Deck 4: Gross Income: Concepts and Inclusions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/125

Play

Full screen (f)

Deck 4: Gross Income: Concepts and Inclusions

1

In 2004,Terry purchased land for $150,000.In 2012,Terry received $10,000 from a local cable television company in exchange for Terry allowing the company to run an underground cable across Terry's property.Terry is not required to recognize income from receiving the $10,000 because it was a return of his capital invested in the land.

True

2

Jessica is a cash basis taxpayer.When Jessica failed to repay a loan,the bank garnished her salary.Each week $60 was withheld from Jessica's salary and paid to the bank.Jessica is required to include the $60 each week in her gross income even though it is the creditor that benefits from the income.

True

3

At the beginning of 2013,Mary purchased a 3-year certificate of deposit (CD)for $8,760.The maturity value of the certificate was $10,000 and it was to yield 4.5%.She also purchased a Series EE bond for $6,400 with a maturity value in 10 years of $10,000.Mary must recognize $1,240 of income from the certificate of deposit in 2013,and $3,600 from the Series EE bonds in 2022.

False

4

Nicholas owned stock that decreased in value by $20,000 during the year,but he did not sell the stock.He earned $45,000 salary,but received only $34,000 because $11,000 in taxes were withheld.Nicholas saved $10,000 of his salary and used the remainder for personal living expenses.Nicholas's economic income for the year exceeded his gross income for tax purposes.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

5

Barney painted his house which saved him $3,000.According to the realization requirement,Barney must recognize $3,000 of income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

6

The financial accounting principle of conservatism is not well-suited to the task of measuring taxable income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

7

In 2012,Juan,a cash basis taxpayer,was offered $3 million for signing a professional baseball contract.He counteroffered that he would receive $900,000 per year for 4 years beginning in 2013.The team accepted the counteroffer.Juan constructively received $3 million in 2012.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

8

Judy is a cash basis attorney.In 2012,she performed services in connection with the formation of a corporation and received stock with a value of $4,000 for her services.By the end of the year,the value of the stock had decreased to $2,000.She continued to hold the stock.Judy must recognize $4,000 of gross income from the stock for 2012.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

9

On December 1,2012,Daniel,an accrual basis taxpayer,collects $12,000 rent for December 2012 and $12,000 for January 2013.Daniel must include the $24,000 in 2012 gross income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

10

In December 2012,Mary collected the December 2012 and January 2013 rent from a tenant.Mary is a cash basis taxpayer.The amount collected in December 2012 for the 2013 rent should be included in her 2013 gross income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

11

Mabel is age 65 and lives on her Social Security benefits and gifts from her son,Fred.Fred is a full-time teacher.He has written a book and receives royalties from it.This year Fred directed the publisher to make the royalty check payable to Mabel because she needs the money for support.Mabel must include the amount of the royalty check in her gross income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

12

On January 1,2012,an accrual basis taxpayer entered into a contract to provide termite inspection service each month for 36 months.The amount received for the contract was $2,400.The taxpayer should report $1,600 of income in 2013.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

13

A cash basis taxpayer purchased a certificate of deposit for $1,000 on July 1,2012 that will pay $1,100 upon its maturity on June 30,2014.The taxpayer must recognize a portion of the income in 2012.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

14

An accrual basis taxpayer who owns and operates a professional basketball team is allowed to allocate income from season ticket sales on the basis of the number of games played during the year.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

15

A sole proprietorship purchased an asset for $1,000 in 2012 and its value was $1,500 at the end of 2012.In 2013,the sole proprietorship sold the asset for $1,400.The sole proprietorship realized a taxable gain of $400 in 2013 but an economic loss of $100 in 2013.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

16

An advance payment received in June 2012 by an accrual basis and calendar year taxpayer for services to be provided over a 36-month period can be spread over four tax years.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

17

The fact that the accounting method the taxpayer uses to measure income is consistent with GAAP does not assure that the method will be acceptable for tax purposes.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

18

Ralph purchased his first Series EE bond during the year.He paid $709 for a 10-year bond with a $1,000 maturity value.The yield to maturity on the bonds was 3.5%.Ralph is not required to recognize the $291 ($1,000 - $709)original issue discount until the bond matures.However,Ralph can elect to amortize the discount over the ten-year period.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

19

The constructive receipt doctrine requires that income must be recognized when it is made available to the cash basis taxpayer,although it has not been actually received.The constructive receipt doctrine does not apply to accrual basis taxpayers.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

20

The realization requirement gives an incentive to own assets that have increased in value and to sell assets whose value has decreased.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

21

Samantha and her son,Brent,are cash basis taxpayers.Samantha gave Brent a corporate bond with a face amount and fair market value of $10,000.On the date of the gift,March 31,2012,the accrued interest on the bond was $100.On December 31,2012,Brent collected $400 interest on the bond.Brent must include in gross income the $300 interest earned after the date of the gift.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

22

After the divorce,Jeff was required to pay $18,000 per year to his former spouse,Darlene,who had custody of their child.Jeff's payments will be reduced to $12,000 per year in the event the child dies or reaches age 21.During the year,Jeff paid the $18,000 required under the divorce agreement.Darlene must include the $12,000 in gross income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

23

If the alimony recapture rules apply,the recipient of the alimony decreases his or her AGI by a portion of the amount included in gross income as alimony in a prior year or years.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

24

Jacob and Emily were co-owners of a personal residence.As part of their divorce agreement,Emily received sole ownership of their personal residence.This property transfer is classified as a property settlement rather than as alimony as the transfer was a result of a divorce.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

25

Mark is a cash basis taxpayer.He is a partner in the M&M partnership,and his share of the partnership's profits for 2012 is $90,000.Only $40,000 was distributed to him in January 2012,and this was his share of the 2011 partnership profits.None of the 2012 profits were distributed although Mark's share of the 2012 profits was $90,000.Mark's gross income from the partnership for 2012 is $40,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

26

Linda delivers pizzas for a pizza shop.On Wednesday,December 31,2012,Linda made several deliveries and collected $400 from customers.However,Linda forgot to turn in the proceeds for the day to her employer until the following Friday,January 2,2013.The pizza shop owner recognizes the income of $400 when he receives it from Linda in 2013.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

27

Ted earned $150,000 during the current year.He paid Alice,his former wife,$75,000 in alimony.Under these facts,the tax is paid by the person who benefits from the income rather than the person who earned the income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

28

Rhonda has a 30% interest in the capital and profits of the ABC Partnership.Her share of the profits for 2012 was $90,000.She withdrew $40,000 from the partnership in 2012.In January 2013,after her share of the profits for 2012 had been computed,she withdrew her remaining $50,000 share of 2012 profits.As a result,Rhonda must recognize $40,000 of gross income in 2012 and $50,000 in 2013.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

29

Jake is the sole shareholder of an S corporation that earned $50,000 in 2012.The corporation was short on cash and therefore distributed only $15,000 to Jake in 2012.Jake is required to recognize $15,000 of income from the S corporation in 2012.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

30

Alimony recapture may occur if there is a substantial decrease in the amount of the alimony payments in the second year.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

31

In some community property states,the income from property that was inherited by a spouse after the marriage is treated as all earned by the spouse who inherited the property.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

32

When stock is sold after the record date for a dividend that has been declared,the seller must recognize as income the dividend received.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

33

ABC Corporation mails out its annual Christmas bonuses to employees on December 24th.Ed,a cash basis taxpayer,is an employee who is on a ski trip until January 7th of the new year,but is aware that his annual Christmas bonus arrives on the 28th of December.Ed cannot delay reporting the income from the bonus until the new year.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

34

When a business is operated as an S corporation,a disadvantage is that the shareholder must pay the tax on his or her share of the S corporation's income even though the S corporation did not distribute the income to the shareholder.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

35

April,a calendar year taxpayer,is a 40% partner in Pale Partnership,whose fiscal year ends on September 30th.For the fiscal year ending September 30,2012,the partnership had $400,000 net income and for fiscal year ending September 30,2013,the partnership had $300,000 net income.April withdrew $100,000 in December of each year.April's gross income from the partnership for 2012 is $160,000 ($400,000 ´ 40%).

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

36

The B & W partnership earned taxable income of $100,000 for the year.Bryan is entitled to 50% of the profits,but Bryan withdrew only $40,000 during the year.Bryan must include in gross income his $50,000 share of the profits from the partnership.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

37

George and Erin are divorced,and George is required to pay Erin $20,000 of alimony each year.George earns $75,000 a year.Erin is not required to include the alimony payments in gross income because George earned the income and therefore he should pay the tax on the income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

38

Tom,a cash basis taxpayer,purchased a bond on March 31 for $10,000,plus $100 accrued interest.In December,Tom collected $500 interest from the bond.Tom's interest income from the bond for the year is $500.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

39

Alvin is the sole shareholder of an S corporation that earned $200,000 in 2012 and distributed $75,000 to Alvin.Alvin must recognize $75,000 as income from the S corporation in 2012.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

40

Paula transfers stock to her former spouse,Fred.The transfer is pursuant to a divorce agreement.Paula's cost of the stock was $75,000 and its fair market value on the date of the transfer is $95,000.Fred later sells the stock for $100,000.Fred's recognized gain from the sale of the stock is $5,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

41

The tax concept and economic concept of income are in agreement on which of the following:

A) The fair rental value of an owner-occupied home should be included in income.

B) The increase in value of assets held for the entire year should be included in income for the year.

C) Rent income for 2013 collected in 2012 is income for 2012.

D) All of the above.

E) None of the above.

A) The fair rental value of an owner-occupied home should be included in income.

B) The increase in value of assets held for the entire year should be included in income for the year.

C) Rent income for 2013 collected in 2012 is income for 2012.

D) All of the above.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

42

On a particular Saturday,Tom had planned to paint a room in his house,but his employer gave him the opportunity to work that day.If Tom works,he must hire a painter for $120.For Tom to have a positive cash flow from working and hiring the painter:

A) Tom must earn more than $160 if he is in the 25% marginal tax bracket.

B) Tom must earn at least $160 if he is in the 33% marginal tax bracket.

C) Tom must earn at least $150 if he is in the 25% marginal tax bracket.

D) Tom must earn at least $135 if he is in the 15% marginal tax bracket.

E) None of the above.

A) Tom must earn more than $160 if he is in the 25% marginal tax bracket.

B) Tom must earn at least $160 if he is in the 33% marginal tax bracket.

C) Tom must earn at least $150 if he is in the 25% marginal tax bracket.

D) Tom must earn at least $135 if he is in the 15% marginal tax bracket.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

43

If the employer provides all employees with group term life insurance equal to twice the employee's annual salary,an employee with a salary of $50,000 has no gross income from the life insurance protection provided by the employer.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

44

The annual increase in the cash surrender value of a life insurance policy:

A) Is taxed according to the original issue discount rules.

B) Is not included in gross income because the policy must be surrendered to receive the cash surrender value.

C) Reduces the deduction for life insurance expense.

D) Is exempt because it is life insurance proceeds.

E) None of the above.

A) Is taxed according to the original issue discount rules.

B) Is not included in gross income because the policy must be surrendered to receive the cash surrender value.

C) Reduces the deduction for life insurance expense.

D) Is exempt because it is life insurance proceeds.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

45

For purposes of determining gross income,which of the following is true?

A) A mechanic completed repairs on an automobile during the year and collects money from the customer. The customer was not satisfied with the repairs and sued the mechanic for a refund. The mechanic can defer recognition of the income until the suit has been settled.

B) A taxpayer who finds a wallet full of money is not required to recognize income because someone will eventually ask for the return of the money.

C) Embezzlement proceeds are included in the embezzler's gross income because the embezzler has an obligation to repay the owner.

D) All of the above are true.

E) None of the above is true.

A) A mechanic completed repairs on an automobile during the year and collects money from the customer. The customer was not satisfied with the repairs and sued the mechanic for a refund. The mechanic can defer recognition of the income until the suit has been settled.

B) A taxpayer who finds a wallet full of money is not required to recognize income because someone will eventually ask for the return of the money.

C) Embezzlement proceeds are included in the embezzler's gross income because the embezzler has an obligation to repay the owner.

D) All of the above are true.

E) None of the above is true.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

46

Detroit Corporation sued Chicago Corporation for intentional damage to Detroit's goodwill.Detroit had created its goodwill through providing high-quality services to its customers.Thus,no basis for the goodwill appeared on Detroit's balance sheet.The suit was settled and Detroit received $1,500,000 for the damages to its goodwill.

A) The $1,500,000 is not taxable because it represents a recovery of capital.

B) The $1,500,000 is taxable because Detroit has no basis in the goodwill.

C) The $1,500,000 is not taxable because Detroit did nothing to earn the money.

D) The $1,500,000 is not taxable because Detroit settled the case.

E) None of the above.

A) The $1,500,000 is not taxable because it represents a recovery of capital.

B) The $1,500,000 is taxable because Detroit has no basis in the goodwill.

C) The $1,500,000 is not taxable because Detroit did nothing to earn the money.

D) The $1,500,000 is not taxable because Detroit settled the case.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

47

The annual increase in the cash surrender value of a life insurance policy:

A) Is taxed when the individual dies and the heirs collect the insurance proceeds.

B) Must be included in gross income each year under the original issue discount rules.

C) Reduces the deduction for life insurance expense.

D) Is not included in gross income each year because of the substantial restrictions on gaining access to the policy's value.

E) None of the above.

A) Is taxed when the individual dies and the heirs collect the insurance proceeds.

B) Must be included in gross income each year under the original issue discount rules.

C) Reduces the deduction for life insurance expense.

D) Is not included in gross income each year because of the substantial restrictions on gaining access to the policy's value.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

48

In the case of a person with other income of $300,000,15% of his or her Social Security benefits received are excluded from gross income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

49

Turner,a successful executive,is negotiating a compensation plan with his potential employer.The employer has offered to pay Turner a $600,000 annual salary,payable at the rate of $50,000 per month.Turner counteroffers to receive a monthly salary of $40,000 ($480,000 annually)and a $180,000 bonus in 5 years when Turner will be age 65.

A) If the employer accepts Turner's counteroffer, Turner will recognize $55,000 ($660,000 12) each month.

B) If the employer accepts Turner's counteroffer, Turner will recognize as gross income $40,000 per month and $180,000 in year 5.

C) If the employer accepts Turner's counteroffer, Turner will be in constructive receipt of $50,000 per month.

D) If the employer accepts Turner's counteroffer, Turner will be in constructive receipt of $50,000 per month and the $180,000 bonus.

E) None of the above.

A) If the employer accepts Turner's counteroffer, Turner will recognize $55,000 ($660,000 12) each month.

B) If the employer accepts Turner's counteroffer, Turner will recognize as gross income $40,000 per month and $180,000 in year 5.

C) If the employer accepts Turner's counteroffer, Turner will be in constructive receipt of $50,000 per month.

D) If the employer accepts Turner's counteroffer, Turner will be in constructive receipt of $50,000 per month and the $180,000 bonus.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

50

Susan purchased an annuity for $200,000.She is to receive $18,000 each year and her life expectancy is 13 years.If Susan collects under the annuity for 14 years,the entire $18,000 received in the 14th year must be included in her gross income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

51

Maroon Corporation expects the employees' income tax rates to increase next year.The employees use the cash method.The company presently pays on the last day of each month.The company is considering changing its policy so that the December salaries will be paid on the first day of the following year.What would be the effect on an employee of the proposed change in company policy for paying its salaries beginning for December 2012.

A) The employee would be required to recognize the income in December 2012 because it is constructively received at the end of the month.

B) The employee would be required to recognize the income in December 2012 because the employee has a claim of right to the income when it is earned.

C) The employee will not be required to recognize the income until it is received, in 2013.

D) The employee can elect to either include the pay in 2012 or 2013.

E) None of the above.

A) The employee would be required to recognize the income in December 2012 because it is constructively received at the end of the month.

B) The employee would be required to recognize the income in December 2012 because the employee has a claim of right to the income when it is earned.

C) The employee will not be required to recognize the income until it is received, in 2013.

D) The employee can elect to either include the pay in 2012 or 2013.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

52

In the case of a below-market gift loan for which there is no exception to the imputed interest rules,the lender is deemed to have received interest income even though no interest is charged and collected.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

53

In the case of a gift loan of less than $100,000,the imputed interest rules apply if the donee has net investment income of over $1,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

54

Lois,who is single,received $9,000 of Social Security benefits.She also received $30,000 from dividends,interest,and her employer's pension plan.If Lois sells a capital asset that produces a $1,000 recognized loss,Lois's taxable income will decrease by less than $1,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

55

Father made an interest-free loan of $25,000 to Son who used the money to buy an SUV.If Son's investment income for the year is less than $1,000,Father is not required to impute interest income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

56

The Blue Utilities Company paid Sue $2,000 for the right to lay an underground electric cable across her property anytime in the future.

A) Sue must recognize $2,000 gross income in the current year if the company did not install the cable during the year.

B) Sue is not required to recognize gross income from the receipt of the funds, but she must reduce her cost basis in the land by $2,000.

C) Sue must recognize $2,000 gross income in the current year regardless of whether the company installed the cable during the year.

D) Sue must recognize $2,000 gross income in the current year, and when the cable is installed, she must reduce her cost basis in the land by $2,000.

E) None of the above.

A) Sue must recognize $2,000 gross income in the current year if the company did not install the cable during the year.

B) Sue is not required to recognize gross income from the receipt of the funds, but she must reduce her cost basis in the land by $2,000.

C) Sue must recognize $2,000 gross income in the current year regardless of whether the company installed the cable during the year.

D) Sue must recognize $2,000 gross income in the current year, and when the cable is installed, she must reduce her cost basis in the land by $2,000.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

57

Under the original issue discount (OID)rules as applied to a three-year certificate of deposit:

A) All of the income must be recognized in the year of maturity.

B) The OID will be included in gross income for the year of purchase.

C) The interest income for the first year will be less than the interest income for the third year.

D) The original issue discount must be amortized using the straight-line method.

E) None of the above is correct.

A) All of the income must be recognized in the year of maturity.

B) The OID will be included in gross income for the year of purchase.

C) The interest income for the first year will be less than the interest income for the third year.

D) The original issue discount must be amortized using the straight-line method.

E) None of the above is correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

58

If a lottery prize winner transfers the prize to a qualified government unit or nonprofit organization,then the prize is excluded from the winner's gross income if the amount of the prize does not exceed 30% of the winner's AGI.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

59

Norma's income for 2012 is $27,000 from part-time work and $9,000 of Social Security benefits.Norma is not married.A portion of her Social Security benefits must be included in her gross income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

60

Terri purchased an annuity for $100,000.She was to receive $8,000 per year and her life expectancy was 20 years.She died after receiving 15 payments.Terri's final return should reflect a loss of $40,000 (5 payments not made ´ $8,000).

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

61

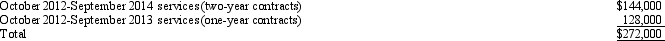

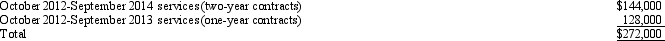

Orange Cable TV Company,an accrual basis taxpayer,allows its customers to pay by the year in advance ($500 per year),or two years in advance ($950).In September 2011,the company collected the following amounts applicable to future services:  As a result of the above,Orange Cable should report as gross income:

As a result of the above,Orange Cable should report as gross income:

A) $272,000 in 2011.

B) $128,000 in 2011.

C) $168,000 in 2012.

D) $222,000 in 2012.

E) None of the above.

As a result of the above,Orange Cable should report as gross income:

As a result of the above,Orange Cable should report as gross income:A) $272,000 in 2011.

B) $128,000 in 2011.

C) $168,000 in 2012.

D) $222,000 in 2012.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

62

With respect to income from services,which of the following is true?

A) The income is always amortized over the period the services will be rendered by an accrual basis taxpayer.

B) A cash basis taxpayer can spread the income from a 24-month service contract over the contract period.

C) If an accrual basis taxpayer sells a 36-month service contract on July 1, 2012 for $3,600, the taxpayer's 2013 gross income from the contract is $3,000.

D) If an accrual basis taxpayer sells a 12-month service contract on July 1, 2012, all of the income is recognized in 2012.

E) None of the above.

A) The income is always amortized over the period the services will be rendered by an accrual basis taxpayer.

B) A cash basis taxpayer can spread the income from a 24-month service contract over the contract period.

C) If an accrual basis taxpayer sells a 36-month service contract on July 1, 2012 for $3,600, the taxpayer's 2013 gross income from the contract is $3,000.

D) If an accrual basis taxpayer sells a 12-month service contract on July 1, 2012, all of the income is recognized in 2012.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

63

The Purple & Gold Gym,Inc.,uses the accrual method of accounting.The corporation sells memberships that entitle the member to use the facilities at any time.A one-year membership costs $360 ($360/12 = $30 per month); a two-year membership costs $600 ($600/24 = $25 per month).Cash payment is required at the beginning of the membership period.On July 1,2012,the company sold a one-year membership and a two-year membership.The company should report as gross income from the two contracts:

A) $960 in 2012.

B) $0 in 2014.

C) $360 in 2012.

D) $480 in 2013.

E) None of the above.

A) $960 in 2012.

B) $0 in 2014.

C) $360 in 2012.

D) $480 in 2013.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

64

On January 5,2012,Tim purchased a bond paying interest at 6% for $30,000.On September 30,2012,he gave the bond to Jane.The bond pays $1,800 interest on December 31.Tim and Jane are cash basis taxpayers.When Jane collects the interest in December 2012:

A) Tim must include all of the interest in his gross income.

B) Jane reports $450 of interest income in 2012, and Tim reports $1,350 of interest income in 2012.

C) Jane reports $1,350 of interest income in 2012, and Tim reports $450 of interest income in 2012.

D) Jane must include all of the interest in her gross income.

E) None of the above is correct.

A) Tim must include all of the interest in his gross income.

B) Jane reports $450 of interest income in 2012, and Tim reports $1,350 of interest income in 2012.

C) Jane reports $1,350 of interest income in 2012, and Tim reports $450 of interest income in 2012.

D) Jane must include all of the interest in her gross income.

E) None of the above is correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

65

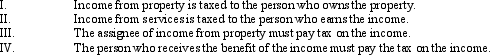

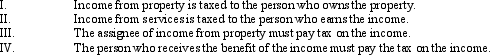

As a general rule:

A) Only I and II are true.

B) Only III and IV are true.

C) I, II, and III are true, but IV is false.

D) I, II, III, and IV are true.

E) None of the above is true.

A) Only I and II are true.

B) Only III and IV are true.

C) I, II, and III are true, but IV is false.

D) I, II, III, and IV are true.

E) None of the above is true.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

66

Wayne owns a 25% interest in the capital and profits of Emerald Company (a calendar year partnership).For tax year 2012,the partnership earned revenue of $900,000 and had operating expenses of $560,000.During the year,Wayne withdrew from the partnership a total of $90,000.He also invested an additional $20,000 in the partnership.For 2012,Wayne's gross income from the partnership is:

A) $70,000.

B) $85,000.

C) $90,000.

D) $110,000.

E) None of the above.

A) $70,000.

B) $85,000.

C) $90,000.

D) $110,000.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

67

Darryl,a cash basis taxpayer,gave 1,000 shares of Copper Company common stock to his daughter on September 29,2012.Copper Company is a publicly held company that has declared a $2.00 per share dividend on September 30th every year for the last 20 years.Just as Darryl had expected,Copper Company declared a $2.00 per share dividend on September 30th,payable on October 15th,to stockholders of record as of October 10th.The daughter received the $2,000 dividend on October 18,2012.

A) Darryl must recognize the $2,000 dividend as his income because he knew the dividend would be paid.

B) Darryl must recognize the income of $2,000 because he constructively received the $2,000.

C) Darryl must recognize $1,500 of the dividend because he owned the stock for three-fourths of the year.

D) The daughter must recognize the income because she owned the stock when the dividend was declared and she received the $2,000.

E) None of the above.

A) Darryl must recognize the $2,000 dividend as his income because he knew the dividend would be paid.

B) Darryl must recognize the income of $2,000 because he constructively received the $2,000.

C) Darryl must recognize $1,500 of the dividend because he owned the stock for three-fourths of the year.

D) The daughter must recognize the income because she owned the stock when the dividend was declared and she received the $2,000.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

68

On November 1,2012,Bob,a cash basis taxpayer,gave Dave common stock.On October 30,2012,the corporation had declared the dividend payable to shareholders of record as of November 22,2012.The dividend was paid on December 15,2012.The corporation has paid the $1,200 dividend once each year for the past ten years,during which Bob owned the stock.When Dave collected the dividend on December 15,2012:

A) Bob must include $1,000 (10/12 x $1,200) of the dividend in his gross income.

B) Bob must include all of the dividend in his gross income.

C) Dave must include all of the dividend in his gross income.

D) Dave should treat the $1,200 as a recovery of capital.

E) None of the above is correct.

A) Bob must include $1,000 (10/12 x $1,200) of the dividend in his gross income.

B) Bob must include all of the dividend in his gross income.

C) Dave must include all of the dividend in his gross income.

D) Dave should treat the $1,200 as a recovery of capital.

E) None of the above is correct.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

69

Under the alimony rules:

A) The income is included in the gross income of the recipient of the payments.

B) A person who receives a property division has experienced an increase in wealth and thus should be subject to tax.

C) State law determine what is alimony for Federal income tax purposes.

D) Payments for child care are included in the child's gross income.

E) None of the above.

A) The income is included in the gross income of the recipient of the payments.

B) A person who receives a property division has experienced an increase in wealth and thus should be subject to tax.

C) State law determine what is alimony for Federal income tax purposes.

D) Payments for child care are included in the child's gross income.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

70

Office Palace,Inc.,leased an all-in-one printer to a new customer,Ashley,on December 27,2012.The printer was to rent for $600 per month for a period of 36 months beginning January 1,2013.Ashley was required to pay the first and last month's rent at the time the lease was signed.Ashley was also required to pay a $1,500 damage deposit.Office Palace must recognize as income for the lease:

A) $0 in 2012, if Office Palace is an accrual basis taxpayer.

B) $7,800 in 2013, if Office Palace is a cash basis taxpayer.

C) $2,700 in 2012, if Office Palace is a cash basis taxpayer.

D) $1,200 in 2012, if Office Palace is an accrual basis taxpayer.

E) None of the above.

A) $0 in 2012, if Office Palace is an accrual basis taxpayer.

B) $7,800 in 2013, if Office Palace is a cash basis taxpayer.

C) $2,700 in 2012, if Office Palace is a cash basis taxpayer.

D) $1,200 in 2012, if Office Palace is an accrual basis taxpayer.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

71

The Green Company,an accrual basis taxpayer,provides business-consulting services.Clients generally pay a retainer at the beginning of a 12-month period.This entitles the client to no more than 40 hours of services.Once the client has received 40 hours of services,Green charges $500 per hour.Green Company allocates the retainer to income based on the number of hours worked on the contract.At the end of the tax year,the company had $50,000 of unearned revenues from these contracts.The company also had $10,000 in unearned rent income received from excess office space leased to other companies.Based on the above,Green must include in gross income for the current year:

A) $60,000.

B) $50,000.

C) $10,000.

D) $0.

E) None of the above.

A) $60,000.

B) $50,000.

C) $10,000.

D) $0.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

72

Daniel purchased a bond on July 1,2012,at par of $10,000 plus accrued interest of $300.On December 31,2012,Daniel collected the $600 interest for the year.On January 1,2013,Daniel sold the bond for $10,200.

A) Daniel must recognize $300 interest income for 2012 and a $200 gain on the sale of the bond in 2013.

B) Daniel must recognize $600 interest income for 2012 and a $200 gain on the sale of the bond in 2013.

C) Daniel must recognize $600 interest income for 2012 and a $100 loss on the sale of the bond in 2013.

D) Daniel must recognize $300 interest income for 2012 and a $100 loss on the sale of the bond in 2013.

E) None of the above.

A) Daniel must recognize $300 interest income for 2012 and a $200 gain on the sale of the bond in 2013.

B) Daniel must recognize $600 interest income for 2012 and a $200 gain on the sale of the bond in 2013.

C) Daniel must recognize $600 interest income for 2012 and a $100 loss on the sale of the bond in 2013.

D) Daniel must recognize $300 interest income for 2012 and a $100 loss on the sale of the bond in 2013.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

73

Teal company is an accrual basis taxpayer.On December 1,2012,a customer paid for an item that was on hand,but the customer wanted the item delivered in early January 2013.Teal delivered the item on January 4,2013.Teal included the sale in its 2012 income for financial accounting purposes.

A) Teal must recognize the income in 2012.

B) Teal must recognize the income in the year title to the goods passed to the customer, as determined under the state laws in which the store is located.

C) Teal can elect to recognize the income in either 2012 or 2013.

D) Teal must recognize the income in 2013.

E) None of the above.

A) Teal must recognize the income in 2012.

B) Teal must recognize the income in the year title to the goods passed to the customer, as determined under the state laws in which the store is located.

C) Teal can elect to recognize the income in either 2012 or 2013.

D) Teal must recognize the income in 2013.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

74

Harry and Wanda were married in Texas,a community property state,but moved to Virginia,a common law state.The calculation of their income on a joint return:

A) Will increase as a result of changing their state of residence.

B) Will decrease as a result of changing their state of residence.

C) Will not change as a result of changing their state of residence.

D) Will not be permitted.

E) None of the above.

A) Will increase as a result of changing their state of residence.

B) Will decrease as a result of changing their state of residence.

C) Will not change as a result of changing their state of residence.

D) Will not be permitted.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

75

Freddy purchased a certificate of deposit for $20,000 on July 1,2012.The certificate's maturity value in two years (June 30,2014)is $21,218,yielding 3% before-tax interest.

A) Freddy must recognize $1,218 gross income in 2012.

B) Freddy must recognize $1,218 gross income in 2014.

C) Freddy must recognize $600 (.03 ´ $20,000) gross income in 2014.

D) Freddy must recognize $300 (.03 ´ $20,000 ´ .5) gross income in 2012.

E) None of the above.

A) Freddy must recognize $1,218 gross income in 2012.

B) Freddy must recognize $1,218 gross income in 2014.

C) Freddy must recognize $600 (.03 ´ $20,000) gross income in 2014.

D) Freddy must recognize $300 (.03 ´ $20,000 ´ .5) gross income in 2012.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

76

Jerry purchased a U.S.Series EE savings bond for $279.The bond has a maturity value in 10 years of $500 and yields 6% interest.This is the first Series EE bond that Jerry has ever owned.

A) Jerry must report the interest income each year using the original issue discount rules.

B) Jerry can report all of the $221 interest income in the year the bond matures.

C) The interest on the bonds is exempt from Federal income tax.

D) Jerry must report ($500 - $279)/10 = $22.10 interest income each year he owns the bond.

E) None of the above.

A) Jerry must report the interest income each year using the original issue discount rules.

B) Jerry can report all of the $221 interest income in the year the bond matures.

C) The interest on the bonds is exempt from Federal income tax.

D) Jerry must report ($500 - $279)/10 = $22.10 interest income each year he owns the bond.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

77

With respect to the prepaid income from services,which of the following is true?

A) The treatment of prepaid income is the same for tax and financial accounting.

B) A cash basis taxpayer can spread the income over the period services are to be provided if all of the services will be completed by the end of the tax year following the year of receipt.

C) An accrual basis taxpayer can spread the income over the period services are to be provided if all of the services will be completed by the end of the tax year following the year of receipt.

D) An accrual basis taxpayer can spread the income over the period services are to be provided on a contract for three years or less.

E) None of the above.

A) The treatment of prepaid income is the same for tax and financial accounting.

B) A cash basis taxpayer can spread the income over the period services are to be provided if all of the services will be completed by the end of the tax year following the year of receipt.

C) An accrual basis taxpayer can spread the income over the period services are to be provided if all of the services will be completed by the end of the tax year following the year of receipt.

D) An accrual basis taxpayer can spread the income over the period services are to be provided on a contract for three years or less.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

78

Mike contracted with Kram Company,Mike's controlled corporation.Mike was a medical doctor and the contract provided that he would work exclusively for the corporation.No other doctor worked for the corporation.The corporation contracted to perform an operation for Rosa for $8,000.The corporation paid Mike $6,500 to perform the operation under the terms of his employment contract.

A) Mike's gross income is $6,500.

B) Mike must recognize the $8,000 gross income because he provided the service.

C) Mike must recognize $8,000 gross income since the patient obviously wanted him to perform the operation.

D) The Kram Company corporation's gross income is $1,500.

E) None of the above.

A) Mike's gross income is $6,500.

B) Mike must recognize the $8,000 gross income because he provided the service.

C) Mike must recognize $8,000 gross income since the patient obviously wanted him to perform the operation.

D) The Kram Company corporation's gross income is $1,500.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

79

Jim and Nora,residents of a community property state,were married in early 2010.Late in 2010 they separated,and in 2012 they were divorced.Each earned a salary,and they received income from community owned investments in all relevant years.They filed separate returns in 2010 and 2011.

A) In 2011, Nora must report only her salary and one-half of the income from community property on her separate return.

B) In 2011, Nora must report on her separate return one-half of the Jim and Nora salary and one-half of the community property income.

C) In 2012, Nora must report on her separate return one-half of the Jim and Nora salary for the period they were married as well as one-half of the community property income and her income earned after the divorce.

D) In 2012, Nora must report only her salary on her separate return.

E) None of the above.

A) In 2011, Nora must report only her salary and one-half of the income from community property on her separate return.

B) In 2011, Nora must report on her separate return one-half of the Jim and Nora salary and one-half of the community property income.

C) In 2012, Nora must report on her separate return one-half of the Jim and Nora salary for the period they were married as well as one-half of the community property income and her income earned after the divorce.

D) In 2012, Nora must report only her salary on her separate return.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

80

Theresa,a cash basis taxpayer,purchased a bond on July 1,2009,for $10,000,plus $400 of accrued interest.The bond paid $800 of interest each December 31.On March 31,2012,she sold the bond for $10,300,which included $200 of accrued interest.

A) Theresa's 2012 interest income from the bond is $200.

B) Theresa has $200 of interest income and a $100 gain from the bond in 2012.

C) Theresa has a $100 loss from the sale of the bond and no interest income.

D) Theresa's gain on the sale of the bond is $200.

E) None of the above.

A) Theresa's 2012 interest income from the bond is $200.

B) Theresa has $200 of interest income and a $100 gain from the bond in 2012.

C) Theresa has a $100 loss from the sale of the bond and no interest income.

D) Theresa's gain on the sale of the bond is $200.

E) None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck