Deck 12: Accounting for Not-For-Profit Organizations and Governments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/37

Play

Full screen (f)

Deck 12: Accounting for Not-For-Profit Organizations and Governments

1

Section 4430 of the CICA Handbook contains a provision applicable to not-for-profit organizations which grants an exemption from capitalizing and amortizing all their fixed assets.The exemption is applicable to:

A)not-for-profit organizations with fewer than ten employees.

B)not-for-profit organizations that have assets less than $1 million.

C)not-for-profit organizations that are unincorporated.

D)not-for-profit organizations whose two year average annual revenues in their statement of operations are less than $500,000.

A)not-for-profit organizations with fewer than ten employees.

B)not-for-profit organizations that have assets less than $1 million.

C)not-for-profit organizations that are unincorporated.

D)not-for-profit organizations whose two year average annual revenues in their statement of operations are less than $500,000.

D

2

Which of the following was NOT a common argument against the Accounting Standards Board's proposal that all capital acquisitions be capitalized and amortized?

A)Capitalization and amortization would be costly to apply.

B)It would change the nature of the operating statement from one that reflects resources spent to one that reflects resources used.

C)It would change the nature of the operating statement from one that reflects resources used to one that reflects resources spent.

D)Small not-for-profit financial statement users are only interested in seeing what money has been spent and what money is left over.

A)Capitalization and amortization would be costly to apply.

B)It would change the nature of the operating statement from one that reflects resources spent to one that reflects resources used.

C)It would change the nature of the operating statement from one that reflects resources used to one that reflects resources spent.

D)Small not-for-profit financial statement users are only interested in seeing what money has been spent and what money is left over.

C

3

The following information pertains to questions

Do-Good Inc.is a newly formed not-for-profit organization.On January,2012,its first day of operations,Do-Good purchased equipment costing $8,000.The equipment is estimated to have a useful life of 4 years,with no residual value at that time.This transaction was the only transaction that took place to date.

For question 14 through 16,assume that the equipment was purchased from a restricted fund contribution of $8,400.

What would be the balance in the Capital Fund on December 31,2012?

A)$4,400

B)$6,400

C)$400

D)($1,600)

Do-Good Inc.is a newly formed not-for-profit organization.On January,2012,its first day of operations,Do-Good purchased equipment costing $8,000.The equipment is estimated to have a useful life of 4 years,with no residual value at that time.This transaction was the only transaction that took place to date.

For question 14 through 16,assume that the equipment was purchased from a restricted fund contribution of $8,400.

What would be the balance in the Capital Fund on December 31,2012?

A)$4,400

B)$6,400

C)$400

D)($1,600)

B

4

The following information pertains to questions

Do-Good Inc.is a newly formed not-for-profit organization.On January,2012,its first day of operations,Do-Good purchased equipment costing $8,000.The equipment is estimated to have a useful life of 4 years,with no residual value at that time.This transaction was the only transaction that took place to date.

For question 14 through 16,assume that the equipment was purchased from a restricted fund contribution of $8,400.

In which fund would the purchase and amortization of the asset be recorded?

A)The General Fund

B)The Operating Fund

C)The Capital Fund

D)The Encumbrance Fund

Do-Good Inc.is a newly formed not-for-profit organization.On January,2012,its first day of operations,Do-Good purchased equipment costing $8,000.The equipment is estimated to have a useful life of 4 years,with no residual value at that time.This transaction was the only transaction that took place to date.

For question 14 through 16,assume that the equipment was purchased from a restricted fund contribution of $8,400.

In which fund would the purchase and amortization of the asset be recorded?

A)The General Fund

B)The Operating Fund

C)The Capital Fund

D)The Encumbrance Fund

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is correct?

A)An endowment is a donation that is received with the proviso that it be spent in a specified manner and often in the form of invested funds and only the earnings from the fund may be spent on the organization.

B)Endowments are unrestricted donations which can be used for any purposes that are consistent with the goals and objectives of the not-for-profit organization.

C)Endowments are provided as donations which only allow a not-for-profit organization to invest in other not-for-profit organizations only.

D)Endowments may be restricted and unrestricted funds which must be used in accordance with the wishes of the contributor and only available during the life of the donor.

A)An endowment is a donation that is received with the proviso that it be spent in a specified manner and often in the form of invested funds and only the earnings from the fund may be spent on the organization.

B)Endowments are unrestricted donations which can be used for any purposes that are consistent with the goals and objectives of the not-for-profit organization.

C)Endowments are provided as donations which only allow a not-for-profit organization to invest in other not-for-profit organizations only.

D)Endowments may be restricted and unrestricted funds which must be used in accordance with the wishes of the contributor and only available during the life of the donor.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

6

assume that the equipment was purchased from an unrestricted fund contribution of $8,000.

What would be the balance in the Capital Fund on December 31,2012?

A)$8,000

B)$6,400

C)$6,000

D)($1,600)

What would be the balance in the Capital Fund on December 31,2012?

A)$8,000

B)$6,400

C)$6,000

D)($1,600)

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is NOT an acceptable way of reporting a not-for-profit entity over which an organization has control?

A)By consolidating the controlled organization in its financial statements.

B)By providing the disclosure set out in paragraph 4450.22 of the Handbook.

C)If the controlled organization is one of a large number of individually immaterial organizations,by adhering to the disclosure requirements set out in paragraph 4450.26 of the Handbook.

D)By using the Equity method.

A)By consolidating the controlled organization in its financial statements.

B)By providing the disclosure set out in paragraph 4450.22 of the Handbook.

C)If the controlled organization is one of a large number of individually immaterial organizations,by adhering to the disclosure requirements set out in paragraph 4450.26 of the Handbook.

D)By using the Equity method.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following financial statements are NOT required by not-for-profit organizations for external reporting purposes?

A)A Statement of financial position

B)A Balance Sheet

C)A Statement of Cash Flows

D)A Statement of Operations

A)A Statement of financial position

B)A Balance Sheet

C)A Statement of Cash Flows

D)A Statement of Operations

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

9

assume that the equipment was purchased from an unrestricted fund contribution of $8,000.

In which fund would the receipt of the unrestricted contribution be recorded?

A)The General Fund

B)The Operating Fund

C)The Capital Fund

D)The Encumbrance Fund

In which fund would the receipt of the unrestricted contribution be recorded?

A)The General Fund

B)The Operating Fund

C)The Capital Fund

D)The Encumbrance Fund

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

10

How would the not-for-profit organization report each controlled profit-oriented enterprise?

A)It is not required to report its interest in for-profit subsidiaries and it is not-for-profit.

B)By disclosure it the notes to the financial statements of the not-for-profit organization.

C)By consolidating the controlled enterprise into its own financial statements or by using the equity method and disclosing additional financial information.

D)By using the cost method together with appropriate note disclosure.

A)It is not required to report its interest in for-profit subsidiaries and it is not-for-profit.

B)By disclosure it the notes to the financial statements of the not-for-profit organization.

C)By consolidating the controlled enterprise into its own financial statements or by using the equity method and disclosing additional financial information.

D)By using the cost method together with appropriate note disclosure.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

11

assume that the equipment was purchased from an unrestricted fund contribution of $8,000.

What would be the balance in the General Fund on December 31,2012?

A)$8,000

B)$6,400

C)$6,000

D)Nil

What would be the balance in the General Fund on December 31,2012?

A)$8,000

B)$6,400

C)$6,000

D)Nil

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

12

How must a not-for-profit organization account for a portfolio investment it has made in profit-seeking entity?

A)By using the cost method.

B)By using the equity method.

C)By using proportionate consolidation.

D)By consolidating the results of the profit-seeking entity with its own.

A)By using the cost method.

B)By using the equity method.

C)By using proportionate consolidation.

D)By consolidating the results of the profit-seeking entity with its own.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

13

The maximum amortization period specified by Section 4430 with respect to capital assets is:

A)5 years.

B)10 years.

C)20 years.

D)No maximum amortization period is specified.

A)5 years.

B)10 years.

C)20 years.

D)No maximum amortization period is specified.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is correct?

A)Unrestricted resources can be used for any purposes by a Not-for-Profit Organization.

B)Unrestricted resources can be used for any purposes that are consistent with the goals and objectives of the Not-for-Profit Organization.

C)Restricted resources can only be used in the case of a serious financial deficit situation.

D)Both restricted and unrestricted funds must be used in accordance with the wishes of the contributor.

A)Unrestricted resources can be used for any purposes by a Not-for-Profit Organization.

B)Unrestricted resources can be used for any purposes that are consistent with the goals and objectives of the Not-for-Profit Organization.

C)Restricted resources can only be used in the case of a serious financial deficit situation.

D)Both restricted and unrestricted funds must be used in accordance with the wishes of the contributor.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

15

Collections are works of art that have been excluded from the definition of capital assets because of all of the following EXCEPT:

A)Many works of art are considered priceless,so it is not possible to establish reasonable amortization guidelines.

B)The works are held for public exhibition,education and research.

C)They are protected,cared for,and preserved.

D)They are subject to organizational policies that require any proceeds from their sale to be used to acquire other items for the collection,or for the direct care of the existing collection.

A)Many works of art are considered priceless,so it is not possible to establish reasonable amortization guidelines.

B)The works are held for public exhibition,education and research.

C)They are protected,cared for,and preserved.

D)They are subject to organizational policies that require any proceeds from their sale to be used to acquire other items for the collection,or for the direct care of the existing collection.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is NOT correct?

A)A contribution receivable should be recognized as an asset when the amount can be reasonable estimated and the ultimate collection is reasonably assured.

B)A contribution receivable should be recognized as an asset when the amount can be reasonable estimated or the ultimate collection is reasonably assured.

C)A contribution receivable is one where in the contributor receives nothing directly in return for his or her contribution.

D)Government grants may qualify as contributions receivable.

A)A contribution receivable should be recognized as an asset when the amount can be reasonable estimated and the ultimate collection is reasonably assured.

B)A contribution receivable should be recognized as an asset when the amount can be reasonable estimated or the ultimate collection is reasonably assured.

C)A contribution receivable is one where in the contributor receives nothing directly in return for his or her contribution.

D)Government grants may qualify as contributions receivable.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

17

Section 4430 contains a compromise applicable to not-for-profit organizations whose provision two-year average annual revenues are less than $500,000.These organizations must disclose all of the following EXCEPT:

A)their accounting policy for capital assets

B)information about capital assets not shown in the balance sheet.

C)the amount expensed in the current period if their policy is to expense capital assets when acquired.

D)an appraised listing of the organizations capital assets,showing book values and appraised market values.

A)their accounting policy for capital assets

B)information about capital assets not shown in the balance sheet.

C)the amount expensed in the current period if their policy is to expense capital assets when acquired.

D)an appraised listing of the organizations capital assets,showing book values and appraised market values.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

18

assume that the equipment was purchased from an unrestricted fund contribution of $8,000.

In which fund would the purchase of the asset be recorded?

A)The General Fund

B)The Operating Fund

C)The Capital Fund

D)The Encumbrance Fund

In which fund would the purchase of the asset be recorded?

A)The General Fund

B)The Operating Fund

C)The Capital Fund

D)The Encumbrance Fund

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

19

The following information pertains to questions

Do-Good Inc.is a newly formed not-for-profit organization.On January,2012,its first day of operations,Do-Good purchased equipment costing $8,000.The equipment is estimated to have a useful life of 4 years,with no residual value at that time.This transaction was the only transaction that took place to date.

For question 14 through 16,assume that the equipment was purchased from a restricted fund contribution of $8,400.

What would be the carrying value of the equipment on December 31,2012?

A)$8,000

B)$8,400

C)$6,000

D)$6,300

Do-Good Inc.is a newly formed not-for-profit organization.On January,2012,its first day of operations,Do-Good purchased equipment costing $8,000.The equipment is estimated to have a useful life of 4 years,with no residual value at that time.This transaction was the only transaction that took place to date.

For question 14 through 16,assume that the equipment was purchased from a restricted fund contribution of $8,400.

What would be the carrying value of the equipment on December 31,2012?

A)$8,000

B)$8,400

C)$6,000

D)$6,300

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

20

Bequests are normally not recorded until:

A)the person making the bequests dies.

B)10 years after the death of the person making the bequest after which period of time the other parties interested in the estate cannot legally challenge the bequest.

C)the beneficiaries of the estate decide to pay out the bequest.

D)the will has been probated.

A)the person making the bequests dies.

B)10 years after the death of the person making the bequest after which period of time the other parties interested in the estate cannot legally challenge the bequest.

C)the beneficiaries of the estate decide to pay out the bequest.

D)the will has been probated.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

21

Prepare the necessary journal entries to record these transactions assuming that the deferral method of accounting for contributions is used.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is NOT a type of contribution as identified by the Handbook?

A)Restricted

B)Endowment

C)Unrestricted

D)Donated

A)Restricted

B)Endowment

C)Unrestricted

D)Donated

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

23

The following information pertains to questions

A government department uses an encumbrance system to keep tabs on spending.On July 1,2013,a department employee issued a purchase order for cleaning supplies estimated to cost $500.The supplies were delivered promptly,and invoiced at $450.

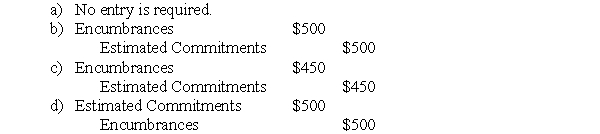

What would be the journal entry to record the Purchase Order?

A government department uses an encumbrance system to keep tabs on spending.On July 1,2013,a department employee issued a purchase order for cleaning supplies estimated to cost $500.The supplies were delivered promptly,and invoiced at $450.

What would be the journal entry to record the Purchase Order?

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

24

Prepare the necessary journal entries to record these transactions assuming that the restricted fund method of accounting for contributions is used.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

25

How is the deferral method of accounting for contributions to not-for-profit organizations applied in the case of unrestricted,endowment and restricted contributions?

A)Unrestricted and restricted contributions must be matched against expenses because of the matching principle.

B)Net assets maintained permanently in endowments.

C)Unrestricted Net Assets

D)Net assets invested in operations.

A)Unrestricted and restricted contributions must be matched against expenses because of the matching principle.

B)Net assets maintained permanently in endowments.

C)Unrestricted Net Assets

D)Net assets invested in operations.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

26

The following are selected transactions from Helpers Cooperative which uses the restricted fund method.Helpers has an operating fund,a capital fund and an endowment fund:

Pledges amounting to $400,000 were received,of which $80,000 applies to the operations of the following year.It is estimated that 2% of the pledges will be uncollectible.

The association purchased office equipment at a cost of $6,000.

Pledges of $300,000 were collected,while pledges amounting to $4,000 were written off as uncollectible.

A local newspaper agreed to offer Helpers a full-page ad.This had an estimated value of $5,000.

Interest and dividends received amounted to $15,000 on endowment fund investments.These earnings are considered unrestricted.

Depreciation for the year amounted to $40,000.

Required:

Prepare journal entries to record the above transactions.Also,indicate which fund will be used for each entry.

Pledges amounting to $400,000 were received,of which $80,000 applies to the operations of the following year.It is estimated that 2% of the pledges will be uncollectible.

The association purchased office equipment at a cost of $6,000.

Pledges of $300,000 were collected,while pledges amounting to $4,000 were written off as uncollectible.

A local newspaper agreed to offer Helpers a full-page ad.This had an estimated value of $5,000.

Interest and dividends received amounted to $15,000 on endowment fund investments.These earnings are considered unrestricted.

Depreciation for the year amounted to $40,000.

Required:

Prepare journal entries to record the above transactions.Also,indicate which fund will be used for each entry.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

27

If a not-for-profit organization that usually has annual revenues well below $500,000 subsequently earns revenues significantly higher than $500,000,how must it report its Capital Assets?

A)It must capitalize and amortize retroactively.

B)It must continue following the same policy.

C)It must disclose any change in policy in a note to its financial statements.

D)It must capitalize,but not amortize,retroactively.

A)It must capitalize and amortize retroactively.

B)It must continue following the same policy.

C)It must disclose any change in policy in a note to its financial statements.

D)It must capitalize,but not amortize,retroactively.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

28

Net assets could be broken down into any of the following categories EXCEPT:

A)Net assets invested in capital assets

B)Net assets maintained permanently in endowments.

C)Unrestricted Net Assets

D)Net assets invested in operations.

A)Net assets invested in capital assets

B)Net assets maintained permanently in endowments.

C)Unrestricted Net Assets

D)Net assets invested in operations.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

29

A not-for-profit organization is required to record the donation of capital assets at:

A)Replacement Cost.

B)Fair Value.

C)Net Realizable Value.

D)the donor's cost.

A)Replacement Cost.

B)Fair Value.

C)Net Realizable Value.

D)the donor's cost.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

30

The following information pertains to questions

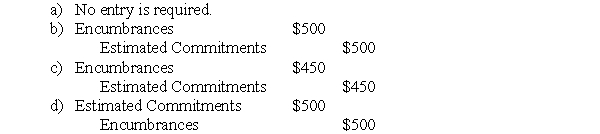

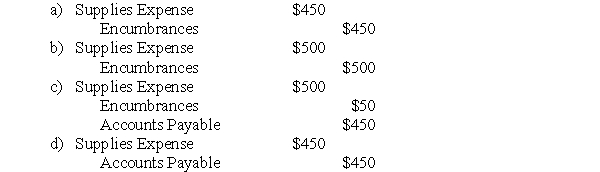

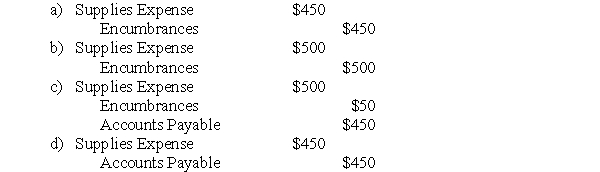

A government department uses an encumbrance system to keep tabs on spending.On July 1,2013,a department employee issued a purchase order for cleaning supplies estimated to cost $500.The supplies were delivered promptly,and invoiced at $450.

What would be the journal entry to record the payment of the invoice?

A government department uses an encumbrance system to keep tabs on spending.On July 1,2013,a department employee issued a purchase order for cleaning supplies estimated to cost $500.The supplies were delivered promptly,and invoiced at $450.

What would be the journal entry to record the payment of the invoice?

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

31

If a not-for-profit organization has revenues in excess of $500,000,how must it report its capital assets?

A)All asset purchases must be immediately and entirely expensed.

B)All capital assets must be capitalized and amortized.

C)All capital assets must be capitalized but not amortized.

D)All capital assets must be disclosed in a note to the financial statements.

A)All asset purchases must be immediately and entirely expensed.

B)All capital assets must be capitalized and amortized.

C)All capital assets must be capitalized but not amortized.

D)All capital assets must be disclosed in a note to the financial statements.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

32

The following information pertains to questions

The following are selected transactions for HELP-ON-US,an NFPO for 2014.

On January 1,the organization purchased fixed assets at a cost of $10,000.The assets were estimated to have a useful life of 5 years with no residual value.Straight-line amortization is used.

Assuming that the assets were purchased from a restricted fund contribution in the amount of $11,000,prepare the required journal entries for 2014,indicating the fund or funds to be used.

The following are selected transactions for HELP-ON-US,an NFPO for 2014.

On January 1,the organization purchased fixed assets at a cost of $10,000.The assets were estimated to have a useful life of 5 years with no residual value.Straight-line amortization is used.

Assuming that the assets were purchased from a restricted fund contribution in the amount of $11,000,prepare the required journal entries for 2014,indicating the fund or funds to be used.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

33

The following information pertains to questions

A government department uses an encumbrance system to keep tabs on spending.On July 1,2013,a department employee issued a purchase order for cleaning supplies estimated to cost $500.The supplies were delivered promptly,and invoiced at $450.

What would be the balance in the encumbrances account after payment of the invoice?

A)Nil

B)$50

C)($50)

D)$500

A government department uses an encumbrance system to keep tabs on spending.On July 1,2013,a department employee issued a purchase order for cleaning supplies estimated to cost $500.The supplies were delivered promptly,and invoiced at $450.

What would be the balance in the encumbrances account after payment of the invoice?

A)Nil

B)$50

C)($50)

D)$500

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

34

The following information pertains to questions

The following are selected transactions for HELP-ON-US,an NFPO for 2014.

On January 1,the organization purchased fixed assets at a cost of $10,000.The assets were estimated to have a useful life of 5 years with no residual value.Straight-line amortization is used.

Assuming that the assets were purchased from unrestricted fund sources,prepare the required journal entries for 2014,indicating the fund or funds to be used.

The following are selected transactions for HELP-ON-US,an NFPO for 2014.

On January 1,the organization purchased fixed assets at a cost of $10,000.The assets were estimated to have a useful life of 5 years with no residual value.Straight-line amortization is used.

Assuming that the assets were purchased from unrestricted fund sources,prepare the required journal entries for 2014,indicating the fund or funds to be used.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

35

Describe what fund accounting is and why is it used for not-for-profit organizations.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

36

The following information pertains to questions

The following are selected transactions for HELP-ON-US,an NFPO for 2014.

On January 1,the organization purchased fixed assets at a cost of $10,000.The assets were estimated to have a useful life of 5 years with no residual value.Straight-line amortization is used.

Prepare journal entries for these transactions,using the deferred contribution method,assuming that the assets were purchased using restricted funds in the amount of $11,000.

The following are selected transactions for HELP-ON-US,an NFPO for 2014.

On January 1,the organization purchased fixed assets at a cost of $10,000.The assets were estimated to have a useful life of 5 years with no residual value.Straight-line amortization is used.

Prepare journal entries for these transactions,using the deferred contribution method,assuming that the assets were purchased using restricted funds in the amount of $11,000.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

37

Where should endowment contributions be presented in the financial statements of a not-for-profit organization under the deferral method?

A)They are reflected in the notes to the financial statements.

B)They are used to effect a reduction to a related expense account.

C)They are reflected in the statement of changes in net assets.

D)They are shown on the Statement of Cash Flows.

A)They are reflected in the notes to the financial statements.

B)They are used to effect a reduction to a related expense account.

C)They are reflected in the statement of changes in net assets.

D)They are shown on the Statement of Cash Flows.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck