Deck 2: Asset Allocation and Security Selection: Part A

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/3

Play

Full screen (f)

Deck 2: Asset Allocation and Security Selection: Part A

What is the correlation coefficient for two assets with a covariance of .0032, if asset 1 has a standard deviation of 12 percent and asset 2 has a standard deviation of 9 percent?

A) 0.2963

B) 0.3456

C) 0.8721

D) 1.5980

A) 0.2963

B) 0.3456

C) 0.8721

D) 1.5980

A

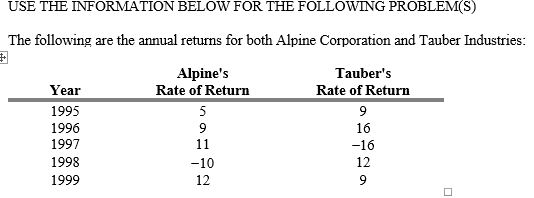

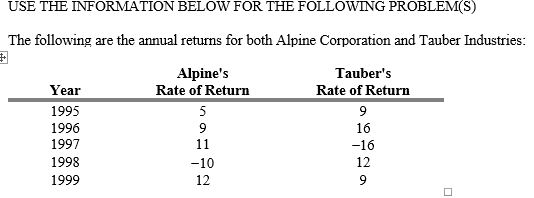

-Refer to Exhibit 2A.1. Calculate the covariance.

A) -32.20

B) -23.32

C) 1.00

D) 23.32

E) 32.20

-32.20

-Refer to Exhibit 2A.1. Calculate the coefficient of correlation.

A) -0.456

B) -0.354

C) 0.000

D) 0.456

E) 3.538

-0.354