Deck 9: Inventory Costing and Capacity Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/210

Play

Full screen (f)

Deck 9: Inventory Costing and Capacity Analysis

1

________ method includes fixed manufacturing overhead costs as inventoriable costs.

A) Variable costing

B) Absorption costing

C) Throughput costing

D) Activity-based costing

A) Variable costing

B) Absorption costing

C) Throughput costing

D) Activity-based costing

B

2

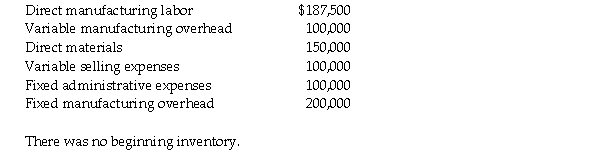

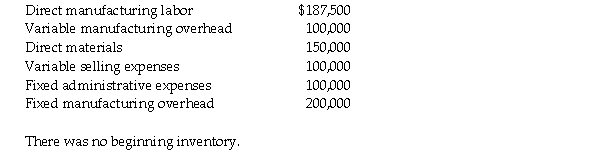

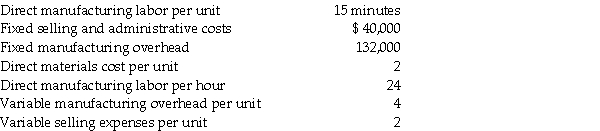

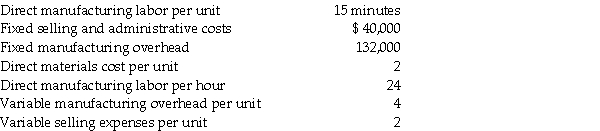

Unile Auto produces and sells an auto part for $60.00 per unit. In 2015, 100,000 parts were produced and 75,000 units were sold. Other information for the year includes:

-What is the inventoriable cost per unit using absorption costing?

A) $25.00

B) $31.00

C) $32.50

D) $38.50

-What is the inventoriable cost per unit using absorption costing?

A) $25.00

B) $31.00

C) $32.50

D) $38.50

$32.50

3

The two most common methods of costing inventories in manufacturing companies are variable costing and absorption costing.

True

4

Which of the following costs is inventoried when using variable costing?

A) rent on factory building

B) electricity consumed in manufacturing process

C) sales commission paid on each sale

D) advertising costs incurred for the product

A) rent on factory building

B) electricity consumed in manufacturing process

C) sales commission paid on each sale

D) advertising costs incurred for the product

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

5

________ is a method of inventory costing in which all variable manufacturing costs (direct and indirect)are included as inventoriable costs and all fixed manufacturing costs are excluded.

A) Variable costing

B) Mixed costing

C) Absorption costing

D) Standard costing

A) Variable costing

B) Mixed costing

C) Absorption costing

D) Standard costing

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

6

Gloria's Decorating produces and sells a mantel clock for $100 per unit. In 2015, 42,125 clocks were produced and 37,958 were sold. Other information for the year includes:

-What is the inventoriable cost per unit using absorption costing?

A) $45.00

B) $52.50

C) $115.00

D) $80.00

-What is the inventoriable cost per unit using absorption costing?

A) $45.00

B) $52.50

C) $115.00

D) $80.00

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

7

________ is a method of inventory costing in which only variable manufacturing costs are included as inventoriable costs.

A) Fixed costing

B) Variable costing

C) Absorption costing

D) Mixed costing

A) Fixed costing

B) Variable costing

C) Absorption costing

D) Mixed costing

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is true of variable costing?

A) It expenses administrative costs as cost of goods sold.

B) It treats direct manufacturing costs as a product cost.

C) It includes fixed manufacturing overhead as an inventoriable cost.

D) It is required for external reporting to shareholders.

A) It expenses administrative costs as cost of goods sold.

B) It treats direct manufacturing costs as a product cost.

C) It includes fixed manufacturing overhead as an inventoriable cost.

D) It is required for external reporting to shareholders.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is true of absorption costing?

A) It expenses marketing costs as cost of goods sold.

B) It treats direct manufacturing costs as a period cost.

C) It includes fixed manufacturing overhead as an inventoriable cost.

D) It treats indirect manufacturing costs as a period cost.

A) It expenses marketing costs as cost of goods sold.

B) It treats direct manufacturing costs as a period cost.

C) It includes fixed manufacturing overhead as an inventoriable cost.

D) It treats indirect manufacturing costs as a period cost.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following costs is inventoried when using absorption costing?

A) variable selling costs

B) fixed administrative costs

C) variable manufacturing costs

D) fixed selling costs

A) variable selling costs

B) fixed administrative costs

C) variable manufacturing costs

D) fixed selling costs

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

11

In ________,fixed manufacturing costs are included as inventoriable costs.

A) variable costing

B) absorption costing

C) throughput costing

D) activity-based costing

A) variable costing

B) absorption costing

C) throughput costing

D) activity-based costing

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

12

Gloria's Decorating produces and sells a mantel clock for $100 per unit. In 2015, 42,125 clocks were produced and 37,958 were sold. Other information for the year includes:

-What is the inventoriable cost per unit using variable costing?

A) $45.00

B) $52.50

C) $65.00

D) $115.00

-What is the inventoriable cost per unit using variable costing?

A) $45.00

B) $52.50

C) $65.00

D) $115.00

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

13

Under absorption costing,fixed manufacturing costs ________.

A) are period costs

B) are inventoriable costs

C) are treated as an expense

D) are sunk costs

A) are period costs

B) are inventoriable costs

C) are treated as an expense

D) are sunk costs

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

14

________ is a method of inventory costing in which all variable manufacturing costs and all fixed manufacturing costs are included as inventoriable costs.

A) Variable costing

B) Mixed costing

C) Absorption costing

D) Standard costing

A) Variable costing

B) Mixed costing

C) Absorption costing

D) Standard costing

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

15

The only difference between variable and absorption costing is the expensing of ________.

A) direct manufacturing costs

B) variable marketing costs

C) fixed manufacturing costs

D) variable administrative costs

A) direct manufacturing costs

B) variable marketing costs

C) fixed manufacturing costs

D) variable administrative costs

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

16

Variable costing regards fixed manufacturing overhead as a(n)________.

A) administrative cost

B) inventoriable cost

C) period cost

D) product cost

A) administrative cost

B) inventoriable cost

C) period cost

D) product cost

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following costs will be treated as period costs under absorption costing?

A) raw materials used in the production

B) sales commission paid on sale of product

C) depreciation on factory equipment

D) rent for factory building

A) raw materials used in the production

B) sales commission paid on sale of product

C) depreciation on factory equipment

D) rent for factory building

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

18

The unit cost of a product is always higher in variable costing than in absorption costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following inventory costing methods shown below is required by GAAP (Generally Accepted Accounting Principles)for external financial reporting?

A) absorption costing

B) variable costing

C) throughput costing

D) direct costing

A) absorption costing

B) variable costing

C) throughput costing

D) direct costing

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

20

Unile Auto produces and sells an auto part for $60.00 per unit. In 2015, 100,000 parts were produced and 75,000 units were sold. Other information for the year includes:

-What is the inventoriable cost per unit using variable costing?

A) $20.00

B) $24.00

C) $25.00

D) $31.00

-What is the inventoriable cost per unit using variable costing?

A) $20.00

B) $24.00

C) $25.00

D) $31.00

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

21

The contribution-margin format is used for ________.

A) variable costing income statement

B) mixed costing income statement

C) absorption costing income statement

D) job order costing income statement

A) variable costing income statement

B) mixed costing income statement

C) absorption costing income statement

D) job order costing income statement

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

22

Zahra's Decoratives produces and sells a decorative pillow for $97.50 per unit. In the first month of operation, 2,000 units were produced and 1,750 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

-What is cost of goods sold using variable costing?

A) $38,675

B) $35,000

C) $44,200

D) $52,000

-What is cost of goods sold using variable costing?

A) $38,675

B) $35,000

C) $44,200

D) $52,000

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is true of gross-margin format of the income statement?

A) It distinguishes between manufacturing and nonmanufacturing costs.

B) It distinguishes variable costs from fixed costs.

C) It is used for variable costing.

D) It calculates the contribution margin from sales.

A) It distinguishes between manufacturing and nonmanufacturing costs.

B) It distinguishes variable costs from fixed costs.

C) It is used for variable costing.

D) It calculates the contribution margin from sales.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

24

a.Explain the difference between the variable and absorption costing methods.

b.Which method(s)are required for external reporting? For internal reporting?

b.Which method(s)are required for external reporting? For internal reporting?

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

25

Under both variable and absorption costing,research and development costs are period costs.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

26

Jean Peck's Furniture's manufactures tables for hospitality sector. It takes only bulk orders and each table is sold for $300 after negotiations. In the month of January, it manufactures 3,000 tables and sells 2,250 tables. Actual fixed costs are the same as the amount fixed costs budgeted for the month.

The following information is provided for the month of January:

At the end of the month Jean Peck's Furniture's has an ending inventory of finished goods of 750 units. The company also incurs a sales commission of $10 per unit.

-What is the operating income when using absorption costing?

A) $337,500

B) $312,500

C) $290,000

D) $260,500

The following information is provided for the month of January:

At the end of the month Jean Peck's Furniture's has an ending inventory of finished goods of 750 units. The company also incurs a sales commission of $10 per unit.

-What is the operating income when using absorption costing?

A) $337,500

B) $312,500

C) $290,000

D) $260,500

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

27

Charlassier Corporation manufactures and sells laptop computers and uses standard costing.For the month of September there was no beginning inventory,there were 3,000 units produced and 2,500 units sold.The manufacturing variable cost per unit is $385 and the variable operating cost per unit was $312.50.The fixed manufacturing cost is $450,000 and the fixed operating cost is $75,000.The selling price per unit is $925.

Required:

Prepare the income statement for Charlassier Corporation for September under variable costing.

Required:

Prepare the income statement for Charlassier Corporation for September under variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

28

The main difference between variable costing and absorption costing is the way in which fixed manufacturing costs are accounted for.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

29

________ are subtracted from sales to calculate gross margin.

A) Variable manufacturing costs

B) Fixed administrative costs

C) Variable administrative costs

D) Fixed selling costs

A) Variable manufacturing costs

B) Fixed administrative costs

C) Variable administrative costs

D) Fixed selling costs

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

30

Zahra's Decoratives produces and sells a decorative pillow for $97.50 per unit. In the first month of operation, 2,000 units were produced and 1,750 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

-What is the contribution margin using variable costing?

A) $118,625

B) $125,125

C) $126,425

D) $135,625

-What is the contribution margin using variable costing?

A) $118,625

B) $125,125

C) $126,425

D) $135,625

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

31

For 2011,Nichols,Inc.,had sales of 150,000 units and production of 200,000 units.Other information for the year included:

Required:

Required:

a.Compute the ending finished goods inventory under both absorption and variable costing.

b.Compute the cost of goods sold under both absorption and variable costing.

Required:

Required:a.Compute the ending finished goods inventory under both absorption and variable costing.

b.Compute the cost of goods sold under both absorption and variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

32

The gross-margin format is used for ________.

A) variable costing income statement

B) mixed costing income statement

C) absorption costing income statement

D) standard costing income statement

A) variable costing income statement

B) mixed costing income statement

C) absorption costing income statement

D) standard costing income statement

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

33

Zahra's Decoratives produces and sells a decorative pillow for $97.50 per unit. In the first month of operation, 2,000 units were produced and 1,750 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

-What is cost of goods sold per unit using variable costing?

A) $22.10

B) $26

C) $39

D) $58.50

-What is cost of goods sold per unit using variable costing?

A) $22.10

B) $26

C) $39

D) $58.50

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

34

Job costing system is an example of absorption costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

35

Jean Peck's Furniture's manufactures tables for hospitality sector. It takes only bulk orders and each table is sold for $300 after negotiations. In the month of January, it manufactures 3,000 tables and sells 2,250 tables. Actual fixed costs are the same as the amount fixed costs budgeted for the month.

The following information is provided for the month of January:

At the end of the month Jean Peck's Furniture's has an ending inventory of finished goods of 750 units. The company also incurs a sales commission of $10 per unit.

-What is the gross margin when using absorption costing?

A) $675,000

B) $527,500

C) $270,000

D) $337,500

The following information is provided for the month of January:

At the end of the month Jean Peck's Furniture's has an ending inventory of finished goods of 750 units. The company also incurs a sales commission of $10 per unit.

-What is the gross margin when using absorption costing?

A) $675,000

B) $527,500

C) $270,000

D) $337,500

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is true of contribution-margin format of the income statement?

A) It is used for absorption costing.

B) It highlights the lump sum of fixed manufacturing costs.

C) It distinguishes manufacturing costs from nonmanufacturing costs.

D) It calculates gross margin.

A) It is used for absorption costing.

B) It highlights the lump sum of fixed manufacturing costs.

C) It distinguishes manufacturing costs from nonmanufacturing costs.

D) It calculates gross margin.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

37

Zahra's Decoratives produces and sells a decorative pillow for $97.50 per unit. In the first month of operation, 2,000 units were produced and 1,750 units were sold. Actual fixed costs are the same as the amount budgeted for the month. Other information for the month includes:

-What is the operating income using variable costing?

A) $125,125

B) $85,125

C) $65,000

D) $60,125

-What is the operating income using variable costing?

A) $125,125

B) $85,125

C) $65,000

D) $60,125

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

38

Under variable costing,lease charges paid on the factory building is an inventoriable cost.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

39

Jean Peck's Furniture's manufactures tables for hospitality sector. It takes only bulk orders and each table is sold for $300 after negotiations. In the month of January, it manufactures 3,000 tables and sells 2,250 tables. Actual fixed costs are the same as the amount fixed costs budgeted for the month.

The following information is provided for the month of January:

At the end of the month Jean Peck's Furniture's has an ending inventory of finished goods of 750 units. The company also incurs a sales commission of $10 per unit.

-What is the cost of goods sold per unit when using absorption costing?

A) $120

B) $128

C) $150

D) $158

The following information is provided for the month of January:

At the end of the month Jean Peck's Furniture's has an ending inventory of finished goods of 750 units. The company also incurs a sales commission of $10 per unit.

-What is the cost of goods sold per unit when using absorption costing?

A) $120

B) $128

C) $150

D) $158

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

40

________ is subtracted from sales while calculating contribution margin.

A) Direct labor in factory

B) Rent on factory building

C) Rent on the headquarterʹs building

D) Sales commission on incremental sales

A) Direct labor in factory

B) Rent on factory building

C) Rent on the headquarterʹs building

D) Sales commission on incremental sales

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

41

Answer the following questions using the information below:

Jupiter Corporation incurred fixed manufacturing costs of $16,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 2,000 units.

Units produced total 2,200 units.

Units sold total 1,900 units.

Variable cost per unit is $4.

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under absorption costing,the production-volume variance is ________.

A) $2,400

B) $2,000

C) $1,600

D) 0

Jupiter Corporation incurred fixed manufacturing costs of $16,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 2,000 units.

Units produced total 2,200 units.

Units sold total 1,900 units.

Variable cost per unit is $4.

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under absorption costing,the production-volume variance is ________.

A) $2,400

B) $2,000

C) $1,600

D) 0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

42

Stiller Corporation incurred fixed manufacturing costs of $24,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 2,000 units.

Units produced total 1,500 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs expensed on the income statement (excluding adjustments for variances)total ________.

A) $14,400

B) $19,200

C) $24,000

D) 0

The budgeted denominator level is 2,000 units.

Units produced total 1,500 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs expensed on the income statement (excluding adjustments for variances)total ________.

A) $14,400

B) $19,200

C) $24,000

D) 0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

43

Answer the following questions using the information below:

Veach Corporation incurred fixed manufacturing costs of $6,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 1,000 units.

Units produced total 750 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs expensed on the income statement (excluding adjustments for variances)total ________.

A) $3,600

B) $4,800

C) $6,000

D) 0

Veach Corporation incurred fixed manufacturing costs of $6,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 1,000 units.

Units produced total 750 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs expensed on the income statement (excluding adjustments for variances)total ________.

A) $3,600

B) $4,800

C) $6,000

D) 0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

44

One possible means of determining the difference between operating incomes for absorption costing and variable costing is by ________.

A) subtracting sales of the previous period from sales of this period

B) subtracting fixed manufacturing overhead in beginning inventory from fixed manufacturing overhead in ending inventory

C) multiplying the number of units produced by the budgeted fixed manufacturing cost rate

D) adding fixed manufacturing costs to the production-volume variance

A) subtracting sales of the previous period from sales of this period

B) subtracting fixed manufacturing overhead in beginning inventory from fixed manufacturing overhead in ending inventory

C) multiplying the number of units produced by the budgeted fixed manufacturing cost rate

D) adding fixed manufacturing costs to the production-volume variance

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

45

Stiller Corporation incurred fixed manufacturing costs of $24,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 2,000 units.

Units produced total 1,500 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Operating income using absorption costing will be ________ than operating income if using variable costing.

A) $9,600 higher

B) $4,800 lower

C) $3,600 higher

D) $14,400 lower

The budgeted denominator level is 2,000 units.

Units produced total 1,500 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Operating income using absorption costing will be ________ than operating income if using variable costing.

A) $9,600 higher

B) $4,800 lower

C) $3,600 higher

D) $14,400 lower

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

46

Answer the following questions using the information below:

Veach Corporation incurred fixed manufacturing costs of $6,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 1,000 units.

Units produced total 750 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

The production-volume variance totals ________.

A) $2,000

B) $1,500

C) $2,400

D) 0

Veach Corporation incurred fixed manufacturing costs of $6,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 1,000 units.

Units produced total 750 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

The production-volume variance totals ________.

A) $2,000

B) $1,500

C) $2,400

D) 0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

47

The difference between operating incomes under variable costing and absorption costing centers on how to account for ________.

A) direct materials costs

B) fixed manufacturing costs

C) variable manufacturing costs

D) selling and administrative costs

A) direct materials costs

B) fixed manufacturing costs

C) variable manufacturing costs

D) selling and administrative costs

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statements is true of absorption costing?

A) Absorption costing allocates fixed manufacturing overhead to actual units produced during the period.

B) Absorption costing carries over nonmanufacturing costs to the future periods.

C) Absorption costing shows the same level of profit as variable costing irrespective of the level of inventories.

D) Absorption costing allocates total manufacturing cost using the budgeted level of production for a particular year.

A) Absorption costing allocates fixed manufacturing overhead to actual units produced during the period.

B) Absorption costing carries over nonmanufacturing costs to the future periods.

C) Absorption costing shows the same level of profit as variable costing irrespective of the level of inventories.

D) Absorption costing allocates total manufacturing cost using the budgeted level of production for a particular year.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

49

If the unit level of inventory increases during an accounting period,then ________.

A) less operating income will be reported under absorption costing than variable costing

B) more operating income will be reported under absorption costing than variable costing

C) operating income will be the same under absorption costing and variable costing

D) the exact effect on operating income cannot be determined

A) less operating income will be reported under absorption costing than variable costing

B) more operating income will be reported under absorption costing than variable costing

C) operating income will be the same under absorption costing and variable costing

D) the exact effect on operating income cannot be determined

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

50

Answer the following questions using the information below:

Jupiter Corporation incurred fixed manufacturing costs of $16,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 2,000 units.

Units produced total 2,200 units.

Units sold total 1,900 units.

Variable cost per unit is $4.

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under variable costing,the fixed manufacturing costs expensed on the income statement (excluding adjustments for variances)total ________.

A) $16,000

B) $15,200

C) $14,400

D) 0

Jupiter Corporation incurred fixed manufacturing costs of $16,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 2,000 units.

Units produced total 2,200 units.

Units sold total 1,900 units.

Variable cost per unit is $4.

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under variable costing,the fixed manufacturing costs expensed on the income statement (excluding adjustments for variances)total ________.

A) $16,000

B) $15,200

C) $14,400

D) 0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

51

Answer the following questions using the information below:

Jupiter Corporation incurred fixed manufacturing costs of $16,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 2,000 units.

Units produced total 2,200 units.

Units sold total 1,900 units.

Variable cost per unit is $4.

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under absorption costing,fixed manufacturing costs expensed on the income statement (excluding adjustments for variances)total ________.

A) $26,400

B) $22,800

C) $24,000

D) $21,818

Jupiter Corporation incurred fixed manufacturing costs of $16,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 2,000 units.

Units produced total 2,200 units.

Units sold total 1,900 units.

Variable cost per unit is $4.

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

Under absorption costing,fixed manufacturing costs expensed on the income statement (excluding adjustments for variances)total ________.

A) $26,400

B) $22,800

C) $24,000

D) $21,818

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

52

An favorable production-volume variance occurs when ________.

A) the denominator level exceeds production

B) production exceeds the denominator level

C) production exceeds unit sales

D) unit sales exceed production

A) the denominator level exceeds production

B) production exceeds the denominator level

C) production exceeds unit sales

D) unit sales exceed production

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

53

Answer the following questions using the information below:

Veach Corporation incurred fixed manufacturing costs of $6,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 1,000 units.

Units produced total 750 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs included in ending inventory total ________.

A) $1,200

B) $1,500

C) $900

D) 0

Veach Corporation incurred fixed manufacturing costs of $6,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 1,000 units.

Units produced total 750 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs included in ending inventory total ________.

A) $1,200

B) $1,500

C) $900

D) 0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

54

Answer the following questions using the information below:

Veach Corporation incurred fixed manufacturing costs of $6,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 1,000 units.

Units produced total 750 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Operating income using variable costing will be ________ than operating income if using absorption costing.

A) $2,400 higher

B) $2,400 lower

C) $3,600 higher

D) $900 lower

Veach Corporation incurred fixed manufacturing costs of $6,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 1,000 units.

Units produced total 750 units.

Units sold total 600 units.

Beginning inventory was zero.

The company uses variable costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Operating income using variable costing will be ________ than operating income if using absorption costing.

A) $2,400 higher

B) $2,400 lower

C) $3,600 higher

D) $900 lower

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

55

When comparing the operating incomes between absorption costing and variable costing,and ending finished inventory exceeds beginning finished inventory,it may be assumed that ________.

A) sales decreased during the period

B) variable cost per unit is more than fixed cost per unit

C) there is a favorable production-volume variance

D) absorption costing operating income exceeds variable costing operating income

A) sales decreased during the period

B) variable cost per unit is more than fixed cost per unit

C) there is a favorable production-volume variance

D) absorption costing operating income exceeds variable costing operating income

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

56

Stiller Corporation incurred fixed manufacturing costs of $24,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 2,000 units.

Units produced total 1,500 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs included in ending inventory total ________.

A) $4,800

B) $6,000

C) $3,600

D) 0

The budgeted denominator level is 2,000 units.

Units produced total 1,500 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

Fixed manufacturing costs included in ending inventory total ________.

A) $4,800

B) $6,000

C) $3,600

D) 0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

57

Answer the following questions using the information below:

Jupiter Corporation incurred fixed manufacturing costs of $16,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 2,000 units.

Units produced total 2,200 units.

Units sold total 1,900 units.

Variable cost per unit is $4.

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

-The operating income using variable costing will be ________ as compared to the operating income under absorption costing.

A) lower by $2,400

B) lower by $4,800

C) higher by $2,400

D) higher by $4,800

Jupiter Corporation incurred fixed manufacturing costs of $16,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 2,000 units.

Units produced total 2,200 units.

Units sold total 1,900 units.

Variable cost per unit is $4.

Beginning inventory is zero.

The fixed manufacturing cost rate is based on the budgeted denominator level.

-The operating income using variable costing will be ________ as compared to the operating income under absorption costing.

A) lower by $2,400

B) lower by $4,800

C) higher by $2,400

D) higher by $4,800

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

58

The following information pertains to Brian Stone Corporation: What is the difference between operating incomes under absorption costing and variable costing?

A) $750

B) $7,500

C) $15,000

D) $30,750

A) $750

B) $7,500

C) $15,000

D) $30,750

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

59

Stiller Corporation incurred fixed manufacturing costs of $24,000 during 2015. Other information for 2015 includes:

The budgeted denominator level is 2,000 units.

Units produced total 1,500 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

The production-volume variance is ________.

A) $8,000

B) $6,000

C) $9,600

D) 0

The budgeted denominator level is 2,000 units.

Units produced total 1,500 units.

Units sold total 1,200 units.

Beginning inventory was zero.

The company uses absorption costing and the fixed manufacturing cost rate is based on the budgeted denominator level. Manufacturing variances are closed to cost of goods sold.

The production-volume variance is ________.

A) $8,000

B) $6,000

C) $9,600

D) 0

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

60

Heston Company has the following information for the current year: What is the difference between operating incomes under absorption costing and variable costing?

A) $140,000

B) $100,000

C) $80,000

D) $10,000

A) $140,000

B) $100,000

C) $80,000

D) $10,000

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

61

Fixed manufacturing costs included in cost of goods available for sale + the production-volume variance will always = total fixed manufacturing costs under absorption costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

62

In absorption costing,fixed manufacturing overhead is treated as a period cost.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

63

Absorption costing enables managers to increase operating income by increasing the unit level of sales,as well as by producing more units.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

64

The production-volume variance,which relates only to fixed manufacturing overhead,exists under absorption costing but not under variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

65

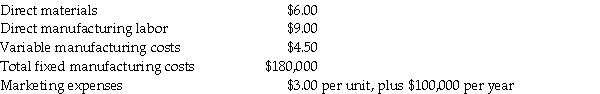

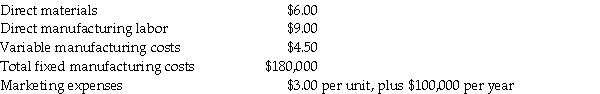

Aspen Manufacturing Company sells its products for $33 each.The current production level is 50,000 units,although only 40,000 units are anticipated to be sold.

Unit manufacturing costs are:

Required:

Required:

a.Prepare an income statement using absorption costing.

b.Prepare an income statement using variable costing.

Unit manufacturing costs are:

Required:

Required:a.Prepare an income statement using absorption costing.

b.Prepare an income statement using variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

66

The income under variable costing will always be the same as the income under absorption costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

67

As a company reduces its inventory levels,operating income differences between absorption costing and variable costing become immaterial.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

68

Ireland Corporation planned to be in operation for three years.

• During the first year,2015,it had no sales but incurred $240,000 in variable manufacturing expenses and $80,000 in fixed manufacturing expenses.

• In 2016,it sold half of the finished goods inventory from 20x1 for $200,000 but it had no manufacturing costs.

• In 2017,it sold the remainder of the inventory for $240,000,had no manufacturing expenses and went out of business.

• Marketing and administrative expenses were fixed and totaled $40,000 each year.

Required:

a.Prepare an income statement for each year using absorption costing.

b.Prepare an income statement for each year using variable costing.

• During the first year,2015,it had no sales but incurred $240,000 in variable manufacturing expenses and $80,000 in fixed manufacturing expenses.

• In 2016,it sold half of the finished goods inventory from 20x1 for $200,000 but it had no manufacturing costs.

• In 2017,it sold the remainder of the inventory for $240,000,had no manufacturing expenses and went out of business.

• Marketing and administrative expenses were fixed and totaled $40,000 each year.

Required:

a.Prepare an income statement for each year using absorption costing.

b.Prepare an income statement for each year using variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

69

Jarvis Golf Company sells a special putter for $20 each.In March,it sold 28,000 putters while manufacturing 30,000.There was no beginning inventory on March 1.Production information for March was:

Required:

Required:

a.Compute the cost per unit under both absorption and variable costing.

b.Compute the ending inventories under both absorption and variable costing.

c.Compute operating income under both absorption and variable costing.

Required:

Required:a.Compute the cost per unit under both absorption and variable costing.

b.Compute the ending inventories under both absorption and variable costing.

c.Compute operating income under both absorption and variable costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

70

Fixed manufacturing overhead is a period cost both under variable costing and under absorption costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

71

The basis of the difference between variable costing and absorption costing is how fixed manufacturing costs are accounted for.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

72

Given a constant contribution margin per unit and constant fixed costs,the period-to-period change in operating income under variable costing is driven solely by changes in the quantity of units actually manufactured.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

73

The production-volume variance only exists under variable costing and not under absorption costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

74

The contribution-margin format of the income statement is used with absorption costing.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

75

Given a constant contribution margin per unit and constant fixed costs,the period-to-period change in operating income under variable costing is driven solely by ________.

A) changes in the quantity of units actually sold

B) changes in the quantity of units produced

C) changes in ending inventory

D) changes in sales price per unit

A) changes in the quantity of units actually sold

B) changes in the quantity of units produced

C) changes in ending inventory

D) changes in sales price per unit

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

76

In general,if inventory increases during an accounting period,________.

A) variable costing will report less operating income than absorption costing

B) absorption costing will report less operating income than variable costing

C) variable costing and absorption costing will report the same operating income

D) both variable costing and absorption costing will show losses

A) variable costing will report less operating income than absorption costing

B) absorption costing will report less operating income than variable costing

C) variable costing and absorption costing will report the same operating income

D) both variable costing and absorption costing will show losses

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

77

The contribution-margin format of the income statement distinguishes manufacturing costs from nonmanufacturing costs.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

78

At the end of the accounting period,Armstrong Corporation reports operating income of $30,000.Which of the following statements is true,if Armstrong's inventory levels decrease during the accounting period?

A) Variable costing will report less operating income than absorption costing.

B) Absorption costing will report less operating income than variable costing.

C) Variable costing and absorption costing will report the same operating income since the cost of goods sold is the same.

D) Variable costing and absorption costing will report the same operating income since the total costs are the same.

A) Variable costing will report less operating income than absorption costing.

B) Absorption costing will report less operating income than variable costing.

C) Variable costing and absorption costing will report the same operating income since the cost of goods sold is the same.

D) Variable costing and absorption costing will report the same operating income since the total costs are the same.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

79

In variable costing,all nonmanufacturing costs are subtracted from contribution margin.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck

80

Absorption-costing income statements do not need to differentiate between variable and fixed costs.

Unlock Deck

Unlock for access to all 210 flashcards in this deck.

Unlock Deck

k this deck