Deck 8: Depreciation,cost Recovery,amortization,and Depletion

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/108

Play

Full screen (f)

Deck 8: Depreciation,cost Recovery,amortization,and Depletion

1

When lessor owned leasehold improvements are abandoned because of the termination of the lease,a loss can be taken for the unrecovered basis.

True

2

The concept of depreciation is based on the premise that an asset benefits more than one accounting period.

True

3

The basis of cost recovery property must be reduced by the cost recovery allowed.

False

4

Under the MACRS mid-quarter convention,an asset sold on December 10 will be treated as though it were sold on November 15 for a calendar year taxpayer.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

5

All eligible real estate under MACRS is permitted a full month of cost recovery in the month of disposition.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

6

Land improvements are generally not eligible for cost recovery.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

7

Taxpayers may elect to use the straight-line method under MACRS for personality.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

8

Under the MACRS straight-line election for personality,the mid-quarter convention is not applicable.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

9

In a farming business,MACRS straight-line cost recovery is required for all fruit bearing trees.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

10

The cost recovery basis for property converted from personal use to business use is the fair market value of the property at the time of the conversion.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

11

The cost recovery period for new farm equipment placed in service during 2010 is seven years.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

12

If more than 40% of the value of property,other than real property,is placed in service during the last quarter,all of the property will be allowed 1.5 months of cost recovery.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

13

The key date for calculating cost recovery is the date the asset is purchased.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

14

Motel buildings are classified as residential rental real estate.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

15

Antiques are not eligible for cost recovery.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

16

Hotels placed in service after May 12,1993 have a cost recovery period of 39 years.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

17

In a farming business,if an election is made to not have the uniform capitalization rules apply,cost is recovered using the ADS straight-line method.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

18

If 150% declining-balance is used,there is no straight-line switchover.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

19

Under MACRS,if the mid-quarter convention is applicable,all property sold is treated as being sold at the mid-point of the quarter in which it is sold.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

20

The cost recovery method for all personal property under MACRS is 200% declining balance.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

21

Once the more-than-50% business usage test is passed for listed property,it does not matter if the business usage for the property drops to 50% or less during the recovery period.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

22

Any § 179 expense amount that is carried forward is subject to the business income limitation in the carryforward year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

23

If a new car that is used predominantly in business is placed in service in 2010,the statutory dollar cost recovery limit under § 280F will depend on whether the taxpayer takes MARCS or straight-line depreciation.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

24

A taxpayer may elect to use the alternative depreciation system (ADS)on property used predominantly outside the United States.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

25

The inclusion amount for a leased automobile is not adjusted by a business usage percentage.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

26

The § 179 limit for a sports utility vehicle with a GVW of 7,000 pounds used in a trade or business is $25,000.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

27

The statutory dollar cost recovery limits under § 280F apply to all passenger automobiles.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

28

For all property placed in service in 2010,the § 179 maximum deduction is limited to $250,000.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

29

The statutory dollar cost recovery limits under § 280F for passenger automobiles do not apply if mid-quarter cost recovery is used.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

30

Taxable income for purposes of § 179 limited expensing is computed without regard to MACRS.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

31

If a new $80,000 automobile used 100% for business in the first year (2010)fails the 50% business usage test in the second year,no cost recovery will be recaptured.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

32

ADS 150% declining-balance depreciation is used to compute earnings and profits.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

33

All listed property is subject to the substantiation requirements of § 274.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

34

The costs of leasehold improvements owned by the lessee on residential rental real estate are recovered over a 27.5-year MACRS recovery period.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

35

If an automobile is placed in service in 2010,the limitation for cost recovery in 2012 will be based on the cost recovery limits for the year 2010.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

36

Property used for the production of income is not eligible for § 179 expensing.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

37

Under the alternative depreciation system (ADS),only the half-year convention is applicable for personality.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

38

If a taxpayer uses regular MACRS for all property,an alternative minimum tax adjustment is made with respect to the depreciation on all property.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

39

The § 179 deduction can exceed $250,000 in 2010 if the taxpayer had a § 179 amount which exceeded the taxable income limitation in the prior year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

40

The basis of property for cost recovery is reduced by the § 179 amount that is disallowed because of the business income limitation.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

41

Barry purchased a used business asset (seven-year property)on November 30,2010,at a cost of $200,000.This is the only asset he purchased during the year.Barry did not elect to expense any of the asset under § 179,nor did he elect straight-line cost recovery.Barry sold the asset on July 17,2011.Determine the cost recovery deduction for 2011.

A)$19,133.

B)$24,490.

C)$34,438.

D)$55,100.

E)None of the above.

A)$19,133.

B)$24,490.

C)$34,438.

D)$55,100.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following assets would be subject to cost recovery?

A)A painting by Picasso hanging on a doctor's office wall.

B)An antique vase in a doctor's waiting room.

C)Improvements to a parking lot used by a doctor's patients.

D)a. ,b. ,and c.

E)None of the above.

A)A painting by Picasso hanging on a doctor's office wall.

B)An antique vase in a doctor's waiting room.

C)Improvements to a parking lot used by a doctor's patients.

D)a. ,b. ,and c.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

43

Self-created intangibles are generally not § 197 intangibles.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

44

Hazel purchased a new business asset (five-year property)on November 30,2010,at a cost of $100,000.This was the only asset acquired by Hazel during 2010.On January 7,2011,Hazel placed the asset in service.She did not elect to expense any of the asset cost under § 179,nor did she elect straight-line cost recovery.If Congress reenacts additional first-year depreciation for 2010,Hazel did elect not to take additional first-year depreciation.On October 25,2012,Hazel sold the asset.Determine the cost recovery for 2012.

A)$9,600.

B)$16,000.

C)$26,000.

D)$38,000.

E)None of the above.

A)$9,600.

B)$16,000.

C)$26,000.

D)$38,000.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

45

The cost of a covenant not to complete for five years incurred in connection with the acquisition of a business is amortized over 15 years.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

46

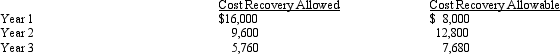

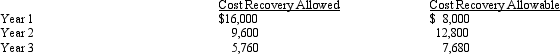

Tara purchased a machine for $40,000 to be used in her business.The cost recovery allowed and allowable for the three years the machine was used are as follows:  If Tara sells the machine after three years for $15,000,how much gain should she recognize?

If Tara sells the machine after three years for $15,000,how much gain should she recognize?

A)$3,480.

B)$6,360.

C)$9,240.

D)$11,480.

E)None of the above.

If Tara sells the machine after three years for $15,000,how much gain should she recognize?

If Tara sells the machine after three years for $15,000,how much gain should she recognize?A)$3,480.

B)$6,360.

C)$9,240.

D)$11,480.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

47

Bonnie purchased a new business asset (five-year property)on March 10,2010,at a cost of $20,000.She also purchased a new business asset (seven-year property)on November 20,2010,at a cost of $13,000.Bonnie did not elect to expense either of the assets under § 179,nor did she elect straight-line cost recovery.If Congress reenacts additional first-year depreciation for 2010,Bonnie did elect not to take additional first-year depreciation.Determine the cost recovery deduction for 2010 for these assets.

A)$5,858.

B)$7,464.

C)$9,586.

D)$19,429.

E)None of the above.

A)$5,858.

B)$7,464.

C)$9,586.

D)$19,429.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

48

For real property,the ADS convention is the mid-month convention.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

49

An election to use straight-line under ADS is made on a class-by-class basis for property other than eligible real estate.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

50

Alice purchased office furniture on September 20,2010,for $100,000.On October 10,she purchased business computers for $80,000.Alice did not elect to expense any of the assets under § 179,nor did she elect straight-line cost recovery.If Congress reenacts additional first-year depreciation for 2010,Alice does elect not to take additional first-year depreciation.Determine the cost recovery deduction for the business assets for 2010.

A)$6,426.

B)$14,710.

C)$25,722.

D)$30,290.

E)None of the above.

A)$6,426.

B)$14,710.

C)$25,722.

D)$30,290.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

51

Intangible drilling costs may be expensed rather than capitalized and written off through depletion.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

52

Goodwill associated with the acquisition of a business cannot be amortized.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

53

On June 1 of the current year,Tab converted a machine from personal use to rental property.At the time of the conversion,the machine was worth $90,000.Five years ago Tab purchased the machine for $70,000.The machine is still encumbered by a $50,000 mortgage.What is the basis of the machine for cost recovery?

A)$70,000.

B)$90,000.

C)$120,000.

D)$140,000.

E)None of the above.

A)$70,000.

B)$90,000.

C)$120,000.

D)$140,000.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

54

Percentage depletion enables the taxpayer to recover more than the cost of an asset.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

55

James purchased a new business asset (three-year personality)on July 23,2010,at a cost of $50,000.He did not elect to expense any of the asset under § 179,nor did he elect straight-line cost recovery.If Congress reenacts additional first-year depreciation for 2010,James did elect not to take additional first-year depreciation.Determine the cost recovery deduction for 2010.

A)$8,333.

B)$16,665.

C)$33,333.

D)$41,665.

E)None of the above.

A)$8,333.

B)$16,665.

C)$33,333.

D)$41,665.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

56

Cost depletion is determined by multiplying the depletion cost per unit by the number of units produced.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

57

Grape Corporation purchased a machine in December of the current year.This was the only asset purchased during the current year.The machine was placed in service in February of the following year.No assets were purchased in the following year.Grape Corporation's cost recovery would begin:

A)In the current year using a mid-quarter convention.

B)In the current year using a half-year convention.

C)In the following year using a mid-quarter convention.

D)In the following year using a half-year convention.

E)None of the above.

A)In the current year using a mid-quarter convention.

B)In the current year using a half-year convention.

C)In the following year using a mid-quarter convention.

D)In the following year using a half-year convention.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

58

The amortization period for $4,000 of startup expenses if no election is made is 180 months.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

59

Tan Company acquires a new machine (ten-year property)on January 15,2010,at a cost of $200,000.Tan also acquires another new machine (seven-year property)on November 5,2010,at a cost of $40,000.No election is made to use the straight-line method.The company does not make the § 179 election.If Congress reenacts additional first-year depreciation for 2010,Tan did elect not to take additional first-year depreciation.Determine the total deductions in calculating taxable income related to the machines for 2010.

A)$24,000.

B)$25,716.

C)$102,000.

D)$132,858.

E)None of the above.

A)$24,000.

B)$25,716.

C)$102,000.

D)$132,858.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

60

If startup expenses total $60,000,the total amount is amortized over 180 months.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

61

On February 20,2010,Susan paid $200,000 for a unique leasehold improvement to an office building that she is going to lease to John.The lease will begin on June 1,2010,and terminate on May 31,2025.At the termination of the lease,the improvement will be worthless.Determine Susan's deductible loss as a result of the termination of the lease.

A)$0.

B)$123,503.

C)$127,990.

D)$128,631.

E)None of the above.

A)$0.

B)$123,503.

C)$127,990.

D)$128,631.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

62

White Company acquires a new machine (seven-year property)on January 10,2010,at a cost of $900,000.White makes the election to expense the maximum amount under § 179.No election is made to use the straight-line method.If Congress reenacts additional first-year depreciation for 2010,White does elect not to take additional first-year depreciation.Determine the total deductions in calculating taxable income related to the machine for 2010 assuming White has taxable income of $500,000.

A)$64,000.

B)$128,610.

C)$257,175.

D)$500,000.

E)None of the above.

A)$64,000.

B)$128,610.

C)$257,175.

D)$500,000.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

63

On June 1,2010,Irene places in service a new automobile that cost $21,000.The car is used 70% for business and 30% for personal use.(Assume this percentage is maintained for the life of the car. )If Congress reenacts additional first-year depreciation for 2010,she does elect not to take additional first-year depreciation.Determine the cost recovery deduction for 2011.

A)$3,060.

B)$3,290.

C)$3,430.

D)$6,720.

E)None of the above.

A)$3,060.

B)$3,290.

C)$3,430.

D)$6,720.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

64

Cora purchased a hotel building on May 17,2010,for $6,000,000.Determine the cost recovery deduction for 2011.

A)$96,300.

B)$119,040.

C)$138,000.

D)$218,160.

E)None of the above.

A)$96,300.

B)$119,040.

C)$138,000.

D)$218,160.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

65

The only asset Bill purchased during 2010 was a new seven-year class asset.The asset,which was listed property,was acquired on June 17 at a cost of $50,000.The asset was used 40% for business,30% for the production of income,and the rest of the time for personal use.Bill always elects to expense the maximum amount under § 179 whenever it is applicable.The net income from the business before the § 179 deduction is $100,000.Determine Bill's maximum deduction with respect to the property for 2010.

A)$1,428.

B)$2,499.

C)$26,749.

D)$33,375.

E)None of the above.

A)$1,428.

B)$2,499.

C)$26,749.

D)$33,375.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

66

Janet purchased a new car on June 5,2010,at a cost of $18,000.She used the car 80% for business and 20% for personal use in 2010.She used the automobile 40% for business and 60% for personal use in 2011.If Congress reenacts additional first-year depreciation for 2010,Janet elects not to take additional first-year depreciation.Determine Janet's cost recovery recapture for 2011.

A)$0.

B)$928.

C)$1,008.

D)$1,440.

E)None of the above.

A)$0.

B)$928.

C)$1,008.

D)$1,440.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

67

Mary purchased a new five-year class asset on March 7,2010.The asset was listed property (not an automobile).It was used 60% for business and the rest of the time for personal use.The asset cost $600,000.Mary made the § 179 election.The income from the business before the § 179 deduction was $300,000.If Congress reenacts additional first-year depreciation for 2010,Mary does elect not to take additional first-year depreciation.Determine the total deductions with respect to the asset for 2010.

A)$72,000.

B)$250,000.

C)$272,000.

D)$300,000.

E)None of the above.

A)$72,000.

B)$250,000.

C)$272,000.

D)$300,000.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

68

On June 1,2010,James places in service a new automobile that cost $40,000.The car is used 60% for business and 40% for personal use.(Assume this percentage is maintained for the life of the car. )If Congress reenacts additional first-year depreciation for 2010,James does elect not to take additional first-year depreciation.Determine the cost recovery deduction for 2010.

A)$1,776.

B)$1,836.

C)$6,576.

D)$8,000.

E)None of the above.

A)$1,776.

B)$1,836.

C)$6,576.

D)$8,000.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

69

Howard's business is raising and harvesting peaches.On March 10,2010,Howard purchased 10,000 new peach trees at a cost of $50,000.Howard does not elect to expense assets under § 179.Determine the cost recovery deduction for 2010.

A)$0.

B)$1,250.

C)$2,500.

D)$10,000.

E)None of the above.

A)$0.

B)$1,250.

C)$2,500.

D)$10,000.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

70

Doug purchased a new factory building on January 15,1987,for $4,000,000.On March 1,2010,the building was sold.Determine the cost recovery deduction for the year of the sale assuming he did not use the MACRS straight-line method.

A)$0.

B)$15,870.

C)$26,450.

D)$126,960.

E)None of the above.

A)$0.

B)$15,870.

C)$26,450.

D)$126,960.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

71

On May 15,2010,Brent purchased new farm equipment for $80,000.Brent used the equipment in connection with his farming business.Brent does not elect to expense assets under § 179.If Congress reenacts additional first-year depreciation for 2010,Brent does elect not to take additional first-year depreciation.Determine the cost recovery deduction for 2010.

A)$8,000.

B)$12,000.

C)$16,000.

D)$20,000.

E)None of the above.

A)$8,000.

B)$12,000.

C)$16,000.

D)$20,000.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

72

Augie purchased one used asset during the year (five-year property)on November 10,2010,at a cost of $400,000.She made the § 179 election.The income from the business before the cost recovery deduction and the § 179 deduction was $100,000.Determine the total cost recovery deduction with respect to the asset for 2010.

A)$7,500.

B)$92,500.

C)$100,000.

D)$250,000.

E)None of the above.

A)$7,500.

B)$92,500.

C)$100,000.

D)$250,000.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

73

Hans purchased a new passenger automobile on August 17,2010,for $40,000.During the year the car was used 40% for business and 60% for personal use.Determine his cost recovery deduction for the car for 2010.

A)$500.

B)$1,000.

C)$1,224.

D)$1,500.

E)None of the above.

A)$500.

B)$1,000.

C)$1,224.

D)$1,500.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

74

In 2009,Gail had a § 179 deduction carryover of $15,000.In 2010,she elected § 179 for an asset acquired at a cost of $115,000.Gail's § 179 business income limitation for 2010 is $127,000.Determine Gail's § 179 deduction for 2010.

A)$15,000.

B)$115,000.

C)$128,000.

D)$130,000.

E)None of the above.

A)$15,000.

B)$115,000.

C)$128,000.

D)$130,000.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

75

On July 17,2010,Kevin places in service a used automobile that cost $18,000.The car is used 80% for business and 20% for personal use.In 2011,he used the automobile 40% for business and 60% for personal use.Determine the cost recovery recapture for 2011.

A)$0.

B)$1,200.

C)$1,248.

D)$2,400.

E)None of the above.

A)$0.

B)$1,200.

C)$1,248.

D)$2,400.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

76

On May 2,2010,Karen places in service a new sports utility vehicle that cost $70,000 and has a gross vehicle weight of 6,300 lbs.The vehicle is used 40% for business and 60% for personal use.Determine the cost recovery deduction for 2010.

A)$1,224.

B)$2,800.

C)$7,000.

D)$18,000.

E)None of the above.

A)$1,224.

B)$2,800.

C)$7,000.

D)$18,000.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

77

Carlos purchased an apartment building on November 16,1989,for $1,000,000.Determine the cost recovery for 2010.

A)$36,360.

B)$32,100.

C)$45,500.

D)$331,850.

E)None of the above.

A)$36,360.

B)$32,100.

C)$45,500.

D)$331,850.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

78

Diane purchased a factory building on November 15,1993,for $5,000,000.She sells the factory building on February 2,2010.Determine the cost recovery deduction for the year of the sale.

A)$16,025.

B)$19,844.

C)$26,458.

D)$158,750.

E)None of the above.

A)$16,025.

B)$19,844.

C)$26,458.

D)$158,750.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

79

On May 30,2010,Jane signed a 20-year lease on a factory building to use for her business.The lease begins on June 1,2010.In August of 2010,Jane paid $100,000 for leasehold improvements to the building.Determine Jane's cost recovery for the leasehold improvements for 2010.

A)$0.

B)$963.

C)$1,391.

D)$5,000.

E)None of the above.

A)$0.

B)$963.

C)$1,391.

D)$5,000.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

80

On June 1,2010,Sam purchased new farm machinery for $50,000.Sam used the machinery in connection with his farming business.Sam does not elect to expense assets under § 179.Sam has,however,made an election to not have the uniform capitalization rules apply to the farming business.If Congress reenacts additional first-year depreciation for 2010,Sam does elect not to take additional first-year depreciation.Determine the cost recovery deduction for 2010.

A)$5,000.

B)$7,500.

C)$10,000.

D)$12,500.

E)None of the above.

A)$5,000.

B)$7,500.

C)$10,000.

D)$12,500.

E)None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck