Deck 5: Corporations: Earnings Profits and Dividend Distributions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/89

Play

Full screen (f)

Deck 5: Corporations: Earnings Profits and Dividend Distributions

1

A distribution from a corporation will be taxable to the recipient shareholders only to the extent of the corporation's E & P.

False

2

The dividends received deduction is added back to taxable income to determine E & P.

True

3

Distributions by a corporation to its shareholders are presumed to be a return of capital unless the parties can prove otherwise.

False

4

Distributions that are not dividends are a return of capital and cause the shareholder's capital account to increase.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

5

When a corporation makes an installment sale,for E & P purposes the realized gain is recognized as payments are received.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

6

A distribution in excess of E & P is treated as capital gain by shareholders.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

7

Cash distributions received from a corporation with a deficit balance in accumulated E & P at the beginning of the year will not be taxed as dividend income.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

8

To determine E & P,some (but not all)previously excluded income items are added back to taxable income.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

9

A corporation borrows money to purchase State of Texas bonds.The interest on the loan has an impact on both taxable income and current E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

10

When computing current E & P,taxable income is not adjusted for the deferred gain in a § 1033 involuntary conversion.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

11

Use of MACRS cost recovery when computing taxable income requires an E & P adjustment.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

12

When computing E & P,an adjustment to taxable income is necessary for any domestic production activities deduction.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

13

The terms "earnings and profits" and "retained earnings" are identical in meaning.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

14

In the current year,Pink Corporation has a § 179 expense of $80,000.As a result,next year,taxable income must be decreased by $16,000 to determine current E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

15

Federal income tax paid in the current year must be added back to taxable income to determine E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

16

A realized gain from a like-kind exchange under § 1031 that is not recognized for income tax purposes has no effect on E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

17

Dividends are always taxed as ordinary income.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

18

Any loss in current E & P must be treated as occurring ratably during the year.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

19

Of the § 179 expense deducted in the current year,80% must be added to this year's taxable income to determine current E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

20

Nondeductible meal and entertainment expenses must be subtracted from taxable income to determine current E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

21

If a stock dividend is taxable,the shareholder's basis of the newly received shares is determined by reallocating the basis of the previously owned stock.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

22

If stock rights are taxable,the recipient has income to the extent of the fair market value of the rights.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

23

A pro rata distribution of nonconvertible preferred stock to common shareholders is not generally taxable.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

24

When current E & P has a deficit and accumulated E & P is positive,the two accounts are netted at the date of the distribution.If a positive balance results,the distribution is treated as a return of capital.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

25

Under no circumstances can a distribution generate (or add to)a deficit in E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

26

If a distribution of stock rights is taxable and their fair market value is less than 15 percent of the value of the old stock,then either a zero basis or a portion of the old stock basis may be assigned to the rights,at the shareholder's option.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

27

A corporate shareholder that receives a constructive dividend cannot apply a dividends received deduction to the distribution.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

28

Constructive dividends have no effect on a distributing corporation's E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

29

Dividends from foreign corporations are not qualified dividends.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

30

Dividends taxed at a 15% rate are not considered investment income for purposes of the investment interest expense limitation.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

31

During the year,White Corporation distributes land to its sole shareholder.If the fair market value of the land is more than its adjusted basis,White will not recognize gain on the distribution.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

32

Corporate distributions are presumed to be paid out of E & P and are treated as dividends unless the parties to the transaction can show otherwise.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

33

The amount of dividend income recognized by a shareholder from a property distribution is always reduced by the amount of liabilities assumed by the shareholder.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

34

Regardless of any deficit in accumulated E & P,distributions during the year are treated as dividends to the extent of current E & P.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

35

All dividends received by individual shareholders are subject to either a 15% or a 0% tax rate.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

36

When current E & P is positive and accumulated E & P has a deficit balance,the two accounts are netted for dividend determination purposes.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

37

The rules used to determine the taxability of stock dividends also apply to distributions of stock rights.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

38

Property distributed by a corporation as a dividend is subject to a liability in excess of its basis.For purposes of determining gain on the distribution,the basis of the property is treated as being not less than the amount of liability.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

39

A constructive dividend must satisfy the legal requirements of a dividend as set forth by applicable state law.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

40

A corporation that distributes a property dividend must reduce its E & P by the fair market value of the property less any liability on the property.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

41

Stacey and Andrew each own one-half of the stock in Parakeet Corporation,a calendar year taxpayer.Cash distributions from Parakeet are: $350,000 to Stacey on April 1 and $150,000 to Andrew on May 1.If Parakeet's current E & P is $60,000,how much is allocated to Andrew's distribution?

A)$5,000.

B)$10,000.

C)$18,000.

D)$30,000.

E)None of the above.

A)$5,000.

B)$10,000.

C)$18,000.

D)$30,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

42

Maria and Christopher each own 50% of Cockatoo Corporation,a calendar year taxpayer.Distributions from Cockatoo are: $750,000 to Maria on April 1 and $250,000 to Christopher on May 1.Cockatoo's current E & P is $300,000 and its accumulated E & P is $600,000.How much of the accumulated E & P is allocated to Christopher's distribution?

A)$0.

B)$75,000.

C)$150,000.

D)$300,000.

E)None of the above.

A)$0.

B)$75,000.

C)$150,000.

D)$300,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

43

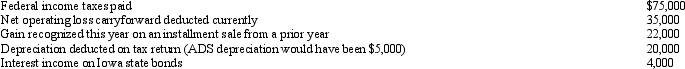

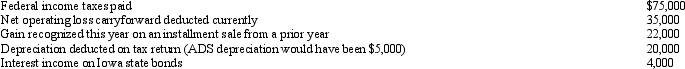

Beige Corporation (a calendar year taxpayer)has taxable income of $150,000,and its financial records reflect the following for the year.

Beige Corporation's current E & P is:

A)$68,000.

B)$77,000.

C)$103,000.

D)$107,000.

E)None of the above.

Beige Corporation's current E & P is:

A)$68,000.

B)$77,000.

C)$103,000.

D)$107,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements is incorrect with respect to determining current E & P?

A)All tax-exempt income should be added back to taxable income.

B)Dividends received deductions should be added back to taxable income.

C)Charitable contributions in excess of the 10% of taxable income limit should be subtracted from taxable income.

D)Federal income tax refunds should be added back to taxable income.

E)None of the above statements are incorrect.

A)All tax-exempt income should be added back to taxable income.

B)Dividends received deductions should be added back to taxable income.

C)Charitable contributions in excess of the 10% of taxable income limit should be subtracted from taxable income.

D)Federal income tax refunds should be added back to taxable income.

E)None of the above statements are incorrect.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

45

Blue Corporation,a cash basis taxpayer,has taxable income of $700,000 for the current year.Blue elected $80,000 of § 179 expense.It also had a related party loss of $30,000 and a realized (not recognized)gain from an involuntary conversion of $85,000.It paid Federal income tax of $185,000 and a nondeductible fine of $20,000.Blue's current E & P is:

A)$465,000.

B)$529,000.

C)$614,000.

D)$630,000.

E)None of the above.

A)$465,000.

B)$529,000.

C)$614,000.

D)$630,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

46

Pheasant Corporation ended its first year of operations with taxable income of $225,000.At the time of Pheasant's formation,it incurred $50,000 of organizational expenses.In calculating its taxable income for the year,Pheasant claimed an $8,000 deduction for the organizational expenses.What is Pheasant's current E & P?

A)$175,000.

B)$183,000.

C)$225,000.

D)$233,000.

E)None of the above.

A)$175,000.

B)$183,000.

C)$225,000.

D)$233,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

47

On January 2,2010,Orange Corporation purchased equipment for $300,000 with an ADS recovery period of 10 years and a MACRS useful life of 7 years.Section 179 was not elected.MACRS depreciation properly claimed on the asset,including depreciation in the year of sale,totaled $79,605.The equipment was sold on July 1,2011,for $290,000.As a result of the sale,the adjustment to taxable income needed to arrive at current E & P is:

A)No adjustment is required.

B)Decrease $49,605.

C)Increase $49,605.

D)Decrease $79,605.

E)None of the above.

A)No adjustment is required.

B)Decrease $49,605.

C)Increase $49,605.

D)Decrease $79,605.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

48

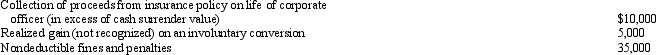

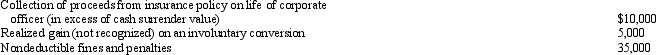

Red Corporation,a calendar year taxpayer,has taxable income of $600,000.Among its transactions for the year are the following:

Disregarding any provision for Federal income taxes,Red Corporation's current E & P is:

A)$565,000.

B)$575,000.

C)$580,000.

D)$650,000.

E)None of the above.

Disregarding any provision for Federal income taxes,Red Corporation's current E & P is:

A)$565,000.

B)$575,000.

C)$580,000.

D)$650,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

49

The tax treatment of corporate distributions at the shareholder level does not depend on:

A)The basis of stock in the hands of the shareholder.

B)The earnings and profits of the corporation.

C)The character of the property being distributed.

D)Whether the distributed property is received by an individual or a corporation.

E)None of the above.

A)The basis of stock in the hands of the shareholder.

B)The earnings and profits of the corporation.

C)The character of the property being distributed.

D)Whether the distributed property is received by an individual or a corporation.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

50

During the current year,Gander Corporation sold equipment for $250,000 (adjusted basis of $130,000).The equipment was purchased a few years ago for $280,000 and $150,000 in MACRS deductions have been claimed.ADS depreciation would have been $100,000.As a result of the sale,the adjustment to taxable income needed to determine E & P is:

A)No adjustment is required.

B)Add $50,000.

C)Subtract $50,000.

D)Add $40,000.

E)None of the above.

A)No adjustment is required.

B)Add $50,000.

C)Subtract $50,000.

D)Add $40,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

51

Renee,the sole shareholder of Indigo Corporation,sold her stock to Chad on July 1 for $180,000.Renee's stock basis at the beginning of the year was $120,000.Indigo made a $60,000 cash distribution to Renee immediately before the sale,while Chad received a $120,000 cash distribution from Indigo on November 1.As of the beginning of the current year,Indigo had $26,000 in accumulated E & P,while current E & P (before distributions)was $90,000.Which of the following statements is correct?

A)Renee recognizes a $60,000 gain on the sale of the stock.

B)Renee recognizes a $64,000 gain on the sale of the stock.

C)Chad recognizes dividend income of $120,000.

D)Chad recognizes dividend income of $30,000.

E)None of the above.

A)Renee recognizes a $60,000 gain on the sale of the stock.

B)Renee recognizes a $64,000 gain on the sale of the stock.

C)Chad recognizes dividend income of $120,000.

D)Chad recognizes dividend income of $30,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

52

Mallard Corporation is a calendar year taxpayer formed in 2005.Mallard's E & P for each of the past 5 years is listed below.

2009 $140,000

2008 $200,000

2007 $195,000

2006 $340,000

2005 $ 80,000

Mallard Corporation made the following distributions in the previous 5 years.

2008 Land (basis of $350,000,fair market value of $400,000)

2005 $100,000 cash

Mallard's accumulated E & P as of January 1,2010 is:

A)$455,000.

B)$475,000.

C)$505,000.

D)$525,000.

E)None of the above.

2009 $140,000

2008 $200,000

2007 $195,000

2006 $340,000

2005 $ 80,000

Mallard Corporation made the following distributions in the previous 5 years.

2008 Land (basis of $350,000,fair market value of $400,000)

2005 $100,000 cash

Mallard's accumulated E & P as of January 1,2010 is:

A)$455,000.

B)$475,000.

C)$505,000.

D)$525,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

53

Glenda is the sole shareholder of Condor Corporation.She sold her stock to Melissa on October 31 for $150,000.Glenda's basis in Condor stock was $50,000 at the start of the year.Condor distributed land to Glenda immediately before the sale.Condor's basis in the land was $20,000 (fair market value of $25,000).On December 31,Melissa received a $75,000 cash distribution from Condor.During the year,Condor has $20,000 of current E & P and its accumulated E & P balance on January 1 is $10,000.Which of the following statements is true?

A)Glenda recognizes a $110,000 gain on the sale of her stock.

B)Glenda recognizes a $100,000 gain on the sale of her stock.

C)Melissa receives $5,000 of dividend income.

D)Glenda receives $20,000 of dividend income.

E)None of the above.

A)Glenda recognizes a $110,000 gain on the sale of her stock.

B)Glenda recognizes a $100,000 gain on the sale of her stock.

C)Melissa receives $5,000 of dividend income.

D)Glenda receives $20,000 of dividend income.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

54

Tracy and Lance,equal shareholders in Macaw Corporation,receive $250,000 each in distributions on December 31 of the current year.During the current year,Macaw sold an appreciated asset for $500,000 (basis of $150,000).Payment for the sale of the asset will be made as follows: 50% next year and 50% in the following year,with interest payable at a rate of 7.5%.Before considering the effect of the asset sale,Macaw's current year E & P is $400,000 and it has no accumulated E & P.How much of Tracy's distribution will be taxed as a dividend?

A)$0.

B)$200,000.

C)$250,000.

D)$425,000.

E)None of the above.

A)$0.

B)$200,000.

C)$250,000.

D)$425,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

55

Wendy and David,equal shareholders in Loon Corporation,receive $300,000 each in distributions on December 31 of the current year.Loon's current year E & P is $500,000 and it has no accumulated E & P.Last year,Loon sold an appreciated asset for $600,000 (basis of $200,000).Payment for one half of the sale of the asset was made this year.How much of Wendy's distribution will be taxed as a dividend?

A)$0.

B)$150,000.

C)$250,000.

D)$300,000.

E)None of the above.

A)$0.

B)$150,000.

C)$250,000.

D)$300,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

56

Mulberry Corporation has an August 31 year-end.Mulberry had $50,000 in accumulated E & P at the beginning of its 2011 fiscal year (September 1,2010)and during the year,it incurred a $75,000 operating loss.It also distributed $65,000 to its sole shareholder,Charles,on November 30,2010.If Charles is a calendar year taxpayer,how should he treat the distribution when he files his 2010 income tax return (assuming the return is filed by April 15,2011)?

A)The distribution has no effect on Charles in the current year.

B)$50,000 of dividend income and $15,000 recovery of capital.

C)$60,000 of dividend income and $5,000 recovery of capital.

D)$65,000 of dividend income.

E)None of the above.

A)The distribution has no effect on Charles in the current year.

B)$50,000 of dividend income and $15,000 recovery of capital.

C)$60,000 of dividend income and $5,000 recovery of capital.

D)$65,000 of dividend income.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

57

Falcon Corporation has $200,000 of current E & P and a deficit in accumulated E & P of $90,000.If Swan pays a $300,000 distribution to its shareholders on July 1,how much dividend income do the shareholders report?

A)$0.

B)$10,000.

C)$110,000.

D)$200,000.

E)None of the above.

A)$0.

B)$10,000.

C)$110,000.

D)$200,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

58

Gold Corporation,a calendar year cash basis taxpayer,made estimated tax payments of $400 each quarter in 2010,for a total of $1,600.Gold filed its 2010 tax return in 2011 and the return showed a tax liability $2,100.At the time of filing,March 15,2011,Gold paid an additional $500 in Federal income taxes.How does the additional payment of $500 impact Gold's E & P?

A)Increase by $500 in 2010.

B)Increase by $500 in 2011.

C)Decrease by $500 in 2010.

D)Decrease by $500 in 2011.

E)None of the above.

A)Increase by $500 in 2010.

B)Increase by $500 in 2011.

C)Decrease by $500 in 2010.

D)Decrease by $500 in 2011.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

59

Yellow Corporation has a deficit in accumulated E & P of $600,000 and has current E & P of $450,000.On July 1,Yellow distributes $500,000 to its sole shareholder,Eugene,who has a basis in his stock of $105,000.As a result of the distribution,Eugene has:

A)Dividend income of $450,000 and no adjustment to stock basis.

B)Dividend income of $105,000 and reduces his stock basis to zero.

C)Dividend income of $450,000 and reduces his stock basis to $55,000.

D)No dividend income,reduces his stock basis to zero,and has a capital gain of $500,000.

E)None of the above.

A)Dividend income of $450,000 and no adjustment to stock basis.

B)Dividend income of $105,000 and reduces his stock basis to zero.

C)Dividend income of $450,000 and reduces his stock basis to $55,000.

D)No dividend income,reduces his stock basis to zero,and has a capital gain of $500,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

60

Swan,a calendar year corporation,has a deficit in current E & P of $200,000 and a $580,000 positive balance in accumulated E & P.If Swan determines that a $1 million distribution to its shareholders is appropriate at some point during the year,what is the maximum amount of the distribution that could potentially be treated as a dividend?

A)$0.

B)$380,000.

C)$480,000.

D)$580,000.

E)None of the above.

A)$0.

B)$380,000.

C)$480,000.

D)$580,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

61

Blue Corporation distributes property to its sole shareholder,Zeke.The property has a fair market value of $450,000,an adjusted basis of $305,000,and is subject to a liability of $250,000.Current E & P is $550,000.With respect to the distribution,Blue has a gain of:

A)$200,000 and Zeke has dividend income of $450,000.

B)$145,000 and Zeke's basis is the distributed property is $305,000.

C)$200,000 and Zeke's basis in the distributed property is $450,000.

D)$145,000 and Zeke has dividend income of $200,000.

E)None of the above.

A)$200,000 and Zeke has dividend income of $450,000.

B)$145,000 and Zeke's basis is the distributed property is $305,000.

C)$200,000 and Zeke's basis in the distributed property is $450,000.

D)$145,000 and Zeke has dividend income of $200,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is not an economic distortion created by the double tax on dividends?

A)An incentive to invest in noncorporate rather than corporate businesses.

B)An incentive for corporations to finance operations with debt rather than equity.

C)An incentive to invest domestically rather than internationally.

D)An incentive for corporations to retain earnings and structure distributions to avoid dividend treatment.

E)All of the above represent economic distortions created by the double tax on dividends.

A)An incentive to invest in noncorporate rather than corporate businesses.

B)An incentive for corporations to finance operations with debt rather than equity.

C)An incentive to invest domestically rather than internationally.

D)An incentive for corporations to retain earnings and structure distributions to avoid dividend treatment.

E)All of the above represent economic distortions created by the double tax on dividends.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements regarding constructive dividends is not correct?

A)Constructive dividends do not need to be formally declared or designated as a dividend.

B)Constructive dividends need not be paid pro rata to the shareholders.

C)Corporations that receive constructive dividends may not use the dividends received deduction.

D)Constructive dividends are taxable as dividends only to the extent of earnings and profits.

E)All of the above.

A)Constructive dividends do not need to be formally declared or designated as a dividend.

B)Constructive dividends need not be paid pro rata to the shareholders.

C)Corporations that receive constructive dividends may not use the dividends received deduction.

D)Constructive dividends are taxable as dividends only to the extent of earnings and profits.

E)All of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

64

Jose receives a nontaxable distribution of stock rights during the year from Gold Corporation on January 30.Each right entitles the holder to purchase one share of stock for $50.One right is issued for every share of stock owned.Jose owns 100 shares of stock purchased two years ago for $5,000.At the date of distribution,the rights are worth $1,000 (100 rights at $10 per right)and Jose's stock in Gold is worth $6,000 (or $60 per share).On December 1,Jose sells all stock rights for $13 per right.How much gain does Jose recognize on the sale?

A)$1,300.

B)$586.

C)$500.

D)$0.

E)None of the above.

A)$1,300.

B)$586.

C)$500.

D)$0.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

65

Jacqueline owns stock in Dove Corporation (basis of $40,000)as an investment.Dove distributes property (fair market value of $150,000;basis of $75,000)to her during the year.Dove has current E & P of $10,000 and accumulated E & P of $40,000 and makes no other distributions during the year.What is Jacqueline's capital gain on the distribution?

A)$0.

B)$40,000.

C)$60,000.

D)$75,000.

E)None of the above.

A)$0.

B)$40,000.

C)$60,000.

D)$75,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

66

Robin Corporation distributes equipment (basis of $80,000 and fair market value of $100,000)as a property dividend to its shareholders.The equipment is subject to a liability of $110,000.Robin Corporation recognizes gain of:

A)$0.

B)$20,000.

C)$30,000.

D)$110,000.

E)None of the above.

A)$0.

B)$20,000.

C)$30,000.

D)$110,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

67

Navy Corporation makes a property distribution to its sole shareholder,Troy.The property distributed is a car (fair market value of $10,000;basis of $15,000)that is subject to a $2,000 liability which Troy assumes.Navy makes no other distributions during the current year.Navy has no accumulated E & P and $15,000 of current E & P from other sources during the year.What is Navy's E & P after taking into account the distribution of the car?

A)$2,000.

B)$3,000.

C)$5,000.

D)$7,000.

E)None of the above.

A)$2,000.

B)$3,000.

C)$5,000.

D)$7,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

68

Goose Corporation makes a property distribution to its sole shareholder,Michael.The property distributed is a hunting cabin (fair market value of $270,000;basis of $220,000)that is subject to a $350,000 mortgage which Michael assumes.Before considering the consequences of the distribution,Goose's current E & P is $50,000 and its accumulated E & P is 200,000.Goose makes no other distributions during the current year.What is Goose's taxable gain on the distribution of the cabin?

A)$0.

B)$30,000.

C)$50,000.

D)$130,000.

E)None of the above.

A)$0.

B)$30,000.

C)$50,000.

D)$130,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

69

At the beginning of the current year,Dan and Andy each own 50% of Swallow Corporation.In July,Dan sold his stock to Kim for $140,000.At the beginning of the year,Swallow Corporation had accumulated E & P of $240,000 and its current E & P is $280,000 (prior to any distributions).Swallow distributed $300,000 on March 10 ($150,000 to Dan and $150,000 to Andy)and distributed another $300,000 on October 1 ($150,000 to Kim and $150,000 to Andy).Kim has dividend income of:

A)$70,000.

B)$110,000.

C)$140,000.

D)$150,000.

E)None of the above.

A)$70,000.

B)$110,000.

C)$140,000.

D)$150,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

70

Ten years ago,Connie purchased 4,000 shares in Platinum Corporation for $40,000.In the current year,Connie receives a nontaxable stock dividend of 40 shares of Platinum preferred.Values at the time of the dividend are: $8,000 for the preferred stock and $72,000 for the common.Based on this information,Connie's basis is:

A)$40,000 in the common and $16,000 in the preferred.

B)$4,000 in the common and $136,000 in the preferred.

C)$36,000 in the common and $4,000 in the preferred.

D)$39,600 in the common and $400 in the preferred.

E)None of the above.

A)$40,000 in the common and $16,000 in the preferred.

B)$4,000 in the common and $136,000 in the preferred.

C)$36,000 in the common and $4,000 in the preferred.

D)$39,600 in the common and $400 in the preferred.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

71

On January 1,Gull Corporation (a calendar year taxpayer)has accumulated E & P of $200,000.During the year,Gull incurs a net loss of $280,000 from operations that accrues ratably.On June 30,Gull distributes $120,000 to Sharon,its sole shareholder,who has a basis in her stock of $75,000.How much of the $120,000 is a dividend to Sharon?

A)$0.

B)$60,000.

C)$75,000.

D)$120,000.

E)None of the above.

A)$0.

B)$60,000.

C)$75,000.

D)$120,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

72

Rust Corporation has accumulated E & P of $30,000 on January 1,2010.In 2010,Rust Corporation had an operating loss of $40,000.It distributed cash of $20,000 to Andre,its sole shareholder,on December 31,2010.Rust Corporation's balance in its E & P account as of January 1,2011,is:

A)$30,000 deficit.

B)$10,000 deficit.

C)$0.

D)$30,000.

E)None of the above.

A)$30,000 deficit.

B)$10,000 deficit.

C)$0.

D)$30,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

73

Coral Corporation declares a nontaxable dividend payable in rights to subscribe to common stock.Each right entitles the holder to purchase one share of stock for $25.One right is issued for every two shares of stock owned.John owns 100 shares of stock in Coral,which he purchased three years ago for $3,000.At the time of the distribution,the value of the stock is $45 per share and the value of the rights is $2 per share.John receives 50 rights.He exercises 25 rights and sells the remaining 25 rights three months later for $2.50 per right.

A)John must allocate a part of the basis of his original stock in Coral to the rights.

B)If John does not allocate a part of the basis of his original stock to the rights,his basis in the new stock is zero.

C)Sale of the rights produces ordinary income to John of $62.50.

D)If John does not allocate a part of the basis of his original stock to the rights,his basis in the new stock is $625.

E)None of the above.

A)John must allocate a part of the basis of his original stock in Coral to the rights.

B)If John does not allocate a part of the basis of his original stock to the rights,his basis in the new stock is zero.

C)Sale of the rights produces ordinary income to John of $62.50.

D)If John does not allocate a part of the basis of his original stock to the rights,his basis in the new stock is $625.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

74

Pelican Corporation has E & P of $260,000.It distributes land with a fair market value of $80,000 (adjusted basis of $30,000)to its sole shareholder,Bernard.The land is subject to a liability of $45,000 that Bernard assumes.Bernard has a taxable dividend of:

A)$10,000.

B)$35,000.

C)$55,000.

D)$80,000.

E)None of the above.

A)$10,000.

B)$35,000.

C)$55,000.

D)$80,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

75

Green Corporation has accumulated E & P of $50,000 on January 1,2010.In 2010,Green has current E & P of $65,000 (before any distribution).On December 31,2010,the corporation distributes $125,000 to its sole shareholder,Maxwell (an individual).Green Corporation's E & P as of January 1,2011 is:

A)$0.

B)($10,000).

C)$50,000.

D)$65,000.

E)None of the above.

A)$0.

B)($10,000).

C)$50,000.

D)$65,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

76

In August,Sunglow Corporation declares a $4 dividend out of E & P on each share of common stock to shareholders of record on October 1.Elaine and Tom each purchase 100 shares of Sunglow stock on September 1.On September 15,Elaine also purchases a short position in Sunglow.Tom sells 50 of his shares on October 15 and continues to hold the remaining 50 shares through the end of the year.Elaine closes her short position in Sunglow on December 15.With respect to the dividends,which of the following is correct?

A)Tom will have $200 of qualifying dividends subject to reduced tax rates and $200 of ordinary income.

B)Elaine will have $400 of qualifying dividends subject to reduced tax rates and $400 of ordinary income (from dividends paid on the short position of Sunglow stock).

C)All $800 of Elaine's dividends will qualify for reduced tax rates.

D)All $400 of Tom's dividends will qualify for reduced tax rates.

E)None of the above.

A)Tom will have $200 of qualifying dividends subject to reduced tax rates and $200 of ordinary income.

B)Elaine will have $400 of qualifying dividends subject to reduced tax rates and $400 of ordinary income (from dividends paid on the short position of Sunglow stock).

C)All $800 of Elaine's dividends will qualify for reduced tax rates.

D)All $400 of Tom's dividends will qualify for reduced tax rates.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

77

As of January 1,Warbler Corporation has a deficit in accumulated E & P of $150,000.For the year,current E & P (accrued ratably)is $260,000 (prior to any distributions).On July 1,Warbler Corporation distributes $295,000 to its sole shareholder.The amount of the distribution that is a dividend is:

A)$10,000.

B)$110,000.

C)$260,000.

D)$295,000.

E)None of the above.

A)$10,000.

B)$110,000.

C)$260,000.

D)$295,000.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

78

Which one of the following statements is false?

A)Most countries that trade with the U.S.do not impose a double tax on dividends.

B)Tax proposals that include corporate integration would eliminate the double tax on dividends.

C)The double tax on dividends may make corporations more financially vulnerable during economic downturns.

D)Many of the arguments in support of the double tax on dividends relate to fairness.

E)None of the above.

A)Most countries that trade with the U.S.do not impose a double tax on dividends.

B)Tax proposals that include corporate integration would eliminate the double tax on dividends.

C)The double tax on dividends may make corporations more financially vulnerable during economic downturns.

D)Many of the arguments in support of the double tax on dividends relate to fairness.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

79

Which one of the following statements about property distributions is false?

A)When the basis of distributed property is greater than its fair market value,a deficit may be created in E & P.

B)When the basis of distributed property is less than its fair market value,the distributing corporation recognizes gain.

C)When the basis of distributed property is greater than its fair market value,the distributing corporation does not recognize loss.

D)The amount of a distribution received by a shareholder is measured by using the property's fair market value.

E)All of the above statements are true.

A)When the basis of distributed property is greater than its fair market value,a deficit may be created in E & P.

B)When the basis of distributed property is less than its fair market value,the distributing corporation recognizes gain.

C)When the basis of distributed property is greater than its fair market value,the distributing corporation does not recognize loss.

D)The amount of a distribution received by a shareholder is measured by using the property's fair market value.

E)All of the above statements are true.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

80

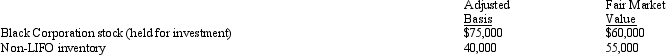

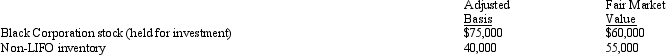

In the current year,Verdigris Corporation (with E & P of $250,000)made the following property distributions to its shareholders (all corporations):

Verdigris Corporation is not a member of a controlled group.As a result of the distribution:

A)The shareholders have dividend income of $100,000.

B)The shareholders have dividend income of $130,000.

C)Verdigris has a gain of $15,000 and a loss of $15,000,both of which it must recognize.

D)Verdigris has no recognized gain or loss.

E)None of the above.

Verdigris Corporation is not a member of a controlled group.As a result of the distribution:

A)The shareholders have dividend income of $100,000.

B)The shareholders have dividend income of $130,000.

C)Verdigris has a gain of $15,000 and a loss of $15,000,both of which it must recognize.

D)Verdigris has no recognized gain or loss.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck