Deck 5: Corporations: Earnings Profits and Dividend Distributions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/89

Play

Full screen (f)

Deck 5: Corporations: Earnings Profits and Dividend Distributions

1

In the current year, Pink Corporation has a § 179 expense of $80,000. As a result, next year, taxable income must be decreased by $16,000 to determine current E & P.

True

2

To determine E & P, some (but not all) previously excluded income items are added back to taxable income.

False

3

When a corporation makes an installment sale, for E & P purposes the realized gain is recognized in the year of sale.

True

4

A distribution in excess of E & P is treated as capital gain by shareholders.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

5

Nondeductible meal and entertainment expenses must be subtracted from taxable income to determine current E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

6

A corporation borrows money to purchase State of Texas bonds. The interest on the loan has no impact on either taxable income or current E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

7

Distributions that are not dividends are a return of capital and decrease the shareholder's basis. Once basis is reduced to zero, any excess is taxed as a capital gain.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

8

Federal income tax paid in the current year must be subtracted from taxable income to determine E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

9

The terms "earnings and profits" and "retained earnings" are identical in meaning.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

10

Any loss in current E & P must be treated as occurring ratably during the year.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

11

The dividends received deduction is added back to taxable income to determine E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

12

When computing E & P, an adjustment to taxable income is necessary for any domestic production activities deduction.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

13

A realized gain from an involuntary conversion under § 1033 that is not recognized for income tax purposes has no effect on E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

14

Use of MACRS cost recovery when computing taxable income does not require an E & P adjustment.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

15

When computing E & P, taxable income is not adjusted for additional first-year depreciation.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

16

An increase in the LIFO recapture amount must be added to taxable income to determine E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

17

Distributions by a corporation to its shareholders are presumed to be a return of capital unless the parties can prove otherwise.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

18

When computing current E & P, taxable income is not adjusted for the deferred gain in a § 1031 like-kind exchange.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

19

Cash distributions received from a corporation with a positive balance in accumulated E & P at the beginning of the year will be taxed as dividend income.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

20

A distribution from a corporation will be taxable to the recipient shareholders only to the extent of the corporation's E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

21

When current E & P is positive and accumulated E & P has a deficit balance, the two accounts are netted for dividend determination purposes.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

22

The rules used to determine the taxability of stock dividends also apply to distributions of stock rights.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

23

A pro rata distribution of nonconvertible preferred stock to common shareholders is not generally taxable.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

24

If a distribution of stock rights is taxable and their fair market value is less than 15 percent of the value of the old stock, then either a zero basis or a portion of the old stock basis may be assigned to the rights, at the shareholder's option.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

25

If a stock dividend is taxable, the shareholder's basis in the newly received shares is equal to the fair market value of the shares received in the distribution.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

26

If stock rights are taxable, the recipient has income to the extent of the fair market value of the rights.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

27

Corporate distributions are presumed to be paid out of E & P and are treated as dividends unless the parties to the transaction can show otherwise.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

28

Constructive dividends have no effect on a distributing corporation's E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

29

During the year, Blue Corporation distributes land to its sole shareholder. If the fair market value of the land is less than its adjusted basis, Blue will recognize a loss on the distribution.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

30

Certain dividends from foreign corporations can be qualified dividends for purposes of the 15% rate available to individuals.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

31

Dividends taxed as ordinary income are considered investment income for purposes of the investment interest expense limitation.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

32

A corporate shareholder that receives a constructive dividend cannot apply a dividends received deduction to the distribution.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

33

Property distributed by a corporation as a dividend is subject to a liability in excess of its basis. For purposes of determining gain on the distribution, the basis of the property is treated as being not less than the amount of liability.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

34

In certain circumstances, the amount of dividend income recognized by a shareholder from a property distribution is not reduced by the amount of liability assumed by a shareholder.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

35

Regardless of any deficit in current E & P, distributions during the year are taxed as dividends to the extent of accumulated E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

36

A corporation that distributes a property dividend must reduce its E & P by the adjusted basis of the property less any liability on the property.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

37

Constructive dividends do not need to satisfy the legal requirements for a dividend as set forth by applicable state law.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

38

Under certain circumstances, a distribution can generate (or add to) a deficit in E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

39

When current E & P has a deficit and accumulated E & P is positive, the two accounts are netted at the date of the distribution. If a positive balance results, the distribution is a dividend to the extent of the balance.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

40

Dividends paid to shareholders who hold both long and short positions do not qualify for the reduced tax rate available to individuals in certain years.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

41

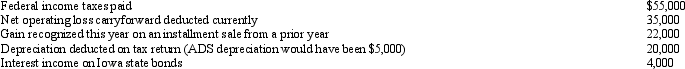

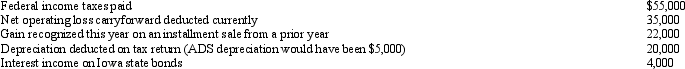

Scarlet Corporation (a calendar year taxpayer) has taxable income of $150,000, and its financial records reflect the following for the year.  Scarlet Corporation's current E & P is:

Scarlet Corporation's current E & P is:

A) $127,000.

B) $107,000.

C) $97,000.

D) $57,000.

E) None of the above.

Scarlet Corporation's current E & P is:

Scarlet Corporation's current E & P is:A) $127,000.

B) $107,000.

C) $97,000.

D) $57,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

42

Stacey and Andrew each own one-half of the stock in Parakeet Corporation, a calendar year taxpayer. Cash distributions from Parakeet are: $350,000 to Stacey on April 1 and $150,000 to Andrew on May 1. If Parakeet's current E & P is $60,000, how much is allocated to Andrew's distribution?

A) $5,000.

B) $10,000.

C) $18,000.

D) $30,000.

E) None of the above.

A) $5,000.

B) $10,000.

C) $18,000.

D) $30,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

43

Renee, the sole shareholder of Indigo Corporation, sold her stock to Chad on July 1 for $180,000. Renee's stock basis at the beginning of the year was $120,000. Indigo made a $60,000 cash distribution to Renee immediately before the sale, while Chad received a $120,000 cash distribution from Indigo on November 1. As of the beginning of the current year, Indigo had $26,000 in accumulated E & P, while current E & P (before distributions) was $90,000. Which of the following statements is correct?

A) Renee recognizes a $60,000 gain on the sale of the stock.

B) Renee recognizes a $64,000 gain on the sale of the stock.

C) Chad recognizes dividend income of $120,000.

D) Chad recognizes dividend income of $30,000.

E) None of the above.

A) Renee recognizes a $60,000 gain on the sale of the stock.

B) Renee recognizes a $64,000 gain on the sale of the stock.

C) Chad recognizes dividend income of $120,000.

D) Chad recognizes dividend income of $30,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

44

Orange Corporation has a deficit in accumulated E & P of $600,000 and has current E & P of $450,000. On July 1, Orange distributes $500,000 to its sole shareholder, Morris, who has a basis in his stock of $105,000. As a result of the distribution, Morris has:

A) Dividend income of $450,000 and reduces his stock basis to $55,000.

B) Dividend income of $105,000 and reduces his stock basis to zero.

C) Dividend income of $450,000 and no adjustment to stock basis.

D) No dividend income, reduces his stock basis to zero, and has a capital gain of $500,000.

E) None of the above.

A) Dividend income of $450,000 and reduces his stock basis to $55,000.

B) Dividend income of $105,000 and reduces his stock basis to zero.

C) Dividend income of $450,000 and no adjustment to stock basis.

D) No dividend income, reduces his stock basis to zero, and has a capital gain of $500,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

45

Tungsten Corporation, a calendar year cash basis taxpayer, made estimated tax payments of $800 each quarter in 2011, for a total of $3,200. Tungsten filed its 2011 tax return in 2012 and the return showed a tax liability $4,200. At the time of filing, March 15, 2012, Tungsten paid an additional $1,000 in Federal income taxes. How does the additional payment of $1,000 impact Tungsten's E & P?

A) Increase by $1,000 in 2011.

B) Increase by $1,000 in 2012.

C) Decrease by $1,000 in 2011.

D) Decrease by $1,000 in 2012.

E) None of the above.

A) Increase by $1,000 in 2011.

B) Increase by $1,000 in 2012.

C) Decrease by $1,000 in 2011.

D) Decrease by $1,000 in 2012.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

46

Blue Corporation, a cash basis taxpayer, has taxable income of $700,000 for the current year. Blue elected $80,000 of § 179 expense. It also had a related party loss of $30,000 and a realized (not recognized) gain from an involuntary conversion of $85,000. It paid Federal income tax of $185,000 and a nondeductible fine of $20,000. Blue's current E & P is:

A) $465,000.

B) $529,000.

C) $614,000.

D) $630,000.

E) None of the above.

A) $465,000.

B) $529,000.

C) $614,000.

D) $630,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

47

Tangelo Corporation has an August 31 year-end. Tangelo had $50,000 in accumulated E & P at the beginning of its 2012 fiscal year (September 1, 2011) and during the year, it incurred a $75,000 operating loss. It also distributed $65,000 to its sole shareholder, Cass, on November 30, 2011. If Cass is a calendar year taxpayer, how should she treat the distribution when she files her 2011 income tax return (assuming the return is filed by April 15, 2012)?

A) $65,000 of dividend income.

B) $60,000 of dividend income and $5,000 recovery of capital.

C) $50,000 of dividend income and $15,000 recovery of capital.

D) The distribution has no effect on Cass in the current year.

E) None of the above.

A) $65,000 of dividend income.

B) $60,000 of dividend income and $5,000 recovery of capital.

C) $50,000 of dividend income and $15,000 recovery of capital.

D) The distribution has no effect on Cass in the current year.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

48

Duck Corporation is a calendar year taxpayer formed in 2005. Duck's E & P for each of the past 5 years is listed below. 2010 $280,000

2009 $400,000

2008 $390,000

2007 $680,000

2006 $160,000

Duck Corporation made the following distributions in the previous 5 years.

2009 Land (basis of $700,000, fair market value of $800,000)

2006 $200,000 cash

Duck's accumulated E & P as of January 1, 2011 is:

A) $910,000.

B) $950,000.

C) $1,010,000.

D) $1,050,000.

E) None of the above.

2009 $400,000

2008 $390,000

2007 $680,000

2006 $160,000

Duck Corporation made the following distributions in the previous 5 years.

2009 Land (basis of $700,000, fair market value of $800,000)

2006 $200,000 cash

Duck's accumulated E & P as of January 1, 2011 is:

A) $910,000.

B) $950,000.

C) $1,010,000.

D) $1,050,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

49

Falcon Corporation has $200,000 of current E & P and a deficit in accumulated E & P of $90,000. If Swan pays a $300,000 distribution to its shareholders on July 1, how much dividend income do the shareholders report?

A) $0.

B) $10,000.

C) $110,000.

D) $200,000.

E) None of the above.

A) $0.

B) $10,000.

C) $110,000.

D) $200,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

50

Pheasant Corporation ended its first year of operations with taxable income of $225,000. At the time of Pheasant's formation, it incurred $50,000 of organizational expenses. In calculating its taxable income for the year, Pheasant claimed an $8,000 deduction for the organizational expenses. What is Pheasant's current E & P?

A) $175,000.

B) $183,000.

C) $225,000.

D) $233,000.

E) None of the above.

A) $175,000.

B) $183,000.

C) $225,000.

D) $233,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

51

Maria and Christopher each own 50% of Cockatoo Corporation, a calendar year taxpayer. Distributions from Cockatoo are: $750,000 to Maria on April 1 and $250,000 to Christopher on May 1. Cockatoo's current E & P is $300,000 and its accumulated E & P is $600,000. How much of the accumulated E & P is allocated to Christopher's distribution?

A) $0.

B) $75,000.

C) $150,000.

D) $300,000.

E) None of the above.

A) $0.

B) $75,000.

C) $150,000.

D) $300,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements is incorrect with respect to determining current E & P?

A) All tax-exempt income should be added back to taxable income.

B) Dividends received deductions should be added back to taxable income.

C) Charitable contributions in excess of the 10% of taxable income limit should be subtracted from taxable income.

D) Federal income tax refunds should be added back to taxable income.

E) None of the above statements are incorrect.

A) All tax-exempt income should be added back to taxable income.

B) Dividends received deductions should be added back to taxable income.

C) Charitable contributions in excess of the 10% of taxable income limit should be subtracted from taxable income.

D) Federal income tax refunds should be added back to taxable income.

E) None of the above statements are incorrect.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

53

The tax treatment of corporate distributions at the shareholder level does not depend on:

A) The character of the property being distributed.

B) The earnings and profits of the corporation.

C) The basis of stock in the hands of the shareholder.

D) Whether the distributed property is received by an individual or a corporation.

E) None of the above.

A) The character of the property being distributed.

B) The earnings and profits of the corporation.

C) The basis of stock in the hands of the shareholder.

D) Whether the distributed property is received by an individual or a corporation.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

54

On January 2, 2011, Orange Corporation purchased equipment for $300,000 with an ADS recovery period of 10 years and a MACRS useful life of 7 years. Section 179 was not elected. MACRS depreciation properly claimed on the asset, including depreciation in the year of sale, totaled $79,605. The equipment was sold on July 1, 2012, for $290,000. As a result of the sale, the adjustment to taxable income needed to arrive at current E & P is:

A) No adjustment is required.

B) Decrease $49,605.

C) Increase $49,605.

D) Decrease $79,605.

E) None of the above.

A) No adjustment is required.

B) Decrease $49,605.

C) Increase $49,605.

D) Decrease $79,605.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

55

Tracy and Lance, equal shareholders in Macaw Corporation, receive $600,000 each in distributions on December 31 of the current year. Macaw's current year taxable income is $1 million and it has no accumulated E & P. Last year, Macaw sold an appreciated asset for $1,200,000 (basis of $400,000). Payment for one-half of the sale of the asset was made this year. How much of Tracy's distribution will be taxed as a dividend?

A) $0.

B) $300,000.

C) $500,000.

D) $600,000.

E) None of the above.

A) $0.

B) $300,000.

C) $500,000.

D) $600,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

56

Gander, a calendar year corporation, has a deficit in current E & P of $100,000 and a $290,000 positive balance in accumulated E & P. If Gander determines that a $500,000 distribution to its shareholders is appropriate at some point during the year, what is the maximum amount of the distribution that could potentially be treated as a dividend?

A) $0.

B) $190,000.

C) $240,000.

D) $290,000.

E) None of the above.

A) $0.

B) $190,000.

C) $240,000.

D) $290,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

57

Glenda is the sole shareholder of Condor Corporation. She sold her stock to Melissa on October 31 for $150,000. Glenda's basis in Condor stock was $50,000 at the start of the year. Condor distributed land to Glenda immediately before the sale. Condor's basis in the land was $20,000 (fair market value of $25,000). On December 31, Melissa received a $75,000 cash distribution from Condor. During the year, Condor has $20,000 of current E & P and its accumulated E & P balance on January 1 is $10,000. Which of the following statements is true?

A) Glenda recognizes a $110,000 gain on the sale of her stock.

B) Glenda recognizes a $100,000 gain on the sale of her stock.

C) Melissa receives $5,000 of dividend income.

D) Glenda receives $20,000 of dividend income.

E) None of the above.

A) Glenda recognizes a $110,000 gain on the sale of her stock.

B) Glenda recognizes a $100,000 gain on the sale of her stock.

C) Melissa receives $5,000 of dividend income.

D) Glenda receives $20,000 of dividend income.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

58

Ashley and Andrew, equal shareholders in Parrot Corporation, receive $250,000 each in distributions on December 31 of the current year. During the current year, Parrot sold an appreciated asset for $500,000 (basis of $150,000). Payment for the sale of the asset will be made as follows: 50% next year and 50% in the following year, with interest payable at a rate of 7.5%. Before considering the effect of the asset sale, Parrot's current year E & P is $400,000 and it has no accumulated E & P. How much of Ashley's distribution will be taxed as a dividend?

A) $0.

B) $200,000.

C) $250,000.

D) $425,000.

E) None of the above.

A) $0.

B) $200,000.

C) $250,000.

D) $425,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

59

During the current year, Goose Corporation sold equipment for $500,000 (adjusted basis of $260,000). The equipment was purchased a few years ago for $560,000 and $300,000 in MACRS deductions have been claimed. ADS depreciation would have been $200,000. As a result of the sale, the adjustment to taxable income needed to determine current E & P is:

A) No adjustment is required.

B) Subtract $100,000.

C) Add $100,000.

D) Add $80,000.

E) None of the above.

A) No adjustment is required.

B) Subtract $100,000.

C) Add $100,000.

D) Add $80,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

60

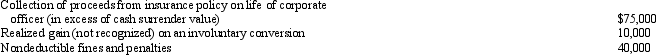

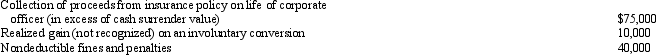

Platinum Corporation, a calendar year taxpayer, has taxable income of $500,000. Among its transactions for the year are the following:  Disregarding any provision for Federal income taxes, Platinum Corporation's current E & P is:

Disregarding any provision for Federal income taxes, Platinum Corporation's current E & P is:

A) $455,000.

B) $535,000.

C) $545,000.

D) $625,000.

E) None of the above.

Disregarding any provision for Federal income taxes, Platinum Corporation's current E & P is:

Disregarding any provision for Federal income taxes, Platinum Corporation's current E & P is:A) $455,000.

B) $535,000.

C) $545,000.

D) $625,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

61

Jose receives a nontaxable distribution of stock rights during the year from Gold Corporation on January 30. Each right entitles the holder to purchase one share of stock for $50. One right is issued for every share of stock owned. Jose owns 100 shares of stock purchased two years ago for $5,000. At the date of distribution, the rights are worth $1,000 (100 rights at $10 per right) and Jose's stock in Gold is worth $6,000 (or $60 per share). On December 1, Jose sells all stock rights for $13 per right. How much gain does Jose recognize on the sale?

A) $1,300.

B) $586.

C) $500.

D) $0.

E) None of the above.

A) $1,300.

B) $586.

C) $500.

D) $0.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

62

Which one of the following statements is false?

A) Most countries that trade with the U.S. do not impose a double tax on dividends.

B) Tax proposals that include corporate integration would eliminate the double tax on dividends.

C) The double tax on dividends may make corporations more financially vulnerable during economic downturns.

D) Many of the arguments in support of the double tax on dividends relate to fairness.

E) None of the above.

A) Most countries that trade with the U.S. do not impose a double tax on dividends.

B) Tax proposals that include corporate integration would eliminate the double tax on dividends.

C) The double tax on dividends may make corporations more financially vulnerable during economic downturns.

D) Many of the arguments in support of the double tax on dividends relate to fairness.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

63

Pelican Corporation has E & P of $260,000. It distributes land with a fair market value of $80,000 (adjusted basis of $30,000) to its sole shareholder, Bernard. The land is subject to a liability of $45,000 that Bernard assumes. Bernard has a taxable dividend of:

A) $10,000.

B) $35,000.

C) $55,000.

D) $80,000.

E) None of the above.

A) $10,000.

B) $35,000.

C) $55,000.

D) $80,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

64

Samantha owns stock in Pigeon Corporation (basis of $80,000) as an investment. Pigeon distributes property (fair market value of $300,000; basis of $150,000) to her during the year. Pigeon has current E & P of $20,000 and accumulated E & P of $80,000 and makes no other distributions during the year. What is Samantha's capital gain on the distribution?

A) $0.

B) $80,000.

C) $120,000.

D) $150,000.

E) None of the above.

A) $0.

B) $80,000.

C) $120,000.

D) $150,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

65

Rust Corporation has accumulated E & P of $30,000 on January 1, 2011. In 2011, Rust Corporation had an operating loss of $40,000. It distributed cash of $20,000 to Andre, its sole shareholder, on December 31, 2011. Rust Corporation's balance in its E & P account as of January 1, 2012, is:

A) $30,000 deficit.

B) $10,000 deficit.

C) $0.

D) $30,000.

E) None of the above.

A) $30,000 deficit.

B) $10,000 deficit.

C) $0.

D) $30,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

66

As of January 1, Warbler Corporation has a deficit in accumulated E & P of $150,000. For the year, current E & P (accrued ratably) is $260,000 (prior to any distributions). On July 1, Warbler Corporation distributes $295,000 to its sole shareholder. The amount of the distribution that is a dividend is:

A) $10,000.

B) $110,000.

C) $260,000.

D) $295,000.

E) None of the above.

A) $10,000.

B) $110,000.

C) $260,000.

D) $295,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

67

In June of the current year, Marigold Corporation declares a $4 dividend out of E & P on each share of common stock to shareholders of record on August 1. Ellen and Tim each purchase 100 shares of Marigold stock on July 1. On July 15, Ellen also purchases a short position in Marigold. Tim sells 50 of his shares on August 10 and continues to hold the remaining 50 shares through the end of the year. Ellen closes her short position in Marigold on October 15. With respect to the dividends, which of the following is correct?

A) Ellen will have $400 of qualifying dividends subject to reduced tax rates and $400 of ordinary income (from dividends paid on the short position of Marigold stock).

B) Tim will have $200 of qualifying dividends subject to reduced tax rates and $200 of ordinary income.

C) All $800 of Ellen's dividends will qualify for reduced tax rates.

D) All $400 of Tim's dividends will qualify for reduced tax rates.

E) None of the above.

A) Ellen will have $400 of qualifying dividends subject to reduced tax rates and $400 of ordinary income (from dividends paid on the short position of Marigold stock).

B) Tim will have $200 of qualifying dividends subject to reduced tax rates and $200 of ordinary income.

C) All $800 of Ellen's dividends will qualify for reduced tax rates.

D) All $400 of Tim's dividends will qualify for reduced tax rates.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements regarding constructive dividends is not correct?

A) Constructive dividends do not need to be formally declared or designated as a dividend.

B) Constructive dividends need not be paid pro rata to the shareholders.

C) Corporations that receive constructive dividends may not use the dividends received deduction.

D) Constructive dividends are taxable as dividends only to the extent of earnings and profits.

E) All of the above.

A) Constructive dividends do not need to be formally declared or designated as a dividend.

B) Constructive dividends need not be paid pro rata to the shareholders.

C) Corporations that receive constructive dividends may not use the dividends received deduction.

D) Constructive dividends are taxable as dividends only to the extent of earnings and profits.

E) All of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

69

Robin Corporation distributes furniture (basis of $40,000; fair market value of $50,000) as a property dividend to its shareholders. The furniture is subject to a liability of $55,000. Robin Corporation recognizes gain of:

A) $55,000.

B) $15,000.

C) $10,000.

D) $0.

E) None of the above.

A) $55,000.

B) $15,000.

C) $10,000.

D) $0.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

70

Which one of the following statements about property distributions is false?

A) When the basis of distributed property is greater than its fair market value, a deficit may be created in E & P.

B) When the basis of distributed property is less than its fair market value, the distributing corporation recognizes gain.

C) When the basis of distributed property is greater than its fair market value, the distributing corporation does not recognize loss.

D) The amount of a distribution received by a shareholder is measured by using the property's fair market value.

E) All of the above statements are true.

A) When the basis of distributed property is greater than its fair market value, a deficit may be created in E & P.

B) When the basis of distributed property is less than its fair market value, the distributing corporation recognizes gain.

C) When the basis of distributed property is greater than its fair market value, the distributing corporation does not recognize loss.

D) The amount of a distribution received by a shareholder is measured by using the property's fair market value.

E) All of the above statements are true.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

71

Ten years ago, Connie purchased 4,000 shares in Platinum Corporation for $40,000. In the current year, Connie receives a nontaxable stock dividend of 40 shares of Platinum preferred. Values at the time of the dividend are: $8,000 for the preferred stock and $72,000 for the common. Based on this information, Connie's basis is:

A) $40,000 in the common and $16,000 in the preferred.

B) $4,000 in the common and $136,000 in the preferred.

C) $36,000 in the common and $4,000 in the preferred.

D) $39,600 in the common and $400 in the preferred.

E) None of the above.

A) $40,000 in the common and $16,000 in the preferred.

B) $4,000 in the common and $136,000 in the preferred.

C) $36,000 in the common and $4,000 in the preferred.

D) $39,600 in the common and $400 in the preferred.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

72

Swan Corporation makes a property distribution to its sole shareholder, Matthew. The property distributed is a cottage (fair market value of $135,000; basis of $110,000) that is subject to a $175,000 mortgage that Matthew assumes. Before considering the consequences of the distribution, Swan's current E & P is $25,000 and its accumulated E & P is 100,000. Swan makes no other distributions during the current year. What is Swan's taxable gain on the distribution of the cottage?

A) $0.

B) $15,000.

C) $25,000.

D) $65,000.

E) None of the above.

A) $0.

B) $15,000.

C) $25,000.

D) $65,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

73

Blue Corporation distributes property to its sole shareholder, Zeke. The property has a fair market value of $450,000, an adjusted basis of $305,000, and is subject to a liability of $250,000. Current E & P is $550,000. With respect to the distribution, Blue has a gain of:

A) $200,000 and Zeke has dividend income of $450,000.

B) $145,000 and Zeke's basis is the distributed property is $305,000.

C) $200,000 and Zeke's basis in the distributed property is $450,000.

D) $145,000 and Zeke has dividend income of $200,000.

E) None of the above.

A) $200,000 and Zeke has dividend income of $450,000.

B) $145,000 and Zeke's basis is the distributed property is $305,000.

C) $200,000 and Zeke's basis in the distributed property is $450,000.

D) $145,000 and Zeke has dividend income of $200,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is not an economic distortion created by the double tax on dividends?

A) An incentive to invest in noncorporate rather than corporate businesses.

B) An incentive for corporations to finance operations with debt rather than equity.

C) An incentive to invest domestically rather than internationally.

D) An incentive for corporations to retain earnings and structure distributions to avoid dividend treatment.

E) All of the above represent economic distortions created by the double tax on dividends.

A) An incentive to invest in noncorporate rather than corporate businesses.

B) An incentive for corporations to finance operations with debt rather than equity.

C) An incentive to invest domestically rather than internationally.

D) An incentive for corporations to retain earnings and structure distributions to avoid dividend treatment.

E) All of the above represent economic distortions created by the double tax on dividends.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

75

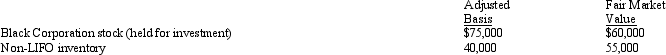

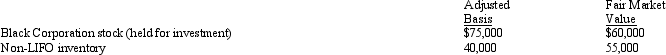

In the current year, Verdigris Corporation (with E & P of $250,000) made the following property distributions to its shareholders (all corporations):  Verdigris Corporation is not a member of a controlled group. As a result of the distribution:

Verdigris Corporation is not a member of a controlled group. As a result of the distribution:

A) The shareholders have dividend income of $100,000.

B) The shareholders have dividend income of $130,000.

C) Verdigris has a gain of $15,000 and a loss of $15,000, both of which it must recognize.

D) Verdigris has no recognized gain or loss.

E) None of the above.

Verdigris Corporation is not a member of a controlled group. As a result of the distribution:

Verdigris Corporation is not a member of a controlled group. As a result of the distribution:A) The shareholders have dividend income of $100,000.

B) The shareholders have dividend income of $130,000.

C) Verdigris has a gain of $15,000 and a loss of $15,000, both of which it must recognize.

D) Verdigris has no recognized gain or loss.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

76

Pink Corporation declares a nontaxable dividend payable in rights to subscribe to common stock. Each right entitles the holder to purchase one share of stock for $25. One right is issued for every two shares of stock owned. Jack owns 100 shares of stock in Pink, which he purchased three years ago for $3,000. At the time of the distribution, the value of the stock is $45 per share and the value of the rights is $2 per share. Jack receives 50 rights. He exercises 25 rights and sells the remaining 25 rights three months later for $2.50 per right.

A) Jack must allocate a part of the basis of his original stock in Pink to the rights.

B) If Jack does not allocate a part of the basis of his original stock to the rights, his basis in the new stock is zero.

C) Sale of the rights produces ordinary income to Jack of $62.50.

D) If Jack does not allocate a part of the basis of his original stock to the rights, his basis in the new stock is $625.

E) None of the above.

A) Jack must allocate a part of the basis of his original stock in Pink to the rights.

B) If Jack does not allocate a part of the basis of his original stock to the rights, his basis in the new stock is zero.

C) Sale of the rights produces ordinary income to Jack of $62.50.

D) If Jack does not allocate a part of the basis of his original stock to the rights, his basis in the new stock is $625.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

77

Navy Corporation makes a property distribution to its sole shareholder, Troy. The property distributed is a car (fair market value of $10,000; basis of $15,000) that is subject to a $2,000 liability which Troy assumes. Navy makes no other distributions during the current year. Navy has no accumulated E & P and $15,000 of current E & P from other sources during the year. What is Navy's E & P after taking into account the distribution of the car?

A) $2,000.

B) $3,000.

C) $5,000.

D) $7,000.

E) None of the above.

A) $2,000.

B) $3,000.

C) $5,000.

D) $7,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

78

On January 1, Gull Corporation (a calendar year taxpayer) has accumulated E & P of $200,000. During the year, Gull incurs a net loss of $280,000 from operations that accrues ratably. On June 30, Gull distributes $120,000 to Sharon, its sole shareholder, who has a basis in her stock of $75,000. How much of the $120,000 is a dividend to Sharon?

A) $0.

B) $60,000.

C) $75,000.

D) $120,000.

E) None of the above.

A) $0.

B) $60,000.

C) $75,000.

D) $120,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

79

At the beginning of the current year, Doug and Alfred each own 50% of Amaryllis Corporation (a calendar year taxpayer). In July, Doug sold his stock to Kevin for $140,000. At the beginning of the year, Amaryllis Corporation had accumulated E & P of $240,000 and its current E & P is $280,000 (prior to any distributions). Amaryllis distributed $300,000 on February 15 ($150,000 to Doug and $150,000 to Alfred) and distributed another $300,000 on November 1 ($150,000 to Kevin and $150,000 to Alfred). Kevin has dividend income of:

A) $150,000.

B) $140,000.

C) $110,000.

D) $70,000.

E) None of the above.

A) $150,000.

B) $140,000.

C) $110,000.

D) $70,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

80

Purple Corporation has accumulated E & P of $100,000 on January 1, 2011. In 2011, Purple has current E & P of $130,000 (before any distribution). On December 31, 2011, the corporation distributes $250,000 to its sole shareholder, Cindy (an individual). Purple Corporation's E & P as of January 1, 2012 is:

A) $0.

B) ($20,000).

C) $100,000.

D) $130,000.

E) None of the above.

A) $0.

B) ($20,000).

C) $100,000.

D) $130,000.

E) None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck