Deck 3: Corporations: Special Situations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/110

Play

Full screen (f)

Deck 3: Corporations: Special Situations

1

A company with a NOL carryforward for a tax year is ineligible for the DPAD if the carryforward eliminates current income.

True

2

The penalty taxes of § 531 and § 541 apply to S corporations as well as C corporations.

False

3

May Corporation,a Miami contractor,pays Crane Engineering a fee to design bridges for a highway May will build in the Cayman Islands.The fee Crane receives is DPGR.

False

4

An S corporation cannot take advantage of the DPAD.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

5

DPGR - Allowable Indirect Costs = QPAI.Is this formula correct?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

6

A sole proprietor shows the DPAD as a deduction for adjusted gross income (DFOR)on Form 1040.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

7

In terms of the effect of DPAD,the maximum tax savings for a corporation with $15 million of taxable income is $472,500 in 2012.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

8

The DPAD directly reduces earnings and profits since it is a deduction.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

9

Maper,a real estate developer,pays Alan,a general contractor,to construct a housing project.Alan has no DPGR since he does not own the property.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

10

The lower a taxpayer's W-2 wages,the less the potential DPAD amount.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

11

DPGR cannot include the cost of an embedded service that is part of in the sale of a manufactured product.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

12

If QPAI cannot be used in any one year due to the TI limitation,it can be carried over for 3 years.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

13

A manufacturing concern determines its DPAD on the profits from the sale of items produced,not on the cost of production.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

14

In connection with the construction of a housing project,a contractor pays an architect to design the homes being built.The architect's fee is an embedded service that qualifies as DPGR.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

15

In 2012,the DPAD reduces the corporate tax rates by about 3 percentage points.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

16

The ACE adjustment applies to business entities other than corporations.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

17

As taxable income is reduced by an NOL carryback,there is a corresponding increase in the DPAD.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

18

The DPAD cannot exceed 60% of the employer's allocable W-2 wages.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

19

Blue Company,a U.S.corporation based in Texas,manufactures and sells a product which includes some components made in Mexico.None of Blue's income from sales constitute DPGR.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

20

One of the components of DPGR is qualified production property (QPP).The QPP must be manufactured,produced,grown,or extracted entirely within the U.S.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

21

If mining exploration and development costs are capitalized and written off over 10 years,no adjustment is necessary for AMT purposes.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

22

The definition of an expanded affiliated group (EAG)for DPAD purposes is broader than that applicable to the filing of consolidated tax returns.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

23

NOLs are negative adjustments.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

24

Once a small corporation for AMT purposes,always a small corporation.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

25

Under some circumstances,the sale of prepared food at a taxpayer's retail facility can qualify as DPGR.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

26

Stacey,an advertising executive,pays a contractor to build a lodge on property she owns in Arizona.If Stacey sells the lodge,the proceeds (less the cost of the land)will be DPGR.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

27

A taxpayer who prepares and sells Chinese food at several of its restaurant locations can qualify for DPAD as to the receipts only from take-out orders and home-delivery sales.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

28

The DPAD is not allowed for AMT purposes.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

29

Intangible drilling costs are a tax preference item only for integrated oil companies.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

30

Tax-exempt interest on state and local private activity bonds (issued in 2010)is a tax preference item.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

31

Passive activity losses of certain closely held corporations and personal service corporations are tax preferences.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

32

The objective of the AMT is to force taxpayers that are more profitable than their taxable income reflects to pay additional income taxes.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

33

The AMT rate for corporations is the same as for individuals.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

34

Some of the meals a food service company prepares for its chain of restaurants is frozen and shipped to supermarkets for resale.The proceeds from such sales will qualify as DPGR.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

35

In working with the W-2 wage limitation on DPAD,a partner can count any guaranteed payments he receives from the partnership.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

36

Netting refers to the process of AMT adjustments reversing themselves and then being deducted from taxable income to arrive at AMTI.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

37

Junco Corporation is a member of an expanded affiliated group (EAG)and has QPAI but no W-2 wages.Junco cannot claim a DPAD.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

38

The ACE adjustment can be positive or negative.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

39

In the case of corporations that are members of an expanded affiliated group (EAG),the DPAD is determined by treating the group as a single taxpayer.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

40

Grebe Corporation was formed in 2001.If in 2012,it has average gross receipts of under $7.5 million,the company cannot be subject to the AMT.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

41

Tanweer,Inc. ,manufactures and sells glassware.The company also sells dinnerware that is purchased from unrelated foreign producers.During tax year 2012,Tanweer had a U.S.profit of $1.3 million (QPAI)and a loss from the imported dinnerware of $300,000.What is Tanweer's DPAD?

A)None.

B)$33,000.

C)$66,000.

D)$90,000.

E)None of the above.

A)None.

B)$33,000.

C)$66,000.

D)$90,000.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

42

The AMT exemption amount of $40,000 phases out entirely once a corporation's average gross receipts exceeds $310,000.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

43

Reasonable needs for purposes of the accumulated earnings tax include loans to suppliers and customers.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

44

Map,Inc. ,has taxable income of $13 million in 2012.What is the maximum DPAD tax savings for this C corporation?

A)None.

B)$204,000.

C)$210,000.

D)$409,500.

E)$441,000.

A)None.

B)$204,000.

C)$210,000.

D)$409,500.

E)$441,000.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

45

The regular foreign tax credit is available to reduce AMT liability.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

46

The accumulated earnings credit is always the greater of the minimum credit of $250,000 or the current E & P for the year needed to meet the reasonable needs of the business.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

47

The personal holding company tax rate in 2012 is 35%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

48

Hay Corporation manufactures and sells ceramic dinnerware.The company also sells dinnerware that is purchased from unrelated foreign producers.During the tax year 2012,Hay had a U.S.profit of $1.2 million (QPAI)and a profit from the imported merchandise of $200,000.What is Hay's DPAD?

A)$36,000.

B)$72,000.

C)$108,000.

D)$117,000.

E)None of the above.

A)$36,000.

B)$72,000.

C)$108,000.

D)$117,000.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

49

Which,if any,of the following is a characteristic of the DPAD?

A)Not applicable in situations involving S corporations.

B)Applicable only to manufactured goods that are exported from the U.S.

C)Can never apply when the rendition of personal services is involved.

D)Can sometimes apply when some of the components of a product are manufactured in foreign countries.

E)None of the above.

A)Not applicable in situations involving S corporations.

B)Applicable only to manufactured goods that are exported from the U.S.

C)Can never apply when the rendition of personal services is involved.

D)Can sometimes apply when some of the components of a product are manufactured in foreign countries.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

50

If a corporation is subject to both the § 531 tax and the § 541 tax,the § 541 tax predominates.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

51

Yvonne Corporation manufactures and sells ceramic dinnerware.The company also sells dinnerware that is purchased from unrelated foreign producers.During tax year 2012,Yvonne had a U.S.profit of $1.3 million (QPAI)and a loss from the imported merchandise of $200,000.What is Yvonne's DPAD?

A)$33,000.

B)$66,000.

C)$99,000.

D)$1,080,000.

E)None of the above.

A)$33,000.

B)$66,000.

C)$99,000.

D)$1,080,000.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

52

Crisco,Inc. ,has taxable income of $16 million in 2012.What is the maximum DPAD tax savings for this C corporation?

A)$132,600.

B)$265,200.

C)$472,500.

D)$504,000.

E)None of the above.

A)$132,600.

B)$265,200.

C)$472,500.

D)$504,000.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

53

In a sole proprietorship situation,a DPAD would be a:

A)Deduction from AGI.

B)Deduction for AGI.

C)Possible deduction from and deduction for.

D)Not deductible.

E)All of the above.

A)Deduction from AGI.

B)Deduction for AGI.

C)Possible deduction from and deduction for.

D)Not deductible.

E)All of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

54

Which statement is false?

A)The overall tax effect of a DPAD is a rate reduction or a tax credit.

B)For a flow-through entity,modified AGI is substituted for taxable income.

C)FASB requires the DPAD to be reported as a special charge.

D)MPGE refers to a merge,paid,gain,and expense.

E)All of the above are correct.

A)The overall tax effect of a DPAD is a rate reduction or a tax credit.

B)For a flow-through entity,modified AGI is substituted for taxable income.

C)FASB requires the DPAD to be reported as a special charge.

D)MPGE refers to a merge,paid,gain,and expense.

E)All of the above are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

55

Undistributed PHCI = Taxable Income - Adjustments - Dividends paid.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

56

AMTI may be defined as regular taxable income after AMT adjustments (other than the NOL and ACE adjustments)and after tax preferences.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

57

Which formula is correct for DPAD?

A)Smaller of 9% of QPAI or 9% of modified AGI,not to exceed 50% of allocable wages.

B)Larger of 9% of QPAI or 9% of taxable income,not to exceed 50% of allocable wages.

C)Smaller of 9% of QPAI or 9% of taxable income,not to exceed 60% of allocable wages.

D)Larger of 9% of QPAI or 9% of alternative minimum tax,not to exceed 60% of allocable wages.

E)None of the above.

A)Smaller of 9% of QPAI or 9% of modified AGI,not to exceed 50% of allocable wages.

B)Larger of 9% of QPAI or 9% of taxable income,not to exceed 50% of allocable wages.

C)Smaller of 9% of QPAI or 9% of taxable income,not to exceed 60% of allocable wages.

D)Larger of 9% of QPAI or 9% of alternative minimum tax,not to exceed 60% of allocable wages.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

58

Nontaxable dividend payments reduce both ATI and undistributed PHCI.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

59

A negative ACE adjustment is beneficial to a corporation.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

60

Which statement is false?

A)The AMT is not limited to C corporations.

B)The DPAD is not limited to C corporations.

C)The penalty tax on PHCs is not dependent on the existence of a tax avoidance motive.

D)In the case of a sole proprietor,the DPAD is a deduction for adjusted gross income.

E)All are true.

A)The AMT is not limited to C corporations.

B)The DPAD is not limited to C corporations.

C)The penalty tax on PHCs is not dependent on the existence of a tax avoidance motive.

D)In the case of a sole proprietor,the DPAD is a deduction for adjusted gross income.

E)All are true.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

61

Wow Corporation manufactures an exercise machine at a cost of $700 and sells the machine to Kite Corporation for $1,000 in 2012.Kite incurs TV advertising expenses of $300 and sells the machine by phone order for $1,600.If Wow and Kite corporations are members of an expanded affiliated group (EAG),their DPAD is:

A)$30.

B)$45.

C)$54.

D)$500.

E)None of the above.

A)$30.

B)$45.

C)$54.

D)$500.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is added in arriving at ACE?

A)Tax-exempt income (net of expenses).

B)Federal income tax.

C)Premiums paid on key employees insurance.

D)Loss on sale between related parties.

E)None of the above.

A)Tax-exempt income (net of expenses).

B)Federal income tax.

C)Premiums paid on key employees insurance.

D)Loss on sale between related parties.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

63

Which statement,if any,is false?

A)An S corporation is subject to the corporate AMT.

B)A high level of investment in assets (e.g. ,equipment or structures)is a reason a company may be subject to the AMT.

C)Many of the adjustments that apply to individuals also apply to corporations.

D)The AMT is a separate tax system from the corporate income tax.

E)None of the above.

A)An S corporation is subject to the corporate AMT.

B)A high level of investment in assets (e.g. ,equipment or structures)is a reason a company may be subject to the AMT.

C)Many of the adjustments that apply to individuals also apply to corporations.

D)The AMT is a separate tax system from the corporate income tax.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

64

Boat Corporation manufactures an exercise machine at a cost of $800 and sells the machine to Kirby Corporation for $1,000 in 2012.Kirby incurs TV advertising expenses of $200 and sells the machine by phone order for $1,700.If Boat and Kirby corporations are members of an expanded affiliated group (EAG),their QPAI is:

A)$30.

B)$700.

C)$1,000.

D)$1,600.

E)None of the above.

A)$30.

B)$700.

C)$1,000.

D)$1,600.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following items will be a deduction from unadjusted AMTI in arriving at ACE?

A)Federal income tax.

B)80% dividends received deduction.

C)Penalties and fines.

D)Premiums paid on key employee insurance.

E)None of the above.

A)Federal income tax.

B)80% dividends received deduction.

C)Penalties and fines.

D)Premiums paid on key employee insurance.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following would not be a positive tax preference item in 2012?

A)Accelerated depreciation on real property in excess of straight-line.

B)Intangible drilling costs.

C)Alternative minimum tax NOL deduction.

D)Percentage depletion in excess of adjusted basis.

E)None of the above.

A)Accelerated depreciation on real property in excess of straight-line.

B)Intangible drilling costs.

C)Alternative minimum tax NOL deduction.

D)Percentage depletion in excess of adjusted basis.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following items will be an addition to AMTI in arriving at ACE?

A)Excess capital loss.

B)Federal income tax.

C)Tax-exempt income.

D)Excess charitable contributions.

E)None of the above.

A)Excess capital loss.

B)Federal income tax.

C)Tax-exempt income.

D)Excess charitable contributions.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following has no effect in arriving at ACE?

A)Tax-exempt income (net of expenses).

B)Excess charitable contributions.

C)Key employee insurance proceeds.

D)Deferred gain on installment sales.

E)Premiums paid on key employee insurance.

A)Tax-exempt income (net of expenses).

B)Excess charitable contributions.

C)Key employee insurance proceeds.

D)Deferred gain on installment sales.

E)Premiums paid on key employee insurance.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

69

Which statement is false?

A)The starting point for computing AMTI is taxable income.

B)A tax preference is added to taxable income.

C)The ACE adjustment can be a negative amount.

D)The starting point for computing ACE is taxable income.

E)None of the above.

A)The starting point for computing AMTI is taxable income.

B)A tax preference is added to taxable income.

C)The ACE adjustment can be a negative amount.

D)The starting point for computing ACE is taxable income.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

70

Trahan,Inc. ,an S corporation,has taxable income of $12 million in 2012.Assume there are two shareholders,each in the top individual tax bracket.What is the maximum total DPAD tax savings for the S corporation shareholders?

A)None.

B)$294,000.

C)$378,000.

D)$1,260,000.

E)None of the above.

A)None.

B)$294,000.

C)$378,000.

D)$1,260,000.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

71

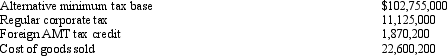

Lime,Inc. ,has the following items related to the AMT:  The corporation's AMT,if any,is:

The corporation's AMT,if any,is:

A)$0.

B)$7,555,800.

C)$9,426,000.

D)$18,251,000.

E)None of the above.

The corporation's AMT,if any,is:

The corporation's AMT,if any,is:A)$0.

B)$7,555,800.

C)$9,426,000.

D)$18,251,000.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following items will have an effect (add or subtract)on unadjusted AMTI to arrive at ACE?

A)Federal income tax.

B)Tax-exempt interest income.

C)Excess capital losses.

D)80% dividends received deduction.

E)None of the above.

A)Federal income tax.

B)Tax-exempt interest income.

C)Excess capital losses.

D)80% dividends received deduction.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

73

Tara's sole proprietorship consists of a bakery and retail food sales.The bakery's DPGR is $700,000,but after CGS,direct expenses,and a ratable portion of indirect expenses are deducted,QPAI is $200,000.W-2 wages related to DPGR are significant.The retail food sales have a loss of $1 million.If Tara files a joint return and her modified AGI is $109,420,what is her allowable DPAD,if any,for 2012?

A)None.

B)$6,000.

C)$9,000.

D)$18,000.

E)Some other amount.

A)None.

B)$6,000.

C)$9,000.

D)$18,000.

E)Some other amount.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

74

Which AMT adjustment would only be negative?

A)Passive activity losses.

B)AMT NOL deduction.

C)DPAD.

D)Completed contract method.

E)None of the above.

A)Passive activity losses.

B)AMT NOL deduction.

C)DPAD.

D)Completed contract method.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

75

Macon Corporation manufactures an exercise machine at a cost of $800 and sells the machine to Kershaw Corporation for $1,000 in 2012.Kershaw incurs TV advertising expenses of $300 and sells the machine by phone order for $1,500.If Macon and Kershaw corporations are members of an expanded affiliated group (EAG),their DPGR is:

A)$30.

B)$800.

C)$1,200.

D)$1,500.

E)None of the above.

A)$30.

B)$800.

C)$1,200.

D)$1,500.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following statements does not reflect the rules regarding pass-through entities and DPAD?

A)Since the deduction is determined at the owner level,each owner must make the computation separately.

B)The entity allocates to each owner his or her share of any QPAI.

C)In the case of partnerships,guaranteed payments are regarded as W-2 wages.

D)A partner cannot be allocated any W-2 wages if the share of QPAI is zero.

E)None of the above.

A)Since the deduction is determined at the owner level,each owner must make the computation separately.

B)The entity allocates to each owner his or her share of any QPAI.

C)In the case of partnerships,guaranteed payments are regarded as W-2 wages.

D)A partner cannot be allocated any W-2 wages if the share of QPAI is zero.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

77

Which statement is false?

A)The stock ownership requirement for the EAG rules is 80%.

B)Members of an EAG are treated as a single taxpayer for purposes of the DPAD.

C)For an EAG,the DPAD is allocated among the members in proportion to each member's respective amount of QPAI.

D)The DPAD of a consolidated group must be allocated to the group's members in proportion to each member's QPAI.

E)None of the above is false.

A)The stock ownership requirement for the EAG rules is 80%.

B)Members of an EAG are treated as a single taxpayer for purposes of the DPAD.

C)For an EAG,the DPAD is allocated among the members in proportion to each member's respective amount of QPAI.

D)The DPAD of a consolidated group must be allocated to the group's members in proportion to each member's QPAI.

E)None of the above is false.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

78

Politz Corporation has average gross receipts of $4.7 million,$4.6 million,and $6.2 million in 2009,2010,and 2011,respectively.In 2012,Politz is:

A)Not subject to the corporate income tax.

B)A small corporation with respect to the AMT.

C)Subject to the AMT.

D)Not a small corporation with respect to the AMT.

E)None of the above.

A)Not subject to the corporate income tax.

B)A small corporation with respect to the AMT.

C)Subject to the AMT.

D)Not a small corporation with respect to the AMT.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

79

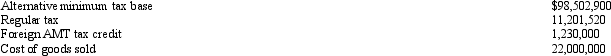

A corporation has the following items related to the AMT.  The corporation's AMT,if any,is:

The corporation's AMT,if any,is:

A)$0.

B)$7,099,060.

C)$7,269,060.

D)$18,300,580.

E)None of the above.

The corporation's AMT,if any,is:

The corporation's AMT,if any,is:A)$0.

B)$7,099,060.

C)$7,269,060.

D)$18,300,580.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

80

Which reason is unlikely to cause a regular corporation to have to pay AMT?

A)A service-type of company with little inventory.

B)A high level of investment in assets such as equipment and structures.

C)Low taxable income due to a cyclical downturn,strong international competition,a low-margin industry,or other factors.

D)Investment at low real interest rates,which increases the company's deductions for depreciation relative to those for interest payments.

E)None of the above.

A)A service-type of company with little inventory.

B)A high level of investment in assets such as equipment and structures.

C)Low taxable income due to a cyclical downturn,strong international competition,a low-margin industry,or other factors.

D)Investment at low real interest rates,which increases the company's deductions for depreciation relative to those for interest payments.

E)None of the above.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck