Deck 11: Worldwide Accounting Diversity and International Accounting Standards

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

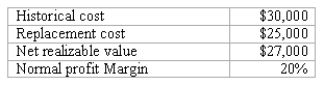

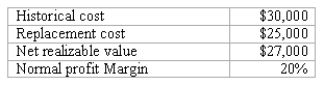

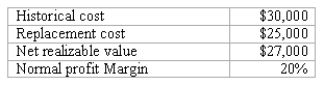

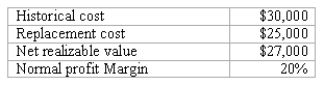

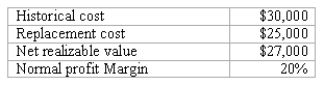

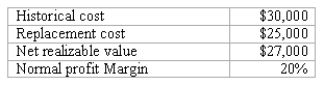

Question

Question

Question

Question

Question

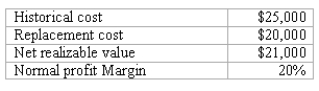

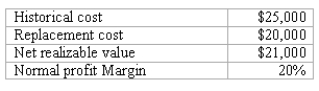

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/58

Play

Full screen (f)

Deck 11: Worldwide Accounting Diversity and International Accounting Standards

1

In countries where there is less pressure for public accountability and information disclosure

A)accounting practice is designed to provide adequate information to investors and creditors.

B)banks are the primary source of financing for companies.

C)accounting information is prepared to meet the needs of taxing authorities.

D)accounting standards emphasize accounting for high inflation situations.

E)the accounting focus is on recent market economy reforms.

A)accounting practice is designed to provide adequate information to investors and creditors.

B)banks are the primary source of financing for companies.

C)accounting information is prepared to meet the needs of taxing authorities.

D)accounting standards emphasize accounting for high inflation situations.

E)the accounting focus is on recent market economy reforms.

A

2

Harmonization of financial reporting practices is:

A)The process of reducing differences in financial reporting practices across countries.

B)The process of translating differences in financial reporting practices across countries.

C)The process of increasing differences in financial reporting practices across countries.

D)The process of allowing different countries to create unique financial reporting practices.

E)The process of creating similar accounting practices according to geographic regions of the world.

A)The process of reducing differences in financial reporting practices across countries.

B)The process of translating differences in financial reporting practices across countries.

C)The process of increasing differences in financial reporting practices across countries.

D)The process of allowing different countries to create unique financial reporting practices.

E)The process of creating similar accounting practices according to geographic regions of the world.

A

3

What international organization currently promulgates IFRSs?

A)IASB.

B)IASC.

C)IOSCO.

D)FASB.

E)EU.

A)IASB.

B)IASC.

C)IOSCO.

D)FASB.

E)EU.

A

4

The standard-setting organization in Canada today is the

A)Accounting Standards Fellowship.

B)Accounting Standards Institute.

C)Institute of Chartered Accountants in Canada.

D)Consultative Committee of Accountancy Bodies.

E)Accounting Standards Board.

A)Accounting Standards Fellowship.

B)Accounting Standards Institute.

C)Institute of Chartered Accountants in Canada.

D)Consultative Committee of Accountancy Bodies.

E)Accounting Standards Board.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

5

Which topic is NOT covered under the short-term convergence project?

A)Inventory costs.

B)Asset exchanges.

C)Liability transfers.

D)Accounting changes.

E)Earnings-per-share.

A)Inventory costs.

B)Asset exchanges.

C)Liability transfers.

D)Accounting changes.

E)Earnings-per-share.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

6

Which one of the following countries is in the macro class of accounting systems?

A)Canada.

B)Ireland.

C)United Kingdom.

D)Australia.

E)Japan.

A)Canada.

B)Ireland.

C)United Kingdom.

D)Australia.

E)Japan.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is false regarding providers of financing?

A)There is less pressure to provide accounting information in those countries in which financing is primarily by banks.

B)In countries where capital stock is the primary source of financing,accounting emphasizes the income statement.

C)Disclosures are less extensive in those countries financed primarily by stock.

D)Bankers tend to focus more on solvency and stockholders focus more on profitability.

E)As companies become more dependent on financing by stock,more information is demanded.

A)There is less pressure to provide accounting information in those countries in which financing is primarily by banks.

B)In countries where capital stock is the primary source of financing,accounting emphasizes the income statement.

C)Disclosures are less extensive in those countries financed primarily by stock.

D)Bankers tend to focus more on solvency and stockholders focus more on profitability.

E)As companies become more dependent on financing by stock,more information is demanded.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

8

For Japanese companies,what is the primary source of financing?

A)large banks.

B)the United States stock markets.

C)international stock markets in London.

D)the Tokyo Stock Exchange.

E)governmental loans and subsidies.

A)large banks.

B)the United States stock markets.

C)international stock markets in London.

D)the Tokyo Stock Exchange.

E)governmental loans and subsidies.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

9

In countries where there are requirements for extensive disclosures in accounting reports,

A)accounting practice is designed to provide adequate information to investors and creditors.

B)accounting standards emphasize accounting for high inflation situations.

C)accounting information is prepared to meet the needs of governmental planners.

D)banks are the primary source of financing for companies.

E)the accounting focus is on recent market economy reforms.

A)accounting practice is designed to provide adequate information to investors and creditors.

B)accounting standards emphasize accounting for high inflation situations.

C)accounting information is prepared to meet the needs of governmental planners.

D)banks are the primary source of financing for companies.

E)the accounting focus is on recent market economy reforms.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

10

Which authoritative pronouncement does not make up the International Financial Reporting Standards (IFRSs)?

1)International Financial Reporting Standards issued by the IASB

2)International Accounting standards issued by the IASC adopted by the IASB

3)Intrepretations originated by the International Financial Reporting Interpretations Committee (IFRIC)

4)US Generally Accepted Accounting Principles

A)1 and 4.

B)3 and 4.

C)1,3,and 4.

D)2,3,and 4.

E)1,2,3,and 4.

1)International Financial Reporting Standards issued by the IASB

2)International Accounting standards issued by the IASC adopted by the IASB

3)Intrepretations originated by the International Financial Reporting Interpretations Committee (IFRIC)

4)US Generally Accepted Accounting Principles

A)1 and 4.

B)3 and 4.

C)1,3,and 4.

D)2,3,and 4.

E)1,2,3,and 4.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

11

The U.S.Securities and Exchange Commission (SEC)requires foreign companies that wish to have stocks traded on U.S.stock exchanges to

A)present financial statements which comply with international accounting standards.

B)conform with U.S.GAAP or to present a reconciliation to U.S.GAAP.

C)have a demonstrated need for capital to be used for operations in the U.S.

D)use the U.S.dollar as their reporting currency.

E)become licensed to do business in the U.S.

A)present financial statements which comply with international accounting standards.

B)conform with U.S.GAAP or to present a reconciliation to U.S.GAAP.

C)have a demonstrated need for capital to be used for operations in the U.S.

D)use the U.S.dollar as their reporting currency.

E)become licensed to do business in the U.S.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

12

In countries of Latin America,

A)accounting practice is designed to provide adequate information to investors and creditors.

B)accounting standards emphasize accounting for high inflation situations.

C)banks are the primary source of financing for companies.

D)focuses on recent market economy reforms.

E)accounting information is prepared to meet the needs of governmental planners.

A)accounting practice is designed to provide adequate information to investors and creditors.

B)accounting standards emphasize accounting for high inflation situations.

C)banks are the primary source of financing for companies.

D)focuses on recent market economy reforms.

E)accounting information is prepared to meet the needs of governmental planners.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is not a factor influencing a country's financial reporting practices?

A)Providers of financing.

B)Inflation.

C)Legal system.

D)Gross National Product.

E)Political and economic ties.

A)Providers of financing.

B)Inflation.

C)Legal system.

D)Gross National Product.

E)Political and economic ties.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

14

The financial statements of German and Japanese companies

A)usually overstate earnings.

B)usually overstate assets.

C)tend to underestimate earnings.

D)provide a realistic estimate of earnings.

E)do not include an income statement or the equivalent.

A)usually overstate earnings.

B)usually overstate assets.

C)tend to underestimate earnings.

D)provide a realistic estimate of earnings.

E)do not include an income statement or the equivalent.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements is false regarding a country's legal system?

A)The two major types of legal systems are common law and codified Roman law.

B)Common law originated in the Roman jus civile.

C)Code law countries tend to have more statute governing a wider range of human activity.

D)Accounting law is rather general in code law countries.

E)A nongovernmental organization is more likely to develop in a common law country than in a code law country.

A)The two major types of legal systems are common law and codified Roman law.

B)Common law originated in the Roman jus civile.

C)Code law countries tend to have more statute governing a wider range of human activity.

D)Accounting law is rather general in code law countries.

E)A nongovernmental organization is more likely to develop in a common law country than in a code law country.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not an argument for harmonization of financial reporting practices?

A)Increased ease of investors to evaluate potential investments in foreign securities.

B)Simplification of the evaluation by multinational companies of possible foreign takeover targets.

C)Enable companies to lower their cost of capital.

D)Reduced cost of preparing worldwide consolidated financial statements.

E)Difficulty in accomplishing a common set of standards.

A)Increased ease of investors to evaluate potential investments in foreign securities.

B)Simplification of the evaluation by multinational companies of possible foreign takeover targets.

C)Enable companies to lower their cost of capital.

D)Reduced cost of preparing worldwide consolidated financial statements.

E)Difficulty in accomplishing a common set of standards.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following items is not one of the ten accounting issues most commonly requiring adjustments in foreign reconciliations to U.S.GAAP?

A)Foreign currency translation.

B)Depreciation expense.

C)Deferred taxes.

D)Gain/loss on disposal of assets.

E)Interest expense.

A)Foreign currency translation.

B)Depreciation expense.

C)Deferred taxes.

D)Gain/loss on disposal of assets.

E)Interest expense.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is not a problem caused by diverse accounting practices?

A)Lack of comparability of financial statement between companies in the same country.

B)Preparation of consolidated financial statements.

C)Gaining access to foreign capital markets.

D)Adverse effects when making foreign acquisition decisions.

E)Translating IFRSs into other languages.

A)Lack of comparability of financial statement between companies in the same country.

B)Preparation of consolidated financial statements.

C)Gaining access to foreign capital markets.

D)Adverse effects when making foreign acquisition decisions.

E)Translating IFRSs into other languages.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

19

Which one of the following countries today most likely does not use a function of expense format to report operating income?

A)Bangladesh.

B)Netherlands.

C)Mexico.

D)France.

E)Germany.

A)Bangladesh.

B)Netherlands.

C)Mexico.

D)France.

E)Germany.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

20

The IASB and FASB are working on several joint projects.What is the purpose of the Business Combinations Project?

A)to provide guidance on the application of the purchase method.

B)to enhance the usefulness of information in assessing the financial performance of the reporting enterprise.

C)to develop a common comprehensive standard on revenue recognition.

D)to develop a common conceptual framework that both boards can use as a basis of futures standards.

E)to allow pooling of interests accounting.

A)to provide guidance on the application of the purchase method.

B)to enhance the usefulness of information in assessing the financial performance of the reporting enterprise.

C)to develop a common comprehensive standard on revenue recognition.

D)to develop a common conceptual framework that both boards can use as a basis of futures standards.

E)to allow pooling of interests accounting.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

21

REFERENCE: 11_03

A company acquired a new piece of equipment on January 1,2006 at a cost of $200,000.The equipment is expected to have a useful life of 10 years,a residual value of $20,000 and is being depreciated on a straightline basis.On January 1,2008,the equipment was appraised and determined to have a fair value of $190,000 and a residual value of $25,000 and a remaining useful life of 10 years.

At what amount should the equipment be reported on the December 2008 balance sheet under US GAAP?

A)$200,000

B)$180,000

C)$164,000

D)$160,000

E)$146,000

A company acquired a new piece of equipment on January 1,2006 at a cost of $200,000.The equipment is expected to have a useful life of 10 years,a residual value of $20,000 and is being depreciated on a straightline basis.On January 1,2008,the equipment was appraised and determined to have a fair value of $190,000 and a residual value of $25,000 and a remaining useful life of 10 years.

At what amount should the equipment be reported on the December 2008 balance sheet under US GAAP?

A)$200,000

B)$180,000

C)$164,000

D)$160,000

E)$146,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

22

REFERENCE: Ref.11_04

A company incurs research and development costs of $200,000 in 2008 and relates $50,000 of these costs to development activities subsequent to a point in time when certain criteria have been met that suggest that an intangible asset has been created.

What amount should be recognized as research and development expense in 2008 using IFRSs?

A)$50,000.

B)$150,000.

C)$200,000.

D)$0.

E)$250,000.

A company incurs research and development costs of $200,000 in 2008 and relates $50,000 of these costs to development activities subsequent to a point in time when certain criteria have been met that suggest that an intangible asset has been created.

What amount should be recognized as research and development expense in 2008 using IFRSs?

A)$50,000.

B)$150,000.

C)$200,000.

D)$0.

E)$250,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

23

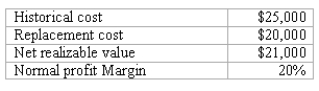

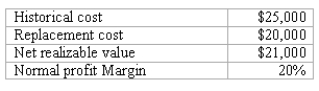

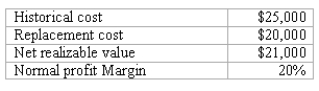

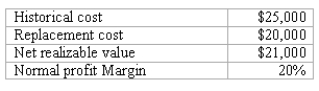

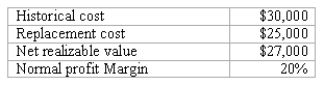

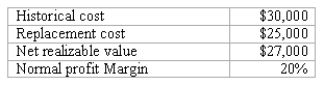

REFERENCE: Ref.11_02

The following information pertains to inventory held by a company on December 31,2008.

What amount of inventory should be reported under IFRSs?

A)$25,000.

B)$27,000.

C)$30,000.

D)$5,000.

E)$2,000.

The following information pertains to inventory held by a company on December 31,2008.

What amount of inventory should be reported under IFRSs?

A)$25,000.

B)$27,000.

C)$30,000.

D)$5,000.

E)$2,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

24

REFERENCE: Ref.11_05

A company sells a building to a bank in 2008 at a gain of $100,000 and immediately leases the building back for period of five years.The lease is accounted for as an operating lease.The building was originally purchased for $200,000 and currently has a book value of $50,000.

What amount should be recognized in 2008 as a gain on the sale using U.S.GAAP?

A)$20,000.

B)$50,000.

C)$100,000.

D)$150,000.

E)$200,000.

A company sells a building to a bank in 2008 at a gain of $100,000 and immediately leases the building back for period of five years.The lease is accounted for as an operating lease.The building was originally purchased for $200,000 and currently has a book value of $50,000.

What amount should be recognized in 2008 as a gain on the sale using U.S.GAAP?

A)$20,000.

B)$50,000.

C)$100,000.

D)$150,000.

E)$200,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

25

REFERENCE: 11_03

A company acquired a new piece of equipment on January 1,2006 at a cost of $200,000.The equipment is expected to have a useful life of 10 years,a residual value of $20,000 and is being depreciated on a straightline basis.On January 1,2008,the equipment was appraised and determined to have a fair value of $190,000 and a residual value of $25,000 and a remaining useful life of 10 years.

At what amount should the equipment be reported on the December 2008 balance sheet under IFRSs alternative treatment?

A)$200,000

B)$190,000

C)$173,500

D)$146,000

E)$140,000

A company acquired a new piece of equipment on January 1,2006 at a cost of $200,000.The equipment is expected to have a useful life of 10 years,a residual value of $20,000 and is being depreciated on a straightline basis.On January 1,2008,the equipment was appraised and determined to have a fair value of $190,000 and a residual value of $25,000 and a remaining useful life of 10 years.

At what amount should the equipment be reported on the December 2008 balance sheet under IFRSs alternative treatment?

A)$200,000

B)$190,000

C)$173,500

D)$146,000

E)$140,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

26

REFERENCE: Ref.11_05

A company sells a building to a bank in 2008 at a gain of $100,000 and immediately leases the building back for period of five years.The lease is accounted for as an operating lease.The building was originally purchased for $200,000 and currently has a book value of $50,000.

What amount should be recognized as a gain in 2008 using IFRSs?

A)$20,000.

B)$50,000.

C)$100,000.

D)$150,000.

E)$200,000.

A company sells a building to a bank in 2008 at a gain of $100,000 and immediately leases the building back for period of five years.The lease is accounted for as an operating lease.The building was originally purchased for $200,000 and currently has a book value of $50,000.

What amount should be recognized as a gain in 2008 using IFRSs?

A)$20,000.

B)$50,000.

C)$100,000.

D)$150,000.

E)$200,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

27

The IASB and FASB are working on several joint projects.What is the purpose of the Performance Reporting Project?

A)to provide guidance on the application of the purchase method.

B)to enhance the usefulness of information in assessing the financial performance of the reporting enterprise.

C)to develop a common comprehensive standard on revenue recognition.

D)to develop a common conceptual framework that both boards can use as a basis of futures standards.

E)to agree upon financial statement titles that will have no differentiation after translation to various languages.

A)to provide guidance on the application of the purchase method.

B)to enhance the usefulness of information in assessing the financial performance of the reporting enterprise.

C)to develop a common comprehensive standard on revenue recognition.

D)to develop a common conceptual framework that both boards can use as a basis of futures standards.

E)to agree upon financial statement titles that will have no differentiation after translation to various languages.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

28

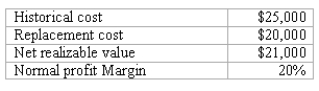

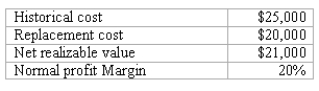

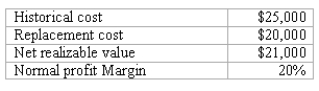

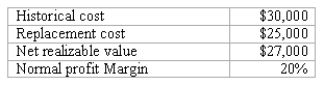

REFERENCE: Ref.11_01

The following information pertains to inventory held by a company upon December 31,2008.

What is the amount of inventory loss shown on the income statement under US GAAP?

A)$1,000.

B)$2,000.

C)$4,000.

D)$5,000.

E)$6,000.

The following information pertains to inventory held by a company upon December 31,2008.

What is the amount of inventory loss shown on the income statement under US GAAP?

A)$1,000.

B)$2,000.

C)$4,000.

D)$5,000.

E)$6,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

29

REFERENCE: Ref.11_01

The following information pertains to inventory held by a company upon December 31,2008.

What is the amount of inventory loss shown on the income statement under IFRSs?

A)$1,000.

B)$2,000.

C)$4,000.

D)$5,000.

E)$6,000.

The following information pertains to inventory held by a company upon December 31,2008.

What is the amount of inventory loss shown on the income statement under IFRSs?

A)$1,000.

B)$2,000.

C)$4,000.

D)$5,000.

E)$6,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

30

REFERENCE: Ref.11_01

The following information pertains to inventory held by a company upon December 31,2008.

What amount of inventory should be reported under US GAAP?

A)$25,000.

B)$21,000.

C)$20,000.

D)$4,000.

E)$5,000.

The following information pertains to inventory held by a company upon December 31,2008.

What amount of inventory should be reported under US GAAP?

A)$25,000.

B)$21,000.

C)$20,000.

D)$4,000.

E)$5,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

31

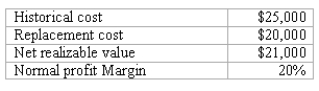

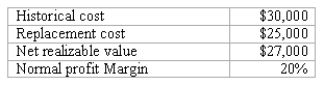

REFERENCE: Ref.11_02

The following information pertains to inventory held by a company on December 31,2008.

What is the amount of inventory loss shown on the income statement under IFRSs?

A)$1,000.

B)$2,000.

C)$3,000.

D)$4,000.

E)$6,000.

The following information pertains to inventory held by a company on December 31,2008.

What is the amount of inventory loss shown on the income statement under IFRSs?

A)$1,000.

B)$2,000.

C)$3,000.

D)$4,000.

E)$6,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

32

REFERENCE: Ref.11_04

A company incurs research and development costs of $200,000 in 2008 and relates $50,000 of these costs to development activities subsequent to a point in time when certain criteria have been met that suggest that an intangible asset has been created.

What amount should be recognized as research and development expense in 2008 using U.S.GAAP?

A)$50,000.

B)$150,000.

C)$200,000.

D)$0.

E)$250,000.

A company incurs research and development costs of $200,000 in 2008 and relates $50,000 of these costs to development activities subsequent to a point in time when certain criteria have been met that suggest that an intangible asset has been created.

What amount should be recognized as research and development expense in 2008 using U.S.GAAP?

A)$50,000.

B)$150,000.

C)$200,000.

D)$0.

E)$250,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

33

REFERENCE: Ref.11_02

The following information pertains to inventory held by a company on December 31,2008.

What is the amount of inventory loss shown on the income statement under US GAAP?

A)$1,000.

B)$2,000.

C)$4,000.

D)$5,000.

E)$6,000.

The following information pertains to inventory held by a company on December 31,2008.

What is the amount of inventory loss shown on the income statement under US GAAP?

A)$1,000.

B)$2,000.

C)$4,000.

D)$5,000.

E)$6,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

34

REFERENCE: Ref.11_02

The following information pertains to inventory held by a company on December 31,2008.

As a result of inventory loss,what is the difference in income between reporting using US GAAP and IFRSs?

A)US GAAP income is $1000 higher.

B)US GAAP income is $2000 lower.

C)IFRSs income is $1000 higher.

D)IFRSs income is $1000 lower.

E)IFRSs income is $2000 higher.

The following information pertains to inventory held by a company on December 31,2008.

As a result of inventory loss,what is the difference in income between reporting using US GAAP and IFRSs?

A)US GAAP income is $1000 higher.

B)US GAAP income is $2000 lower.

C)IFRSs income is $1000 higher.

D)IFRSs income is $1000 lower.

E)IFRSs income is $2000 higher.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

35

REFERENCE: Ref.11_01

The following information pertains to inventory held by a company upon December 31,2008.

What amount of inventory should be reported under IFRSs?

A)$25,000

B)$21,000

C)$20,000

D)$4,000

E)$5,000

The following information pertains to inventory held by a company upon December 31,2008.

What amount of inventory should be reported under IFRSs?

A)$25,000

B)$21,000

C)$20,000

D)$4,000

E)$5,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

36

The IASB and FASB are working on several joint projects.What is the purpose of the Revenue Recognition Project?

A)to provide guidance on the application of the purchase method

B)to enhance the usefulness of information in assessing the financial performance of the reporting enterprise

C)to develop a common comprehensive standard on revenue recognition

D)to develop a common conceptual framework that both boards can use as a basis of futures standards

E)to agree upon financial statement titles that will have no differentiation after translation to various languages.

A)to provide guidance on the application of the purchase method

B)to enhance the usefulness of information in assessing the financial performance of the reporting enterprise

C)to develop a common comprehensive standard on revenue recognition

D)to develop a common conceptual framework that both boards can use as a basis of futures standards

E)to agree upon financial statement titles that will have no differentiation after translation to various languages.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

37

REFERENCE: 11_03

A company acquired a new piece of equipment on January 1,2006 at a cost of $200,000.The equipment is expected to have a useful life of 10 years,a residual value of $20,000 and is being depreciated on a straightline basis.On January 1,2008,the equipment was appraised and determined to have a fair value of $190,000 and a residual value of $25,000 and a remaining useful life of 10 years.

At what amount should the equipment be reported on the December 2008 balance sheet under IFRSs benchmark treatment?

A)$200,000

B)$180,000

C)$164,000

D)$160,000

E)$146,000

A company acquired a new piece of equipment on January 1,2006 at a cost of $200,000.The equipment is expected to have a useful life of 10 years,a residual value of $20,000 and is being depreciated on a straightline basis.On January 1,2008,the equipment was appraised and determined to have a fair value of $190,000 and a residual value of $25,000 and a remaining useful life of 10 years.

At what amount should the equipment be reported on the December 2008 balance sheet under IFRSs benchmark treatment?

A)$200,000

B)$180,000

C)$164,000

D)$160,000

E)$146,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

38

REFERENCE: Ref.11_01

The following information pertains to inventory held by a company upon December 31,2008.

As a result of inventory loss,what is the difference in income between reporting using US GAAP and IFRSs?

A)US GAAP income is $1000 higher.

B)US GAAP income is $2000 lower.

C)IFRSs income is $1000 higher.

D)IFRSs income is $1000 lower.

E)IFRSs income is $5000 higher.

The following information pertains to inventory held by a company upon December 31,2008.

As a result of inventory loss,what is the difference in income between reporting using US GAAP and IFRSs?

A)US GAAP income is $1000 higher.

B)US GAAP income is $2000 lower.

C)IFRSs income is $1000 higher.

D)IFRSs income is $1000 lower.

E)IFRSs income is $5000 higher.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

39

REFERENCE: Ref.11_04

A company incurs research and development costs of $200,000 in 2008 and relates $50,000 of these costs to development activities subsequent to a point in time when certain criteria have been met that suggest that an intangible asset has been created.

As a result of research and development costs,what is the difference in income between reporting using US GAAP and IFRSs in 2008?

A)US GAAP income is $50,000 higher.

B)US GAAP income is $50,000 lower.

C)IFRSs income is $50,000 lower.

D)IFRSs income is $150,000 lower.

E)IFRSs income is $150,000 higher.

A company incurs research and development costs of $200,000 in 2008 and relates $50,000 of these costs to development activities subsequent to a point in time when certain criteria have been met that suggest that an intangible asset has been created.

As a result of research and development costs,what is the difference in income between reporting using US GAAP and IFRSs in 2008?

A)US GAAP income is $50,000 higher.

B)US GAAP income is $50,000 lower.

C)IFRSs income is $50,000 lower.

D)IFRSs income is $150,000 lower.

E)IFRSs income is $150,000 higher.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

40

REFERENCE: Ref.11_02

The following information pertains to inventory held by a company on December 31,2008.

What amount of inventory should be reported under US GAAP?

A)$25,000.

B)$27,000.

C)$30,000.

D)$5,000.

E)$2,000.

The following information pertains to inventory held by a company on December 31,2008.

What amount of inventory should be reported under US GAAP?

A)$25,000.

B)$27,000.

C)$30,000.

D)$5,000.

E)$2,000.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

41

What are the three authoritative pronouncements that make up the International Financial Reporting Standards (IFRSs)?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

42

What are the two major types of legal systems used around the world?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

43

What are the arguments against accounting harmonization?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

44

REFERENCE: Ref.11_05

A company sells a building to a bank in 2008 at a gain of $100,000 and immediately leases the building back for period of five years.The lease is accounted for as an operating lease.The building was originally purchased for $200,000 and currently has a book value of $50,000.

As a result of the sale and leaseback transaction in 2008,what is the difference between income between reporting using US GAAP and IFRSs in 2008?

A)US GAAP income is $80,000 higher.

B)US GAAP income is $100,000 higher.

C)IFRSs income is $50,000 lower.

D)IFRSs income is $100,000 lower.

E)IFRSs income is $80,000 higher.

A company sells a building to a bank in 2008 at a gain of $100,000 and immediately leases the building back for period of five years.The lease is accounted for as an operating lease.The building was originally purchased for $200,000 and currently has a book value of $50,000.

As a result of the sale and leaseback transaction in 2008,what is the difference between income between reporting using US GAAP and IFRSs in 2008?

A)US GAAP income is $80,000 higher.

B)US GAAP income is $100,000 higher.

C)IFRSs income is $50,000 lower.

D)IFRSs income is $100,000 lower.

E)IFRSs income is $80,000 higher.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

45

The major providers of financing in some countries are stockholders,while other countries predominantly use banks as the main financing source.What difference does it make to accounting disclosures in comparing a company from one of each of those countries?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

46

What is the IOSCO?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

47

What are the topics covered under the short-term convergence project?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

48

What are the six key FASB initiatives to further convergence?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

49

What problems are caused by diverse accounting practices?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

50

What are measurement differences in international reporting and what would be an example of a difference?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

51

Why does each country have its own unique set of financial reporting practices?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

52

How did the early IASs obtain support from a sufficient number of board members?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

53

What are the different ways IFRSs can be used?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

54

What are recognition differences in international reporting and what would be an example of a difference?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

55

What are the arguments in favor of accounting harmonization?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

56

What were the major objectives of the Treaty of Rome?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

57

What is meant by harmonization of accounting standards?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

58

Which two EU directives have helped harmonize accounting standards?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck