Deck 1: Comparable Companies Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/28

Play

Full screen (f)

Deck 1: Comparable Companies Analysis

1

How should one adjust net income when using the If-Converted method for a comparable companies analysis?

A)Adjust net income downward

B)Adjust net income upward

C)Make no adjustment to net income

D)It depends

A)Adjust net income downward

B)Adjust net income upward

C)Make no adjustment to net income

D)It depends

B

2

Given the following information, calculate the dividend yield.

Quarterly dividend: $0.50 per share

Current share price: $20.00

A)10%

B)2.5%

C)5%

D)1%

Quarterly dividend: $0.50 per share

Current share price: $20.00

A)10%

B)2.5%

C)5%

D)1%

10%

3

Calculate the share dilution using the TSM method given the following information:

100.0mm basic shares outstanding

Current share price of $10.00

10.0mm options outstanding with an exercise price of $20.00

A)110.0mm

B)150.0mm

C)100.0mm

D)220.0mm

100.0mm basic shares outstanding

Current share price of $10.00

10.0mm options outstanding with an exercise price of $20.00

A)110.0mm

B)150.0mm

C)100.0mm

D)220.0mm

100.0mm

4

Which calculation measures the return generated by all capital provided to a company?

A)ROE

B)ROA

C)ROIC

D)ROI

A)ROE

B)ROA

C)ROIC

D)ROI

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is likely to be a non-recurring item on an income statement?

A)SG&A

B)Interest expense

C)Depreciation

D)Goodwill impairment

A)SG&A

B)Interest expense

C)Depreciation

D)Goodwill impairment

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

6

Given the following information, what, by itself, would cause the enterprise value to equal $1,300.0mm?

Equity Value: $1,400mm

Cash: $200mm

Total Debt: $300mm

A)A $100mm decrease in debt

B)A $100mm increase in cash

C)A $200mm increase in debt

D)A $200mm increase in cash

Equity Value: $1,400mm

Cash: $200mm

Total Debt: $300mm

A)A $100mm decrease in debt

B)A $100mm increase in cash

C)A $200mm increase in debt

D)A $200mm increase in cash

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

7

Calculate the EBITDA margin given the following information.

EBITDA: $200.0m

COGS: $200.0m

Sales: $1,000.0m

Net income: $150.0m

A)20%

B)15%

C)40%

D)25%

EBITDA: $200.0m

COGS: $200.0m

Sales: $1,000.0m

Net income: $150.0m

A)20%

B)15%

C)40%

D)25%

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

8

All of the following are reasons why EBITDA is an important metric when performing a comparable companies analysis EXCEPT: I.It represents a more accurate look at a company's operating cash flow

II)It is free from differences resulting from capital structure

III)It represents the profit after all of a company's expenses have been netted out

IV)It is free from differences in tax expenses

A)It represents a more accurate look at a company's operating cash flow

B)It is free from differences resulting from capital structure

C)It represents the profit after all of a company's expenses have been netted out

D)It is free from differences in tax expenses

II)It is free from differences resulting from capital structure

III)It represents the profit after all of a company's expenses have been netted out

IV)It is free from differences in tax expenses

A)It represents a more accurate look at a company's operating cash flow

B)It is free from differences resulting from capital structure

C)It represents the profit after all of a company's expenses have been netted out

D)It is free from differences in tax expenses

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

9

Which financial metric can help indicate a company's size?

A)ROIC

B)EV

C)DOL

D)FCF Yield

A)ROIC

B)EV

C)DOL

D)FCF Yield

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

10

A company's capital expenditures can be found on all of the following forms EXCEPT:

A)10-K

B)8-K

C)Proxy Statement

D)10-Q

A)10-K

B)8-K

C)Proxy Statement

D)10-Q

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

11

An 8-K or current report may be helpful for a comparable companies analysis as it contains which of the following?

A)Management discussion and analysis

B)Pro forma adjustments

C)Material corporate events or changes

D)A comprehensive company overview

A)Management discussion and analysis

B)Pro forma adjustments

C)Material corporate events or changes

D)A comprehensive company overview

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

12

Given the following information, calculate the gross profit margin.

Revenue: $200.0mm

COGS: $100.0mm

Operating Expenses: $50.0mm

A)40%

B)50%

C)25%

D)10%

Revenue: $200.0mm

COGS: $100.0mm

Operating Expenses: $50.0mm

A)40%

B)50%

C)25%

D)10%

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

13

Calculate the debt-to-EBITDA ratio given the following information.

EBIT: $100.0m

D&A: $150.0m

Cash: $50.0m

Debt: $75.0m

A)25%

B)30%

C)50%

D)37.5%

EBIT: $100.0m

D&A: $150.0m

Cash: $50.0m

Debt: $75.0m

A)25%

B)30%

C)50%

D)37.5%

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

14

What is the difference between 2011 YTD revenues and LTM revenues? Revenues:

Q1 2011: $200.0m

Q2 2011: $150.0m

Q3 2011: $220.0m

Q4 2011: $175.0m

Q1 2012: $250.0m

Q2 2012: $175.0m

A)$75.0m

B)$50.0m

C)$175.0m

D)$100.0m

Q1 2011: $200.0m

Q2 2011: $150.0m

Q3 2011: $220.0m

Q4 2011: $175.0m

Q1 2012: $250.0m

Q2 2012: $175.0m

A)$75.0m

B)$50.0m

C)$175.0m

D)$100.0m

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

15

What happens to the enterprise value EV) if a company issues equity and uses the proceeds to repay debt?

A)The EV goes up

B)The EV remains the same

C)The EV goes down

D)It depends

A)The EV goes up

B)The EV remains the same

C)The EV goes down

D)It depends

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

16

Based on Moody's rating scale, what grade is Baa1 considered?

A)High quality

B)Highly speculative

C)Medium grade

D)Extremely speculative

A)High quality

B)Highly speculative

C)Medium grade

D)Extremely speculative

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

17

All of the following are reasons why comparable companies analysis should be used in conjunction with other valuation methodologies EXCEPT: I.Markets may be skewed due to investor sentiment

II)No two companies are the same

III)Valuation methods vary by sector

IV)Intrinsic valuation may be needed

A)Markets may be skewed due to investor sentiment

B)No two companies are the same

C)Valuation methods may vary by sector

D)Intrinsic valuation may be needed

II)No two companies are the same

III)Valuation methods vary by sector

IV)Intrinsic valuation may be needed

A)Markets may be skewed due to investor sentiment

B)No two companies are the same

C)Valuation methods may vary by sector

D)Intrinsic valuation may be needed

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

18

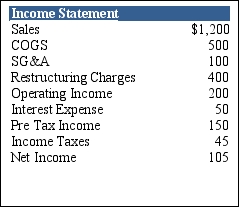

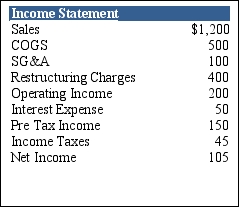

What is normalized net income given the following information? SHAPE \* MERGEFORMAT

A)$505

B)$550

C)$385

D)$275

A)$505

B)$550

C)$385

D)$275

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

19

Calculate the compounded annual growth rate CAGR) if revenues grew from $50.0m in 2005 to $350.0m in 2012.

A)32%

B)24%

C)55%

D)18%

A)32%

B)24%

C)55%

D)18%

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

20

What is the equity value of the company given the following information?

Current share price: $40.00

Basic shares outstanding: 400.0mm

50.0mm options outstanding with an exercise price of $20.00

5.0mm warrants with an exercise price of $45.00

A)$1,600.0mm

B)$1,500.0mm

C)$1,700.0mm

D)$1,625.0mm

Current share price: $40.00

Basic shares outstanding: 400.0mm

50.0mm options outstanding with an exercise price of $20.00

5.0mm warrants with an exercise price of $45.00

A)$1,600.0mm

B)$1,500.0mm

C)$1,700.0mm

D)$1,625.0mm

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is both a pro and a con of performing a comparable companies analysis?

A)It is quick to perform

B)It is current data

C)It is relative to other companies

D)It is market based

A)It is quick to perform

B)It is current data

C)It is relative to other companies

D)It is market based

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

22

What happens to enterprise value if a company raises $100.0m debt and holds it on its balance sheet as cash?

A)EV remains the same

B)EV increases by $100.0m

C)EV decreases by $100.0m

D)EV decreases by $200.0m

A)EV remains the same

B)EV increases by $100.0m

C)EV decreases by $100.0m

D)EV decreases by $200.0m

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is NOT included in calculating a company's capitalization ratio?

A)Debt

B)Preferred stock

C)Equity

D)EBITDA

A)Debt

B)Preferred stock

C)Equity

D)EBITDA

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

24

Given the following information, calculate a company's EBITDA margin. Operating income: $250.0m

Sales: $800.0m

D&A: $50.0m

Gross profit: $500.0m

A)40.0%

B)37.5%

C)31.25%

D)68.75%

Sales: $800.0m

D&A: $50.0m

Gross profit: $500.0m

A)40.0%

B)37.5%

C)31.25%

D)68.75%

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

25

What is a common multiple to use in a comparable companies analysis for a retail company?

A)EV / Subscribers

B)EV / Reserves

C)EV / Square footage

D)EV / Production

A)EV / Subscribers

B)EV / Reserves

C)EV / Square footage

D)EV / Production

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

26

Calculate COGS given the following information. Sales: $800.0m

SG&A: $250.0m

EBITDA: $300.0m

D&A: $50.0m

A)$250.0m

B)$200.0m

C)$500.0m

D)$300.0m

SG&A: $250.0m

EBITDA: $300.0m

D&A: $50.0m

A)$250.0m

B)$200.0m

C)$500.0m

D)$300.0m

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

27

What is EBITDA a proxy for?

A)Sales

B)Growth

C)Cash flow

D)Debt

A)Sales

B)Growth

C)Cash flow

D)Debt

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

28

For what company would a valuation metric like EV / Sales be helpful?

A)A company with high gross margins

B)A company with no earnings

C)A company with low gross margins

D)A company with no debt

A)A company with high gross margins

B)A company with no earnings

C)A company with low gross margins

D)A company with no debt

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck