Deck 6: An Introduction to Portfolio Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/114

Play

Full screen (f)

Deck 6: An Introduction to Portfolio Management

1

Risk is defined as the uncertainty of future outcomes.

True

2

Prior to the work of Markowitz in the late 1950's and early 1960's, portfolio managers did NOT have a well-developed, quantitative means of measuring risk.

True

3

For a two stock portfolio containing Stocks i and j, the correlation coefficient of returns (rij) is equal to the square root of the covariance (covij).

False

4

A measure that only considers deviations above the mean is semi-variance.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

5

A good portfolio is a collection of individually good assets.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

6

In a three-asset portfolio, the standard deviation of the portfolio is one-third of the square root of the sum of the individual standard deviations.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

7

The expected return and standard deviation of a portfolio of risky assets is equal to the weighted average of the individual asset's expected returns and standard deviation.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

8

Assuming that everyone agrees on the efficient frontier (given a set of costs), there would be consensus that the optimal portfolio on the frontier would be where the ratio of return per unit of risk was greatest.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

9

An investor is risk neutral if she chooses the asset with lower risk given a choice of several assets with equal returns.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

10

Markowitz assumed that, given an expected return, investors prefer to minimize risk.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

11

If the covariance of two stocks is positive, these stocks tend to move together over time.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

12

Combining assets that are NOT perfectly correlated does affect both the expected return of the portfolio as well as the risk of the portfolio.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

13

A basic assumption of the Markowitz model is that investors base decisions solely on expected return and risk.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

14

As the number of risky assets in a portfolio increases, the total risk of the portfolio decreases.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

15

Investors choose a portfolio on the efficient frontier based on their utility functions that reflect their attitudes towards risk.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

16

The combination of two assets that are completely negatively correlated provides maximum returns.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

17

A portfolio is efficient if no other asset or portfolios offer higher expected return with the same (or lower) risk or lower risk with the same (or higher) expected return.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

18

The correlation coefficient and the covariance are measures of the extent to which two random variables move together.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

19

The set of portfolios with the maximum rate of return for every given risk level is known as the optimal frontier.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

20

Increasing the correlation among assets in a portfolio results in an increase in the standard deviation of the portfolio.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

21

The market portfolio consists of all risky assets.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

22

Semivariance, when applied to portfolio theory, is concerned with

A) the square root of deviations from the mean.

B) all deviations below the mean.

C) all deviations above the mean.

D) all deviations.

E) the summation of the squared deviations from the mean.

A) the square root of deviations from the mean.

B) all deviations below the mean.

C) all deviations above the mean.

D) all deviations.

E) the summation of the squared deviations from the mean.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

23

Studies have shown that a well-diversified investor needs as few as five stocks.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

24

The portfolios on the capital market line are combinations of the risk-free asset and the market portfolio.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

25

One of the assumptions of capital market theory is that investors can borrow or lend at the risk-free rate.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

26

Markowitz believes that any asset or portfolio of assets can be described by ____ parameter(s).

A) one

B) two

C) three

D) four

E) five

A) one

B) two

C) three

D) four

E) five

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

27

All of the following are assumptions of the Markowitz model EXCEPT

A) risk is measured based on the variability of returns.

B) investors maximize one-period expected utility.

C) investors' utility curves demonstrate properties of diminishing marginal utility of wealth.

D) investors base decisions solely on expected return and time.

E) there are no tax costs involved.

A) risk is measured based on the variability of returns.

B) investors maximize one-period expected utility.

C) investors' utility curves demonstrate properties of diminishing marginal utility of wealth.

D) investors base decisions solely on expected return and time.

E) there are no tax costs involved.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

28

The probability of an adverse outcome is a definition of

A) statistics.

B) variance.

C) random.

D) risk.

E) semi-variance above the mean.

A) statistics.

B) variance.

C) random.

D) risk.

E) semi-variance above the mean.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

29

Because many of the assumptions made by the capital market theory are unrealistic, the theory is NOT applicable in the real world.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

30

If you borrow money at the RFR and invest the money in the market portfolio, the rate of return on your portfolio will be higher than the market rate of return.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

31

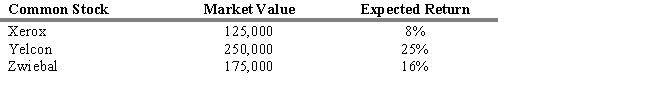

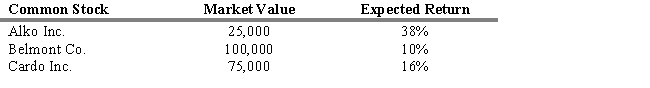

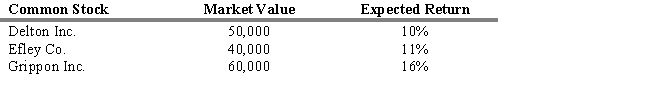

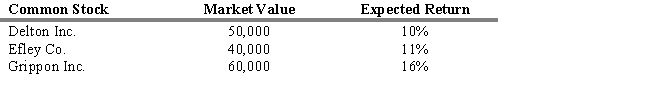

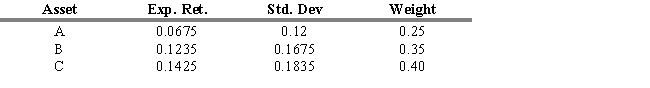

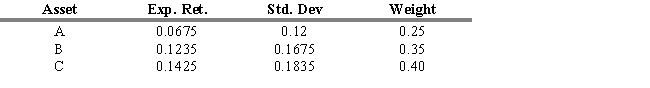

What is the expected return of the three-stock portfolio described below?

A) 18.27%

B) 14.33%

C) 16.33%

D) 12.72%

E) 16.45%

A) 18.27%

B) 14.33%

C) 16.33%

D) 12.72%

E) 16.45%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

32

A risk-free asset is one in which the return is completely guaranteed; there is no uncertainty.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

33

The capital market line is the tangent line between the risk-free rate of return and the efficient frontier.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

34

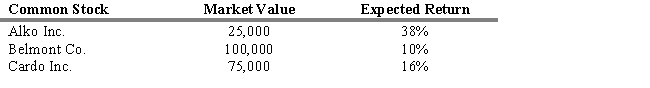

What is the expected return of the three-stock portfolio described below?

A) 18.45%

B) 12.82%

C) 13.38%

D) 15.27%

E) 16.67%

A) 18.45%

B) 12.82%

C) 13.38%

D) 15.27%

E) 16.67%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

35

When individuals evaluate their portfolios, they should evaluate

A) all the U.S. and non-U.S. stocks.

B) all marketable securities.

C) all marketable securities and other liquid assets.

D) all assets.

E) all assets and liabilities.

A) all the U.S. and non-U.S. stocks.

B) all marketable securities.

C) all marketable securities and other liquid assets.

D) all assets.

E) all assets and liabilities.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

36

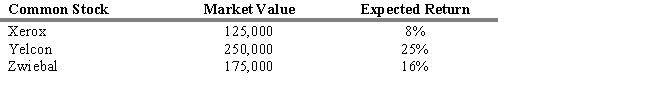

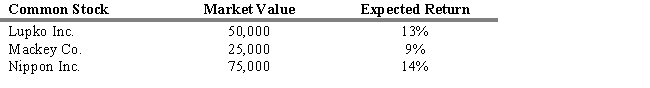

What is the expected return of the three-stock portfolio described below?

A) 21.33%

B) 12.50%

C) 32.00%

D) 15.75%

E) 16.80%

A) 21.33%

B) 12.50%

C) 32.00%

D) 15.75%

E) 16.80%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

37

The Markowitz model is based on several assumptions regarding investor behavior. Which of the following is NOT such any assumption?

A) Investors consider each investment alternative as being represented by a probability distribution of expected returns over some holding period.

B) Investors maximize one-period expected utility.

C) Investors estimate the risk of the portfolio on the basis of the variability of expected returns.

D) Investors base decisions solely on expected return and risk.

E) None of these are correct (that is, all are assumptions of the Markowitz model).

A) Investors consider each investment alternative as being represented by a probability distribution of expected returns over some holding period.

B) Investors maximize one-period expected utility.

C) Investors estimate the risk of the portfolio on the basis of the variability of expected returns.

D) Investors base decisions solely on expected return and risk.

E) None of these are correct (that is, all are assumptions of the Markowitz model).

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

38

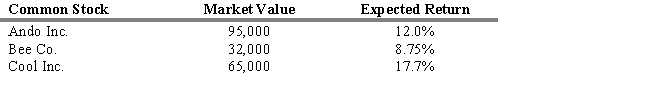

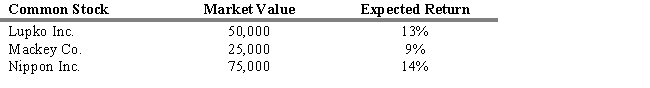

What is the expected return of the three-stock portfolio described below?

A) 12.04%

B) 12.83%

C) 13.07%

D) 15.89%

E) 17.91%

A) 12.04%

B) 12.83%

C) 13.07%

D) 15.89%

E) 17.91%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

39

The introduction of lending and borrowing severely limits the available risk/return opportunities.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

40

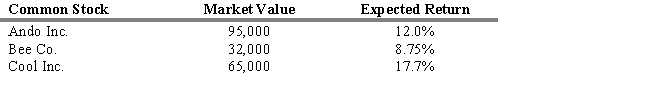

16.99%What is the expected return of the three-stock portfolio described below?

A) 14.89%

B) 16.22%

C) 12.66%

D) 13.85%

E) 16.99%

A) 14.89%

B) 16.22%

C) 12.66%

D) 13.85%

E) 16.99%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

41

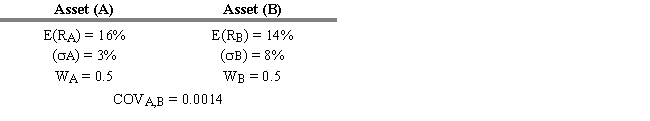

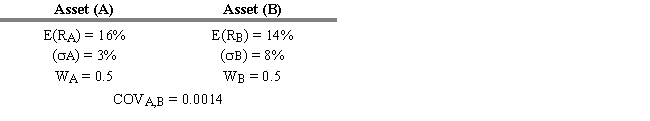

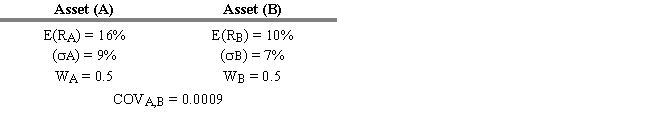

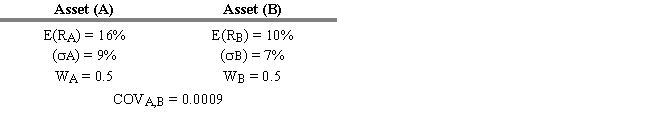

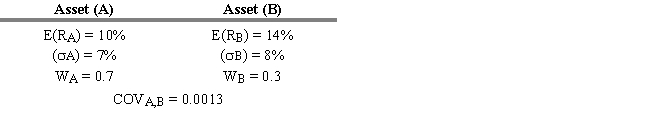

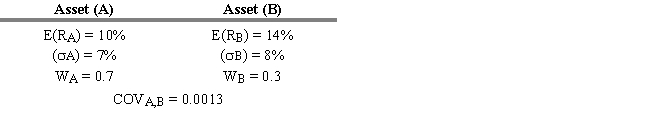

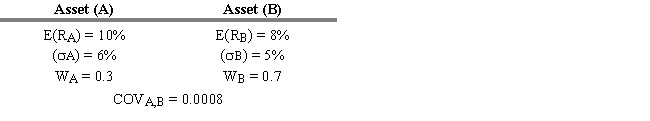

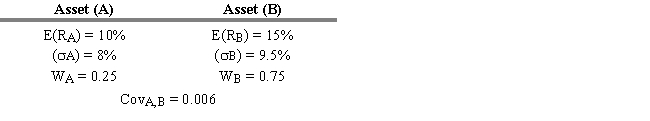

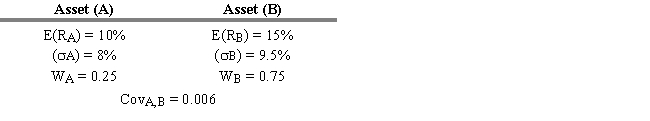

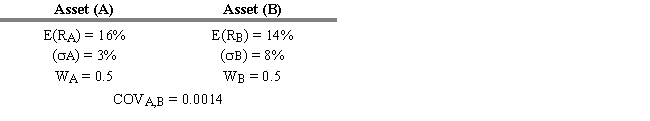

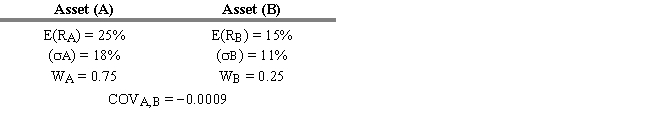

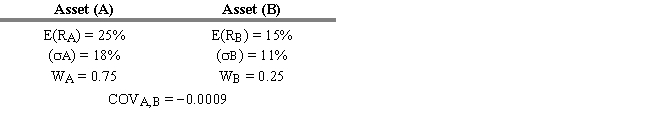

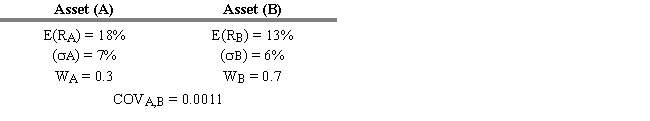

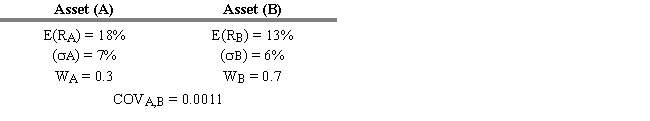

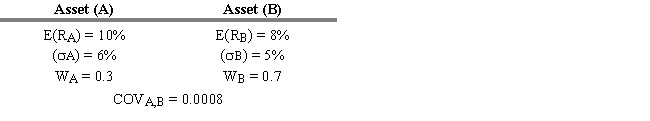

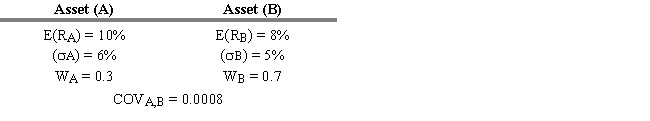

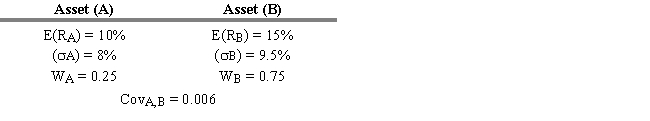

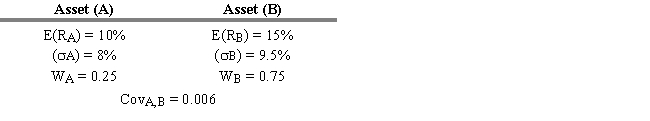

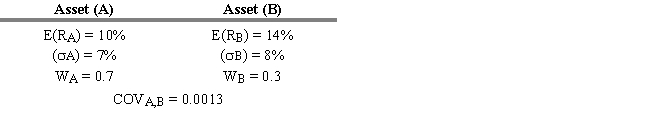

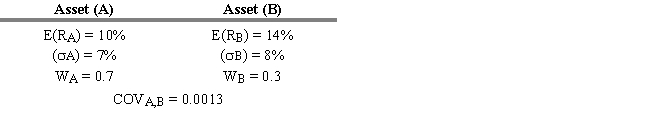

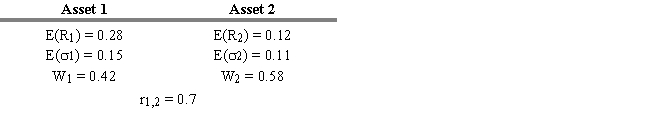

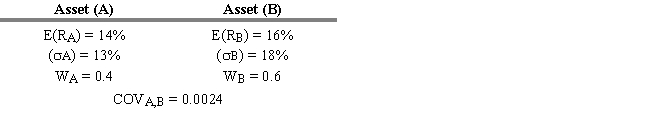

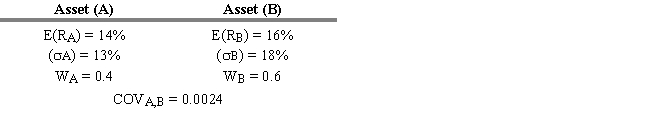

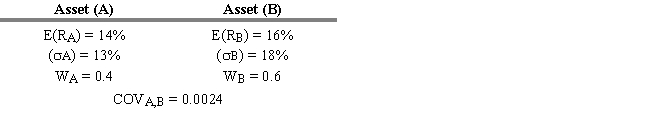

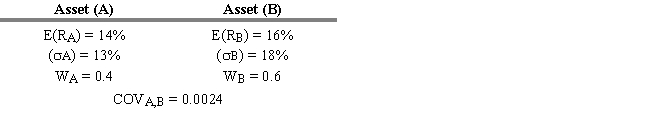

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.10. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 11%

B) 12%

C) 13%

D) 14%

E) 15%

-Refer to Exhibit 6.10. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 11%

B) 12%

C) 13%

D) 14%

E) 15%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

42

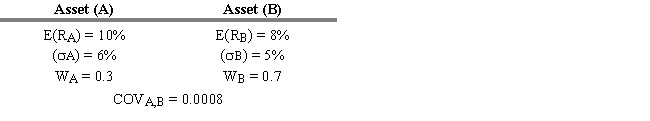

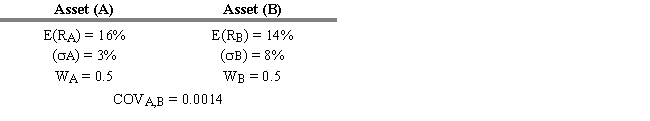

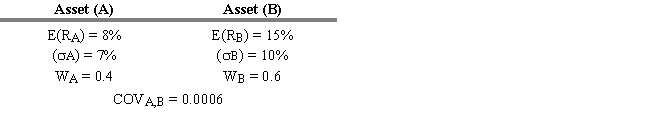

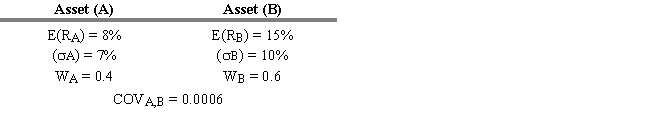

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.6. What is the standard deviation of this portfolio?

A) 6.08%

B) 5.89%

C) 7.06%

D) 6.54%

E) 7.26%

Refer to Exhibit 6.6. What is the standard deviation of this portfolio?

A) 6.08%

B) 5.89%

C) 7.06%

D) 6.54%

E) 7.26%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

43

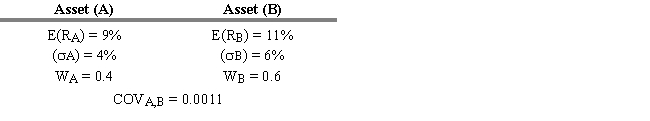

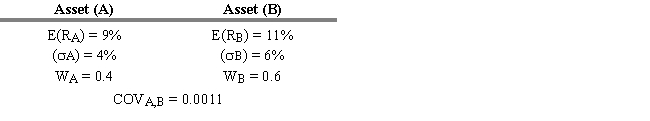

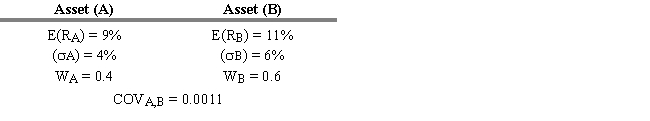

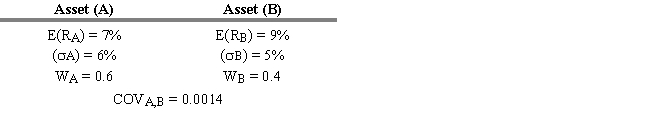

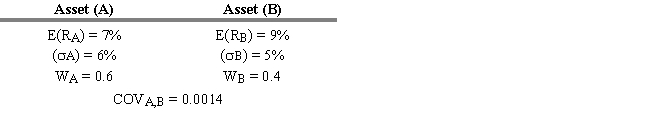

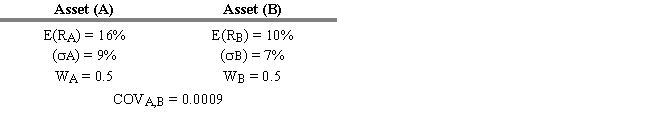

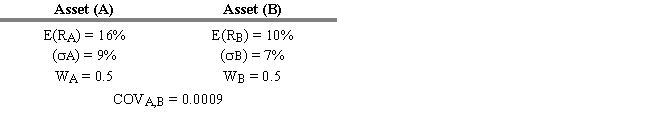

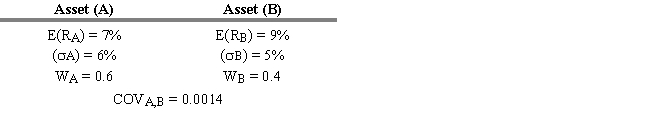

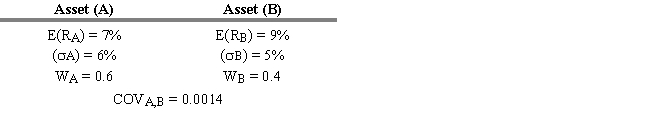

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.5. What is the standard deviation of this portfolio?

A) 3.89%

B) 4.61%

C) 5.02%

D) 6.83%

E) 6.09%

Refer to Exhibit 6.5. What is the standard deviation of this portfolio?

A) 3.89%

B) 4.61%

C) 5.02%

D) 6.83%

E) 6.09%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

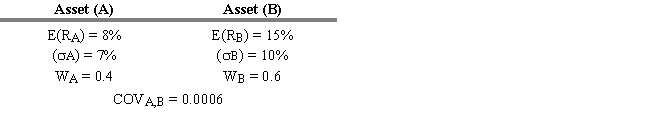

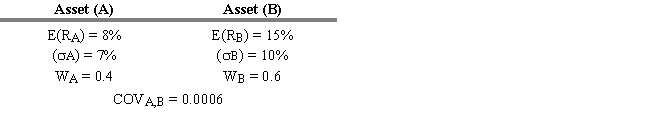

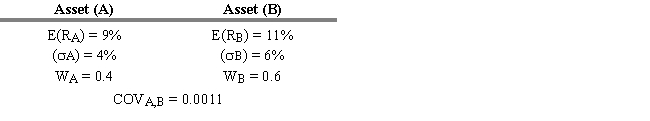

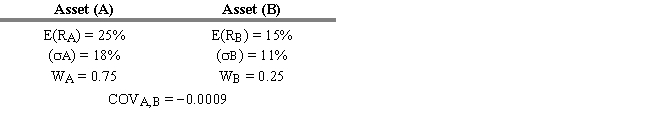

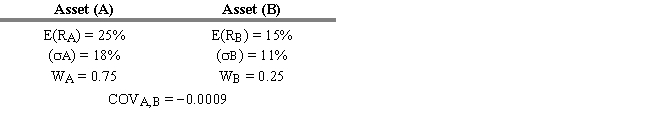

44

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.8. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 6.4%

B) 9.1%

C) 10.2%

D) 10.8%

E) 11.2%

-Refer to Exhibit 6.8. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 6.4%

B) 9.1%

C) 10.2%

D) 10.8%

E) 11.2%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

45

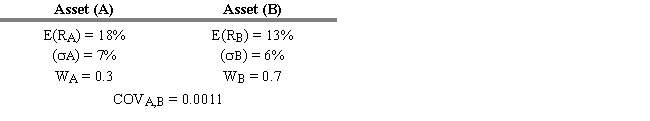

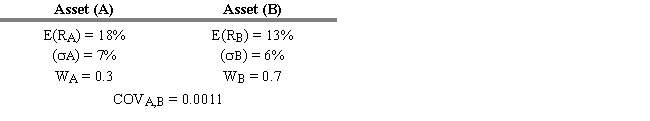

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.3. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 8.95%

B) 9.30%

C) 9.95%

D) 10.20%

E) 10.70%

-Refer to Exhibit 6.3. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 8.95%

B) 9.30%

C) 9.95%

D) 10.20%

E) 10.70%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

46

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.4. What is the standard deviation of this portfolio?

A) 5.02%

B) 3.88%

C) 6.21%

D) 4.04%

E) 5.64%

Refer to Exhibit 6.4. What is the standard deviation of this portfolio?

A) 5.02%

B) 3.88%

C) 6.21%

D) 4.04%

E) 5.64%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

47

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.3. What is the standard deviation of this portfolio?

A) 3.68%

B) 4.56%

C) 4.99%

D) 5.16%

E) 6.02%

Refer to Exhibit 6.3. What is the standard deviation of this portfolio?

A) 3.68%

B) 4.56%

C) 4.99%

D) 5.16%

E) 6.02%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

48

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.1. What is the standard deviation of this portfolio?

A) 8.79%

B) 13.75%

C) 12.5%

D) 7.72%

E) 5.64%

Refer to Exhibit 6.1. What is the standard deviation of this portfolio?

A) 8.79%

B) 13.75%

C) 12.5%

D) 7.72%

E) 5.64%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

49

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.7. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 5.8%

B) 6.1%

C) 6.9%

D) 7.8%

E) 8.9%

-Refer to Exhibit 6.7. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 5.8%

B) 6.1%

C) 6.9%

D) 7.8%

E) 8.9%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

50

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.10. What is the standard deviation of this portfolio?

A) 3.02%

B) 4.88%

C) 5.24%

D) 5.98%

E) 6.52%

Refer to Exhibit 6.10. What is the standard deviation of this portfolio?

A) 3.02%

B) 4.88%

C) 5.24%

D) 5.98%

E) 6.52%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

51

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.6. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 10.6%

B) 10.2%

C) 13.0%

D) 11.9%

E) 14.0%

-Refer to Exhibit 6.6. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 10.6%

B) 10.2%

C) 13.0%

D) 11.9%

E) 14.0%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

52

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.2. What is the standard deviation of this portfolio?

A) 5.45%

B) 18.64%

C) 20.0%

D) 22.5%

E) 13.65%

Refer to Exhibit 6.2. What is the standard deviation of this portfolio?

A) 5.45%

B) 18.64%

C) 20.0%

D) 22.5%

E) 13.65%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

53

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.5. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 8.0%

B) 12.2%

C) 7.4%

D) 9.1%

E) 11.6%

-Refer to Exhibit 6.5. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 8.0%

B) 12.2%

C) 7.4%

D) 9.1%

E) 11.6%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

54

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.9. What is the standard deviation of this portfolio?

A) 5.16%

B) 5.89%

C) 6.11%

D) 6.57%

E) 7.02%

Refer to Exhibit 6.9. What is the standard deviation of this portfolio?

A) 5.16%

B) 5.89%

C) 6.11%

D) 6.57%

E) 7.02%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

55

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.7. What is the standard deviation of this portfolio?

A) 4.87%

B) 3.62%

C) 4.13%

D) 5.76%

E) 6.02%

Refer to Exhibit 6.7. What is the standard deviation of this portfolio?

A) 4.87%

B) 3.62%

C) 4.13%

D) 5.76%

E) 6.02%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

56

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.4. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 8.6%

B) 8.1%

C) 9.3%

D) 10.2%

E) 11.6%

-Refer to Exhibit 6.4. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 8.6%

B) 8.1%

C) 9.3%

D) 10.2%

E) 11.6%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

57

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.9. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 10.10%

B) 11.60%

C) 13.88%

D) 14.50%

E) 15.37%

-Refer to Exhibit 6.9. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 10.10%

B) 11.60%

C) 13.88%

D) 14.50%

E) 15.37%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

58

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.1. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 8.79%

B) 12.5%

C) 13.75%

D) 7.72%

E) 12%

-Refer to Exhibit 6.1. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 8.79%

B) 12.5%

C) 13.75%

D) 7.72%

E) 12%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

59

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.2. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 18.64%

B) 20.0%

C) 22.5%

D) 13.65%

E) 11%

-Refer to Exhibit 6.2. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 18.64%

B) 20.0%

C) 22.5%

D) 13.65%

E) 11%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

60

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.8. What is the standard deviation of this portfolio?

A) 4.51%

B) 5.94%

C) 6.75%

D) 7.09%

E) 8.62%

Refer to Exhibit 6.8. What is the standard deviation of this portfolio?

A) 4.51%

B) 5.94%

C) 6.75%

D) 7.09%

E) 8.62%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

61

The purpose of calculating the covariance between two stocks is to provide a(n) ____ measure of their movement together.

A) absolute

B) relative

C) indexed

D) loglinear

E) squared

A) absolute

B) relative

C) indexed

D) loglinear

E) squared

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

62

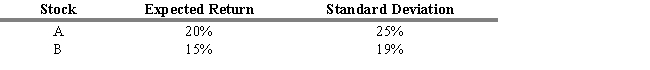

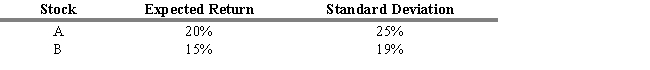

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.11. Calculate the expected return of the two-stock portfolio.

A) 0.107

B) 0.1367

C) 0.1169

D) 0.1872

E) 0.20

Refer to Exhibit 6.11. Calculate the expected return of the two-stock portfolio.

A) 0.107

B) 0.1367

C) 0.1169

D) 0.1872

E) 0.20

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

63

Consider two securities, A and B. Security A and B have a correlation coefficient of 0.65. Security A has standard deviation of 12, and security B has standard deviation of 25. Calculate the covariance between these two securities.

A) 300

B) 461.54

C) 261.54

D) 195

E) 200

A) 300

B) 461.54

C) 261.54

D) 195

E) 200

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

64

What is the standard deviation of an equally weighted portfolio of two stocks with a covariance of 0.009, if the standard deviation of the first stock is 15% and the standard deviation of the second stock is 20%?

A) 2.0%

B) 2.1%

C) 7.8%

D) 14.2%

E) 14.7%

A) 2.0%

B) 2.1%

C) 7.8%

D) 14.2%

E) 14.7%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

65

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.11. Calculate the expected standard deviation of the two-stock portfolio.

A) 0.1367

B) 0.1872

C) 0.1169

D) 0.20

E) 0.3950

Refer to Exhibit 6.11. Calculate the expected standard deviation of the two-stock portfolio.

A) 0.1367

B) 0.1872

C) 0.1169

D) 0.20

E) 0.3950

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

66

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Based on the economic outlook for the industry, a financial analyst covering Top Choice Corporation has determined the following three possible returns given three different states of the economy over the next period.

Refer to Exhibit 6.16. What is the standard deviation for Top Choice Corporation?

A) 0.1 percent

B) 6.3 percent

C) 7.9 percent

D) 9.4 percent

E) 12.1 percent

Based on the economic outlook for the industry, a financial analyst covering Top Choice Corporation has determined the following three possible returns given three different states of the economy over the next period.

Refer to Exhibit 6.16. What is the standard deviation for Top Choice Corporation?

A) 0.1 percent

B) 6.3 percent

C) 7.9 percent

D) 9.4 percent

E) 12.1 percent

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

67

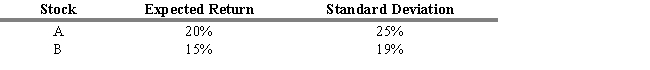

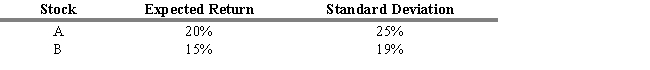

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

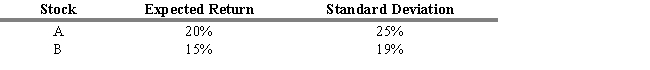

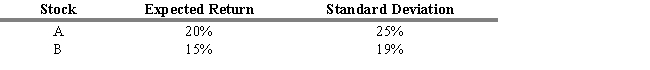

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the standard deviation of the stock A and B portfolio?

A) 0.0%

B) 0.5%

C) 4.1%

D) 6.9%

E) 20.3%

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the standard deviation of the stock A and B portfolio?

A) 0.0%

B) 0.5%

C) 4.1%

D) 6.9%

E) 20.3%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

68

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

A financial analyst covering Magnum Oil has determined the following four possible returns given four different states of the economy over the next period.

Refer to Exhibit 6.13. Calculate the standard deviation for Magnum Oil.

A) 0 percent

B) 11 percent

C) 16 percent

D) 20 percent

E) 26 percent

A financial analyst covering Magnum Oil has determined the following four possible returns given four different states of the economy over the next period.

Refer to Exhibit 6.13. Calculate the standard deviation for Magnum Oil.

A) 0 percent

B) 11 percent

C) 16 percent

D) 20 percent

E) 26 percent

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

69

In a two-stock portfolio, if the correlation coefficient between two stocks were to decrease over time, everything else remaining constant, the portfolio's risk would

A) decrease.

B) remain constant.

C) increase.

D) fluctuate positively and negatively.

E) be a negative value.

A) decrease.

B) remain constant.

C) increase.

D) fluctuate positively and negatively.

E) be a negative value.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

70

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Based on the economic outlook for the industry, a financial analyst covering Top Choice Corporation has determined the following three possible returns given three different states of the economy over the next period.

Refer to Exhibit 6.16. What is the expected return for Top Choice Corporation?

A) 5.2 percent

B) 10.4 percent

C) 13.7 percent

D) 15.0 percent

E) 17.6 percent

Based on the economic outlook for the industry, a financial analyst covering Top Choice Corporation has determined the following three possible returns given three different states of the economy over the next period.

Refer to Exhibit 6.16. What is the expected return for Top Choice Corporation?

A) 5.2 percent

B) 10.4 percent

C) 13.7 percent

D) 15.0 percent

E) 17.6 percent

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

71

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

A financial analyst covering Magnum Oil has determined the following four possible returns given four different states of the economy over the next period.

Refer to Exhibit 6.13. Calculate the expected return for Magnum Oil.

A) 5.0 percent

B) 10.3 percent

C) 13.7 percent

D) 17.5 percent

E) 20.0 percent

A financial analyst covering Magnum Oil has determined the following four possible returns given four different states of the economy over the next period.

Refer to Exhibit 6.13. Calculate the expected return for Magnum Oil.

A) 5.0 percent

B) 10.3 percent

C) 13.7 percent

D) 17.5 percent

E) 20.0 percent

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

72

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 6.15. What is the standard deviation of this portfolio?

A) 10.0%

B) 12.5%

C) 14.4%

D) 15.5%

E) 16.0%

Refer to Exhibit 6.15. What is the standard deviation of this portfolio?

A) 10.0%

B) 12.5%

C) 14.4%

D) 15.5%

E) 16.0%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

73

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the expected return of the stock A and B portfolio?

A) 17.0%

B) 17.5%

C) 18.0%

D) 18.5%

E) 19.0%

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the expected return of the stock A and B portfolio?

A) 17.0%

B) 17.5%

C) 18.0%

D) 18.5%

E) 19.0%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

74

Given the following weights and expected security returns, calculate the expected return for the portfolio.

A) 0.085

B) 0.090

C) 0.092

D) 0.097

E) 0.099

A) 0.085

B) 0.090

C) 0.092

D) 0.097

E) 0.099

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

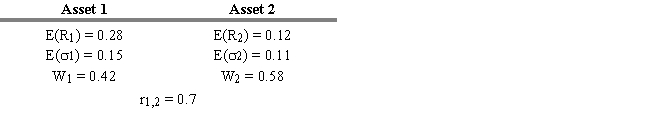

75

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

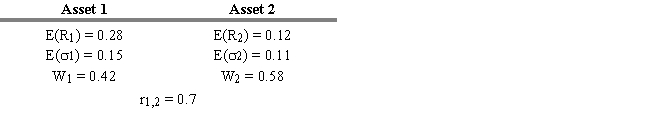

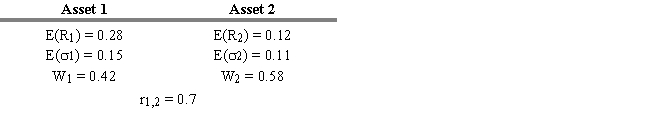

Refer to Exhibit 6.12. Calculate the expected returns and expected standard deviations of a two-stock portfolio when r1,2 = .80 and w1 = .60.

A) .144 and .0002

B) .144 and .0018

C) .136 and .0045

D) .136 and .0455

E) .136 and .4554

Refer to Exhibit 6.12. Calculate the expected returns and expected standard deviations of a two-stock portfolio when r1,2 = .80 and w1 = .60.

A) .144 and .0002

B) .144 and .0018

C) .136 and .0045

D) .136 and .0455

E) .136 and .4554

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

76

Calculate the expected return for a three-asset portfolio with the following

A) 11.71 percent

B) 11.12 percent

C) 15.70 percent

D) 14.25 percent

E) 6.75 percent

A) 11.71 percent

B) 11.12 percent

C) 15.70 percent

D) 14.25 percent

E) 6.75 percent

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

77

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.12. Calculate the expected return and expected standard deviation of a two-stock portfolio when r1,2 = -0.60 and w1 = .75.

A) .13 and .0024

B) .13 and .0455

C) .12 and .0585

D) .12 and .5585

E) .13 and .6758

-Refer to Exhibit 6.12. Calculate the expected return and expected standard deviation of a two-stock portfolio when r1,2 = -0.60 and w1 = .75.

A) .13 and .0024

B) .13 and .0455

C) .12 and .0585

D) .12 and .5585

E) .13 and .6758

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

78

All of the following are common risk measurements EXCEPT

A) standard deviation.

B) variance.

C) semivariance.

D) covariance.

E) range of returns.

A) standard deviation.

B) variance.

C) semivariance.

D) covariance.

E) range of returns.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

79

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.15. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 13.8%

B) 14.6%

C) 15.0%

D) 15.2%

E) 16.8%

-Refer to Exhibit 6.15. What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation ( i), covariance (COVi,j), and asset weight (Wi) are as shown above?

A) 13.8%

B) 14.6%

C) 15.0%

D) 15.2%

E) 16.8%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

80

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What percentage of stock A should be invested to obtain the minimum risk portfolio that contains stock A and B?

A) 35%

B) 42%

C) 58%

D) 65%

E) 72%

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What percentage of stock A should be invested to obtain the minimum risk portfolio that contains stock A and B?

A) 35%

B) 42%

C) 58%

D) 65%

E) 72%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck