Deck 8: Consolidated Cash Flows and Ownership Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/58

Play

Full screen (f)

Deck 8: Consolidated Cash Flows and Ownership Issues

1

The following information pertains to questions

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows: Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

What would be the balance in Hanson's investment in Marvin account on December 31,2010?

A)$236,000

B)$200,000

C)$303,000

D)$304,625.

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows:

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.What would be the balance in Hanson's investment in Marvin account on December 31,2010?

A)$236,000

B)$200,000

C)$303,000

D)$304,625.

D

2

A Inc.owns 80% of B's outstanding voting shares.Under which of the following scenarios would A's ownership percentage of B change?

A)B Inc.announces a 2-for-1 stock split to all its common shareholders.

B)B issues an additional 10,000 voting shares.A acquires 8,000 shares of the new issue.

C)B issues an additional 10,000 voting shares.A acquires 6,400 shares of the new issue.

D)B retires 20,000 voting share,and in doing so,buy back 16,000 shares from B.

A)B Inc.announces a 2-for-1 stock split to all its common shareholders.

B)B issues an additional 10,000 voting shares.A acquires 8,000 shares of the new issue.

C)B issues an additional 10,000 voting shares.A acquires 6,400 shares of the new issue.

D)B retires 20,000 voting share,and in doing so,buy back 16,000 shares from B.

C

3

The following information pertains to questions

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows: Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

What would be the amount of the unamortized acquisition differential at the end of 2010?

A)Nil.

B)$30,000

C)$24,000

D)$42,000

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows:

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.What would be the amount of the unamortized acquisition differential at the end of 2010?

A)Nil.

B)$30,000

C)$24,000

D)$42,000

D

4

The following information pertains to questions

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows: Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

What is the amount of the acquisition differential amortization for 2009?

A)$6,250

B)$4,375

C)$5,625

D)$12,000

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows:

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.What is the amount of the acquisition differential amortization for 2009?

A)$6,250

B)$4,375

C)$5,625

D)$12,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

5

Assume that X Corp.controls X Corp.X constantly purchases and sells Y's voting shares on the open market while always ensuring that it maintains a controlling interest over Y.Which of the following statements pertaining to X buying and selling activity is correct?

A)X's activity has no effect on the non-controlling interest.

B)As X sells shares of Y,the non-controlling interest Increases.

C)As X sells shares of Y,the non-controlling interest decreases.

D)As X buys shares of Y,the non-controlling interest Increases.

A)X's activity has no effect on the non-controlling interest.

B)As X sells shares of Y,the non-controlling interest Increases.

C)As X sells shares of Y,the non-controlling interest decreases.

D)As X buys shares of Y,the non-controlling interest Increases.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

6

The following information pertains to questions

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows: Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

What is Hanson's ownership interest in Marvin after its January 1,2010 purchase?

A)60%

B)70%

C)80%

D)90%

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows:

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.What is Hanson's ownership interest in Marvin after its January 1,2010 purchase?

A)60%

B)70%

C)80%

D)90%

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

7

The following information pertains to questions

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows: Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Assuming that Hanson had no recorded goodwill prior to January 1,2009,what would be the amount of goodwill appearing on Hanson' December 31,2009 consolidated balance Sheet?

A)$80,000

B)$75,000

C)$89,900

D)$195,000

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows:

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.Assuming that Hanson had no recorded goodwill prior to January 1,2009,what would be the amount of goodwill appearing on Hanson' December 31,2009 consolidated balance Sheet?

A)$80,000

B)$75,000

C)$89,900

D)$195,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

8

What is the amount of unamortized acquisition differential after the sale?

A)$350,000

B)$140,000

C)$200,000

D)$300,000

A)$350,000

B)$140,000

C)$200,000

D)$300,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

9

The following information pertains to questions

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows: Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

By how much would the non-controlling interest amount have changed as a result of the Hanson's second purchase?

A)An Increase of $37,857.

B)A decrease of $37,857.

C)An Increase of $51,900

D)A decrease of $51,900

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows:

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.By how much would the non-controlling interest amount have changed as a result of the Hanson's second purchase?

A)An Increase of $37,857.

B)A decrease of $37,857.

C)An Increase of $51,900

D)A decrease of $51,900

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

10

What is ABC's ownership interest in 123 after its sale?

A)21%

B)36%

C)56%

D)42%

A)21%

B)36%

C)56%

D)42%

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

11

The following information pertains to questions

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows: Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

What is the amount of goodwill arising from Hanson's January 1,2009 acquisition?

A)$80,000

B)$50,000

C)$60,000

D)$200,000

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows:

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.What is the amount of goodwill arising from Hanson's January 1,2009 acquisition?

A)$80,000

B)$50,000

C)$60,000

D)$200,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

12

What is the amount of the non-controlling interest at acquisition?

A)$50,000

B)$18,000

C)$8,400

D)$150,000

A)$50,000

B)$18,000

C)$8,400

D)$150,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

13

The following information pertains to questions

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows: Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Assuming that Hanson had no recorded goodwill prior to January 1,2009,what would be the amount of goodwill appearing on Hanson' December 31,2010 Consolidated Balance Sheet?

A)$200,000

B)$75,000

C)$293,000

D)$209,900

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows:

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.Assuming that Hanson had no recorded goodwill prior to January 1,2009,what would be the amount of goodwill appearing on Hanson' December 31,2010 Consolidated Balance Sheet?

A)$200,000

B)$75,000

C)$293,000

D)$209,900

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

14

What is the carrying value of the trademark after the sale?

A)$30,000

B)$18,000

C)$20,000

D)$12,600

A)$30,000

B)$18,000

C)$20,000

D)$12,600

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

15

The following information pertains to questions

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows: Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

What is the amount of the acquisition differential amortization for 2010?

A)$1,500

B)$7,750

C)$6,500

D)$16,500

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows:

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.What is the amount of the acquisition differential amortization for 2010?

A)$1,500

B)$7,750

C)$6,500

D)$16,500

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

16

What is the amount of goodwill arising from this business combination?

A)$5,000

B)$150,000

C)($5,000)

D)Nil.

A)$5,000

B)$150,000

C)($5,000)

D)Nil.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

17

The following information pertains to questions

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows: Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

What percentage of Marvin's shares was purchased by Hanson on January 1,2009?

A)60%

B)10%

C)70%

D)90%

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows:

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.What percentage of Marvin's shares was purchased by Hanson on January 1,2009?

A)60%

B)10%

C)70%

D)90%

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

18

What would be the balance in the investment in 123 Inc.accounts after the sale?

A)$150,000

B)$100,000

C)$210,000

D)$225,000

A)$150,000

B)$100,000

C)$210,000

D)$225,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

19

What percentage of the Investment in 123 was sold by ABC?

A)14%

B)21%

C)28%

D)40%

A)14%

B)21%

C)28%

D)40%

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

20

The following information pertains to questions

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows: Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

What effect (if any)would Hanson's January 1,2010 purchase have on the company's consolidated cash flows for the year?

A)There would be no effect.

B)There would be a decrease in cash of $45,000 to the consolidated entity.

C)There would be a decrease in cash of $200,000 to the consolidated entity.

D)There would be a decrease in cash of $236,000 to the consolidated entity.

On January 1,2009,Hanson Inc.purchased 54,000 of Marvin Inc.'s 90,000 outstanding voting shares for $240,000.On that date,Marvin's common stock and retained earnings were valued at $60,000 and $90,000 respectively.Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment,which was estimated to have a fair market value that was $50,000 in excess of its recorded book value.The equipment was estimated to have a useful life of eight years.Both companies use straight line amortization exclusively.

On January 1,2010,Hanson purchased an additional 9,000 shares of Marvin Inc.on the open market for $45,000.On this date,Marvin's book values were equal to its fair market values with the exception of the company's equipment,which is now thought to be undervalued by $60,000.Moreover,the equipment's estimated useful life was revised to 4 years on this date.

Marvin's net Income and dividends for 2009 and 2010 are as follows:

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.

Marvin's goodwill was subject to an impairment loss of $5,000 during 2009.Hanson ABC Inc.uses the equity method to account for its investment in Marvin Inc.What effect (if any)would Hanson's January 1,2010 purchase have on the company's consolidated cash flows for the year?

A)There would be no effect.

B)There would be a decrease in cash of $45,000 to the consolidated entity.

C)There would be a decrease in cash of $200,000 to the consolidated entity.

D)There would be a decrease in cash of $236,000 to the consolidated entity.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

21

P Corp.owns 800 of Q Corp.'s 1,000 outstanding voting common shares which it accounts for using the equity method.On December 31,2009,the shareholder's equity section of Q Corp.was comprised of $15,000 in common stock and retained earnings in the amount of $450,000.

Q Corp.reported net Income and paid dividends of $120,000 and $20,000 respectively for the year ended December 31,2010.

On January 1,2011,P Corp.sold 200 shares of its investment in Q Corp.for $125,000.On January 1,2010,the investment account had a balance of $420,000.The acquisition differential was to be allocated as follows:

60% to patents (6 year remaining life).

30% to equipment (9 year remaining life).

What is the amount of Goodwill that arose from P's investment in Q?

A)Nil.

B)$18,000

C)$36,000

D)$6,000

Q Corp.reported net Income and paid dividends of $120,000 and $20,000 respectively for the year ended December 31,2010.

On January 1,2011,P Corp.sold 200 shares of its investment in Q Corp.for $125,000.On January 1,2010,the investment account had a balance of $420,000.The acquisition differential was to be allocated as follows:

60% to patents (6 year remaining life).

30% to equipment (9 year remaining life).

What is the amount of Goodwill that arose from P's investment in Q?

A)Nil.

B)$18,000

C)$36,000

D)$6,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

22

X owns 70% of Y which in turn owns 25% of Z.X also owns 20% of Z.Which of the following statements is correct?

A)X has direct control over Z.

B)X has indirect control over Z.

C)X has no control over Z.

D)X has contingent control over Z.

A)X has direct control over Z.

B)X has indirect control over Z.

C)X has no control over Z.

D)X has contingent control over Z.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

23

The following information pertains to questions

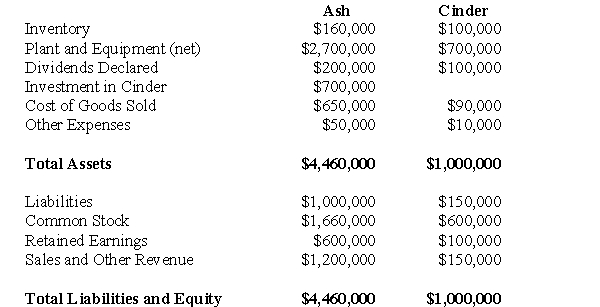

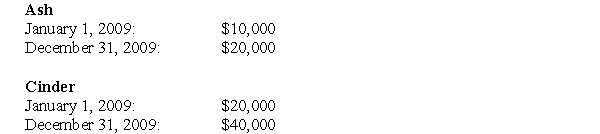

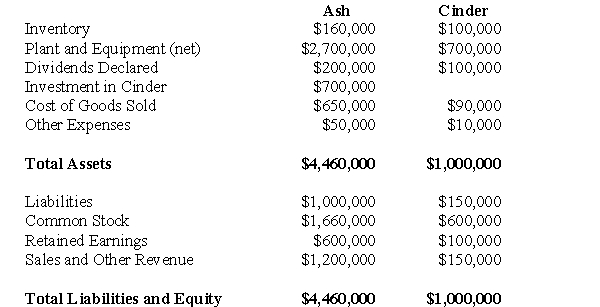

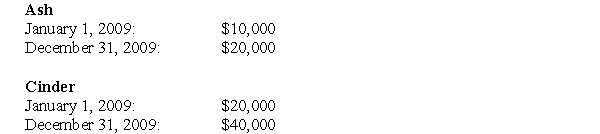

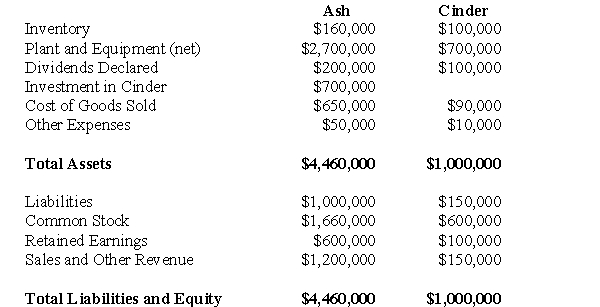

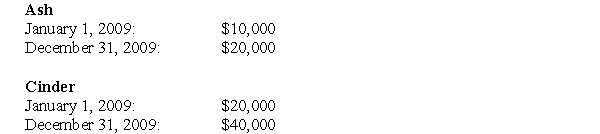

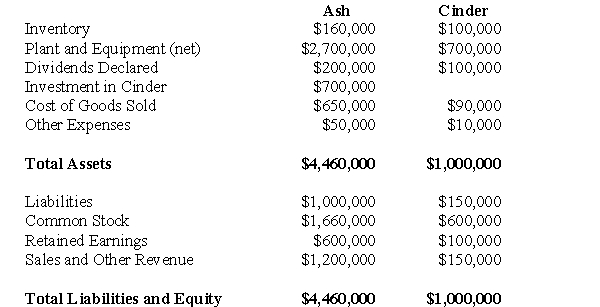

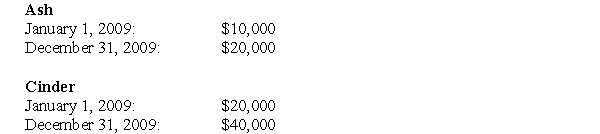

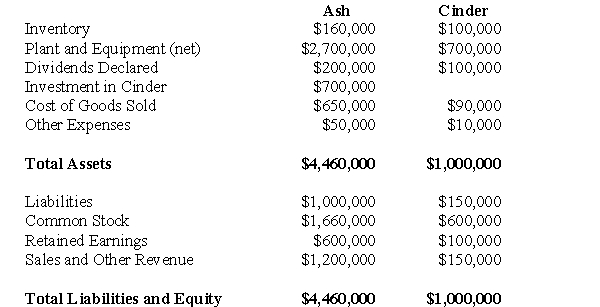

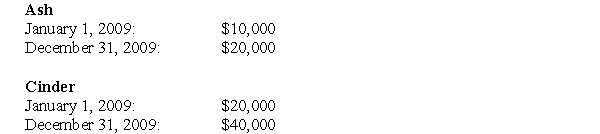

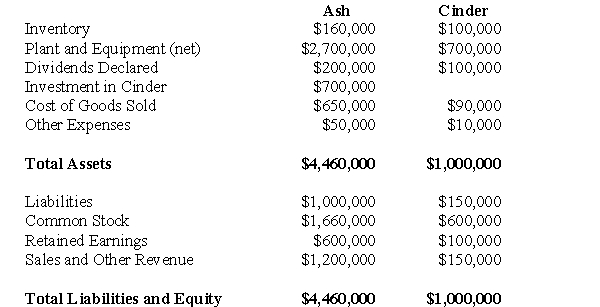

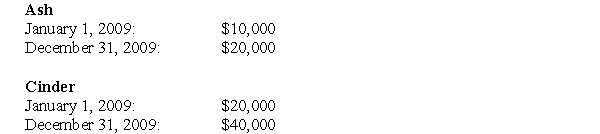

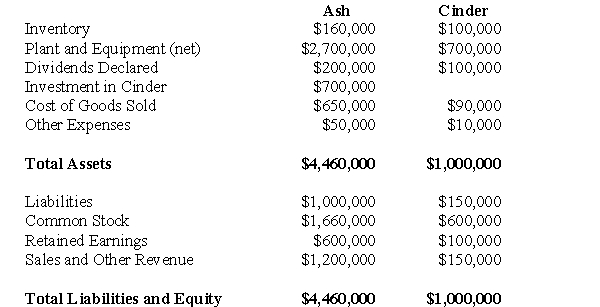

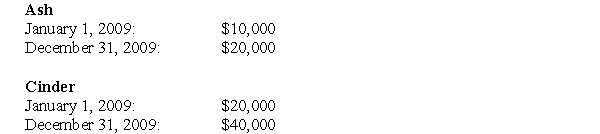

Whine purchased 80% of the outstanding voting shares of Dine Inc.on December 31,2009.The Balance Sheets of both companies on that date are shown below: Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.

Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.

The acquisition differential on the date of acquisition was attributed entirely to equipment which had a remaining useful life of ten years from the date of acquisition.

Whine Inc.uses the equity method to account for its investment in Dine Inc.There were no unrealized intercompany profits on December 31,2009.

What would be the amount of the unamortized acquisition differential on December 31,2009?

A)$40,000

B)$125,000

C)$50,000

D)$80,000

Whine purchased 80% of the outstanding voting shares of Dine Inc.on December 31,2009.The Balance Sheets of both companies on that date are shown below:

Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.

Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.The acquisition differential on the date of acquisition was attributed entirely to equipment which had a remaining useful life of ten years from the date of acquisition.

Whine Inc.uses the equity method to account for its investment in Dine Inc.There were no unrealized intercompany profits on December 31,2009.

What would be the amount of the unamortized acquisition differential on December 31,2009?

A)$40,000

B)$125,000

C)$50,000

D)$80,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

24

The following information pertains to questions

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows: Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.

Approximately what percentage of the non-controlling interest was due to G's own earnings?

A)19%

B)45%

C)30%

D)5%

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.Approximately what percentage of the non-controlling interest was due to G's own earnings?

A)19%

B)45%

C)30%

D)5%

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

25

Assuming that A acquired a controlling interest in B through numerous small acquisitions,what would be appropriate accounting with respect to these acquisitions?

A)An acquisition differential must be computed following each purchase.

B)The equity method must be adopted retroactively once 20% ownership is obtained.

C)The purchases should all be grouped together and treated as a single block purchase.

D)The cost method should be used until a controlling interest is acquired.

A)An acquisition differential must be computed following each purchase.

B)The equity method must be adopted retroactively once 20% ownership is obtained.

C)The purchases should all be grouped together and treated as a single block purchase.

D)The cost method should be used until a controlling interest is acquired.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

26

The following information pertains to questions

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows: Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.

What is the amount of non-controlling interest that would appear on A Inc.'s Consolidated Income Statement?

A)$660,000

B)$396,375

C)$400,000

D)Nil.

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.What is the amount of non-controlling interest that would appear on A Inc.'s Consolidated Income Statement?

A)$660,000

B)$396,375

C)$400,000

D)Nil.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

27

The following information pertains to questions

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows: Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.

What is the Consolidated Net Income for the year?

A)$2,170,000

B)$660,000

C)$1,510,000

D)$1,773,625

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.What is the Consolidated Net Income for the year?

A)$2,170,000

B)$660,000

C)$1,510,000

D)$1,773,625

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

28

The following information pertains to questions

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows: Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.

Approximately what percentage of the non-controlling interest was due to Y's own earnings?

A)19%

B)45%

C)30%

D)5%

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.Approximately what percentage of the non-controlling interest was due to Y's own earnings?

A)19%

B)45%

C)30%

D)5%

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

29

Assuming no intercompany transactions,what effect would the elimination of the parent's ownership interest in the shareholder equity of the subsidiary against the investment in the subsidiary have on the preparation have on the preparation of financial statements?

A)The difference arising from the elimination entry would yield the unamortized purchase price discrepancy on that date.

B)The difference arising from the elimination entry would give the purchase price discrepancy amortized to date.

C)The difference arising from the elimination entry would be allocated to goodwill.

D)The difference arising from the elimination entry would provide the balance in the non-controlling interest account.

A)The difference arising from the elimination entry would yield the unamortized purchase price discrepancy on that date.

B)The difference arising from the elimination entry would give the purchase price discrepancy amortized to date.

C)The difference arising from the elimination entry would be allocated to goodwill.

D)The difference arising from the elimination entry would provide the balance in the non-controlling interest account.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

30

The following information pertains to questions

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows: Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.

What is the net Income for the combined entity?

A)$2,170,000

B)$660,000

C)$1,510,000

D)$1,773,625

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.What is the net Income for the combined entity?

A)$2,170,000

B)$660,000

C)$1,510,000

D)$1,773,625

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

31

The following information pertains to questions

Whine purchased 80% of the outstanding voting shares of Dine Inc.on December 31,2009.The Balance Sheets of both companies on that date are shown below: Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.

Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.

The acquisition differential on the date of acquisition was attributed entirely to equipment which had a remaining useful life of ten years from the date of acquisition.

Whine Inc.uses the equity method to account for its investment in Dine Inc.There were no unrealized intercompany profits on December 31,2009.

What would be the amount of cash appearing on Whine's December 31,2009 Consolidated Balance Sheet?

A)$450,000

B)$610,000

C)$850,000

D)$810,000

Whine purchased 80% of the outstanding voting shares of Dine Inc.on December 31,2009.The Balance Sheets of both companies on that date are shown below:

Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.

Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.The acquisition differential on the date of acquisition was attributed entirely to equipment which had a remaining useful life of ten years from the date of acquisition.

Whine Inc.uses the equity method to account for its investment in Dine Inc.There were no unrealized intercompany profits on December 31,2009.

What would be the amount of cash appearing on Whine's December 31,2009 Consolidated Balance Sheet?

A)$450,000

B)$610,000

C)$850,000

D)$810,000

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

32

A owns 80% of B,which in turn owns 55% of C.Which of the following statements is correct?

A)A has direct control over C.

B)A has indirect control over C.

C)A has no control over C.

D)A has contingent control over C.

A)A has direct control over C.

B)A has indirect control over C.

C)A has no control over C.

D)A has contingent control over C.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

33

The following information pertains to questions

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows: Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.

Approximately what percentage of the non-controlling interest was due to J's own earnings?

A)19%

B)45%

C)30%

D)5%

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.Approximately what percentage of the non-controlling interest was due to J's own earnings?

A)19%

B)45%

C)30%

D)5%

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

34

P Corp.owns 800 of Q Corp.'s 1,000 outstanding voting common shares which it accounts for using the equity method.On December 31,2009,the shareholder's equity section of Q Corp.was comprised of $15,000 in common stock and retained earnings in the amount of $450,000.

Q Corp.reported net Income and paid dividends of $120,000 and $20,000 respectively for the year ended December 31,2010.

On January 1,2011,P Corp.sold 200 shares of its investment in Q Corp.for $125,000.On January 1,2010,the investment account had a balance of $420,000.The acquisition differential was to be allocated as follows:

60% to patents (6 year remaining life).

30% to equipment (9 year remaining life).

How much of the acquisition differential was allocated to patents?

A)$36,000

B)$18,000

C)$6,000

D)Nil.

Q Corp.reported net Income and paid dividends of $120,000 and $20,000 respectively for the year ended December 31,2010.

On January 1,2011,P Corp.sold 200 shares of its investment in Q Corp.for $125,000.On January 1,2010,the investment account had a balance of $420,000.The acquisition differential was to be allocated as follows:

60% to patents (6 year remaining life).

30% to equipment (9 year remaining life).

How much of the acquisition differential was allocated to patents?

A)$36,000

B)$18,000

C)$6,000

D)Nil.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

35

The following information pertains to questions

Whine purchased 80% of the outstanding voting shares of Dine Inc.on December 31,2009.The Balance Sheets of both companies on that date are shown below: Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.

Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.

The acquisition differential on the date of acquisition was attributed entirely to equipment which had a remaining useful life of ten years from the date of acquisition.

Whine Inc.uses the equity method to account for its investment in Dine Inc.There were no unrealized intercompany profits on December 31,2009.

What would be Whine's ownership interest in Dine following Chompster's purchase of Whine's shares?

A)75%

B)80%

C)60%

D)64%

Whine purchased 80% of the outstanding voting shares of Dine Inc.on December 31,2009.The Balance Sheets of both companies on that date are shown below:

Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.

Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.The acquisition differential on the date of acquisition was attributed entirely to equipment which had a remaining useful life of ten years from the date of acquisition.

Whine Inc.uses the equity method to account for its investment in Dine Inc.There were no unrealized intercompany profits on December 31,2009.

What would be Whine's ownership interest in Dine following Chompster's purchase of Whine's shares?

A)75%

B)80%

C)60%

D)64%

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

36

P Corp.owns 800 of Q Corp.'s 1,000 outstanding voting common shares which it accounts for using the equity method.On December 31,2009,the shareholder's equity section of Q Corp.was comprised of $15,000 in common stock and retained earnings in the amount of $450,000.

Q Corp.reported net Income and paid dividends of $120,000 and $20,000 respectively for the year ended December 31,2010.

On January 1,2011,P Corp.sold 200 shares of its investment in Q Corp.for $125,000.On January 1,2010,the investment account had a balance of $420,000.The acquisition differential was to be allocated as follows:

60% to patents (6 year remaining life).

30% to equipment (9 year remaining life).

How much of the acquisition differential was allocated to equipment?

A)$36,000

B)$18,000

C)$6,000

D)Nil.

Q Corp.reported net Income and paid dividends of $120,000 and $20,000 respectively for the year ended December 31,2010.

On January 1,2011,P Corp.sold 200 shares of its investment in Q Corp.for $125,000.On January 1,2010,the investment account had a balance of $420,000.The acquisition differential was to be allocated as follows:

60% to patents (6 year remaining life).

30% to equipment (9 year remaining life).

How much of the acquisition differential was allocated to equipment?

A)$36,000

B)$18,000

C)$6,000

D)Nil.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

37

Any unallocated portion of the difference between a parent's ownership interest in the shareholder equity of a subsidiary against the investment in that subsidiary would be:

A)allocated to goodwill.

B)attributable to the non-controlling interest.

C)expensed.

D)pro-rated across all identifiable assets and liabilities.

A)allocated to goodwill.

B)attributable to the non-controlling interest.

C)expensed.

D)pro-rated across all identifiable assets and liabilities.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

38

The following information pertains to questions

Whine purchased 80% of the outstanding voting shares of Dine Inc.on December 31,2009.The Balance Sheets of both companies on that date are shown below: Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.

Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.

The acquisition differential on the date of acquisition was attributed entirely to equipment which had a remaining useful life of ten years from the date of acquisition.

Whine Inc.uses the equity method to account for its investment in Dine Inc.There were no unrealized intercompany profits on December 31,2009.

What would be the gain or loss arising from Dine's share issue to Chompster?

A)A loss of $4,000

B)A gain of $4,000

C)A gain of $2,400

D)A loss of $2,400

Whine purchased 80% of the outstanding voting shares of Dine Inc.on December 31,2009.The Balance Sheets of both companies on that date are shown below:

Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.

Chompster Inc. ,one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc.As a result of the agreement,Dine Inc.would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding)to Chompster for $20 per share.The acquisition differential on the date of acquisition was attributed entirely to equipment which had a remaining useful life of ten years from the date of acquisition.

Whine Inc.uses the equity method to account for its investment in Dine Inc.There were no unrealized intercompany profits on December 31,2009.

What would be the gain or loss arising from Dine's share issue to Chompster?

A)A loss of $4,000

B)A gain of $4,000

C)A gain of $2,400

D)A loss of $2,400

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

39

P Corp.owns 800 of Q Corp.'s 1,000 outstanding voting common shares which it accounts for using the equity method.On December 31,2009,the shareholder's equity section of Q Corp.was comprised of $15,000 in common stock and retained earnings in the amount of $450,000.

Q Corp.reported net Income and paid dividends of $120,000 and $20,000 respectively for the year ended December 31,2010.

On January 1,2011,P Corp.sold 200 shares of its investment in Q Corp.for $125,000.On January 1,2010,the investment account had a balance of $420,000.The acquisition differential was to be allocated as follows:

60% to patents (6 year remaining life).

30% to equipment (9 year remaining life).

What was the amount of acquisition differential amortization for 2010?

A)$6,000

B)$8,000

C)$12,000

D)Nil.

Q Corp.reported net Income and paid dividends of $120,000 and $20,000 respectively for the year ended December 31,2010.

On January 1,2011,P Corp.sold 200 shares of its investment in Q Corp.for $125,000.On January 1,2010,the investment account had a balance of $420,000.The acquisition differential was to be allocated as follows:

60% to patents (6 year remaining life).

30% to equipment (9 year remaining life).

What was the amount of acquisition differential amortization for 2010?

A)$6,000

B)$8,000

C)$12,000

D)Nil.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

40

The following information pertains to questions

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows: Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.

Approximately what percentage of the non-controlling interest was due to D's own earnings?

A)19%

B)45%

C)30%

D)5%

The following information pertains to the shareholdings of an affiliated group of companies.The respective ownership interest of each company is outlined below.

A Inc.:

A Inc.owns 75% of J Inc.and 60% of G Inc.

J Inc.:

J Inc.owns 60% of D Inc.and 20% of G Inc.

G Inc.:

G Inc.owns 10% of J Inc.and 80% of Y Inc.

All intercompany investments are accounted for using the equity method.

The Net Incomes for these companies for the year ended December 31,2009 were as follows:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:

Unrealized intercompany profits earned by the various companies for the year ended December 31,2009 are shown below:  All companies are subject to a 25% tax rate.

All companies are subject to a 25% tax rate.Approximately what percentage of the non-controlling interest was due to D's own earnings?

A)19%

B)45%

C)30%

D)5%

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements pertaining to preferred shares is correct?

A)If the preferred shares are participating only the current year's Net Income would be allocated to the preferred shares.

B)If the preferred shares are non-cumulative dividends are never in arrears.

C)If the preferred shares are participating the current year's Net Income would be allocated to the shares only if the subsidiary is fully owned by the parent.

D)There can never be any dividends in arrears when preferred shares are participating.

A)If the preferred shares are participating only the current year's Net Income would be allocated to the preferred shares.

B)If the preferred shares are non-cumulative dividends are never in arrears.

C)If the preferred shares are participating the current year's Net Income would be allocated to the shares only if the subsidiary is fully owned by the parent.

D)There can never be any dividends in arrears when preferred shares are participating.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

42

The following information pertains to questions

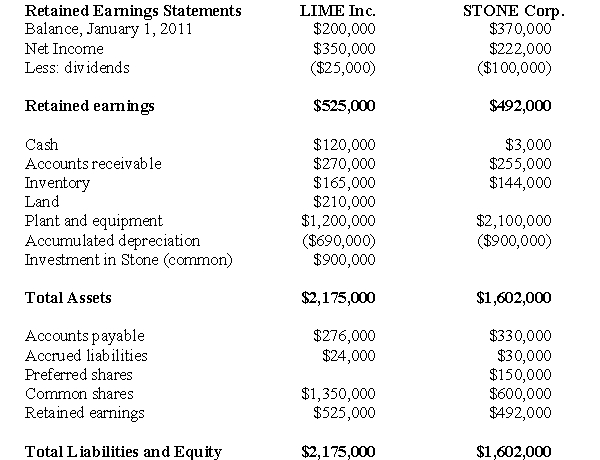

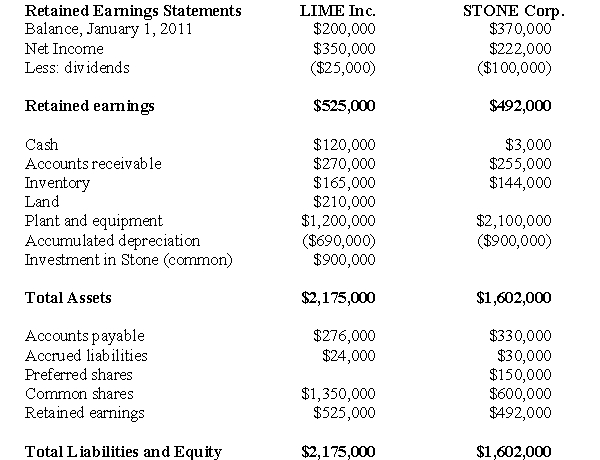

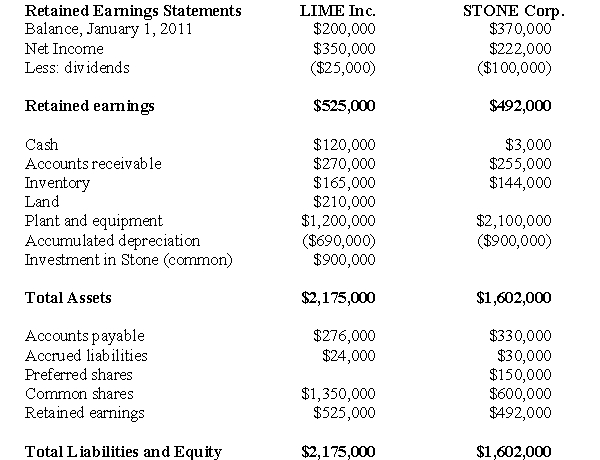

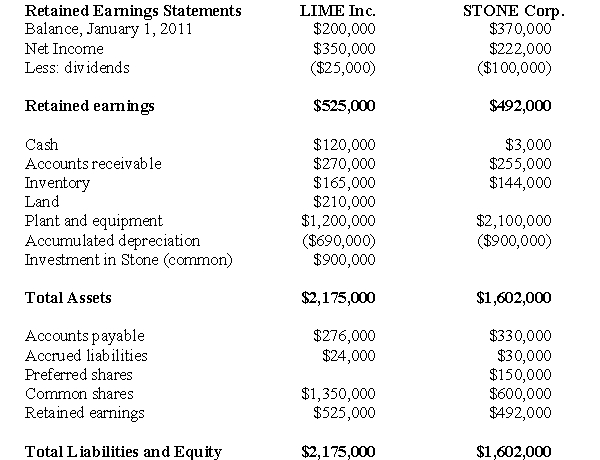

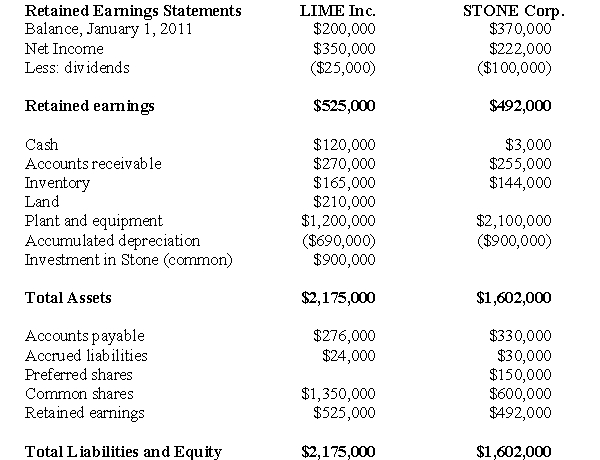

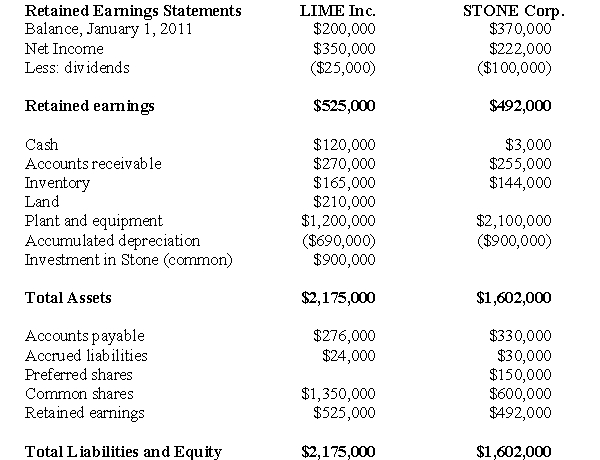

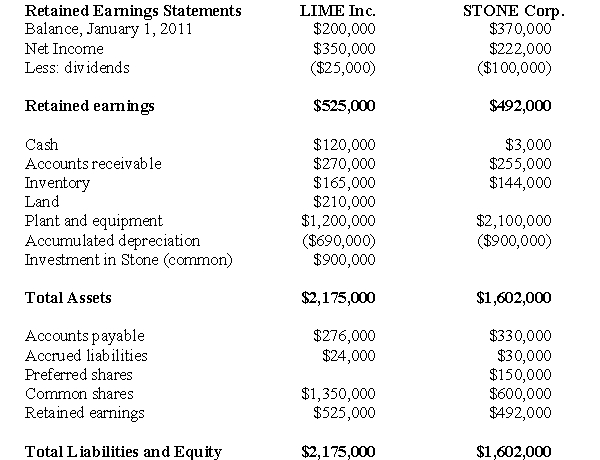

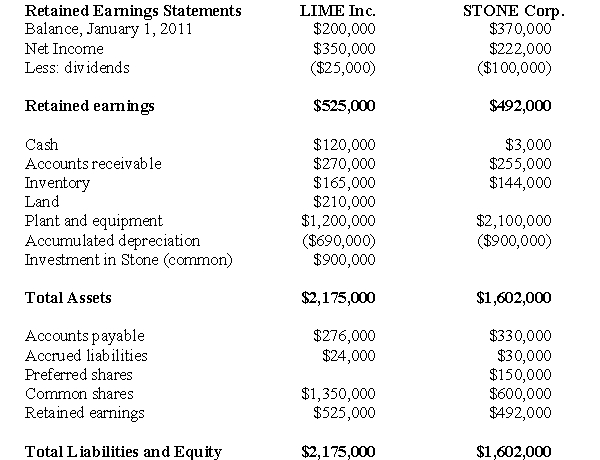

The financial statements of Lime Inc.and its subsidiary Stone Corp.on December 31,2011 are shown below: Other Information:

Other Information:

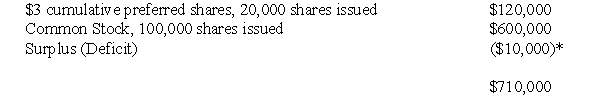

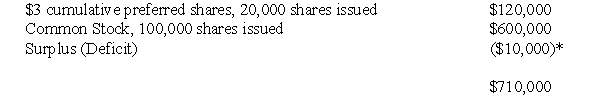

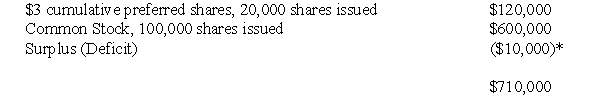

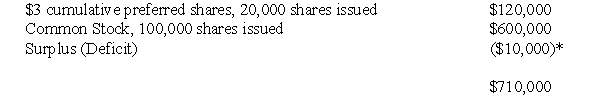

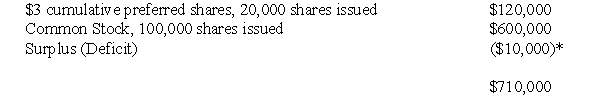

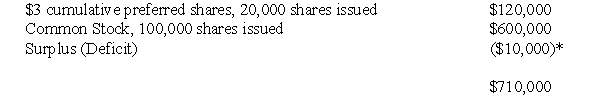

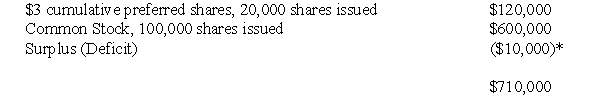

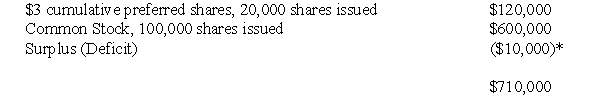

On January 1,2008 Stone's balance sheet showed the following shareholders equity: On this date,Lime acquired 80,000 common shares for $900,000.

On this date,Lime acquired 80,000 common shares for $900,000.

* Stone's preferred share dividends were one year in arrears on that date.

Stone's Fair Values approximated its book values on that date with the following exceptions:

Inventory had a fair value that was $30,000 higher than its book value.Plant and equipment had a fair value $10,000 lower than their book value.

The plant and equipment had an estimated remaining useful life of 10 years from the date of acquisition.

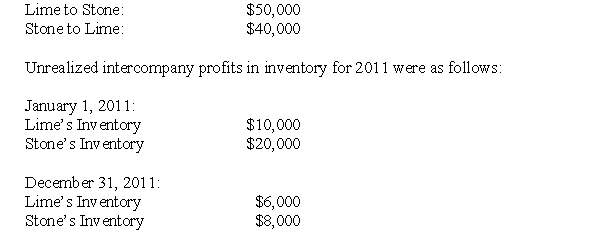

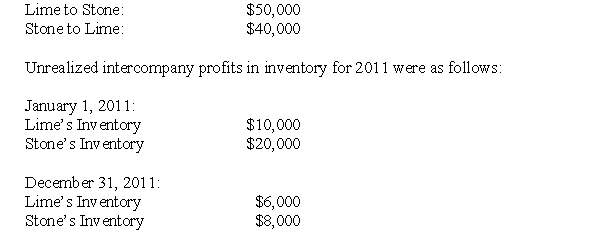

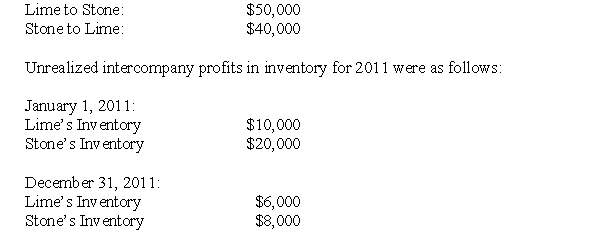

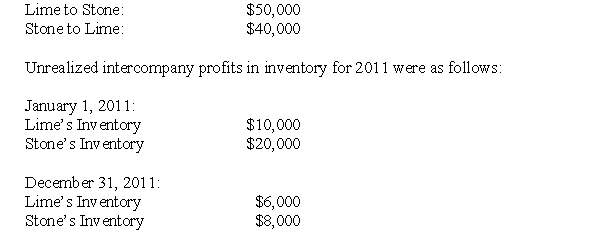

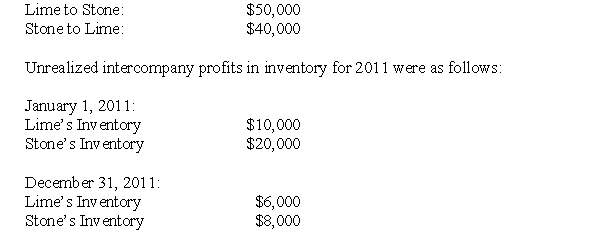

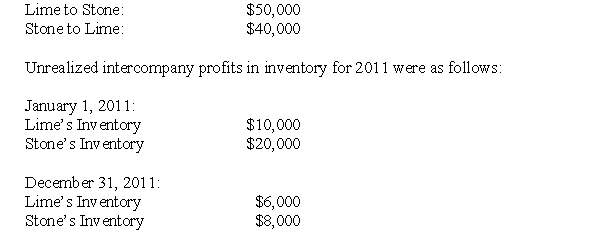

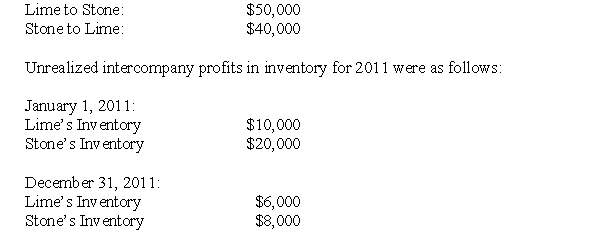

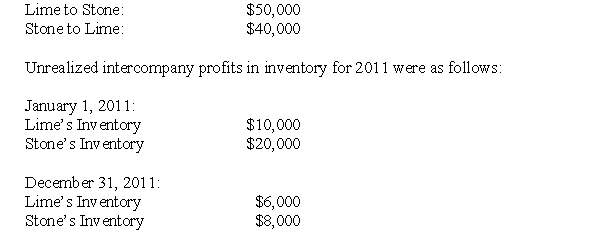

Intercompany sales of inventory for the year were as follows: On January 1,2009,Stone sold equipment to Lime for $30,000.The equipment had a carrying value of $25,000 on that date and an estimated useful life of 3 years.The inventory on hand at the start of 2011 was sold to outsiders during the year.Both companies are subject to a tax rate of 40%.There were no dividends in arrears on December 31,2011.Lime uses the cost method to account for its investment in Stone.

On January 1,2009,Stone sold equipment to Lime for $30,000.The equipment had a carrying value of $25,000 on that date and an estimated useful life of 3 years.The inventory on hand at the start of 2011 was sold to outsiders during the year.Both companies are subject to a tax rate of 40%.There were no dividends in arrears on December 31,2011.Lime uses the cost method to account for its investment in Stone.

Prepare Lime's December 31,2011 Consolidated Balance Sheet.

The financial statements of Lime Inc.and its subsidiary Stone Corp.on December 31,2011 are shown below:

Other Information:

Other Information:On January 1,2008 Stone's balance sheet showed the following shareholders equity:

On this date,Lime acquired 80,000 common shares for $900,000.

On this date,Lime acquired 80,000 common shares for $900,000.* Stone's preferred share dividends were one year in arrears on that date.

Stone's Fair Values approximated its book values on that date with the following exceptions:

Inventory had a fair value that was $30,000 higher than its book value.Plant and equipment had a fair value $10,000 lower than their book value.

The plant and equipment had an estimated remaining useful life of 10 years from the date of acquisition.

Intercompany sales of inventory for the year were as follows: