Deck 14: Taxes on the Financial Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

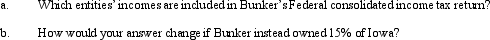

Question

Question

Question

Question

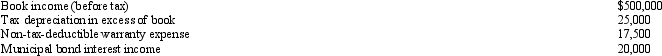

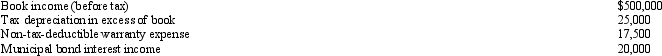

Question

Question

Question

Question

Question

Question

Question

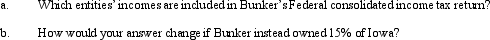

Question

Question

Question

Question

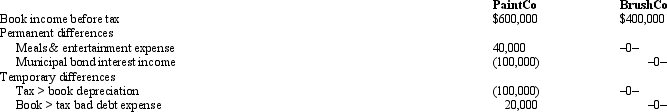

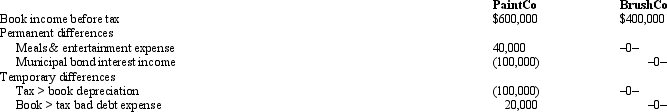

Question

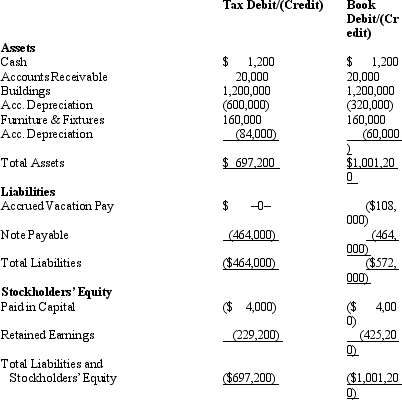

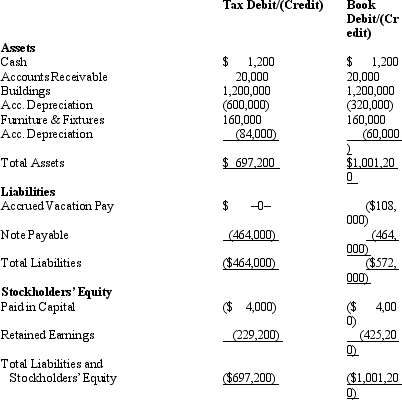

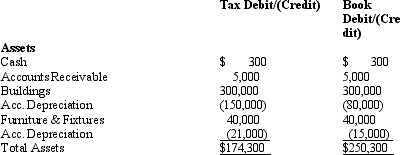

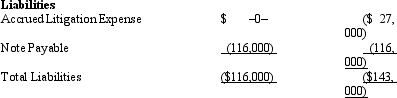

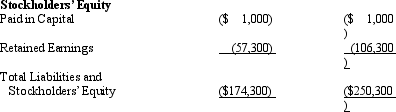

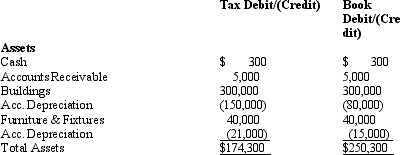

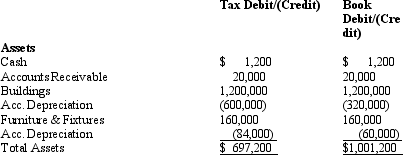

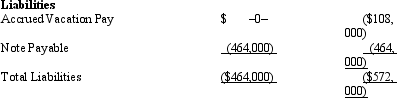

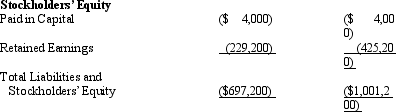

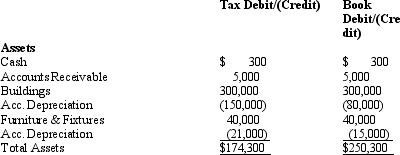

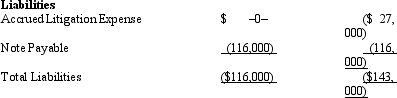

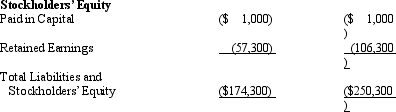

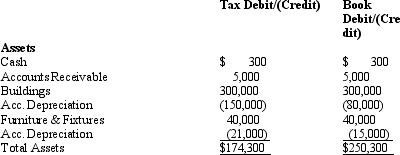

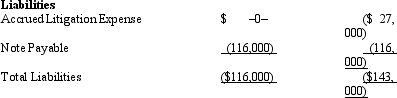

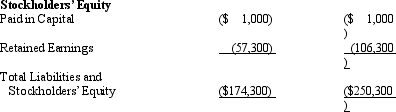

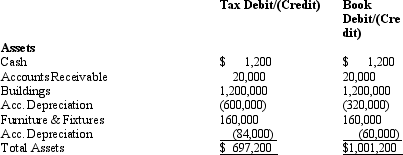

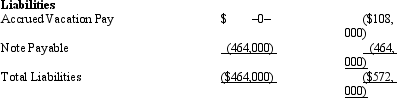

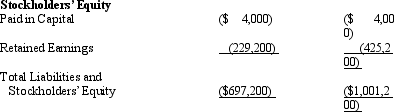

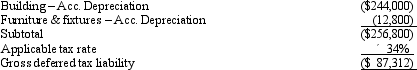

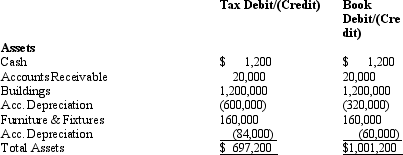

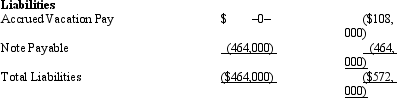

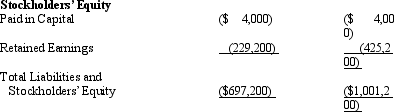

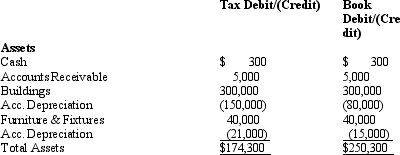

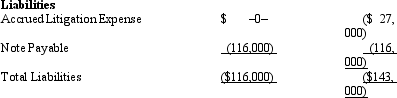

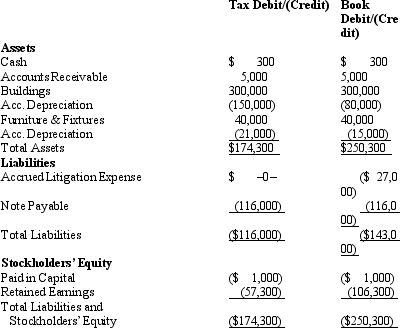

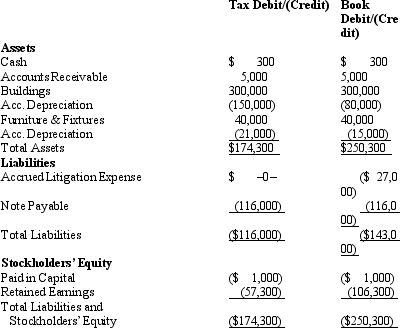

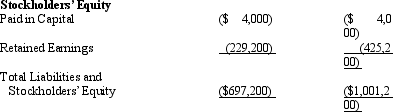

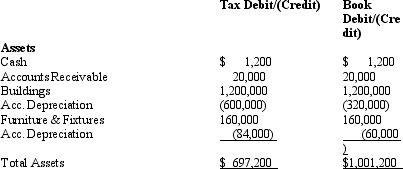

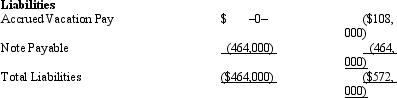

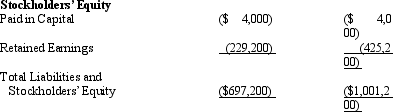

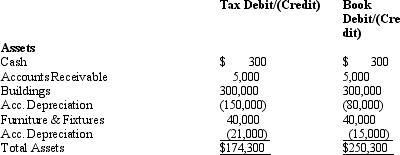

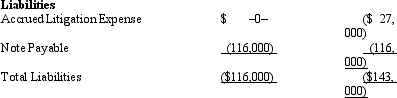

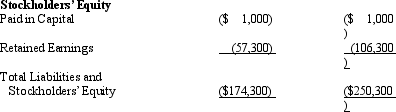

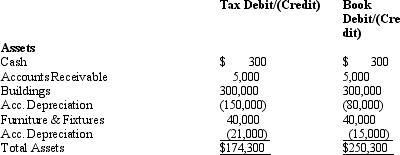

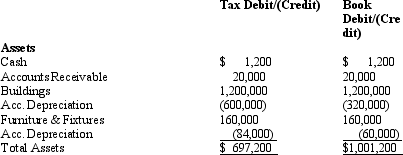

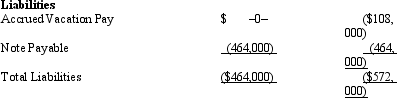

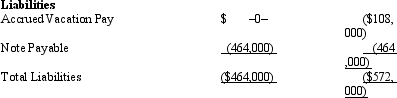

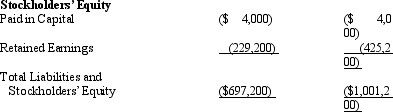

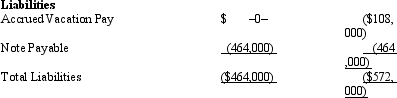

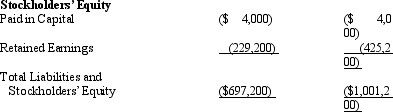

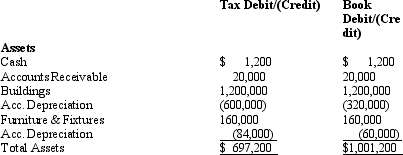

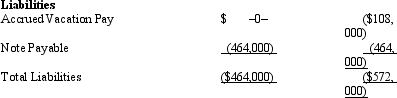

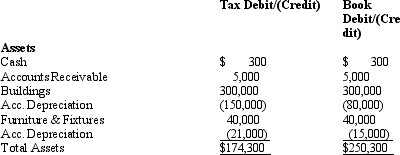

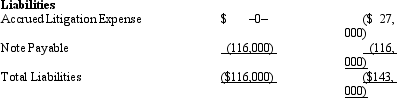

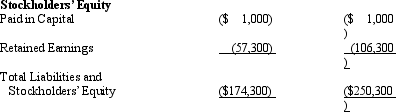

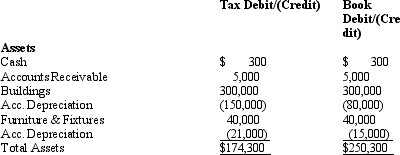

Question

Question

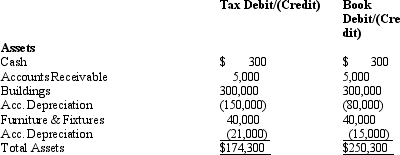

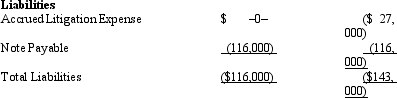

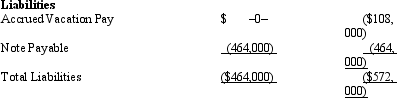

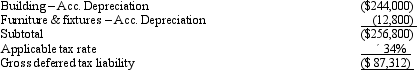

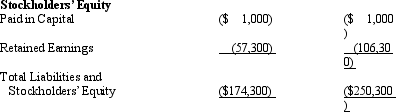

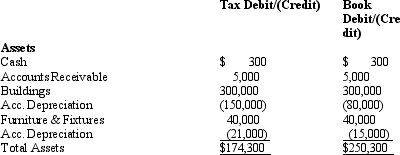

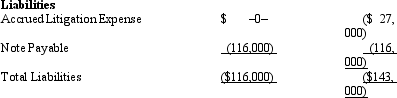

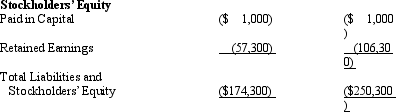

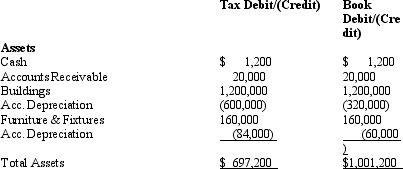

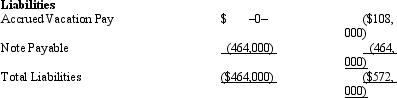

Question

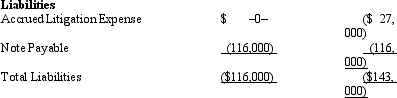

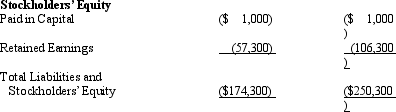

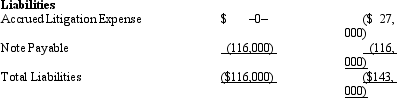

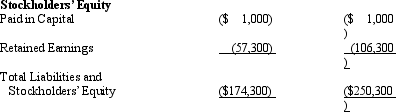

Question

Question

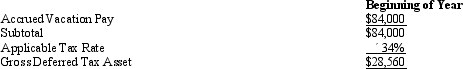

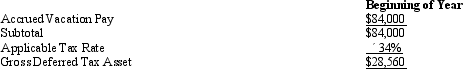

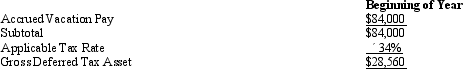

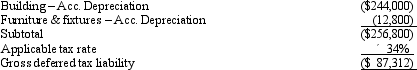

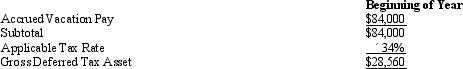

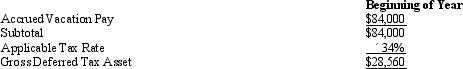

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/87

Play

Full screen (f)

Deck 14: Taxes on the Financial Statements

1

Only U.S.corporations are included in a combined GAAP financial statement.

False

2

A deferred tax asset is the current tax benefit (savings)associated with income or expense to be reported in future year GAAP financial statements.

False

3

If a valuation allowance is increased in the current year,the corporation's effective tax rate is less than if the valuation allowance had not increased.

False

4

If a corporation has no subsidiaries outside the U.S. ,its book and taxable income are identical.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

5

The operations of 80% or more owned domestic subsidiaries can be included in the parent corporation's consolidated tax return,if a proper election is made.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

6

A deferred tax liability represents a potential future tax benefit associated with income reported in the current year GAAP financial statements.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

7

"Temporary differences" are book-tax income differences that eventually appear in both the financial statements and the income tax return,but not in the same reporting period.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

8

The current tax expense reported on the GAAP financial statement generally represents the taxes actually payable to domestic or foreign governmental authorities.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

9

Giant uses the "equity method" to account for the operations of its 40% owned subsidiary Little.A portion of Little's profits for the year are included in Giant's GAAP book income.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

10

Yahr,Inc. ,is a domestic corporation with no subsidiaries.It operates in almost every U.S.state.Yahr records no permanent or temporary book-tax differences this year.Yahr's tax expense on its GAAP financial statements and its tax liability reported on its Federal income tax return are identical.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

11

A deferred tax liability represents a current tax liability associated with income or expense to be reported in future year GAAP financial statements.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

12

Under GAAP,a corporation can defer reporting the U.S.tax expense related to the earnings of foreign subsidiaries,by taking into account its repatriation plans for these earnings.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

13

If a valuation allowance is decreased (released)in the current year,the corporation's effective tax rate is less than if the valuation allowance had not increased.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

14

Schedule UTP of the Form 1120 reconciles financial statement net income after tax with a large corporation's taxable income.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

15

Foreign entities owned at least 80% by the parent are included in a consolidated group's U.S.tax return.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

16

One can describe the benefits of ASC 740-30 (APB 23)as "all or nothing." If it is elected,APB 23 applies to the earnings from all foreign subsidiaries,in the current year and thereafter.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

17

The valuation allowance can reduce either a deferred tax asset or a deferred tax liability.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

18

A deferred tax asset is the expected future tax benefit (savings)associated with income reported in the current year GAAP financial statements.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

19

"Permanent differences" include items that appear in the Federal income tax return as income or deduction,and in the GAAP financial statements as revenue or expense,but in different reporting periods.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

20

In general,the purpose of ASC 740 (SFAS 109)is to compute and disclose the actual taxes paid by a business entity to state,local,Federal,and foreign governments for the current year.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

21

Current tax expense always totals the amount a taxpayer actually paid all Federal,state,and foreign tax authorities in a particular year.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

22

Jogg,Inc. ,earns book net income before tax of $600,000.Jogg puts into service a depreciable asset this year,and first year tax depreciation exceeds book depreciation by $120,000.Jogg has recorded no other temporary or permanent book-tax differences.Assuming that the U.S.tax rate is 35%,and that this is Jogg's first year of operations,what is Jogg's balance in its deferred tax asset and deferred tax liability accounts at year end?

A)$42,000 and $0.

B)$0 and $42,000.

C)$42,000 and $42,000.

D)$0 and $0.

A)$42,000 and $0.

B)$0 and $42,000.

C)$42,000 and $42,000.

D)$0 and $0.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

23

ASC 740 (FIN 48)is the GAAP equivalent of the Form 1120 Schedule M-3.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

24

Create,Inc. ,a domestic corporation,owns 100% of Vinyl,Ltd. ,a foreign corporation and Digital,Inc. ,a domestic corporation.Create also owns 12% of Record,Inc. ,a domestic corporation.Create receives no distributions from any of these corporations.Which of these entities' net income are included in Create's income statement for current year financial reporting purposes?

A)Create,Vinyl,Digital,and Record.

B)Create,Vinyl,and Record.

C)Create,Vinyl,and Digital.

D)Create,Digital,and Record.

E)None of the above.

A)Create,Vinyl,Digital,and Record.

B)Create,Vinyl,and Record.

C)Create,Vinyl,and Digital.

D)Create,Digital,and Record.

E)None of the above.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

25

Purple,Inc. ,a domestic corporation,owns 80% of Blue,Ltd. ,a foreign corporation and Yellow,Inc. ,a domestic corporation.Purple also owns 50% of Green,Inc. ,a domestic corporation.Purple receives no distributions from any of these corporations.Which of these entities' net income are included in Purple's Federal tax return for the current year assuming Purple elects to include all eligible entities in its consolidated Federal income tax return?

A)Purple,Blue,Yellow,and Green.

B)Purple,Blue,and Yellow.

C)Purple,Blue,and Green.

D)Purple and Yellow.

A)Purple,Blue,Yellow,and Green.

B)Purple,Blue,and Yellow.

C)Purple,Blue,and Green.

D)Purple and Yellow.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

26

Phyllis,Inc. ,earns book net income before tax of $600,000.Phyllis puts into service a depreciable asset this year,and first year tax depreciation exceeds book depreciation by $120,000.Phyllis has recorded no other temporary or permanent book-tax differences.Assuming that the U.S.tax rate is 35%,what is Phyllis's total income tax expense reported on its GAAP financial statements?

A)$252,000.

B)$210,000.

C)$168,000.

D)$42,000.

A)$252,000.

B)$210,000.

C)$168,000.

D)$42,000.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

27

ASC 740 (FIN 48)addresses how an entity should report uncertain tax positions in their financial statements.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

28

The major purpose of ASC 740 (SFAS 109)is to match current-year GAAP income with its corresponding tax expenses.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

29

A $50,000 cash tax savings that is temporary has the same effect on a corporation's current year effective tax rate as a $50,000 cash tax savings that is a permanent book-tax difference.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

30

The taxpayer should use ASC 740-30 (APB 23)income deferral only when the tax rates that apply to the subsidiary are less than those of the applicable U.S.income tax rate.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following items represents a temporary book-tax difference?

A)Municipal bond interest.

B)Compensation-related expenses.

C)Meals and entertainment expense deduction.

D)Nondeductible penalties.

A)Municipal bond interest.

B)Compensation-related expenses.

C)Meals and entertainment expense deduction.

D)Nondeductible penalties.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

32

In the "rate reconciliation" of GAAP tax footnotes,temporary book-tax differences are reconciled between book income as if taxed at U.S.tax rates and the actual book income tax expense.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

33

Repatriating prior year earnings from a foreign subsidiary located in a low-tax country where ASC 740-30 (APB 23)benefits were previously adopted will decrease a corporation's current year effective tax rate.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

34

Create,Inc. ,a domestic corporation,owns 90% of Vinyl,Ltd. ,a foreign corporation and Digital,Inc. ,a domestic corporation.Create also owns 60% of Record,Inc. ,a domestic corporation.Create receives no distributions from any of these corporations.Which of these entities' net income are included in Create's Federal tax return for the current year assuming Create elects to include all eligible entities in its consolidated Federal income tax return?

A)Create and Digital.

B)Create,Vinyl,and Digital.

C)Create,Vinyl,and Record.

D)Create,Vinyl,Digital,and Record.

A)Create and Digital.

B)Create,Vinyl,and Digital.

C)Create,Vinyl,and Record.

D)Create,Vinyl,Digital,and Record.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

35

Gravel,Inc. ,earns book net income before tax of $600,000.Gravel puts into service a depreciable asset this year,and first year tax depreciation exceeds book depreciation by $120,000.Gravel has recorded no other temporary or permanent book-tax differences.Assuming that the U.S.tax rate is 35%,what is Gravel's current income tax expense reported on its GAAP financial statements?

A)$252,000.

B)$210,000.

C)$168,000.

D)$42,000.

A)$252,000.

B)$210,000.

C)$168,000.

D)$42,000.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

36

Purple,Inc. ,a domestic corporation,owns 100% of Blue,Ltd. ,a foreign corporation and Yellow,Inc. ,a domestic corporation.Purple also owns 40% of Green,Inc. ,a domestic corporation.Purple receives no distributions from any of these corporations.Which of these entities' net income are included in Purple's GAAP income statement for current year financial reporting purposes?

A)Purple,Blue,Yellow,and Green.

B)Purple,Blue,and Yellow.

C)Purple,Blue,and Green.

D)Purple,Yellow,and Green.

A)Purple,Blue,Yellow,and Green.

B)Purple,Blue,and Yellow.

C)Purple,Blue,and Green.

D)Purple,Yellow,and Green.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following taxes are included in the total income tax expense of a corporation as reported on its financial statements?

A)State income taxes.

B)Foreign income taxes.

C)Federal income taxes.

D)All the above taxes are included.

A)State income taxes.

B)Foreign income taxes.

C)Federal income taxes.

D)All the above taxes are included.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

38

The income tax footnote to the GAAP financial statements includes a reconciliation of a corporation's hypothetical tax on book income to its book tax expense as if it were taxed in full at the applicable U.S.income tax rates.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

39

Clipp,Inc. ,earns book net income before tax of $600,000.Clipp puts into service a depreciable asset this year,and first year tax depreciation exceeds book depreciation by $120,000.Clipp has recorded no other temporary or permanent book-tax differences.Assuming that the U.S.tax rate is 35%,what is Clipp's deferred income tax liability reported on its GAAP financial statements?

A)$252,000.

B)$210,000.

C)$168,000.

D)$42,000.

A)$252,000.

B)$210,000.

C)$168,000.

D)$42,000.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following taxes are included in the total income tax expense of a corporation reported on its Federal tax return?

A)State income taxes.

B)Foreign income taxes.

C)Federal income taxes.

D)All the above taxes are included.

A)State income taxes.

B)Foreign income taxes.

C)Federal income taxes.

D)All the above taxes are included.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

41

Morrisson,Inc. ,earns book net income before tax of $500,000.In computing its book income,Morrisson deducts $50,000 more in warranty expense for book purposes than is allowed for tax purposes.Morrisson records no other temporary or permanent book-tax differences.Assuming that the U.S.tax rate is 35% and no valuation allowance is required,what is Morrisson's current income tax expense reported on its GAAP financial statements?

A)$192,500.

B)$175,000.

C)$157,500.

D)$17,500.

A)$192,500.

B)$175,000.

C)$157,500.

D)$17,500.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

42

How are deferred tax liabilities and assets categorized on the balance sheet?

A)Capital and ordinary.

B)Domestic and foreign.

C)Current and non-current.

D)Positive and negative.

A)Capital and ordinary.

B)Domestic and foreign.

C)Current and non-current.

D)Positive and negative.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

43

Collins,Inc. ,reports an effective tax rate in its income tax footnote of 14%.The only reconciling item with regard to the hypothetical tax at 35% is a valuation allowance reversal of negative 21%.Which of the following statements is true concerning comparing Collins,Inc.'s effective tax rate with its competitors,all of whom have an effective tax rate between 32 and 36%?

A)Collins Inc.is managing its tax burden in a more efficient manner than its competitors.

B)Collins Inc.earned more cash profits because of its lower effective tax rate.

C)Collins Inc.'s structural effective tax rate is actually quite close to its competitors.

D)Collins Inc.is likely to be engaged in tax shelter activities.

A)Collins Inc.is managing its tax burden in a more efficient manner than its competitors.

B)Collins Inc.earned more cash profits because of its lower effective tax rate.

C)Collins Inc.'s structural effective tax rate is actually quite close to its competitors.

D)Collins Inc.is likely to be engaged in tax shelter activities.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

44

Beach,Inc. ,a domestic corporation,owns 100% of Mountain,Ltd. ,a manufacturing facility in Ireland.Mountain has no operations or activities in the United States.The U.S.tax rate is 35% and the Irish tax rate is 10%.For the current year,Beach earns $500,000 in taxable income.Mountain earns $300,000 in taxable income from its operations,pays $30,000 in taxes to Ireland,and makes no distributions to Beach.What is Beach's effective tax rate for GAAP book purposes,assuming that Beach does not make the permanent reinvestment assumption of ASC 740-30 (APB 23)?

A)38.75%.

B)35%.

C)31.25%.

D)25.63%.

A)38.75%.

B)35%.

C)31.25%.

D)25.63%.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

45

Bunker,Inc. ,is a domestic corporation.It owns 100% of Texas,Inc. ,a domestic corporation,100% of Paris,a foreign corporation,and 35% of Iowa,Inc. ,a domestic corporation.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following items are not included in the GAAP financial statement income tax footnote's effective tax rate reconciliation?

A)Hypothetical tax on book income at U.S.Federal corporate tax rate.

B)Total tax expense per the GAAP financial statements.

C)Tax effect of temporary differences.

D)Tax effect of permanent differences.

A)Hypothetical tax on book income at U.S.Federal corporate tax rate.

B)Total tax expense per the GAAP financial statements.

C)Tax effect of temporary differences.

D)Tax effect of permanent differences.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

47

South,Inc. ,earns book net income before tax of $400,000 in 2012.South acquires a depreciable asset in 2012,and first year tax depreciation exceeds book depreciation by $50,000.At the end of 2012,South's deferred tax liability account balance is $17,500.In 2013,South earns $500,000 book net income before tax,and its book depreciation exceeds tax depreciation by $20,000.South records no other temporary or permanent book-tax differences.Assuming that the U.S.tax rate is 35%,what is South's current income tax expense reported on its GAAP financial statements for 2013?

A)$7,000.

B)$168,000.

C)$175,000.

D)$182,000.

A)$7,000.

B)$168,000.

C)$175,000.

D)$182,000.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

48

Beach,Inc. ,a domestic corporation,owns 100% of Mountain,Ltd. ,a manufacturing facility in Ireland.Mountain has no operations or activities in the United States.The U.S.tax rate is 35% and the Irish tax rate is 10%.For the current year,Beach earns $500,000 in taxable income.Mountain earns $300,000 in taxable income from its operations,pays $30,000 in taxes to Ireland,and makes no distributions to Beach.What is Beach's effective tax rate for GAAP book purposes,assuming that Beach makes the permanent reinvestment assumption of ASC 740-30 (APB 23)?

A)38.75%.

B)35%.

C)31.25%.

D)25.63%.

A)38.75%.

B)35%.

C)31.25%.

D)25.63%.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

49

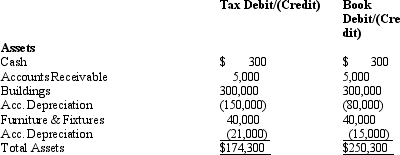

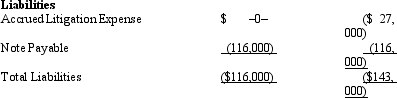

Rochelle,Inc. ,reported the following results for the current year.

Determine Rochelle's taxable income for the current year.Identify any temporary or permanent book-tax differences.

Determine Rochelle's taxable income for the current year.Identify any temporary or permanent book-tax differences.

Determine Rochelle's taxable income for the current year.Identify any temporary or permanent book-tax differences.

Determine Rochelle's taxable income for the current year.Identify any temporary or permanent book-tax differences.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

50

South,Inc. ,earns book net income before tax of $400,000 in 2012.South acquires a depreciable asset in 2012,and first year tax depreciation exceeds book depreciation by $50,000.At the end of 2012,South's deferred tax liability account balance is $17,500.In 2013,South earns $500,000 book net income before tax,and its book depreciation exceeds tax depreciation by $20,000.South records no other temporary or permanent book-tax differences.Assuming that the U.S.tax rate is 35%,what is South's total income tax expense reported on its GAAP financial statements for 2013?

A)$7,000.

B)$168,000.

C)$175,000.

D)$182,000.

A)$7,000.

B)$168,000.

C)$175,000.

D)$182,000.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements best describes considerations regarding a company's tax expense that may be made by users of GAAP financial statements?

A)The breakdown of tax expense between current and deferred may provide useful information regarding the comparison of tax burdens between companies.

B)An analysis of earnings before interest,taxes,depreciation,and amortization (EBITDA)is often a better approach to comparing operating results of two companies.

C)One-time effects within a company's effective tax rate should be removed before comparing effective tax rates across companies (or across years for the same company).

D)All the above observations are correct.

A)The breakdown of tax expense between current and deferred may provide useful information regarding the comparison of tax burdens between companies.

B)An analysis of earnings before interest,taxes,depreciation,and amortization (EBITDA)is often a better approach to comparing operating results of two companies.

C)One-time effects within a company's effective tax rate should be removed before comparing effective tax rates across companies (or across years for the same company).

D)All the above observations are correct.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

52

Never,Inc. ,earns book net income before tax of $500,000.In computing its book income,Never deducts $50,000 more in warranty expense for book purposes than is allowed for tax purposes.Never records no other temporary or permanent book-tax differences.Assuming that the U.S.tax rate is 35% and no valuation allowance is required,what is Never's deferred income tax asset reported on its GAAP financial statements?

A)$192,500.

B)$175,000.

C)$157,500.

D)$17,500.

A)$192,500.

B)$175,000.

C)$157,500.

D)$17,500.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

53

Hot,Inc.'s primary competitor is Cold,Inc.When comparing relative deferred tax asset and liability accounts with Cold,which of the following benchmarking activities should Hot undertake?

A)Scale the deferred tax assets and liabilities by total sales or total assets.

B)Compare raw dollar amounts of deferred tax assets and liabilities.

C)Ignore deferred tax assets and liabilities and focus on overall effective tax rate.

D)Ignore all tax information other than the current tax expense.

A)Scale the deferred tax assets and liabilities by total sales or total assets.

B)Compare raw dollar amounts of deferred tax assets and liabilities.

C)Ignore deferred tax assets and liabilities and focus on overall effective tax rate.

D)Ignore all tax information other than the current tax expense.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

54

South,Inc. ,earns book net income before tax of $400,000 in 2012.South acquires a depreciable asset in 2012,and first year tax depreciation exceeds book depreciation by $50,000.At the end of 2012,South's deferred tax liability account balance is $17,500.In 2013,South earns $500,000 book net income before tax,and its book depreciation exceeds tax depreciation by $20,000.South records no other temporary or permanent book-tax differences.Assuming that the U.S.tax rate is 35%,what is South's balance in its deferred tax liability account at the end of 2013?

A)$0.

B)$7,000.

C)$10,500.

D)$17,500.

A)$0.

B)$7,000.

C)$10,500.

D)$17,500.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following items are not included in the income tax note for a publicly traded company?

A)Breakdown of income between foreign and domestic.

B)Analysis of deferred tax assets and liabilities.

C)Breakdown of income among States.

D)Rate reconciliation.

E)Analysis of total tax expense components.

A)Breakdown of income between foreign and domestic.

B)Analysis of deferred tax assets and liabilities.

C)Breakdown of income among States.

D)Rate reconciliation.

E)Analysis of total tax expense components.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

56

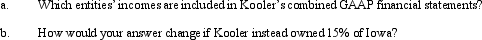

Kooler,Inc. ,is a domestic corporation.It owns 100% of Texas,Inc. ,a domestic corporation,100% of Paris,a foreign corporation,and 45% of Iowa,Inc. ,a domestic corporation.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

57

Cold,Inc. ,reported a $100,000 total tax expense for financial statement purposes in 2012.This total expense consisted of $150,000 in current tax expense and a deferred tax benefit of $50,000.The deferred tax benefit consisted of $90,000 in deferred tax assets reduced by a valuation allowance of $40,000.In 2013,Cold reports $600,000 in book net income before tax.Cold records no other permanent or temporary book-tax differences.At the end of 2013,Cold's auditors determine that the existing valuation allowance of $40,000 should be reduced to zero.What is Cold's total tax expense for 2013?

A)$250,000.

B)$210,000.

C)$170,000.

D)$40,000.

A)$250,000.

B)$210,000.

C)$170,000.

D)$40,000.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

58

Qute,Inc. ,earns book net income before tax of $500,000.In computing its book income,Qute deducts $50,000 more in warranty expense for book purposes than is allowed for tax purposes.Qute records no other temporary or permanent book-tax differences.Assuming that the U.S.tax rate is 35% and no valuation allowance is required,what is Qute's total income tax expense reported on its GAAP financial statements?

A)$192,500.

B)$175,000.

C)$157,500.

D)$17,500.

A)$192,500.

B)$175,000.

C)$157,500.

D)$17,500.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

59

Larson,Inc. ,hopes to report a total book tax expense of $160,000 in the current year.This $160,000 expense consists of $240,000 in current tax expense and an $80,000 tax benefit related to the expected future use of an NOL by Larson.If the auditors determine that a valuation allowance of $30,000 must be placed against Larson's deferred tax assets,what is Larson's total book tax expense?

A)$130,000.

B)$160,000.

C)$190,000.

D)$240,000.

A)$130,000.

B)$160,000.

C)$190,000.

D)$240,000.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

60

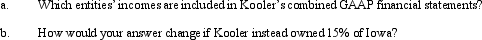

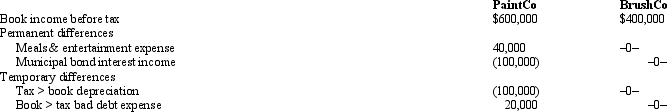

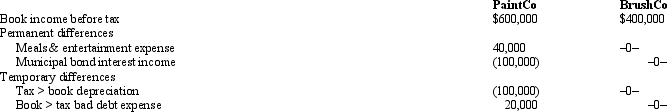

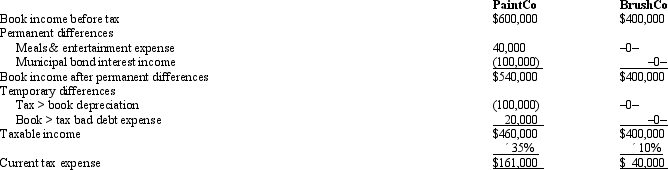

PaintCo Inc. ,a domestic corporation,owns 100% of BrushCo Ltd. ,an Irish corporation.Assume that the U.S.corporate tax rate is 35% and the Irish rate is 10%.PaintCo is permanently reinvesting BrushCo's earnings outside the United States under ASC 740-30 (APB 23).The corporations' book income,permanent and temporary book-tax differences,and current tax expense are as follows.Determine PaintCo's total tax expense reported on its financial statements,its current tax expense (benefit),and its deferred tax expense (benefit).

Unlock Deck

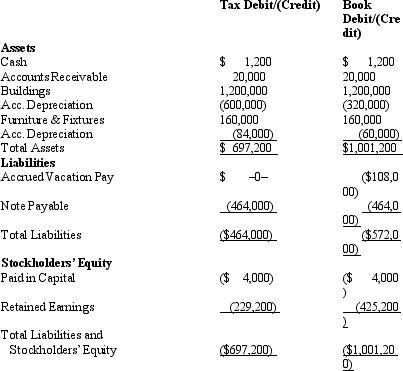

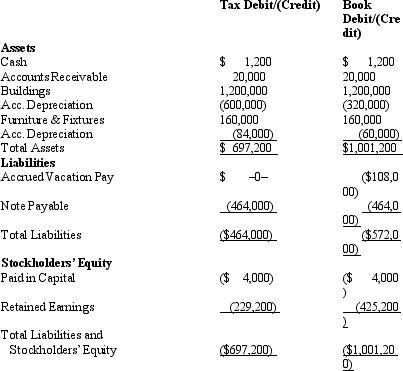

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

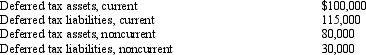

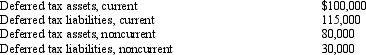

61

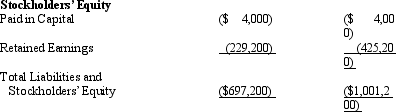

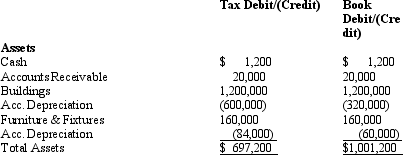

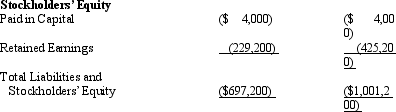

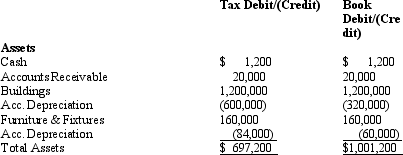

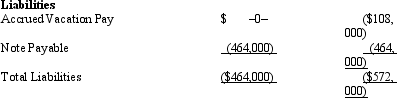

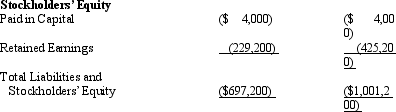

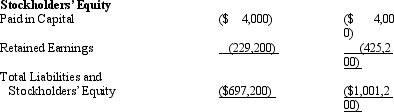

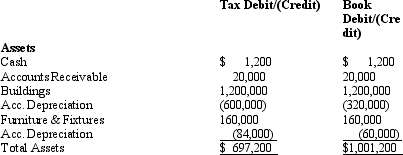

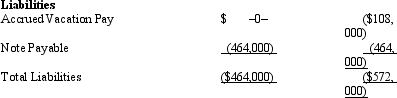

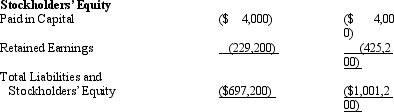

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

62

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

63

Black,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

64

After applying the balance sheet method to determine the GAAP income tax expense of Cutter Inc. ,the following account balances are found.Determine the balance sheet presentation of these amounts.Hint: Which of the accounts should you combine for the final balance sheet disclosure?

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

65

Black,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

66

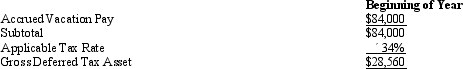

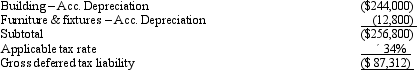

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

67

Black,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

68

PaintCo Inc. ,a domestic corporation,owns 100% of BrushCo Ltd. ,an Irish corporation.Assume that the U.S.corporate tax rate is 35% and the Irish rate is 10%.PaintCo is permanently reinvesting BrushCo's earnings outside the United States under ASC 740-30 (APB 23).The corporations' book income,permanent and temporary book-tax differences,and current tax expense are as follows.Provide the income tax footnote rate reconciliation for PaintCo using both dollar amounts and percentages.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

69

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

70

Black,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

71

Black,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

72

At the beginning of the year,the balance sheet of Jensen Inc. ,shows a $500,000 deferred tax asset relating to a net operating loss carryforward,offset by a $100,000 valuation allowance.At the end of the year,Jensen's auditors agree to release $40,000 of the allowance.Develop the journal entry to record this change in the valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

73

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

74

Black,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

75

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

76

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

77

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

78

Black,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

79

At the beginning of the year,Jensen Inc. ,holds a net operating loss carryforward,and its balance sheet shows a related deferred tax asset of $500,000.At the end of the year,the balance in the deferred tax asset account has not changed,but Jensen's auditors want to record a $100,000 valuation allowance against this amount,because of a persistent downturn in Jensen's profitability.Develop the journal entry to record the valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

80

Black,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck