Deck 9: Sales and Cash Receipts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/125

Play

Full screen (f)

Deck 9: Sales and Cash Receipts

1

A contra-revenue account with a debit balance for returned goods is called:

A)Sales Returns and Allowances.

B)Sales Discount.

C)the credit period.

D)the discount period.

A)Sales Returns and Allowances.

B)Sales Discount.

C)the credit period.

D)the discount period.

A

2

Sales Tax Payable is a:

A)liability account with a debit balance.

B)liability account with a credit balance.

C)contra-asset account with a debit balance.

D)contra-asset account with a credit balance.

A)liability account with a debit balance.

B)liability account with a credit balance.

C)contra-asset account with a debit balance.

D)contra-asset account with a credit balance.

B

3

A characteristic of Sales Returns and Allowances is that:

A)it has a debit balance.

B)it tracks returns from customers.

C)it is a contra-revenue account.

D)All of these answers are correct.

A)it has a debit balance.

B)it tracks returns from customers.

C)it is a contra-revenue account.

D)All of these answers are correct.

D

4

The time frame when customers are allowed to pay their bills and still be eligible for a discount is the:

A)credit period.

B)discount period.

C)closing period.

D)due date.

A)credit period.

B)discount period.

C)closing period.

D)due date.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

5

Merchants who buy goods from wholesalers for resale to customers are:

A)merchandisers.

B)retailers.

C)service companies.

D)None of the above are correct.

A)merchandisers.

B)retailers.

C)service companies.

D)None of the above are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

6

Merchandise is:

A)the same as inventory.

B)an asset.

C)the same as gross sales.

D)Both A and B are correct.

A)the same as inventory.

B)an asset.

C)the same as gross sales.

D)Both A and B are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

7

Lisa's Blankets and Bedding had a sale of $350 to a charge customer, terms 1/15, n/30. Lisa should record this transaction as follows:

A)debit Accounts Receivable $350; credit Sales $350.

B)debit Cash $350; credit Sales $350.

C)debit Accounts Receivable $346.50; debit Sales Discounts $3.50; credit Sales $350.

D)debit Sales $350; credit Accounts Receivable $350.

A)debit Accounts Receivable $350; credit Sales $350.

B)debit Cash $350; credit Sales $350.

C)debit Accounts Receivable $346.50; debit Sales Discounts $3.50; credit Sales $350.

D)debit Sales $350; credit Accounts Receivable $350.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

8

R&R Lumber reports gross sales of $70,000. If sales returns and allowances are $10,000 and sales discounts are $3,000, what are the net sales?

A)$83,000

B)$63,000

C)$57,000

D)$70,000

A)$83,000

B)$63,000

C)$57,000

D)$70,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

9

Net sales equal:

A)gross sales.

B)gross sales - sales returns and allowances.

C)gross sales - sales returns and allowances - sales discounts.

D)sales discounts.

A)gross sales.

B)gross sales - sales returns and allowances.

C)gross sales - sales returns and allowances - sales discounts.

D)sales discounts.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

10

A reduction given to customers for early payment is a:

A)sales returns and allowance.

B)purchase discount.

C)sales discount.

D)purchase return.

A)sales returns and allowance.

B)purchase discount.

C)sales discount.

D)purchase return.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

11

The length of time the customer is allowed to repay the bill is the:

A)discount period.

B)closing period.

C)credit period.

D)due date.

A)discount period.

B)closing period.

C)credit period.

D)due date.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

12

The normal balance of the Sales Returns and Allowances account is:

A)a credit.

B)a debit.

C)zero.

D)It doesn't have a normal balance.

A)a credit.

B)a debit.

C)zero.

D)It doesn't have a normal balance.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

13

Hardware Restoration reports net sales of $50,000. If sales returns and allowances are $10,000 and sales discounts are $1,500, what are gross sales?

A)$50,000

B)$61,500

C)$58,500

D)$38,500

A)$50,000

B)$61,500

C)$58,500

D)$38,500

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

14

Kristi's pottery sold 200 tiles at $25.00 each to a charge customer, terms 1/10, n/30. Which entry is required to record this transaction?

A)Debit Cash for $5,000; credit Tile Sales for $5,000

B)Debit Accounts Receivable for $4,050; credit Tile Sales for $4,050

C)Debit Accounts Receivable for $4,050; debit Sales Discount for $50.00, and credit Tile Sales for $5,000

D)Debit Accounts Receivable for $5,000; credit Tile Sales for $5,000

A)Debit Cash for $5,000; credit Tile Sales for $5,000

B)Debit Accounts Receivable for $4,050; credit Tile Sales for $4,050

C)Debit Accounts Receivable for $4,050; debit Sales Discount for $50.00, and credit Tile Sales for $5,000

D)Debit Accounts Receivable for $5,000; credit Tile Sales for $5,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

15

Unlimited Materials sold goods for $2,000 plus 6% sales tax to a charge customer, terms n/30. Which entry is required to record this transaction?

A)Debit Accounts Receivable for $2,120; credit Sales Tax Payable $120 and credit Sales for $2,000

B)Debit Cash for $2,000; credit Sales for $2,000

C)Debit Accounts Receivable for $2,000; credit Sales for $2,000

D)Debit Accounts Receivable $2,120; credit Sales, $2,120

A)Debit Accounts Receivable for $2,120; credit Sales Tax Payable $120 and credit Sales for $2,000

B)Debit Cash for $2,000; credit Sales for $2,000

C)Debit Accounts Receivable for $2,000; credit Sales for $2,000

D)Debit Accounts Receivable $2,120; credit Sales, $2,120

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

16

A characteristic of the account, Sales Discount, is:

A)debit balance.

B)contra-revenue account.

C)records the cash discounts granted to customers.

D)All of the above are correct.

A)debit balance.

B)contra-revenue account.

C)records the cash discounts granted to customers.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

17

Gross sales equals:

A)net sales minus sales discount.

B)sales discount less net income.

C)the total of cash sales and credit sales.

D)net income plus gross profit.

A)net sales minus sales discount.

B)sales discount less net income.

C)the total of cash sales and credit sales.

D)net income plus gross profit.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

18

Credit terms of 1/10, n/30 mean that:

A)1% discount is allowed if the bill is paid within between 10 and 30 days.

B)a 1% discount is allowed if the bill is paid within 30 days.

C)a 1% discount is allowed if the bill is paid after 10 days.

D)a 1% discount is allowed if the customer pays the bill within 10 days, or the entre amount is due within 30 days.

A)1% discount is allowed if the bill is paid within between 10 and 30 days.

B)a 1% discount is allowed if the bill is paid within 30 days.

C)a 1% discount is allowed if the bill is paid after 10 days.

D)a 1% discount is allowed if the customer pays the bill within 10 days, or the entre amount is due within 30 days.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

19

The side that increases the balance of the Sales Discount account is:

A)a credit.

B)a debit.

C)zero.

D)It does not have a normal balance.

A)a credit.

B)a debit.

C)zero.

D)It does not have a normal balance.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

20

The liability account used to record sales tax owed is:

A)Sales Tax Expense.

B)Prepaid Taxes.

C)Sales Tax Payable.

D)Sales.

A)Sales Tax Expense.

B)Prepaid Taxes.

C)Sales Tax Payable.

D)Sales.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

21

Zach returned $200 of merchandise to Secret Trails. His original purchase was $400, with terms 1/10, n/30. If Justin pays the balance of his account after the discount period, how much should he pay?

A)$204.00

B)$196.00

C)$200.00

D)$400.00

A)$204.00

B)$196.00

C)$200.00

D)$400.00

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

22

The document indicating to the customer that the seller is reducing the amount owed by the customer is:

A)credit memorandum.

B)sales discount.

C)sales returns and allowances.

D)schedule of accounts receivable.

A)credit memorandum.

B)sales discount.

C)sales returns and allowances.

D)schedule of accounts receivable.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

23

Sales discounts are not taken on which of the following?

A)Sales Tax

B)Freight

C)Merchandise returned

D)Sales Discounts are not taken on any of the above.

A)Sales Tax

B)Freight

C)Merchandise returned

D)Sales Discounts are not taken on any of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

24

Logan's Art studio was moving and sold furniture that was no longer needed for cash. The entry would include:

A)a credit to Sales.

B)a debit to Sales.

C)a credit to Furniture.

D)a debit to Furniture.

A)a credit to Sales.

B)a debit to Sales.

C)a credit to Furniture.

D)a debit to Furniture.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

25

Urban Camping sold goods for $200 to a charge customer. The customer returned for credit $90 worth of goods. Which entry is required to record the return transaction?

A)Debit Sales Returns and Allowances $90; credit Accounts Receivable for $90

B)Debit Sales Returns and Allowances for $90; credit Sales for $90

C)Debit Sales $90; credit Sales Returns and Allowances $90

D)Debit Accounts Receivable $90; credit Sales Returns and Allowances for $90

A)Debit Sales Returns and Allowances $90; credit Accounts Receivable for $90

B)Debit Sales Returns and Allowances for $90; credit Sales for $90

C)Debit Sales $90; credit Sales Returns and Allowances $90

D)Debit Accounts Receivable $90; credit Sales Returns and Allowances for $90

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

26

A wholesale customer returned merchandise having already paid for it within the cash discount period. The return will be recorded with:

A)a credit to an asset account.

B)a credit to a liability account.

C)a credit to Capital.

D)None of these are correct.

A)a credit to an asset account.

B)a credit to a liability account.

C)a credit to Capital.

D)None of these are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

27

The total of all cash sales and credit sales equals:

A)net sales.

B)gross sales.

C)sales discount.

D)sales returns and allowances.

A)net sales.

B)gross sales.

C)sales discount.

D)sales returns and allowances.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

28

Sue's Jewelry sold 20 necklaces for $25 each to a credit customer. The invoice included a 6% sales tax and payment terms of 2/10, n/30. In addition, 5 necklaces were returned prior to payment. The entry to record the original sale would include:

A)a debit to Accounts Receivable for $530.

B)a debit to Accounts Receivable for $500.

C)a debit to Sales for $530.

D)a debit to Sales for $500.

A)a debit to Accounts Receivable for $530.

B)a debit to Accounts Receivable for $500.

C)a debit to Sales for $530.

D)a debit to Sales for $500.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

29

Net Sales equals Gross Sales - Sales Returns and Allowances - Cash Sales.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

30

If management wanted to determine if customers were returning goods at a higher rate than usual it could use the Sales Returns and Allowances account to analyze the information.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

31

Secret Trails received payment in full within the credit period for horse boarding for $900 plus 6% sales tax. Terms of the sale were 2/10, n/30. Which entry is required to record this payment?

A)Debit Cash, $900; credit Accounts Receivable Sales, $900

B)Debit Cash, $936; debit Sales Discount $18; credit Accounts Receivable, $954

C)Debit Cash, $954; credit Sales, $954

D)Debit Cash, $936; credit Sales, $936

A)Debit Cash, $900; credit Accounts Receivable Sales, $900

B)Debit Cash, $936; debit Sales Discount $18; credit Accounts Receivable, $954

C)Debit Cash, $954; credit Sales, $954

D)Debit Cash, $936; credit Sales, $936

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

32

The contra-revenue accounts include:

A)Sales Tax Payable.

B)Sales Returns and Allowances.

C)Sales Discount.

D)Both B and C are correct.

A)Sales Tax Payable.

B)Sales Returns and Allowances.

C)Sales Discount.

D)Both B and C are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

33

Monica's Closet received payment in full for goods sold within the discount period on a $500 sales invoice, terms 2/10, n/30. Which entry records this payment?

A)Debit Accounts Receivable; credit Sales for $500

B)Debit Cash; credit Accounts Receivable for $500

C)Debit Cash for $490, debit Sales Discount for $10; and credit Sales for $500

D)Debit Cash for $490, debit Sales Discount for $10; and credit Accounts Receivable for $500

A)Debit Accounts Receivable; credit Sales for $500

B)Debit Cash; credit Accounts Receivable for $500

C)Debit Cash for $490, debit Sales Discount for $10; and credit Sales for $500

D)Debit Cash for $490, debit Sales Discount for $10; and credit Accounts Receivable for $500

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

34

The arrangements between buyer and seller as to when payments for merchandise are to be made are called:

A)credit terms.

B)net cash.

C)cash on demand.

D)gross cash.

A)credit terms.

B)net cash.

C)cash on demand.

D)gross cash.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

35

Customer returned merchandise for credit. This will be recorded with:

A)a debit to an asset account.

B)a debit to a liability account.

C)a credit to an asset account.

D)None of these are correct.

A)a debit to an asset account.

B)a debit to a liability account.

C)a credit to an asset account.

D)None of these are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

36

A sales discount correctly taken by the charge customer was debited to Sales at the time the entry was recorded. This error will cause:

A)the net income for the period to be overstated.

B)the net income for the period to be understated.

C)the sales discount account to be understated.

D)the sales account to be overstated.

A)the net income for the period to be overstated.

B)the net income for the period to be understated.

C)the sales discount account to be understated.

D)the sales account to be overstated.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

37

Medeco sold goods for $100 to a charge customer. The customer returned for credit $25 worth of goods. Terms of the sale were 1/10, n/30. If the customer pays the amount owed within the discount period, what is the amount the customer should pay?

A)$74.25

B)$75.00

C)$100.00

D)$90.00

A)$74.25

B)$75.00

C)$100.00

D)$90.00

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

38

The normal balance of Sales Tax Payable is a credit.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

39

Sold merchandise on account would be recorded with:

A)a debit to an asset account.

B)a debit to a liability account.

C)a debit to Capital.

D)None of these are correct.

A)a debit to an asset account.

B)a debit to a liability account.

C)a debit to Capital.

D)None of these are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

40

Merchandise sold on credit was returned for credit and recorded with a debit to Sales Returns and Allowances and a credit to Accounts Payable. This error will cause:

A)the net income for the period to be overstated.

B)the net income for the period to be understated.

C)the assets to be overstated.

D)the liabilities to be understated.

A)the net income for the period to be overstated.

B)the net income for the period to be understated.

C)the assets to be overstated.

D)the liabilities to be understated.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

41

If a customer returns merchandise, the income for that period will be reduced.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

42

Compare and discuss a discount period versus a credit period.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

43

The time a customer is granted to pay the bill is the discount period.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

44

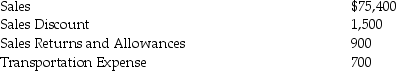

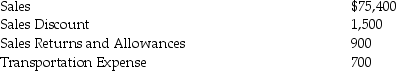

Use the following information to answer the questions below:

The Net Sales are ________.

The Net Sales are ________.

The Net Sales are ________.

The Net Sales are ________.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

45

When a customer returns defective office supplies the Sales Returns and Allowances account will be debited.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

46

Sales Returns and Allowances is a contra-asset.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

47

Sales Discounts is an expense account.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

48

Calculate gross sales:

net sales = $100,000

sales returns and allowances - $25,000

sales discounts - $20,000

accounts receivable - $12,000

net sales = $100,000

sales returns and allowances - $25,000

sales discounts - $20,000

accounts receivable - $12,000

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

49

Explain why the account Sales Tax Payable is credited when a sale is made subject to a sales tax?

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

50

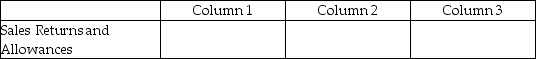

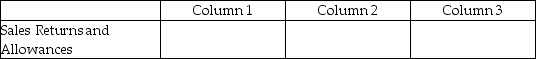

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

51

Sales Tax Payable represents an asset on the books of the seller.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

52

Determine the amount of net sales given:

gross sales = $200,000

sales discounts = $25,000

sales returns and allowances = $40,000

$ ________

gross sales = $200,000

sales discounts = $25,000

sales returns and allowances = $40,000

$ ________

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

53

Sales tax collected by the seller increases the seller's total revenue.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

54

If cash flow is so important to merchandisers, why do they extend credit to their customers?

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

55

Sales Discounts and Sales Returns and Allowances are expense accounts.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

56

The Sales Returns and Allowances account is contra-revenue.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

57

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

58

Terms of 3/10, n/30 means that a customer is allowed a 10% discount in 30 days.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

59

Sales is a revenue account.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

60

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

61

The return of merchandise by a credit customer was recorded with a debit to Accounts Payable and a credit to Accounts Receivable and the subsidiary ledger. This error will cause:

A)the net income for the period to be overstated.

B)the net income for the period to be understated.

C)the control account to not agree with the subsidiary ledger.

D)the assets to be overstated.

A)the net income for the period to be overstated.

B)the net income for the period to be understated.

C)the control account to not agree with the subsidiary ledger.

D)the assets to be overstated.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

62

The credit period is longer than the discount period.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

63

Received payment, within the discount period, for merchandise sold previously. This will be recorded with:

A)a credit to an asset account.

B)a debit to a liability account.

C)a debit to Capital.

D)None of these are correct.

A)a credit to an asset account.

B)a debit to a liability account.

C)a debit to Capital.

D)None of these are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

64

Sue's Jewelry sold 30 necklaces for $25 each to a credit customer. The invoice included a 6% sales tax and payment terms of 2/10, n/30. In addition, 5 necklaces were returned prior to payment. The entry to record the payment would include:

A)a credit to Cash for $625.00.

B)a credit to Cash for $662.50.

C)a credit to Accounts Receivable for $625.00.

D)a credit to Accounts Receivable for $662.50.

A)a credit to Cash for $625.00.

B)a credit to Cash for $662.50.

C)a credit to Accounts Receivable for $625.00.

D)a credit to Accounts Receivable for $662.50.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

65

Collected a payment from a credit customer. This will be recorded with:

A)a credit to an asset account.

B)a credit to a liability account.

C)a credit to Capital.

D)None of these are correct.

A)a credit to an asset account.

B)a credit to a liability account.

C)a credit to Capital.

D)None of these are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

66

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

67

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

68

If a credit memorandum is issued, what account will be increased on the seller's books?

A)Accounts Receivable

B)Accounts Payable

C)Sales Discount

D)Sales Returns and Allowances

A)Accounts Receivable

B)Accounts Payable

C)Sales Discount

D)Sales Returns and Allowances

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

69

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

70

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

71

Sales Returns and Allowances is a contra-revenue account with a normal credit balance.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

72

Sold merchandise subject to a sales tax, accepting cash. This will be recorded with:

A)a credit to an asset account.

B)a credit to a liability account.

C)a debit to Capital.

D)None of these are correct.

A)a credit to an asset account.

B)a credit to a liability account.

C)a debit to Capital.

D)None of these are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

73

Explain why, when a customer returns merchandise after it was paid for, he/she may or may not receive credit equal to the invoice value of the merchandise returned.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

74

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

75

Sue's Jewelry sold 30 necklaces for $25 each to a credit customer. The invoice included a 6% sales tax and payment terms of 2/10, n/30. In addition, 5 necklaces were returned prior to payment. The entry to record the return would include:

A)a debit to Sales Returns and Allowances for $132.50.

B)a debit to Sales Returns and Allowances for $125.00.

C)a credit to Sales Tax Payable for $7.50.

D)a debit to Accounts Receivable for $132.50.

A)a debit to Sales Returns and Allowances for $132.50.

B)a debit to Sales Returns and Allowances for $125.00.

C)a credit to Sales Tax Payable for $7.50.

D)a debit to Accounts Receivable for $132.50.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

76

If a credit memorandum is issued, what account will be decreased on the seller's books?

A)Accounts Receivable

B)Accounts Payable

C)Sales Discount

D)Sales Returns and Allowances

A)Accounts Receivable

B)Accounts Payable

C)Sales Discount

D)Sales Returns and Allowances

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

77

Sold Merchandise for Cash subject to a sales tax accepting cash. This will be recorded with:

A)a credit to an asset account.

B)a debit to a liability account.

C)a debit to Capital.

D)None of these are correct.

A)a credit to an asset account.

B)a debit to a liability account.

C)a debit to Capital.

D)None of these are correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

78

Determine the amount of cash collected on a credit sale with a price of $80,000 and credit terms of 1/10, n/30, assuming the payment was after the discount period had expired.

$ ________

$ ________

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

79

Determine the amount to be paid within the discount period for a previous sale with an invoice price of $10,000, subject to credit terms of 1/10, n/30.

$ ________

$ ________

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

80

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck