Deck 1: The Investment Setting: Part A

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/6

Play

Full screen (f)

Deck 1: The Investment Setting: Part A

1

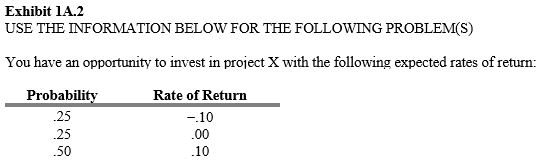

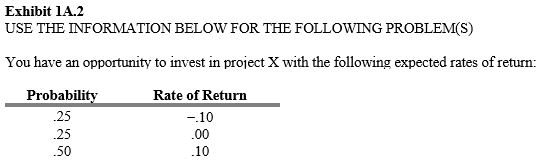

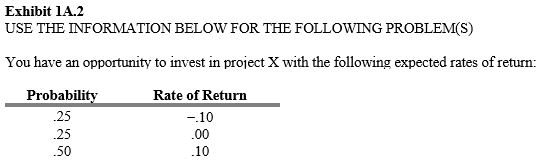

Refer to Exhibit 1A.2. The expected return for project X is

A) 0.0 percent.

B) 0.5 percent.

C) 2.5 percent.

D) 5.0 percent.

E) 7.5 percent.

C

2

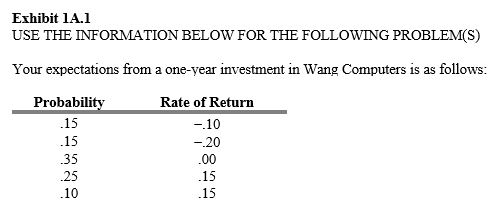

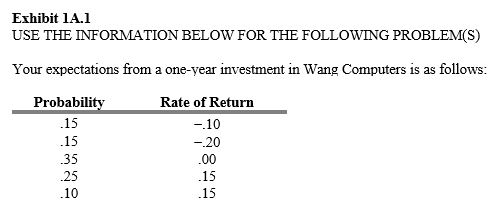

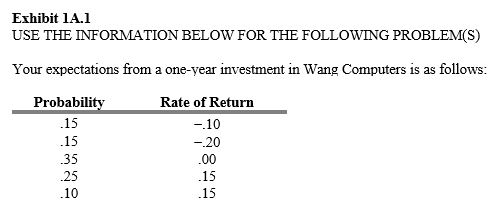

Refer to Exhibit 1A.1. The standard deviation of your expected return from this investment is

A) 0.001.

B) 0.004.

C) 0.124.

D) 1.240.

E) None of these are correct.

C

3

-Refer to Exhibit 1A.1. The expected return from this investment is

A) -0.0752.

B) -0.0040.

C) 0.00.

D) 0.0075.

E) 0.4545.

0.0075.

4

-Refer to Exhibit 1A.2. The standard deviation for project X is

A) -1.581 percent.

B) 0.000 percent.

C) 1.581 percent.

D) 2.738 percent.

E) 5.000 percent.

Unlock Deck

Unlock for access to all 6 flashcards in this deck.

Unlock Deck

k this deck

5

-Refer to Exhibit 1A.1. The coefficient of variation of this investment is

A) -0.06.

B) -0.65.

C) 6.60.

D) 16.53.

E) 165.10.

Unlock Deck

Unlock for access to all 6 flashcards in this deck.

Unlock Deck

k this deck

6

An investment has a standard deviation of 12 percent and an expected return of 7 percent. What is the coefficient of variation for this investment?

A) 1.714

B) 1.372

C) 0.714

D) 0.583

E) 0.500

Unlock Deck

Unlock for access to all 6 flashcards in this deck.

Unlock Deck

k this deck