Deck 13: Automatic Adjustments With Flexible and Fixed Exchange Rates

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/55

Play

Full screen (f)

Deck 13: Automatic Adjustments With Flexible and Fixed Exchange Rates

1

A depreciation of the US dollar makes US products __________________ for European residents,because European residents need _______ euros to purchase each dollar.

A)cheaper; more

B)cheaper; fewer

C)more expensive; more

D)more expensive; fewer

A)cheaper; more

B)cheaper; fewer

C)more expensive; more

D)more expensive; fewer

B

2

The foreign exchange market is stable if:

A)ηM + ηX < 1

B)ηM + ηX = 1

C)ηM + ηX > 1

D)ηM + ηX > 2

A)ηM + ηX < 1

B)ηM + ηX = 1

C)ηM + ηX > 1

D)ηM + ηX > 2

C

3

When a(n)___________________ condition is present,a disturbance from the equilibrium exchange rate gives rise to automatic forces that push the exchange rate back toward the equilibrium rate.

A)unstable foreign exchange market

B)Marshall-Lerner condition

C)J-curve effect

D)stable foreign exchange market

A)unstable foreign exchange market

B)Marshall-Lerner condition

C)J-curve effect

D)stable foreign exchange market

D

4

The US supply curve of euros can be positively sloped,negatively sloped,or vertical,depending on the elasticity of the ____________________.

A)US demand for European imports in terms of euros

B)US demand for US exports in terms of euros

C)foreign demand for European imports in terms of euros

D)foreign demand for US exports in terms of euros

A)US demand for European imports in terms of euros

B)US demand for US exports in terms of euros

C)foreign demand for European imports in terms of euros

D)foreign demand for US exports in terms of euros

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

5

If ηM = -.85 and ηX = -.62 ,then

A)Foreign exchange market is unstable

B)Marshall-Learner condition is not met

C)Foreign exchange market is stable

D)If the exchange rate deviates from the equilibrium value,market forces will not be able to bring it back to the equilibrium on its own

A)Foreign exchange market is unstable

B)Marshall-Learner condition is not met

C)Foreign exchange market is stable

D)If the exchange rate deviates from the equilibrium value,market forces will not be able to bring it back to the equilibrium on its own

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

6

When US demand for imports is price elastic,a(n)___________ in price leads to a ___________ proportionate increase in the quantity demanded so that expenditures on the imports increase.

A)increase; smaller

B)increase; larger

C)decrease; smaller

D)decrease; larger

A)increase; smaller

B)increase; larger

C)decrease; smaller

D)decrease; larger

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

7

When a(n)_____________condition is present,a disturbance from the equilibrium exchange rate pushes the exchange rate farther away from equilibrium.

A)unstable foreign exchange market

B)Marshall-Lerner condition

C)J-curve effect

D)stable foreign exchange market

A)unstable foreign exchange market

B)Marshall-Lerner condition

C)J-curve effect

D)stable foreign exchange market

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

8

If the US currency pass-through is 60 percent,what will occur as a result of a 15 percent depreciation in the value of the dollar?

A)import prices to fall by 9 percent

B)import prices to rise by 15 percent

C)export prices to fall by 9 percent

D)export prices to rise by 15 percent

A)import prices to fall by 9 percent

B)import prices to rise by 15 percent

C)export prices to fall by 9 percent

D)export prices to rise by 15 percent

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

9

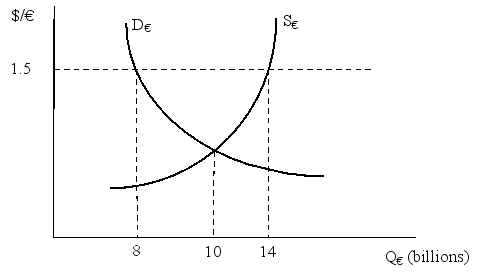

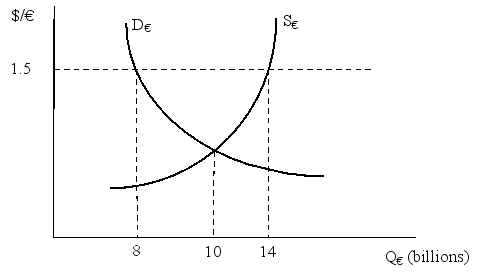

In the following diagram D€ is the US demand curve for Euro and S€ is the US supply curve for Euro.If the exchange rate of Euro is US$1.5/€ then which of the following is true.

A)US has a balance of trade deficit of 6 billion Euro

B)US has a balance of trade surplus of 6 billion Euro

C)US has a balance of trade deficit of 2 billion Euro

D)US has a balance of trade surplus of 4 billion Euro

A)US has a balance of trade deficit of 6 billion Euro

B)US has a balance of trade surplus of 6 billion Euro

C)US has a balance of trade deficit of 2 billion Euro

D)US has a balance of trade surplus of 4 billion Euro

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

10

What signs do the price elasticity of the US demand for imports and the price elasticity of the foreign demand for US exports in euros have?

A)positive

B)negative

C)constant

D)these could be either positive or negative

A)positive

B)negative

C)constant

D)these could be either positive or negative

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

11

The proportion of an exchange rate change that is reflected in export and import price changes is called:

A)J-curve effect

B)Pass-through

C)Marshall-Lerner condition

D)Unstable foreign exchange market

A)J-curve effect

B)Pass-through

C)Marshall-Lerner condition

D)Unstable foreign exchange market

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

12

The foreign exchange market is stable (able to correct a trade deficit by a depreciation of the nation's currency)if ____________________

A)the sum of the absolute values of price elasticities of the US demand for imports and the foreign demand for US exports is greater than one.

B)the sum of the absolute values of price elasticities of the US demand for imports and the foreign demand for US exports is less than one.

C)the sum of the absolute values of price elasticities of the US supply of exports and the foreign supply of imports is greater than one.

D)the sum of the absolute values of price elasticities of the US supply for imports and the foreign demand for US exports is less than one.

A)the sum of the absolute values of price elasticities of the US demand for imports and the foreign demand for US exports is greater than one.

B)the sum of the absolute values of price elasticities of the US demand for imports and the foreign demand for US exports is less than one.

C)the sum of the absolute values of price elasticities of the US supply of exports and the foreign supply of imports is greater than one.

D)the sum of the absolute values of price elasticities of the US supply for imports and the foreign demand for US exports is less than one.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

13

When depreciation of the US dollar occurs compared to the euro,US residents will find European imports __________,because US residents need _________ dollars to purchase each euro.

A)more expensive; more

B)more expensive; fewer

C)less expensive; more

D)less expensive; fewer

A)more expensive; more

B)more expensive; fewer

C)less expensive; more

D)less expensive; fewer

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

14

The ________________ explains why it may take up to two years for a currency depreciation to make significant reductions in a nation's trade deficit.

A)J-curve effect

B)pass-through

C)Marshall-Lerner condition

D)multiplier effect

A)J-curve effect

B)pass-through

C)Marshall-Lerner condition

D)multiplier effect

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

15

The _______________ states that the foreign exchange market is stable when in absolute sense the sum of the price elasticities of demands for imports and exports is greater than one.

A)J-curve effect

B)pass-through condition

C)Marshall-Lerner condition

D)stable market theory

A)J-curve effect

B)pass-through condition

C)Marshall-Lerner condition

D)stable market theory

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

16

The US demand for euros is always___________.

A)negatively sloped

B)positively sloped

C)perfectly elastic

D)perfectly inelastic

A)negatively sloped

B)positively sloped

C)perfectly elastic

D)perfectly inelastic

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

17

The price elasticity of the ______________ in euros is given by the percentage change in the quantity demanded of US exports by foreigners divided by the percentage change in the price of US exports in euros.

A)US demand for exports

B)foreign demand for US imports

C)US demand for imports

D)foreign demand for US exports

A)US demand for exports

B)foreign demand for US imports

C)US demand for imports

D)foreign demand for US exports

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

18

The price elasticity of the US demand for imports in euros is given by:

A)the percentage change in the quantity demanded of imports by US consumers divided by the percentage change in the quantity demanded of US exports by European consumers

B)the percentage change in the quantity demanded of imports by US consumers divided by the percentage change in the price of the US imports in euros

C)the percentage change in the quantity demanded of US exports by European consumers divided by the percentage change in the quantity demanded of imports by US consumers

D)the percentage change in the price of European exports divided by the percentage change in the price of the US imports in euros.

A)the percentage change in the quantity demanded of imports by US consumers divided by the percentage change in the quantity demanded of US exports by European consumers

B)the percentage change in the quantity demanded of imports by US consumers divided by the percentage change in the price of the US imports in euros

C)the percentage change in the quantity demanded of US exports by European consumers divided by the percentage change in the quantity demanded of imports by US consumers

D)the percentage change in the price of European exports divided by the percentage change in the price of the US imports in euros.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

19

When demand is unitary elastic,a change in price will leave expenditures on the commodity___________.

A)unchanged

B)at a greater value

C)at a lower value

D)none of the above

A)unchanged

B)at a greater value

C)at a lower value

D)none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

20

The US supply curve may be vertical or negatively sloped if the foreign demand for US exports in terms of euros is __________.

A)sufficiently elastic

B)sufficiently inelastic

C)unit elastic

D)zero

A)sufficiently elastic

B)sufficiently inelastic

C)unit elastic

D)zero

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

21

The equilibrium level of income in an open economy is where:

A)Savings + Investment = Imports + Exports

B)Consumption + Savings = Imports + Exports

C)Savings + Exports = Investment + Imports

D)Savings + imports = Investment + Exports

A)Savings + Investment = Imports + Exports

B)Consumption + Savings = Imports + Exports

C)Savings + Exports = Investment + Imports

D)Savings + imports = Investment + Exports

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

22

In a stable foreign exchange market,a nation can correct a deficit in its balance of payments by allowing its currency to __________.

A)appreciate

B)depreciate

C)remain constant

D)none of the above

A)appreciate

B)depreciate

C)remain constant

D)none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

23

Business cycles tend to impact nations other than the nation in which they are occurring because of ________________.

A)foreign repercussions

B)absorption

C)the income elasticity of imports

D)the foreign multiplier

A)foreign repercussions

B)absorption

C)the income elasticity of imports

D)the foreign multiplier

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

24

The increase in imports induced by a dollar increase in income is called the ________________.

A)import elasticity of demand

B)marginal propensity to import

C)income elasticity of imports

D)none of the above

A)import elasticity of demand

B)marginal propensity to import

C)income elasticity of imports

D)none of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

25

According to the J-curve effect,when a nation's currency appreciates,the nation's trade balance:

A)Will first move toward deficit,then toward surplus

B)Will first move toward surplus,then toward deficit

C)Will move toward deficit and remain there

D)Will move toward surplus and remain there

A)Will first move toward deficit,then toward surplus

B)Will first move toward surplus,then toward deficit

C)Will move toward deficit and remain there

D)Will move toward surplus and remain there

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

26

In an open economy,if the marginal propensity to save s = .20 and the marginal propensity to import m = .30,then what should be the foreign trade multiplier?

A)2

B)5

C)3)33

D)10

A)2

B)5

C)3)33

D)10

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

27

The ________________ operated from about 1880 until the outbreak of World War I in 1914.

A)gold standard

B)silver standard

C)stable foreign exchange market

D)Marshall-Lerner condition

A)gold standard

B)silver standard

C)stable foreign exchange market

D)Marshall-Lerner condition

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

28

_____________ represents the fixed exchange rates defined by the gold content of each nation's currency.

A)Purchasing power parity

B)Pass through

C)Mint parity

D)Price-specie-flow

A)Purchasing power parity

B)Pass through

C)Mint parity

D)Price-specie-flow

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

29

Which exchange system operated from the end of World War II to 1971?

A)The gold standard

B)The silver standard

C)The managed float

D)The Bretton Woods system

A)The gold standard

B)The silver standard

C)The managed float

D)The Bretton Woods system

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

30

Assume £1 (pounds sterling)gold coin in the United Kingdom contains 113.0016 grains of pure gold,while the $1 gold coin in the US contains 23.22 grains.If the cost of shipping £1 from London to New York was 3 cents,the gold export point of the UK pound is _____,and the gold import point is ________.

A)$113.16; $113.22

B)$4.90; $4.84

C)$19.16; $19.22

D)cannot be determined from information given

A)$113.16; $113.22

B)$4.90; $4.84

C)$19.16; $19.22

D)cannot be determined from information given

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

31

In a closed economy without a government sector,the equilibrium level of income is found where income is equal to

A)planned consumption expenditures divided by planned business investment

B)the ratio of planned business investment to planned consumption expenditures

C)planned consumption expenditures plus planned business investment plus planned net exports

D)planned consumption expenditures plus planned business investment.

A)planned consumption expenditures divided by planned business investment

B)the ratio of planned business investment to planned consumption expenditures

C)planned consumption expenditures plus planned business investment plus planned net exports

D)planned consumption expenditures plus planned business investment.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose a £1 gold coin in the UK contained 115 grains of pure gold,while a $1 gold coin in the US contained 25 grains.What is the mint parity exchange rate between pounds and dollars?

A)£4.87 per dollar

B)$4.87 per pound

C)$)22 per pound

D)£0.22 per dollar

A)£4.87 per dollar

B)$4.87 per pound

C)$)22 per pound

D)£0.22 per dollar

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

33

If for every one dollar increase in income,savings increases by 25 cents,the marginal propensity to consume is _________ and the closed economy multiplier is ______.

A))25,4

B))75,4

C))25,.04

D))75,1.333

A))25,4

B))75,4

C))25,.04

D))75,1.333

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

34

The ________________ served as the automatic adjustment mechanism under the gold standard exchange system.

A)mint parity

B)gold import point

C)price-specie-flow mechanism

D)purchasing power parity model

A)mint parity

B)gold import point

C)price-specie-flow mechanism

D)purchasing power parity model

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

35

For the US,the currency pass-through is about _______ percent

A)10

B)100

C)30

D)40

A)10

B)100

C)30

D)40

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

36

The mint parity plus the cost of shipping an amount of gold equal to one unit of the foreign currency between the two nations is:

A)gold export point

B)gold import point

C)price-specie-flow mechanism

D)equilibrium level of income

A)gold export point

B)gold import point

C)price-specie-flow mechanism

D)equilibrium level of income

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

37

The closed economy multiplier is equal to _____________.

A)The reciprocal of the marginal propensity to save

B)The reciprocal of the marginal propensity to consume

C)The slope of the savings function

D)The ratio of savings to investment

A)The reciprocal of the marginal propensity to save

B)The reciprocal of the marginal propensity to consume

C)The slope of the savings function

D)The ratio of savings to investment

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

38

The equilibrium level of national income in the economy is where _______________.

A)the ratio of leakages to savings = the ratio of injection to consumption

B)leakages = injections

C)leakages + injections = consumption + investment

D)consumption - investment = zero

A)the ratio of leakages to savings = the ratio of injection to consumption

B)leakages = injections

C)leakages + injections = consumption + investment

D)consumption - investment = zero

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

39

The ratio of the change in income to the change in exports and/or investments is:

A)the multiplier

B)the foreign trade multiplier

C)equilibrium level of income

D)the marginal propensity to save

A)the multiplier

B)the foreign trade multiplier

C)equilibrium level of income

D)the marginal propensity to save

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

40

___________ account(s)for the impact a change in a large nation's income and trade has on the rest of the world and which the rest of the world in turn has on a nation.

A)Foreign repercussions

B)Absorption

C)The synthesis of automatic adjustments

D)The foreign multiplier

A)Foreign repercussions

B)Absorption

C)The synthesis of automatic adjustments

D)The foreign multiplier

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

41

The _____ effect explains that,after a depreciation of a nation's currency,the trade balance will worsen for a period of time and then improve.

A)J-curve

B)absorption

C)pass-through

D)Marshall-Lerner

A)J-curve

B)absorption

C)pass-through

D)Marshall-Lerner

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

42

Under flexible exchange rates,a trade deficit is automatically corrected by a deprecation of the deficit nation's currency.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

43

The price elasticity of the US demand for imports in euros is represented by the symbol ηM.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

44

The marginal propensity to save is the amount of additional savings associated with each one-dollar increase in income multiplied by the increase in income.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

45

How does the adjustment mechanism operate under a gold standard?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

46

With a fixed exchange rate system,a nation cannot conduct effective monetary policy.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

47

A country with budget deficit which is also at full employment can improve its deficit situation by allowing its currency to depreciate,only if,

A)the real domestic absorption is reduced

B)the real domestic absorption is increased

C)level of imports can be increased

D)income can be increased

A)the real domestic absorption is reduced

B)the real domestic absorption is increased

C)level of imports can be increased

D)income can be increased

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

48

Please explain the J-Curve effect in exchange rate determination.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

49

The price-specie-flow adjustment mechanism operates by the deficit nation losing gold and experiencing a reduction in its money supply.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

50

For the US,the currency pass-through is about 10 percent.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

51

The gold standard was operated in the US until 1971.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

52

The US supply curve of euros may be vertical or negatively sloped if the foreign demand for US exports in terms of euros is sufficiently inelastic.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

53

When demand is unitary elastic,then a change in price will leave expenditures on the commodity at a greater value.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

54

What is the Marshall-Lerner Condition and how is it used?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

55

Under a fixed exchange rate system,trade deficits are not corrected by automatic changes in domestic prices.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck