Deck 10: Plant Assets, natural Resources, and Intangibles

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

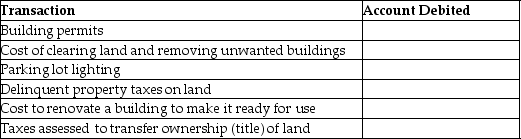

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

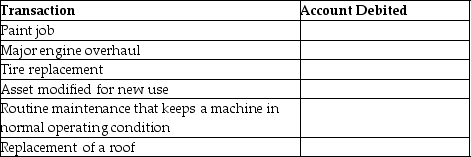

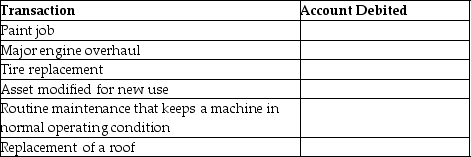

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/212

Play

Full screen (f)

Deck 10: Plant Assets, natural Resources, and Intangibles

1

Which of the following is a characteristic of a plant asset,such as a building?

A)It is used in the operations of a business.

B)It is available for sale to customers in the ordinary course of business.

C)It has a short useful life.

D)It will have a negligible value at the end of its useful life.

A)It is used in the operations of a business.

B)It is available for sale to customers in the ordinary course of business.

C)It has a short useful life.

D)It will have a negligible value at the end of its useful life.

A

2

Plant assets are long-lived,tangible assets used in the operation of a business.

True

3

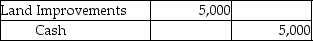

Prepare the journal entry to record the acquisition of fences and signs for $5,000 cash.Omit explanation.

4

Which of the following asset categories would include the cost of clearing land and removing unwanted buildings?

A)land

B)buildings

C)land improvements

D)machinery and equipment

A)land

B)buildings

C)land improvements

D)machinery and equipment

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following should be included in the cost of land?

A)cost to build sidewalks on the land

B)cost to clear the land of old buildings

C)cost of installing signage

D)cost of installing fences

A)cost to build sidewalks on the land

B)cost to clear the land of old buildings

C)cost of installing signage

D)cost of installing fences

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

6

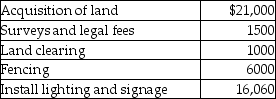

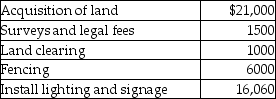

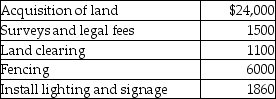

McArthur Company plans to develop a shopping center.In the first quarter,the following amounts were spent:  What amount should be recorded as the land improvements cost?

What amount should be recorded as the land improvements cost?

A)$7000

B)$8500

C)$22,060

D)$2500

What amount should be recorded as the land improvements cost?

What amount should be recorded as the land improvements cost?A)$7000

B)$8500

C)$22,060

D)$2500

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

7

All plant assets are depreciated.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

8

The cost of a plant asset includes all amounts paid to ready the asset for its intended use.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

9

Capitalizing a cost involves crediting the asset account.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

10

The cost of a building depends on whether the company is constructing the building or is acquiring an existing one.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

11

The cost principle requires a business to record the assets acquired,or services received,at their actual cost.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

12

The process of allocating the cost of a plant asset over its useful life is known as cost reduction.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

13

A business that has a vacant building that is not currently being used would classify the building as a plant asset.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is included in the cost of a plant asset?

A)amounts paid to make the asset ready for its intended use

B)regular repair and maintenance costs

C)replacement of damaged parts of the asset

D)wages of workers who use the asset in normal operations

A)amounts paid to make the asset ready for its intended use

B)regular repair and maintenance costs

C)replacement of damaged parts of the asset

D)wages of workers who use the asset in normal operations

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements is incorrect?

A)The life cycle of a plant asset includes: acquisition,usage,and disposal.

B)Depreciation is recorded on all plant assets.

C)Plant assets not currently being used in business operations are classified as long-term investments.

D)Plant assets are long-lived tangible assets used in the operations of a business.

A)The life cycle of a plant asset includes: acquisition,usage,and disposal.

B)Depreciation is recorded on all plant assets.

C)Plant assets not currently being used in business operations are classified as long-term investments.

D)Plant assets are long-lived tangible assets used in the operations of a business.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is included in the cost of land?

A)cost of fencing

B)cost of paving

C)brokerage commission

D)cost of outdoor lighting

A)cost of fencing

B)cost of paving

C)brokerage commission

D)cost of outdoor lighting

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

17

Masonry Construction Group paid $12,000 for a plant asset that had a market value of $14,500.At which of the following amounts should the plant asset be recorded?

A)$14,500

B)$6000

C)$12,000

D)$24,000

A)$14,500

B)$6000

C)$12,000

D)$24,000

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

18

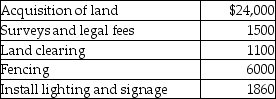

Bachman Company plans to develop a shopping center.In the first quarter,the following amounts were spent:

What amount should be recorded as the cost of the land in the company's books?

What amount should be recorded as the cost of the land in the company's books?

A)$32,600

B)$26,600

C)$28,460

D)$31,100

What amount should be recorded as the cost of the land in the company's books?

What amount should be recorded as the cost of the land in the company's books?A)$32,600

B)$26,600

C)$28,460

D)$31,100

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

19

The cost of land does not include the cost of fencing and paving.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

20

Land and land improvements are one and the same and therefore must be recorded in single account.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

21

The lump-sum amount paid for a group of assets is divided among the acquired assets based on their relative market values.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is NOT included as furniture and fixtures?

A)file cabinets

B)shelving

C)display racks

D)computers

A)file cabinets

B)shelving

C)display racks

D)computers

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

23

Brentwood Auto Repair purchased a new machine and placed it in service on June 14.Which of the following is NOT included in the cost of equipment?

A)cost of testing the machine on June 12

B)purchase commission

C)sales tax

D)a six month insurance policy which was paid on June 5 and became effective on June 15

A)cost of testing the machine on June 12

B)purchase commission

C)sales tax

D)a six month insurance policy which was paid on June 5 and became effective on June 15

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is NOT recorded as the cost of a building?

A)building permits

B)fencing

C)architectural fees

D)contractor charges

A)building permits

B)fencing

C)architectural fees

D)contractor charges

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

25

The cost paid to a laborer to assemble a desk is recorded as an expense.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

26

After a machine is installed and is up and running,repairs and maintenance are recorded as part of the cost of the machine.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

27

The cost of furniture and fixtures includes all costs to ready the asset for its intended use.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

28

An expenditure that increases the capacity or efficiency of a plant asset or that extends the asset's life is known as a revenue expenditure.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

29

When constructing a building for plant operations,payments for materials,labor,and miscellaneous costs are recorded as expenses.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

30

If a minor repair was incorrectly debited to the asset account,expenses and net income would be understated.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

31

Millburn Company has acquired a property that included both land and a building for $530,000.The company hired an appraiser who has determined that the market value of the land is $320,000 and that of the building is $480,000.At what amount should the company record the cost of land? (Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )

A)$349,800

B)$128,000

C)$265,000

D)$212,000

A)$349,800

B)$128,000

C)$265,000

D)$212,000

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

32

Great Plains Company has acquired a property that included both land and a building for $500,000.The company paid cash.The company hired an appraiser who has determined that the market value of the land is $300,000 and that of the building is $400,000.Journalize the lump-sum purchase.Omit explanation.(Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

33

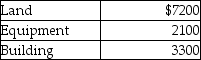

Anderson Company has purchased a group of assets for $23,800.The assets and their relative market values are listed below.  Which of the following amounts would be debited to the Land account? (Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )

Which of the following amounts would be debited to the Land account? (Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )

A)$4200

B)$13,566

C)$4046

D)$6188

Which of the following amounts would be debited to the Land account? (Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )

Which of the following amounts would be debited to the Land account? (Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )A)$4200

B)$13,566

C)$4046

D)$6188

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

34

A lump-sum purchase or basket purchase involves paying a single price for several assets as a group.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

35

Danube Company purchased a used machine for $12,000.The machine required installation costs of $3000 and insurance while in transit of $1500.At which of the following amounts would the machine be recorded?

A)$12,000

B)$15,000

C)$13,500

D)$16,500

A)$12,000

B)$15,000

C)$13,500

D)$16,500

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

36

Repair work that generates a capital expenditure because it extends a plant asset's useful life past the normal expected life is known as an extraordinary repair.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

37

Laramie Company has acquired a property that included both land and a building for $500,000.The company hired an appraiser who has determined that the market value of the land is $300,000 and that of the building is $480,000.At what amount should the company record the cost of the building? (Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )

A)$297,600

B)$310,000

C)$250,000

D)$320,000

A)$297,600

B)$310,000

C)$250,000

D)$320,000

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

38

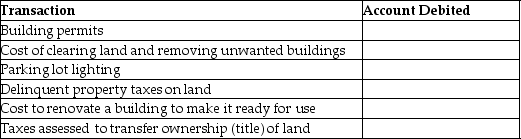

For each of the following amounts paid by a purchaser,determine whether the amount is debited to Land,Land Improvements,or Building.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

39

Ordinary repairs to plant assets are referred to as revenue expenditures.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

40

Installation costs are recorded as part of the cost of equipment.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

41

Provide definitions for the following terms.

1.Depreciation

2.Extraordinary Repair

3.Property,Plant,and Equipment

1.Depreciation

2.Extraordinary Repair

3.Property,Plant,and Equipment

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following requires businesses to record depreciation?

A)revenue recognition principle

B)matching principle

C)cost principle

D)going concern principle

A)revenue recognition principle

B)matching principle

C)cost principle

D)going concern principle

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

43

An asset is considered to be obsolete when a newer asset can perform the job more efficiently.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

44

A company's accountant capitalized a payment that should have been recorded as a revenue expenditure.How will this error affect the company's financial statements?

A)Net income will be overstated.

B)Revenues will be understated.

C)Assets will be understated.

D)Liabilities will be understated.

A)Net income will be overstated.

B)Revenues will be understated.

C)Assets will be understated.

D)Liabilities will be understated.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

45

If a company expenses an extraordinary repair,net income would be understated and the asset would be understated.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

46

Classify each of the following expenditures as capital expenditure (CE)or revenue expenditure (RE).

1.________ Repair of transmission or engine

2.________ Sales tax paid on the purchase price

3.________ Training of personnel for initial operation of machinery

4,________ Modification for new use

1.________ Repair of transmission or engine

2.________ Sales tax paid on the purchase price

3.________ Training of personnel for initial operation of machinery

4,________ Modification for new use

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

47

Freeman Company owns a delivery truck.Which of the following costs,associated with the truck,will be capitalized and depreciated?

A)modification for new use

B)oil change and lubrication

C)replacement of tires

D)normal engine repair

A)modification for new use

B)oil change and lubrication

C)replacement of tires

D)normal engine repair

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

48

Estimated residual value is not depreciated because the company is guaranteed to receive this amount when the asset is sold.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

49

An asset is considered to be obsolete ________.

A)only when it wears out

B)only at the end of its useful life

C)when it is fully depreciated

D)when a newer asset can perform the job more efficiently than the old asset can

A)only when it wears out

B)only at the end of its useful life

C)when it is fully depreciated

D)when a newer asset can perform the job more efficiently than the old asset can

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

50

The useful life of a plant asset is the length of the service period expected from the asset.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following costs related to a business car would be capitalized?

A)the cost to install an engine with higher horsepower

B)the cost to change the oil

C)the cost to replace a broken windshield

D)the cost of new tires

A)the cost to install an engine with higher horsepower

B)the cost to change the oil

C)the cost to replace a broken windshield

D)the cost of new tires

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

52

Provide definitions for the following terms.

1.Capitalize

2.Revenue Expenditure

3.Depreciation

1.Capitalize

2.Revenue Expenditure

3.Depreciation

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

53

A company's accountant capitalized a payment that should have been recorded as a revenue expenditure.How will this error affect the company's financial statements?

A)Net income will be understated.

B)Expenses will be overstated.

C)Assets will be overstated.

D)Liabilities will be overstated.

A)Net income will be understated.

B)Expenses will be overstated.

C)Assets will be overstated.

D)Liabilities will be overstated.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

54

Depreciation means that the business sets aside cash to replace an asset when it is used up.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

55

Newell Company has acquired land and paid $500 as a brokerage commission to acquire the land.However,the company's accountant has recorded the $500 as a revenue expenditure.What is the effect of this error?

A)Net income is understated by $500.

B)Liabilities are overstated by $500.

C)Revenue is overstated by $500.

D)Assets are overstated by $500.

A)Net income is understated by $500.

B)Liabilities are overstated by $500.

C)Revenue is overstated by $500.

D)Assets are overstated by $500.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

56

For each of the following expenditures,indicate whether the amount is debited to an asset account or to an expense account.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

57

Westin Delivery Service Company owns a delivery truck.Which of the following costs,associated with the truck,will be treated as a revenue expenditure?

A)oil change and lubrication

B)major engine overhaul

C)modification for new use

D)addition to storage capacity

A)oil change and lubrication

B)major engine overhaul

C)modification for new use

D)addition to storage capacity

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

58

Classify each of the following expenditures as capital expenditure (CE)or revenue expenditure (RE).

1.________ Ordinary recurring repairs to keep the machinery in good working order

2.________ Major overhaul to extend the useful life of a vehicle by three years

3.________ Installation costs for a new machine

4.________ Painting

1.________ Ordinary recurring repairs to keep the machinery in good working order

2.________ Major overhaul to extend the useful life of a vehicle by three years

3.________ Installation costs for a new machine

4.________ Painting

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

59

Depreciation is the allocation of a plant asset's cost to expense over its useful life.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

60

Residual value is also known as depreciable cost.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following depreciation methods allocate a varying amount of depreciation to expense each year based on an asset's usage?

A)the straight-line method

B)the annuity method

C)the units-of-production method

D)the double-declining-balance method

A)the straight-line method

B)the annuity method

C)the units-of-production method

D)the double-declining-balance method

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

62

The book value of a plant asset is reported on the balance sheet as the cost of the asset minus accumulated depreciation.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

63

The units-of-production method allocates a varying amount of depreciation each year based on an asset's usage.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

64

A company purchased a computer on July 1,2019 for $50,000.The estimated useful life of the computer was five years,and it has no residual value.Which of the following methods should be used to best match its expense against the revenue it produces?

A)the units-of-production method

B)the straight-line method

C)the double-declining-balance method

D)the first-in,first-out method

A)the units-of-production method

B)the straight-line method

C)the double-declining-balance method

D)the first-in,first-out method

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

65

The double-declining-balance method is an accelerated method of depreciation.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

66

Estimated residual value can be zero if the company does not expect to receive anything when disposing of the asset.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

67

Gulfcoast Company purchased a van on January 1,2019,for $930,000.Estimated life of the van was five years,and its estimated residual value was $95,000.Gulfcoast uses the straight-line method of depreciation.Calculate the book value of the van at the end of 2019.

A)$755,625

B)$871,875

C)$835,000

D)$763,000

A)$755,625

B)$871,875

C)$835,000

D)$763,000

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

68

On January 1,2018,Tyson Manufacturing Corporation purchased a machine for $40,000,000.Tyson's management expects to use the machine for 33,000 hours over the next six years.The estimated residual value of the machine at the end of the sixth year is $47,000.The machine was used for 4000 hours in 2018 and 5500 hours in 2019.What is the depreciation expense for 2018 if the corporation uses the units-of-production method of depreciation? (Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )

A)$4,842,800

B)$13,333,333

C)$6,658,850

D)$4,848,480

A)$4,842,800

B)$13,333,333

C)$6,658,850

D)$4,848,480

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

69

The expected value of an asset at the end of its useful life is known as ________.

A)book value

B)residual value

C)carrying value

D)market value

A)book value

B)residual value

C)carrying value

D)market value

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following depreciation methods always allocates a higher amount of depreciation in earlier years than in later years?

A)the units-of-production method

B)the straight-line method

C)the double-declining-balance method

D)the first-in,first-out method

A)the units-of-production method

B)the straight-line method

C)the double-declining-balance method

D)the first-in,first-out method

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

71

When a business uses the straight-line method of depreciation,the amount of depreciation is reduced from year to year.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

72

The cost of an asset is $1,110,000,and its residual value is $110,000.Estimated useful life of the asset is eight years.Calculate depreciation for the second year using the double-declining-balance method of depreciation.(Do not round any intermediate calculations,and round your final answer to the nearest dollar. )

A)$138,750

B)$125,000

C)$250,000

D)$208,125

A)$138,750

B)$125,000

C)$250,000

D)$208,125

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

73

On January 1,2018,Jordan Company acquired a machine for $1,090,000.The estimated useful life of the asset is five years.Residual value at the end of five years is estimated to be $60,000.Calculate the depreciation expense per year using the straight-line method.

A)$218,000

B)$206,000

C)$266,000

D)$272,500

A)$218,000

B)$206,000

C)$266,000

D)$272,500

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

74

On January 1,2018,Sanderson Company acquired a machine for $1,070,000.The estimated useful life of the asset is five years.Residual value at the end of five years is estimated to be $87,000.What is the book value of the machine at the end of 2019 if the company uses the straight-line method of depreciation?

A)$642,000

B)$676,800

C)$589,800

D)$641,996

A)$642,000

B)$676,800

C)$589,800

D)$641,996

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

75

On January 1,2018,McHenry Manufacturing Company purchased a machine for $40,400,000.McHenry's management expects to use the machine for 34,000 hours over the next six years.The estimated residual value of the machine at the end of the sixth year is $50,000.The machine was used for 4600 hours in 2018 and 6000 hours in 2019.Calculate the book value of the machine at the end of 2019 if the company uses the units-of-production method of depreciation.(Round any intermediate calculations to two decimal places,and your final answer to the nearest dollar. )

A)$27,820,344

B)$40,400,000

C)$27,804,656

D)$34,940,904

A)$27,820,344

B)$40,400,000

C)$27,804,656

D)$34,940,904

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

76

An accelerated depreciation method expenses more of the asset's cost at the end of its useful life.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

77

The use of the Modified Accelerated Cost Recovery System (MACRS)is acceptable for financial reporting under GAAP.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

78

For tax purposes,an asset is fully depreciated to a book value of zero.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

79

The double-declining-balance method ignores the residual value until the depreciation expense takes the book value below the residual value.

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck

80

The cost of an asset is $1,090,000,and its residual value is $300,000.Estimated useful life of the asset is eight years.Calculate depreciation for the first year using the double-declining-balance method of depreciation.(Do not round any intermediate calculations,and round your final answer to the nearest dollar. )

A)$197,500

B)$272,500

C)$136,250

D)$98,750

A)$197,500

B)$272,500

C)$136,250

D)$98,750

Unlock Deck

Unlock for access to all 212 flashcards in this deck.

Unlock Deck

k this deck