be ignored in capital-budgeting decisions.

E) The depreciation method used does not affect cash inflows from operations.

A) The accounting book value for all assets in a class equals the UCC for that class.

B) The CCA claimed does not affect cash outflows.

C) The total CCA available over the life of the asset depends on the method of depreciation used.

D) Since CCA does not involve a cash expenditure, it can be ignored in capital-budgeting decisions.

E) The depreciation method used does not affect cash inflows from operations.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

36

What are the tax savings in year 2 from the investment?

A) $3,500

B) $7,000

C) $8,000

D) $5,040

E) $18,400

A) $3,500

B) $7,000

C) $8,000

D) $5,040

E) $18,400

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

37

For Years 1 through 6 Better Products Ltd. had annual net income of $20,000, CCA of $40,000 each year, a 40 percent tax rate, a discount rate of 10 percent and annual cash sales of $200,000. The depreciable assets of Better Products belong in several different classes under the Income tax Act, have a salvage value of zero at the end of six years, and were all bought new at the beginning of Year 1. The present value factors, in simplified form, for 10 percent are:

What is the annual expense deduction for CCA?

A) $16,000

B) $24,000

C) $36,000

D) $40,000

E) $42,500

What is the annual expense deduction for CCA?

A) $16,000

B) $24,000

C) $36,000

D) $40,000

E) $42,500

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following are not considered in capital-budgeting?

A) initial machine investment

B) depreciation

C) cash flow from current disposal of old machine

D) cash flow from terminal disposal of new machine

E) recurring after-tax operating flows

A) initial machine investment

B) depreciation

C) cash flow from current disposal of old machine

D) cash flow from terminal disposal of new machine

E) recurring after-tax operating flows

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

39

Based on the above data only, what are the tax savings from the CCA of class 8 for year 2?

A) $45,760

B) $70,400

C) $75,000

D) $24,640

E) $86,000

A) $45,760

B) $70,400

C) $75,000

D) $24,640

E) $86,000

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

40

For Years 1 through 6 Better Products Ltd. had annual net income of $20,000, CCA of $40,000 each year, a 40 percent tax rate, a discount rate of 10 percent and annual cash sales of $200,000. The depreciable assets of Better Products belong in several different classes under the Income tax Act, have a salvage value of zero at the end of six years, and were all bought new at the beginning of Year 1. The present value factors, in simplified form, for 10 percent are:

What is the tax saving from CCA in each year?

A) $16,000

B) $24,000

C) $36,000

D) $54,000

E) $14,400

What is the tax saving from CCA in each year?

A) $16,000

B) $24,000

C) $36,000

D) $54,000

E) $14,400

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

41

Headwaters Ltd. is considering purchasing a new asset. It has a cost of $1,350,000, an expected 6 year life and a salvage value of $90,000. The equipment would qualify as a class 8 (20% CCA) asset and Headwaters has a required rate of return of 11% and an effective tax rate of 32%.

Required:

Calculate the tax shields that are generated from the purchase of this asset. Assume the asset will be placed in a pool and the pool will continue upon disposition. For tax purposes the disposition will occur on day 1 of Year 7. What is the net tax effect of the asset acquisition?

Required:

Calculate the tax shields that are generated from the purchase of this asset. Assume the asset will be placed in a pool and the pool will continue upon disposition. For tax purposes the disposition will occur on day 1 of Year 7. What is the net tax effect of the asset acquisition?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

42

Clock Manufacturing Company purchased a new piece of equipment at a cost of $60,000 at the beginning of the year. For tax purposes the machine is a Class 8 asset (20% declining balance). The company has a 34 percent income tax rate. Assume that the company has no other Class 8 assets during the period.

Required:

a. Compute the amount of tax savings from CCA for the first three years.

b. Compute the amount of tax savings from CCA for the first three years using a required rate of return of 12 percent.

Required:

a. Compute the amount of tax savings from CCA for the first three years.

b. Compute the amount of tax savings from CCA for the first three years using a required rate of return of 12 percent.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

43

The differential approach calculates the present value of all cash inflows and outflows under each alternative.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

44

Allan Ltd. is considering purchasing a new asset. It has a cost of $435,000, an expected 4 year life and a salvage value of $150,000. The equipment would qualify as a class 10 (30% CCA) asset and Allan has a required rate of return of 13% and an effective tax rate of 36%.

Required:

Assume that this asset is the only asset in the pool. Assuming the asset is disposed of at its estimated salvage value, what is the tax effect on the disposition of the asset? Assume the asset will be disposed of on day 1 of year 5 so the asset is eligible for CCA claims in year 4.

Required:

Assume that this asset is the only asset in the pool. Assuming the asset is disposed of at its estimated salvage value, what is the tax effect on the disposition of the asset? Assume the asset will be disposed of on day 1 of year 5 so the asset is eligible for CCA claims in year 4.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

45

A new machine will cost $720,000. It is in a CCA class pool that uses a declining balance rate of 20%. The company's tax rate is 42% and it requires a 12% rate of return on investments. Calculate the cash savings from the tax shield the first year assuming the savings occur at year end.

A) $60,480.00

B) $54,000.00

C) $27,000.00

D) $30,240.00

E) $37,285.71

A) $60,480.00

B) $54,000.00

C) $27,000.00

D) $30,240.00

E) $37,285.71

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

46

What is the balance in the Class 10 pool after the addition of the new equipment?

A) $780,000

B) $940,000

C) $1,040,000

D) $430,000

E) $1,200,000

A) $780,000

B) $940,000

C) $1,040,000

D) $430,000

E) $1,200,000

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

47

Johnson's Mini Mart is considering the purchase of a new electronic bar code scanner that will keep detailed records of every sale transaction. The scanner is likely to have little effect on operating revenues and expenses. Its acquisition is primarily for increasing management information about sales. The scanner costs $4,600 and would be included in Class 10 for tax purposes. Johnson's accountant has stated that due to the fast write-off of Class 10 assets (30% CCA rate), its real cost is less than $4,600.

Due to technological obsolescence, it would have zero salvage value.

Required:

a. Since the bar code scanner cannot produce a profit or even show short run savings, should it even be evaluated as a capital budgeting expenditure? Explain.

b. Explain whether or not the real cost is less than $4,600.

c. If the company has a 40 percent tax rate and a 10% discount rate, compute the real cost of the bar code scanner. Assume there would be other assets in the class.

Due to technological obsolescence, it would have zero salvage value.

Required:

a. Since the bar code scanner cannot produce a profit or even show short run savings, should it even be evaluated as a capital budgeting expenditure? Explain.

b. Explain whether or not the real cost is less than $4,600.

c. If the company has a 40 percent tax rate and a 10% discount rate, compute the real cost of the bar code scanner. Assume there would be other assets in the class.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

48

Both the total-project approach and the differential approach present a net present value that

A) will always be the same amount.

B) will rarely be the same amount.

C) will only be the same when net present value is positive.

D) will only be the same when net present value is negative.

E) will only be the same when nominal cash flows are considered.

A) will always be the same amount.

B) will rarely be the same amount.

C) will only be the same when net present value is positive.

D) will only be the same when net present value is negative.

E) will only be the same when nominal cash flows are considered.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

49

The total project approach to capital budgeting

A) calculates the present value of all cash inflows and outflows under each alternative separately.

B) calculates the net present value for the incremental cash flows.

C) calculates the net present value of cash flows which differ between alternatives.

D) uses gross cash flows to determine net present values.

E) produces the same answer as the IRR method.

A) calculates the present value of all cash inflows and outflows under each alternative separately.

B) calculates the net present value for the incremental cash flows.

C) calculates the net present value of cash flows which differ between alternatives.

D) uses gross cash flows to determine net present values.

E) produces the same answer as the IRR method.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

50

A new machine will cost $1,800,000. It is in a CCA class pool that uses a declining balance rate of 30%. The company's tax rate is 38% and it requires a 9% rate of return on investments. Calculate the cash savings from the tax shield the first year assuming the savings occur at year end.

A) $153,577.98

B) $188,256.88

C) $167,400.00

D) $94,128.44

E) $102,600.00

A) $153,577.98

B) $188,256.88

C) $167,400.00

D) $94,128.44

E) $102,600.00

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

51

The differential approach is based on the concept of relevance.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

52

A company is considering the purchase of some equipment that in the second year of operation should cause an increase in sales of $200,000, an increase in cash expenses of $120,000, and CCA of $60,000. If the appropriate tax rate is 40%, what will be the after-tax effect on net income in year two?

A) no effect

B) net after-tax inflows of $72,000

C) net after-tax inflows of $12,000

D) net after-tax inflows of $20,000

E) net after-tax inflows of $50,000

A) no effect

B) net after-tax inflows of $72,000

C) net after-tax inflows of $12,000

D) net after-tax inflows of $20,000

E) net after-tax inflows of $50,000

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

53

The differential approach is often considered superior to the total project approach to capital budgeting

A) because it is easier to select the components for the model.

B) because it uses only net cash flows instead of gross cash flows.

C) for all large investment decisions.

D) because it is faster if analyzing fewer than three alternatives.

E) because it can more easily accommodate multiple investment opportunities.

A) because it is easier to select the components for the model.

B) because it uses only net cash flows instead of gross cash flows.

C) for all large investment decisions.

D) because it is faster if analyzing fewer than three alternatives.

E) because it can more easily accommodate multiple investment opportunities.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

54

What is the CCA claim in year 2 from the investment?

A) $20,349

B) $44,100

C) $66,300

D) $53,550

E) $21,000

A) $20,349

B) $44,100

C) $66,300

D) $53,550

E) $21,000

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

55

Tex Corporation trades in a Class 10 (30%) asset during the current year. The opening UCC balance in the Class 10 pool is $420,000. Tex trades in an asset for $25,000, which is deducted from the $125,000 price of the new machine (also Class 10). The appropriate tax rate is 35% and the nominal after-tax rate of return is 10%.

Required: Calculate the UCC at the end of the year for class 10.

Required: Calculate the UCC at the end of the year for class 10.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

56

Headwaters Ltd. is considering purchasing a new asset. It has a cost of $1,350,000, an expected 6 year life and a salvage value of $90,000. The equipment would qualify as a class 8 (20% CCA) asset and Headwaters has a required rate of return of 11% and an effective tax rate of 32%.

Required:

Assume that this asset is the only asset in the pool. Assuming the asset is disposed of at its estimated salvage value, what is the tax effect on the disposition of the asset? Assume the asset will be disposed of on day 1 of year 7 so the asset is eligible for CCA claims in year 6.

Required:

Assume that this asset is the only asset in the pool. Assuming the asset is disposed of at its estimated salvage value, what is the tax effect on the disposition of the asset? Assume the asset will be disposed of on day 1 of year 7 so the asset is eligible for CCA claims in year 6.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

57

Explain why the term tax shield is used in conjunction with amortization.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

58

Based on the above data only, what are the tax savings from the CCA of class 10 for year 2?

A) $78,603

B) $239,700

C) $91,086

D) $128,247

E) $206,850

A) $78,603

B) $239,700

C) $91,086

D) $128,247

E) $206,850

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

59

The total project approach calculates the future value of cash outflows and inflows that differ between the alternatives of using the old machine and replacing the old machine.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

60

What are the tax savings in year 1 from the investment?

A) $31,500

B) $39,900

C) $23,940

D) $11,970

E) $105,000

A) $31,500

B) $39,900

C) $23,940

D) $11,970

E) $105,000

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

61

What is the net present value of the investment, assuming the required rate of return is 24%? Would the company want to purchase the new machine?

A) $52,167

B) $55,041

C) ($5,372)

D) $18,989

E) ($2,948)

A) $52,167

B) $55,041

C) ($5,372)

D) $18,989

E) ($2,948)

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

62

What is the net present value of the investment, assuming the required rate of return is 20%? Would the hospital want to purchase the new machine?

A) $6,955; yes

B) $(16,955); no

C) $(16,955); yes

D) $25,350; yes

E) $3,045; yes

A) $6,955; yes

B) $(16,955); no

C) $(16,955); yes

D) $25,350; yes

E) $3,045; yes

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

63

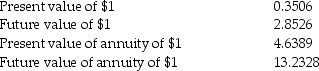

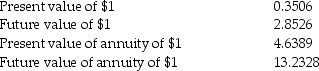

Exar Construction Ltd is contemplating the purchase of new equipment. The equipment would cost $40,000, have an expected life of 8 years, and a zero terminal salvage value. The equipment would be Class 8 (20% CCA rate), and would generate $125,000 additional revenue annually, and Exar would incur additional annual expenses of $115,000 for labour and material. The company's marginal tax rate is 20%, and the required after-tax rate of return is 14%.

Additional data (for interest rate of 14%, 8 periods):

Required:

Required:

Calculate the net after-tax present value, and determine whether Exar should purchase the equipment.

Additional data (for interest rate of 14%, 8 periods):

Required:

Required:Calculate the net after-tax present value, and determine whether Exar should purchase the equipment.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

64

What is the net present value of the investment, assuming the required rate of return is 12%? Would the hospital want to purchase the new machine?

A) $(48,670); no

B) $25,715; no

C) $48,670; yes

D) $83,415; yes

E) $3,670; yes

A) $(48,670); no

B) $25,715; no

C) $48,670; yes

D) $83,415; yes

E) $3,670; yes

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

65

The Toronto Deli & Cafeteria adjoins a large university and receives mostly student customers. It recently purchased a new electronic scanner for student debit card purchases at a cost of $20,000. Amortization has been recorded for one year with six more years remaining. The cafeteria owner has just returned from a trade show where several new scanners were on display. One of the new models, which would be appropriate for the cafeteria, has a cost of $30,000. It has a useful life of 10 years. The manufacturer of the new model predicts that it will result in annual savings of 20 percent over the current operating costs.

Required:

a. Since the current machine is only one year old, should the owner even consider replacing it with the new model? Explain.

b. What are the relevant items to be considered from a capital budgeting perspective in replacing the old machine with the new one?

c. Which of the relevant items have related tax effects?

Required:

a. Since the current machine is only one year old, should the owner even consider replacing it with the new model? Explain.

b. What are the relevant items to be considered from a capital budgeting perspective in replacing the old machine with the new one?

c. Which of the relevant items have related tax effects?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

66

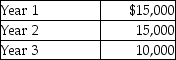

The Columbian Coffee Company is planning on purchasing a special coffee grinding machine that costs $30,000 and is in a CCA class with a 20% rate. The company has decided to use its traditional real rate of return of 10 percent as the required rate of return. It is anticipated the equipment will generate net savings in nominal before-tax dollars as follows:  The anticipated salvage value of the equipment at the end of three years is $5,000 and is not taxable. The income tax rate of Columbian Coffee is 40 percent.

The anticipated salvage value of the equipment at the end of three years is $5,000 and is not taxable. The income tax rate of Columbian Coffee is 40 percent.

What is the after-tax net present value of the investment?

A) $(12,220)

B) $(1,941)

C) $(5,700)

D) $(14,080)

E) $(14,000)

The anticipated salvage value of the equipment at the end of three years is $5,000 and is not taxable. The income tax rate of Columbian Coffee is 40 percent.

The anticipated salvage value of the equipment at the end of three years is $5,000 and is not taxable. The income tax rate of Columbian Coffee is 40 percent.What is the after-tax net present value of the investment?

A) $(12,220)

B) $(1,941)

C) $(5,700)

D) $(14,080)

E) $(14,000)

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

67

The real rate of return is the rate of return which deals with the inflation element.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

68

Declines in the general purchasing power of the dollar will inflate future cash flows above what they would have been without inflation.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

69

Jasper Company Ltd. has a payback goal of three years on new equipment acquisitions. Jasper is evaluating new equipment that costs $450,000, will have a CCA rate of 20%, an estimated useful life of 8 years, and a zero terminal disposal price. The company's marginal tax rate is 40%.

Required:

Calculate the amount of after-tax savings in annual cash operating costs that must be generated by the new equipment in order to meet the company's payback goal.

Required:

Calculate the amount of after-tax savings in annual cash operating costs that must be generated by the new equipment in order to meet the company's payback goal.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

70

It is an error when accounting for inflation in capital budgeting to state cash inflows and outflows in real terms and using a nominal discount rate.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

71

Good Bread Bakery installed an oven costing $100,000 on January 1 of the current year. Due to unexpected advances in technology, the equipment's value was reduced to $24,000 in only one week. The equipment is class 8 which has a CCA rate of 20% for tax purposes. The incremental costs of operating the oven over four years is $80,000 annually, excluding depreciation. A new replacement machine with all the new advances can be purchased now for $120,000. It also has a useful life of four years and can be operated for $30,000 a year, excluding depreciation. The company's tax rate is 40 percent. Neither oven has a salvage value at the end of the four years. Assume that the company will replace the oven (whichever one it chooses) after the four years.

Required:

a. Calculate the relevant cash flows using both a total project approach and a differential approach if the company's required rate of return is 10 percent.

b. What is the difference between the two methods?

Required:

a. Calculate the relevant cash flows using both a total project approach and a differential approach if the company's required rate of return is 10 percent.

b. What is the difference between the two methods?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

72

The nominal rate of return considers inflation.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

73

Melvin, Otto, and Clapman consulting firm is considering the purchase of a new telephone system for $10,000. It is believed that the new equipment will save $750 a year over current costs. Telephone equipment is included in Class 3 for tax purposes. Class 3 CCA rate is 5%. The new equipment has an estimated life of five years. Its salvage value is estimated at $400 at the end of five years.

Required:

What items must be considered in the analysis of the purchase?

Required:

What items must be considered in the analysis of the purchase?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

74

Morrison Limited has an opportunity to purchase new, more efficient production equipment to replace existing machinery. The new machine will cost $850,000 and has an expected 8 year life and a salvage value of $125,000.

The existing machine can be sold for $255,000. It is estimated that 8 years from now the salvage value of the old equipment will be zero.

Annual cash flows to be generated by the new machine through productivity improvements are estimated at $198,000 per year (before tax).

The equipment is in Class 8 and Morrison's tax rate is 40%. Morrison uses a cost of capital of 15%.

Required:

Using NPV analysis, should the new equipment be purchased? Assume the asset will be disposed of on January 1 of year 9 for tax purposes and there will be assets remaining in the pool.

The existing machine can be sold for $255,000. It is estimated that 8 years from now the salvage value of the old equipment will be zero.

Annual cash flows to be generated by the new machine through productivity improvements are estimated at $198,000 per year (before tax).

The equipment is in Class 8 and Morrison's tax rate is 40%. Morrison uses a cost of capital of 15%.

Required:

Using NPV analysis, should the new equipment be purchased? Assume the asset will be disposed of on January 1 of year 9 for tax purposes and there will be assets remaining in the pool.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

75

The nominal approach to incorporating inflation into the net present value method predicts cash inflows in real monetary units and uses a real rate as the required rate of return.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

76

The rate of return earned in the market is called the

A) real rate.

B) investment risk rate.

C) nominal rate.

D) inflation rate.

E) marginal rate.

A) real rate.

B) investment risk rate.

C) nominal rate.

D) inflation rate.

E) marginal rate.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

77

The nominal rate of return is the rate of return demanded to cover investment risk.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

78

Bacon Jewelers are interested in buying a new stone-polishing machine for $25,000. The new machine will reduce stone polishing time substantially and annual operating costs are expected to be only $5,000. The current machine, with a fair market value of $10,000 and a book value of $15,000, has annual operating costs of $12,500. The current machine can be updated for a cost of $17,500. Because of advancing technology, neither the new machine nor the remodelled old machine is expected to last longer than four years. The new machine will have a salvage value after taxes of $500 but the remodelled machine will have a salvage value of zero. The company has a tax rate of 30 percent. For tax purposes, the equipment is class 8, which has a CCA rate of 20% .

Required:

Several categories of cash flows are common in capital budgeting analysis. Place as much information from this problem as possible into each one of the cash flow categories.

Required:

Several categories of cash flows are common in capital budgeting analysis. Place as much information from this problem as possible into each one of the cash flow categories.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

79

What is the net present value of the investment assuming a discount rate of 13%?

A) $31,707

B) $48,288

C) $35,706

D) $52,287

E) $101,131

A) $31,707

B) $48,288

C) $35,706

D) $52,287

E) $101,131

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

80

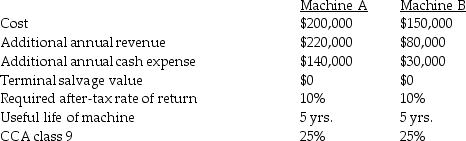

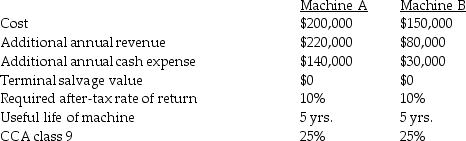

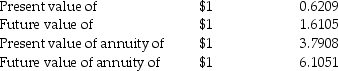

Avilas Corp. has a marginal tax rate of 25%, and is considering the following two capital projects:

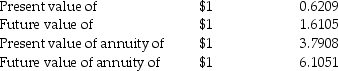

Additional data (for interest rate of 10%, 5 periods):

Additional data (for interest rate of 10%, 5 periods):

Required:

Required:

Which project has a higher net after-tax present value?

Additional data (for interest rate of 10%, 5 periods):

Additional data (for interest rate of 10%, 5 periods): Required:

Required:Which project has a higher net after-tax present value?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck