Deck 20: Distributions in Complete Liquidation and an Overview of Reorganizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/66

Play

Full screen (f)

Deck 20: Distributions in Complete Liquidation and an Overview of Reorganizations

1

Brown Corporation purchased 85% of the stock of Green Corporation five years ago for $1.2 million.In the current year,Brown Corporation liquidates Green Corporation and acquires assets with a basis to Green Corporation of $800,000 (fair market value of $1.3 million).Brown Corporation will have a basis in the assets of $1.2 million,the same as Brown's basis in the Green stock.

False

2

When planning a corporate reorganization,the tax laws should be considered only after the reorganization has been structured.

False

3

To ensure the desired tax treatment,parties contemplating a corporate reorganization should apply for a letter ruling from the IRS.

True

4

When a shareholder receives property subject to a liability pursuant to a complete liquidation (not a parent-subsidiary liquidation),the fair market value of the property is reduced by the amount of the liability in computing the shareholder's gain (or loss)on the liquidation.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

5

Shareholders may defer gain,to the point of collection,on a liquidating distribution of installment notes obtained by the corporation in the sale of its assets.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

6

One advantage of acquiring a corporation via a stock purchase instead of an asset purchase is that a stock purchase avoids the transfer of the acquired corporation's liabilities.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

7

If a parent corporation makes a § 338 election,the subsidiary corporation need not be liquidated.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

8

For purposes of the built-in loss limitation,the 2-year presumptive rule of tax avoidance can be rebutted if there is a clear and substantial relationship between the contributed property and the corporation's business.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

9

For purposes of the related-party loss limitation,"disqualified property" is defined as property that is acquired by the liquidating corporation in a § 351 or contribution to capital transaction during the two-year period ending on the date of the distribution.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

10

United States tax policy tries to encourage business development.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

11

Corporate shareholders would prefer to have a gain on a reorganization treated as a dividend rather than as a capital gain,because of the dividends received deduction.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

12

A subsidiary is liquidated pursuant to § 332.The parent has held 100% of the stock in the subsidiary for the past ten years.The subsidiary has E & P of $600,000 at the time of liquidation.The subsidiary's E & P disappears as a result of the liquidation.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

13

If a liquidation qualifies under § 332,any minority shareholder will recognize gain (but not loss)equal to the difference between the fair market value of assets received and the basis of the shareholder's stock.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

14

As a general rule,a liquidating corporation recognizes gains and losses on the distribution of property in complete liquidation.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

15

For a corporate restructuring to qualify as a tax-free reorganization,the transaction must have a sound business purpose.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

16

For purposes of the § 338 election,a corporation must acquire,in a taxable transaction,at least 50% of the stock (voting power and value)of another corporation within an 12-month period.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

17

Section 332 will apply to a parent-subsidiary liquidation even if the subsidiary corporation is insolvent on the date of the liquidation.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

18

Legal dissolution under state law is not required for a liquidation to be complete for tax purposes.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

19

If a parent corporation makes a § 338 election,the subsidiary recognizes gains and losses as result of a deemed sale of its assets.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

20

One similarity between the tax treatment accorded nonliquidating and liquidating distributions is with respect to the recognition of losses by the distributing corporation.As a general rule,a corporation recognizes losses on both nonliquidating and liquidating distributions of depreciated property (fair market value less than basis).

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

21

If the target corporation in a reorganization has a deficit in earnings and profits,any gains recognized by the shareholders are treated as stock redemptions and not as dividends.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

22

Pursuant to a complete liquidation,Woodpecker Corporation distributes the following assets to its unrelated shareholders: land held for six years as an investment (basis of $100,000,fair market value of $300,000),inventory (basis of $100,000,fair market value of $140,000),and marketable securities held for two years as an investment (basis of $200,000,fair market value of $120,000).What are the tax results to Woodpecker Corporation as a result of the liquidation?

A)Woodpecker Corporation would recognize ordinary income of $40,000 and a net capital gain of $200,000.

B)Woodpecker Corporation would recognize ordinary income of $40,000 and a net capital gain of $120,000.

C)Woodpecker Corporation would recognize ordinary income of $40,000 and a net capital loss of $80,000.

D)Woodpecker Corporation would recognize no gain or loss on the liquidation.

E)None of the above.

A)Woodpecker Corporation would recognize ordinary income of $40,000 and a net capital gain of $200,000.

B)Woodpecker Corporation would recognize ordinary income of $40,000 and a net capital gain of $120,000.

C)Woodpecker Corporation would recognize ordinary income of $40,000 and a net capital loss of $80,000.

D)Woodpecker Corporation would recognize no gain or loss on the liquidation.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

23

After a plan of complete liquidation has been adopted,Condor Corporation sells its only asset,land (basis of $170,000),to Eduardo (an unrelated party)for $400,000.Under the terms of the sale,Condor Corporation receives cash of $100,000 and Eduardo's notes for the balance of $300,000.The notes are payable over the next five years ($60,000 per year)and carry an appropriate interest rate.Immediately after the sale,Condor Corporation distributes the cash and notes to Maria,the sole shareholder of Condor Corporation.Maria has a basis of $80,000 in the Condor stock.The installment notes have a value equal to their face amount.If Maria wishes to defer as much gain as possible on the transaction,which of the following is correct?

A)Maria recognizes a gain of $80,000 in the year of liquidation.

B)Condor Corporation recognizes no gain or loss on the distribution of the installment notes.

C)Maria recognizes a gain of $240,000 in the year of liquidation.

D)Maria recognizes a gain of $320,000 in the year of liquidation.

E)None of the above.

A)Maria recognizes a gain of $80,000 in the year of liquidation.

B)Condor Corporation recognizes no gain or loss on the distribution of the installment notes.

C)Maria recognizes a gain of $240,000 in the year of liquidation.

D)Maria recognizes a gain of $320,000 in the year of liquidation.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

24

On April 7,2009,Crow Corporation acquired land in a transaction that qualified under § 351.The land had a basis of $480,000 to the contributing shareholder and a fair market value of $350,000.Assume that the shareholder also transferred equipment (basis of $50,000,fair market value of $200,000)in the same § 351 exchange.Crow Corporation adopted a plan of liquidation on October 6,2010.On December 8,2010,Crow Corporation distributes the land to Ali,a shareholder who owns 20% of the stock in Crow Corporation.The land's fair market value was $300,000 on the date of the distribution to Ali.Crow Corporation acquired the land to use as security for a loan it had hoped to obtain from a local bank.In negotiating with the bank for a loan,the bank required the additional capital investment as a condition of its making a loan to Crow Corporation.How much loss can Crow Corporation recognize on the distribution of the land?

A)$0.

B)$50,000.

C)$180,000.

D)$230,000.

E)None of the above.

A)$0.

B)$50,000.

C)$180,000.

D)$230,000.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

25

Debt security holders recognize gain when the principal amount of the securities received is greater than the principal amount given up.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

26

The gain postponed by a corporation in a corporate reorganization is the difference between the realized gain and the boot recognized.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

27

Corporate reorganizations can meet the requirements to qualify as like-kind exchanges if there is no boot involved.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

28

In corporate reorganizations in which the target receives property other than stock,gains but not losses can be recognized.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

29

Shareholders receiving other property as a part of a corporate reorganization may be treated as having their stock redeemed under § 302(b)and be in the adverse position of being treated as having sold a capital asset.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

30

The tax basis of the stock and securities received by a shareholder pursuant to a tax-free reorganization generally is the same as the basis of the stock and securities surrendered.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

31

Pursuant to a complete liquidation,Oriole Corporation distributes to its shareholders land with a basis of $450,000 and a fair market value of $550,000.The land is subject to a liability of $600,000.What is Oriole's recognized gain or loss on the distribution?

A)$0.

B)$100,000 gain.

C)$150,000 gain.

D)$50,000 loss.

E)None of the above.

A)$0.

B)$100,000 gain.

C)$150,000 gain.

D)$50,000 loss.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

32

The stock in Black Corporation is owned entirely by Nancy (80%)and Wanda (20%),mother and daughter.Three years ago,Nancy contributed land (basis of $200,000,fair market value of $250,000)to Black Corporation in a transaction that qualified under § 351.In the current year and pursuant to a complete liquidation of Black,the land is distributed proportionately to Nancy and Wanda.At the time of the liquidating distribution,the land had a fair market value of $100,000.What amount of loss will Black Corporation recognize on the distribution of the land?

A)$20,000.

B)$80,000.

C)$100,000.

D)$150,000.

E)None of the above.

A)$20,000.

B)$80,000.

C)$100,000.

D)$150,000.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

33

Magenta Corporation acquired land in a § 351 exchange one year ago.The land had a basis of $400,000 and a fair market value of $480,000 on the date of the transfer.Magenta Corporation has two equal shareholders,Mark and Megan,who are father and daughter.Magenta Corporation adopts a plan of liquidation in the current year.On this date,the land has decreased in value to $360,000.Magenta Corporation sells the land for $360,000 and distributes the proceeds pro rata to Mark and Megan.What amount of loss may Magenta Corporation recognize on the sale of the land?

A)$0.

B)$20,000.

C)$40,000.

D)$130,000.

E)None of the above.

A)$0.

B)$20,000.

C)$40,000.

D)$130,000.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

34

Originally the courts (in opposition to Congress)determined that businesses should be able to restructure without being subject to taxation.To be consistent with court findings,Congress changed the Code to provide reorganizations with treatment similar to that given under § 351 for starting a corporation.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

35

Purple Corporation has two equal shareholders,Joshua and Ellie,who are father and daughter.One year ago,the two shareholders transferred properties to Purple in a § 351 exchange.Joshua transferred undeveloped land (basis of $230,000,fair market value of $160,000)and securities (basis of $10,000,fair market value of $90,000),while Ellie transferred equipment (basis of $175,000,fair market value of $250,000).In the current year,Purple Corporation adopts a plan of liquidation,sells all of its assets,and distributes the proceeds pro rata to Joshua and Ellie.The only loss realized upon disposition of the properties was with respect to the undeveloped land that had decreased in value to $120,000 and was sold for this amount.Purple never used the land for any business purpose during the time it was owned by the corporation.What amount of loss can Purple Corporation recognize on the sale of the undeveloped land?

A)$0.

B)$40,000.

C)$70,000.

D)$120,000.

E)None of the above.

A)$0.

B)$40,000.

C)$70,000.

D)$120,000.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

36

The stock in Lark Corporation is owned equally by Olaf and his son Pete.In a liquidation of the corporation,Lark Corporation distributes to Olaf land that it had purchased three years ago for $550,000.The property has a fair market value on the date of distribution of $400,000.Later,Olaf sells the land for $420,000.What loss will Lark Corporation recognize with respect to the distribution of the land?

A)$0.

B)$20,000.

C)$130,000.

D)$150,000.

E)None of the above.

A)$0.

B)$20,000.

C)$130,000.

D)$150,000.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

37

In the current year,Dove Corporation (E & P of $1 million)distributes all of its property in a complete liquidation.Alexandra,a shareholder,receives land having a fair market value of $300,000.Dove Corporation had purchased the land as an investment three years ago for $375,000,and the land was distributed subject to a $270,000 liability.Alexandra took the land subject to the $270,000 liability.What is Alexandra's basis in the land?

A)$375,000.

B)$300,000.

C)$270,000.

D)$30,000.

E)None of the above.

A)$375,000.

B)$300,000.

C)$270,000.

D)$30,000.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

38

Noncorporate shareholders may elect out of § 368 and recognize losses when property subject to a liability is distributed to them in a corporate reorganization.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

39

Skylark Corporation owns 90% of the outstanding stock of Quail Corporation,having purchased the stock five years ago for $550,000.Pursuant to a plan of liquidation adopted by Quail Corporation on March 4,2010,Quail distributes all its property on December 1,2010,to its shareholders.Quail Corporation had never been insolvent and had E & P of $830,000 on the date of liquidation.Pursuant to the liquidation,Quail distributed property worth $690,000 (basis $580,000)to Skylark Corporation.How much gain must the parties recognize in 2010 on the transfer of this property to Skylark Corporation?

A)$140,000 as to Skylark and $110,000 as to Quail.

B)$0 as to Skylark and $110,000 as to Quail.

C)$140,000 as to Skylark and $0 as to Quail.

D)$30,000 as to Skylark and $110,000 as to Quail.

E)None of the above.

A)$140,000 as to Skylark and $110,000 as to Quail.

B)$0 as to Skylark and $110,000 as to Quail.

C)$140,000 as to Skylark and $0 as to Quail.

D)$30,000 as to Skylark and $110,000 as to Quail.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

40

During the current year,Ecru Corporation is liquidated and distributes its only asset,land,to Kena,the sole shareholder.On the date of distribution,the land has a basis of $300,000,a fair market value of $650,000,and is subject to a liability of $400,000.Kena,who takes the land subject to the liability,has a basis of $75,000 in the Ecru stock.With respect to the distribution of the land,which of the following statements is correct?

A)Ecru Corporation recognizes a gain of $100,000.

B)Kena has a basis of $250,000 in the land.

C)Kena recognizes a gain of $175,000.

D)Kena has a basis of $300,000 in the land.

E)Kena recognizes a gain of $575,000.

A)Ecru Corporation recognizes a gain of $100,000.

B)Kena has a basis of $250,000 in the land.

C)Kena recognizes a gain of $175,000.

D)Kena has a basis of $300,000 in the land.

E)Kena recognizes a gain of $575,000.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

41

Jupiter Corporation acquires all of Titian Corporation's stock in exchange for its voting stock.Iris received 1,000 shares of Jupiter valued at $50,000 for her 8,000 shares of Titian that cost Iris $100,000 five years ago.In addition to the Jupiter stock,she receives a $30,000 bond.How does Iris treat this transaction for tax purposes?

A)Iris recognizes a loss of $50,000.Her Jupiter stock basis is $50,000.

B)Iris recognizes a loss of $20,000.Her Jupiter stock basis is $80,000.

C)Iris recognizes a $20,000 loss and a $25,000 gain.Her Jupiter stock basis is $105,000.

D)Iris realizes a $20,000 loss that is not recognized.Her Jupiter stock basis is $120,000.

E)None of the above.

A)Iris recognizes a loss of $50,000.Her Jupiter stock basis is $50,000.

B)Iris recognizes a loss of $20,000.Her Jupiter stock basis is $80,000.

C)Iris recognizes a $20,000 loss and a $25,000 gain.Her Jupiter stock basis is $105,000.

D)Iris realizes a $20,000 loss that is not recognized.Her Jupiter stock basis is $120,000.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

42

All of the following statements are true about gains recognized in a corporate reorganization except:

A)Taxable amounts in a reorganization are classified as a dividend or capital gain.

B)Corporate shareholders would prefer taxable amounts in a reorganization be classified as a capital gain.

C)Individuals are taxed at the same rate for dividends and capital gains.

D)Capital gains and dividend income can be totally eliminated in a corporate reorganization with careful tax planning.

E)All of the above statements are true.

A)Taxable amounts in a reorganization are classified as a dividend or capital gain.

B)Corporate shareholders would prefer taxable amounts in a reorganization be classified as a capital gain.

C)Individuals are taxed at the same rate for dividends and capital gains.

D)Capital gains and dividend income can be totally eliminated in a corporate reorganization with careful tax planning.

E)All of the above statements are true.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

43

The stock of Cardinal Corporation is held as follows: 90% by Blue Jay Corporation (basis of $500,000)and 10% by Samuel (basis of $70,000).Cardinal Corporation is liquidated on October 20,2010,pursuant to a plan adopted on January 8,2010.Pursuant to the liquidation,Cardinal Corporation distributed Asset A (basis of $450,000,fair market value of $720,000)to Blue Jay,and Asset B (basis of $45,000,fair market value of $80,000)to Samuel.No election is made under § 338.With respect to the liquidation of Cardinal:

A)Samuel recognizes no gain (or loss).

B)Blue Jay has a basis in Asset A of $720,000.

C)Cardinal Corporation recognizes a gain of $35,000.

D)Blue Jay recognizes a gain of $220,000.

E)None of the above.

A)Samuel recognizes no gain (or loss).

B)Blue Jay has a basis in Asset A of $720,000.

C)Cardinal Corporation recognizes a gain of $35,000.

D)Blue Jay recognizes a gain of $220,000.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

44

Yellow Corporation and Green Corporation enter into a "Type A" reorganization.Raul currently holds a 15-year $100,000 Green bond paying 6% interest.In exchange for his Green bond,Raul receives a 5-year $125,000 Yellow bond paying 5% interest.Raul is happy with the Yellow bond because,even though it pays a lower interest rate,the yield provides slightly more interest than the Green bond,and both bonds mature on the same date.How does Raul treat this transaction on his tax return?

A)Raul recognizes gain of $25,000 on the exchange ($125,000 - $100,000).

B)Raul recognizes a $5,000 gain ($100,000 ´ 6% = $120,000 ´ 5%;$125,000 - $120,000 = $5,000).

C)Raul recognizes $1,250 gain ($5,000 ´ 5% ´ 5 years remaining on bond).

D)Raul has no gain because he exchanges a security for a security.

E)None of the above.

A)Raul recognizes gain of $25,000 on the exchange ($125,000 - $100,000).

B)Raul recognizes a $5,000 gain ($100,000 ´ 6% = $120,000 ´ 5%;$125,000 - $120,000 = $5,000).

C)Raul recognizes $1,250 gain ($5,000 ´ 5% ´ 5 years remaining on bond).

D)Raul has no gain because he exchanges a security for a security.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is not a reorganization designated under § 368(a)(1)?

A)Transfers due to a bankruptcy or receivership proceeding.

B)Recapitalization.

C)Transferring assets to a controlled corporation in exchange for stock that is given to the distributing corporation's shareholders.

D)Acquisition of target stock by exchanging voting stock of the acquiring corporation.

E)All of the above are reorganizations listed in § 368(a)(1).

A)Transfers due to a bankruptcy or receivership proceeding.

B)Recapitalization.

C)Transferring assets to a controlled corporation in exchange for stock that is given to the distributing corporation's shareholders.

D)Acquisition of target stock by exchanging voting stock of the acquiring corporation.

E)All of the above are reorganizations listed in § 368(a)(1).

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

46

On April 17,2009,Blue Corporation purchased 15% of the Gold Corporation stock outstanding.Blue Corporation purchased an additional 50% of the stock in Gold on November 23,2009,and an additional 20% on May 4,2010.On September 24,2010,Blue Corporation purchased the remaining 15% of Gold Corporation stock outstanding.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

47

Carlos purchased 20% of Target Corporation's stock five years ago for $50,000.In a transaction qualifying as a "Type A" reorganization,Carlos received $40,000 cash and 6% of Acquiring Corporation's stock (valued at $60,000)in exchange for his Target stock.Target had $300,000 accumulated earnings and profits prior to the reorganization.How does Carlos treat the exchange for tax purposes?

A)As a sale of stock and recognizes a $50,000 long-term capital gain.

B)As a sale of stock and recognizes a $10,000 long-term capital loss.

C)As a dividend of $40,000.

D)As a stock redemption and recognizes a $40,000 long-term capital gain.

E)Not enough information is available to determine proper treatment.

A)As a sale of stock and recognizes a $50,000 long-term capital gain.

B)As a sale of stock and recognizes a $10,000 long-term capital loss.

C)As a dividend of $40,000.

D)As a stock redemption and recognizes a $40,000 long-term capital gain.

E)Not enough information is available to determine proper treatment.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

48

During the current year,Goldfinch Corporation purchased 100% of the stock of Dove Corporation and made a qualified election under § 338.Which of the following statements is incorrect with respect to the § 338 election?

A)Dove is treated as a new corporation as of the day following the qualified stock purchase date.

B)If Dove is liquidated,Goldfinch will have a basis in the assets received equal to Dove's basis in the assets.

C)Goldfinch is treated as having bought all of Dove's assets on the qualified stock purchase date.

D)Dove can recognize gain or loss as a result of the § 338 election.

E)None of the above.

A)Dove is treated as a new corporation as of the day following the qualified stock purchase date.

B)If Dove is liquidated,Goldfinch will have a basis in the assets received equal to Dove's basis in the assets.

C)Goldfinch is treated as having bought all of Dove's assets on the qualified stock purchase date.

D)Dove can recognize gain or loss as a result of the § 338 election.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

49

Lyon has 100,000 shares outstanding that are worth $10 per share.It uses 32% of its stock plus $80,000 to acquire Zebra Corporation in a "Type A" reorganization.Zebra's assets are valued at $400,000 and its accumulated earnings and profits are $25,000 at the time of the reorganization.The Lyon shares and cash are distributed to the Zebra shareholders as follows.Jake (owning 62.5% of Zebra)receives 18,000 shares (value $180,000)and $70,000.Kara (owning 320.5% of Zebra)receives 14,000 shares (value $140,000)and $10,000.Jake and Kara each recognize gains to the extent of the cash they received.What is the character of Jake's and Kara's gains?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

50

The stock of Tan Corporation (E & P of $800,000)is owned as follows: 85% by Egret Corporation (basis of $470,000),and 15% by Zoe (basis of $45,000).Both shareholders acquired their shares in Tan more than six years ago.In the current year,Tan Corporation liquidates and distributes land (fair market value of $870,000,basis of $950,000)and equipment (fair market value of $405,000,basis of $280,000)to Egret Corporation,and securities (fair market value of $225,000,basis of $250,000)to Zoe.What are the tax consequences of these distributions to Egret,to Tan,and to Zoe?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

51

Cocoa Corporation is acquiring Milk Corporation in a "Type A" reorganization by exchanging 40% of its voting stock and $50,000 for all of Milk's assets (value of $850,000 and basis of $600,000)and liabilities ($200,000).The shareholders of Milk are Elsie (650 shares)and Ferdinand (350 shares).They bought their stock for $500 per share.What is the amount of gains or losses that Elsie and Ferdinand will recognize due to the reorganization? What is the value of the stock they received from Cocoa and what is their basis in the Cocoa stock?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

52

One of the tenets of U.S.tax policy is to encourage business development.Which of the following Code sections does not support this tenet?

A)Section 351,which allows entities to incorporate tax-free.

B)Section 1031,which allows the exchange of stock of one corporation for stock of another.

C)Section 368,which allows for tax-favorable corporate restructuring through mergers and acquisitions.

D)Section 381,which allows the target corporation's tax benefits to carryover to the successor corporation.

E)All of the above provisions support the tenet.

A)Section 351,which allows entities to incorporate tax-free.

B)Section 1031,which allows the exchange of stock of one corporation for stock of another.

C)Section 368,which allows for tax-favorable corporate restructuring through mergers and acquisitions.

D)Section 381,which allows the target corporation's tax benefits to carryover to the successor corporation.

E)All of the above provisions support the tenet.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

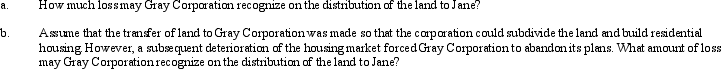

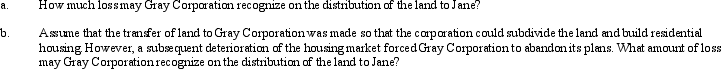

53

Mary and Jane,unrelated taxpayers,own Gray Corporation's stock equally.One year before the complete liquidation of Gray,Mary transfers land (basis of $300,000,fair market value of $280,000)to Gray Corporation as a contribution to capital.Assume that Mary also contributed other property in the same transaction having a basis of $10,000 and fair market value of $50,000.In liquidation,Gray distributes the land to Jane.At the time of the liquidation,the land is worth $200,000.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

54

The stock of Brown Corporation (E & P of $680,000)is owned as follows: 95% by Black Corporation (basis of $380,000),and 5% by Susanna (basis of $20,000).Both shareholders purchased their shares in Brown five years ago.In the current year,Brown Corporation liquidates and distributes land (fair market value of $950,000,basis of $550,000)to Black Corporation,and securities (fair market value of $50,000,basis of $35,000)to Susanna.Which of the following statements is incorrect with respect to the tax consequences resulting from these distributions?

A)Susanna recognizes a $30,000 gain and has a $35,000 basis in the securities.

B)Brown recognizes no gain on the distribution of the land.

C)Black recognizes no gain and has a $550,000 basis in the land.

D)Brown recognizes a $15,000 gain on the distribution of the securities.

E)None of the above.

A)Susanna recognizes a $30,000 gain and has a $35,000 basis in the securities.

B)Brown recognizes no gain on the distribution of the land.

C)Black recognizes no gain and has a $550,000 basis in the land.

D)Brown recognizes a $15,000 gain on the distribution of the securities.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

55

A shareholder bought 2,000 shares of Zee Corporation for $90,000 several years ago.When the stock is valued at $200,000,Zee redeems these shares in exchange for 6,000 shares of Yea Corporation stock.This transaction meets the requirements of § 368.Which of the following statements is true with regard to this transaction?

A)The shareholder has a recognized gain of $110,000.

B)The shareholder has a postponed gain of $110,000.

C)The shareholder has a basis in the Yea stock of $200,000.

D)Gain or loss cannot be determined because the value of the Yea stock is not given.

E)None of the above are true.

A)The shareholder has a recognized gain of $110,000.

B)The shareholder has a postponed gain of $110,000.

C)The shareholder has a basis in the Yea stock of $200,000.

D)Gain or loss cannot be determined because the value of the Yea stock is not given.

E)None of the above are true.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements is correct with respect to the § 338 election?

A)The subsidiary corporation makes the § 338 election.

B)A qualified stock purchase occurs when a corporation acquires,in a taxable transaction,at least 80% of the stock (voting power and value)of another corporation within a 18-month period.

C)The subsidiary corporation must be liquidated pursuant to the § 338 election.

D)For purposes of the qualified stock purchase requirement,subsidiary corporation stock acquired by any member of an affiliated group that includes the parent corporation is considered acquired by the parent.

E)None of the above.

A)The subsidiary corporation makes the § 338 election.

B)A qualified stock purchase occurs when a corporation acquires,in a taxable transaction,at least 80% of the stock (voting power and value)of another corporation within a 18-month period.

C)The subsidiary corporation must be liquidated pursuant to the § 338 election.

D)For purposes of the qualified stock purchase requirement,subsidiary corporation stock acquired by any member of an affiliated group that includes the parent corporation is considered acquired by the parent.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

57

Penguin Corporation purchased bonds (basis of $95,000)of its 100% owned subsidiary,Finch Corporation,at a discount.Pursuant to a § 332 liquidation and in satisfaction of the indebtedness,Finch distributes land worth $100,000 (basis of $110,000)to Penguin.Which of the following statements is correct with respect to the distribution of land?

A)Neither Finch nor Penguin recognize gain (or loss).

B)Finch recognizes a loss of $10,000 and Penguin recognizes no gain.

C)Finch recognizes a loss of $10,000 and Penguin recognizes a gain of $5,000.

D)Finch recognizes no loss and Penguin recognizes a gain of $5,000.

E)None of the above.

A)Neither Finch nor Penguin recognize gain (or loss).

B)Finch recognizes a loss of $10,000 and Penguin recognizes no gain.

C)Finch recognizes a loss of $10,000 and Penguin recognizes a gain of $5,000.

D)Finch recognizes no loss and Penguin recognizes a gain of $5,000.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

58

Silver Corporation redeems all of Alluvia's 3,000 shares and distributes to her 1,000 shares of Gold Corporation stock plus $20,000 cash.Alluvia's basis in her 30% interest in Silver is $80,000 and the stock's market value is $120,000.At the time Silver is acquired by Gold,the accumulated earnings and profits of Silver are $100,000 and Gold's are $50,000.How does Alluvia treat this transaction for tax purposes?

A)No gain is recognized by Alluvia in this reorganization.

B)Alluvia reports a $20,000 recognized dividend.

C)Alluvia reports a $20,000 recognized capital gain.

D)Alluvia reports a $15,000 recognized dividend and a $5,000 capital gain.

E)None of the above.

A)No gain is recognized by Alluvia in this reorganization.

B)Alluvia reports a $20,000 recognized dividend.

C)Alluvia reports a $20,000 recognized capital gain.

D)Alluvia reports a $15,000 recognized dividend and a $5,000 capital gain.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

59

Three years ago,Loon Corporation purchased 100% of the stock of Pelican Corporation for $950,000.Currently,Pelican Corporation has assets with a basis of $700,000 and a fair market value of $1.2 million.If Loon liquidates Pelican,what basis will Loon have in the assets it acquires from Pelican Corporation?

A)$0.

B)$700,000.

C)$950,000.

D)$1.2 million.

E)None of the above.

A)$0.

B)$700,000.

C)$950,000.

D)$1.2 million.

E)None of the above.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

60

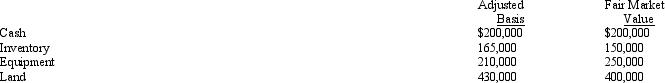

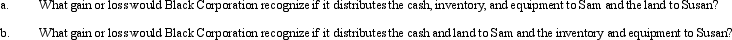

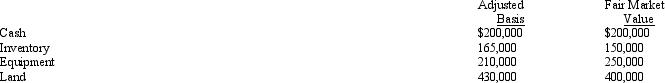

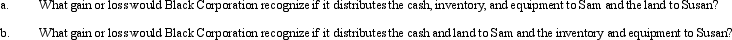

The stock in Black Corporation is owned by Sam and Susan,who are unrelated.Sam owns 60% and Susan owns 40% of the stock in Black Corporation.All of Black Corporation's assets were acquired by purchase.The following assets are to be distributed in complete liquidation of Black Corporation:

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

61

The text discusses four different limitations on loss recognition by liquidating corporations.Provide a brief description of each of these loss limitations.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

62

In a corporate liquidation governed by § 332,what considerations should be given in the distribution of property to a minority shareholder?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

63

Compare the sale of a corporation's assets with a sale of its stock in terms of problems to the seller.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

64

Explain how the tax treatment for parties involved in a tax-free reorganization almost exactly parallels the treatment under the like-kind exchange provisions of § 1031.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

65

Once a gain is recognized in a corporate reorganization,its character must be determined.What are the different tax character possibilities that a corporate reorganization gain may trigger?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

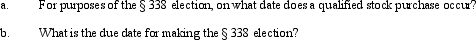

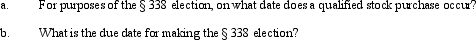

66

Describe the requirements for and tax consequences of a § 338 election.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck