Deck 9: Consolidation Ownership Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 9: Consolidation Ownership Issues

1

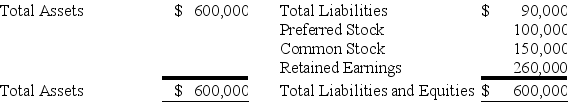

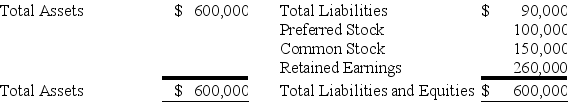

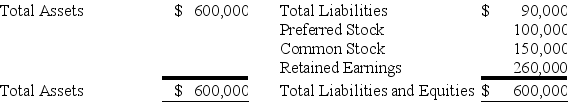

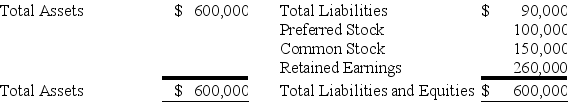

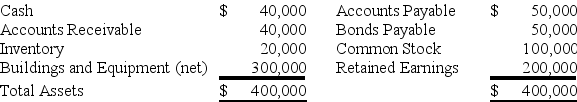

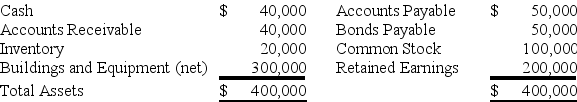

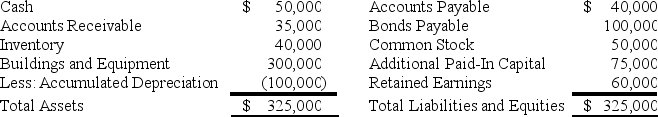

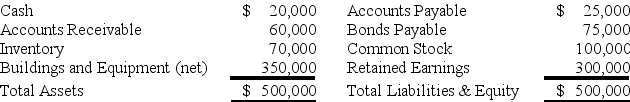

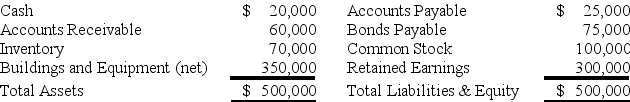

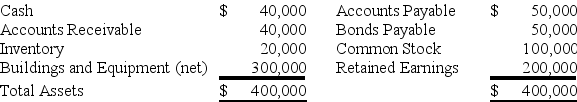

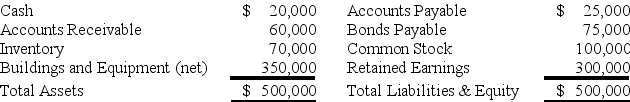

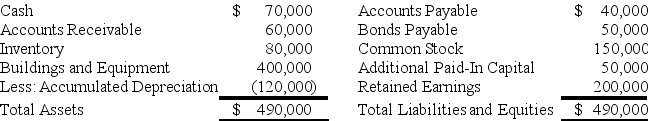

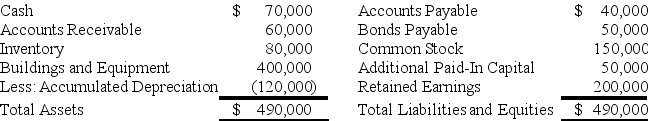

Protective Corporation acquired 70 percent of the common shares and 60 percent of the preferred shares of Safety Corporation at underlying book value on January 1,20X6.At that date,the fair value of the noncontrolling interest in Safety's common stock was equal to 30 percent of the book value of its common stock.Safety's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

Based on the preceding information,what will be the amount of income to be assigned to the noncontrolling interest in the 20X6 consolidated income statement?

A)$3,200

B)$18,400

C)$21,600

D)$24,800

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.Based on the preceding information,what will be the amount of income to be assigned to the noncontrolling interest in the 20X6 consolidated income statement?

A)$3,200

B)$18,400

C)$21,600

D)$24,800

D

2

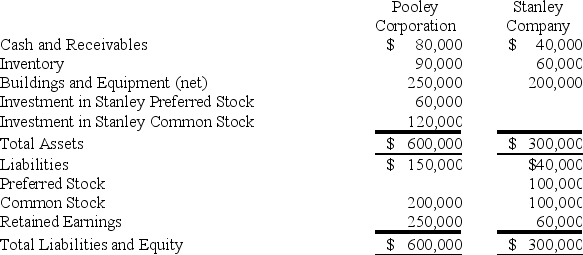

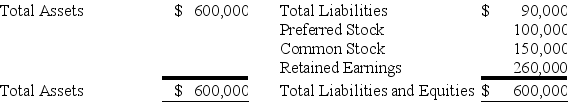

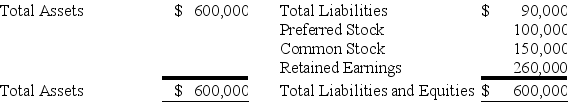

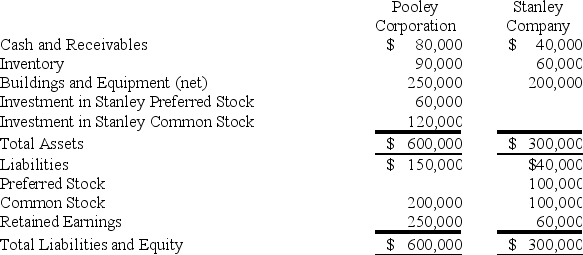

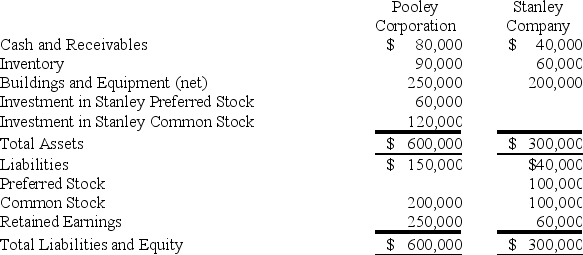

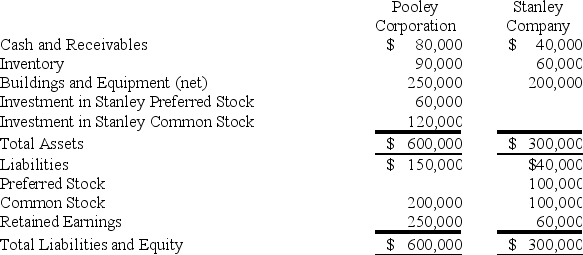

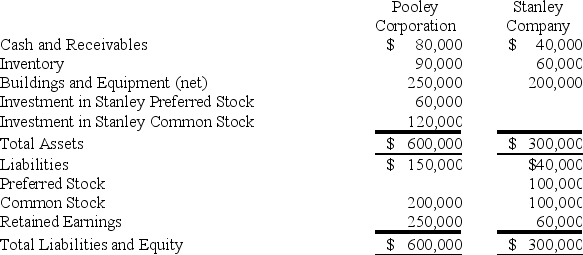

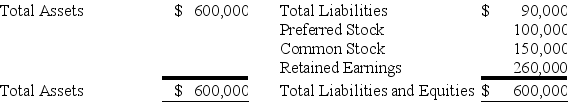

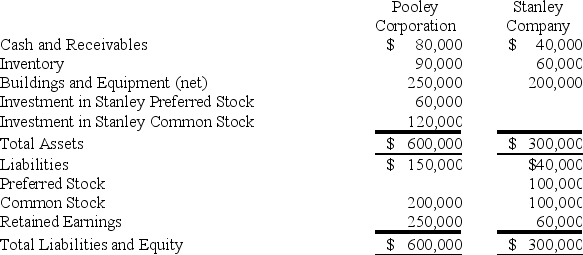

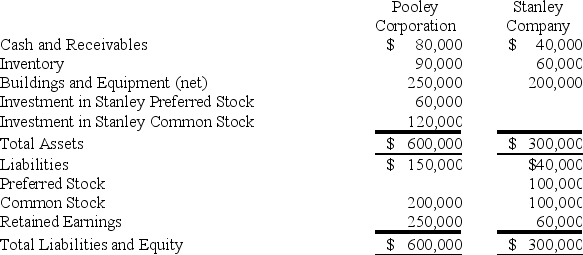

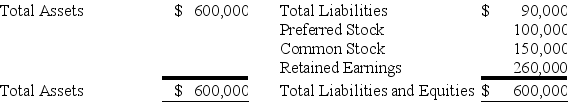

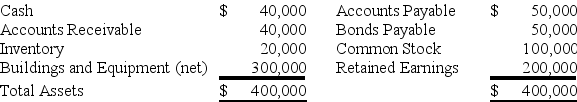

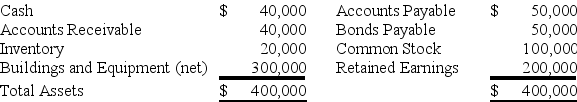

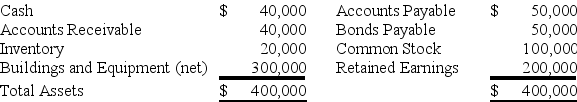

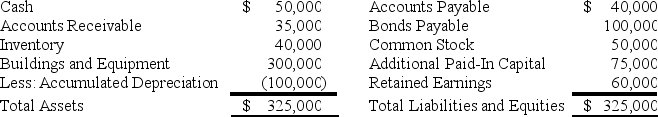

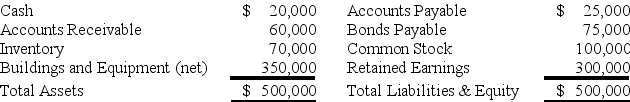

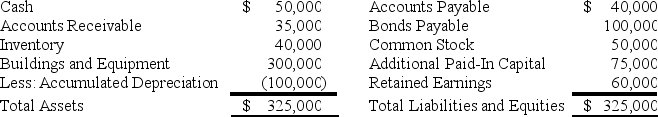

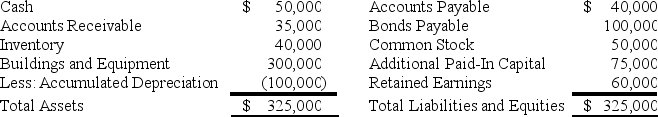

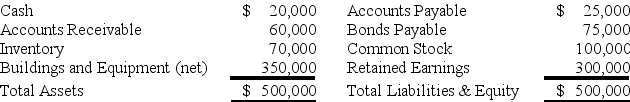

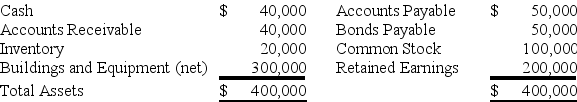

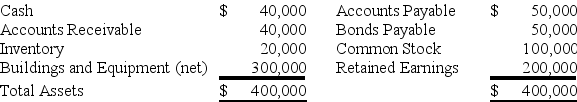

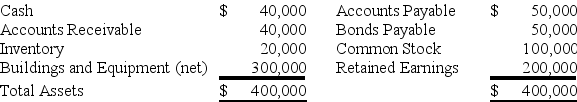

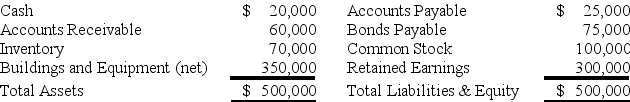

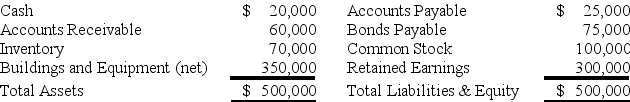

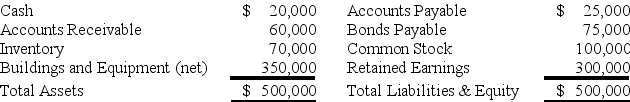

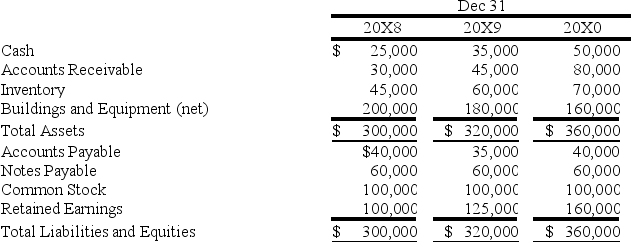

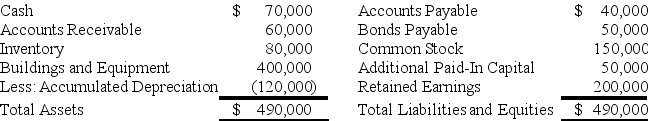

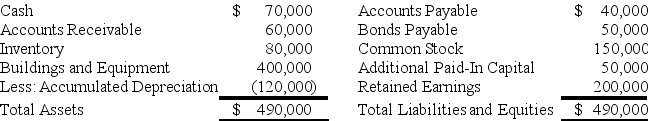

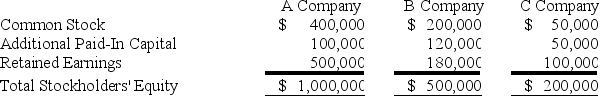

Pooley Corporation owns 75 percent of the common shares and 60 percent of the preferred shares of Stanley Company,all acquired at underlying book value on January 1,20X8.At that date,the fair value of the noncontrolling interest in Stanley's common stock was equal to 25 percent of the book value of its common stock.The balance sheets of Pooley and Stanley immediately after the acquisition contained these balances:

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Based on the preceding information,what amount of income is attributable to the controlling interest in the consolidated income statement for 20X8?

A)$75,000

B)$105,000

C)$96,000

D)$103,200

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.Based on the preceding information,what amount of income is attributable to the controlling interest in the consolidated income statement for 20X8?

A)$75,000

B)$105,000

C)$96,000

D)$103,200

D

3

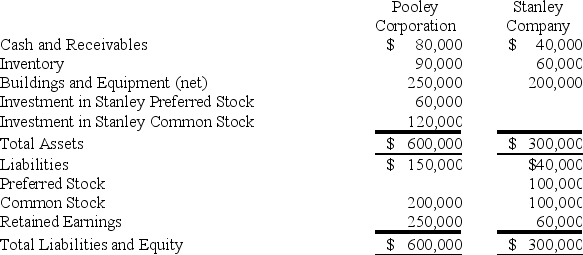

Pooley Corporation owns 75 percent of the common shares and 60 percent of the preferred shares of Stanley Company,all acquired at underlying book value on January 1,20X8.At that date,the fair value of the noncontrolling interest in Stanley's common stock was equal to 25 percent of the book value of its common stock.The balance sheets of Pooley and Stanley immediately after the acquisition contained these balances:

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Based on the preceding information,what is the total noncontrolling interest reported in the consolidated balance sheet as of January 1,20X8?

A)$80,000

B)$40,000

C)$50,000

D)$60,000

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.Based on the preceding information,what is the total noncontrolling interest reported in the consolidated balance sheet as of January 1,20X8?

A)$80,000

B)$40,000

C)$50,000

D)$60,000

A

4

Protective Corporation acquired 70 percent of the common shares and 60 percent of the preferred shares of Safety Corporation at underlying book value on January 1,20X6.At that date,the fair value of the noncontrolling interest in Safety's common stock was equal to 30 percent of the book value of its common stock.Safety's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

Based on the preceding information,the amount assigned to the noncontrolling stockholders' share of preferred stock interest in the preparation of a consolidated balance sheet on January 1,20X6 is

A)$57,600.

B)$49,600.

C)$48,000.

D)$40,000.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.Based on the preceding information,the amount assigned to the noncontrolling stockholders' share of preferred stock interest in the preparation of a consolidated balance sheet on January 1,20X6 is

A)$57,600.

B)$49,600.

C)$48,000.

D)$40,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

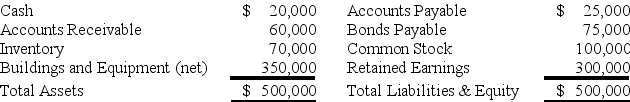

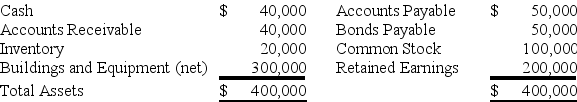

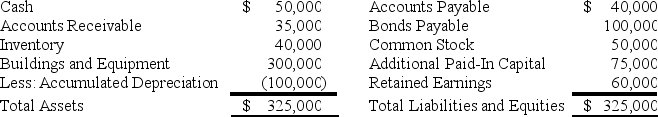

Pail Corporation acquired 80 percent of the common shares and 70 percent of the preferred shares of Shovel Corporation at underlying book value on January 1,20X9.At that date,the fair value of the noncontrolling interest in Shovel's common stock was equal to 20 percent of the book value of its common stock.Shovel's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

Based on the preceding information,what is the portion of Shovel's retained earnings assignable to its preferred shareholders on January 1,20X9?

A)$40,000

B)$50,000

C)$60,000

D)$70,000

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.Based on the preceding information,what is the portion of Shovel's retained earnings assignable to its preferred shareholders on January 1,20X9?

A)$40,000

B)$50,000

C)$60,000

D)$70,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

Pail Corporation acquired 80 percent of the common shares and 70 percent of the preferred shares of Shovel Corporation at underlying book value on January 1,20X9.At that date,the fair value of the noncontrolling interest in Shovel's common stock was equal to 20 percent of the book value of its common stock.Shovel's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

Based on the information provided,what amount will be reported as the noncontrolling interest in the consolidated balance sheet on January 1,20X9?

A)$70,000

B)$130,000

C)$118,000

D)$142,000

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.Based on the information provided,what amount will be reported as the noncontrolling interest in the consolidated balance sheet on January 1,20X9?

A)$70,000

B)$130,000

C)$118,000

D)$142,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

Pail Corporation acquired 80 percent of the common shares and 70 percent of the preferred shares of Shovel Corporation at underlying book value on January 1,20X9.At that date,the fair value of the noncontrolling interest in Shovel's common stock was equal to 20 percent of the book value of its common stock.Shovel's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

Based on the preceding information,the amount assigned to noncontrolling stockholders' share of preferred stock interest in the preparation of a consolidated balance sheet on January 1,20X9,is:

A)$40,000

B)$42,000

C)$36,000

D)$48,000

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.Based on the preceding information,the amount assigned to noncontrolling stockholders' share of preferred stock interest in the preparation of a consolidated balance sheet on January 1,20X9,is:

A)$40,000

B)$42,000

C)$36,000

D)$48,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

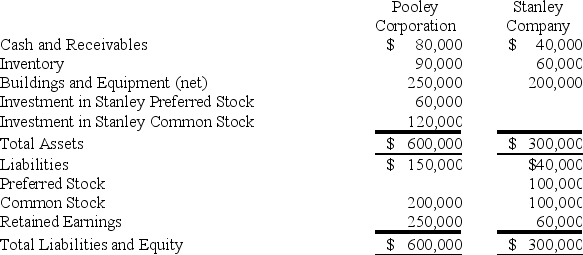

Pooley Corporation owns 75 percent of the common shares and 60 percent of the preferred shares of Stanley Company,all acquired at underlying book value on January 1,20X8.At that date,the fair value of the noncontrolling interest in Stanley's common stock was equal to 25 percent of the book value of its common stock.The balance sheets of Pooley and Stanley immediately after the acquisition contained these balances:

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Based on the preceding information,what is the income assigned to the noncontrolling interest in the 20X8 consolidated income statement?

A)$10,000

B)$7,000

C)$11,800

D)$4,800

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.Based on the preceding information,what is the income assigned to the noncontrolling interest in the 20X8 consolidated income statement?

A)$10,000

B)$7,000

C)$11,800

D)$4,800

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

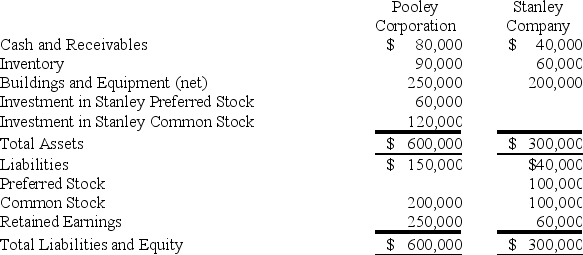

Pooley Corporation owns 75 percent of the common shares and 60 percent of the preferred shares of Stanley Company,all acquired at underlying book value on January 1,20X8.At that date,the fair value of the noncontrolling interest in Stanley's common stock was equal to 25 percent of the book value of its common stock.The balance sheets of Pooley and Stanley immediately after the acquisition contained these balances:

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Based on the preceding information,what amount is reported as preferred stock outstanding reported in the consolidated balance sheet as of January 1,20X8?

A)$0

B)$40,000

C)$50,000

D)$44,000

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.Based on the preceding information,what amount is reported as preferred stock outstanding reported in the consolidated balance sheet as of January 1,20X8?

A)$0

B)$40,000

C)$50,000

D)$44,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

On January 1,20X9,Princeton Company acquired 80 percent of the common stock and 60 percent of the preferred stock of Stanford Company,for $400,000 and $60,000,respectively.At the time of acquisition,the fair value of the common shares of Stanford Company held by the noncontrolling interest was $100,000.Stanford Company's balance sheet contained the following balances:

Preferred Stock ($5 par value)$ 100,000

Common Stock ($10 par value)200,000

Retained Earnings 300,000

Total Stockholders' Equity $ 600,000

For the year ended December 31,20X9,Stanford Company reported net income of $100,000 and paid dividends of $40,000.The preferred stock is cumulative and pays an annual dividend of 10 percent.

Based on the preceding information,the consolidating entry to prepare the consolidated financial statements for Princeton Company as of December 31,20X9 will include a credit to Investment in Stanford Company-Common Stock for:

A)$506,000

B)$448,000

C)$400,000

D)$500,000

Preferred Stock ($5 par value)$ 100,000

Common Stock ($10 par value)200,000

Retained Earnings 300,000

Total Stockholders' Equity $ 600,000

For the year ended December 31,20X9,Stanford Company reported net income of $100,000 and paid dividends of $40,000.The preferred stock is cumulative and pays an annual dividend of 10 percent.

Based on the preceding information,the consolidating entry to prepare the consolidated financial statements for Princeton Company as of December 31,20X9 will include a credit to Investment in Stanford Company-Common Stock for:

A)$506,000

B)$448,000

C)$400,000

D)$500,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

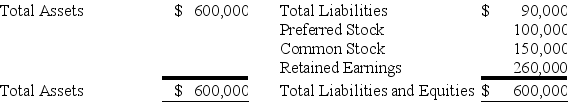

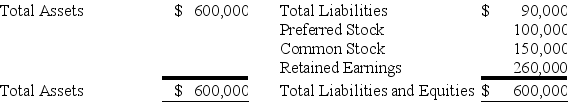

On January 1,20X9,Princeton Company acquired 80 percent of the common stock and 60 percent of the preferred stock of Stanford Company,for $400,000 and $60,000,respectively.At the time of acquisition,the fair value of the common shares of Stanford Company held by the noncontrolling interest was $100,000.Stanford Company's balance sheet contained the following balances:

Preferred Stock ($5 par value)$ 100,000

Common Stock ($10 par value)200,000

Retained Earnings 300,000

Total Stockholders' Equity $ 600,000

For the year ended December 31,20X9,Stanford Company reported net income of $100,000 and paid dividends of $40,000.The preferred stock is cumulative and pays an annual dividend of 10 percent.

Based on the preceding information,the consolidating entry to prepare the consolidated financial statements for Princeton Company as of December 31,20X9 will include a credit to noncontrolling interest in Stanford Company for:

A)$140,000

B)$154,000

C)$152,000

D)$150,000

Preferred Stock ($5 par value)$ 100,000

Common Stock ($10 par value)200,000

Retained Earnings 300,000

Total Stockholders' Equity $ 600,000

For the year ended December 31,20X9,Stanford Company reported net income of $100,000 and paid dividends of $40,000.The preferred stock is cumulative and pays an annual dividend of 10 percent.

Based on the preceding information,the consolidating entry to prepare the consolidated financial statements for Princeton Company as of December 31,20X9 will include a credit to noncontrolling interest in Stanford Company for:

A)$140,000

B)$154,000

C)$152,000

D)$150,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

Pail Corporation acquired 80 percent of the common shares and 70 percent of the preferred shares of Shovel Corporation at underlying book value on January 1,20X9.At that date,the fair value of the noncontrolling interest in Shovel's common stock was equal to 20 percent of the book value of its common stock.Shovel's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

Based on the preceding information,what will be the amount of income to be assigned to the noncontrolling interest in the 20X9 consolidated income statement?

A)$21,000

B)$18,000

C)$23,000

D)$15,000

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.Based on the preceding information,what will be the amount of income to be assigned to the noncontrolling interest in the 20X9 consolidated income statement?

A)$21,000

B)$18,000

C)$23,000

D)$15,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

Pail Corporation acquired 80 percent of the common shares and 70 percent of the preferred shares of Shovel Corporation at underlying book value on January 1,20X9.At that date,the fair value of the noncontrolling interest in Shovel's common stock was equal to 20 percent of the book value of its common stock.Shovel's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

Based on the preceding information,what is Shovel's contribution to consolidated net income for 20X9?

A)$80,000

B)$100,000

C)$90,000

D)$50,000

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.Based on the preceding information,what is Shovel's contribution to consolidated net income for 20X9?

A)$80,000

B)$100,000

C)$90,000

D)$50,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

Pooley Corporation owns 75 percent of the common shares and 60 percent of the preferred shares of Stanley Company,all acquired at underlying book value on January 1,20X8.At that date,the fair value of the noncontrolling interest in Stanley's common stock was equal to 25 percent of the book value of its common stock.The balance sheets of Pooley and Stanley immediately after the acquisition contained these balances:

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

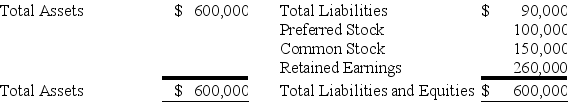

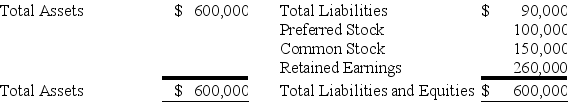

Based on the preceding information,what is the total stockholders' equity reported in the consolidated balance sheet as of January 1,20X8?

A)$450,000

B)$530,000

C)$490,000

D)$370,000

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.

Stanley's preferred stock pays a 12 percent dividend and is cumulative.For 20X8,Stanley reports net income of $40,000 and pays no dividends.Pooley reports income from its separate operations of $75,000 and pays dividends of $30,000 during 20X8.Based on the preceding information,what is the total stockholders' equity reported in the consolidated balance sheet as of January 1,20X8?

A)$450,000

B)$530,000

C)$490,000

D)$370,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

Pail Corporation acquired 80 percent of the common shares and 70 percent of the preferred shares of Shovel Corporation at underlying book value on January 1,20X9.At that date,the fair value of the noncontrolling interest in Shovel's common stock was equal to 20 percent of the book value of its common stock.Shovel's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

Based on the information provided,what is the book value of the common stock on January 1,20X9?

A)$410,000

B)$360,000

C)$390,000

D)$350,000

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.

The preferred shares are cumulative and have a 10 percent annual dividend rate and are four years in arrears on January 1,20X9.All of the $5 par value preferred shares are callable at $6 per share.During 20X9,Shovel reported net income of $100,000 and paid no dividends.Based on the information provided,what is the book value of the common stock on January 1,20X9?

A)$410,000

B)$360,000

C)$390,000

D)$350,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

Protective Corporation acquired 70 percent of the common shares and 60 percent of the preferred shares of Safety Corporation at underlying book value on January 1,20X6.At that date,the fair value of the noncontrolling interest in Safety's common stock was equal to 30 percent of the book value of its common stock.Safety's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

Based on the preceding information,what is Safety's contribution to consolidated net income for 20X6?

A)$48,000

B)$56,000

C)$72,000

D)$80,000

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.Based on the preceding information,what is Safety's contribution to consolidated net income for 20X6?

A)$48,000

B)$56,000

C)$72,000

D)$80,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

Protective Corporation acquired 70 percent of the common shares and 60 percent of the preferred shares of Safety Corporation at underlying book value on January 1,20X6.At that date,the fair value of the noncontrolling interest in Safety's common stock was equal to 30 percent of the book value of its common stock.Safety's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

Based on the preceding information,what is the portion of Safety's retained earnings assignable to its preferred shareholders on January 1,20X6?

A)$52,000

B)$44,000

C)$36,000

D)$28,000

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.Based on the preceding information,what is the portion of Safety's retained earnings assignable to its preferred shareholders on January 1,20X6?

A)$52,000

B)$44,000

C)$36,000

D)$28,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

Protective Corporation acquired 70 percent of the common shares and 60 percent of the preferred shares of Safety Corporation at underlying book value on January 1,20X6.At that date,the fair value of the noncontrolling interest in Safety's common stock was equal to 30 percent of the book value of its common stock.Safety's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

Based on the information provided,what is the book value of the common stock on January 1,20X6?

A)$390,000

B)$420,000

C)$446,000

D)$490,000

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.Based on the information provided,what is the book value of the common stock on January 1,20X6?

A)$390,000

B)$420,000

C)$446,000

D)$490,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

Protective Corporation acquired 70 percent of the common shares and 60 percent of the preferred shares of Safety Corporation at underlying book value on January 1,20X6.At that date,the fair value of the noncontrolling interest in Safety's common stock was equal to 30 percent of the book value of its common stock.Safety's balance sheet at the time of acquisition contained the following balances:

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

Based on the information provided,what amount will be reported as the noncontrolling interest in the consolidated balance sheet on January 1,20X6?

A)$133,800

B)$191,400

C)$204,600

D)$210,000

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.

The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1,20X6.All of the $10 par value preferred shares are callable at $12 per share.During 20X6,Safety reported net income of $80,000 and paid no dividends.Based on the information provided,what amount will be reported as the noncontrolling interest in the consolidated balance sheet on January 1,20X6?

A)$133,800

B)$191,400

C)$204,600

D)$210,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

On January 1,20X9,Princeton Company acquired 80 percent of the common stock and 60 percent of the preferred stock of Stanford Company,for $400,000 and $60,000,respectively.At the time of acquisition,the fair value of the common shares of Stanford Company held by the noncontrolling interest was $100,000.Stanford Company's balance sheet contained the following balances:

Preferred Stock ($5 par value)$ 100,000

Common Stock ($10 par value)200,000

Retained Earnings 300,000

Total Stockholders' Equity $ 600,000

For the year ended December 31,20X9,Stanford Company reported net income of $100,000 and paid dividends of $40,000.The preferred stock is cumulative and pays an annual dividend of 10 percent.

Based on the preceding information,what will be the equity method income reported by Princeton Company from its investment in Stanford Company during 20X9?

A)$32,000

B)$30,000

C)$72,000

D)$48,000

Preferred Stock ($5 par value)$ 100,000

Common Stock ($10 par value)200,000

Retained Earnings 300,000

Total Stockholders' Equity $ 600,000

For the year ended December 31,20X9,Stanford Company reported net income of $100,000 and paid dividends of $40,000.The preferred stock is cumulative and pays an annual dividend of 10 percent.

Based on the preceding information,what will be the equity method income reported by Princeton Company from its investment in Stanford Company during 20X9?

A)$32,000

B)$30,000

C)$72,000

D)$48,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

On January 1,20X7,Pisa Company acquired 80 percent of Siena Company by purchasing 40,000 shares of Siena's common stock.There was no differential related to this transaction.The noncontrolling interest had a fair value equal to 20 percent of book value.The book value of Siena on December 31,20X7 was as follows:

On January 1,20X8,Pisa purchased an additional 12,500 shares directly from Siena for $25 per share.

On January 1,20X8,Pisa purchased an additional 12,500 shares directly from Siena for $25 per share.

Based on the preceding information,by what amount did the Investment in Siena account change?

A)Increase of $296,500

B)Decrease of $296,500

C)Increase of $64,000

D)Decrease of $64,000

On January 1,20X8,Pisa purchased an additional 12,500 shares directly from Siena for $25 per share.

On January 1,20X8,Pisa purchased an additional 12,500 shares directly from Siena for $25 per share.Based on the preceding information,by what amount did the Investment in Siena account change?

A)Increase of $296,500

B)Decrease of $296,500

C)Increase of $64,000

D)Decrease of $64,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

Patty Corporation holds 75 percent of Slider Corporation's voting common stock,acquired at book value.The fair value of the noncontrolling interest at the date of acquisition was equal to 25 percent of the book value of Slider Corporation.On December 31,20X8,Slider Corporation acquired 25 percent of Patty Corporation's stock.Slider records dividends received from Patty as nonoperating income.In 20X9,Patty reported operating income of $100,000 and paid dividends of $40,000.During the same year,Slider reported operating income of $75,000 and paid $20,000 in dividends.

Based on the information provided,what amount will be reported as income assigned to the controlling interest for 20X9 under the treasury stock method?

A)$18,750

B)$156,250

C)$175,000

D)$100,000

Based on the information provided,what amount will be reported as income assigned to the controlling interest for 20X9 under the treasury stock method?

A)$18,750

B)$156,250

C)$175,000

D)$100,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

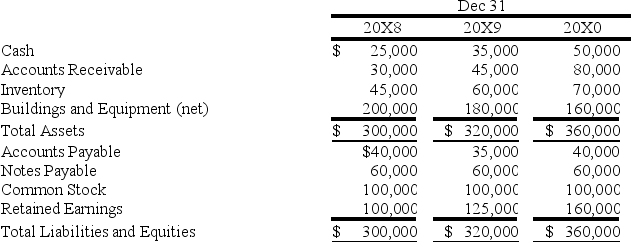

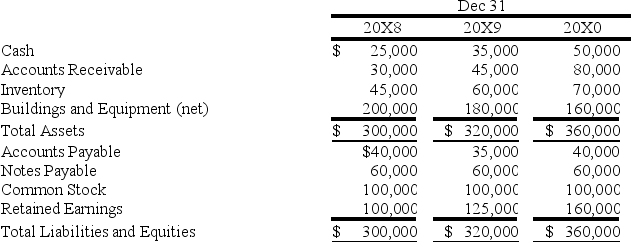

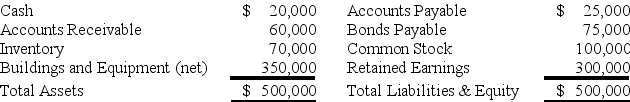

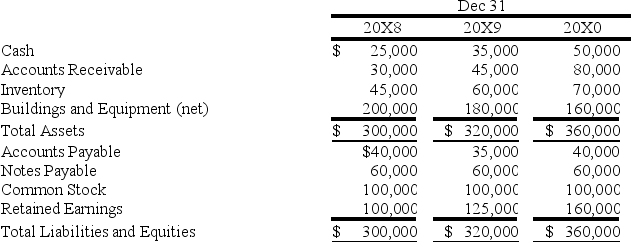

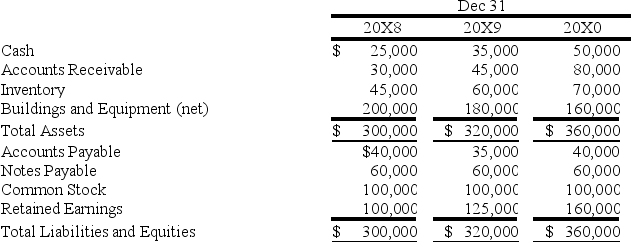

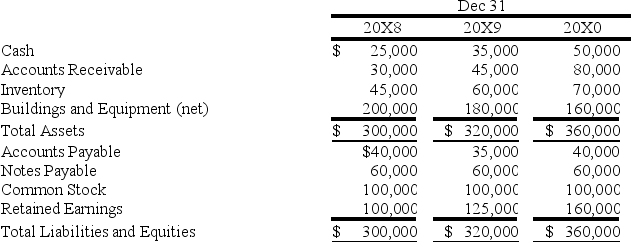

Perfect Corporation acquired 70 percent of Storm Company's shares on December 31,20X8,for $140,000.At that date,the fair value of the noncontrolling interest was $60,000.On January 1,20X0,Perfect acquired an additional 10 percent of Storm's common stock for $32,500.Summarized balance sheets for Storm on the dates indicated are as follows:

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.

Based on the preceding information,Storm Company's net income for 20X9 and 20X0 are:

A)$10,000 and $20,000 respectively.

B)$25,000 and $35,000 respectively.

C)$35,000 and $45,000 respectively.

D)$25,000 and $45,000 respectively.

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.Based on the preceding information,Storm Company's net income for 20X9 and 20X0 are:

A)$10,000 and $20,000 respectively.

B)$25,000 and $35,000 respectively.

C)$35,000 and $45,000 respectively.

D)$25,000 and $45,000 respectively.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

Plate Corporation acquired 75 percent of the stock of Silver Company on January 1,20X7,for $225,000.At that date,the fair value of the noncontrolling interest was $75,000.Silver's balance sheet contained the following amounts at the time of the combination:

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

Based on the preceding information,in the journal entry recorded by Plate for sale of shares,Additional Paid-in Capital will be credited for:

A)$0.

B)$15,000.

C)$9,000.

D)$45,000.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.Based on the preceding information,in the journal entry recorded by Plate for sale of shares,Additional Paid-in Capital will be credited for:

A)$0.

B)$15,000.

C)$9,000.

D)$45,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

Petunia Corporation acquired 90 percent of the stock of Spring Company on January 1,20X2,for $360,000.At that date,the fair value of the noncontrolling interest was $40,000.Spring's balance sheet contained the following amounts at the time of the combination:

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

Based on the preceding information,what was the balance in the investment account reported by Petunia on January 1,20X4,before its sale of shares?

A)$360,000

B)$450,000

C)$486,000

D)$500,000

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.Based on the preceding information,what was the balance in the investment account reported by Petunia on January 1,20X4,before its sale of shares?

A)$360,000

B)$450,000

C)$486,000

D)$500,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

Plate Corporation acquired 75 percent of the stock of Silver Company on January 1,20X7,for $225,000.At that date,the fair value of the noncontrolling interest was $75,000.Silver's balance sheet contained the following amounts at the time of the combination:

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

Based on the preceding information,what was the balance in the investment account reported by Plate on January 1,20X9,before its sale of shares?

A)$225,000

B)$285,000

C)$245,000

D)$255,000

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.Based on the preceding information,what was the balance in the investment account reported by Plate on January 1,20X9,before its sale of shares?

A)$225,000

B)$285,000

C)$245,000

D)$255,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

Plate Corporation acquired 75 percent of the stock of Silver Company on January 1,20X7,for $225,000.At that date,the fair value of the noncontrolling interest was $75,000.Silver's balance sheet contained the following amounts at the time of the combination:

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

Based on the preceding information,in the elimination entries to complete a full consolidation worksheet for 20X9,noncontrolling interest in the net income of Silver Co.will be credited for:

A)$12,000.

B)$7,500.

C)$8,000.

D)$2,500.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.Based on the preceding information,in the elimination entries to complete a full consolidation worksheet for 20X9,noncontrolling interest in the net income of Silver Co.will be credited for:

A)$12,000.

B)$7,500.

C)$8,000.

D)$2,500.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

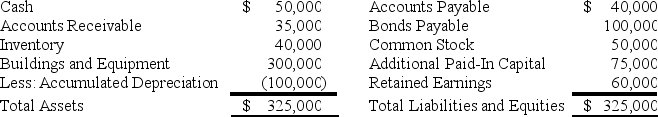

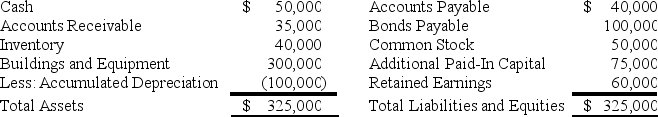

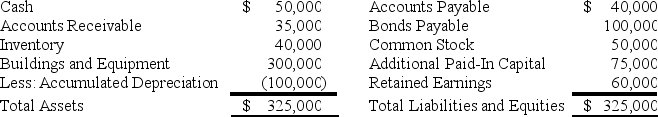

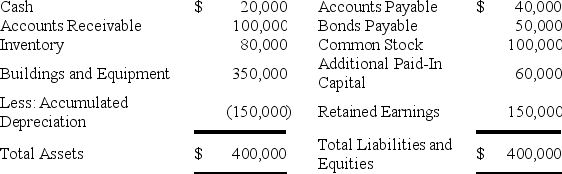

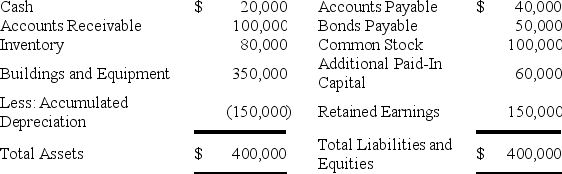

Play Company acquired 70 percent of Screen Corporation's shares on December 31,20X5,at underlying book value of $98,000.At that date,the fair value of the noncontrolling interest was equal to 30 percent of the book value of Screen Corporation.Screen's balance sheet on January 1,20X8,contained the following balances:

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

Based on the preceding information,in the consolidating entry needed in preparing a consolidated balance sheet immediately following the acquisition of shares,Investment in Screen stock will be credited for:

A)$165,625.

B)$135,625.

C)$185,000.

D)$155,000.

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.Based on the preceding information,in the consolidating entry needed in preparing a consolidated balance sheet immediately following the acquisition of shares,Investment in Screen stock will be credited for:

A)$165,625.

B)$135,625.

C)$185,000.

D)$155,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

Play Company acquired 70 percent of Screen Corporation's shares on December 31,20X5,at underlying book value of $98,000.At that date,the fair value of the noncontrolling interest was equal to 30 percent of the book value of Screen Corporation.Screen's balance sheet on January 1,20X8,contained the following balances:

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

Based on the preceding information,the consolidating entry needed in preparing a consolidated balance sheet immediately following the acquisition of shares will include:

A)a credit to Noncontrolling Interest in Net Assets of Screen Corp.for $19,375.

B)a credit to Additional Paid-In Capital for $75,000.

C)a debit to Treasury Shares for $30,000.

D)a credit to Investment in Screen stock for $6,125.

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.Based on the preceding information,the consolidating entry needed in preparing a consolidated balance sheet immediately following the acquisition of shares will include:

A)a credit to Noncontrolling Interest in Net Assets of Screen Corp.for $19,375.

B)a credit to Additional Paid-In Capital for $75,000.

C)a debit to Treasury Shares for $30,000.

D)a credit to Investment in Screen stock for $6,125.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

Petunia Corporation acquired 90 percent of the stock of Spring Company on January 1,20X2,for $360,000.At that date,the fair value of the noncontrolling interest was $40,000.Spring's balance sheet contained the following amounts at the time of the combination:

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

Based on the preceding information,in the consolidation entries to complete a full consolidation worksheet for 20X4,noncontrolling interest in the net income of Spring will be credited for

A)$2,000.

B)$7,000.

C)$12,500.

D)$17,500.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.Based on the preceding information,in the consolidation entries to complete a full consolidation worksheet for 20X4,noncontrolling interest in the net income of Spring will be credited for

A)$2,000.

B)$7,000.

C)$12,500.

D)$17,500.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

Play Company acquired 70 percent of Screen Corporation's shares on December 31,20X5,at underlying book value of $98,000.At that date,the fair value of the noncontrolling interest was equal to 30 percent of the book value of Screen Corporation.Screen's balance sheet on January 1,20X8,contained the following balances:

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

Based on the preceding information,what is the increase in the book value of the equity attributable to the parent as a result of the repurchase of shares by Screen Corporation?

A)$19,375

B)$6,125

C)$2,625

D)$9,000

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.Based on the preceding information,what is the increase in the book value of the equity attributable to the parent as a result of the repurchase of shares by Screen Corporation?

A)$19,375

B)$6,125

C)$2,625

D)$9,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

Petunia Corporation acquired 90 percent of the stock of Spring Company on January 1,20X2,for $360,000.At that date,the fair value of the noncontrolling interest was $40,000.Spring's balance sheet contained the following amounts at the time of the combination:

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

Based on the preceding information,in the journal entry recorded by Petunia for the sale of shares,Additional Paid-in Capital will be credited for

A)$240,000.

B)$15,000.

C)$9,000.

D)$0.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.Based on the preceding information,in the journal entry recorded by Petunia for the sale of shares,Additional Paid-in Capital will be credited for

A)$240,000.

B)$15,000.

C)$9,000.

D)$0.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

Plate Corporation acquired 75 percent of the stock of Silver Company on January 1,20X7,for $225,000.At that date,the fair value of the noncontrolling interest was $75,000.Silver's balance sheet contained the following amounts at the time of the combination:

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

Based on the preceding information,in the journal entry recorded by Plate for sale of shares:

A)Cash will be credited for $60,000.

B)Investment in Silver Stock will be credited for $51,000.

C)Investment in Silver Stock will be credited for $60,000.

D)Additional Paid-in Capital will be credited for $45,000.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.Based on the preceding information,in the journal entry recorded by Plate for sale of shares:

A)Cash will be credited for $60,000.

B)Investment in Silver Stock will be credited for $51,000.

C)Investment in Silver Stock will be credited for $60,000.

D)Additional Paid-in Capital will be credited for $45,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

Play Company acquired 70 percent of Screen Corporation's shares on December 31,20X5,at underlying book value of $98,000.At that date,the fair value of the noncontrolling interest was equal to 30 percent of the book value of Screen Corporation.Screen's balance sheet on January 1,20X8,contained the following balances:

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

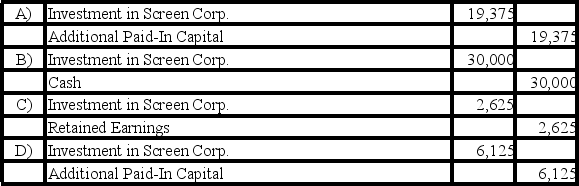

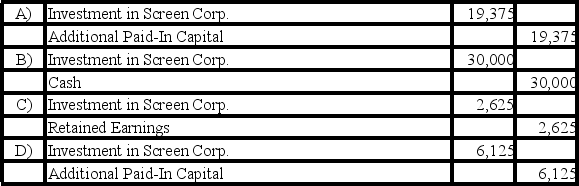

Based on the preceding information,what will be the journal entry to be recorded on Play Company's books to recognize the change in the book value of the shares it holds?

A)Option A

B)Option B

C)Option C

D)Option D

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.

On January 1,20X8,Screen acquired 5,000 of its own $2 par value common shares from Nonaffiliated Corporation for $6 per share.Based on the preceding information,what will be the journal entry to be recorded on Play Company's books to recognize the change in the book value of the shares it holds?

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

Patty Corporation holds 75 percent of Slider Corporation's voting common stock,acquired at book value.The fair value of the noncontrolling interest at the date of acquisition was equal to 25 percent of the book value of Slider Corporation.On December 31,20X8,Slider Corporation acquired 25 percent of Patty Corporation's stock.Slider records dividends received from Patty as nonoperating income.In 20X9,Patty reported operating income of $100,000 and paid dividends of $40,000.During the same year,Slider reported operating income of $75,000 and paid $20,000 in dividends.

Based on the information provided,what amount will be reported as consolidated net income for 20X9 under the treasury stock method?

A)$150,000

B)$100,000

C)$75,000

D)$175,000

Based on the information provided,what amount will be reported as consolidated net income for 20X9 under the treasury stock method?

A)$150,000

B)$100,000

C)$75,000

D)$175,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

Plate Corporation acquired 75 percent of the stock of Silver Company on January 1,20X7,for $225,000.At that date,the fair value of the noncontrolling interest was $75,000.Silver's balance sheet contained the following amounts at the time of the combination:

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

Based on the preceding information,in the consolidating entries to complete a full consolidation worksheet,Investment in Silver Stock at January 1,20X9,will be credited for:

A)$255,000.

B)$240,000.

C)$204,000.

D)$136,000.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.

During each of the next three years,Silver reported net income of $30,000 and paid dividends of $10,000.On January 1,20X9,Plate sold 1,500 shares of Silver's $10 par value shares for $60,000 in cash.Plate used the fully adjusted equity method in accounting for its ownership of Silver Company.Based on the preceding information,in the consolidating entries to complete a full consolidation worksheet,Investment in Silver Stock at January 1,20X9,will be credited for:

A)$255,000.

B)$240,000.

C)$204,000.

D)$136,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

Petunia Corporation acquired 90 percent of the stock of Spring Company on January 1,20X2,for $360,000.At that date,the fair value of the noncontrolling interest was $40,000.Spring's balance sheet contained the following amounts at the time of the combination:

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

Based on the preceding information,in the consolidation entries to complete a consolidation worksheet at January 1,20X4 (after the sale of the 3,000 shares of Spring stock),Investment in Spring Stock will be credited for

A)$360,000.

B)$375,000.

C)$405,000.

D)$450,000.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.Based on the preceding information,in the consolidation entries to complete a consolidation worksheet at January 1,20X4 (after the sale of the 3,000 shares of Spring stock),Investment in Spring Stock will be credited for

A)$360,000.

B)$375,000.

C)$405,000.

D)$450,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

Petunia Corporation acquired 90 percent of the stock of Spring Company on January 1,20X2,for $360,000.At that date,the fair value of the noncontrolling interest was $40,000.Spring's balance sheet contained the following amounts at the time of the combination:

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

Based on the preceding information,in the journal entry recorded by Petunia for the sale of shares

A)Cash will be credited for $90,000.

B)Investment in Spring Stock will be credited for $90,000.

C)Investment in Spring Stock will be credited for $75,000.

D)Additional Paid-in Capital will be credited for $9,000.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.

During each of the next three years,Spring reported net income of $70,000 and paid dividends of $20,000.On January 1,20X4,Petunia sold 3,000 shares of Spring's $5 par value shares for $90,000 in cash.Petunia used the fully adjusted equity method in accounting for its ownership of Spring Company.Based on the preceding information,in the journal entry recorded by Petunia for the sale of shares

A)Cash will be credited for $90,000.

B)Investment in Spring Stock will be credited for $90,000.

C)Investment in Spring Stock will be credited for $75,000.

D)Additional Paid-in Capital will be credited for $9,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

Perfect Corporation acquired 70 percent of Storm Company's shares on December 31,20X8,for $140,000.At that date,the fair value of the noncontrolling interest was $60,000.On January 1,20X0,Perfect acquired an additional 10 percent of Storm's common stock for $32,500.Summarized balance sheets for Storm on the dates indicated are as follows:

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.

Based on the preceding information,what was the balance in Perfect's Investment in Storm Company Stock account on December 31,20X0?

A)$211,500

B)$218,000

C)$173,000

D)$216,000

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.Based on the preceding information,what was the balance in Perfect's Investment in Storm Company Stock account on December 31,20X0?

A)$211,500

B)$218,000

C)$173,000

D)$216,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

Perfect Corporation acquired 70 percent of Storm Company's shares on December 31,20X8,for $140,000.At that date,the fair value of the noncontrolling interest was $60,000.On January 1,20X0,Perfect acquired an additional 10 percent of Storm's common stock for $32,500.Summarized balance sheets for Storm on the dates indicated are as follows:

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.

Based on the preceding information,what was the balance in Perfect's Investment in Storm Company Stock account on December 31,20X9?

A)$164,500

B)$157,500

C)$165,000

D)$168,000

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.

Storm paid dividends of $10,000 in each of the three years.Perfect uses the fully adjusted equity method in accounting for its investment in Storm and amortizes all differentials over 5 years against the related investment income.All differentials are assigned to patents in the consolidated financial statements.Based on the preceding information,what was the balance in Perfect's Investment in Storm Company Stock account on December 31,20X9?

A)$164,500

B)$157,500

C)$165,000

D)$168,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

X Corporation owns 80 percent of Y Corporation's common stock and 40 percent of Z Corporation's common stock.Additionally,Y Corporation owns 35 percent of Z Corporation's common stock.The acquisitions were made at book values.The following information is available for 20X8:

Based on the information provided,what amount of income will be assigned to the noncontrolling interest in the 20X8 consolidated income statement?

A)$23,750

B)$25,000

C)$18,000

D)$33,750

Based on the information provided,what amount of income will be assigned to the noncontrolling interest in the 20X8 consolidated income statement?

A)$23,750

B)$25,000

C)$18,000

D)$33,750

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

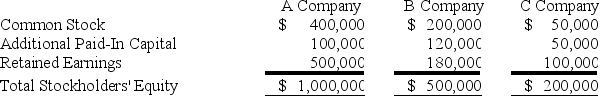

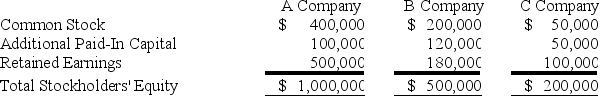

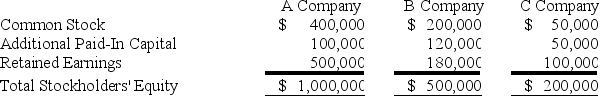

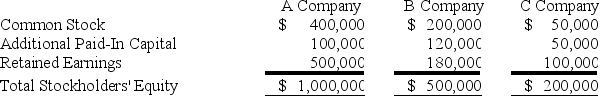

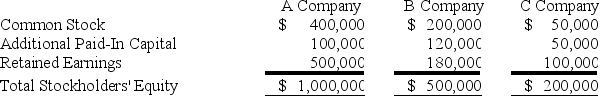

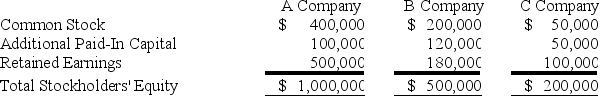

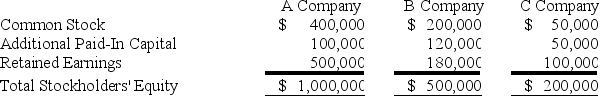

On January 1,20X9,A Company acquired 85 percent of B Company's voting common stock for $425,000.At that date,the fair value of the noncontrolling interest of B Company was $75,000.Immediately after A Company acquired its ownership,B Company acquired 75 percent of C Company's stock for $150,000.The fair value of the noncontrolling interest of C Company was $50,000 at that date.At January 1,20X9,the stockholders' equity sections of the balance sheets of the companies were as follows:

During 20X9,A Company reported operating income of $175,000 and paid dividends of $50,000.B Company reported operating income of $125,000 and paid dividends of $40,000.C Company reported net income of $100,000 and paid dividends of $25,000.

During 20X9,A Company reported operating income of $175,000 and paid dividends of $50,000.B Company reported operating income of $125,000 and paid dividends of $40,000.C Company reported net income of $100,000 and paid dividends of $25,000.

Based on the information provided,what amount of consolidated net income will A Company report for 20X9?

A)$175,000

B)$285,000