Deck 4: Corporations: Organization and Capital Structure

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/93

Play

Full screen (f)

Deck 4: Corporations: Organization and Capital Structure

1

Tina incorporates her sole proprietorship with assets having a fair market value of $100,000 and an adjusted basis of $110,000.Even though § 351 applies,Tina may recognize her realized loss of $10,000.

False

2

Gabriella and Juanita form Luster Corporation,each receiving 50 shares of its stock.Gabriella transfers cash of $50,000,while Juanita transfers a secret process (basis of zero and a fair market value of $50,000).Neither Gabriella nor Juanita recognizes gain as a result of these transfers.

True

3

In order to retain the services of Eve,a key employee in Ted's sole proprietorship,Ted contracts with Eve to make her a 30% owner.Ted incorporates the business receiving in return 100% of the stock.Three days later,Ted transfers 30% of the stock to Eve.Under these circumstances,§ 351 will not apply to the incorporation of Ted's business.

True

4

Similar to like-kind exchanges,the receipt of "boot" under § 351 can cause gain to be recognized.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

5

Similar to the like-kind exchange provision,§ 351 can be partly justified under the wherewithal to pay concept.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

6

The receipt of securities (i.e. ,long-term debt)in exchange for the transfer of appreciated property to a controlled corporation results in recognition of realized gain to the transferor.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

7

In a § 351 transfer,gain will be recognized to the extent of the greater of realized gain or the boot received.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

8

In a § 351 transaction,if a transferor receives consideration other than stock,the transaction can be taxable.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

9

The definition of property for purposes of § 351 includes unrealized receivables transferred by a cash basis taxpayer.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

10

In a § 351 transfer,a shareholder receives boot of $10,000 but ends up with a realized loss of $3,000.Only $7,000 of the boot will be taxed to the shareholder.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

11

When consideration is transferred to a corporation in return for stock,the definition of "property" is important because tax deferral treatment of § 351 is available only to taxpayers who transfer property.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

12

Eileen transfers property worth $200,000 (basis of $60,000)to Goldfinch Corporation.In return,she receives 80% of the stock in Goldfinch Corporation (fair market value of $180,000)and a long-term note,executed by Goldfinch and made payable to Eileen (fair market value of $20,000).Eileen recognizes no gain on the transfer.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

13

One month after Sally incorporates her sole proprietorship,she gives 25% of the stock to her children.Section 351 cannot apply to Sally because she has not satisfied the 80% control requirement.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

14

Beth forms Lark Corporation with a transfer of appreciated property in exchange for all of its shares.Shortly thereafter,she transfers half her shares to her son,Ted.The later transfer to Ted could cause the original transfer to be taxable.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

15

A taxpayer may never recognize a loss on the transfer of property in a transaction subject to § 351.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

16

The receipt of nonqualified preferred stock in exchange for the transfer of appreciated property to a controlled corporation results in recognition of gain to the transferor.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

17

Adam transfers inventory with an adjusted basis of $120,000,fair market value of $300,000,for 85% of the stock of Heron Corporation.In addition,he receives cash of $30,000.Adam recognizes a capital gain of $30,000 on the transfer.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

18

Three individuals form Skylark Corporation with the following contributions: Cliff,cash of $50,000 for 50 shares;Brad,land (fair market value of $20,000)for 20 shares;and Ron,cattle (fair market value of $9,000)for 9 shares and services (fair market value of $21,000)for 21 shares.Section 351 will not apply in this situation because the control requirement has not been satisfied.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

19

The use of § 351 is not limited to the initial formation of a corporation,and it can apply to later transfers as well.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

20

The transfer of an installment obligation in a transaction qualifying under § 351 is a disposition of the obligation that causes gain to be recognized by the transferor.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

21

When a taxpayer transfers property subject to a mortgage to a controlled corporation in an exchange qualifying under § 351,the transferor shareholder's basis in stock received in the transferee corporation is increased by the amount of the mortgage on the property.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

22

The bona fide business requirement of § 357(b)is easily satisfied as long as the liability arose in the normal course of conducting the business that is incorporated.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

23

When a taxpayer incorporates her business,she transfers several liabilities to the corporation.If one of the liabilities is personal in nature,only that liability is treated as boot.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

24

In general,the basis of property to a corporation in a transfer that qualifies as a nontaxable exchange under § 351 is the basis in the hands of the transferor shareholder decreased by the amount of any gain recognized on the transfer.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

25

Carl and Ben form Condor Corporation.Carl transfers cash of $50,000 for 50 shares of stock of Condor.Ben transfers a secret process with a tax basis of zero and a fair market value of $50,000 for the remaining 50 shares in Condor.Both Carl and Ben will have a tax basis of $50,000 in their stock in Condor Corporation.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

26

A shareholder contributes land to his wholly owned corporation but receives no stock in return.The corporation has a zero basis in the land.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

27

If both §§ 357(b)and (c)apply to the same transfer (i.e. ,the liability is not supported by a bona fide business purpose and also exceeds the basis of the properties transferred),§ 357(b)predominates.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

28

In determining whether § 357(c)applies,assess whether the liabilities involved exceed the bases of all assets a shareholder transfers to the corporation.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

29

In order to encourage the development of an industrial park,a county donates land to Ecru Corporation.The donation does not result in gross income to Ecru.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

30

A taxpayer transfers assets and liabilities to a corporation in return for its stock.If the liabilities exceed the basis of the assets transferred,the taxpayer will have a negative basis in the stock.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

31

To help avoid the thin capitalization problem,it is advisable to make the repayment of the debt contingent upon the corporation's earnings.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

32

When depreciable property is transferred to a controlled corporation under § 351,any recapture potential disappears and does not carry over to the corporation.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

33

Silver Corporation receives $1 million in cash from Madison County as an inducement to expand its operations.Within one year,Silver spends $1.5 million to enlarge its existing plant.Silver Corporation's basis in the expansion is $500,000.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

34

In return for legal services rendered incident to its formation,Crimson Corporation issues stock to Greta,an attorney.Crimson cannot immediately deduct the value of this stock but must treat it as a capital expenditure.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

35

A shareholder transfers a capital asset to Red Corporation for its stock.If the transfer qualifies under § 351,Red's holding period for the asset begins on the day of the exchange.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

36

Basis of appreciated property transferred minus boot received (including liabilities transferred)plus gain recognized equals basis of stock received in a § 351 transfer.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

37

If a corporation is thinly capitalized,all debt is reclassified as equity.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

38

Kim,a real estate dealer,and others form Eagle Corporation under § 351.Kim contributes inventory (land held for resale)in return for Eagle stock.The holding period for the stock includes the holding period of the inventory.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

39

To ease a liquidity problem,all of the shareholders of Osprey Corporation contribute additional cash to its capital.Osprey has no tax consequences from the contribution.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

40

A shareholder's holding period for stock received under § 351 includes the holding period of the property transferred to the corporation.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

41

If a shareholder owns stock received as a gift from her mother,it cannot be § 1244 stock.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

42

Tara incorporates her sole proprietorship,transferring it to newly formed Black Corporation.The assets transferred have an adjusted basis of $240,000 and a fair market value of $300,000.Also transferred was $10,000 in liabilities,$1,000 of which was personal and the balance of $9,000 being business related.In return for these transfers,Tara receives all of the stock in Black Corporation.

A)Black Corporation has a basis of $241,000 in the property.

B)Black Corporation has a basis of $240,000 in the property.

C)Tara's basis in the Black Corporation stock is $241,000.

D)Tara's basis in the Black Corporation stock is $249,000.

E)None of the above.

A)Black Corporation has a basis of $241,000 in the property.

B)Black Corporation has a basis of $240,000 in the property.

C)Tara's basis in the Black Corporation stock is $241,000.

D)Tara's basis in the Black Corporation stock is $249,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

43

Sarah and Tony (mother and son)form Dove Corporation with the following investments: cash by Sarah of $55,000;land by Tony (basis of $35,000 and fair market value of $45,000).Dove Corporation issues 200 shares of stock,100 each to Sarah and Tony.Thus,each receives stock in Dove worth $50,000.

A)Section 351 cannot apply since Sarah should have received 110 shares instead of only 100.

B)As a result of the transfer,Tony recognizes a gain of $10,000.

C)Tony's basis in the stock of Dove Corporation is $50,000.

D)Section 351 may apply because stock need not be issued to Sarah and Tony in proportion to the value of the property transferred.

E)None of the above.

A)Section 351 cannot apply since Sarah should have received 110 shares instead of only 100.

B)As a result of the transfer,Tony recognizes a gain of $10,000.

C)Tony's basis in the stock of Dove Corporation is $50,000.

D)Section 351 may apply because stock need not be issued to Sarah and Tony in proportion to the value of the property transferred.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

44

Sarah and Emily form Red Corporation with the following investments: Sarah transfers computers worth $200,000 (basis of $80,000),while Emily transfers real estate worth $180,000 (basis of $40,000)and services (worth $20,000)rendered in organizing the corporation.Each is issued 600 shares in Red Corporation.With respect to the transfers:

A)Sarah has no recognized gain;Emily recognizes income/gain of $160,000.

B)Neither Sarah nor Emily recognizes gain or income.

C)Red Corporation has a basis of $60,000 in the real estate.

D)Emily has a basis of $60,000 in the shares of Red Corporation.

E)None of the above.

A)Sarah has no recognized gain;Emily recognizes income/gain of $160,000.

B)Neither Sarah nor Emily recognizes gain or income.

C)Red Corporation has a basis of $60,000 in the real estate.

D)Emily has a basis of $60,000 in the shares of Red Corporation.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

45

Ann,Irene,and Bob incorporate their respective businesses and form Dove Corporation.Ann exchanges her property (basis of $100,000 and fair market value of $400,000)for 200 shares in Dove Corporation on March 3,2008.Irene exchanges her property (basis of $140,000 and fair market value of $600,000)for 300 shares in Dove Corporation on April 10,2008.Bob transfers his property (basis of $250,000 and fair market value of $1,000,000)for 500 shares in Dove Corporation on May 17,2010.Bob's transfer is not part of a prearranged plan with Ann and Irene to incorporate their businesses.What gain,if any,will Bob recognize on the transfer?

A)$1,000,000.

B)$750,000.

C)$250,000.

D)$0.

E)None of the above.

A)$1,000,000.

B)$750,000.

C)$250,000.

D)$0.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

46

Erica transfers land worth $500,000,basis of $100,000,to a newly formed corporation,Robin Corporation,for all of Robin's stock,worth $300,000,and a 10-year note.The note was executed by Robin and made payable to Erica in the amount of $200,000.As a result of the transfer:

A)Erica does not recognize gain.

B)Erica recognizes gain of $400,000.

C)Robin Corporation has a basis of $100,000 in the land.

D)Robin Corporation has a basis of $300,000 in the land.

E)None of the above.

A)Erica does not recognize gain.

B)Erica recognizes gain of $400,000.

C)Robin Corporation has a basis of $100,000 in the land.

D)Robin Corporation has a basis of $300,000 in the land.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

47

Wade and Paul form Swan Corporation with the following investments.Wade transfers machinery (basis of $40,000 and fair market value of $100,000),while Paul transfers land (basis of $20,000 and fair market value of $90,000)and services rendered (worth $10,000)in organizing the corporation.Each is issued 25 shares in Swan Corporation.With respect to the transfers:

A)Wade has no recognized gain;Paul recognizes income/gain of $80,000.

B)Neither Wade nor Paul has recognized gain or income on the transfers.

C)Swan Corporation has a basis of $30,000 in the land transferred by Paul.

D)Paul has a basis of $30,000 in the 25 shares he acquires in Swan Corporation.

E)None of the above.

A)Wade has no recognized gain;Paul recognizes income/gain of $80,000.

B)Neither Wade nor Paul has recognized gain or income on the transfers.

C)Swan Corporation has a basis of $30,000 in the land transferred by Paul.

D)Paul has a basis of $30,000 in the 25 shares he acquires in Swan Corporation.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

48

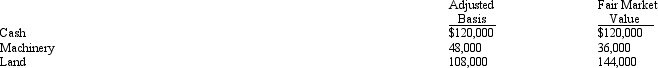

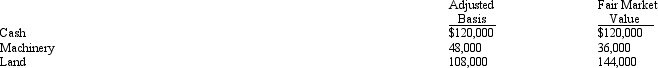

Hazel transferred the following assets to Starling Corporation.

In exchange,Hazel received 50% of Starling Corporation's only class of stock outstanding.The stock has no established value.However,all parties sincerely believe that the value of the stock Hazel received is the equivalent of the value of the assets she transferred.The only other shareholder,Rick,formed Starling Corporation five years ago.

A)Hazel has no gain or loss on the transfer.

B)Starling Corporation has a basis of $48,000 in the machinery and $108,000 in the land.

C)Starling Corporation has a basis of $36,000 in the machinery and $144,000 in the land.

D)Hazel has a basis of $276,000 in the stock of Starling Corporation.

E)None of the above.

In exchange,Hazel received 50% of Starling Corporation's only class of stock outstanding.The stock has no established value.However,all parties sincerely believe that the value of the stock Hazel received is the equivalent of the value of the assets she transferred.The only other shareholder,Rick,formed Starling Corporation five years ago.

A)Hazel has no gain or loss on the transfer.

B)Starling Corporation has a basis of $48,000 in the machinery and $108,000 in the land.

C)Starling Corporation has a basis of $36,000 in the machinery and $144,000 in the land.

D)Hazel has a basis of $276,000 in the stock of Starling Corporation.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

49

Amy owns 20% of the stock of Wren Corporation,which she acquired several years ago at a cost of $10,000.Amy is Vice-President of Wren and earns a salary of $80,000 annually.Last year,Wren Corporation was experiencing financial problems,and Amy loaned the corporation $25,000.In the current year,Wren becomes bankrupt,and both her stock investment and the loan become worthless.Amy has a nonbusiness bad debt deduction this year of $25,000.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

50

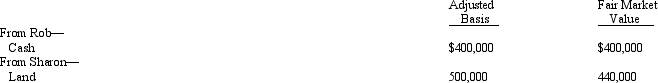

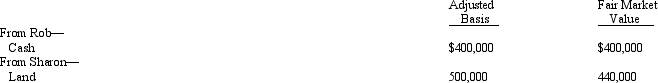

Rob and Sharon form Swallow Corporation with the following consideration:

Each receives 50% of Swallow's stock.In addition,Sharon receives cash of $40,000.One result of these transfers is that Sharon has a:

A)Recognized loss of $60,000.

B)Recognized loss of $20,000.

C)Basis of $460,000 in the Swallow stock (assuming Swallow reduces its basis in the land to $440,000).

D)Basis of $400,000 in the Swallow stock (assuming Swallow reduces its basis in the land to $440,000).

E)None of the above.

Each receives 50% of Swallow's stock.In addition,Sharon receives cash of $40,000.One result of these transfers is that Sharon has a:

A)Recognized loss of $60,000.

B)Recognized loss of $20,000.

C)Basis of $460,000 in the Swallow stock (assuming Swallow reduces its basis in the land to $440,000).

D)Basis of $400,000 in the Swallow stock (assuming Swallow reduces its basis in the land to $440,000).

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

51

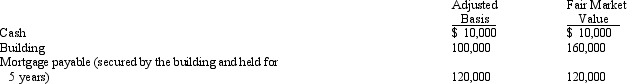

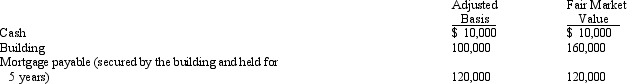

Ronald,a cash basis taxpayer,incorporates his sole proprietorship.He transfers the following items to newly created Robin Corporation.

With respect to this transaction:

A)Robin Corporation's basis in the building is $100,000.

B)Ronald has no recognized gain.

C)Ronald has a recognized gain of $20,000.

D)Ronald has a recognized gain of $10,000.

E)None of the above.

With respect to this transaction:

A)Robin Corporation's basis in the building is $100,000.

B)Ronald has no recognized gain.

C)Ronald has a recognized gain of $20,000.

D)Ronald has a recognized gain of $10,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

52

Kim owns 100% of the stock of Cardinal Corporation.In the current year Kim transfers an installment obligation,tax basis of $30,000 and fair market value of $200,000,for additional stock in Cardinal worth $200,000.

A)Kim recognizes no taxable gain on the transfer.

B)Kim has a taxable gain of $170,000.

C)Kim has a taxable gain of $180,000.

D)Kim has a basis of $200,000 in the additional stock she received in Cardinal Corporation.

E)None of the above.

A)Kim recognizes no taxable gain on the transfer.

B)Kim has a taxable gain of $170,000.

C)Kim has a taxable gain of $180,000.

D)Kim has a basis of $200,000 in the additional stock she received in Cardinal Corporation.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

53

Kevin and Nicole form Indigo Corporation with the following transfers: inventory from Kevin (basis of $360,000 and fair market value of $400,000)and improved real estate from Nicole (basis of $320,000 and fair market value of $375,000).Nicole,an accountant,agrees to contribute her services (worth $25,000)in organizing Indigo.The corporation's stock is distributed equally to Kevin and Nicole.As a result of these transfers:

A)Indigo can deduct $25,000 as a business expense.

B)Nicole has a recognized gain of $55,000 on the transfer of the real estate.

C)Indigo has a basis of $360,000 in the inventory.

D)Indigo has a basis of $375,000 in the real estate.

E)None of the above.

A)Indigo can deduct $25,000 as a business expense.

B)Nicole has a recognized gain of $55,000 on the transfer of the real estate.

C)Indigo has a basis of $360,000 in the inventory.

D)Indigo has a basis of $375,000 in the real estate.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

54

Ira,a calendar year taxpayer,purchases as an investment stock in Redbird Corporation on November 2,2009.On February 1,2010,Redbird Corporation is declared bankrupt,and Ira's stock becomes worthless.Presuming § 1244 (stock in a small business corporation)does not apply,Ira has a short-term capital loss for 2010.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

55

Albert transfers land (basis of $140,000 and fair market value of $320,000)to Gold Corporation for 80% of its stock and a note payable in the amount of $80,000.Gold assumes Albert's mortgage on the land of $200,000.

A)Albert has a recognized gain on the transfer of $140,000.

B)Albert has a recognized gain on the transfer of $80,000.

C)Albert has a recognized gain on the transfer of $60,000.

D)Gold Corporation has a basis in the land of $220,000.

E)None of the above.

A)Albert has a recognized gain on the transfer of $140,000.

B)Albert has a recognized gain on the transfer of $80,000.

C)Albert has a recognized gain on the transfer of $60,000.

D)Gold Corporation has a basis in the land of $220,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

56

Jane and Walt form Yellow Corporation.Jane transfers equipment worth $950,000 (basis of $200,000)and cash of $50,000 to Yellow Corporation for 50% of its stock.Walt transfers a building and land worth $1,050,000 (basis of $400,000)for 50% of Yellow's stock and $50,000 cash.

A)Jane recognizes no gain;Walt recognizes a gain of $50,000.

B)Jane recognizes a gain of $50,000;Walt recognizes no gain.

C)Neither Jane nor Walt recognizes gain.

D)Jane recognizes a gain of $750,000;Walt recognizes a gain of $650,000.

E)None of the above.

A)Jane recognizes no gain;Walt recognizes a gain of $50,000.

B)Jane recognizes a gain of $50,000;Walt recognizes no gain.

C)Neither Jane nor Walt recognizes gain.

D)Jane recognizes a gain of $750,000;Walt recognizes a gain of $650,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

57

Gabriella and Juanita form Luster Corporation.Gabriella transfers cash of $50,000 for 50 shares of stock,while Juanita transfers a secret process (basis of zero and fair market value of $50,000)for 50 shares of stock.

A)The transfers to Luster are fully taxable to both Gabriella and Juanita.

B)Juanita must recognize gain of $50,000.

C)Because Juanita is required to recognize gain on the transfer,Gabriella also must recognize gain.

D)Neither Gabriella nor Juanita will recognize gain on the transfer.

E)None of the above.

A)The transfers to Luster are fully taxable to both Gabriella and Juanita.

B)Juanita must recognize gain of $50,000.

C)Because Juanita is required to recognize gain on the transfer,Gabriella also must recognize gain.

D)Neither Gabriella nor Juanita will recognize gain on the transfer.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

58

Hunter and Warren form Tan Corporation.Hunter transfers equipment (basis of $210,000 and fair market value of $180,000)while Warren transfers land (basis of $15,000 and fair market value of $150,000)and $30,000 of cash.Each receives 50% of Tan's stock.As a result of these transfers:

A)Hunter has a recognized loss of $30,000;Warren has a recognized gain of $135,000.

B)Neither Hunter nor Warren has any recognized gain or loss.

C)Hunter has no recognized loss;Warren has a recognized gain of $30,000.

D)Tan Corporation has a basis in the land of $45,000.

E)None of the above.

A)Hunter has a recognized loss of $30,000;Warren has a recognized gain of $135,000.

B)Neither Hunter nor Warren has any recognized gain or loss.

C)Hunter has no recognized loss;Warren has a recognized gain of $30,000.

D)Tan Corporation has a basis in the land of $45,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

59

Eve transfers property (basis of $120,000 and fair market value of $400,000)to Green Corporation for 80% of its stock (worth $350,000)and a long-term note (worth $50,000),executed by Green Corporation and made payable to Eve.As a result of the transfer:

A)Eve recognizes no gain.

B)Eve recognizes a gain of $230,000.

C)Eve recognizes a gain of $280,000.

D)Eve recognizes a gain of $50,000.

E)None of the above.

A)Eve recognizes no gain.

B)Eve recognizes a gain of $230,000.

C)Eve recognizes a gain of $280,000.

D)Eve recognizes a gain of $50,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

60

Eileen transfers property worth $200,000 (basis of $60,000)to Goldfinch Corporation.In return,she receives 80% of the stock in Goldfinch Corporation (fair market value of $180,000)and a long-term note (fair market value of $20,000)executed by Goldfinch and made payable to Eileen.Eileen recognizes gain on the transfer of:

A)$0.

B)$20,000.

C)$60,000.

D)$140,000.

E)None of the above.

A)$0.

B)$20,000.

C)$60,000.

D)$140,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

61

Art,an unmarried individual,transfers property (basis of $130,000 and fair market value of $120,000)to Condor Corporation in exchange for § 1244 stock.The transfer qualifies as a nontaxable exchange under § 351 and Art's basis in the Condor stock is $130,000.Five years later,Art sells the Condor stock for $50,000.With respect to the sale,Art has:

A)An ordinary loss of $80,000.

B)An ordinary loss of $70,000 and a capital loss of $10,000.

C)A capital loss of $80,000.

D)A capital loss of $30,000 and an ordinary loss of $50,000.

E)None of the above.

A)An ordinary loss of $80,000.

B)An ordinary loss of $70,000 and a capital loss of $10,000.

C)A capital loss of $80,000.

D)A capital loss of $30,000 and an ordinary loss of $50,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

62

Leah transfers equipment (basis of $400,000 and fair market value of $500,000)for additional stock in Crow Corporation.After the transfer,Leah owns 80% of Crow's stock.Associated with the equipment is § 1245 depreciation recapture potential of $70,000.As a result of the transfer:

A)Leah recognizes ordinary income of $70,000.

B)The § 1245 depreciation recapture potential carries over to Crow Corporation.

C)The § 1245 depreciation recapture potential disappears.

D)Leah recognizes ordinary income of $70,000 and § 1231 gain of $30,000.

E)None of the above.

A)Leah recognizes ordinary income of $70,000.

B)The § 1245 depreciation recapture potential carries over to Crow Corporation.

C)The § 1245 depreciation recapture potential disappears.

D)Leah recognizes ordinary income of $70,000 and § 1231 gain of $30,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

63

Dawn,a sole proprietor,was engaged in a service business and reported her income on a cash basis.Later,she incorporates her business and transfers the assets of the business to the corporation in return for all the stock in the corporation plus the corporation's assumption of the liabilities of her proprietorship.All the receivables and the unpaid trade payables are transferred to the newly formed corporation.The assets of the proprietorship had a basis of $105,000 and fair market value of $300,000.The trade accounts payable totaled $25,000.There was a note payable to the bank in the amount of $95,000 that the corporation assumes.The note was issued for the purchase of computers and other business equipment.

A)Dawn has a gain on the transfer of $15,000.

B)The basis of the assets to the corporation is $300,000.

C)Dawn has a basis of $10,000 in the stock she receives.

D)Dawn has a zero basis in the stock she receives.

E)None of the above.

A)Dawn has a gain on the transfer of $15,000.

B)The basis of the assets to the corporation is $300,000.

C)Dawn has a basis of $10,000 in the stock she receives.

D)Dawn has a zero basis in the stock she receives.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

64

In order to induce Parakeet Corporation to build a new manufacturing facility in Oxford,Mississippi,the city donates land (fair market value of $250,000)and cash of $50,000 to the corporation.Within several months of the donation,Parakeet Corporation spends $350,000 (which includes the $50,000 received from Oxford)on the construction of a new plant located on the donated land.

A)Parakeet recognizes income of $50,000 as to the donation.

B)Parakeet has a zero basis in the land and a basis of $350,000 in the plant.

C)Parakeet recognizes income of $300,000 as to the donation.

D)Parakeet has a zero basis in the land and a basis of $300,000 in the plant.

E)None of the above.

A)Parakeet recognizes income of $50,000 as to the donation.

B)Parakeet has a zero basis in the land and a basis of $350,000 in the plant.

C)Parakeet recognizes income of $300,000 as to the donation.

D)Parakeet has a zero basis in the land and a basis of $300,000 in the plant.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

65

Trudy forms Oak Corporation by transferring land with a basis of $150,000 (fair market value of $800,000),subject to a mortgage of $450,000.Two weeks prior to incorporating Oak,Trudy borrows $10,000 for personal purposes and gives the lender a second mortgage on the land.Oak Corporation issues stock worth $340,000 to Trudy and assumes the two mortgages on the land.What are the tax consequences to Trudy and to Oak Corporation?

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

66

Ashley,a 70% shareholder of Wren Corporation,transfers property with a basis of $250,000 and a fair market value of $900,000 to Wren Corporation for additional stock.Ashley owns 78% of Wren after the transfer.Two other shareholders in Wren transfer a nominal amount of property to Wren along with Ashley's transfer so that Ashley and the two shareholders own 90% of the Wren stock after the transfer.Does Ashley have taxable gain on the transfer?

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

67

Carl transfers land to Cardinal Corporation for 90% of the stock in Cardinal Corporation worth $20,000 plus a note payable to Carl in the amount of $40,000 and the assumption by Cardinal Corporation of a mortgage on the land in the amount of $100,000.The land,which has a basis to Carl of $70,000,is worth $160,000.

A)Carl will have a gain on the transfer of $70,000.

B)Carl will have a gain on the transfer of $30,000.

C)Cardinal Corporation will have a basis in the land transferred by Carl of $70,000.

D)Cardinal Corporation will have a basis in the land transferred by Carl of $160,000.

E)None of the above.

A)Carl will have a gain on the transfer of $70,000.

B)Carl will have a gain on the transfer of $30,000.

C)Cardinal Corporation will have a basis in the land transferred by Carl of $70,000.

D)Cardinal Corporation will have a basis in the land transferred by Carl of $160,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

68

Kirby and Helen form Red Corporation.Kirby transfers property,basis of $20,000 and value of $300,000,for 100 shares in Red Corporation.Helen transfers property,basis of $40,000 and value of $280,000,and provides legal services in organizing the corporation.The value of her services is $20,000.In return Helen receives 100 shares in Red Corporation.With respect to the transfers:

A)Kirby will recognize gain.

B)Helen will not recognize any gain or income.

C)Red Corporation will have a basis of $280,000 in the property it acquired from Helen.

D)Red will have a business deduction of $20,000.

E)None of the above.

A)Kirby will recognize gain.

B)Helen will not recognize any gain or income.

C)Red Corporation will have a basis of $280,000 in the property it acquired from Helen.

D)Red will have a business deduction of $20,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

69

Blue Corporation made loans to a customer,Cedar Corporation.In the current year,these loans become worthless.

A)Blue Corporation cannot claim a deduction for the worthless loans.

B)The loans provide a nonbusiness bad debt deduction to Blue Corporation.

C)The loans provide Blue Corporation with a business bad debt deduction.

D)Blue Corporation may claim a capital loss as to these loans.

E)None of the above.

A)Blue Corporation cannot claim a deduction for the worthless loans.

B)The loans provide a nonbusiness bad debt deduction to Blue Corporation.

C)The loans provide Blue Corporation with a business bad debt deduction.

D)Blue Corporation may claim a capital loss as to these loans.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

70

Art,an unmarried individual,transfers property (basis of $130,000 and fair market value of $120,000)to Condor Corporation in exchange for § 1244 stock.The transfer qualifies as a nontaxable exchange under § 351.Five years later,Art sells the Condor stock for $50,000.With respect to the sale,Art has:

A)An ordinary loss of $80,000.

B)An ordinary loss of $70,000 and a capital loss of $10,000.

C)A capital loss of $80,000.

D)A capital loss of $30,000 and an ordinary loss of $50,000.

E)None of the above.

A)An ordinary loss of $80,000.

B)An ordinary loss of $70,000 and a capital loss of $10,000.

C)A capital loss of $80,000.

D)A capital loss of $30,000 and an ordinary loss of $50,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

71

Adam transfers cash of $300,000 and land worth $200,000 to Camel Corporation for 100% of the stock in Camel.In the first year of operation,Camel has net taxable income of $70,000.If Camel distributes $50,000 to Adam:

A)Adam has taxable income of $50,000.

B)Camel Corporation has a tax deduction of $50,000.

C)Adam has no taxable income from the distribution.

D)Camel Corporation reduces its basis in the land to $150,000.

E)None of the above.

A)Adam has taxable income of $50,000.

B)Camel Corporation has a tax deduction of $50,000.

C)Adam has no taxable income from the distribution.

D)Camel Corporation reduces its basis in the land to $150,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

72

Earl and Mary form Crow Corporation.Earl transfers property,basis of $200,000 and value of $1,600,000,for 50 shares in Crow Corporation.Mary transfers property,basis of $80,000 and value of $1,480,000,and agrees to serve as manager of Crow for one year;in return Mary receives 50 shares of Crow.The value of Mary's services is $120,000.With respect to the transfers:

A)Mary will not recognize gain or income.

B)Earl will recognize a gain of $1,400,000.

C)Crow Corporation has a basis of $1,480,000 in the property it received from Mary.

D)Crow will have a business deduction of $120,000 for the value of the services Mary will render.

E)None of the above.

A)Mary will not recognize gain or income.

B)Earl will recognize a gain of $1,400,000.

C)Crow Corporation has a basis of $1,480,000 in the property it received from Mary.

D)Crow will have a business deduction of $120,000 for the value of the services Mary will render.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

73

Perry organized Cardinal Corporation 10 years ago by contributing property worth $2 million,basis of $450,000,for 2,500 shares of stock in Cardinal,representing 100% of the stock in the corporation.Perry later gave each of his children,Brittany and Julie,750 shares of stock in Cardinal Corporation.In the current year,Perry transfers property worth $600,000,basis of $150,000,to Cardinal for 1,000 shares in the corporation.What gain,if any,will Perry recognize on the transfer?

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

74

George transfers cash of $150,000 to Grouse Corporation,a newly formed corporation,for 100% of the stock in Grouse worth $80,000 and debt in the amount of $70,000,payable in equal annual installments of $7,000 plus interest at the rate of 9% per annum.In the first year of operation,Grouse has net taxable income of $40,000.If Grouse pays George interest of $6,300 and $7,000 principal payment on the note:

A)George has dividend income of $13,300.

B)Grouse Corporation does not have a tax deduction with respect to the payment.

C)George has dividend income of $7,000.

D)Grouse Corporation has an interest expense deduction of $6,300.

E)None of the above.

A)George has dividend income of $13,300.

B)Grouse Corporation does not have a tax deduction with respect to the payment.

C)George has dividend income of $7,000.

D)Grouse Corporation has an interest expense deduction of $6,300.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

75

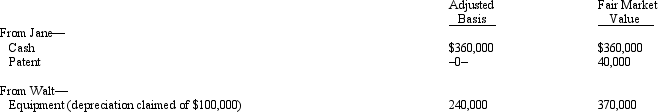

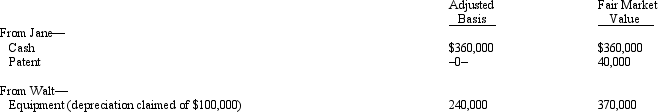

Four individuals form Chickadee Corporation under § 351.Two of these individuals,Jane and Walt,made the following contributions:

Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

A)Jane must recognize income of $40,000;Walt has no income.

B)Neither Jane nor Walt recognize income.

C)Walt must recognize income of $130,000;Jane has no income.

D)Walt must recognize income of $100,000;Jane has no income.

E)None of the above.

Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

A)Jane must recognize income of $40,000;Walt has no income.

B)Neither Jane nor Walt recognize income.

C)Walt must recognize income of $130,000;Jane has no income.

D)Walt must recognize income of $100,000;Jane has no income.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

76

Lynn transfers property (basis of $225,000 and fair market value of $300,000)to Falcon Corporation in exchange for § 1244 stock.The transfer qualifies as a nontaxable exchange under § 351.In the current year,Lynn sells the Falcon stock for $100,000.Assume Lynn files a joint return with her husband,Ricky.With respect to the sale,Lynn has:

A)An ordinary loss of $125,000.

B)An ordinary loss of $100,000 and a capital loss of $25,000.

C)A capital loss of $125,000.

D)An ordinary loss of $100,000 and a capital loss of $100,000.

E)None of the above.

A)An ordinary loss of $125,000.

B)An ordinary loss of $100,000 and a capital loss of $25,000.

C)A capital loss of $125,000.

D)An ordinary loss of $100,000 and a capital loss of $100,000.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

77

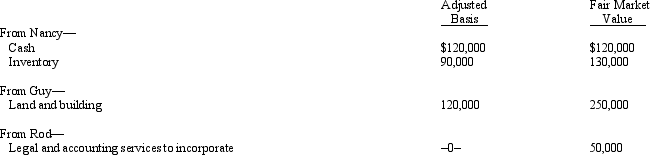

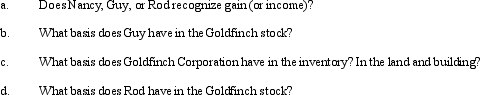

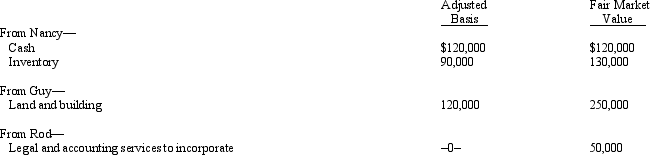

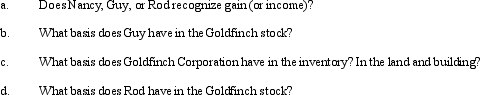

Nancy,Guy,and Rod form Goldfinch Corporation with the following consideration.

Goldfinch issues its 500 shares of stock as follows: 250 to Nancy,200 to Guy,and 50 to Rod.In addition,Guy gets $50,000 in cash.

Goldfinch issues its 500 shares of stock as follows: 250 to Nancy,200 to Guy,and 50 to Rod.In addition,Guy gets $50,000 in cash.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

78

Penny,Miesha,and Sabrina transfer property to Owl Corporation for 75% of its stock.Nancy,their attorney,receives 25% of the stock in Owl for legal services rendered in incorporating the business.What are the tax consequences of these transactions? How should this be handled?

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

79

Joe and Kay form Gull Corporation.Joe transfers cash of $250,000 for 200 shares in Gull Corporation.Kay transfers property with a basis of $50,000 and fair market value of $240,000.She agrees to accept 200 shares in Gull Corporation for the property and for providing bookkeeping services to the corporation in its first year of operation.The value of Kay's services is $10,000.With respect to the transfer:

A)Gull Corporation has a basis of $240,000 in the property transferred by Kay.

B)Neither Joe nor Kay recognizes gain or income on the exchanges.

C)Gull Corporation has a business deduction under § 162 of $10,000.

D)Gull capitalizes $10,000 as organizational costs.

E)None of the above.

A)Gull Corporation has a basis of $240,000 in the property transferred by Kay.

B)Neither Joe nor Kay recognizes gain or income on the exchanges.

C)Gull Corporation has a business deduction under § 162 of $10,000.

D)Gull capitalizes $10,000 as organizational costs.

E)None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

80

Juan exchanges property,basis of $200,000 and fair market value of $2.5 million,for 65% of the stock of Green Corporation.The other 35% is owned by Gloria who acquired it several years ago.What are the tax consequences to the parties involved?

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck