Deck 7: Asset Pricing Models

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

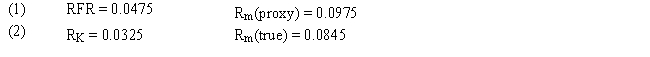

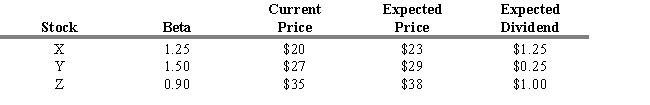

Question

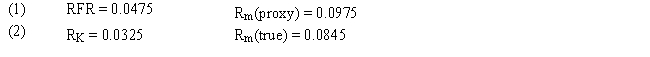

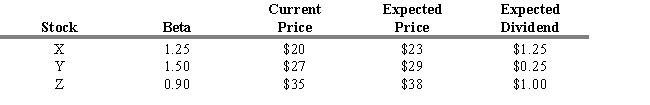

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/152

Play

Full screen (f)

Deck 7: Asset Pricing Models

1

CML and SML measure total risk by the standard deviation of the investment.

False

2

The capital asset pricing model (CAPM) extends capital market theory in a way that allows investors to evaluate the risk-return trade-off for both diversified portfolios and individual securities.

True

3

Securities with returns that lie above the security market line are undervalued.

True

4

If an incorrect proxy market portfolio such as the S&P index is used when developing the security market line, the slope of the line will tend to be underestimated.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

5

Correlation of the market portfolio and the zero-beta portfolio will be linear.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

6

Studies have shown the beta is more stable for portfolios than for individual securities.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

7

Beta is a measure of unsystematic risk.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

8

Using the S&P index as the proxy market portfolio when evaluating a portfolio manager relative to the SML will tend to underestimate the manager's performance.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

9

The planning period for the CAPM is the same length of time for every investor.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

10

Beta can be thought of as indexing the asset's systematic risk to that of the market portfolio.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

11

The only way to estimate a beta for a security is to calculate the covariance of the security with the market.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

12

CAPM states that only the overall market risk premium matters.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

13

CML can be applied only to portfolio holdings that are already fully diversified, whereas the SML can be applied to any individual asset or collection of assets.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

14

Because the market portfolio is reasonable in theory, it is easy to implement when testing or using the CAPM.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

15

If the market portfolio is mean-variance efficient, it has the lowest risk for a given level of return among the attainable set of portfolios.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

16

There can be only one zero-beta portfolio.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

17

The CAPM can also be illustrated as the security market line (SML).

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

18

The existence of transaction costs indicates that at some point the additional cost of diversification relative to its benefit would be excessive for most investors.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

19

Fama and French suggest a four-factor model approach that explains many prior market anomalies.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

20

Securities with returns that lie below the security market line are undervalued.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

21

The APT assumes that capital markets are perfectly competitive.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

22

Two approaches to defining factors for multifactor models are to use macroeconomic variables or individual characteristics of the securities.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

23

Multifactor models of risk and return can be broadly grouped into models that use macroeconomic factors and models that use microeconomic factors.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

24

Findings by Basu that stocks with high P/E ratios tended to outperform stocks with low P/E ratios challenge the efficacy of the CAPM.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

25

In the APT model, the identity of all the factors is known.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

26

The APT does not require a market portfolio.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

27

A major advantage of the Arbitrage Pricing Theory is the risk factors are clearly and universally identifiable.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

28

Arbitrage Pricing Theory (APT) specifies the exact number of risk factors and their identity.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

29

All of the following are assumptions of the Capital Asset Pricing Model (CAPM) EXCEPT

A) investors can borrow and lend any amount at the risk-free rate.

B) investors all have homogeneous expectations regarding expected returns.

C) investors can have different time horizons, daily, weekly, annual, or some other period.

D) all investments are infinitely divisible.

E) capital markets are in equilibrium.

A) investors can borrow and lend any amount at the risk-free rate.

B) investors all have homogeneous expectations regarding expected returns.

C) investors can have different time horizons, daily, weekly, annual, or some other period.

D) all investments are infinitely divisible.

E) capital markets are in equilibrium.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

30

Findings by Fama and French that stocks with high Book Value to Market Price ratios tended to produce larger risk adjusted returns than stocks with low Book Value to Market Price ratios challenge the efficacy of the CAPM.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

31

Studies strongly suggest that the CAPM be abandoned and replaced with the APT.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

32

The "true" market portfolio is unknown.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

33

Empirical tests of the APT model have found that as the size of a portfolio increased, so did the number of factors.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

34

The usefulness of CAPM theory is limited in practice due to benchmark error.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

35

Overall, the correlation coefficients of industries to the market portfolio vary widely, which is expected due to the wide variance of industry Betas.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

36

The Capital Market Line (CML) refers only to those portfolios that lie on the line segment that extends from the risk-free asset to the point of tangency on the efficient frontier known as the market portfolio.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

37

Studies indicate that neither firm size nor the time interval used is important when computing beta.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

38

According to the APT model, all securities should be priced such that riskless arbitrage is possible.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

39

The January Effect is an anomaly in that returns in January are significantly smaller than in any other month.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

40

The APT assumes that security returns are normally distributed.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

41

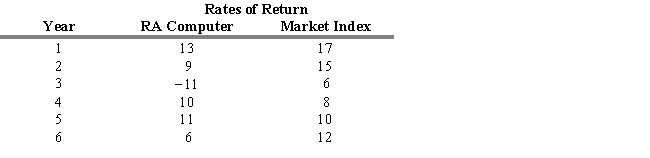

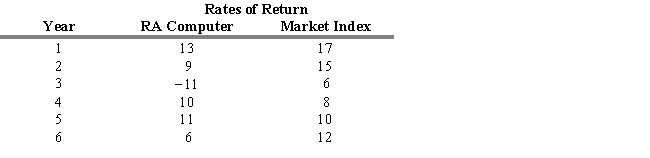

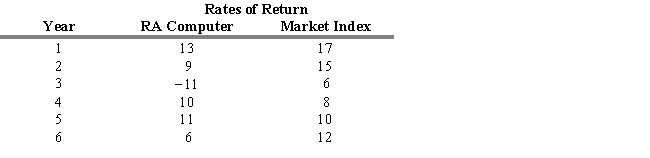

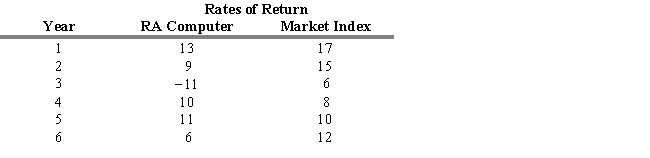

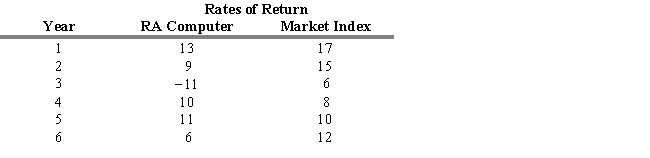

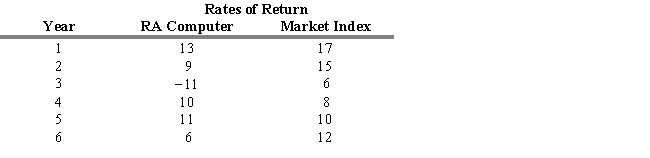

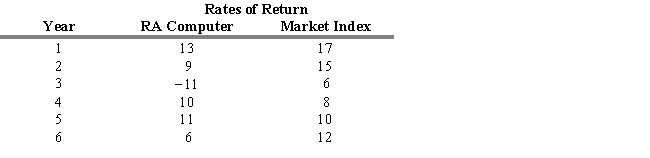

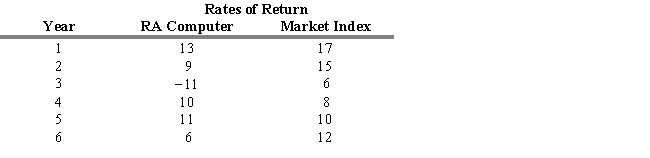

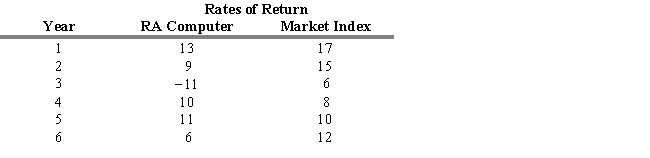

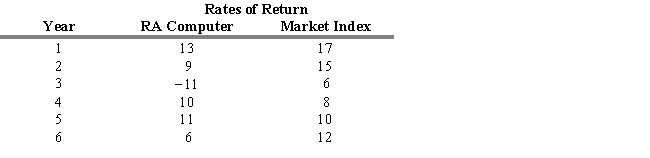

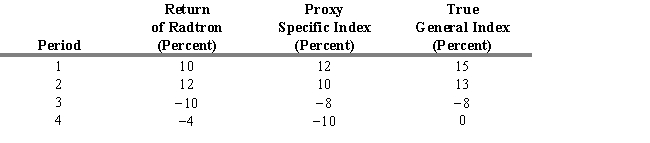

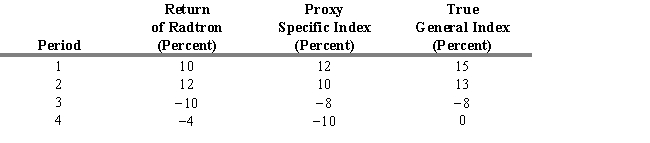

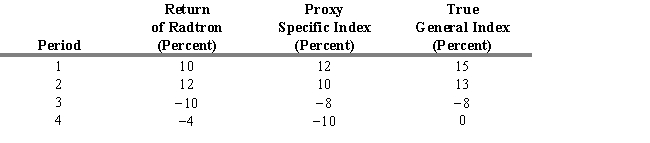

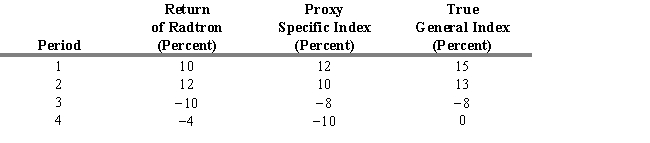

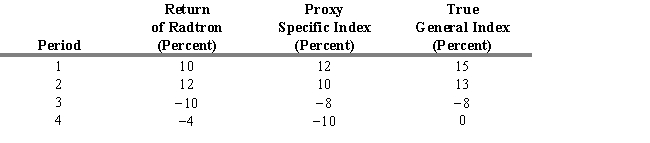

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 7.1. Compute the intercept of the characteristic line for RA Computer.

A) -9.41

B) 11.63

C) 4.92

D) -4.92

E) -7.98

-Refer to Exhibit 7.1. Compute the intercept of the characteristic line for RA Computer.

A) -9.41

B) 11.63

C) 4.92

D) -4.92

E) -7.98

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

42

Calculate the expected return for A Industries, which has a beta of 1.75 when the risk free rate is 0.03 and you expect the market return to be 0.11.

A) 11.13 percent

B) 14.97 percent

C) 16.25 percent

D) 22.25 percent

E) 17.0 percent

A) 11.13 percent

B) 14.97 percent

C) 16.25 percent

D) 22.25 percent

E) 17.0 percent

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

43

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 7.1. The equation of the characteristic line for RA is

A) RRA = 11.63 + 1.2195RMI.

B) RRA = -7.98 + 1.1023RMI.

C) RRA = -9.41 + 1.3893RMI.

D) RRA = -4.92 - 0.7715RMI.

E) RRA = 4.92 + 0.7715RMI.

-Refer to Exhibit 7.1. The equation of the characteristic line for RA is

A) RRA = 11.63 + 1.2195RMI.

B) RRA = -7.98 + 1.1023RMI.

C) RRA = -9.41 + 1.3893RMI.

D) RRA = -4.92 - 0.7715RMI.

E) RRA = 4.92 + 0.7715RMI.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

44

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 7.1. Compute the beta for RA Computer using the historic returns presented above.

A) 0.7715

B) 1.2195

C) 1.3893

D) 1.1023

E) -0.7715

-Refer to Exhibit 7.1. Compute the beta for RA Computer using the historic returns presented above.

A) 0.7715

B) 1.2195

C) 1.3893

D) 1.1023

E) -0.7715

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

45

Calculate the expected return for B Services which has a beta of 0.83 when the risk-free rate is 0.05 and you expect the market return to be 0.12.

A) 14.96 percent

B) 16.15 percent

C) 10.81 percent

D) 17.00 percent

E) 15.25 percent

A) 14.96 percent

B) 16.15 percent

C) 10.81 percent

D) 17.00 percent

E) 15.25 percent

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

46

If an individual owns only one security the most appropriate measure of risk is

A) standard deviation.

B) correlation.

C) beta.

D) covariance.

E) the risk-free rate.

A) standard deviation.

B) correlation.

C) beta.

D) covariance.

E) the risk-free rate.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is NOT a major difference between the capital market line (CML) and the capital asset pricing model (CAPM)?

A) Definitions of portfolio risk are based on systematic and total risk.

B) One is related to the market portfolio, and the other is not.

C) The number of calculations to determine risk is significantly greater for one method.

D) One requires a tangency point on the efficient frontier, and the other does not.

E) CML measures total risk by the standard deviation of the investment, while the SML considers only the systematic component of an investment's volatility.

A) Definitions of portfolio risk are based on systematic and total risk.

B) One is related to the market portfolio, and the other is not.

C) The number of calculations to determine risk is significantly greater for one method.

D) One requires a tangency point on the efficient frontier, and the other does not.

E) CML measures total risk by the standard deviation of the investment, while the SML considers only the systematic component of an investment's volatility.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

48

In the presence of transactions costs, the SML will be

A) a single straight line.

B) a kinked line.

C) a set of lines rather than a single straight line.

D) a curve rather than a single straight line.

E) impossible to determine.

A) a single straight line.

B) a kinked line.

C) a set of lines rather than a single straight line.

D) a curve rather than a single straight line.

E) impossible to determine.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

49

The ____ the number of stocks in a portfolio and the ____ the time period, the ____ the portfolio beta.

A) larger, longer, less stable

B) larger, longer, more stable

C) larger, shorter, less stable

D) larger, shorter, more stable

E) smaller, longer, more stable

A) larger, longer, less stable

B) larger, longer, more stable

C) larger, shorter, less stable

D) larger, shorter, more stable

E) smaller, longer, more stable

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

50

Beta is a measure of

A) company specific risk.

B) industry risk.

C) diversifiable risk.

D) systematic risk.

E) unique risk.

A) company specific risk.

B) industry risk.

C) diversifiable risk.

D) systematic risk.

E) unique risk.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

51

Calculate the expected return for E Services, which has a beta of 1.5 when the risk-free rate is 0.05 and you expect the market return to be 0.11.

A) 10.6 percent

B) 12.1 percent

C) 13.6 percent

D) 14.0 percent

E) 16.2 percent

A) 10.6 percent

B) 12.1 percent

C) 13.6 percent

D) 14.0 percent

E) 16.2 percent

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

52

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 7.1. Compute the correlation coefficient between RA Computer and the Market Index.

A) -0.32

B) 0.78

C) 0.66

D) 0.58

E) 0.32

-Refer to Exhibit 7.1. Compute the correlation coefficient between RA Computer and the Market Index.

A) -0.32

B) 0.78

C) 0.66

D) 0.58

E) 0.32

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

53

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 7.1. If you expected the return on the Market Index to be 12%, what would you expect the return on RA Computer to be?

A) 7.26%

B) 6.75%

C) 8.00%

D) 9.37%

E) -3.29%

-Refer to Exhibit 7.1. If you expected the return on the Market Index to be 12%, what would you expect the return on RA Computer to be?

A) 7.26%

B) 6.75%

C) 8.00%

D) 9.37%

E) -3.29%

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

54

The capital market line (CML) uses ____ as a risk measurement, whereas the capital asset pricing model (CAPM) uses ____.

A) beta; total risk

B) standard deviation; total risk

C) standard deviation; systematic risk

D) unsystematic risk; total risk

E) systematic risk; beta

A) beta; total risk

B) standard deviation; total risk

C) standard deviation; systematic risk

D) unsystematic risk; total risk

E) systematic risk; beta

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

55

Calculate the expected return for C Inc., which has a beta of 0.8 when the risk-free rate is 0.04 and you expect the market return to be 0.12.

A) 8.10 percent

B) 9.60 percent

C) 10.40 percent

D) 11.20 percent

E) 12.60 percent

A) 8.10 percent

B) 9.60 percent

C) 10.40 percent

D) 11.20 percent

E) 12.60 percent

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

56

If the assumption that there are no transaction costs is relaxed, the SML will be a

A) straight line.

B) band of securities.

C) convex curve.

D) concave curve.

E) parabolic curve.

A) straight line.

B) band of securities.

C) convex curve.

D) concave curve.

E) parabolic curve.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

57

A completely diversified portfolio would have a correlation with the market portfolio that is

A) equal to zero because it has only unsystematic risk.

B) equal to one because it has only systematic risk.

C) less than zero because it has only systematic risk.

D) less than one because it has only unsystematic risk.

E) less than one because it has only systematic risk.

A) equal to zero because it has only unsystematic risk.

B) equal to one because it has only systematic risk.

C) less than zero because it has only systematic risk.

D) less than one because it has only unsystematic risk.

E) less than one because it has only systematic risk.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

58

Calculate the expected return for D Industries, which has a beta of 1.0 when the risk-free rate is 0.03 and you expect the market return to be 0.13.

A) 8.6 percent

B) 9.2 percent

C) 11.0 percent

D) 12.0 percent

E) 13.0 percent

A) 8.6 percent

B) 9.2 percent

C) 11.0 percent

D) 12.0 percent

E) 13.0 percent

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

59

Calculate the expected return for F Inc., which has a beta of 1.3 when the risk-free rate is 0.06 and you expect the market return to be 0.125.

A) 12.65 percent

B) 13.55 percent

C) 14.45 percent

D) 15.05 percent

E) 16.34 percent

A) 12.65 percent

B) 13.55 percent

C) 14.45 percent

D) 15.05 percent

E) 16.34 percent

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

60

The betas for the market portfolio and risk-free security are: Market Risk-free

A) 0 1

B) 1 0

C) -1 1

D) 1 -1

E) 2 1

A) 0 1

B) 1 0

C) -1 1

D) 1 -1

E) 2 1

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

61

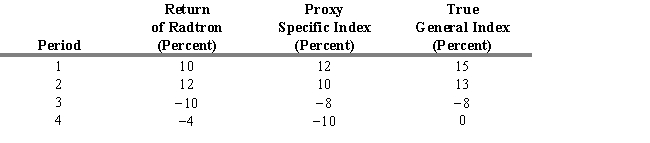

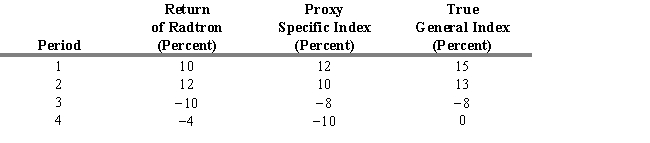

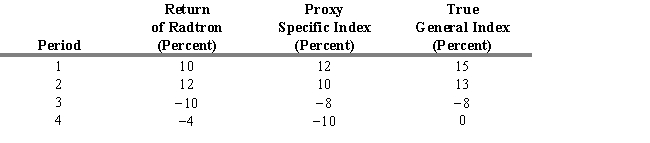

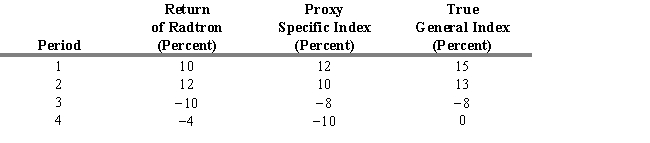

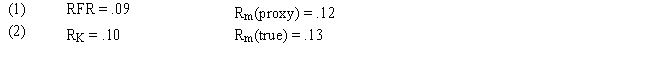

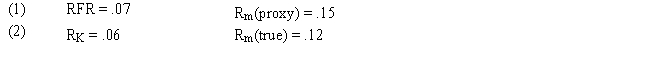

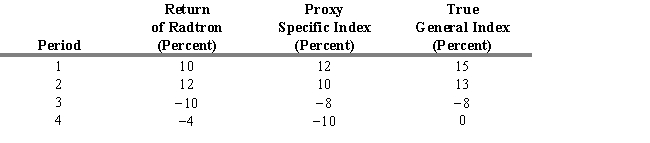

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 7.3. The covariance between Radtron and the true index is

A) 57.30.

B) 86.50.

C) 88.00.

D) 92.50.

E) 107.90.

Refer to Exhibit 7.3. The covariance between Radtron and the true index is

A) 57.30.

B) 86.50.

C) 88.00.

D) 92.50.

E) 107.90.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

62

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

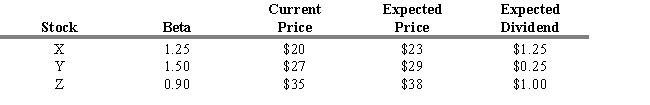

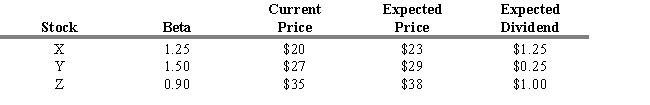

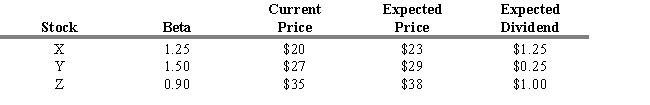

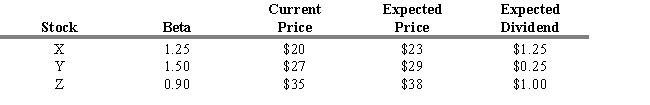

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

Refer to Exhibit 7.2. What are the expected (required) rates of return for the three stocks (in the order X, Y, Z)?

A) 16.50 percent, 5.50 percent, 22.00 percent

B) 9.25 percent, 10.5 percent, 7.5 percent

C) 21.25 percent, 8.33 percent, 11.43 percent

D) 6.20 percent, 2.20 percent, 8.20 percent

E) 15.00 percent, 3.50 percent, 7.30 percent

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

Refer to Exhibit 7.2. What are the expected (required) rates of return for the three stocks (in the order X, Y, Z)?

A) 16.50 percent, 5.50 percent, 22.00 percent

B) 9.25 percent, 10.5 percent, 7.5 percent

C) 21.25 percent, 8.33 percent, 11.43 percent

D) 6.20 percent, 2.20 percent, 8.20 percent

E) 15.00 percent, 3.50 percent, 7.30 percent

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

63

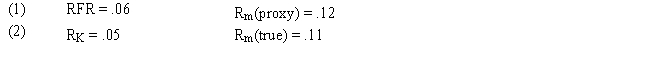

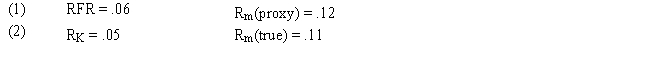

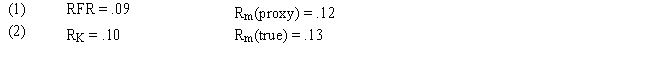

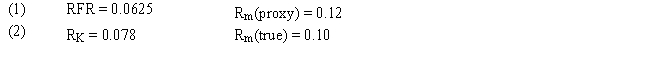

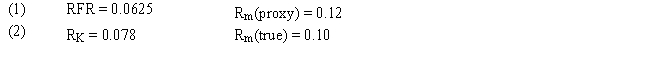

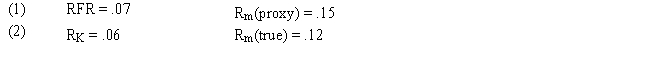

Assume that as a portfolio manager the beta of your portfolio is 1.4 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 2.0 percent lower

B) 0.5 percent lower

C) 0.5 percent lower

D) 1.0 percent higher

E) 2.0 percent higher

A) 2.0 percent lower

B) 0.5 percent lower

C) 0.5 percent lower

D) 1.0 percent higher

E) 2.0 percent higher

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

64

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

Refer to Exhibit 7.2. What is your investment strategy concerning the three stocks?

A) buy X and Y; sell Z

B) sell X, Y, and Z

C) sell X and Z; buy Y

D) buy X, Y, and Z

E) buy X and Z; sell Y

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

Refer to Exhibit 7.2. What is your investment strategy concerning the three stocks?

A) buy X and Y; sell Z

B) sell X, Y, and Z

C) sell X and Z; buy Y

D) buy X, Y, and Z

E) buy X and Z; sell Y

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

65

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 7.3. The average return for Radtron is

A) 1 percent.

B) 2 percent.

C) 3 percent.

D) 4 percent.

E) 5 percent.

Refer to Exhibit 7.3. The average return for Radtron is

A) 1 percent.

B) 2 percent.

C) 3 percent.

D) 4 percent.

E) 5 percent.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

66

A friend has some reliable information that the stock of Puddles Company is going to rise from $43.00 to $50.00 per share over the next year. You know that the annual return on the S&P 500 has been 11 percent and the 90-day T-bill rate has been yielding 5 percent per year over the past 10 years. If beta for Puddles is 1.5, will you purchase the stock?

A) Yes, because it is overvalued.

B) Yes, because it is undervalued.

C) No, because it is undervalued.

D) No, because it is overvalued.

E) Yes, because the expected return equals the estimated return.

A) Yes, because it is overvalued.

B) Yes, because it is undervalued.

C) No, because it is undervalued.

D) No, because it is overvalued.

E) Yes, because the expected return equals the estimated return.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

67

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 7.3. The average true return is

A) 1 percent.

B) 2 percent.

C) 3 percent.

D) 4 percent.

E) 5 percent.

Refer to Exhibit 7.3. The average true return is

A) 1 percent.

B) 2 percent.

C) 3 percent.

D) 4 percent.

E) 5 percent.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

68

Recently you have received a tip that the stock of Buttercup Industries is going to rise from $76.00 to $85.00 per share over the next year. You know that the annual return on the S&P 500 has been 13 percent and the 90-day T-bill rate has been yielding 3 percent per year over the past 10 years. If beta for Buttercup is 1.0, will you purchase the stock?

A) Yes, because it is overvalued.

B) Yes, because it is undervalued.

C) No, because it is undervalued.

D) No, because it is overvalued.

E) Yes, because the expected return equals the estimated return.

A) Yes, because it is overvalued.

B) Yes, because it is undervalued.

C) No, because it is undervalued.

D) No, because it is overvalued.

E) Yes, because the expected return equals the estimated return.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

69

Assume that as a portfolio manager the beta of your portfolio is 1.2 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 2 percent lower

B) 1 percent lower

C) 5 percent lower

D) 1 percent higher

E) 2 percent higher

A) 2 percent lower

B) 1 percent lower

C) 5 percent lower

D) 1 percent higher

E) 2 percent higher

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

70

Assume that as a portfolio manager the beta of your portfolio is 0.85 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 1.33% higher

B) 2.35% lower

C) 8% lower

D) 1.33% lower

E) 2.35% higher

A) 1.33% higher

B) 2.35% lower

C) 8% lower

D) 1.33% lower

E) 2.35% higher

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

71

A friend has information that the stock of Zip Incorporated is going to rise from $62.00 to $65.00 per share over the next year. You know that the annual return on the S&P 500 has been 10 percent and the 90-day T-bill rate has been yielding 6 percent per year over the past 10 years. If beta for Zip is 0.9, will you purchase the stock?

A) Yes, because it is overvalued.

B) Yes, because it is undervalued.

C) No, because it is undervalued.

D) No, because it is overvalued.

E) Yes, because the expected return equals the estimated return.

A) Yes, because it is overvalued.

B) Yes, because it is undervalued.

C) No, because it is undervalued.

D) No, because it is overvalued.

E) Yes, because the expected return equals the estimated return.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

72

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

Refer to Exhibit 7.2. What are the estimated rates of return for the three stocks (in the order X, Y, Z)?

A) 21.25 percent, 8.33 percent, 11.43 percent

B) 6.20 percent, 2.20 percent, 8.20 percent

C) 16.50 percent, 5.50 percent, 22.00 percent

D) 9.25 percent, 10.5 percent, 7.5 percent

E) 15.00 percent, 3.50 percent, 7.30 percent

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

Refer to Exhibit 7.2. What are the estimated rates of return for the three stocks (in the order X, Y, Z)?

A) 21.25 percent, 8.33 percent, 11.43 percent

B) 6.20 percent, 2.20 percent, 8.20 percent

C) 16.50 percent, 5.50 percent, 22.00 percent

D) 9.25 percent, 10.5 percent, 7.5 percent

E) 15.00 percent, 3.50 percent, 7.30 percent

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

73

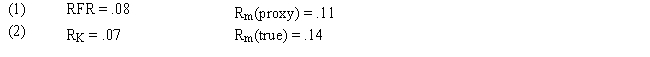

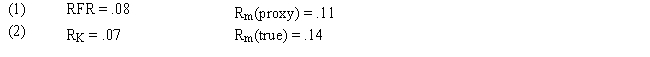

Assume that as a portfolio manager the beta of your portfolio is 1.15 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 2.53 percent lower

B) 3.85 percent lower

C) 2.53 percent higher

D) 4.4 percent higher

E) 3.85 percent higher

A) 2.53 percent lower

B) 3.85 percent lower

C) 2.53 percent higher

D) 4.4 percent higher

E) 3.85 percent higher

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

74

Assume that as a portfolio manager the beta of your portfolio is 1.3 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 4.2 percent lower

B) 3.6 percent lower

C) 3.8 percent lower

D) 4.2 percent higher

E) 3.6 percent higher

A) 4.2 percent lower

B) 3.6 percent lower

C) 3.8 percent lower

D) 4.2 percent higher

E) 3.6 percent higher

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

75

Recently your broker has advised you that he believes that the stock of Casey Incorporated is going to rise from $55.00 to $70.00 per share over the next year. You know that the annual return on the S&P 500 has been 12.5 percent and the 90-day T-bill rate has been yielding 6 percent per year over the past 10 years. If beta for Casey is 1.3, will you purchase the stock?

A) Yes, because it is overvalued.

B) Yes, because it is undervalued.

C) No, because it is undervalued.

D) No, because it is overvalued.

E) Yes, because the expected return equals the estimated return.

A) Yes, because it is overvalued.

B) Yes, because it is undervalued.

C) No, because it is undervalued.

D) No, because it is overvalued.

E) Yes, because the expected return equals the estimated return.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

76

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 7.3. The covariance between Radtron and the proxy index is

A) 57.30.

B) 86.50.

C) 88.00.

D) 92.50.

E) 107.90.

Refer to Exhibit 7.3. The covariance between Radtron and the proxy index is

A) 57.30.

B) 86.50.

C) 88.00.

D) 92.50.

E) 107.90.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

77

Your broker has advised you that he believes that the stock of Brat Inc. is going to rise from $20 to $22.15 per share over the next year. You know that the annual return on the S&P 500 has been 11.25 percent and the 90-day T-bill rate has been yielding 4.75 percent per year over the past 10 years. If beta for Brat is 1.25, will you purchase the stock?

A) Yes, because it is overvalued.

B) No, because it is overvalued.

C) No, because it is undervalued.

D) Yes, because it is undervalued.

E) Yes, because the expected return equals the estimated return.

A) Yes, because it is overvalued.

B) No, because it is overvalued.

C) No, because it is undervalued.

D) Yes, because it is undervalued.

E) Yes, because the expected return equals the estimated return.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

78

Assume that as a portfolio manager the beta of your portfolio is 1.1 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 3.2 percent lower

B) 6.4 percent lower

C) 4.9 percent lower

D) 3.2 percent higher

E) 6.4 percent higher

A) 3.2 percent lower

B) 6.4 percent lower

C) 4.9 percent lower

D) 3.2 percent higher

E) 6.4 percent higher

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

79

Recently you have received a tip that the stock of Bubbly Incorporated is going to rise from $57 to $61 per share over the next year. You know that the annual return on the S&P 500 has been 9.25 percent and the 90-day T-bill rate has been yielding 3.75 percent per year over the past 10 years. If beta for Bubbly is 0.85, will you purchase the stock?

A) Yes, because it is overvalued.

B) No, because it is overvalued.

C) No, because it is undervalued.

D) Yes, because it is undervalued.

E) Yes, because the expected return equals the estimated return.

A) Yes, because it is overvalued.

B) No, because it is overvalued.

C) No, because it is undervalued.

D) Yes, because it is undervalued.

E) Yes, because the expected return equals the estimated return.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

80

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 7.3. The average proxy return is

A) 1 percent.

B) 2 percent.

C) 3 percent.

D) 4 percent.

E) 5 percent.

Refer to Exhibit 7.3. The average proxy return is

A) 1 percent.

B) 2 percent.

C) 3 percent.

D) 4 percent.

E) 5 percent.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck