Deck 22: Management Control Systems, transfer Pricing, and Multinational Considerations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

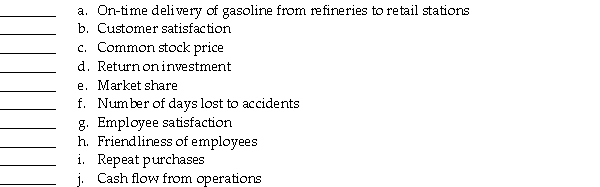

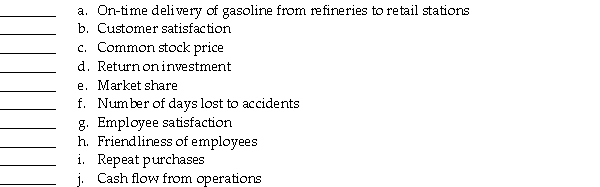

Question

Question

Question

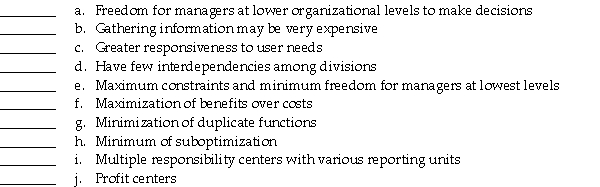

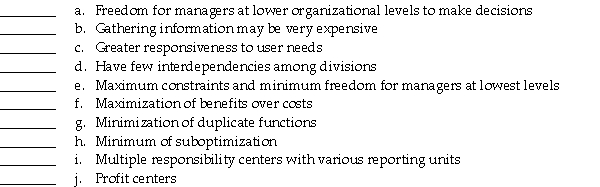

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/150

Play

Full screen (f)

Deck 22: Management Control Systems, transfer Pricing, and Multinational Considerations

1

Line managers supervising individual refineries are concerned with ________.

A) obtaining information about the firm's opportunity costs

B) obtaining information about the firm's sunk costs

C) obtaining information about the firm's equipment downtime and product quality

D) obtaining information about customer satisfaction and market share

A) obtaining information about the firm's opportunity costs

B) obtaining information about the firm's sunk costs

C) obtaining information about the firm's equipment downtime and product quality

D) obtaining information about customer satisfaction and market share

C

2

Of the four perspectives of the balanced scorecard the customer perspective refers to employee satisfaction,absenteeism,information systems capabilities,and number of processes with real-time feedback.

False

3

Which of the following is true of goal congruence?

A) It exists when the management's strategy is in line with the shareholders' requirements.

B) It exists when individuals and groups work toward achieving the organization's goals.

C) It exists when both internal and external stakeholders of an organization have similar goals.

D) It exists when an organization's goals are in line with the social acceptability of organizational goals.

A) It exists when the management's strategy is in line with the shareholders' requirements.

B) It exists when individuals and groups work toward achieving the organization's goals.

C) It exists when both internal and external stakeholders of an organization have similar goals.

D) It exists when an organization's goals are in line with the social acceptability of organizational goals.

B

4

Which of the following is a part of the formal management control system?

A) mutual commitments among the members of the organization

B) the quality system which provides information about defective products

C) shared values and loyalties among the members of the organization

D) general understanding about acceptable behavior for managers

A) mutual commitments among the members of the organization

B) the quality system which provides information about defective products

C) shared values and loyalties among the members of the organization

D) general understanding about acceptable behavior for managers

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

5

Management control systems is designed only for top level managers and is not applicable to line managers.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

6

Effective management control systems should also motivate managers and other employees.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

7

If an oil refinery used refinery down-time as a Balanced Scorecard control measure,it would represent the ________ perspective.

A) financial

B) customer

C) internal business process

D) learning and growth

A) financial

B) customer

C) internal business process

D) learning and growth

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

8

The formal management control system includes shared values,loyalties,and mutual commitments among members of the company,company culture,and norms about acceptable behavior for managers and other employees.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is a characteristic of a management control system?

A) It aids and coordinates the process of making decisions.

B) It encourages short-term profitability and maximizing net income.

C) It helps individuals throughout the organization to act independently and maximize the profitability of their departments.

D) It deals with coordinating planning across the organization and is not concerned with behavioral aspects of management like employee motivation.

A) It aids and coordinates the process of making decisions.

B) It encourages short-term profitability and maximizing net income.

C) It helps individuals throughout the organization to act independently and maximize the profitability of their departments.

D) It deals with coordinating planning across the organization and is not concerned with behavioral aspects of management like employee motivation.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

10

If a computer manufacturer used its common stock price as a Balanced Scorecard control measure,it would represent the ________ perspective.

A) financial

B) customer

C) internal business process

D) learning and growth

A) financial

B) customer

C) internal business process

D) learning and growth

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

11

The formal management control system includes the shared values,loyalties,and mutual commitments among members of the organization.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

12

The management accounting system is an informal management control system which provide information about the firm's costs,revenues,and income.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

13

Effort in terms of management control systems is defined in terms of physical exertion such as a worker producing at a faster rate.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

14

A well-designed management control system uses information from ________.

A) internal sources only as they are the most reliable sources of information

B) external sources only as they are more dynamic and future oriented

C) both internal and external sources as a wide range of information is required

D) external sources only as they are the most reliable sources of information

A) internal sources only as they are the most reliable sources of information

B) external sources only as they are more dynamic and future oriented

C) both internal and external sources as a wide range of information is required

D) external sources only as they are the most reliable sources of information

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

15

The human resources systems is a part of the formal management control systems of an organization.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

16

Goal congruence exists when individuals work toward achieving one goal,and groups work toward achieving a different goal.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

17

Management control systems should be designed to support the organizational responsibilities of individual managers.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

18

________,in the perspective of an effective management control,is the extent to which managers strive or endeavor in order to achieve a goal.

A) Efficiency

B) Effectiveness

C) Effort

D) Variance

A) Efficiency

B) Effectiveness

C) Effort

D) Variance

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

19

Effort refers to physical exertion,such as a worker producing at a faster rate,but excludes non-physical aspects like acumen and diligence of a worker.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

20

An organization should design its management control system independently of its strategies,so that the system is not affected by change of strategies in future.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is a drawback of decentralizing a multinational company?

A) It may lead to increased exchange rate risk.

B) It may result in lack of control and results in increasing risk.

C) It creates less responsiveness to the needs of a subunit's customers, suppliers, and employees.

D) It may lead to an increase in bureaucracy.

A) It may lead to increased exchange rate risk.

B) It may result in lack of control and results in increasing risk.

C) It creates less responsiveness to the needs of a subunit's customers, suppliers, and employees.

D) It may lead to an increase in bureaucracy.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

22

In a profit center,the manager is accountable for investments,revenues,and costs.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

23

________ means minimum constraints and maximum freedom for managers at the lowest levels of an organization to make decisions and to take actions.

A) Total centralization

B) Use of market-based transfer pricing

C) Total decentralization

D) Use of negotiated transfer pricing

A) Total centralization

B) Use of market-based transfer pricing

C) Total decentralization

D) Use of negotiated transfer pricing

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

24

An advantage of decentralization is that it ________.

A) creates greater responsiveness to local needs

B) focuses manager's attention on the organization as a whole

C) does not result in a duplication of activities

D) reduces the cost of gathering information

A) creates greater responsiveness to local needs

B) focuses manager's attention on the organization as a whole

C) does not result in a duplication of activities

D) reduces the cost of gathering information

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

25

For each of the following Balanced Scorecard measures,identify which of the four perspectives (Financial,Customer,Internal Business Process,or Learning and Growth)the measure best represents.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

26

An investment center is always a decentralized subunit.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

27

________ occurs when a decision's benefits for one subunit is more than offset by the costs to the organization as a whole.

A) Suboptimal decision making

B) Independent decision making

C) Congruent decision making

D) Departmental decision making

A) Suboptimal decision making

B) Independent decision making

C) Congruent decision making

D) Departmental decision making

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

28

For each of the following activities,characteristics,and applications,identify whether they can be found in a centralized organization,a decentralized organization,or both types of organizations.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

29

Decentralization in multinational companies may lead to lack of control.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is a responsibility center to measure the revenues and costs of subunits in centralized or decentralized companies?

A) investment center

B) environmental center

C) exchange policy center

D) taxation rebate center

A) investment center

B) environmental center

C) exchange policy center

D) taxation rebate center

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is an advantage of decentralization?

A) It creates greater responsiveness to local needs.

B) It focuses managers' attention on the organization as a whole.

C) It does not result in a duplication of activities.

D) It encourages suboptimal decision making.

A) It creates greater responsiveness to local needs.

B) It focuses managers' attention on the organization as a whole.

C) It does not result in a duplication of activities.

D) It encourages suboptimal decision making.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

32

Incongruent decision making occurs when individuals and groups work toward achieving the organization's goals even if departmental performance is adversely affected.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

33

What is goal congruence?

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements is true of decentralization?

A) A decentralized structure does not empower employees to handle customer complaints directly.

B) A decentralized structure forces top management to lose some control over the organization.

C) Decentralization slows responsiveness to local needs for decision making.

D) A decentralized structure only delegate recurring and structured decisions to lower levels.

A) A decentralized structure does not empower employees to handle customer complaints directly.

B) A decentralized structure forces top management to lose some control over the organization.

C) Decentralization slows responsiveness to local needs for decision making.

D) A decentralized structure only delegate recurring and structured decisions to lower levels.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is a benefit of decentralization?

A) It creates greater responsiveness to local needs.

B) It helps in rasing capital at a local level.

C) It relieves top managers of accountability.

D) It eliminates the need for enforcing goal congruence among the departments.

A) It creates greater responsiveness to local needs.

B) It helps in rasing capital at a local level.

C) It relieves top managers of accountability.

D) It eliminates the need for enforcing goal congruence among the departments.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

36

"Management control systems consist of formal and informal control systems." Briefly explain the formal and informal management systems and enlist their components.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

37

Decisions regarding sources of long-term financing are best made at subunit level as the subunit has local knowledge and can leverage it in negotiations.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

38

The labels profit center and cost center are dependent on the degree of centralization or decentralization in a company.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

39

Surveys indicate that decisions made most frequently at the corporate level are related to sources of supplies and products to manufacture.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following areas lends themselves to the concept of decentralization?

A) dividend decisions

B) long-term financing

C) product advertising

D) strategic planning

A) dividend decisions

B) long-term financing

C) product advertising

D) strategic planning

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following best describes a transfer price?

A) It is the price charged by an organization when it transfer goods to another organization in lieu of services provided by it.

B) It is the price that is to be used while calculating revenue from sales to customers for tax purposes.

C) It is the price that is charged by a department of an organization when it sells its goods to its competitors.

D) It is the price one subunit charges for a product or service supplied to another subunit of the same organization.

A) It is the price charged by an organization when it transfer goods to another organization in lieu of services provided by it.

B) It is the price that is to be used while calculating revenue from sales to customers for tax purposes.

C) It is the price that is charged by a department of an organization when it sells its goods to its competitors.

D) It is the price one subunit charges for a product or service supplied to another subunit of the same organization.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

42

Transfer-pricing systems enable managers to focus on maximizing the performance of their subunits.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

43

The product or service transferred between subunits of an organization is called an intermediate product.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

44

Answer the following questions using the information below:

Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Extraction Division and 15,000 barrels from other suppliers at $60 per barrel.

-What is the transfer price per barrel from the Extraction Division to the Refining Division,assuming the method used to place a value on each barrel of oil is 180% of variable costs?

A) $12.60

B) $21.60

C) $72.00

D) $130.00

Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Extraction Division and 15,000 barrels from other suppliers at $60 per barrel.

-What is the transfer price per barrel from the Extraction Division to the Refining Division,assuming the method used to place a value on each barrel of oil is 180% of variable costs?

A) $12.60

B) $21.60

C) $72.00

D) $130.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

45

What is decentralization and what are its benefits?

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

46

Negotiated transfer prices are often employed when ________.

A) market prices are stable

B) market prices are volatile

C) market prices change by a regular percentage each year

D) goal congruence is not a major objective

A) market prices are stable

B) market prices are volatile

C) market prices change by a regular percentage each year

D) goal congruence is not a major objective

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

47

Answer the following questions using the information below:

Timekeeper Corporation has two divisions, Distribution and Manufacturing. The company's primary product is high-end watches. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 units a week and usually purchases 2,000,000 units from the Manufacturing Division and 2,000,000 units from other suppliers at $9.00 per unit.

-What is the transfer price per watch from the Manufacturing Division to the Distribution Division,assuming the method used to place a value on each pound of fertilizer is 160% of variable costs?

A) $1.00

B) $1.60

C) $2.20

D) $8.00

Timekeeper Corporation has two divisions, Distribution and Manufacturing. The company's primary product is high-end watches. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 units a week and usually purchases 2,000,000 units from the Manufacturing Division and 2,000,000 units from other suppliers at $9.00 per unit.

-What is the transfer price per watch from the Manufacturing Division to the Distribution Division,assuming the method used to place a value on each pound of fertilizer is 160% of variable costs?

A) $1.00

B) $1.60

C) $2.20

D) $8.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

48

Answer the following questions using the information below:

Timekeeper Corporation has two divisions, Distribution and Manufacturing. The company's primary product is high-end watches. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 units a week and usually purchases 2,000,000 units from the Manufacturing Division and 2,000,000 units from other suppliers at $9.00 per unit.

-What is the transfer price per watch from the Manufacturing Division to the Distribution Division,assuming the method used to place a value on each transfer is 120% of full costs?

A) $6.00

B) $7.20

C) $9.00

D) $11.00

Timekeeper Corporation has two divisions, Distribution and Manufacturing. The company's primary product is high-end watches. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 units a week and usually purchases 2,000,000 units from the Manufacturing Division and 2,000,000 units from other suppliers at $9.00 per unit.

-What is the transfer price per watch from the Manufacturing Division to the Distribution Division,assuming the method used to place a value on each transfer is 120% of full costs?

A) $6.00

B) $7.20

C) $9.00

D) $11.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

49

Answer the following questions using the information below:

Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Extraction Division and 15,000 barrels from other suppliers at $60 per barrel.

-Assume 200 barrels are transferred from the Extraction Division to the Refining Division for a transfer price of $18 per barrel.The Refining Division sells the 200 barrels at a price of $120 each to customers.What is the operating income of both divisions together?

A) $7,200

B) $9,600

C) $10,800

D) $20,400

Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Extraction Division and 15,000 barrels from other suppliers at $60 per barrel.

-Assume 200 barrels are transferred from the Extraction Division to the Refining Division for a transfer price of $18 per barrel.The Refining Division sells the 200 barrels at a price of $120 each to customers.What is the operating income of both divisions together?

A) $7,200

B) $9,600

C) $10,800

D) $20,400

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

50

What are transfer prices and what are its criteria?

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

51

Answer the following questions using the information below:

Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Extraction Division and 15,000 barrels from other suppliers at $60 per barrel.

-What is the transfer price per barrel from the Extraction Division to the Refining Division,assuming the method used to place a value on each barrel of oil is 110% of full costs?

A) $12.00

B) $13.20

C) $44.00

D) $79.00

Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,000 barrels a day and usually purchases 25,000 barrels of oil from the Extraction Division and 15,000 barrels from other suppliers at $60 per barrel.

-What is the transfer price per barrel from the Extraction Division to the Refining Division,assuming the method used to place a value on each barrel of oil is 110% of full costs?

A) $12.00

B) $13.20

C) $44.00

D) $79.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is true of hybrid transfer prices?

A) The cost used in hybrid transfer prices is always the actual cost.

B) The cost used in hybrid transfer prices is always the budgeted cost.

C) They take into account both cost and market information.

D) They are less popular in manufacturing industry.

A) The cost used in hybrid transfer prices is always the actual cost.

B) The cost used in hybrid transfer prices is always the budgeted cost.

C) They take into account both cost and market information.

D) They are less popular in manufacturing industry.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

53

The transfer price creates revenues for the selling subunit and costs for the buying subunit affecting each subunit's operating income.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

54

To reduce the excessive focus of subunit managers on their own subunits,many companies compensate subunit managers on the basis of ________.

A) both the operating income earned by their respective subunits and the company as a whole

B) both the investing income earned by their respective subunits and the company as a whole

C) only the investing income earned by their respective subunits

D) both the net income and earned by their respective subunits and the company as a whole

A) both the operating income earned by their respective subunits and the company as a whole

B) both the investing income earned by their respective subunits and the company as a whole

C) only the investing income earned by their respective subunits

D) both the net income and earned by their respective subunits and the company as a whole

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

55

Why is decentralization costly?

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

56

The president of Silicon Company has just returned from a week of professional development courses and is very excited that she will not have to change the organization from a centralized structure to a decentralized structure just to have responsibility centers.However,she is somewhat confused about how responsibility centers relate to centralized organizations where a few managers have most of the authority.

Required:

Explain how a centralized organization might allow for responsibility centers.

Required:

Explain how a centralized organization might allow for responsibility centers.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

57

The costs used in cost-based transfer prices ________.

A) are actual costs

B) are budgeted costs

C) can either be actual or budgeted costs

D) are lower than the market-based transfer prices

A) are actual costs

B) are budgeted costs

C) can either be actual or budgeted costs

D) are lower than the market-based transfer prices

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

58

A product may be passed from one subunit to another subunit in the same organization.The product is known as a(n)________.

A) interdepartmental product

B) intermediate product

C) subunit product

D) transfer product

A) interdepartmental product

B) intermediate product

C) subunit product

D) transfer product

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

59

A transfer-pricing method leads to goal congruence when ________.

A) there is a price difference in different markets due to market inefficiencies

B) managers do no act for their own best interest and work for the long-term best interest of the manager's subunit

C) managers act in their own best interest and the decision is in the long-term best interest of the company

D) there is a low degree of centralization

A) there is a price difference in different markets due to market inefficiencies

B) managers do no act for their own best interest and work for the long-term best interest of the manager's subunit

C) managers act in their own best interest and the decision is in the long-term best interest of the company

D) there is a low degree of centralization

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following is true of transfer pricing?

A) It creates costs for the selling subunit.

B) It creates revenues for the buying subunit.

C) It helps top managers evaluate the performance of individual subunits.

D) It makes managers' information-processing and decision-making tasks difficult.

A) It creates costs for the selling subunit.

B) It creates revenues for the buying subunit.

C) It helps top managers evaluate the performance of individual subunits.

D) It makes managers' information-processing and decision-making tasks difficult.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

61

Answer the following questions using the information below:

Division A sells ground veal internally to Division B, which in turn, produces veal burgers that sell for $10 per pound. Division A incurs costs of $1.25 per pound while Division B incurs additional costs of $5.00 per pound.

What is Division A's operating income per burger,assuming the transfer price of the ground veal is set at $2.00 per burger?

A) $0.75

B) $1.50

C) $2.25

D) $3.00

Division A sells ground veal internally to Division B, which in turn, produces veal burgers that sell for $10 per pound. Division A incurs costs of $1.25 per pound while Division B incurs additional costs of $5.00 per pound.

What is Division A's operating income per burger,assuming the transfer price of the ground veal is set at $2.00 per burger?

A) $0.75

B) $1.50

C) $2.25

D) $3.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

62

Negotiated transfer prices are often employed when market prices are stable.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

63

Answer the following questions using the information below:

Division A sells ground veal internally to Division B, which in turn, produces veal burgers that sell for $10 per pound. Division A incurs costs of $1.25 per pound while Division B incurs additional costs of $5.00 per pound.

Which of the following formulas correctly reflects the company's operating income per pound?

A) $10.00 - ($1.25 + $5.00) = $3.75

B) $10.00 - ($2.50 + $5.00) = $2.50

C) $10.00 - ($1.25 + $7.50) = $1.25

D) $10.00 - ($0.50 + $2.50 + $7.00) = 0

Division A sells ground veal internally to Division B, which in turn, produces veal burgers that sell for $10 per pound. Division A incurs costs of $1.25 per pound while Division B incurs additional costs of $5.00 per pound.

Which of the following formulas correctly reflects the company's operating income per pound?

A) $10.00 - ($1.25 + $5.00) = $3.75

B) $10.00 - ($2.50 + $5.00) = $2.50

C) $10.00 - ($1.25 + $7.50) = $1.25

D) $10.00 - ($0.50 + $2.50 + $7.00) = 0

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

64

Transfer prices do not affect managers whose compensation is directly dependent on an organization's operating income because transfer prices affect only divisional profits and not the organization's profit.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

65

The choice of a transfer-pricing method has minimal effect on the allocation of company-wide operating income among divisions.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

66

If the Polishing Division sells 100,000 pairs of shoes at a price of $120 a pair to customers,what is the operating income of both divisions together?

A) $8,800,000

B) $6,800,000

C) $6,000,000

D) $5,200,000

A) $8,800,000

B) $6,800,000

C) $6,000,000

D) $5,200,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

67

Assume the transfer price for a pair of shoes is 180% of total costs of the Stitching Division and 40,000 of soles are produced and transferred to the Polishing Division.The Stitching Division's operating income is ________.

A) $896,000

B) $720,000

C) $800,000

D) $880,000

A) $896,000

B) $720,000

C) $800,000

D) $880,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

68

Answer the following questions using the information below:

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoe and sells it to retailers. The Stitching Division "sells"shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $42. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Polishing Division are assumed to be $14 per pair at 100,000 units.

Stitching's costs per pair of soles are:

Polishing's costs per completed pair of shoes are:

-What is the transfer price per pair of shoes from the Stitching Division to the Polishing Division if the transfer price per pair of soles is 125% of full costs?

A) $12.50

B) $22.50

C) $30.00

D) $35.00

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoe and sells it to retailers. The Stitching Division "sells"shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $42. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Polishing Division are assumed to be $14 per pair at 100,000 units.

Stitching's costs per pair of soles are:

Polishing's costs per completed pair of shoes are:

-What is the transfer price per pair of shoes from the Stitching Division to the Polishing Division if the transfer price per pair of soles is 125% of full costs?

A) $12.50

B) $22.50

C) $30.00

D) $35.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

69

Answer the following questions using the information below:

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoe and sells it to retailers. The Stitching Division "sells"shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $42. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Polishing Division are assumed to be $14 per pair at 100,000 units.

Stitching's costs per pair of soles are:

Polishing's costs per completed pair of shoes are:

-What is the transfer price per pair of shoes from the Stitching Division to the Polishing Division if the method used to place a value on each pair of shoes is 180% of variable costs?

A) $18.00

B) $32.40

C) $43.20

D) $57.60

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoe and sells it to retailers. The Stitching Division "sells"shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $42. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Polishing Division are assumed to be $14 per pair at 100,000 units.

Stitching's costs per pair of soles are:

Polishing's costs per completed pair of shoes are:

-What is the transfer price per pair of shoes from the Stitching Division to the Polishing Division if the method used to place a value on each pair of shoes is 180% of variable costs?

A) $18.00

B) $32.40

C) $43.20

D) $57.60

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

70

Answer the following questions using the information below:

Timekeeper Corporation has two divisions, Distribution and Manufacturing. The company's primary product is high-end watches. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 units a week and usually purchases 2,000,000 units from the Manufacturing Division and 2,000,000 units from other suppliers at $9.00 per unit.

-Assume 100,000 pounds are transferred from the Manufacturing Division to the Distribution Division for a transfer price of $8.00 per pound.The Distribution Division sells the 100,000 pounds at a price of $11.00 each to customers.What is the operating income of both divisions together?

A) $200,000

B) $300,000

C) $400,000

D) $500,000

Timekeeper Corporation has two divisions, Distribution and Manufacturing. The company's primary product is high-end watches. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 units a week and usually purchases 2,000,000 units from the Manufacturing Division and 2,000,000 units from other suppliers at $9.00 per unit.

-Assume 100,000 pounds are transferred from the Manufacturing Division to the Distribution Division for a transfer price of $8.00 per pound.The Distribution Division sells the 100,000 pounds at a price of $11.00 each to customers.What is the operating income of both divisions together?

A) $200,000

B) $300,000

C) $400,000

D) $500,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

71

Answer the following questions using the information below:

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoe and sells it to retailers. The Stitching Division "sells"shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $42. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Polishing Division are assumed to be $14 per pair at 100,000 units.

Stitching's costs per pair of soles are:

Polishing's costs per completed pair of shoes are:

-What is the market-based transfer price per pair of shoes from the Stitching Division to the Polishing Division?

A) $20

B) $32

C) $42

D) $52

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoe and sells it to retailers. The Stitching Division "sells"shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $42. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Polishing Division are assumed to be $14 per pair at 100,000 units.

Stitching's costs per pair of soles are:

Polishing's costs per completed pair of shoes are:

-What is the market-based transfer price per pair of shoes from the Stitching Division to the Polishing Division?

A) $20

B) $32

C) $42

D) $52

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

72

Answer the following questions using the information below:

Plish Company manufactures only one type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $40.00. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Fabrication Division are assumed to be $7.50 per unit at 10,000 units.

Compressor's costs per compressor are:

Fabrication's costs per completed air conditioner are:

-What is the market-based transfer price per compressor from the Compressor Division to the Fabrication Division?

A) $17.00

B) $27.25

C) $34.75

D) $40.00

Plish Company manufactures only one type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $40.00. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Fabrication Division are assumed to be $7.50 per unit at 10,000 units.

Compressor's costs per compressor are:

Fabrication's costs per completed air conditioner are:

-What is the market-based transfer price per compressor from the Compressor Division to the Fabrication Division?

A) $17.00

B) $27.25

C) $34.75

D) $40.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

73

Answer the following questions using the information below:

Plish Company manufactures only one type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $40.00. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Fabrication Division are assumed to be $7.50 per unit at 10,000 units.

Compressor's costs per compressor are:

Fabrication's costs per completed air conditioner are:

-What is the transfer price per compressor from the Compressor Division to the Fabrication Division if the transfer price per compressor is 110% of full costs?

A) $16.50

B) $24.50

C) $28.18

D) $36.03

Plish Company manufactures only one type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $40.00. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Fabrication Division are assumed to be $7.50 per unit at 10,000 units.

Compressor's costs per compressor are:

Fabrication's costs per completed air conditioner are:

-What is the transfer price per compressor from the Compressor Division to the Fabrication Division if the transfer price per compressor is 110% of full costs?

A) $16.50

B) $24.50

C) $28.18

D) $36.03

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

74

Hybrid transfer prices can be arrived at through negotiations.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

75

If the Fabrication Division sells 1,000 air conditioners at a price of $375.00 per washing machine to customers,what is the operating income of both divisions together?

A) $105,500

B) $102,250

C) $97,000

D) $82,875

A) $105,500

B) $102,250

C) $97,000

D) $82,875

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

76

Answer the following questions using the information below:

Plish Company manufactures only one type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $40.00. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Fabrication Division are assumed to be $7.50 per unit at 10,000 units.

Compressor's costs per compressor are:

Fabrication's costs per completed air conditioner are:

-What is the transfer price per compressor from the Compressor Division to the Fabrication Division if the method used to place a value on each compressor is 150% of variable costs?

A) $22.50

B) $37.88

C) $45.00

D) $50.50

Plish Company manufactures only one type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $40.00. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Fabrication Division are assumed to be $7.50 per unit at 10,000 units.

Compressor's costs per compressor are:

Fabrication's costs per completed air conditioner are:

-What is the transfer price per compressor from the Compressor Division to the Fabrication Division if the method used to place a value on each compressor is 150% of variable costs?

A) $22.50

B) $37.88

C) $45.00

D) $50.50

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

77

The cost used in cost-based transfer prices can be actual cost or budgeted cost.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

78

Assume the transfer price for a compressor is 150% of total costs of the Compressor Division and 1,000 of the compressors are produced and transferred to the Fabrication Division.The Compressor Division's operating income is ________.

A) $15,875

B) $16,375

C) $17,375

D) $18,250

A) $15,875

B) $16,375

C) $17,375

D) $18,250

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

79

Hybrid transfer prices take into account both cost and market information.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

80

Calculate and compare the difference in overall corporate net income of Branded Shoe Company between Scenario A and Scenario B if the Assembly Division sells 100,000 pairs of shoes for $120 per pair to customers.

Scenario A: Negotiated transfer price of $30 per pair of soles

Scenario B: Market-based transfer price

A) $1,000,000 more net income under Scenario A

B) $1,000,000 of net income using Scenario B

C) $200,000 of net income using Scenario A.

D) The net income would be the same under both scenarios.

Scenario A: Negotiated transfer price of $30 per pair of soles

Scenario B: Market-based transfer price

A) $1,000,000 more net income under Scenario A

B) $1,000,000 of net income using Scenario B

C) $200,000 of net income using Scenario A.

D) The net income would be the same under both scenarios.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck