Deck 3: Computing the Tax

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/187

Play

Full screen (f)

Deck 3: Computing the Tax

1

An increase in a taxpayer's AGI could decrease the amount of charitable contribution that can be claimed.

False

2

The additional standard deduction for age and blindness is greater for married taxpayers than for single taxpayers.

False

3

A decrease in a taxpayer's AGI could increase the amount of medical expenses that can be deducted.

True

4

The basic and additional standard deductions both are subject to an annual adjustment for inflation.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

5

In 2017,Ed is 66 and single.If he has itemized deductions of $7,400,he should not claim the standard deduction alternative.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

6

Once they reach age 65,many taxpayers will switch from itemizing their deductions from AGI and start claiming the standard deduction.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

7

Under the Federal income tax formula for individuals,a choice must be made between claiming deductions for AGI and itemized deductions.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

8

Under the income tax formula,a taxpayer must choose between deductions for AGI and the standard deduction.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

9

Lee,a citizen of Korea,is a resident of the U.S.Any rent income Lee receives from land he owns in Korea is not subject to the U.S.income tax.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

10

Claude's deductions from AGI exceed the standard deduction allowed for the current year.Under these circumstances,Claude cannot claim the standard deduction.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

11

The filing status of a taxpayer (e.g.,single,head of household) must be identified before the applicable standard deduction is determined.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

12

All exclusions from gross income are reported on Form 1040.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

13

Under the Federal income tax formula for individuals,the determination of adjusted gross income (AGI) precedes that of taxable income (TI).

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

14

An "above the line" deduction refers to a deduction for AGI.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

15

Because they appear on page 1 of Form 1040,itemized deductions are also referred to as "page 1 deductions."

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

16

Howard,age 82,dies on January 2,2017.On Howard's final income tax return,the full amount of the basic and additional standard deductions will be allowed even though Howard lived for only 2 days during the year.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

17

Many taxpayers who previously itemized will start claiming the standard deduction when they purchase a home.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

18

As opposed to itemizing deductions from AGI,the majority of individual taxpayers choose the standard deduction.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

19

After Ellie moves out of the apartment she had rented as her personal residence,she recovers her damage deposit of $1,000.The $1,000 is not income to Ellie.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

20

Adjusted gross income (AGI) appears at the bottom of page 1 and at the top of page 2 of Form 1040.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

21

Butch and Minerva are divorced in December of 2017.Since they were married for more than one-half of the year,they are considered as married for 2017.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

22

Debby,age 18,is claimed as a dependent by her mother.During 2017,she earned $1,100 in interest income on a savings account.Debby's standard deduction is $1,450 ($1,100 + $350).

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

23

For the year a spouse dies,the surviving spouse is considered married for the entire year for income tax purposes.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

24

After her divorce,Hope continues to support her ex-husband's sister,Cindy,who does not live with her.Hope can claim Cindy as a dependent.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

25

In determining whether the gross income test is met for dependency exemption purposes,only the taxable portion of a scholarship is considered.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

26

In 2017,Hal furnishes more than half of the support of his ex-wife and her father,both of whom live with him.The divorce occurred in 2016.Hal may claim the father-in-law and the ex-wife as dependents.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

27

When separate income tax returns are filed by married taxpayers,one spouse cannot claim the other spouse as an exemption.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

28

Jason and Peg are married and file a joint return.Both are over 65 years of age and Jason is blind.Their standard deduction for 2017 is $16,450 ($12,700 + $1,250 + $1,250 + $1,250).

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

29

Clara,age 68,claims head of household filing status.If she has itemized deductions of $10,500 for 2017,she should claim the standard deduction.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

30

Katrina,age 16,is claimed as a dependent by her parents.During 2017,she earned $5,600 as a checker at a grocery store.Her standard deduction is $5,950 ($5,600 earned income + $350).

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

31

If an individual does not spend funds that have been received from another source (e.g.,interest on municipal bonds),the unexpended amounts are not considered for purposes of the support test.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

32

Roy and Linda were divorced in 2016.The divorce decree awards custody of their children to Linda but is silent as to who is entitled to claim them as dependents.If Roy furnished more than half of their support,he can claim them as dependents in 2017.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

33

Derek,age 46,is a surviving spouse.If he has itemized deductions of $12,900 for 2017,Derek should not claim the standard deduction.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

34

Buddy and Hazel are ages 72 and 71 and file a joint return.If they have itemized deductions of $14,600 for 2017,they should not claim the standard deduction.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

35

Using borrowed funds from a mortgage on her home,Leah provides 52% of her own support,while her sons furnished the rest.Leah can be claimed as a dependent under a multiple support agreement.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

36

Benjamin,age 16,is claimed as a dependent by his parents.During 2017,he earned $850 at a car wash.Benjamin's standard deduction is $1,400 ($1,050 + $350).

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

37

A dependent cannot claim a personal exemption on his or her own return.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

38

Dan and Donna are husband and wife and file separate returns for the year.If Dan itemizes his deductions from AGI,Donna cannot claim the standard deduction.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

39

Albert buys his mother a TV.For purposes of meeting the support test,Albert cannot include the cost of the TV.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

40

Monique is a resident of the U.S.and a citizen of France.If she files a U.S.income tax return,Monique cannot claim the standard deduction.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

41

Ed is divorced and maintains a home in which he and a dependent friend live.Ed does not qualify for head of household filing status.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

42

Currently,the top income tax rate in effect is not the highest it has ever been.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

43

Kim,a resident of Oregon,supports his parents who are residents of Canada but citizens of Korea.Kim can claim his parents as dependents.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

44

In terms of income tax consequences,abandoned spouses are treated the same way as married persons filing separate returns.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

45

For dependents who have income,special filing requirements apply.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

46

Married taxpayers who file separately cannot later (i.e.,after the due date for filing) change to a joint return.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

47

Married taxpayers who file a joint return cannot later (i.e.,after the filing due date) switch to separate returns for that year.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

48

A taxpayer who itemizes must use Form 1040,and cannot use Form 1040EZ or Form 1040A.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

49

For tax purposes,married persons filing separate returns are treated the same as single taxpayers.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

50

Katelyn is divorced and maintains a household in which she and her daughter,Crissa,live.Crissa,age 22,earns $11,000 during 2017 as a model.Katelyn does not qualify for head of household filing status.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

51

Stealth taxes are directed at lower income taxpayers.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

52

Lucas,age 17 and single,earns $6,000 during 2017.Lucas's parents cannot claim him as a dependent if he does not live with them.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

53

An individual taxpayer uses a fiscal year of March 1 to February 28.The due date of this taxpayer's Federal income tax return is May 15 of each tax year.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

54

In terms of timing as to any one year,the Tax Tables are available before the Tax Rate Schedules.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

55

In determining the filing requirement based on gross income received,both additional standard deductions (i.e.,age and blindness) are taken into account.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

56

Sarah furnishes more than 50% of the support of her son and daughter-in-law who live with her.If the son and daughter-in-law file a joint return,Sarah cannot claim them as dependents.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

57

Since an abandoned spouse is treated as not married and has one or more dependent children,he or she qualifies for the standard deduction available to head of household.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

58

In January 2017,Jake's wife dies and he does not remarry.For tax year 2017,Jake may not be able to use the filing status available to married persons filing joint returns.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

59

Darren,age 20 and not disabled,earns $4,100 during 2017.Darren's parents cannot claim him as a dependent unless he is a full-time student.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

60

Surviving spouse filing status begins in the year in which the deceased spouse died.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

61

Frank sold his personal use automobile for a loss of $9,000.He also sold a personal coin collection for a gain of $10,000.As a result of these sales,$10,000 is subject to income tax.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

62

When the kiddie tax applies,the child need not file an income tax return because the child's income will be reported on the parents' return.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

63

Gain on the sale of collectibles held for more than 12 months always is subject to a tax rate of 28%.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

64

Which,if any,of the statements regarding the standard deduction is correct?

A)Some taxpayers may qualify for two types of standard deductions.

B)The standard deduction is not available to taxpayers who choose to deduct their personal and dependency exemptions.

C)The standard deduction may be taken as a for AGI deduction.

D)The basic standard deduction is indexed for inflation but the additional standard deduction is not.

E)None of these.

A)Some taxpayers may qualify for two types of standard deductions.

B)The standard deduction is not available to taxpayers who choose to deduct their personal and dependency exemptions.

C)The standard deduction may be taken as a for AGI deduction.

D)The basic standard deduction is indexed for inflation but the additional standard deduction is not.

E)None of these.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

65

In terms of the tax formula applicable to individual taxpayers,which,if any,of the following statements is correct?

A)In arriving at AGI, a taxpayer must elect between claiming deductions for AGI and deductions from AGI.

B)In arriving at taxable income, a taxpayer must elect between claiming deductions for AGI and deductions from AGI.

C)If a taxpayer has deductions for AGI, the standard deduction is not available.

D)In arriving at taxable income, a taxpayer must elect between deductions for AGI and the standard deduction.

E)None of these.

A)In arriving at AGI, a taxpayer must elect between claiming deductions for AGI and deductions from AGI.

B)In arriving at taxable income, a taxpayer must elect between claiming deductions for AGI and deductions from AGI.

C)If a taxpayer has deductions for AGI, the standard deduction is not available.

D)In arriving at taxable income, a taxpayer must elect between deductions for AGI and the standard deduction.

E)None of these.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

66

A child who is married cannot be subject to the kiddie tax.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

67

A child who has unearned income of $2,100 or less cannot be subject to the kiddie tax.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

68

The kiddie tax does not apply to a child whose earned income is more than one-half of his or her support.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

69

Once a child reaches age 19,the kiddie tax no longer applies.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

70

Which,if any,of the following statements relating to the standard deduction is correct?

A)If a taxpayer dies during the year, his (or her) standard deduction must be prorated.

B)If a taxpayer is claimed as a dependent of another, his (or her) additional standard deduction is allowed in full (i.e., no adjustment is necessary).

C)If spouses file separate returns, both spouses must claim the standard deduction (rather than itemize their deductions from AGI).

D)If a taxpayer is claimed as a dependent of another, no basic standard deduction is allowed.

E)None of these.

A)If a taxpayer dies during the year, his (or her) standard deduction must be prorated.

B)If a taxpayer is claimed as a dependent of another, his (or her) additional standard deduction is allowed in full (i.e., no adjustment is necessary).

C)If spouses file separate returns, both spouses must claim the standard deduction (rather than itemize their deductions from AGI).

D)If a taxpayer is claimed as a dependent of another, no basic standard deduction is allowed.

E)None of these.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

71

Which,if any,of the following is a deduction for AGI?

A)State and local sales taxes

B)Interest on home mortgage

C)Charitable contributions

D)Unreimbursed moving expenses of an employee

E)None of these

A)State and local sales taxes

B)Interest on home mortgage

C)Charitable contributions

D)Unreimbursed moving expenses of an employee

E)None of these

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

72

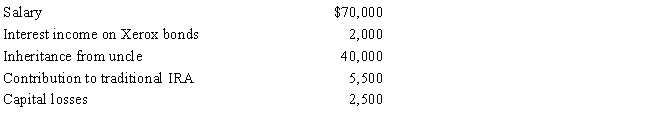

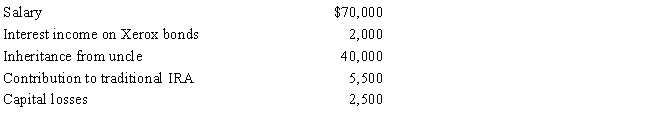

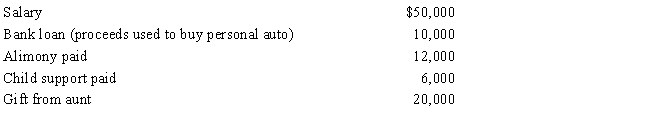

During 2017,Esther had the following transactions:

Esther's AGI is:

A)$62,000.

B)$64,000.

C)$67,000.

D)$102,000.

E)$104,000.

Esther's AGI is:

A)$62,000.

B)$64,000.

C)$67,000.

D)$102,000.

E)$104,000.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

73

Which,if any,of the following is a deduction for AGI?

A)Contributions to a traditional Individual Retirement Account.

B)Child support payments.

C)Funeral expenses.

D)Loss on the sale of a personal residence.

E)Medical expenses.

A)Contributions to a traditional Individual Retirement Account.

B)Child support payments.

C)Funeral expenses.

D)Loss on the sale of a personal residence.

E)Medical expenses.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

74

In terms of the tax formula applicable to individual taxpayers,which,if any,of the following statements is correct?

A)In arriving at taxable income, a taxpayer must choose between the standard deduction and deductions from AGI.

B)In arriving at AGI, personal and dependency exemptions must be subtracted from gross income.

C)In arriving at taxable income, a taxpayer must choose between the standard deduction and claiming personal and dependency exemptions.

D)The formula does not apply if a taxpayer elects to claim the standard deduction.

E)None of these.

A)In arriving at taxable income, a taxpayer must choose between the standard deduction and deductions from AGI.

B)In arriving at AGI, personal and dependency exemptions must be subtracted from gross income.

C)In arriving at taxable income, a taxpayer must choose between the standard deduction and claiming personal and dependency exemptions.

D)The formula does not apply if a taxpayer elects to claim the standard deduction.

E)None of these.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

75

When the kiddie tax applies and the parents are divorced,the applicable parent (for determining the parental tax) is the one with the greater taxable income.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

76

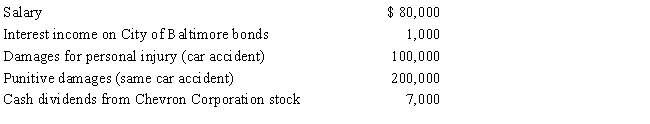

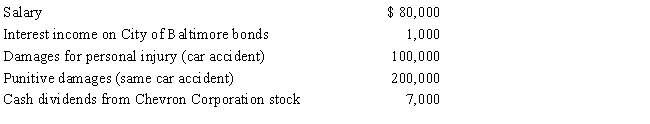

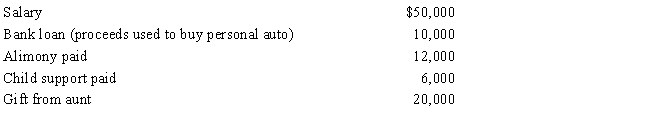

During 2017,Sarah had the following transactions:

Sarah's AGI is:

A)$185,000.

B)$187,000.

C)$285,000.

D)$287,000.

E)$387,000.

Sarah's AGI is:

A)$185,000.

B)$187,000.

C)$285,000.

D)$287,000.

E)$387,000.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

77

Stuart has a short-term capital loss,a collectible long-term capital gain,and a long-term capital gain from land held as investment.The short-term loss is first applied to the collectible capital gain.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

78

During 2017,Marvin had the following transactions:

Marvin's AGI is:

A)$32,000.

B)$38,000.

C)$44,000.

D)$56,000.

E)$64,000.

Marvin's AGI is:

A)$32,000.

B)$38,000.

C)$44,000.

D)$56,000.

E)$64,000.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following items,if any,is deductible?

A)Parking expenses incurred in connection with jury duty-taxpayer is a dentist.

B)Substantiated gambling losses (not in excess of gambling winnings) from state lottery.

C)Contributions to mayor's reelection campaign.

D)Speeding ticket incurred while on business.

E)Premiums paid on personal life insurance policy.

A)Parking expenses incurred in connection with jury duty-taxpayer is a dentist.

B)Substantiated gambling losses (not in excess of gambling winnings) from state lottery.

C)Contributions to mayor's reelection campaign.

D)Speeding ticket incurred while on business.

E)Premiums paid on personal life insurance policy.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

80

Regarding the tax formula and its relationship to Form 1040,which,if any,of the following statements is correct?

A)Most exclusions from gross income are reported on page 2 of Form 1040.

B)An "above the line deduction" refers to a deduction from AGI.

C)A "page 1 deduction" refers to a deduction for AGI.

D)The taxable income (TI) amount appears both at the bottom of page 1 and at the top of page 2 of Form 1040.

E)None of these.

A)Most exclusions from gross income are reported on page 2 of Form 1040.

B)An "above the line deduction" refers to a deduction from AGI.

C)A "page 1 deduction" refers to a deduction for AGI.

D)The taxable income (TI) amount appears both at the bottom of page 1 and at the top of page 2 of Form 1040.

E)None of these.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck