Deck 6: An Introduction to Portfolio Management: Part A

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/2

Play

Full screen (f)

Deck 6: An Introduction to Portfolio Management: Part A

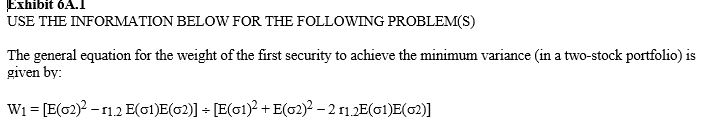

![<strong> -Refer to Exhibit 6A.1. Show the minimum portfolio variance for a two-stock portfolio when r<sub>1.2</sub> = 1.</strong> A) E( \sigma 2) \div [E( \sigma 1) -E( \sigma 2)] B) E( \sigma 2) \div [E( \sigma 1) + E( \sigma 2)] C) E( \sigma 1) \div [E( \sigma 1) - E( \sigma 2)] D) E( \sigma 1) \div [E( \sigma 1) + E( \sigma 2)] E) None of these are correct.](https://d2lvgg3v3hfg70.cloudfront.net/TB6829/11ea87ad_a367_28a8_b530_b1acd341d9ba_TB6829_00_TB6829_00.jpg)

-Refer to Exhibit 6A.1. Show the minimum portfolio variance for a two-stock portfolio when r1.2 = 1.

A) E( 2) [E( 1) -E( 2)]

B) E( 2) [E( 1) + E( 2)]

C) E( 1) [E( 1) - E( 2)]

D) E( 1) [E( 1) + E( 2)]

E) None of these are correct.

E( 2) [E( 1) -E( 2)]

-Refer to Exhibit 6A.1. What weight of security 1 gives the minimum portfolio variance when r1.2 = .60, E( 1) = .10 and E( 2) = .16?

A) .0244

B) .3679

C) .5697

D) .6309

E) .9756

.9756