Deck 13: Transfer Pricing in Divisionalized Companies

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/63

Play

Full screen (f)

Deck 13: Transfer Pricing in Divisionalized Companies

1

The optimal transfer price from the viewpoint of the company is

A) variable cost.

B) absorption cost plus markup.

C) variable cost plus opportunity cost.

D) absorption cost plus selling expenses.

A) variable cost.

B) absorption cost plus markup.

C) variable cost plus opportunity cost.

D) absorption cost plus selling expenses.

C

2

Transfer pricing is used when:

A) multiple cost centres are conducting business within the company.

B) a decentralized company has profit centres or investment centres.

C) the return on investment ratio cannot be computed.

D) a company is transferring goods to the government.

A) multiple cost centres are conducting business within the company.

B) a decentralized company has profit centres or investment centres.

C) the return on investment ratio cannot be computed.

D) a company is transferring goods to the government.

B

3

Negotiated prices transfer prices are:

A) determined between a division and corporate headquarters.

B) negotiated with external customers.

C) used when supplying and buying divisions independently agree on a price.

D) agreed to by division management and unions.

A) determined between a division and corporate headquarters.

B) negotiated with external customers.

C) used when supplying and buying divisions independently agree on a price.

D) agreed to by division management and unions.

C

4

The output of one division that can be used as input in another division is called a

A) work-in-process product

B) transferred (good) product

C) final product

D) finished goods product

A) work-in-process product

B) transferred (good) product

C) final product

D) finished goods product

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

5

The opportunity cost approach to setting a transfer price would set the maximum transfer price as

A) the opportunity cost of the firm as a whole

B) the opportunity cost of the selling division

C) the opportunity cost of the buying division

D) none of the above

A) the opportunity cost of the firm as a whole

B) the opportunity cost of the selling division

C) the opportunity cost of the buying division

D) none of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is a legitimate disadvantage of negotiated transfer pricing?

A) Negotiated based transfer pricing fails to provide adequate autonomy to divisional managers.

B) Negotiated based transfer prices will always be higher than market price.

C) Negotiated based transfer prices usually fail to allow the seller to cover variable costs.

D) Negotiated prices may lead to some less than optimal decisions.

A) Negotiated based transfer pricing fails to provide adequate autonomy to divisional managers.

B) Negotiated based transfer prices will always be higher than market price.

C) Negotiated based transfer prices usually fail to allow the seller to cover variable costs.

D) Negotiated prices may lead to some less than optimal decisions.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

7

When there is an outside market for an intermediate product which is perfectly competitive, the most equitable method of transfer pricing is

A) market price.

B) production cost pricing.

C) variable cost pricing.

D) cost plus markup pricing.

A) market price.

B) production cost pricing.

C) variable cost pricing.

D) cost plus markup pricing.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

8

A transfer pricing system should satisfy which of the following objectives?

A) accurate performance evaluation

B) goal congruence

C) preservation of divisional autonomy

D) all of the above

A) accurate performance evaluation

B) goal congruence

C) preservation of divisional autonomy

D) all of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

9

A selling division produces components for a buying division that is considering accepting a special order for the products it produces. The selling division has excess capacity. The maximum price the buying division would be willing to accept is

A) the selling division's variable costs

B) the buying division's outside purchase price

C) the price that would allow the buying division to cover its incremental cost of the special order

D) the price that would allow the selling division to maintain its current ROI

A) the selling division's variable costs

B) the buying division's outside purchase price

C) the price that would allow the buying division to cover its incremental cost of the special order

D) the price that would allow the selling division to maintain its current ROI

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

10

The objective of a transfer pricing system should be

A) to maximize the transfer price

B) to minimize the transfer price

C) to maintain goal congruence between the divisions and the entire firm

D) none of the above

A) to maximize the transfer price

B) to minimize the transfer price

C) to maintain goal congruence between the divisions and the entire firm

D) none of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

11

Figure 1

Universe Industries has two divisions: the Haley Division and the Comet Division. Information about a component that the Haley Division produces is as follows:

The Haley Division can produce up to 5,000 components per year. The Comet Division needs 200 units of the component for a product it manufactures.

Refer to Figure 1 above. The minimum transfer price that the Haley Division would be willing to accept is

A) £120

B) £70

C) £50

D) £30

Universe Industries has two divisions: the Haley Division and the Comet Division. Information about a component that the Haley Division produces is as follows:

The Haley Division can produce up to 5,000 components per year. The Comet Division needs 200 units of the component for a product it manufactures.

Refer to Figure 1 above. The minimum transfer price that the Haley Division would be willing to accept is

A) £120

B) £70

C) £50

D) £30

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

12

A transfer pricing system should satisfy which of the following objectives?

A) accurate performance evaluation

B) goal congruence

C) preservation of divisional autonomy

D) all of the above

A) accurate performance evaluation

B) goal congruence

C) preservation of divisional autonomy

D) all of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

13

In a negotiated transfer price,

A) market prices may not be suitable

B) opportunity costs could be used to set boundaries

C) buyers and sellers influence the transfer price set

D) all of the above are true

A) market prices may not be suitable

B) opportunity costs could be used to set boundaries

C) buyers and sellers influence the transfer price set

D) all of the above are true

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following types of transfer prices do NOT encourage the selling division to be efficient?

A) transfer prices based upon market prices

B) transfer prices based upon actual costs

C) transfer prices based upon standard costs

D) transfer prices based upon standard costs plus a markup for profit

A) transfer prices based upon market prices

B) transfer prices based upon actual costs

C) transfer prices based upon standard costs

D) transfer prices based upon standard costs plus a markup for profit

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

15

If it is available, the correct transfer price is

A) the market price from a perfectly competitive market

B) the negotiated transfer price

C) the variable production costs of the firm

D) none of the above

A) the market price from a perfectly competitive market

B) the negotiated transfer price

C) the variable production costs of the firm

D) none of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

16

A selling division produces components for a buying division that is considering accepting a special order for the products it produces. The selling division has excess capacity. The minimum price the selling division would be willing to accept is

A) the selling division's variable costs

B) the buying division's outside purchase price

C) the price that would allow the buying division to cover its incremental cost of the special order

D) the price that would allow the selling division to maintain its current ROI

A) the selling division's variable costs

B) the buying division's outside purchase price

C) the price that would allow the buying division to cover its incremental cost of the special order

D) the price that would allow the selling division to maintain its current ROI

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

17

The opportunity cost approach to setting a transfer price would set the minimum transfer price as

A) the opportunity cost of the firm as a whole

B) the opportunity cost of the selling division

C) the opportunity cost of the buying division

D) none of the above

A) the opportunity cost of the firm as a whole

B) the opportunity cost of the selling division

C) the opportunity cost of the buying division

D) none of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

18

_____ is when the transfer price is computed equal to a sales price received by the reseller less an appropriate markup.

A) Advance pricing agreement

B) Comparable uncontrolled price approach

C) Cost-plus approach

D) Resale price method

A) Advance pricing agreement

B) Comparable uncontrolled price approach

C) Cost-plus approach

D) Resale price method

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

19

When an outside market exists for an intermediate product that is perfectly competitive, the ideal method of transfer pricing is often:

A) market price.

B) the one that creates the highest margin to the selling unit.

C) one that is higher than what the outside market is quoting.

D) based on management accounting numbers.

A) market price.

B) the one that creates the highest margin to the selling unit.

C) one that is higher than what the outside market is quoting.

D) based on management accounting numbers.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

20

Figure 1

Universe Industries has two divisions: the Haley Division and the Comet Division. Information about a component that the Haley Division produces is as follows:

The Haley Division can produce up to 5,000 components per year. The Comet Division needs 200 units of the component for a product it manufactures.

Refer to Figure 1 above. The maximum transfer price that the Comet Division would be willing to pay is

A) £120

B) £70

C) £50

D) £30

Universe Industries has two divisions: the Haley Division and the Comet Division. Information about a component that the Haley Division produces is as follows:

The Haley Division can produce up to 5,000 components per year. The Comet Division needs 200 units of the component for a product it manufactures.

Refer to Figure 1 above. The maximum transfer price that the Comet Division would be willing to pay is

A) £120

B) £70

C) £50

D) £30

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

21

Pautner Company had the following historical accounting data per unit: The units are normally transferred internally from Division A to Division B. The units also may be sold externally for £210 per unit. The minimum profit level accepted by the company is a markup of 30 percent. There were no beginning or ending inventories.

What would be the transfer price if Division X uses full cost plus markup?

A) £167.70

B) £198.90

C) £136.50

D) £129.00

What would be the transfer price if Division X uses full cost plus markup?

A) £167.70

B) £198.90

C) £136.50

D) £129.00

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

22

Figure 2

Klaehn Industries is a decentralized company that evaluates its divisions based on ROI. The Fahl Division has the capacity to make 1,000 units of a component. The Fahl Division's variable costs are £40 per unit.

The Melton Division can use the component in one of its products. The Melton Division would incur £50 of variable costs to convert the component into its own product that sells for £160.

Refer to Figure 2 above. Assume the Fahl Division can sell 800 units at £120 each. Any excess capacity will be unused unless the units are purchased by the Melton Division, which could use up to 100 units. The maximum transfer price that the Melton Division would be willing to pay would be

A) £120

B) £110

C) £100

D) £60

Klaehn Industries is a decentralized company that evaluates its divisions based on ROI. The Fahl Division has the capacity to make 1,000 units of a component. The Fahl Division's variable costs are £40 per unit.

The Melton Division can use the component in one of its products. The Melton Division would incur £50 of variable costs to convert the component into its own product that sells for £160.

Refer to Figure 2 above. Assume the Fahl Division can sell 800 units at £120 each. Any excess capacity will be unused unless the units are purchased by the Melton Division, which could use up to 100 units. The maximum transfer price that the Melton Division would be willing to pay would be

A) £120

B) £110

C) £100

D) £60

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

23

Figure 3

The Adam Division produces a component that is used by the West Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 250,000 components

Other costs incurred by the Adam Division are as follows:

The component usually sells for £90 in the external market. The Adam Division is capable of producing 250,000 components per year; however, only 200,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £90 in the external market. The Adam Division is capable of producing 250,000 components per year; however, only 200,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The West Division has been buying the same component from an external supplier for £80 each. The West Division expects to use 40,000 units of the component next year. The manager of the West Division has offered to buy 40,000 units from the Adam Division for £56 each.

Refer to Figure 3. The minimum transfer price that the Adam Division would accept is

A) £60

B) £50

C) £48

D) £30

The Adam Division produces a component that is used by the West Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 250,000 components

Other costs incurred by the Adam Division are as follows:

The component usually sells for £90 in the external market. The Adam Division is capable of producing 250,000 components per year; however, only 200,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £90 in the external market. The Adam Division is capable of producing 250,000 components per year; however, only 200,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.The West Division has been buying the same component from an external supplier for £80 each. The West Division expects to use 40,000 units of the component next year. The manager of the West Division has offered to buy 40,000 units from the Adam Division for £56 each.

Refer to Figure 3. The minimum transfer price that the Adam Division would accept is

A) £60

B) £50

C) £48

D) £30

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

24

Figure 5

Allied Industries has two divisions: the Bradley Division and the Rommel Division. Information about the component that the Bradley Division produces is as follows:

The Bradley Division can produce up to 12,000 components per year. The Rommel Division needs 800 units of the component for a product it manufactures

Refer to Figure 5 above. If the selling division did NOT have excess capacity, the minimum transfer price the selling division would be willing to accept would be

A) £50

B) £80

C) £130

D) £180

Allied Industries has two divisions: the Bradley Division and the Rommel Division. Information about the component that the Bradley Division produces is as follows:

The Bradley Division can produce up to 12,000 components per year. The Rommel Division needs 800 units of the component for a product it manufactures

Refer to Figure 5 above. If the selling division did NOT have excess capacity, the minimum transfer price the selling division would be willing to accept would be

A) £50

B) £80

C) £130

D) £180

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

25

Figure 3

The Adam Division produces a component that is used by the West Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 250,000 components

Other costs incurred by the Adam Division are as follows:

The component usually sells for £90 in the external market. The Adam Division is capable of producing 250,000 components per year; however, only 200,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £90 in the external market. The Adam Division is capable of producing 250,000 components per year; however, only 200,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The West Division has been buying the same component from an external supplier for £80 each. The West Division expects to use 40,000 units of the component next year. The manager of the West Division has offered to buy 40,000 units from the Adam Division for £56 each.

Refer to Figure 3 above. The effect on firmwide income if 40,000 components are transferred internally at £56 each instead of purchased from an external supplier at £80 per unit would be a

A) £1,920,000 decrease

B) £1,280,000 increase

C) £960,000 decrease

D) £960,000 increase

The Adam Division produces a component that is used by the West Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 250,000 components

Other costs incurred by the Adam Division are as follows:

The component usually sells for £90 in the external market. The Adam Division is capable of producing 250,000 components per year; however, only 200,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £90 in the external market. The Adam Division is capable of producing 250,000 components per year; however, only 200,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.The West Division has been buying the same component from an external supplier for £80 each. The West Division expects to use 40,000 units of the component next year. The manager of the West Division has offered to buy 40,000 units from the Adam Division for £56 each.

Refer to Figure 3 above. The effect on firmwide income if 40,000 components are transferred internally at £56 each instead of purchased from an external supplier at £80 per unit would be a

A) £1,920,000 decrease

B) £1,280,000 increase

C) £960,000 decrease

D) £960,000 increase

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

26

Pautner Company had the following historical accounting data per unit: The units are normally transferred internally from Division A to Division B. The units also may be sold externally for £210 per unit. The minimum profit level accepted by the company is a markup of 30 percent. There were no beginning or ending inventories.

If variable manufacturing costs without a fixed fee are used as the transfer price, Division A's transfer price would be

A) £60

B) £90

C) £105

D) £144

If variable manufacturing costs without a fixed fee are used as the transfer price, Division A's transfer price would be

A) £60

B) £90

C) £105

D) £144

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

27

Figure 4

The Simonds Division produces a component that is used by the Allen Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 400,000 components

Other costs incurred by the Simonds Division are as follows:

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The Allen Division has been buying the same component from an external supplier for £34 each. The Allen Division expects to use 50,000 units of the component next year. The manager of the Allen Division has offered to buy 50,000 units from the Simonds Division for £22.50 each.

Refer to Figure 4. The maximum transfer price that the Allen Division would be willing to pay is

A) £20.00

B) £25.00

C) £26.50

D) £34.00

The Simonds Division produces a component that is used by the Allen Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 400,000 components

Other costs incurred by the Simonds Division are as follows:

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.The Allen Division has been buying the same component from an external supplier for £34 each. The Allen Division expects to use 50,000 units of the component next year. The manager of the Allen Division has offered to buy 50,000 units from the Simonds Division for £22.50 each.

Refer to Figure 4. The maximum transfer price that the Allen Division would be willing to pay is

A) £20.00

B) £25.00

C) £26.50

D) £34.00

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

28

Figure 6

Callahan Industries is a decentralized company that evaluates its divisions based on ROI. The Jones Division has the capacity to make 5,000 units of a component. The Jones Division's variable costs are £200 per unit.

The Thomas Division can use the component in one of its products. The Thomas Division would incur £100 of variable costs to put the component in its own product that sells for £500.

Refer to Figure 6 above. The Jones Division can sell all that it produces for £360 each. The Jones Division needs 200 units. What is the correct transfer price?

A) £400

B) £200

C) £420

D) £360

Callahan Industries is a decentralized company that evaluates its divisions based on ROI. The Jones Division has the capacity to make 5,000 units of a component. The Jones Division's variable costs are £200 per unit.

The Thomas Division can use the component in one of its products. The Thomas Division would incur £100 of variable costs to put the component in its own product that sells for £500.

Refer to Figure 6 above. The Jones Division can sell all that it produces for £360 each. The Jones Division needs 200 units. What is the correct transfer price?

A) £400

B) £200

C) £420

D) £360

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

29

Figure 4

The Simonds Division produces a component that is used by the Allen Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 400,000 components

Other costs incurred by the Simonds Division are as follows:

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The Allen Division has been buying the same component from an external supplier for £34 each. The Allen Division expects to use 50,000 units of the component next year. The manager of the Allen Division has offered to buy 50,000 units from the Simonds Division for £22.50 each.

Refer to Figure 4. The effect on firmwide income if 50,000 components are transferred internally at £22.50 each instead of purchased from an external supplier at £34 per unit would be a

A) £700,000 increase

B) £700,000 decrease

C) £575,000 increase

D) £575,000 decrease

The Simonds Division produces a component that is used by the Allen Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 400,000 components

Other costs incurred by the Simonds Division are as follows:

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.The Allen Division has been buying the same component from an external supplier for £34 each. The Allen Division expects to use 50,000 units of the component next year. The manager of the Allen Division has offered to buy 50,000 units from the Simonds Division for £22.50 each.

Refer to Figure 4. The effect on firmwide income if 50,000 components are transferred internally at £22.50 each instead of purchased from an external supplier at £34 per unit would be a

A) £700,000 increase

B) £700,000 decrease

C) £575,000 increase

D) £575,000 decrease

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

30

Figure 2

Klaehn Industries is a decentralized company that evaluates its divisions based on ROI. The Fahl Division has the capacity to make 1,000 units of a component. The Fahl Division's variable costs are £40 per unit.

The Melton Division can use the component in one of its products. The Melton Division would incur £50 of variable costs to convert the component into its own product that sells for £160.

Refer to Figure 2. Assume the Fahl Division can sell 800 units at £120 each. Any excess capacity will be unused unless the units are purchased by the Melton Division, which could use up to 100 units. The minimum transfer price that the Fahl Division would be willing to accept would be

A) £120

B) £110

C) £100

D) £40

Klaehn Industries is a decentralized company that evaluates its divisions based on ROI. The Fahl Division has the capacity to make 1,000 units of a component. The Fahl Division's variable costs are £40 per unit.

The Melton Division can use the component in one of its products. The Melton Division would incur £50 of variable costs to convert the component into its own product that sells for £160.

Refer to Figure 2. Assume the Fahl Division can sell 800 units at £120 each. Any excess capacity will be unused unless the units are purchased by the Melton Division, which could use up to 100 units. The minimum transfer price that the Fahl Division would be willing to accept would be

A) £120

B) £110

C) £100

D) £40

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

31

Figure 3

The Adam Division produces a component that is used by the West Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 250,000 components

Other costs incurred by the Adam Division are as follows:

The component usually sells for £90 in the external market. The Adam Division is capable of producing 250,000 components per year; however, only 200,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £90 in the external market. The Adam Division is capable of producing 250,000 components per year; however, only 200,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The West Division has been buying the same component from an external supplier for £80 each. The West Division expects to use 40,000 units of the component next year. The manager of the West Division has offered to buy 40,000 units from the Adam Division for £56 each.

Refer to Figure 3 above. The maximum transfer price that the West Division would be willing to pay is

A) £90

B) £60

C) £48

D) £38

The Adam Division produces a component that is used by the West Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 250,000 components

Other costs incurred by the Adam Division are as follows:

The component usually sells for £90 in the external market. The Adam Division is capable of producing 250,000 components per year; however, only 200,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £90 in the external market. The Adam Division is capable of producing 250,000 components per year; however, only 200,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.The West Division has been buying the same component from an external supplier for £80 each. The West Division expects to use 40,000 units of the component next year. The manager of the West Division has offered to buy 40,000 units from the Adam Division for £56 each.

Refer to Figure 3 above. The maximum transfer price that the West Division would be willing to pay is

A) £90

B) £60

C) £48

D) £38

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

32

Figure 1

Universe Industries has two divisions: the Haley Division and the Comet Division. Information about a component that the Haley Division produces is as follows:

The Haley Division can produce up to 5,000 components per year. The Comet Division needs 200 units of the component for a product it manufactures.

Refer to Figure 1 above. If the selling division did NOT have excess capacity, the minimum transfer price the selling division would be willing to accept is

A) £120

B) £75

C) £50

D) £30

Universe Industries has two divisions: the Haley Division and the Comet Division. Information about a component that the Haley Division produces is as follows:

The Haley Division can produce up to 5,000 components per year. The Comet Division needs 200 units of the component for a product it manufactures.

Refer to Figure 1 above. If the selling division did NOT have excess capacity, the minimum transfer price the selling division would be willing to accept is

A) £120

B) £75

C) £50

D) £30

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

33

Figure 5

Allied Industries has two divisions: the Bradley Division and the Rommel Division. Information about the component that the Bradley Division produces is as follows:

The Bradley Division can produce up to 12,000 components per year. The Rommel Division needs 800 units of the component for a product it manufactures

Refer to Figure 5 above. The maximum transfer price that the Rommel Division would be willing to pay is

A) £50

B) £80

C) £130

D) £180

Allied Industries has two divisions: the Bradley Division and the Rommel Division. Information about the component that the Bradley Division produces is as follows:

The Bradley Division can produce up to 12,000 components per year. The Rommel Division needs 800 units of the component for a product it manufactures

Refer to Figure 5 above. The maximum transfer price that the Rommel Division would be willing to pay is

A) £50

B) £80

C) £130

D) £180

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

34

The Engine Division provides engines for the Tractor Division of a company. The standard unit costs for Engine Division are as follows: The engine department has excess capacity. What is the best transfer price to avoid transfer price problems?

A) £1,350

B) £300

C) £900

D) £2,100

A) £1,350

B) £300

C) £900

D) £2,100

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

35

Figure 2

Klaehn Industries is a decentralized company that evaluates its divisions based on ROI. The Fahl Division has the capacity to make 1,000 units of a component. The Fahl Division's variable costs are £40 per unit.

The Melton Division can use the component in one of its products. The Melton Division would incur £50 of variable costs to convert the component into its own product that sells for £160.

Refer to Figure 2. Assume the Fahl Division can sell all that it produces for £100 each. The Melton Division needs 100 units. What is the correct transfer price?

A) £120

B) £110

C) £100

D) £60

Klaehn Industries is a decentralized company that evaluates its divisions based on ROI. The Fahl Division has the capacity to make 1,000 units of a component. The Fahl Division's variable costs are £40 per unit.

The Melton Division can use the component in one of its products. The Melton Division would incur £50 of variable costs to convert the component into its own product that sells for £160.

Refer to Figure 2. Assume the Fahl Division can sell all that it produces for £100 each. The Melton Division needs 100 units. What is the correct transfer price?

A) £120

B) £110

C) £100

D) £60

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

36

The Engine Division provides engines for the Tractor Division of a company. The standard unit costs for Engine Division are as follows: What is the best transfer price to avoid transfer price problems?

A) £2,730

B) £600

C) £1,800

D) £2,100

A) £2,730

B) £600

C) £1,800

D) £2,100

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

37

Figure 5

Allied Industries has two divisions: the Bradley Division and the Rommel Division. Information about the component that the Bradley Division produces is as follows:

The Bradley Division can produce up to 12,000 components per year. The Rommel Division needs 800 units of the component for a product it manufactures

.Refer to Figure 5. The minimum transfer price that the Bradley Division would be willing to accept is

A) £50

B) £80

C) £130

D) £180

Allied Industries has two divisions: the Bradley Division and the Rommel Division. Information about the component that the Bradley Division produces is as follows:

The Bradley Division can produce up to 12,000 components per year. The Rommel Division needs 800 units of the component for a product it manufactures

.Refer to Figure 5. The minimum transfer price that the Bradley Division would be willing to accept is

A) £50

B) £80

C) £130

D) £180

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

38

Figure 4

The Simonds Division produces a component that is used by the Allen Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 400,000 components

Other costs incurred by the Simonds Division are as follows:

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The Allen Division has been buying the same component from an external supplier for £34 each. The Allen Division expects to use 50,000 units of the component next year. The manager of the Allen Division has offered to buy 50,000 units from the Simonds Division for £22.50 each.

Figure 4 The Simonds Division produces a component that is used by the Allen Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 400,000 components

Other costs incurred by the Simonds Division are as follows:

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The Allen Division has been buying the same component from an external supplier for £34 each. The Allen Division expects to use 50,000 units of the component next year. The manager of the Allen Division has offered to buy 50,000 units from the Simonds Division for £22.50 each.

Refer to Figure 4. The minimum transfer price that the Simonds Division would accept is

A) £25

B) £21

C) £20

D) £16

The Simonds Division produces a component that is used by the Allen Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 400,000 components

Other costs incurred by the Simonds Division are as follows:

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.The Allen Division has been buying the same component from an external supplier for £34 each. The Allen Division expects to use 50,000 units of the component next year. The manager of the Allen Division has offered to buy 50,000 units from the Simonds Division for £22.50 each.

Figure 4 The Simonds Division produces a component that is used by the Allen Division. The cost of manufacturing the component is as follows:

aBased on a practical volume of 400,000 components

Other costs incurred by the Simonds Division are as follows:

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.

The component usually sells for £35 in the external market. The Simonds Division is capable of producing 500,000 components per year; however, only 400,000 components are expected to be sold next year. The variable selling expenses are avoidable if the component is sold internally.The Allen Division has been buying the same component from an external supplier for £34 each. The Allen Division expects to use 50,000 units of the component next year. The manager of the Allen Division has offered to buy 50,000 units from the Simonds Division for £22.50 each.

Refer to Figure 4. The minimum transfer price that the Simonds Division would accept is

A) £25

B) £21

C) £20

D) £16

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

39

Figure 6

Callahan Industries is a decentralized company that evaluates its divisions based on ROI. The Jones Division has the capacity to make 5,000 units of a component. The Jones Division's variable costs are £200 per unit.

The Thomas Division can use the component in one of its products. The Thomas Division would incur £100 of variable costs to put the component in its own product that sells for £500.

Refer to Figure 6 above. Assume the Jones Division can sell 4,000 units at £420. Any excess capacity will be unused unless the units are purchased by the Thomas Division, which could use up to 200 units. The minimum transfer price that the Jones Division would be willing to accept would be

A) £400

B) £200

C) £420

D) £360

Callahan Industries is a decentralized company that evaluates its divisions based on ROI. The Jones Division has the capacity to make 5,000 units of a component. The Jones Division's variable costs are £200 per unit.

The Thomas Division can use the component in one of its products. The Thomas Division would incur £100 of variable costs to put the component in its own product that sells for £500.

Refer to Figure 6 above. Assume the Jones Division can sell 4,000 units at £420. Any excess capacity will be unused unless the units are purchased by the Thomas Division, which could use up to 200 units. The minimum transfer price that the Jones Division would be willing to accept would be

A) £400

B) £200

C) £420

D) £360

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

40

Figure 6

Callahan Industries is a decentralized company that evaluates its divisions based on ROI. The Jones Division has the capacity to make 5,000 units of a component. The Jones Division's variable costs are £200 per unit.

The Thomas Division can use the component in one of its products. The Thomas Division would incur £100 of variable costs to put the component in its own product that sells for £500.

Refer to Figure 6 above. Assume the Jones Division can sell 4,000 units at £420. Any excess capacity will be unused unless the units are purchased by the Thomas Division, which could use up to 200 units. The maximum transfer price that the Thomas Division would be willing to pay would be

A) £400

B) £200

C) £420

D) £360

Callahan Industries is a decentralized company that evaluates its divisions based on ROI. The Jones Division has the capacity to make 5,000 units of a component. The Jones Division's variable costs are £200 per unit.

The Thomas Division can use the component in one of its products. The Thomas Division would incur £100 of variable costs to put the component in its own product that sells for £500.

Refer to Figure 6 above. Assume the Jones Division can sell 4,000 units at £420. Any excess capacity will be unused unless the units are purchased by the Thomas Division, which could use up to 200 units. The maximum transfer price that the Thomas Division would be willing to pay would be

A) £400

B) £200

C) £420

D) £360

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

41

The Kelly Division of Zimmer Company sells all of its output to the Finishing Division of the company. The only product of the Kelly Division is chair legs that are used by the Finishing Division. The retail price of the legs is £20 per leg. Each chair completed by the Finishing Division requires four legs. Production quantity and cost data for 2004 are as follows:

Required:

Compute the transfer price for a chair leg using:

a.

market price.

b.

variable product costs plus a fixed fee of 20 percent.

c.

full cost plus 20 percent markup.

d.

variable costs.

e.

full cost plus 10 percent markup.

Required:

Compute the transfer price for a chair leg using:

a.

market price.

b.

variable product costs plus a fixed fee of 20 percent.

c.

full cost plus 20 percent markup.

d.

variable costs.

e.

full cost plus 10 percent markup.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

42

Bernie Manufacturing Company has two divisions, X and Y. Division X prepares the steel for processing. Division Y processes the steel into the final product. No inventories exist in either division at the beginning or end of 2004. During the year, Division X prepared 80,000 lbs. of steel at a cost of £800,000. All the steel was transferred to Division Y where additional operating costs of £5 per lb. were incurred. The final product was sold for £3,000,000.

Required:

a.

Determine the gross profit for each division and for the company as a whole if the transfer price is £8 per lb.

b.

Determine the gross profit for each division and for the company as a whole if the transfer price is £12 per lb.

Required:

a.

Determine the gross profit for each division and for the company as a whole if the transfer price is £8 per lb.

b.

Determine the gross profit for each division and for the company as a whole if the transfer price is £12 per lb.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

43

The Bat Division of Baseball Company has just revised its actual cost data for 2004. Bat Division transfers goods to the Sport Division. Sport Division can buy the same goods in the open market for £122 each. Bat's new cost data are as follows:

Current production is 200,000 units, and the Bat Division has a capacity of 300,000 units.

Required:

a.

What is the lowest price the Bat Division should charge for the internal transfers of its goods?

b.

What is the highest price the Sport Division should pay for the units?

c.

Give the primary reason why the Bat Division should reduce its price.

Current production is 200,000 units, and the Bat Division has a capacity of 300,000 units.

Required:

a.

What is the lowest price the Bat Division should charge for the internal transfers of its goods?

b.

What is the highest price the Sport Division should pay for the units?

c.

Give the primary reason why the Bat Division should reduce its price.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

44

Explain why it is important for the multinational company to separate the evaluation of the manager of the division from the evaluation of the division.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

45

If the divisions exchanging goods are located in different countries with different tax rate structures, the key determinant of transfer prices could be based largely on:

A) variable costs

B) negotiations

C) market prices

D) tax minimization strategy

A) variable costs

B) negotiations

C) market prices

D) tax minimization strategy

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

46

In most cases, _____ transfer prices achieve the optimal outcome for both the divisions and the company as a whole.

A) cost-based

B) market-based

C) negotiated

D) all of the above

A) cost-based

B) market-based

C) negotiated

D) all of the above

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

47

Miggs Manufacturing has one plant located in Belgium and another plant located in the United States. The Belgium plant manufactures a component used in a finished product manufactured at the U.S. plant. Currently, the Belgium plant is operating at 70 percent capacity. In Belgium, the income tax rate is 42 percent; in the United States, the corporate income tax rate is 35 percent. The market price of the component is $200 and the Belgium plant's costs to manufacture the component are as follows:

What is the minimum transfer price that the Belgium division would be willing to accept?

A) $70

B) $110

C) $120

D) $200

What is the minimum transfer price that the Belgium division would be willing to accept?

A) $70

B) $110

C) $120

D) $200

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

48

Conner Manufacturing has one plant located in Italy and another plant located in the United States. The Italian plant manufactures a component used in a finished product manufactured at the U.S. plant. Currently, the Italian plant is operating at 75 percent capacity. In Italy, the income tax rate is 32 percent; in the United States, the corporate income tax rate is 35 percent. The market price of the component is $240 and the Italian plant's costs to manufacture the component are as follows:

Which transfer price would be in the best interest of the overall company?

A) $120

B) $100

C) $150

D) $240

Which transfer price would be in the best interest of the overall company?

A) $120

B) $100

C) $150

D) $240

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

49

The Engine Division provides engines for the Tractor Division of a company. The standard unit costs for Engine Division are as follows: What is the transfer price based on variable product costs plus a fixed fee of £210?

A) £210

B) £1,800

C) £2,100

D) £2,310

A) £210

B) £1,800

C) £2,100

D) £2,310

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

50

Miggs Manufacturing has one plant located in Belgium and another plant located in the United States. The Belgium plant manufactures a component used in a finished product manufactured at the U.S. plant. Currently, the Belgium plant is operating at 70 percent capacity. In Belgium, the income tax rate is 42 percent; in the United States, the corporate income tax rate is 35 percent. The market price of the component is $200 and the Belgium plant's costs to manufacture the component are as follows:

Which transfer price would be in the best interest of the overall company?

A) $£70

B) $110

C) $120

D) $200

Which transfer price would be in the best interest of the overall company?

A) $£70

B) $110

C) $120

D) $200

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

51

Chantilly Industries has two divisions: the Triangle Division and the Square Division. The Triangle Division produces a component that is used by the Square Division. Information about that component is as follows:

The Triangle Division can produce up to 15,000 components per year. The Square Division needs 1,500 units of the component for a product it manufactures.

Required:

a.

Determine the minimum transfer price that the Triangle Division would accept.

b.

Determine the maximum transfer price that the Square Division would pay.

c.

If the Triangle Division produces and sells 15,000 units in a highly competitive market, what would be the correct transfer price?

The Triangle Division can produce up to 15,000 components per year. The Square Division needs 1,500 units of the component for a product it manufactures.

Required:

a.

Determine the minimum transfer price that the Triangle Division would accept.

b.

Determine the maximum transfer price that the Square Division would pay.

c.

If the Triangle Division produces and sells 15,000 units in a highly competitive market, what would be the correct transfer price?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

52

_____ exists when divisions, acting in their own best interests, set transfer prices or make decisions based on transfer prices that are not in the best interest of the organization as a whole.

A) centralization

B) decentralization

C) decision support

D) suboptimization

A) centralization

B) decentralization

C) decision support

D) suboptimization

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

53

British International has a division in the United States that produces tires for automobiles. These tires are transferred to an automobile division in Germany. The tires can be (and are) sold externally in the United States for £60 each. The cost to produce a tire is £40. It costs £3 per tire for shipping and £5 per tire for import duties. When the tires are sold externally, British International spends £2 per tire for commissions and an average of £1 per tire for advertising. An acceptable markup is 30 percent of costs. What is the transfer price if the cost-plus method is used?

A) £78.00

B) £60.00

C) £84.50

D) £52.00

A) £78.00

B) £60.00

C) £84.50

D) £52.00

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

54

Brown Industries has two divisions: the Hank Division and the Murray Division. Information about a component that the Hank Division produces is as follows:

The Hank Division can produce up to 22,000 components per year. The Murray Division needs 1,000 units of the component for a product it manufactures.

Required:

a.

Determine the minimum transfer price that the selling division would be willing to accept.

b.

Determine the maximum transfer price that the buying division would be willing to pay.

c.

If the Hank Division did not have excess capacity, what would be the correct transfer price?

The Hank Division can produce up to 22,000 components per year. The Murray Division needs 1,000 units of the component for a product it manufactures.

Required:

a.

Determine the minimum transfer price that the selling division would be willing to accept.

b.

Determine the maximum transfer price that the buying division would be willing to pay.

c.

If the Hank Division did not have excess capacity, what would be the correct transfer price?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

55

Garland Industries is a decentralized company that evaluates its divisions based on ROI. The Shelly Division has the capacity to make 4,000 units of a component. The Shelly Division's variable costs are £160 per unit.

The Blake Division can use the Shelly component in the manufacturing of one of its own products. The Blake Division would incur £170 of variable costs to convert the component into its own product, which sells for £600.

Required:

The following requirements are independent of each other:

a.

Assume the Shelly Division can sell all of the components that it produces for £400 each. The Blake Division needs 200 units. What is the correct transfer price?

b.

Assume the Shelly Division can sell 3,500 units at £440. Any excess capacity will be unused unless the units are purchased by the Blake Division, which could use up to 200 units.

Determine the minimum transfer price that the Shelly Division would be willing to accept.

Determine the maximum transfer price that the Blake Division would be willing to pay.

The Blake Division can use the Shelly component in the manufacturing of one of its own products. The Blake Division would incur £170 of variable costs to convert the component into its own product, which sells for £600.

Required:

The following requirements are independent of each other:

a.

Assume the Shelly Division can sell all of the components that it produces for £400 each. The Blake Division needs 200 units. What is the correct transfer price?

b.

Assume the Shelly Division can sell 3,500 units at £440. Any excess capacity will be unused unless the units are purchased by the Blake Division, which could use up to 200 units.

Determine the minimum transfer price that the Shelly Division would be willing to accept.

Determine the maximum transfer price that the Blake Division would be willing to pay.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

56

Gregg Manufacturing has one plant located in Belgium and another plant located in the United States. The Belgium plant manufactures a component used in a finished product manufactured at the U.S. plant. Currently, the Belgium plant is operating at 70 percent capacity. In Belgium, the income tax rate is 30 percent; in the United States, the corporate income tax rate is 35 percent. The market price of the component is $280 and the Belgium plant's costs to manufacture the component are as follows:

What is the maximum transfer price that the U.S. division would be willing to pay?

A) $280

B) $148

C) $136

D) $92

What is the maximum transfer price that the U.S. division would be willing to pay?

A) $280

B) $148

C) $136

D) $92

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

57

Gregg Manufacturing has one plant located in Belgium and another plant located in the United States. The Belgium plant manufactures a component used in a finished product manufactured at the U.S. plant. Currently, the Belgium plant is operating at 70 percent capacity. In Belgium, the income tax rate is 30 percent; in the United States, the corporate income tax rate is 35 percent. The market price of the component is $280 and the Belgium plant's costs to manufacture the component are as follows:

What is the minimum transfer price that the Belgium division would be willing to accept?

A) $280

B) $148

C) $136

D) $92

What is the minimum transfer price that the Belgium division would be willing to accept?

A) $280

B) $148

C) $136

D) $92

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

58

Halber Industries is a decentralized company that evaluates its divisions based on ROI. The Brock Division has the capacity to make 2,000 units of a component. The Brock Division's variable costs are £80 per unit.

The Cliff Division can use the Brock component in the manufacturing of one of its own products. The Cliff Division would incur £60 of variable costs to convert the component into its own product, which sells for £300.

Required:

The following requirements are independent of each other:

a.

Assume the Brock Division can sell all of the components that it produces for £180 each. The Cliff Division needs 100 units. What is the correct transfer price?

b.

Assume the Brock Division can sell 1,800 units at £260. Any excess capacity will be unused unless the units are purchased by the Cliff Division, which could use up to 100 units.

Determine the minimum transfer price that the Brock Division would be willing to accept.

Determine the maximum transfer price that the Cliff Division would be willing to pay.

The Cliff Division can use the Brock component in the manufacturing of one of its own products. The Cliff Division would incur £60 of variable costs to convert the component into its own product, which sells for £300.

Required:

The following requirements are independent of each other:

a.

Assume the Brock Division can sell all of the components that it produces for £180 each. The Cliff Division needs 100 units. What is the correct transfer price?

b.

Assume the Brock Division can sell 1,800 units at £260. Any excess capacity will be unused unless the units are purchased by the Cliff Division, which could use up to 100 units.

Determine the minimum transfer price that the Brock Division would be willing to accept.

Determine the maximum transfer price that the Cliff Division would be willing to pay.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

59

Discuss the advantages of decentralization in a multinational company.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

60

Miggs Manufacturing has one plant located in Belgium and another plant located in the United States. The Belgium plant manufactures a component used in a finished product manufactured at the U.S. plant. Currently, the Belgium plant is operating at 70 percent capacity. In Belgium, the income tax rate is 42 percent; in the United States, the corporate income tax rate is 35 percent. The market price of the component is $200 and the Belgium plant's costs to manufacture the component are as follows:

What is the maximum transfer price that the U.S. division would be willing to pay?

A) $70

B) $110

C) 4120

D) $200

What is the maximum transfer price that the U.S. division would be willing to pay?

A) $70

B) $110

C) 4120

D) $200

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

61

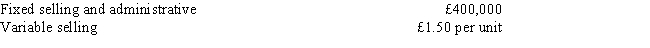

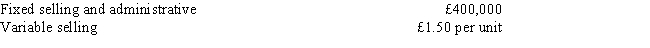

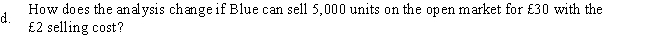

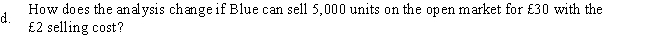

MultiCorp is a decentralized company that rewards divisional managers based on ROI. The Blue Division produces a component that is used by Jam Division. Blue's unit cost of manufacturing 5,000 components (capacity) is:

Blue can sell 4,000 units on the open market for £30 by incurring selling costs of £2 per unit.

An outside supplier has offered Jam 5,000 units of this same component for £29. Orders of less than 5,000 units would cost the Jam Division £31 each. Jam needs the 5,000 components to make finished goods, which provide a total contribution of £245,000 excluding the cost of the component.

The Jam Division's manager has approached the Blue Division manager with an offer to purchase the entire 5,000 units from the Blue Division for a total cost of £130,000 (£26 per unit). If this internal transaction is completed, the Blue Division would not incur the £2 unit selling costs.

Required: Analyze the effect of this offer considering the following:

a.

Is the Blue Division better off by accepting the offer to sell 5,000 units internally for £26 each?

b.

How much is the company as a whole better or worse off if the transaction is completed internally as opposed to each division dealing externally? Justify your answer.

c.

What is the highest price the Jam Division would consider paying the Blue Division for the component?

Blue can sell 4,000 units on the open market for £30 by incurring selling costs of £2 per unit.

An outside supplier has offered Jam 5,000 units of this same component for £29. Orders of less than 5,000 units would cost the Jam Division £31 each. Jam needs the 5,000 components to make finished goods, which provide a total contribution of £245,000 excluding the cost of the component.

The Jam Division's manager has approached the Blue Division manager with an offer to purchase the entire 5,000 units from the Blue Division for a total cost of £130,000 (£26 per unit). If this internal transaction is completed, the Blue Division would not incur the £2 unit selling costs.

Required: Analyze the effect of this offer considering the following:

a.

Is the Blue Division better off by accepting the offer to sell 5,000 units internally for £26 each?

b.

How much is the company as a whole better or worse off if the transaction is completed internally as opposed to each division dealing externally? Justify your answer.

c.

What is the highest price the Jam Division would consider paying the Blue Division for the component?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

62

Flugel Enterprises is a decentralized company that evaluates its divisions based on their reported return on investment. One of Flugel's divisions, the Pipe division, manufactures pipe fittings that are used by the Equipment division as well as other users outside the organization. Pipe has the capacity to make only 3,000 of these fittings at a variable cost of £12 per fitting. Fixed costs of the Pipe division are £90,000 per period and include costs that are common to other products the Pipe division makes. Fixed costs allocated to the fittings sold to the Equipment division are £24,000 per period.

The Equipment division uses the fittings and incurs £100 per unit of additional variable costs to make the equipment that sells on the open market for £150. Equipment expects to sell 1,000 pieces of equipment this period. Fixed costs of this division related to depreciation on past expenditures are estimated at £30,000.

Fittings like those transferred from Pipe to Equipment sell on the open market for £25 each.

Top management of the organization allows divisions to negotiate transfer prices and has a policy of not inferring with the negotiation process.

Required:

a.

What is the absolute minimum price Pipe would accept from Equipment for the fittings if Pipe has excess capacity? State any assumptions necessary to answer the question.

b.

What is the maximum price Equipment would pay the Pipe division for the fittings?

c.

What is the minimum price Pipe would accept if Pipe is operating at capacity to fill orders for these fittings on the open market?

The Equipment division uses the fittings and incurs £100 per unit of additional variable costs to make the equipment that sells on the open market for £150. Equipment expects to sell 1,000 pieces of equipment this period. Fixed costs of this division related to depreciation on past expenditures are estimated at £30,000.

Fittings like those transferred from Pipe to Equipment sell on the open market for £25 each.

Top management of the organization allows divisions to negotiate transfer prices and has a policy of not inferring with the negotiation process.

Required:

a.

What is the absolute minimum price Pipe would accept from Equipment for the fittings if Pipe has excess capacity? State any assumptions necessary to answer the question.

b.

What is the maximum price Equipment would pay the Pipe division for the fittings?

c.

What is the minimum price Pipe would accept if Pipe is operating at capacity to fill orders for these fittings on the open market?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

63

What is the role of transfer pricing in a decentralized firm?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck