Deck 3: Discounted Cash Flow Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/28

Play

Full screen (f)

Deck 3: Discounted Cash Flow Analysis

1

When there are limited or no) pure play peer companies, which valuation method should be used?

A)Comparable companies analysis

B)Precedent transaction analysis

C)Vertical analysis

D)Discounted cash flow analysis

A)Comparable companies analysis

B)Precedent transaction analysis

C)Vertical analysis

D)Discounted cash flow analysis

D

2

When there is no debt in the capital structure, what is WAAC equal to?

A)Cost of debt

B)Debt-to-total capitalization ratio

C)Equity-to-total capitalization ratio

D)Cost of equity

A)Cost of debt

B)Debt-to-total capitalization ratio

C)Equity-to-total capitalization ratio

D)Cost of equity

D

3

Capex is expensed over its useful life through which of the following?

A)Depreciation

B)Amortization

C)EBIAT

D)Goodwill

A)Depreciation

B)Amortization

C)EBIAT

D)Goodwill

A

4

In a DCF analysis, what is used to capture the remaining value of the target beyond the projection period?

A)Intrinsic value

B)Terminal Value

C)WACC

D)Enterprise Value

A)Intrinsic value

B)Terminal Value

C)WACC

D)Enterprise Value

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

5

What is inventory divided by to obtain DIH?

A)COGS

B)Sales

C)Accounts Receivable

D)Gross Profit

A)COGS

B)Sales

C)Accounts Receivable

D)Gross Profit

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

6

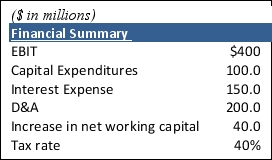

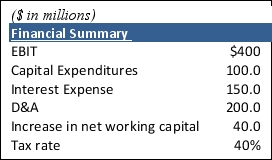

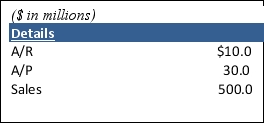

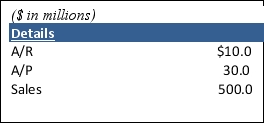

Calculate the company's free cash flow given the following information.

A)$250.0mm

B)$340.0mm

C)$500.0mm

D)$300.0mm

A)$250.0mm

B)$340.0mm

C)$500.0mm

D)$300.0mm

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

7

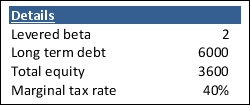

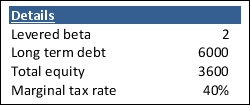

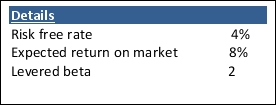

Calculate the unlevered beta given the following information. SHAPE \* MERGEFORMAT

A)1.8

B)1.2

C)1

D)1.4

A)1.8

B)1.2

C)1

D)1.4

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

8

In a DCF analysis, the target's projected FCF and terminal value are discounted to the present and summed to calculate the target's:

A)Enterprise value

B)Market cap

C)Equity value

D)Current value

A)Enterprise value

B)Market cap

C)Equity value

D)Current value

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

9

How does a decrease net working capital affect FCF?

A)Overstates FCF

B)Does not affect FCF

C)Understates FCF

D)It depends

A)Overstates FCF

B)Does not affect FCF

C)Understates FCF

D)It depends

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

10

In which calculation is the exit multiple method or the perpetuity growth method used?

A)Present value

B)Terminal value

C)WACC

D)FCF

A)Present value

B)Terminal value

C)WACC

D)FCF

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is considered a use of cash?

A)Amortization

B)Depreciation

C)Decrease in net working capital

D)Increase in net working capital

A)Amortization

B)Depreciation

C)Decrease in net working capital

D)Increase in net working capital

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

12

Calculate the DSO of a company given the following information.

A)0.02

B)0.06

C)21.9

D)7.3

A)0.02

B)0.06

C)21.9

D)7.3

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

13

Which expense reduces the life of an intangible asset?

A)Depreciation

B)Accelerated Depreciation

C)Amortization

D)Capex

A)Depreciation

B)Accelerated Depreciation

C)Amortization

D)Capex

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

14

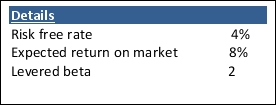

Calculate the market risk premium given the following information. SHAPE \* MERGEFORMAT

A)13%

B)6%

C)7%

D)20%

A)13%

B)6%

C)7%

D)20%

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

15

A DCF analysis is premised on the principle that the value of a company can be derived from the present value of which of the following?

A)Revenues

B)Gross profits

C)Free cash flow

D)Net working capital

A)Revenues

B)Gross profits

C)Free cash flow

D)Net working capital

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

16

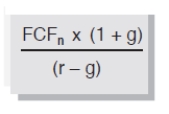

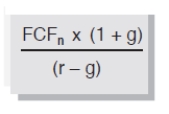

Identify the following formula.

A)CAPM

B)DCF

C)PGM

D)EEM

A)CAPM

B)DCF

C)PGM

D)EEM

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

17

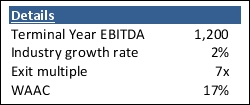

Calculate the CAPM given the following information. SHAPE \* MERGEFORMAT

A)12%

B)16%

C)20%

D)8.32%

A)12%

B)16%

C)20%

D)8.32%

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

18

What happens to WAAC as the proportion of debt in a capital structure increases?

A)It stays the same

B)It decreases

C)It increases

D)It depends

A)It stays the same

B)It decreases

C)It increases

D)It depends

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

19

What is used to calculate the expected return on a company's equity?

A)FCF

B)CAPM

C)DCM

D)EEM

A)FCF

B)CAPM

C)DCM

D)EEM

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

20

Calculate the ratio of debt-to-total capitalization given the following information. SHAPE \* MERGEFORMAT

A)3%

B)2.7%

C)1.5%

D)2%

A)3%

B)2.7%

C)1.5%

D)2%

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

21

Calculate the discount factor for $1.00 received at the end of one year, assuming a 12% discount rate.

A).80

B).95

C).87

D).89

A).80

B).95

C).87

D).89

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

22

Which variable generally represents the majority of a DCF valuation?

A)CAPM

B)Beta

C)WAAC

D)Terminal value

A)CAPM

B)Beta

C)WAAC

D)Terminal value

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

23

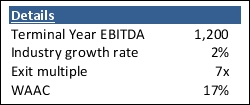

Calculate the terminal value using the EMM method given the following information. SHAPE \* MERGEFORMAT

A)8,400.0m

B)8.160.0m

C)8,000.0m

D)8,480.0m

A)8,400.0m

B)8.160.0m

C)8,000.0m

D)8,480.0m

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

24

If a DCF is constructed on the basis of EBIT or EBITDA, what must be driven as a percentage of sales?

A)COGS

B)SG&A

C)Net working capital

D)D&A

A)COGS

B)SG&A

C)Net working capital

D)D&A

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is a true statement about capital expenditures?

A)They represent actual cash outflows

B)They represent theoretical cash outflows

C)They represent intangible assets

D)They are expenses

A)They represent actual cash outflows

B)They represent theoretical cash outflows

C)They represent intangible assets

D)They are expenses

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

26

Calculate the present value of FCF using a year-end discount factor given the following information. SHAPE \* MERGEFORMAT

A)$180.0m

B)$200.0m

C)$185.0mm

D)$190.0m

A)$180.0m

B)$200.0m

C)$185.0mm

D)$190.0m

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

27

All of the following assets can be amortized EXCEPT:

A)Copyrights

B)Patents

C)Goodwill

D)PP&E

A)Copyrights

B)Patents

C)Goodwill

D)PP&E

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

28

When determining a terminal value for a cyclical company, the banker must make sure that:

A)Earnings are normalized

B)Earnings are at a cyclical high

C)Earnings are at a cyclical low

D)The perpetuity growth method is used

A)Earnings are normalized

B)Earnings are at a cyclical high

C)Earnings are at a cyclical low

D)The perpetuity growth method is used

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck