Deck 16: The Monetary and Financial System

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/123

Play

Full screen (f)

Deck 16: The Monetary and Financial System

1

Comparison of the price of a cup of coffee and the price of a glass of juice represents the use of money as:

A) a medium of exchange.

B) a unit of account.

C) a store of value.

D) a leverage of your income.

A) a medium of exchange.

B) a unit of account.

C) a store of value.

D) a leverage of your income.

B

2

Barter is:

A) the indirect exchange of a service for money.

B) the direct exchange of a dollar for an orange.

C) the direct exchange of an apple for an orange.

D) the direct exchange of coins for a pizza.

A) the indirect exchange of a service for money.

B) the direct exchange of a dollar for an orange.

C) the direct exchange of an apple for an orange.

D) the direct exchange of coins for a pizza.

C

3

Credit cards are:

A) M1 money.

B) M2 money.

C) M3 money.

D) not money.

A) M1 money.

B) M2 money.

C) M3 money.

D) not money.

D

4

One hundred dollars on deposit in a cheque account represents the use of money as a:

A) medium of exchange.

B) store of value.

C) unit of account.

D) coincident exchange.

A) medium of exchange.

B) store of value.

C) unit of account.

D) coincident exchange.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

5

Money can:

A) remove a problem of increasing wants.

B) create a problem of coincidence of wants.

C) remove the problem of coincidence of wants.

D) create a problem of reducing wants.

A) remove a problem of increasing wants.

B) create a problem of coincidence of wants.

C) remove the problem of coincidence of wants.

D) create a problem of reducing wants.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

6

Comparing how many dollars it takes to run your car each year to annual earnings on a job, instead of recording costs in terms of litres of petrol and oil represents the use of money as:

A) a means of payment.

B) a unit of account.

C) a store of purchasing power.

D) a form of plastic money.

A) a means of payment.

B) a unit of account.

C) a store of purchasing power.

D) a form of plastic money.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

7

Fiat money is paper money:

A) backed dollar for dollar by gold.

B) backed dollar for dollar by silver.

C) produced by an Italian car manufacturer.

D) which is not backed by or convertible into any good.

A) backed dollar for dollar by gold.

B) backed dollar for dollar by silver.

C) produced by an Italian car manufacturer.

D) which is not backed by or convertible into any good.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is the best description of fiat money?

A) Coins made of gold and silver.

B) Paper money that can be redeemed for gold or silver.

C) Legal tender that has no intrinsic value.

D) Cheque accounts and debit cards.

A) Coins made of gold and silver.

B) Paper money that can be redeemed for gold or silver.

C) Legal tender that has no intrinsic value.

D) Cheque accounts and debit cards.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following could not serve as commodity money?

A) Gold.

B) Cattle.

C) Sugar.

D) Paper money that is not backed up by a valuable commodity.

A) Gold.

B) Cattle.

C) Sugar.

D) Paper money that is not backed up by a valuable commodity.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

10

Which one is not a primary function of money?

A) Medium of exchange.

B) Unit of exchange.

C) Unit of account.

D) Store value.

A) Medium of exchange.

B) Unit of exchange.

C) Unit of account.

D) Store value.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

11

The key property of money is that it is:

A) always desired.

B) fluent.

C) liquid.

D) expensive.

A) always desired.

B) fluent.

C) liquid.

D) expensive.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements is false?

A) Round stones with holes in the centre can serve as money.

B) Money eases the process of exchanging goods and services in a modern economy.

C) Money serves as a measure of value only when it is backed by gold or silver.

D) Money is used as a measure of the relative value of goods and services in an economy.

A) Round stones with holes in the centre can serve as money.

B) Money eases the process of exchanging goods and services in a modern economy.

C) Money serves as a measure of value only when it is backed by gold or silver.

D) Money is used as a measure of the relative value of goods and services in an economy.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

13

If every person is willing to accept money rather than goods and services for payment, money serves as a:

A) medium of exchange.

B) unit of account.

C) store of value.

D) coincident exchange.

A) medium of exchange.

B) unit of account.

C) store of value.

D) coincident exchange.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

14

The statement that Computech's profits totalled $500 million last year represents the use of money as a:

A) medium of exchange.

B) store of value.

C) unit of account.

D) means of coincidence.

A) medium of exchange.

B) store of value.

C) unit of account.

D) means of coincidence.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

15

The currency of Australia is:

A) backed dollar for dollar by gold.

B) backed by a gold cover of 50 per cent.

C) not backed by any precious metal.

D) backed by the government's silver reserves.

A) backed dollar for dollar by gold.

B) backed by a gold cover of 50 per cent.

C) not backed by any precious metal.

D) backed by the government's silver reserves.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

16

The primary functions of money are:

A) velocity, liquidity and transactions.

B) speculative demand, measure of value and precautionary demand.

C) a medium of exchange, a measure of value and a store of value.

D) a store of value, heterogeneity and a medium of exchange.

A) velocity, liquidity and transactions.

B) speculative demand, measure of value and precautionary demand.

C) a medium of exchange, a measure of value and a store of value.

D) a store of value, heterogeneity and a medium of exchange.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

17

The characteristics that money should have include:

A) portability, durability and flexibility.

B) durability, flexibility and stability.

C) durability, portability and homogeneity.

D) scarcity, portability and divisibility.

A) portability, durability and flexibility.

B) durability, flexibility and stability.

C) durability, portability and homogeneity.

D) scarcity, portability and divisibility.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

18

Money is a mechanism for transforming income earned in the present into:

A) past experience.

B) a sacred treasure.

C) future purchases.

D) a unit of selling capacity.

A) past experience.

B) a sacred treasure.

C) future purchases.

D) a unit of selling capacity.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following items does not provide a store of value?

A) Currency.

B) Bonds.

C) Credit cards.

D) Gold.

A) Currency.

B) Bonds.

C) Credit cards.

D) Gold.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

20

Precious metals and cigarettes are the example of:

A) gold-exempt money.

B) non-backed money.

C) paper money.

D) commodity money.

A) gold-exempt money.

B) non-backed money.

C) paper money.

D) commodity money.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

21

The M1 definition of the money supply includes currency plus:

A) cheque account deposits and savings accounts.

B) cheque account deposits and credit cards.

C) cheque account deposits and debit cards.

D) cheque account deposits and traveller's cheques.

A) cheque account deposits and savings accounts.

B) cheque account deposits and credit cards.

C) cheque account deposits and debit cards.

D) cheque account deposits and traveller's cheques.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

22

People learn to hold a specific quantity of money for their groceries, theatre tickets, petrol, clothes, film and other items they habitually purchase. This behaviour is representative of the:

A) precautionary demand.

B) speculative demand.

C) transactions demand.

D) volatility demand.

A) precautionary demand.

B) speculative demand.

C) transactions demand.

D) volatility demand.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

23

One reason that people hold money is to pay for unexpected car repairs and other unpredictable expenses. This motive for holding money is called:

A) transactions demand.

B) precautionary demand.

C) speculative demand.

D) non-cyclical demand.

A) transactions demand.

B) precautionary demand.

C) speculative demand.

D) non-cyclical demand.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is true?

A) The speculative demand for money at possible interest rates gives the demand for money curve its upward slope.

B) There is a direct relationship between the quantity of money demanded and the interest rate.

C) According to the quantity theory of money, any change in the money supply will have no effect on the price level.

D) People hold money to pay unpredictable expenses or against 'rainy days'.

A) The speculative demand for money at possible interest rates gives the demand for money curve its upward slope.

B) There is a direct relationship between the quantity of money demanded and the interest rate.

C) According to the quantity theory of money, any change in the money supply will have no effect on the price level.

D) People hold money to pay unpredictable expenses or against 'rainy days'.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

25

The precautionary demand for money:

A) varies inversely with the income level.

B) varies inversely with the price level.

C) is used as an insurance agent against unexpected needs.

D) states that nominal income must exceed real income.

A) varies inversely with the income level.

B) varies inversely with the price level.

C) is used as an insurance agent against unexpected needs.

D) states that nominal income must exceed real income.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

26

As the interest rate decreases, the quantity of money people will hold:

A) decreases.

B) increases.

C) stays the same.

D) rises and then falls.

A) decreases.

B) increases.

C) stays the same.

D) rises and then falls.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

27

Three important motives for people to hold money and forego earning interest payments are:

A) the opportunity cost motive, precautionary motive and speculative motive.

B) the transaction motive, precautionary motive and speculative motive.

C) the transaction motive, safety motive and speculative motive.

D) the transaction motive, precautionary motive and special motive.

A) the opportunity cost motive, precautionary motive and speculative motive.

B) the transaction motive, precautionary motive and speculative motive.

C) the transaction motive, safety motive and speculative motive.

D) the transaction motive, precautionary motive and special motive.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

28

Other things being equal, the quantity of money that people wish to hold can be expected to:

A) increase as the interest rate increases.

B) increase as the interest rate decreases.

C) decrease as real GDP increases.

D) decrease as the fixed interest deposits decrease.

A) increase as the interest rate increases.

B) increase as the interest rate decreases.

C) decrease as real GDP increases.

D) decrease as the fixed interest deposits decrease.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is not counted as part of M1?

A) Silver coins.

B) Reserve Bank notes or 'paper money'.

C) Passbook savings deposits.

D) Cheque account deposits.

A) Silver coins.

B) Reserve Bank notes or 'paper money'.

C) Passbook savings deposits.

D) Cheque account deposits.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

30

The quantity of money demanded to satisfy transaction needs:

A) is intended for unexpected expenditures.

B) increases with the level of real GDP.

C) decreases with the level of real GDP.

D) is unrelated to either national income or the interest rate.

A) is intended for unexpected expenditures.

B) increases with the level of real GDP.

C) decreases with the level of real GDP.

D) is unrelated to either national income or the interest rate.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

31

Keynes called the money that people hold to make routine day-to-day purchases the:

A) transactions demand for holding money.

B) precautionary demand for spending money.

C) speculative demand for holding money.

D) store of value demand for holding money.

A) transactions demand for holding money.

B) precautionary demand for spending money.

C) speculative demand for holding money.

D) store of value demand for holding money.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

32

Other things being equal, an increase in the rate of interest causes a/an:

A) upward movement along the demand for money curve.

B) downward movement along the demand for money curve.

C) rightward shift of the demand for money curve.

D) leftward shift of the demand for money curve.

A) upward movement along the demand for money curve.

B) downward movement along the demand for money curve.

C) rightward shift of the demand for money curve.

D) leftward shift of the demand for money curve.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

33

The precautionary demand for money is the demand for money:

A) for normal transactions purposes.

B) for normal investment purposes.

C) for special stock purchases.

D) to cover unexpected events.

A) for normal transactions purposes.

B) for normal investment purposes.

C) for special stock purchases.

D) to cover unexpected events.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

34

Fiat money is:

A) commodity money issued by the central bank that does not have intrinsic value.

B) paper money issued by the central bank that does have intrinsic value.

C) paper money issued by the central bank.

D) paper money issued by the central bank that does not have intrinsic value.

A) commodity money issued by the central bank that does not have intrinsic value.

B) paper money issued by the central bank that does have intrinsic value.

C) paper money issued by the central bank.

D) paper money issued by the central bank that does not have intrinsic value.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

35

The speculative demand for money shows the relationship between money demand and:

A) income levels.

B) interest rates.

C) price levels.

D) investment rates.

A) income levels.

B) interest rates.

C) price levels.

D) investment rates.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

36

When interest rates rise, the quantity demanded of money held for the:

A) speculative demand rises.

B) precautionary demand rises.

C) transactions demand falls.

D) speculative demand falls.

A) speculative demand rises.

B) precautionary demand rises.

C) transactions demand falls.

D) speculative demand falls.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

37

Which type of demand for money causes the demand for money curve to slope downward?

A) Speculative demand.

B) Precautionary demand.

C) Transactions demand.

D) Foreign-exchange demand.

A) Speculative demand.

B) Precautionary demand.

C) Transactions demand.

D) Foreign-exchange demand.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

38

Fiat money:

A) is accepted because of the market value of the material.

B) has intrinsic worth.

C) does not have intrinsic worth.

D) is accepted by law.

A) is accepted because of the market value of the material.

B) has intrinsic worth.

C) does not have intrinsic worth.

D) is accepted by law.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

39

Keynes called the money that people hold in order to buy bonds, stocks or other non-money financial assets the:

A) transactions demand for spending money.

B) precautionary demand for holding money.

C) speculative demand for holding money.

D) unit of account demand for holding money.

A) transactions demand for spending money.

B) precautionary demand for holding money.

C) speculative demand for holding money.

D) unit of account demand for holding money.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

40

The M1 money supply is defined as the sum of currency, traveller's cheques and:

A) cheque account deposits.

B) Treasury bonds.

C) savings accounts.

D) long-time deposits.

A) cheque account deposits.

B) Treasury bonds.

C) savings accounts.

D) long-time deposits.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

41

Assume a fixed demand for money curve and the RBA increases the money supply. In response, people will:

A) sell bonds, thus driving up the interest rate.

B) sell bonds, thus driving down the interest rate.

C) buy bonds, thus driving up the interest rate.

D) buy bonds, thus driving down the interest rate.

A) sell bonds, thus driving up the interest rate.

B) sell bonds, thus driving down the interest rate.

C) buy bonds, thus driving up the interest rate.

D) buy bonds, thus driving down the interest rate.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

42

When the interest rate falls:

A) the opportunity cost of holding money rises.

B) people shift out of holding interest-yielding bonds into holding money.

C) the quantity of money people will hold decreases.

D) investment spending decreases.

A) the opportunity cost of holding money rises.

B) people shift out of holding interest-yielding bonds into holding money.

C) the quantity of money people will hold decreases.

D) investment spending decreases.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

43

If people attempt to sell bonds because of excess money demand, then the interest rate will:

A) rise.

B) fall.

C) remain unchanged.

D) react unpredictably.

A) rise.

B) fall.

C) remain unchanged.

D) react unpredictably.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

44

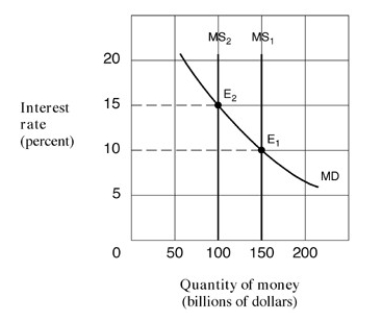

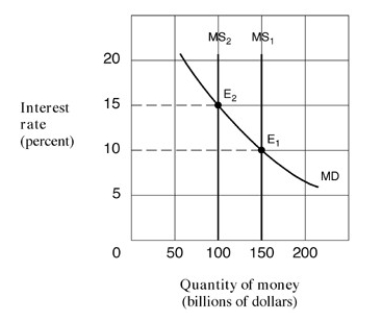

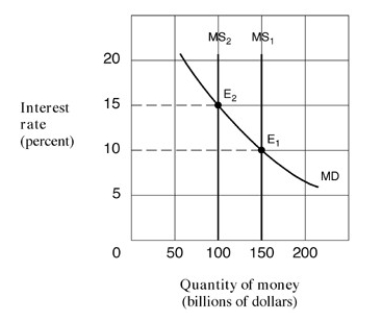

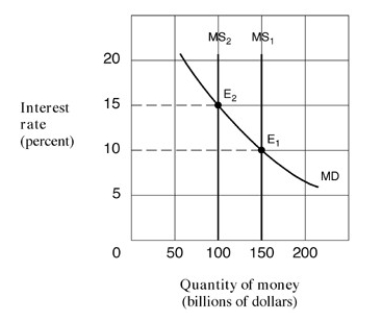

Narrbegin Exhibit 15.1 Money market demand and supply curves

-Starting from an equilibrium at E1 in Exhibit 15.1, a leftward shift of the money supply curve from MS1 to MS2 would cause an excess:

A) demand for money, leading people to sell bonds.

B) demand for money, leading people to buy bonds.

C) supply of money, leading people to sell bonds.

D) supply of money, leading people to buy bonds.

-Starting from an equilibrium at E1 in Exhibit 15.1, a leftward shift of the money supply curve from MS1 to MS2 would cause an excess:

A) demand for money, leading people to sell bonds.

B) demand for money, leading people to buy bonds.

C) supply of money, leading people to sell bonds.

D) supply of money, leading people to buy bonds.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

45

Assume the RBA decreases the money supply and the demand for money curve is fixed. In response, people will:

A) sell bonds, thus driving up the interest rate.

B) buy bonds, thus driving down the interest rate.

C) buy bonds, thus driving up the interest rate.

D) sell bonds, thus driving down the interest rate.

A) sell bonds, thus driving up the interest rate.

B) buy bonds, thus driving down the interest rate.

C) buy bonds, thus driving up the interest rate.

D) sell bonds, thus driving down the interest rate.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

46

The relationship between bond prices and the interest rate is:

A) an undefined relationship.

B) a steady relationship.

C) a direct relationship.

D) an inverse relationship.

A) an undefined relationship.

B) a steady relationship.

C) a direct relationship.

D) an inverse relationship.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

47

In Keynes' view, an excess quantity of money demanded causes people to:

A) sell bonds pushing the interest rate up.

B) buy bonds pushing the interest rate down.

C) buy bonds pushing the interest rate up.

D) increase speculative balances.

A) sell bonds pushing the interest rate up.

B) buy bonds pushing the interest rate down.

C) buy bonds pushing the interest rate up.

D) increase speculative balances.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

48

If people are selling bonds, it causes the interest rate to:

A) rise and MD > MS.

B) fall and MS > MD.

C) fall and MD = MS.

D) The demand for money has fallen.

A) rise and MD > MS.

B) fall and MS > MD.

C) fall and MD = MS.

D) The demand for money has fallen.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

49

Assume the demand for money curve is stationary and the RBA increases the money supply. The result is that people:

A) increase the supply of bonds, thus driving up the interest rate.

B) increase the supply of bonds, thus driving down the interest rate.

C) increase the demand for bonds, thus driving up the interest rate.

D) increase the demand for bonds, thus driving down the interest rate.

A) increase the supply of bonds, thus driving up the interest rate.

B) increase the supply of bonds, thus driving down the interest rate.

C) increase the demand for bonds, thus driving up the interest rate.

D) increase the demand for bonds, thus driving down the interest rate.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

50

Assume a fixed demand for money curve and the RBA decreases the money supply. In response, people will:

A) sell bonds, thus driving up the interest rate.

B) sell bonds, thus driving down the interest rate.

C) buy bonds, thus driving up the interest rate.

D) buy bonds, thus driving down the interest rate.

A) sell bonds, thus driving up the interest rate.

B) sell bonds, thus driving down the interest rate.

C) buy bonds, thus driving up the interest rate.

D) buy bonds, thus driving down the interest rate.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

51

Suppose you transfer $1000 from your cheque account to your savings account. How does this action affect the M1 and M3 money supplies?

A) M1 and M3 are both unchanged.

B) M1 falls by $1000 and M3 rises by $1000.

C) M1 is unchanged and M3 rises by $1000.

D) M1 falls by $1000 and M3 is unchanged.

A) M1 and M3 are both unchanged.

B) M1 falls by $1000 and M3 rises by $1000.

C) M1 is unchanged and M3 rises by $1000.

D) M1 falls by $1000 and M3 is unchanged.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

52

Expansionary monetary policy is:

A) reducing interest rates by increasing money supply.

B) increasing interest rates by increasing money supply.

C) reducing interest rates by decreasing money supply.

D) increasing interest rates by decreasing money supply.

A) reducing interest rates by increasing money supply.

B) increasing interest rates by increasing money supply.

C) reducing interest rates by decreasing money supply.

D) increasing interest rates by decreasing money supply.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

53

Currency is:

A) the less liquid of all financial assets.

B) the sum of M1 and M3.

C) the sum of M3 and the non-deposit borrowings from the private sector by AFIs.

D) the sum of coins and paper money.

A) the less liquid of all financial assets.

B) the sum of M1 and M3.

C) the sum of M3 and the non-deposit borrowings from the private sector by AFIs.

D) the sum of coins and paper money.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

54

Assume a fixed demand for money curve and the RBA increases the money supply. The result is a temporary:

A) excess quantity of money demanded.

B) excess quantity of money supplied.

C) new equilibrium interest rate.

D) decrease in the demand for loans.

A) excess quantity of money demanded.

B) excess quantity of money supplied.

C) new equilibrium interest rate.

D) decrease in the demand for loans.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

55

If there is excess money supply in the economy, which of the following is most likely to occur?

A) People will buy bonds, raising bond prices and decreasing interest rates.

B) People will buy bonds, raising bond prices and increasing interest rates.

C) People will sell bonds, raising bond prices and decreasing interest rates.

D) People will sell bonds, decreasing bond prices and decreasing the interest rate.

A) People will buy bonds, raising bond prices and decreasing interest rates.

B) People will buy bonds, raising bond prices and increasing interest rates.

C) People will sell bonds, raising bond prices and decreasing interest rates.

D) People will sell bonds, decreasing bond prices and decreasing the interest rate.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following falls when bond prices rise?

A) Stock prices.

B) Interest rates.

C) Money demand.

D) Money supply.

A) Stock prices.

B) Interest rates.

C) Money demand.

D) Money supply.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

57

People react to an excess supply of money by:

A) selling bonds, thus driving up the interest rate.

B) selling bonds, thus driving down the interest rate.

C) buying bonds, thus driving up the interest rate.

D) buying bonds, thus driving down the interest rate.

A) selling bonds, thus driving up the interest rate.

B) selling bonds, thus driving down the interest rate.

C) buying bonds, thus driving up the interest rate.

D) buying bonds, thus driving down the interest rate.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

58

The expansionary and contractionary policies are the:

A) monetary policies.

B) current policies.

C) fiscal policies.

D) relevant policies.

A) monetary policies.

B) current policies.

C) fiscal policies.

D) relevant policies.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

59

Monetary Base is:

A) the most popular of all financial assets.

B) the least liquid of all financial assets.

C) the most liquid of all financial assets.

D) difficult to sustain.

A) the most popular of all financial assets.

B) the least liquid of all financial assets.

C) the most liquid of all financial assets.

D) difficult to sustain.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

60

The money supply known as M3:

A) includes large-denomination time deposits.

B) excludes interest-earning cheque accounts in savings and loans.

C) does not include money-market mutual accounts.

D) includes savings accounts and small-denomination time deposits.

A) includes large-denomination time deposits.

B) excludes interest-earning cheque accounts in savings and loans.

C) does not include money-market mutual accounts.

D) includes savings accounts and small-denomination time deposits.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

61

According to Keynesian economists, which of the following is not a consequence of increasing the money supply?

A) A lower interest rate.

B) Greater investment.

C) Lower real GDP.

D) Higher real GDP.

A) A lower interest rate.

B) Greater investment.

C) Lower real GDP.

D) Higher real GDP.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

62

The expansionary monetary policy can be seen as an:

A) outward shift in the aggregate demand curve.

B) inward shift in the aggregate supply curve.

C) outward shift in the aggregate supply curve.

D) inward shift in the aggregate demand curve.

A) outward shift in the aggregate demand curve.

B) inward shift in the aggregate supply curve.

C) outward shift in the aggregate supply curve.

D) inward shift in the aggregate demand curve.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

63

If the economy is inflationary, the RBA would most likely:

A) encourage banks to provide loans by buying government securities.

B) encourage banks to provide loans by raising the cash rate.

C) encourage banks to provide loans by selling government securities.

D) restrict bank lending by selling government securities.

A) encourage banks to provide loans by buying government securities.

B) encourage banks to provide loans by raising the cash rate.

C) encourage banks to provide loans by selling government securities.

D) restrict bank lending by selling government securities.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

64

A decrease in the money supply:

A) raises the interest rate, causing an increase in investment and an increase in GDP.

B) lowers the interest rate, causing an increase in investment and an increase in GDP.

C) raises the interest rate, causing a decrease in investment and a decrease in GDP.

D) lowers the interest rate, causing a decrease in investment and an increase in GDP.

A) raises the interest rate, causing an increase in investment and an increase in GDP.

B) lowers the interest rate, causing an increase in investment and an increase in GDP.

C) raises the interest rate, causing a decrease in investment and a decrease in GDP.

D) lowers the interest rate, causing a decrease in investment and an increase in GDP.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

65

According to Keynesians, an increase in the money supply will:

A) decrease the interest rate and increase investment, aggregate demand, prices, real GDP and employment.

B) decrease the interest rate and decrease investment, aggregate demand, prices, real GDP and employment.

C) increase the interest rate and decrease investment, aggregate demand, prices, real GDP and employment.

D) only increases prices.

A) decrease the interest rate and increase investment, aggregate demand, prices, real GDP and employment.

B) decrease the interest rate and decrease investment, aggregate demand, prices, real GDP and employment.

C) increase the interest rate and decrease investment, aggregate demand, prices, real GDP and employment.

D) only increases prices.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

66

According to Keynesians, an increase in the money supply will:

A) decrease the interest rate and increase investment and aggregate demand, prices, real GDP and employment.

B) decrease the interest rate and decrease investment and aggregate demand, prices, real GDP and employment.

C) increase the interest rate and decrease investment and aggregate demand, prices, real GDP and employment.

D) only increase prices.

A) decrease the interest rate and increase investment and aggregate demand, prices, real GDP and employment.

B) decrease the interest rate and decrease investment and aggregate demand, prices, real GDP and employment.

C) increase the interest rate and decrease investment and aggregate demand, prices, real GDP and employment.

D) only increase prices.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

67

If there is a recession, the RBA would most likely:

A) encourage banks to provide loans by lowering the cash rate.

B) encourage banks to provide loans by raising the cash rate.

C) restrict bank lending by lowering the cash rate.

D) restrict bank lending by raising the cash rate.

A) encourage banks to provide loans by lowering the cash rate.

B) encourage banks to provide loans by raising the cash rate.

C) restrict bank lending by lowering the cash rate.

D) restrict bank lending by raising the cash rate.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

68

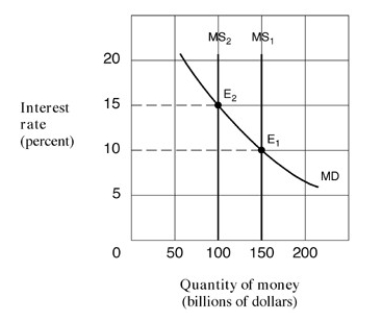

Narrbegin Exhibit 15.1 Money market demand and supply curves

-As shown in Exhibit 15.1, assume the money supply curve shifts leftward from MS1 to MS2 and the economy is operating along the intermediate segment of the aggregate supply curve. The result will be a:

A) higher investment, lower real GDP and lower price level.

B) lower investment, lower real GDP and lower price level.

C) higher investment, higher real GDP and higher price level.

D) higher interest rate and no effect on real GDP or the price level.

-As shown in Exhibit 15.1, assume the money supply curve shifts leftward from MS1 to MS2 and the economy is operating along the intermediate segment of the aggregate supply curve. The result will be a:

A) higher investment, lower real GDP and lower price level.

B) lower investment, lower real GDP and lower price level.

C) higher investment, higher real GDP and higher price level.

D) higher interest rate and no effect on real GDP or the price level.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

69

If the economy is inflationary, the RBA would most likely:

A) encourage banks to provide loans by lowering the cash rate.

B) encourage banks to provide loans by raising the cash rate.

C) restrict bank lending by lowering the cash rate.

D) restrict bank lending by raising the cash rate.

A) encourage banks to provide loans by lowering the cash rate.

B) encourage banks to provide loans by raising the cash rate.

C) restrict bank lending by lowering the cash rate.

D) restrict bank lending by raising the cash rate.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

70

The monetary policy transmission mechanism describes:

A) how a regulatory policy change might be transmitted into the economy affecting market structure.

B) how an export policy change might be transmitted into the economy affecting spending multipliers.

C) how a monetary policy change might be transmitted into the economy affecting prices, output and employment.

D) how a competition policy change might be transmitted into the economy affecting prices, output and employment.

A) how a regulatory policy change might be transmitted into the economy affecting market structure.

B) how an export policy change might be transmitted into the economy affecting spending multipliers.

C) how a monetary policy change might be transmitted into the economy affecting prices, output and employment.

D) how a competition policy change might be transmitted into the economy affecting prices, output and employment.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

71

The effect of expansionary monetary policy on aggregate demand is as follows:

A) the decrease in money supply causes the interest rates to drop and investment and production to increase.

B) the increase in money supply causes the interest rates to grow and investment and production to increase.

C) the increase in money supply causes the interest rates to drop and investment and production to increase.

D) the increase in money supply causes the interest rates to drop and investment and production to decrease.

A) the decrease in money supply causes the interest rates to drop and investment and production to increase.

B) the increase in money supply causes the interest rates to grow and investment and production to increase.

C) the increase in money supply causes the interest rates to drop and investment and production to increase.

D) the increase in money supply causes the interest rates to drop and investment and production to decrease.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

72

The monetary policy transmission mechanism explains changes in:

A) monetary policy, money supply, interest rate, investment, aggregate demand, prices, real GDP and employment.

B) monetary policy, money demand, interest rate, investment, aggregate supply, prices, real GDP and employment.

C) monetary policy, money supply, interest rate, research and development, aggregate demand, prices, real GDP and employment.

D) monetary policy, money supply, interest rate, investment, aggregate demand, prices, nominal GDP and employment.

A) monetary policy, money supply, interest rate, investment, aggregate demand, prices, real GDP and employment.

B) monetary policy, money demand, interest rate, investment, aggregate supply, prices, real GDP and employment.

C) monetary policy, money supply, interest rate, research and development, aggregate demand, prices, real GDP and employment.

D) monetary policy, money supply, interest rate, investment, aggregate demand, prices, nominal GDP and employment.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

73

The minimum liquidity requirement is the:

A) actual amount of reserves that banks must hold.

B) excess amount of reserves that a bank must hold.

C) minimum amount of reserves the RBA requires a bank to hold.

D) total amount of reserves that banks hold at all times.

A) actual amount of reserves that banks must hold.

B) excess amount of reserves that a bank must hold.

C) minimum amount of reserves the RBA requires a bank to hold.

D) total amount of reserves that banks hold at all times.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

74

The lower interest rates:

A) stimulate investment and consumer durable demand and this increases aggregate

Demand.

B) discourage investment and consumer durable demand and this increases aggregate

Demand.

C) stimulate investment and consumer durable demand and this decreases aggregate

Demand.

D) discourage investment and consumer durable demand and this decreases aggregate

Demand.

A) stimulate investment and consumer durable demand and this increases aggregate

Demand.

B) discourage investment and consumer durable demand and this increases aggregate

Demand.

C) stimulate investment and consumer durable demand and this decreases aggregate

Demand.

D) discourage investment and consumer durable demand and this decreases aggregate

Demand.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

75

Keynesian economists argue that monetary policy works, through its effects on:

A) budget deficits and trade deficits.

B) price and wage flexibility.

C) interest rates and investment.

D) the spending and money multipliers.

A) budget deficits and trade deficits.

B) price and wage flexibility.

C) interest rates and investment.

D) the spending and money multipliers.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

76

Assume that Paris First National Bank is a thriving bank with deposits of $20 million. If the minimum liquidity requirement is 20 per cent and the bank is fully loaned out, the bank will keep what amount of required reserves?

A) $2 million.

B) $4 million.

C) $10 million.

D) $16 million.

A) $2 million.

B) $4 million.

C) $10 million.

D) $16 million.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

77

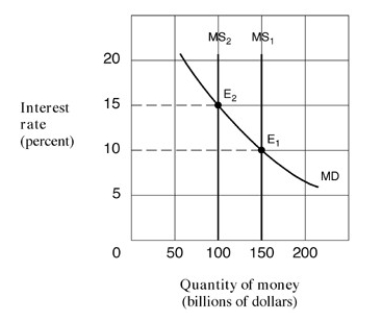

Narrbegin Exhibit 15.1 Money market demand and supply curves

-Beginning from an equilibrium at E1 in Exhibit 15.1, a decrease in the money supply from $150 billion to $100 billion causes people to:

A) sell bonds and drive the price of bonds down.

B) sell bonds and drive the price of bonds up.

C) buy bonds and drive the price of bonds down.

D) buy bonds and drive the price of bonds up.

-Beginning from an equilibrium at E1 in Exhibit 15.1, a decrease in the money supply from $150 billion to $100 billion causes people to:

A) sell bonds and drive the price of bonds down.

B) sell bonds and drive the price of bonds up.

C) buy bonds and drive the price of bonds down.

D) buy bonds and drive the price of bonds up.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

78

A decrease in the money supply:

A) lowers the interest rate, causing a decrease in investment and a decrease in GDP.

B) lowers the interest rate, causing a decrease in investment and an increase in GDP.

C) raises the interest rate, causing an increase in investment and a decrease in GDP.

D) raises the interest rate, causing an increase in investment and an increase in GDP.

A) lowers the interest rate, causing a decrease in investment and a decrease in GDP.

B) lowers the interest rate, causing a decrease in investment and an increase in GDP.

C) raises the interest rate, causing an increase in investment and a decrease in GDP.

D) raises the interest rate, causing an increase in investment and an increase in GDP.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

79

Using the aggregate supply and demand model, assume the economy is operating along the intermediate portion of the aggregate supply curve. An increase in the money supply will increase the price level and:

A) lower both the interest rate and real GDP.

B) raise both the interest rate and nominal GDP.

C) lower the interest rate and raise GDP.

D) raise the interest rate and lower real GDP.

A) lower both the interest rate and real GDP.

B) raise both the interest rate and nominal GDP.

C) lower the interest rate and raise GDP.

D) raise the interest rate and lower real GDP.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

80

The Reserve Bank of Australia:

A) is America's central bank.

B) is Australia's central bank.

C) is Australia's only bank.

D) is Australia's best bank.

A) is America's central bank.

B) is Australia's central bank.

C) is Australia's only bank.

D) is Australia's best bank.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck