Deck 10: Government-Wide Financial Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 10: Government-Wide Financial Statements

1

When should property tax revenues be recognized in government-wide financial statements?

A)in the period for which the taxes are levied (net of estimated refunds and uncollectibles),provided they are measurable and available

B)in the period for which the taxes are levied (net of estimated refunds and uncollectibles),even if the enforceable legal claim arises or due date for payment is in a different period

C)in the period they are collected in cash,together with an accrual for uncollected taxes

D)in the period when an enforceable legal claim arises or when the resources are received,whichever occurs first

A)in the period for which the taxes are levied (net of estimated refunds and uncollectibles),provided they are measurable and available

B)in the period for which the taxes are levied (net of estimated refunds and uncollectibles),even if the enforceable legal claim arises or due date for payment is in a different period

C)in the period they are collected in cash,together with an accrual for uncollected taxes

D)in the period when an enforceable legal claim arises or when the resources are received,whichever occurs first

B

2

An Internal Service Fund (ISF)provided services to two agencies financed by the General Fund -- the Tax Department (which it billed $200,000)and the Comptroller's Office (which it billed $100,000).In the fund financial statements,the ISF reported a loss of $30,000.How should this information be reported in the government-wide statement of activities?

A)Under "business-type activities," in a separate line captioned ISF,revenues of $300,000,expenses of $330,000,and net expenses of ($30,000)should be reported

B)Under "governmental-type activities," in a separate line captioned ISF,revenues of$300,000,expenses of $330,000,and net expenses of ($30,000)should be reported

C)ISF activities should not be reported,but expenses reported for the Tax Department and the Comptroller's Office should be increased by $20,000 and $10,000,respectively

D)ISF activities should not be reported,but expenses reported for the Tax Department and the Comptroller's Office should be reduced by $20,000 and $10,000,respectively

A)Under "business-type activities," in a separate line captioned ISF,revenues of $300,000,expenses of $330,000,and net expenses of ($30,000)should be reported

B)Under "governmental-type activities," in a separate line captioned ISF,revenues of$300,000,expenses of $330,000,and net expenses of ($30,000)should be reported

C)ISF activities should not be reported,but expenses reported for the Tax Department and the Comptroller's Office should be increased by $20,000 and $10,000,respectively

D)ISF activities should not be reported,but expenses reported for the Tax Department and the Comptroller's Office should be reduced by $20,000 and $10,000,respectively

C

3

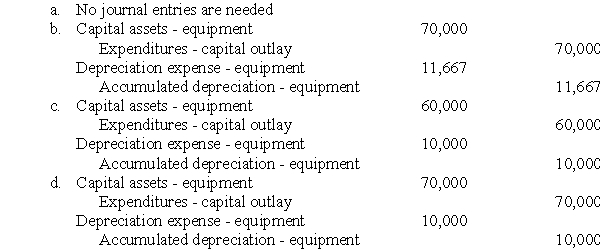

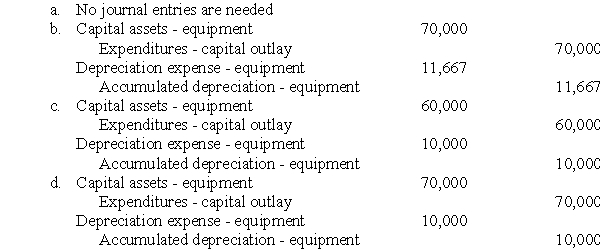

Describe the adjustment or adjustments needed to prepare government-wide financial statements from the city's calendar year 2012 fund-level financial statements

A)No adjustments are needed

B)Record capital assets,and record six months' depreciation ($10,000)

C)Record capital assets,reduce capital outlay expenditures,and record six months' depreciation ($11,667)

D)Record capital assets,reduce capital outlay expenditures,and record six months' depreciation ($10,000)

A)No adjustments are needed

B)Record capital assets,and record six months' depreciation ($10,000)

C)Record capital assets,reduce capital outlay expenditures,and record six months' depreciation ($11,667)

D)Record capital assets,reduce capital outlay expenditures,and record six months' depreciation ($10,000)

D

4

How should the difference between assets,deferred outflows,deferred inflows,and liabilities be characterized in government-wide financial statements?

A)as fund balances

B)as net position

C)as fund equity

D)as available for spending

A)as fund balances

B)as net position

C)as fund equity

D)as available for spending

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

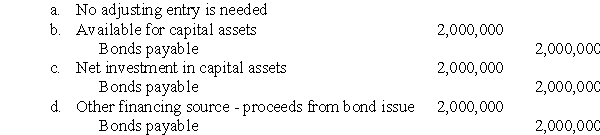

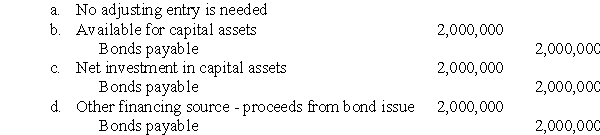

Just before the close of its fiscal year,a city government issues $2 million of bonds to finance the acquisition of capital assets.However,no part of the debt is repaid by year-end and no part of the debt is used to purchase capital assets.What adjusting entry is needed to prepare the city's government-wide financial statements from its fund-level financial statements?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

Which measurement focus should be used in government-wide financial statements?

A)the same measurement focus as that used in accounting for each fund type

B)the current financial resources measurement focus

C)the economic resources measurement focus

D)the economic resources measurement focus for governmental fund types and the current financial resource measurement focus for proprietary and fiduciary fund types

A)the same measurement focus as that used in accounting for each fund type

B)the current financial resources measurement focus

C)the economic resources measurement focus

D)the economic resources measurement focus for governmental fund types and the current financial resource measurement focus for proprietary and fiduciary fund types

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

A city experienced several auto damage claims during its year ended December 31,2012.The total amount claimed was $600,000.No cash was paid out in 2012.However,claims totaling $200,000 were settled by December 31,2012.These claims were settled for $80,000,and were scheduled for payment on January 15,2013.City attorneys felt that the remaining $400,000 of claims could be settled during 2013 for about $160,000.How much should the city recognize as claims expenses in its government-wide financial statements for 2012?

A)$0

B)$80,000

C)$240,000

D)$480,000

A)$0

B)$80,000

C)$240,000

D)$480,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

Identify the adjustment entries,if any,necessary to prepare government-wide financial statements from the city's calendar year 2012 fund-level statements

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

How should Internal Service Fund (ISF)activities be reported in the government-wide statement of activities?

A)ISF activities should be reported in a separate column

B)ISF activities should be included in the column headed "business-type activities."

C)ISF activities should be included in the column headed "governmental-type activities."

D)ISF activities (revenues and expenses)should be eliminated and interfund profits or losses should be eliminated by decreasing or increasing the costs of the activities that were billed

A)ISF activities should be reported in a separate column

B)ISF activities should be included in the column headed "business-type activities."

C)ISF activities should be included in the column headed "governmental-type activities."

D)ISF activities (revenues and expenses)should be eliminated and interfund profits or losses should be eliminated by decreasing or increasing the costs of the activities that were billed

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

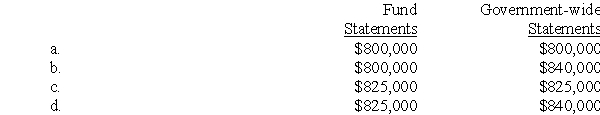

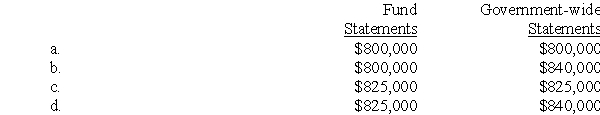

10

A small village (which keeps its records on a calendar-year basis)issued $1 million of bonds on April 1,2012.The first payment of principal was due April 1,2013,but interest at 6 percent per annum on the outstanding debt was due on October 1,2012 and April 1,2013.How much interest expenditure (expense)should the village recognize in its governmental fund and government-wide financial statements for the calendar year 2012?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

How much should the city report in its December 31,2012,government-wide financial statements as net position invested in capital assets,net of related debt?

A)$70,000

B)$60,000

C)$58,333

D)$10,000

A)$70,000

B)$60,000

C)$58,333

D)$10,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

A city government levies property taxes that are recorded directly into a Debt Service Fund,rather than the General Fund.How should those property taxes be reported in the government-wide statement of activities?

A)as property tax revenue in the general revenues section

B)as a direct reduction of interest expenses in the functional expense section

C)as an element of program revenue,which reduce gross interest expenses

D)as a negative expense,which is then allocated to all functions or programs

A)as property tax revenue in the general revenues section

B)as a direct reduction of interest expenses in the functional expense section

C)as an element of program revenue,which reduce gross interest expenses

D)as a negative expense,which is then allocated to all functions or programs

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

Merchants remit $800,000 to a county government in calendar year 2013 for sales taxes collected in 2013.In January,2014,they send the county an additional $25,000 applicable to the year 2014.Based on past experience,the county expects to receive an additional $15,000 later in 2014,but applicable to 2013.How much should the county recognize as sales tax revenues when it prepares its fund and government-wide financial statements?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

To what extent should fund or fund type data be displayed on the face of government-wide financial statements?

A)Information should be displayed for the government as a whole,but individual funds or fund types should not be displayed

B)Information should be displayed by fund type,with a total for the government as a whole

C)Information should be displayed by major fund,with a total for the government as a whole

D)Information should be displayed by major fund,except for fiduciary funds

A)Information should be displayed for the government as a whole,but individual funds or fund types should not be displayed

B)Information should be displayed by fund type,with a total for the government as a whole

C)Information should be displayed by major fund,with a total for the government as a whole

D)Information should be displayed by major fund,except for fiduciary funds

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

How should bonds payable be reported on government-wide financial statements?

A)Bonds payable should be reported as an offset to capital assets in the assets section of the statement of net position

B)Bonds payable should not be reported on the government-wide financial statements

C)Bonds payable should be separated between amounts due to be paid in one year and amounts due to be paid in more than one year

D)Bonds payable should be reported in the net position section of the statement of net position

A)Bonds payable should be reported as an offset to capital assets in the assets section of the statement of net position

B)Bonds payable should not be reported on the government-wide financial statements

C)Bonds payable should be separated between amounts due to be paid in one year and amounts due to be paid in more than one year

D)Bonds payable should be reported in the net position section of the statement of net position

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

How should component units be displayed in government-wide financial statements?

A)Component units should not be reported in government-wide financial statements

B)All component units should be included either in the column for governmental activities or in the column for business-type activities

C)Component units should be blended where appropriate;discretely presented component units should be reported in a separate column

D)All component units should be included with other business-type activities

A)Component units should not be reported in government-wide financial statements

B)All component units should be included either in the column for governmental activities or in the column for business-type activities

C)Component units should be blended where appropriate;discretely presented component units should be reported in a separate column

D)All component units should be included with other business-type activities

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

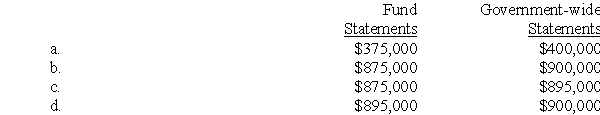

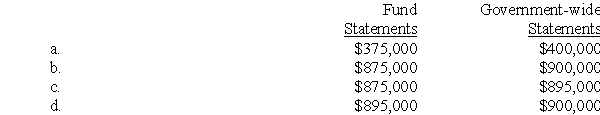

17

A county,that did not previously have a property tax levies a property tax for $900,000 in December 2012.The tax is for the budget year January 1 - December 31,2013.Because it sends out the bills on December 1,it actually collects $500,000 in cash before December 31,2012.It collects an additional $375,000 of 2013 property taxes during calendar year 2013,$20,000 during January 1 - February 28,2014,and the remaining $5,000 in June 2014.How much property tax revenue should the county report in its 2013 fund and government-wide financial statements?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

A city health department charges fees for copies of birth certificates provided to its citizens.How should those fees be reported in the government-wide statement of activities?

A)as a separate item of revenue in the revenue section

B)as a direct reduction of the expenses of the health department

C)as an element of program revenues,which reduce gross expenses of the health department

D)as a special item

A)as a separate item of revenue in the revenue section

B)as a direct reduction of the expenses of the health department

C)as an element of program revenues,which reduce gross expenses of the health department

D)as a special item

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

In accordance with a bond agreement,assets are being accumulated in a sinking fund to pay bonds due in 20 years.The assets are reported as Investments.What other information should be reported about that item on the face of the government-wide financial statements?

A)It should be reported as part of net position invested in capital assets,net of related debt

B)It should be reported as part of net position restricted for debt service

C)It should be reported as part of net position reserved for debt service

D)It should be reported as part of fund balance reserved for debt service

A)It should be reported as part of net position invested in capital assets,net of related debt

B)It should be reported as part of net position restricted for debt service

C)It should be reported as part of net position reserved for debt service

D)It should be reported as part of fund balance reserved for debt service

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

Pursuant to law,a state agrees to reimburse a county 50 percent of the costs incurred by the county to maintain county roads,provided the county incurs no more than $800,000 in allowable costs.Allowable costs include accrued but unpaid salaries,but do not include encumbrances.For its calendar year 2012,the county's records show the following for its road maintenance program: cash disbursements - $780,000;accrued salaries payable -$15,000;encumbrances - $10,000.How much intergovernmental revenue should the county recognize in its government-wide financial statements?

A)$390,000

B)$397,500

C)$400,000

D)$402,500

A)$390,000

B)$397,500

C)$400,000

D)$402,500

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

If a government uses the "modified approach" in accounting for its infrastructure assets,which of the following items properly will not appear in its government-wide statement of activities?

A)depreciation expense for any capital assets

B)interest expense for bonds issued to finance any capital assets

C)depreciation expense for infrastructure capital assets

D)interest expense for bonds issued to finance infrastructure capital assets

A)depreciation expense for any capital assets

B)interest expense for bonds issued to finance any capital assets

C)depreciation expense for infrastructure capital assets

D)interest expense for bonds issued to finance infrastructure capital assets

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Jace Township's General Fund reports a balance due from another fund.This item and the corresponding interfund liability will appear in Jace Township's government-wide statement of net position only if the debtor fund is

A)an enterprise fund

B)a capital projects fund

C)an internal service fund

D)a permanent fund

A)an enterprise fund

B)a capital projects fund

C)an internal service fund

D)a permanent fund

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

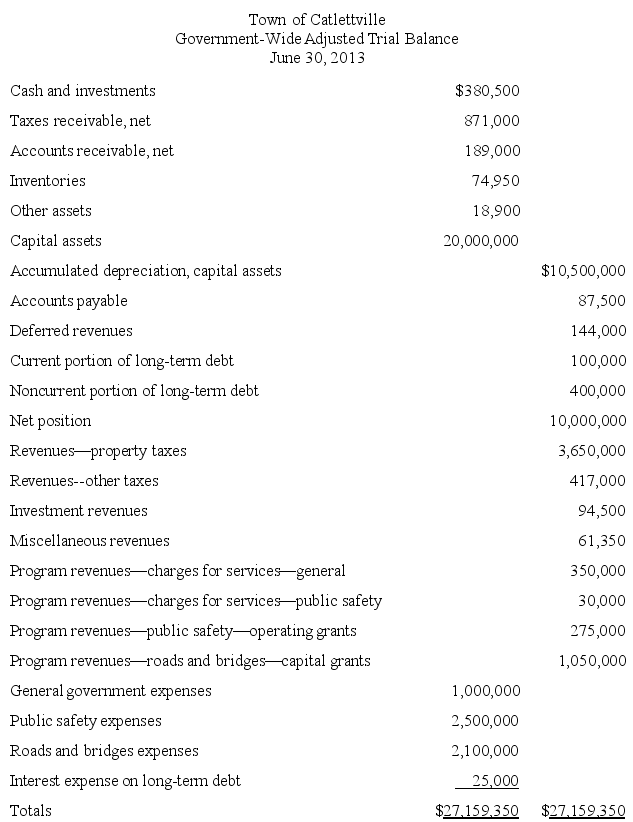

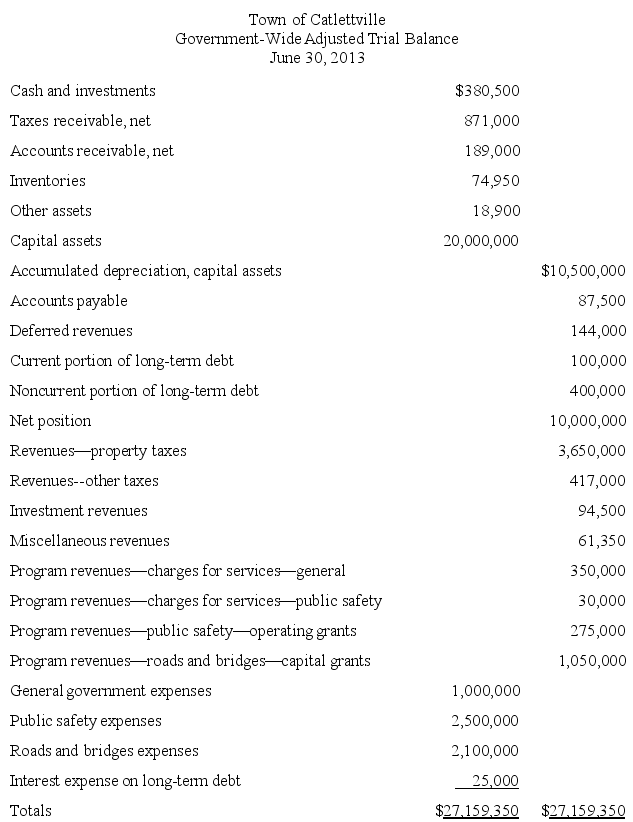

(Preparation of Government-Wide Financial Statements)

On the following page is the government-wide adjusted trial balance for the Town of Catlettville as of June 30,2013,the end of the fiscal year.The adjustments needed to convert accounting information from the current financial resources measurement focus and modified accrual basis of accounting to the economic resources measurement focus and accrual basis of accounting have been made.

The Town government performs three functions,general government,public safety and roads and bridges.The Town has no business-type activities nor any component units.Program revenues include charges for services (related to the general government and public safety functions),operating grants (for public safety)and capital grants (for roads and bridges).General revenue sources are property taxes,other taxes,investment revenues,and miscellaneous revenues.

Using this information,prepare in good form (a)the government-wide statement of net position (using a classified format),and (b)the government-wide statement of activities as of,and for the year ended,June 30,2013.There are no restricted assets or liabilities;the long-term debt (both portions)is the only debt related to the Town's capital assets.

On the following page is the government-wide adjusted trial balance for the Town of Catlettville as of June 30,2013,the end of the fiscal year.The adjustments needed to convert accounting information from the current financial resources measurement focus and modified accrual basis of accounting to the economic resources measurement focus and accrual basis of accounting have been made.

The Town government performs three functions,general government,public safety and roads and bridges.The Town has no business-type activities nor any component units.Program revenues include charges for services (related to the general government and public safety functions),operating grants (for public safety)and capital grants (for roads and bridges).General revenue sources are property taxes,other taxes,investment revenues,and miscellaneous revenues.

Using this information,prepare in good form (a)the government-wide statement of net position (using a classified format),and (b)the government-wide statement of activities as of,and for the year ended,June 30,2013.There are no restricted assets or liabilities;the long-term debt (both portions)is the only debt related to the Town's capital assets.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

What must a government do to avoid depreciating its infrastructure assets and still meet the GASB's financial reporting standards?

A)have an asset management system and document that its assets are being preserved at a condition level that it establishes and discloses

B)estimate the dollar amount of its infrastructure assets and report that amount in the government-wide statement of net position

C)leave the dollar value of its infrastructure assets off both the government-wide statement of net position and the governmental fund balance sheet

D)take a compete inventory of its infrastructure assets every year

A)have an asset management system and document that its assets are being preserved at a condition level that it establishes and discloses

B)estimate the dollar amount of its infrastructure assets and report that amount in the government-wide statement of net position

C)leave the dollar value of its infrastructure assets off both the government-wide statement of net position and the governmental fund balance sheet

D)take a compete inventory of its infrastructure assets every year

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is a plausible explanation for the difference between the net change in fund balances of governmental funds (fund-level statement of revenues,expenditures,and changes in fund balances)and the change in net position of governmental activities (government-wide statement of activities)?

A)Some expenses reported in the statement of activities do not require the use of current financial resources and are not reported as expenditures in the fund-level statements

B)Amounts reported as expenditures in the statement of activities are reported as capital assets in the fund-level statements

C)Debt proceeds provide current financial resources in the statement of activities,but are reported as long-term liabilities in the fund-level statements

D)Depreciation of general fixed assets is not reported as an expense in the statement of activities,but it is reported as an expense in the fund-level statements

A)Some expenses reported in the statement of activities do not require the use of current financial resources and are not reported as expenditures in the fund-level statements

B)Amounts reported as expenditures in the statement of activities are reported as capital assets in the fund-level statements

C)Debt proceeds provide current financial resources in the statement of activities,but are reported as long-term liabilities in the fund-level statements

D)Depreciation of general fixed assets is not reported as an expense in the statement of activities,but it is reported as an expense in the fund-level statements

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

(Entries to prepare government-wide financial statements - revenue and expense accruals)

For the following situations,make adjusting entries necessary to prepare government-wide financial statements.Where appropriate,take account of the amounts reported in the fund-level financial statements.

a.To prepare its government-wide financial statements for the year ended December 31,2012,the city reported a $900,000 long-term liability for estimated judgments and claims.At December 31,2013,the city estimated that the long-term liability would be $935,000.(Hint: Carry forward the starting liability and adjust for the increase. )

b.For the calendar year 2013,the city reported sales taxes of $800,000 in its fund-level financial statements.This amount includes all taxes collected in 2013 (applicable to 2013 and 2012),as well as the accrual for larger merchant remittances in January,2014.The accrual does not include estimated remittances of $35,000 from smaller merchants in April,2014.

b.A city instituted a new sales tax starting January 1,2012.It collected $600,000 of sales taxes during 2012.When the city prepared its fund-level statements,it accrued an additional $200,000 for sales taxes remitted by larger businesses in January,2013,for taxes collected in the fourth quarter of 2012.However,smaller businesses are not required to remit fourth quarter collections until April,2013.No accrual was made for those taxes,which were estimated to be $28,000.

c.See facts in situation

For the following situations,make adjusting entries necessary to prepare government-wide financial statements.Where appropriate,take account of the amounts reported in the fund-level financial statements.

a.To prepare its government-wide financial statements for the year ended December 31,2012,the city reported a $900,000 long-term liability for estimated judgments and claims.At December 31,2013,the city estimated that the long-term liability would be $935,000.(Hint: Carry forward the starting liability and adjust for the increase. )

b.For the calendar year 2013,the city reported sales taxes of $800,000 in its fund-level financial statements.This amount includes all taxes collected in 2013 (applicable to 2013 and 2012),as well as the accrual for larger merchant remittances in January,2014.The accrual does not include estimated remittances of $35,000 from smaller merchants in April,2014.

b.A city instituted a new sales tax starting January 1,2012.It collected $600,000 of sales taxes during 2012.When the city prepared its fund-level statements,it accrued an additional $200,000 for sales taxes remitted by larger businesses in January,2013,for taxes collected in the fourth quarter of 2012.However,smaller businesses are not required to remit fourth quarter collections until April,2013.No accrual was made for those taxes,which were estimated to be $28,000.

c.See facts in situation

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

A government issued $4 million of bonds on November 1,2012,to build a fire house.The first debt service payment ($200,000 principal plus 6 percent interest per annum on outstanding debt)was due November 1,2013.To prepare government-wide financial statements at December 31,2012,what journal entry is needed regarding the debt service due on November 1,2013?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

On the government-wide statement of net position,assets and liabilities may be reported:

A)in a classified format

B)in order of relative liquidity

C)in either order of relative liquidity or a classified format

D)in separate columns

A)in a classified format

B)in order of relative liquidity

C)in either order of relative liquidity or a classified format

D)in separate columns

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

Tinsel Town has only two funds,the General Fund (GF),and a Capital Projects Fund (CPF).Summarized operating statements for each of the funds for fiscal 2013 are as follows:

The total net position balance for Tinsel Town's governmental activities at the end of fiscal 2013 is

A)63

B)43

C)68

D)75

The total net position balance for Tinsel Town's governmental activities at the end of fiscal 2013 is

A)63

B)43

C)68

D)75

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

The unrestricted net position balance for a local government

A)cannot be negative

B)normally is the largest component of the total net position balance

C)can be negative

D)equals the sum of the unrestricted fund balances of the major governmental funds

A)cannot be negative

B)normally is the largest component of the total net position balance

C)can be negative

D)equals the sum of the unrestricted fund balances of the major governmental funds

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

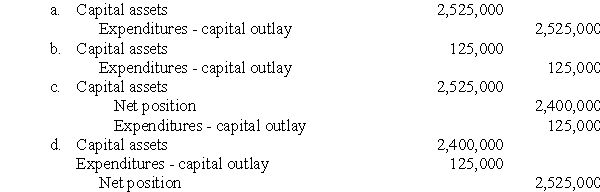

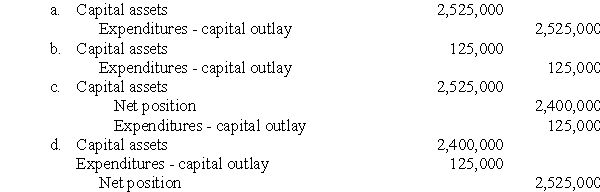

31

On January 1,2012,a county's government-wide financial statements shows general fixed assets of $2,400,000.For the year ended December 31,2012,the county's fund financial statement shows an amount of $125,000 next to the caption "Expenditures - capital outlay." To prepare its 2012 government-wide financial statements,the preparer makes a worksheet that uses the 2012 fund-level financial statements as the starting point.As a result,the worksheet does not show any capital assets at the beginning of the year.What adjusting entry is needed to report the facts about capital assets on the government-wide statements?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following elements properly will not be displayed as a specific item in a government-wide statement of activities prepared by a city or county government?

A)program revenues

B)interfund reimbursements

C)interest expense on long-term debt

D)the beginning net position balance(s)

A)program revenues

B)interfund reimbursements

C)interest expense on long-term debt

D)the beginning net position balance(s)

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is a typical reconciling item between the fund-level financial statements and the government-wide financial statements?

A)reporting the amount of cash on hand for governmental activities

B)reporting revenues on the accrual basis,rather than the modified accrual basis,for business-type activities

C)reporting depreciation expense,rather than capital outlay expenditures,for governmental activities

D)reporting the net effect of transfers between the general fund and debt service fund

A)reporting the amount of cash on hand for governmental activities

B)reporting revenues on the accrual basis,rather than the modified accrual basis,for business-type activities

C)reporting depreciation expense,rather than capital outlay expenditures,for governmental activities

D)reporting the net effect of transfers between the general fund and debt service fund

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

The City of Bogue provides other postemployment benefits (OPEB)to its full-time employees.The City uses an actuary to measure its obligation.Which of the following should the City report as a liability in its government-wide statement of net position?

A)the contribution it made to the OPEB plan during the year

B)the unpaid portion of medical benefits it expects to pay retirees for events that happened during the year.

C)the cumulative difference between the annual accrual basis OPEB expense,as determined by the actuary,less payments to retirees and contributions to the OPEB plan

D)nothing.The liability should only be reported in the governmental fund balance sheet.

A)the contribution it made to the OPEB plan during the year

B)the unpaid portion of medical benefits it expects to pay retirees for events that happened during the year.

C)the cumulative difference between the annual accrual basis OPEB expense,as determined by the actuary,less payments to retirees and contributions to the OPEB plan

D)nothing.The liability should only be reported in the governmental fund balance sheet.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is the most accurate statement regarding the depreciation of general capital assets in the governmental activities column of the statement of activities?

A)All general capital assets must be depreciated

B)General capital assets are not required to be depreciated

C)General capital assets should be depreciated,but financial statement preparers may choose not to depreciate land and infrastructure assets

D)General capital assets should be depreciated,except for land and infrastructure assets that are reported using the "modified approach."

A)All general capital assets must be depreciated

B)General capital assets are not required to be depreciated

C)General capital assets should be depreciated,but financial statement preparers may choose not to depreciate land and infrastructure assets

D)General capital assets should be depreciated,except for land and infrastructure assets that are reported using the "modified approach."

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

In 2013,Monks Town received a State grant of $300,000 that can only be used to hire additional police officers.How should this revenue be reported in the Town's government-wide statement of activities?

A)as a general revenue

B)as a program-specific capital grant

C)as a charge for services

D)as a program-specific operating grant

A)as a general revenue

B)as a program-specific capital grant

C)as a charge for services

D)as a program-specific operating grant

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

During its calendar year 2012,a city issued $800,000 of bonds to acquire various items of capital equipment.By the end of 2013,the city had spent all the bond proceeds to purchase capital assets.Accumulated depreciation on the assets was $120,000,and $150,000 of the bonds had been paid off.How much should the city report in its government-wide statement of net position as net investment in capital assets?

A)$0

B)$30,000

C)$630,000

D)$650,000

A)$0

B)$30,000

C)$630,000

D)$650,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

Westenhover City is a municipality that has governmental activities,business-type activities,a discrete component unit,and a blended component unit.Which of the following would not properly appear as a specific line item in Westenhover City's government-wide statement of net position?

A)revenues of the blended component unit

B)revenues of the discrete component unit

C)revenues of the governmental activities

D)revenues of the business-type activities

A)revenues of the blended component unit

B)revenues of the discrete component unit

C)revenues of the governmental activities

D)revenues of the business-type activities

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

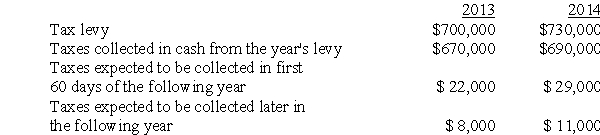

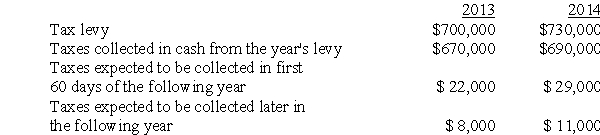

(Entries to prepare government-wide statements - property tax revenue deferral)

When it prepared its financial statements for calendar year 2012,Watson Town assumed that it would collect all unpaid property taxes during the first 60 days of 2013.As a result,no deferred revenues were reported.The following facts pertain to the property tax revenues for calendar years 2013 and 2014.Make adjusting entries needed to prepare both the fund-level and the government-wide financial statements for 2013 and 2014.Watson Town does not record deferred revenues until it makes end of the year adjustments.

Assume that all taxes expected to be collected in the following year were actually collected when expected.Also assume that all journal entries to record the tax levy,tax collections and so on were made,as appropriate.

When it prepared its financial statements for calendar year 2012,Watson Town assumed that it would collect all unpaid property taxes during the first 60 days of 2013.As a result,no deferred revenues were reported.The following facts pertain to the property tax revenues for calendar years 2013 and 2014.Make adjusting entries needed to prepare both the fund-level and the government-wide financial statements for 2013 and 2014.Watson Town does not record deferred revenues until it makes end of the year adjustments.

Assume that all taxes expected to be collected in the following year were actually collected when expected.Also assume that all journal entries to record the tax levy,tax collections and so on were made,as appropriate.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

What is the general rule for reporting capital assets in the governmental activities column of the government-wide statement of net position?

A)Capital assets are not reported in that column

B)Both proprietary fund and general capital assets are reported in that column

C)All general capital assets should be reported in that column

D)All general capital assets,except infrastructure assets,should be reported in that column.

A)Capital assets are not reported in that column

B)Both proprietary fund and general capital assets are reported in that column

C)All general capital assets should be reported in that column

D)All general capital assets,except infrastructure assets,should be reported in that column.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck