Deck 17: Process Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

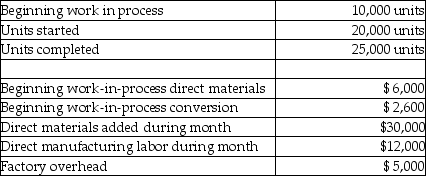

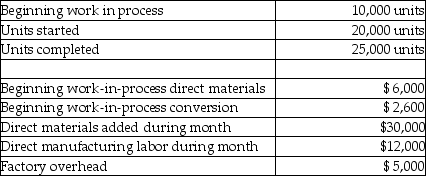

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/149

Play

Full screen (f)

Deck 17: Process Costing

1

Process costing should be used to assign costs to products when ________.

A) the units produced are similar

B) cost reduction is the top most priority

C) the units produced are dissimilar

D) cost reduction is not the primary objective

A) the units produced are similar

B) cost reduction is the top most priority

C) the units produced are dissimilar

D) cost reduction is not the primary objective

A

2

The principal difference between process costing and job costing is that in job costing an averaging process is used to compute the unit costs of products or services.

False

3

Costing systems that are used for the costing of like or similar units of products in mass production are called ________.

A) inventory-costing systems

B) job-costing systems

C) process-costing systems

D) weighted-average costing systems

A) inventory-costing systems

B) job-costing systems

C) process-costing systems

D) weighted-average costing systems

C

4

If two different direct materials-such as the circuit board and microphone-are added to the process at different times,a company will need two different direct-materials categories to assign direct materials cost.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

5

The president of the Gulf Coast Refining Corporation wants to know why his golfing partner,who is the chief financial officer of a large construction company,calculates his costs by the job,but his own corporation calculates costs by large units rather than by individual barrel of oil.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following companies is most likely to use process costing?

A) Crimpson Color, a company selling customized garments for niche customers

B) Effel & Associates, a consulting firm providing various audit and related services

C) Red Paste Inc., a company manufacturing and selling toothpaste on a large scale

D) Grimpy Corp., a company manufacturing furniture for customers as per their requirements

A) Crimpson Color, a company selling customized garments for niche customers

B) Effel & Associates, a consulting firm providing various audit and related services

C) Red Paste Inc., a company manufacturing and selling toothpaste on a large scale

D) Grimpy Corp., a company manufacturing furniture for customers as per their requirements

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

7

Job-costing and process-costing are mutually exclusive,hence a hybrid costing system that combines elements of both job and process costing cannot be used.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

8

Estimating the degree of completion for the calculation of equivalent units is usually easier for conversion costs than it is for direct materials.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

9

Job-costing systems separate costs into cost categories according to when costs are introduced into the process of manufacture.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is true?

A) In a job-costing system, average production cost is calculated for all units produced.

B) In a process-costing system, each unit uses approximately the same amount of resources.

C) In a job-costing system, overheads are allocated to all units equally.

D) In a process-costing system, individual jobs use different quantities of production resources.

A) In a job-costing system, average production cost is calculated for all units produced.

B) In a process-costing system, each unit uses approximately the same amount of resources.

C) In a job-costing system, overheads are allocated to all units equally.

D) In a process-costing system, individual jobs use different quantities of production resources.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements best describes conversion costs?

A) Conversion costs are all manufacturing and nonmanufacturing cost.

B) Conversion costs are all manufacturing costs other than direct materials costs.

C) Conversion costs are all nonmanufacturing costs including marketing costs.

D) Conversion costs are all nonmanufacturing costs other than fixed selling and distribution costs.

A) Conversion costs are all manufacturing and nonmanufacturing cost.

B) Conversion costs are all manufacturing costs other than direct materials costs.

C) Conversion costs are all nonmanufacturing costs including marketing costs.

D) Conversion costs are all nonmanufacturing costs other than fixed selling and distribution costs.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements is true of conversion costs?

A) In process costing, they include all the factors of production.

B) They include all manufacturing costs including direct materials, direct labor, and other direct and indirect manufacturing costs.

C) In process costing, they are usually considered to be added evenly throughout the production process.

D) They include only direct materials and excludes all other manufacturing and non-manufacturing costs.

A) In process costing, they include all the factors of production.

B) They include all manufacturing costs including direct materials, direct labor, and other direct and indirect manufacturing costs.

C) In process costing, they are usually considered to be added evenly throughout the production process.

D) They include only direct materials and excludes all other manufacturing and non-manufacturing costs.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

13

Describe the differences between process costing and job costing.Discuss some typical products which would be more likely to use process costing as compared to some which would be more likely to use job costing.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

14

If manufacturing labor costs are added to the process at a different time compared to other conversion costs,an additional cost category-direct manufacturing labor costs-would be needed to assign these costs to products.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

15

In a process-costing system average unit costs are calculated ________.

A) by dividing total costs in a given accounting period by total units produced in that period

B) by multiplying total costs in a given accounting period by total units produced in that period

C) by dividing total costs in a given accounting period by units started in that period

D) by multiplying total costs in a given accounting period by units started in that period

A) by dividing total costs in a given accounting period by total units produced in that period

B) by multiplying total costs in a given accounting period by total units produced in that period

C) by dividing total costs in a given accounting period by units started in that period

D) by multiplying total costs in a given accounting period by units started in that period

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

16

An example of a business which would have no beginning or ending inventory but which could use process costing to compute unit costs would be a ________.

A) clothing manufacturer

B) corporation whose sole business activity is processing the customer deposits of several banks

C) manufacturer of custom houses

D) manufacturer of large TVs

A) clothing manufacturer

B) corporation whose sole business activity is processing the customer deposits of several banks

C) manufacturer of custom houses

D) manufacturer of large TVs

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

17

There are basically two distinct methods of calculating product costs.

Required:

Compare and contrast the two methods.

Required:

Compare and contrast the two methods.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

18

Why do we need to accumulate and calculate unit costs in process costing (and also job costing)?

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

19

Conversion costs include direct materials and direct labor but excludes all other manufacturing and non-manufacturing costs.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

20

Vital Industries manufactured 1,200 units of its product Huge in the month of April.It incurred a total cost of $120,000 during the month.Out of this $120,000,$45,000 comprised of direct materials used in the product and the rest was incurred because of the conversion cost involved in the process.Ryan had no opening or closing inventory.What will be the total cost per unit of the product,assuming conversion costs contained $10,000 of indirect labor?

A) $100

B) $90

C) $70

D) $30

A) $100

B) $90

C) $70

D) $30

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

21

How many units were completed and transferred out of the Finishing Department during March?

A) 1,000 units

B) 1,200 units

C) 1,700 units

D) 2,000 units

A) 1,000 units

B) 1,200 units

C) 1,700 units

D) 2,000 units

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

22

Answer the following questions using the information below:

Stefan Ceramics is in the business of selling ceramic vases. It has two departments - molding and finishing. Molding department purchases tungsten carbide and produces ceramic vases out of it. Ceramic Vases are then transferred to finishing department, which designs it as per the requirement of the customers.

During the month of July, molding department purchased 500 kgs of tungsten carbide at $60 per kg. It started manufacture of 4,000 vases and completed and transferred 3,200 vases during the month. It has 800 vases in the process at the end of the month. It incurred direct labor charges of $1,000 and other manufacturing costs of $500, which included electricity costs of $200. Stefan had no inventory of tungsten carbide at the end of the month. It also had no beginning inventory of vases. The ending inventory was 50% complete in respect of conversion costs.

-The journal entry to record tungsten carbide purchased and used in production during July is ________.

A)

B)

C)

D)

Stefan Ceramics is in the business of selling ceramic vases. It has two departments - molding and finishing. Molding department purchases tungsten carbide and produces ceramic vases out of it. Ceramic Vases are then transferred to finishing department, which designs it as per the requirement of the customers.

During the month of July, molding department purchased 500 kgs of tungsten carbide at $60 per kg. It started manufacture of 4,000 vases and completed and transferred 3,200 vases during the month. It has 800 vases in the process at the end of the month. It incurred direct labor charges of $1,000 and other manufacturing costs of $500, which included electricity costs of $200. Stefan had no inventory of tungsten carbide at the end of the month. It also had no beginning inventory of vases. The ending inventory was 50% complete in respect of conversion costs.

-The journal entry to record tungsten carbide purchased and used in production during July is ________.

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

23

Answer the following questions using the information below:

Charlie Chairs Inc., manufactures plastic moldings for car seats. Its costing system utilizes two cost categories, direct materials and conversion costs. Each product must pass through Department A and Department B. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production.

-How many units were completed and transferred out of Department A during February?

A) 300 units

B) 800 units

C) 900 units

D) 1,000 units

Charlie Chairs Inc., manufactures plastic moldings for car seats. Its costing system utilizes two cost categories, direct materials and conversion costs. Each product must pass through Department A and Department B. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production.

-How many units were completed and transferred out of Department A during February?

A) 300 units

B) 800 units

C) 900 units

D) 1,000 units

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is true of conversion costs?

A) Estimating the degree of completion is usually easier for direct material costs than for conversion costs.

B) The calculation of equivalent units is relatively easy for the textile industry.

C) The conversion cost needed for a completed un0it and the conversion cost in a partially completed unit can be measured accurately.

D) If conversion costs are added evenly during the assembly we can conclude that there are more than one indirect-cost category.

A) Estimating the degree of completion is usually easier for direct material costs than for conversion costs.

B) The calculation of equivalent units is relatively easy for the textile industry.

C) The conversion cost needed for a completed un0it and the conversion cost in a partially completed unit can be measured accurately.

D) If conversion costs are added evenly during the assembly we can conclude that there are more than one indirect-cost category.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

25

Answer the following questions using the information below:

Stefan Ceramics is in the business of selling ceramic vases. It has two departments - molding and finishing. Molding department purchases tungsten carbide and produces ceramic vases out of it. Ceramic Vases are then transferred to finishing department, which designs it as per the requirement of the customers.

During the month of July, molding department purchased 500 kgs of tungsten carbide at $60 per kg. It started manufacture of 4,000 vases and completed and transferred 3,200 vases during the month. It has 800 vases in the process at the end of the month. It incurred direct labor charges of $1,000 and other manufacturing costs of $500, which included electricity costs of $200. Stefan had no inventory of tungsten carbide at the end of the month. It also had no beginning inventory of vases. The ending inventory was 50% complete in respect of conversion costs.

-What is the cost of tungsten carbide that will be assigned to vases finished and transferred to the finishing department for the month of July?

A) $30,000

B) $28,000

C) $26,000

D) $24,000

Stefan Ceramics is in the business of selling ceramic vases. It has two departments - molding and finishing. Molding department purchases tungsten carbide and produces ceramic vases out of it. Ceramic Vases are then transferred to finishing department, which designs it as per the requirement of the customers.

During the month of July, molding department purchased 500 kgs of tungsten carbide at $60 per kg. It started manufacture of 4,000 vases and completed and transferred 3,200 vases during the month. It has 800 vases in the process at the end of the month. It incurred direct labor charges of $1,000 and other manufacturing costs of $500, which included electricity costs of $200. Stefan had no inventory of tungsten carbide at the end of the month. It also had no beginning inventory of vases. The ending inventory was 50% complete in respect of conversion costs.

-What is the cost of tungsten carbide that will be assigned to vases finished and transferred to the finishing department for the month of July?

A) $30,000

B) $28,000

C) $26,000

D) $24,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following entries is used to record direct materials purchased and used in production during a month in the Assembly department,before transferring the goods to Testing department?

A) Work in Process-Assembly

Wages Payable Control

B) Accounts Payable Control

Work in Process-Assembly

C) Work in Process-Assembly

Accounts Payable Control

D) Accounts Payable Control

Cash

A) Work in Process-Assembly

Wages Payable Control

B) Accounts Payable Control

Work in Process-Assembly

C) Work in Process-Assembly

Accounts Payable Control

D) Accounts Payable Control

Cash

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

27

Underestimating the degree of completion of ending work in process leads to increase in operating income.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

28

Answer the following questions using the information below:

Stefan Ceramics is in the business of selling ceramic vases. It has two departments - molding and finishing. Molding department purchases tungsten carbide and produces ceramic vases out of it. Ceramic Vases are then transferred to finishing department, which designs it as per the requirement of the customers.

During the month of July, molding department purchased 500 kgs of tungsten carbide at $60 per kg. It started manufacture of 4,000 vases and completed and transferred 3,200 vases during the month. It has 800 vases in the process at the end of the month. It incurred direct labor charges of $1,000 and other manufacturing costs of $500, which included electricity costs of $200. Stefan had no inventory of tungsten carbide at the end of the month. It also had no beginning inventory of vases. The ending inventory was 50% complete in respect of conversion costs.

-The journal entry to record direct labor for July is ________.

A)

B)

C)

D)

Stefan Ceramics is in the business of selling ceramic vases. It has two departments - molding and finishing. Molding department purchases tungsten carbide and produces ceramic vases out of it. Ceramic Vases are then transferred to finishing department, which designs it as per the requirement of the customers.

During the month of July, molding department purchased 500 kgs of tungsten carbide at $60 per kg. It started manufacture of 4,000 vases and completed and transferred 3,200 vases during the month. It has 800 vases in the process at the end of the month. It incurred direct labor charges of $1,000 and other manufacturing costs of $500, which included electricity costs of $200. Stefan had no inventory of tungsten carbide at the end of the month. It also had no beginning inventory of vases. The ending inventory was 50% complete in respect of conversion costs.

-The journal entry to record direct labor for July is ________.

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

29

Answer the following questions using the information below:

Charlie Chairs Inc., manufactures plastic moldings for car seats. Its costing system utilizes two cost categories, direct materials and conversion costs. Each product must pass through Department A and Department B. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production.

-What is the unit cost per equivalent unit of beginning inventory in Department A?

A) $750

B) $1,750

C) $2,800

D) $3,250

Charlie Chairs Inc., manufactures plastic moldings for car seats. Its costing system utilizes two cost categories, direct materials and conversion costs. Each product must pass through Department A and Department B. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production.

-What is the unit cost per equivalent unit of beginning inventory in Department A?

A) $750

B) $1,750

C) $2,800

D) $3,250

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

30

In a process-costing system,the calculation of equivalent units is used for calculating ________.

A) the dollar amount of sales affected during the period

B) the dollar amount of the cost of goods sold for the accounting period

C) the dollar price earned for a particular job

D) the dollar amount of revenue for the period including the revenue estimated to be received from the sale of equivalent units

A) the dollar amount of sales affected during the period

B) the dollar amount of the cost of goods sold for the accounting period

C) the dollar price earned for a particular job

D) the dollar amount of revenue for the period including the revenue estimated to be received from the sale of equivalent units

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

31

The equivalent unit concept is a means by which a process costing system can compare partially completed work done in each of the various process categories to obtain a total measure of work done.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

32

What is the unit cost per equivalent unit of the beginning inventory in the Finishing Department?

A) $200

B) $400

C) $800

D) $1,000

A) $200

B) $400

C) $800

D) $1,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

33

Serile Pharma places 900 units in production during the month of January.All 900 units are completed during the month.It had no opening inventory.Direct material costs added during January was $81,000 and conversion costs added during January was $9,000.What is the total cost per unit of the product produced during January?

A) $100

B) $90

C) $80

D) $10

A) $100

B) $90

C) $80

D) $10

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

34

When a company has no opening or ending inventory during the month,the cost per unit is calculated by dividing the total costs incurred in the period by the total units produced during the period.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

35

The accuracy of the completion estimate of conversion costs depends on the care,skill,and experience of the estimator and also the nature of the conversion process.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

36

The purpose of the equivalent-unit computation is to ________.

A) convert completed units into the amount of partially completed output units that could be made with that quantity of input

B) assist the business in determining the cost assigned to ending inventory and work-in-process inventory

C) predict the future production capabilities of the organization

D) satisfy the GAAP requirements which requires all partially completed goods to be reported as equivalent-units

A) convert completed units into the amount of partially completed output units that could be made with that quantity of input

B) assist the business in determining the cost assigned to ending inventory and work-in-process inventory

C) predict the future production capabilities of the organization

D) satisfy the GAAP requirements which requires all partially completed goods to be reported as equivalent-units

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

37

The last step in a process-costing system is to compute cost per equivalent unit.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

38

When a Bakery transfers goods from the Mixing Department to the Baking Department,the accounting entry is ________.

A) Work in Process - Mixing Department Work in Process - Baking Department

B) Work in Process - Baking Department Accounts Payable

C) Work in Process - Baking Department Work in Process - Mixing Department

D) Work in Process - Mixing Department Accounts Payable

A) Work in Process - Mixing Department Work in Process - Baking Department

B) Work in Process - Baking Department Accounts Payable

C) Work in Process - Baking Department Work in Process - Mixing Department

D) Work in Process - Mixing Department Accounts Payable

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

39

Answer the following questions using the information below:

Stefan Ceramics is in the business of selling ceramic vases. It has two departments - molding and finishing. Molding department purchases tungsten carbide and produces ceramic vases out of it. Ceramic Vases are then transferred to finishing department, which designs it as per the requirement of the customers.

During the month of July, molding department purchased 500 kgs of tungsten carbide at $60 per kg. It started manufacture of 4,000 vases and completed and transferred 3,200 vases during the month. It has 800 vases in the process at the end of the month. It incurred direct labor charges of $1,000 and other manufacturing costs of $500, which included electricity costs of $200. Stefan had no inventory of tungsten carbide at the end of the month. It also had no beginning inventory of vases. The ending inventory was 50% complete in respect of conversion costs.

-What is the total conversion costs for the month of July?

A) $1,700

B) $1,500

C) $1,300

D) $1,000

Stefan Ceramics is in the business of selling ceramic vases. It has two departments - molding and finishing. Molding department purchases tungsten carbide and produces ceramic vases out of it. Ceramic Vases are then transferred to finishing department, which designs it as per the requirement of the customers.

During the month of July, molding department purchased 500 kgs of tungsten carbide at $60 per kg. It started manufacture of 4,000 vases and completed and transferred 3,200 vases during the month. It has 800 vases in the process at the end of the month. It incurred direct labor charges of $1,000 and other manufacturing costs of $500, which included electricity costs of $200. Stefan had no inventory of tungsten carbide at the end of the month. It also had no beginning inventory of vases. The ending inventory was 50% complete in respect of conversion costs.

-What is the total conversion costs for the month of July?

A) $1,700

B) $1,500

C) $1,300

D) $1,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

40

In a process-costing system,there is always a separate Work-in-Process account for each different process.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

41

The accounting entry to record the conversion cost of the Assembly Department is:

Work in Process-Assembly Department

Accounts Payable Control

Work in Process-Assembly Department

Accounts Payable Control

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

42

Answer the following questions using the information below:

Assembly department of Zahra Technologies had 100 units as work in process at the beginning of the month. These units were 50% complete. It has 200 units which are 25% complete at the end of the month. During the month, it completed and transferred 500 units. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production. Zahra uses weighted-average process-costing method.

Calculate the total equivalent units in ending inventory for assignment of conversion costs?

A) 25 units

B) 50 units

C) 150 units

D) 200 units

Assembly department of Zahra Technologies had 100 units as work in process at the beginning of the month. These units were 50% complete. It has 200 units which are 25% complete at the end of the month. During the month, it completed and transferred 500 units. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production. Zahra uses weighted-average process-costing method.

Calculate the total equivalent units in ending inventory for assignment of conversion costs?

A) 25 units

B) 50 units

C) 150 units

D) 200 units

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

43

Bright Colors Company placed 315,000 gallons of direct materials into the mixing process.All direct materials are placed in mixing at the beginning of the process and conversion costs occur evenly during the process.Bright Colors uses weighted-average costing.The initial forecast for the end of the month was to have 75,000 gallons still in process,15% converted as to labor and factory overhead.

Required:

a.Determine the total equivalent units (in process and transferred out)for direct materials and for conversion costs,assuming there was no beginning inventory.

b.With the installation of a new paint processing filtration device,the forecast for the end of the month was to have 50,000 gallons still in process,70% converted as to labor and factory overhead.In this event,determine the equivalent units (in process and transferred out)for direct materials and for conversion costs,assuming there was no beginning inventory.

Required:

a.Determine the total equivalent units (in process and transferred out)for direct materials and for conversion costs,assuming there was no beginning inventory.

b.With the installation of a new paint processing filtration device,the forecast for the end of the month was to have 50,000 gallons still in process,70% converted as to labor and factory overhead.In this event,determine the equivalent units (in process and transferred out)for direct materials and for conversion costs,assuming there was no beginning inventory.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

44

Answer the following questions using the information below:

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

-What is the direct materials cost per equivalent unit during June?

A) $569

B) $560

C) $552

D) $480

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

-What is the direct materials cost per equivalent unit during June?

A) $569

B) $560

C) $552

D) $480

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

45

The weighted-average process-costing method calculates the equivalent units by ________.

A) considering only the work done during the current period

B) the units started during the current period minus the units in ending inventory

C) the units started during the current period plus the units in ending inventory

D) the equivalent units completed during the current period plus the equivalent units in ending inventory

A) considering only the work done during the current period

B) the units started during the current period minus the units in ending inventory

C) the units started during the current period plus the units in ending inventory

D) the equivalent units completed during the current period plus the equivalent units in ending inventory

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

46

When calculating the equivalent units,we should only focus on dollar amounts of inventory.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

47

Sodius Chemical Inc.placed 220,000 liters of direct materials into the mixing process.At the end of the month,5,000 liters were still in process,30% converted as to labor and factory overhead.All direct materials are placed in mixing at the beginning of the process and conversion costs occur evenly during the process.Sodius uses weighted-average costing.

Required:

a.Determine the equivalent units in process for direct materials and conversion costs,assuming there was no beginning inventory.

b.Determine the equivalent units in process for direct materials and conversion costs,assuming that 12,000 liters of chemicals were 40% complete prior to the addition of the 220,000 liters.

Required:

a.Determine the equivalent units in process for direct materials and conversion costs,assuming there was no beginning inventory.

b.Determine the equivalent units in process for direct materials and conversion costs,assuming that 12,000 liters of chemicals were 40% complete prior to the addition of the 220,000 liters.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

48

Marv and Vicki own and operate a vegetable canning plant.In recent years,their business has grown tremendously and,at any point in time,they may have 30 to 35 different vegetables being processed.Also,during the peak summer months there are several thousand bushels of vegetables in some stage of processing at any one time.With the company's growth during the past few years,the owners decided to employ an accountant to provide cost estimations on each vegetable category and prepare monthly financial statements.Although the accountant is doing exactly as instructed,Marv and Vicki are confused about the monthly operating costs.Although they process an average of 50,000 canned units a month,the monthly production report fluctuates wildly.

Required:

Explain how the production report can fluctuate wildly if they process a constant amount of vegetables each month.

Required:

Explain how the production report can fluctuate wildly if they process a constant amount of vegetables each month.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

49

A production cost worksheet is used to summarize total costs to account for,compute cost per equivalent unit,and assign total costs to units completed and to units in ending work-in-process.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

50

Jordana Woolens is a manufacturer of wool cloth.The information for March is as follows:

Beginning work in process was half converted as to labor and overhead.Direct materials are added at the beginning of the process.All conversion costs are incurred evenly throughout the process.Ending work in process was 60% complete.

Beginning work in process was half converted as to labor and overhead.Direct materials are added at the beginning of the process.All conversion costs are incurred evenly throughout the process.Ending work in process was 60% complete.

Required:

Prepare a production cost worksheet using the weighted-average method.Include any necessary supporting schedules.

Beginning work in process was half converted as to labor and overhead.Direct materials are added at the beginning of the process.All conversion costs are incurred evenly throughout the process.Ending work in process was 60% complete.

Beginning work in process was half converted as to labor and overhead.Direct materials are added at the beginning of the process.All conversion costs are incurred evenly throughout the process.Ending work in process was 60% complete.Required:

Prepare a production cost worksheet using the weighted-average method.Include any necessary supporting schedules.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

51

Big Bernard Corporation was recently formed to produce a semiconductor chip that forms an essential part of the personal computer manufactured by a major corporation.The direct materials are added at the start of the production process while conversion costs are added uniformly throughout the production process.June is Big Bernard's first month of operations,and therefore,there was no beginning inventory.Direct materials cost for the month totaled $935,000,while conversion costs equaled $4,552,000.Accounting records indicate that 475,000 chips were started in June and 425,000 chips were completed.

Ending inventory was 50% complete as to conversion costs.

Required:

a.What is the total manufacturing cost per chip for June?

b.Allocate the total costs between the completed chips and the chips in ending inventory.

Ending inventory was 50% complete as to conversion costs.

Required:

a.What is the total manufacturing cost per chip for June?

b.Allocate the total costs between the completed chips and the chips in ending inventory.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

52

If there was no beginning work in process and no ending work in process under the weighted-average process costing method,the number of equivalent units for direct materials,if direct materials were added at the start of the process,would be ________.

A) more than the units started or transferred in during the period

B) equal to the units completed during the period

C) less than the units completed during the period

D) equal to total of units started and units completed during the period

A) more than the units started or transferred in during the period

B) equal to the units completed during the period

C) less than the units completed during the period

D) equal to total of units started and units completed during the period

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

53

List and describe the five steps in process costing.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

54

Answer the following questions using the information below:

Assembly department of Zahra Technologies had 100 units as work in process at the beginning of the month. These units were 50% complete. It has 200 units which are 25% complete at the end of the month. During the month, it completed and transferred 500 units. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production. Zahra uses weighted-average process-costing method.

The number of equivalent units of work done during the month for direct materials is ________.

A) 600 units

B) 800 units

C) 700 units

D) 500 units

Assembly department of Zahra Technologies had 100 units as work in process at the beginning of the month. These units were 50% complete. It has 200 units which are 25% complete at the end of the month. During the month, it completed and transferred 500 units. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production. Zahra uses weighted-average process-costing method.

The number of equivalent units of work done during the month for direct materials is ________.

A) 600 units

B) 800 units

C) 700 units

D) 500 units

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

55

Answer the following questions using the information below:

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

-What are the equivalent units for direct materials and conversion costs,respectively,for June?

A) 1,250 units; 1,210.64 units

B) 1,250 units; 1,212.5 units

C) 1,100 units; 1,100 units

D) 1012 units; 1040 units

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

-What are the equivalent units for direct materials and conversion costs,respectively,for June?

A) 1,250 units; 1,210.64 units

B) 1,250 units; 1,212.5 units

C) 1,100 units; 1,100 units

D) 1012 units; 1040 units

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

56

Answer the following questions using the information below:

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

-What is the total amount debited to the Work-in-Process account during the month of June?

A) $225,000

B) $1,000,000

C) $1,135,000

D) $1,225,000

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

-What is the total amount debited to the Work-in-Process account during the month of June?

A) $225,000

B) $1,000,000

C) $1,135,000

D) $1,225,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

57

Under the weighted-average method,the stage of completion of beginning work in process ________.

A) is relevant in determining the equivalent units

B) must be combined with the work done during the current period to determine the equivalent units

C) is irrelevant in determining the equivalent-unit calculation

D) can almost always be determined with a high degree of precision

A) is relevant in determining the equivalent units

B) must be combined with the work done during the current period to determine the equivalent units

C) is irrelevant in determining the equivalent-unit calculation

D) can almost always be determined with a high degree of precision

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

58

Answer the following questions using the information below:

Assembly department of Zahra Technologies had 100 units as work in process at the beginning of the month. These units were 50% complete. It has 200 units which are 25% complete at the end of the month. During the month, it completed and transferred 500 units. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production. Zahra uses weighted-average process-costing method.

What is the total equivalent units in ending inventory for assignment of direct materials cost?

A) 25 units

B) 50 units

C) 150 units

D) 200 units

Assembly department of Zahra Technologies had 100 units as work in process at the beginning of the month. These units were 50% complete. It has 200 units which are 25% complete at the end of the month. During the month, it completed and transferred 500 units. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production. Zahra uses weighted-average process-costing method.

What is the total equivalent units in ending inventory for assignment of direct materials cost?

A) 25 units

B) 50 units

C) 150 units

D) 200 units

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

59

In the computation of the cost per equivalent unit,the weighted-average method of process costing considers all the costs ________.

A) entering work in process from the units in beginning inventory plus the costs for the work completed during the current accounting period

B) costs that have entered work in process from the units started or transferred in during the current accounting period

C) that have entered work in process during the current accounting period from the units started or transferred in minus the costs associated with ending inventory

D) that have entered work in process during the current accounting period from the units started or transferred in plus the costs associated with ending inventory

A) entering work in process from the units in beginning inventory plus the costs for the work completed during the current accounting period

B) costs that have entered work in process from the units started or transferred in during the current accounting period

C) that have entered work in process during the current accounting period from the units started or transferred in minus the costs associated with ending inventory

D) that have entered work in process during the current accounting period from the units started or transferred in plus the costs associated with ending inventory

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

60

The Esther Valve Corporation was recently formed to produce a brass valve that forms an essential part of a compressor manufactured by a major corporation.The direct materials are added at the start of the production process while conversion costs are added uniformly throughout the production process.September is Parson's first month of operations,and therefore,there was no beginning inventory.Direct materials cost for the month totaled $2,800,000,while conversion costs equaled $3,600,000.Accounting records indicate that 1,600,000 valves were started in September and 1,400,000 valves were completed.

Ending inventory was 20% complete as to conversion costs.

Required:

a.What is the total manufacturing cost per valve for September?

b.Allocate the total costs between the completed valves and the valves in ending inventory.

Ending inventory was 20% complete as to conversion costs.

Required:

a.What is the total manufacturing cost per valve for September?

b.Allocate the total costs between the completed valves and the valves in ending inventory.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

61

Answer the following questions using the information below:

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2015 for the Assembly department.

-What amount of direct materials costs is assigned to the ending Work-in-Process account for March?

A) $31,363

B) $63,636

C) $75,075

D) $95,000

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2015 for the Assembly department.

-What amount of direct materials costs is assigned to the ending Work-in-Process account for March?

A) $31,363

B) $63,636

C) $75,075

D) $95,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

62

Answer the following questions using the information below:

The Swivel Chair Company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 145,000 chairs. During the month, the firm completed 175,000 chairs and transferred them to the Finishing Department. The firm ended the month with 18,000 chairs in ending inventory. All direct materials costs are added at the beginning of the production cycle. Weighted-average costing is used by Swivel.

How many chairs were in inventory at the beginning of the month? Conversion costs are incurred uniformly over the production cycle.

A) 8,000 chairs

B) 18,000 chairs

C) 38,000 chairs

D) 48,000 chairs

The Swivel Chair Company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 145,000 chairs. During the month, the firm completed 175,000 chairs and transferred them to the Finishing Department. The firm ended the month with 18,000 chairs in ending inventory. All direct materials costs are added at the beginning of the production cycle. Weighted-average costing is used by Swivel.

How many chairs were in inventory at the beginning of the month? Conversion costs are incurred uniformly over the production cycle.

A) 8,000 chairs

B) 18,000 chairs

C) 38,000 chairs

D) 48,000 chairs

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

63

Answer the following questions using the information below:

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2015 for the Assembly department.

-What amount of conversion costs is assigned to the ending Work-in-Process account for April?

A) $140,952

B) $95,000

C) $70,476

D) $247,500

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2015 for the Assembly department.

-What amount of conversion costs is assigned to the ending Work-in-Process account for April?

A) $140,952

B) $95,000

C) $70,476

D) $247,500

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

64

Answer the following questions using the information below:

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

-What amount of conversion costs is assigned to the ending Work-in-Process account for June?

A) $82,800.50

B) $49,639.50

C) $66,186.50

D) $38,256.50

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

-What amount of conversion costs is assigned to the ending Work-in-Process account for June?

A) $82,800.50

B) $49,639.50

C) $66,186.50

D) $38,256.50

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

65

Weighty Steel processes a single type of steel.For the current period the following information is given: All materials are added at the beginning of the production process.The beginning inventory was 40% complete as to conversion,while the ending inventory was 30% completed for conversion purposes.

Weighty uses the weighted-average costing method.

What is the total cost assigned to the units completed and transferred this period?

A) $107,010

B) $109,440

C) $113,160

D) $120,100

Weighty uses the weighted-average costing method.

What is the total cost assigned to the units completed and transferred this period?

A) $107,010

B) $109,440

C) $113,160

D) $120,100

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

66

Answer the following questions using the information below:

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2015 for the Assembly department.

-What is the direct materials cost per equivalent unit during March?

A) $995

B) $950

C) $636

D) $313

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2015 for the Assembly department.

-What is the direct materials cost per equivalent unit during March?

A) $995

B) $950

C) $636

D) $313

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

67

Answer the following questions using the information below:

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

-What amount of direct materials costs is assigned to the ending Work-in-Process account for June?

A) $82,800

B) $62,100

C) $37,240

D) $30,454

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

-What amount of direct materials costs is assigned to the ending Work-in-Process account for June?

A) $82,800

B) $62,100

C) $37,240

D) $30,454

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

68

Answer the following questions using the information below:

The Swivel Chair Company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 145,000 chairs. During the month, the firm completed 175,000 chairs and transferred them to the Finishing Department. The firm ended the month with 18,000 chairs in ending inventory. All direct materials costs are added at the beginning of the production cycle. Weighted-average costing is used by Swivel.

Of the 145,000 units Swivel started during February,how many were finished during the month?

A) 177,000

B) 197,000

C) 127,000

D) 217,000

The Swivel Chair Company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 145,000 chairs. During the month, the firm completed 175,000 chairs and transferred them to the Finishing Department. The firm ended the month with 18,000 chairs in ending inventory. All direct materials costs are added at the beginning of the production cycle. Weighted-average costing is used by Swivel.

Of the 145,000 units Swivel started during February,how many were finished during the month?

A) 177,000

B) 197,000

C) 127,000

D) 217,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

69

Answer the following questions using the information below:

Comfort chair company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 73,000 chairs. During the month, the firm completed 78,000 chairs, and transferred them to the Finishing Department. The firm ended the month with 10,000 chairs in ending inventory. There were 15,000 chairs in beginning inventory. All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process. The FIFO method of process costing is used by Comfort. Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs.

Beginning inventory:

Manufacturing costs added auring the œcounting period:

Direct materials

Conversion costs

-What is the amount of direct materials cost assigned to ending work-in-process inventory at the end of February?

A) $19,000

B) $23,000

C) $25,000

D) $27,000

Comfort chair company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 73,000 chairs. During the month, the firm completed 78,000 chairs, and transferred them to the Finishing Department. The firm ended the month with 10,000 chairs in ending inventory. There were 15,000 chairs in beginning inventory. All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process. The FIFO method of process costing is used by Comfort. Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs.

Beginning inventory:

Manufacturing costs added auring the œcounting period:

Direct materials

Conversion costs

-What is the amount of direct materials cost assigned to ending work-in-process inventory at the end of February?

A) $19,000

B) $23,000

C) $25,000

D) $27,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

70

An assumption of the FIFO process-costing method is that ________.

A) the units in beginning inventory are not necessarily assumed to be completed by the end of the period

B) the units in beginning inventory are assumed to be completed first

C) ending inventory will always be completed in the next accounting period

D) no calculation of conversion costs is possible

A) the units in beginning inventory are not necessarily assumed to be completed by the end of the period

B) the units in beginning inventory are assumed to be completed first

C) ending inventory will always be completed in the next accounting period

D) no calculation of conversion costs is possible

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

71

Answer the following questions using the information below:

Comfort chair company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 73,000 chairs. During the month, the firm completed 78,000 chairs, and transferred them to the Finishing Department. The firm ended the month with 10,000 chairs in ending inventory. There were 15,000 chairs in beginning inventory. All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process. The FIFO method of process costing is used by Comfort. Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs.

Beginning inventory:

Manufacturing costs added auring the œcounting period:

Direct materials

Conversion costs

-What were the equivalent units for conversion costs during February?

A) 81,500

B) 83,000

C) 73,000

D) 77,500

Comfort chair company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 73,000 chairs. During the month, the firm completed 78,000 chairs, and transferred them to the Finishing Department. The firm ended the month with 10,000 chairs in ending inventory. There were 15,000 chairs in beginning inventory. All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process. The FIFO method of process costing is used by Comfort. Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs.

Beginning inventory:

Manufacturing costs added auring the œcounting period:

Direct materials

Conversion costs

-What were the equivalent units for conversion costs during February?

A) 81,500

B) 83,000

C) 73,000

D) 77,500

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

72

Answer the following questions using the information below:

Comfort chair company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 73,000 chairs. During the month, the firm completed 78,000 chairs, and transferred them to the Finishing Department. The firm ended the month with 10,000 chairs in ending inventory. There were 15,000 chairs in beginning inventory. All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process. The FIFO method of process costing is used by Comfort. Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs.

Beginning inventory:

Manufacturing costs added auring the œcounting period:

Direct materials

Conversion costs

-How many of the units that were started and completed during February?

A) 83,000

B) 78,000

C) 73,000

D) 63,000

Comfort chair company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 73,000 chairs. During the month, the firm completed 78,000 chairs, and transferred them to the Finishing Department. The firm ended the month with 10,000 chairs in ending inventory. There were 15,000 chairs in beginning inventory. All direct materials costs are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process. The FIFO method of process costing is used by Comfort. Beginning work in process was 30% complete as to conversion costs, while ending work in process was 80% complete as to conversion costs.

Beginning inventory:

Manufacturing costs added auring the œcounting period:

Direct materials

Conversion costs

-How many of the units that were started and completed during February?

A) 83,000

B) 78,000

C) 73,000

D) 63,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

73

Answer the following questions using the information below:

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2015 for the Assembly department.

-What are the equivalent units for direct materials and conversion costs,respectively,for March?

A) 1,100 units; 1,100 units

B) 1,050 units; 1,100 units

C) 1,100 units; 1,050 units

D) 1000 units; 1050 units

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2015 for the Assembly department.

-What are the equivalent units for direct materials and conversion costs,respectively,for March?

A) 1,100 units; 1,100 units

B) 1,050 units; 1,100 units

C) 1,100 units; 1,050 units

D) 1000 units; 1050 units

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

74

Answer the following questions using the information below:

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2015 for the Assembly department.

-What is the conversion cost per equivalent unit in March?

A) $1,595.52

B) $1,409.52

C) $1,345.52

D) $1,066.52

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2015 for the Assembly department.

-What is the conversion cost per equivalent unit in March?

A) $1,595.52

B) $1,409.52

C) $1,345.52

D) $1,066.52

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

75

Answer the following questions using the information below:

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2015 for the Assembly department.

-What is the total amount debited to the Work-in-Process account during the month of March?

A) $2,525,000

B) $2,180,000

C) $1,820,000

D) $700,000

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

The following information is available for the month of March 2015 for the Assembly department.

-What is the total amount debited to the Work-in-Process account during the month of March?

A) $2,525,000

B) $2,180,000

C) $1,820,000

D) $700,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

76

Answer the following questions using the information below:

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

-What is the conversion cost per equivalent unit in June?

A) $552.00

B) $541.24

C) $441.24

D) $428.00

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

-What is the conversion cost per equivalent unit in June?

A) $552.00

B) $541.24

C) $441.24

D) $428.00

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

77

On occasion,the FIFO and the weighted-average methods of process costing will result in the same dollar amount of costs being transferred to the next department.Which of the following scenarios would have that result?

A) when the beginning and ending inventories are equal in terms of unit numbers

B) when the beginning and ending inventories are equal in terms of the percentage of completion for both direct materials, and conversion costs

C) when there is no ending inventory

D) when there is no beginning inventory

A) when the beginning and ending inventories are equal in terms of unit numbers

B) when the beginning and ending inventories are equal in terms of the percentage of completion for both direct materials, and conversion costs

C) when there is no ending inventory

D) when there is no beginning inventory

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

78

Answer the following questions using the information below:

The Swivel Chair Company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 145,000 chairs. During the month, the firm completed 175,000 chairs and transferred them to the Finishing Department. The firm ended the month with 18,000 chairs in ending inventory. All direct materials costs are added at the beginning of the production cycle. Weighted-average costing is used by Swivel.

What were the equivalent units for materials for February?

A) 193,000 chairs

B) 173,000 chairs

C) 163,000 chairs

D) 153,000 chairs

The Swivel Chair Company manufacturers a standard recliner. During February, the firm's Assembly Department started production of 145,000 chairs. During the month, the firm completed 175,000 chairs and transferred them to the Finishing Department. The firm ended the month with 18,000 chairs in ending inventory. All direct materials costs are added at the beginning of the production cycle. Weighted-average costing is used by Swivel.

What were the equivalent units for materials for February?

A) 193,000 chairs

B) 173,000 chairs

C) 163,000 chairs

D) 153,000 chairs

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

79

A distinct feature of the FIFO process-costing method is that the ________.

A) work done on beginning inventory before the current period is blended with the work done during the current period in the calculation of equivalent units