Deck 14: Intercorporate Investments in Common Stock

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

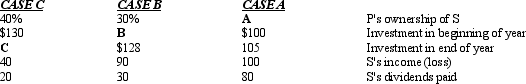

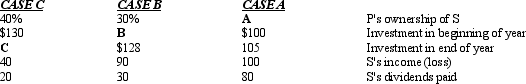

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/103

Play

Full screen (f)

Deck 14: Intercorporate Investments in Common Stock

1

U.S.GAAP and IFRS view investments of less than 20% of the voting shares of another company as minority, passive investments in most cases.

True

2

The accounting for investments in common stock depends on (1) the expected holding period, and (2) the purpose of the investment, as determined by both the percentage held and management intent.

True

3

U.S.GAAP and IFRS view investments of between 20% and 50% of the voting stock of another company as minority, active investments unless evidence indicates that the investor cannot exert significant influence.

True

4

If the combined market value of trading securities at the end of the year is less than the market value of the same portfolio of trading securities at the beginning of the year, the difference should be accounted for by

A)reporting an unrealized loss in security investments in the stockholders' equity section of the balance sheet.

B)reporting an unrealized loss in security investments in the income statement.

C)a footnote to the financial statements.

D)a credit to Investment in Trading Securities.

E)None of these answer choices is correct.

A)reporting an unrealized loss in security investments in the stockholders' equity section of the balance sheet.

B)reporting an unrealized loss in security investments in the income statement.

C)a footnote to the financial statements.

D)a credit to Investment in Trading Securities.

E)None of these answer choices is correct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

5

The rationale for the equity method is that it better measures an investor's income from investing activities when, because of its ownership interest, it can exert significant influence over the operations and dividend policy of the investee.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

6

U.S.GAAP and IFRS view ownership of more than 50% of an investee as implying an ability to control the investee, unless evidence indicates to the contrary.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

7

In the acquisition method for a business combination, the excess of the fair value of the consideration over the fair value of the acquired firm's identifiable assets net of identifiable liabilities is goodwill.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is/are true regarding minority, passive investments?

A)An investor acquires the common stock of another entity for the interest, dividends, and capital gains anticipated from share ownership.

B)The acquiring company's ownership percentage is sufficiently small that it cannot control or exert significant influence over the other company.

C)U.S.GAAP and IFRS view investments of less than 20% of the voting shares of another company as minority, passive investments in most cases.

D)An investor who intends to hold the shares for less than a year would classify them as current assets; if the expected holding period is longer, the investor would classify them as noncurrent assets.

E)all of the above

A)An investor acquires the common stock of another entity for the interest, dividends, and capital gains anticipated from share ownership.

B)The acquiring company's ownership percentage is sufficiently small that it cannot control or exert significant influence over the other company.

C)U.S.GAAP and IFRS view investments of less than 20% of the voting shares of another company as minority, passive investments in most cases.

D)An investor who intends to hold the shares for less than a year would classify them as current assets; if the expected holding period is longer, the investor would classify them as noncurrent assets.

E)all of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is/are true regarding majority, active investments?

A)An investor acquires shares of an investee so that the investor can control the investee both at the broad policy-making level and at the day-to-day operational level.

B)U.S.GAAP views ownership of more than 50% of an investee as implying an ability to control the investee, unless evidence indicates to the contrary.

C)IFRS views ownership of more than 50% of an investee as implying an ability to control the investee, unless evidence indicates to the contrary.

D)An investor cannot exercise control of a majority-owned investee if a court effectively controls the investee in bankruptcy proceedings or if the investee is a foreign company whose government restricts the withdrawal of assets from the country.

E)all of the above

A)An investor acquires shares of an investee so that the investor can control the investee both at the broad policy-making level and at the day-to-day operational level.

B)U.S.GAAP views ownership of more than 50% of an investee as implying an ability to control the investee, unless evidence indicates to the contrary.

C)IFRS views ownership of more than 50% of an investee as implying an ability to control the investee, unless evidence indicates to the contrary.

D)An investor cannot exercise control of a majority-owned investee if a court effectively controls the investee in bankruptcy proceedings or if the investee is a foreign company whose government restricts the withdrawal of assets from the country.

E)all of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is/are true?

A)Trading securities can be classified as current or noncurrent depending on management's intent.

B)Held-to-maturity securities should not be classified as current under any circumstance.

C)Trading securities should not be classified as current under any circumstance.

D)Available-for-sale securities can be classified as current or noncurrent depending on management's intent.

E)None of these answer choices is correct.

A)Trading securities can be classified as current or noncurrent depending on management's intent.

B)Held-to-maturity securities should not be classified as current under any circumstance.

C)Trading securities should not be classified as current under any circumstance.

D)Available-for-sale securities can be classified as current or noncurrent depending on management's intent.

E)None of these answer choices is correct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

11

A major mining company owns a mining subsidiary in South America, where the government enforces stringent control over cash payments outside the country.The parent cannot control all the assets of the subsidiary, despite owning a majority of the voting shares, but should prepare consolidated statements with the subsidiary.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is/are true regarding minority, active investments?

A)An investor acquires common shares of an investee with the intent of exerting significant influence over the investee's activities, perhaps through representation on the investee's board of directors.

B)An investor can exert significant influence over an investee with ownership of less than a majority of the voting stock, because many different individuals or entities own most publicly held corporations, and those owners typically do not collaborate in voting their shares.

C)U.S.GAAP and IFRS view investments of between 20% and 50% of the voting stock of another company as minority, active investments unless evidence indicates that the investor cannot exert significant influence.

D)Minority, active investments appear as noncurrent assets on the balance sheet.

E)all of the above

A)An investor acquires common shares of an investee with the intent of exerting significant influence over the investee's activities, perhaps through representation on the investee's board of directors.

B)An investor can exert significant influence over an investee with ownership of less than a majority of the voting stock, because many different individuals or entities own most publicly held corporations, and those owners typically do not collaborate in voting their shares.

C)U.S.GAAP and IFRS view investments of between 20% and 50% of the voting stock of another company as minority, active investments unless evidence indicates that the investor cannot exert significant influence.

D)Minority, active investments appear as noncurrent assets on the balance sheet.

E)all of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

13

Securities that firms expect to hold for more than one year from the date of the balance sheet appear in investments in securities, classified as a current asset on the balance sheet.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

14

Securities that firms expect to sell within the next year appear as investment securities in current assets on the balance sheet.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

15

U.S.GAAP and IFRS require firms to account for minority, active investments, generally those where the investor owns between _____ using the equity method.Under the equity method, the investor recognizes as revenue (expense) each period its share of the net income (loss) of the investee.The investor recognizes dividends received from the investee as a return (reduction) of investment, not as income.

A)10% and 50%

B)20% and 50%

C)30% and 50%

D)40% and 60%

E)50% and 60%

A)10% and 50%

B)20% and 50%

C)30% and 50%

D)40% and 60%

E)50% and 60%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

16

The accounting for investments in common stock depends on the

A)expected holding period.

B)purpose of the investment, as determined by the percentage held.

C)purpose of the investment, as determined by management intent.

D)all of the above

E)none of the above

A)expected holding period.

B)purpose of the investment, as determined by the percentage held.

C)purpose of the investment, as determined by management intent.

D)all of the above

E)none of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

17

For various reasons, a single economic entity may exist in the form of a parent and several legally separate subsidiaries, often referred to as an affiliated group.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

18

If an entity qualifies as a variable interest entity (VIE), U.S.GAAP requires the primary beneficiary of the VIE to consolidate the VIE.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

19

The summary of significant accounting principles, a required part of the financial statement notes, must include a statement about the parent's consolidation policy.If an investor does not consolidate a significant majority-owned subsidiary, the notes will disclose that fact.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

20

When an investor owns less than a majority of the voting stock of another corporation, the accountant must judge when the investor can exert significant influence.For the sake of uniformity, U.S.GAAP and IFRS presume that significant influence exists at ownership of _____ or more of the voting stock of the investee. (Assume that management does not have a contractual or other basis to demonstrate that influence.)

A)5 percent

B)10 percent

C)15 percent

D)20 percent

E)30 percent

A)5 percent

B)10 percent

C)15 percent

D)20 percent

E)30 percent

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

21

Under the equity method, the investor recognizes as revenue (expense) each period _____.The investor recognizes dividends received from the investee as a(n) _____.

A)only when it receives dividends; a return (reduction) of investment.

B)only when it receives dividends; income

C)its share of the net income (loss) of the investee; a return (reduction) of investment.

D)its share of the net income (loss) of the investee; income

E)all of the net income (loss) of the investee; a return (reduction) of investment.

A)only when it receives dividends; a return (reduction) of investment.

B)only when it receives dividends; income

C)its share of the net income (loss) of the investee; a return (reduction) of investment.

D)its share of the net income (loss) of the investee; income

E)all of the net income (loss) of the investee; a return (reduction) of investment.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

22

Paula Company measures its investments in available-for-sale marketable securities

A)at cost on the balance sheet and recognizes income only when it receives a dividend (revenue) or sells some of the securities at a gain or loss.

B)at fair value on the income statement and recognizes income when it receives a dividend (revenue) .

C)at cost on the balance sheet and recognizes income only when it receives a dividend (revenue).

D)at fair value on the balance sheet and recognizes income only when it receives a dividend (revenue) or sells some of the securities at a gain or loss.

E)at cost on the balance sheet and recognizes income only when it sells some of the securities at a gain or loss.

A)at cost on the balance sheet and recognizes income only when it receives a dividend (revenue) or sells some of the securities at a gain or loss.

B)at fair value on the income statement and recognizes income when it receives a dividend (revenue) .

C)at cost on the balance sheet and recognizes income only when it receives a dividend (revenue).

D)at fair value on the balance sheet and recognizes income only when it receives a dividend (revenue) or sells some of the securities at a gain or loss.

E)at cost on the balance sheet and recognizes income only when it sells some of the securities at a gain or loss.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

23

Paula Company recognizes unrealized changes in the fair value of available-for-sale securities in

A)net income.

B)retained earnings.

C)additional paid-in-capital.

D)other comprehensive income, not in earnings.

E)none of the above

A)net income.

B)retained earnings.

C)additional paid-in-capital.

D)other comprehensive income, not in earnings.

E)none of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

24

Penney Corporation acquires 30% of the outstanding voting common shares of the Instat Corporation for $600,000.Penney Corporation acquires the investment in Instat Corporation by buying previously issued shares of Instat Corporation from other investors. Between the time of the acquisition and the end of Penney Corporation's next accounting period, Instat Corporation reports earnings of $80,000.Penney Corporation records the following journal entry:

A)Equity in Earnings of Affiliate ..........................24,000 Investment in Stock of Instat Corporation ............... . . .24,000

B)Investment in Stock of Instat Corporation ...............24,000 Equity in Earnings of Affiliate ............................. 24,000

C)Equity in Earnings of Affiliate ..........................80,000 Investment in Stock of Instat Corporation ............... . . 80,000

D)Investment in Stock of Instat Corporation ...............80,000 Equity in Earnings of Affiliate ............................. 80,000

E)Investment in Stock of Instat Corporation ...............24,000 Investment Revenue..................................... 24,000

A)Equity in Earnings of Affiliate ..........................24,000 Investment in Stock of Instat Corporation ............... . . .24,000

B)Investment in Stock of Instat Corporation ...............24,000 Equity in Earnings of Affiliate ............................. 24,000

C)Equity in Earnings of Affiliate ..........................80,000 Investment in Stock of Instat Corporation ............... . . 80,000

D)Investment in Stock of Instat Corporation ...............80,000 Equity in Earnings of Affiliate ............................. 80,000

E)Investment in Stock of Instat Corporation ...............24,000 Investment Revenue..................................... 24,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

25

Marcoff Corporation acquires 30% of the outstanding voting common shares of the Invicta Corporation for $600,000.Marcoff Corporation acquires the investment in Invicta Corporation by buying previously issued shares of Invicta Corporation from other investors. The entry to record the acquisition is:

A)Investment in Stock of Invicta Corporation ..............600,000 Marketable Securities.....................................600,000

B)Cash ........................................... 600,000 Marketable Securities ....................................600,000

C)Investment in Stock of Invicta Corporation ..............600,000 Cash ................................................. 600,000

D)Marketable Securities ............... ................ 600,000 Cash .................................................600,000

E)Common Stock .................................... 600,000 Cash .................................................600,000

A)Investment in Stock of Invicta Corporation ..............600,000 Marketable Securities.....................................600,000

B)Cash ........................................... 600,000 Marketable Securities ....................................600,000

C)Investment in Stock of Invicta Corporation ..............600,000 Cash ................................................. 600,000

D)Marketable Securities ............... ................ 600,000 Cash .................................................600,000

E)Common Stock .................................... 600,000 Cash .................................................600,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

26

Marcoff Corporation acquires 30% of the outstanding voting common shares of the Invicta Corporation for $600,000.Marcoff Corporation acquires the investment in Invicta Corporation by buying previously issued shares of Invicta Corporation from other investors. If Invicta Corporation declares and pays a dividend of $30,000 to holders of its common stock, Marcoff Corporation records the following journal entry:

A)Cash.............................................9,000 Investment in Stock of Invicta Corporation ............... . . . 9,000

B)Investment in Stock of Invicta Corporation ............... 9,000 Equity in Earnings of Affiliate ............................. 9,000

C)Equity in Earnings of Affiliate ..........................9,000 Investment in Stock of Invicta Corporation ............... . . 9,000

D)Investment in Stock of Invicta Corporation ............... 9,000 Investment Revenue.................................. 9,000

E)Investment in Stock of Invicta Corporation ............... 9,000 Investment Revenue..................................... 9,000

A)Cash.............................................9,000 Investment in Stock of Invicta Corporation ............... . . . 9,000

B)Investment in Stock of Invicta Corporation ............... 9,000 Equity in Earnings of Affiliate ............................. 9,000

C)Equity in Earnings of Affiliate ..........................9,000 Investment in Stock of Invicta Corporation ............... . . 9,000

D)Investment in Stock of Invicta Corporation ............... 9,000 Investment Revenue.................................. 9,000

E)Investment in Stock of Invicta Corporation ............... 9,000 Investment Revenue..................................... 9,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

27

The equity method records the initial purchase of an investment in voting common stock at _____. Each period, the investor treats as revenue its share of the _____ of the investee.The investor treats dividends declared by the investee as _____.

A)acquisition cost; dividends; income

B)acquisition cost; periodic earnings; a reduction of the investor's investment in stock of the investee account

C)present value of future cash flows; dividends; a reduction of the investor's investment in stock of the investee account

D)present value of future cash flows; periodic earnings; a reduction of the investor's investment in stock of the investee account

E)future value of present cash flows; dividends; a reduction of the investor's investment in stock of the investee account

A)acquisition cost; dividends; income

B)acquisition cost; periodic earnings; a reduction of the investor's investment in stock of the investee account

C)present value of future cash flows; dividends; a reduction of the investor's investment in stock of the investee account

D)present value of future cash flows; periodic earnings; a reduction of the investor's investment in stock of the investee account

E)future value of present cash flows; dividends; a reduction of the investor's investment in stock of the investee account

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

28

The rationale for the equity method is that it better measures an investor's income from investing activities when, because of its ownership interest, it

A)can exert control over the operations and dividend policy of the investee.

B)can exert significant influence over the operations and dividend policy of the investee.

C)cannot exert significant influence over the operations and dividend policy of the investee.

D)can exert control over the operations and dividend policy of the investor.

E)can exert significant influence over the operations and dividend policy of the investor.

A)can exert control over the operations and dividend policy of the investee.

B)can exert significant influence over the operations and dividend policy of the investee.

C)cannot exert significant influence over the operations and dividend policy of the investee.

D)can exert control over the operations and dividend policy of the investor.

E)can exert significant influence over the operations and dividend policy of the investor.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

29

Purchaser Corporation acquires 30% of the outstanding voting common shares of the Investee Corporation for $600,000.Purchaser Corporation acquires the investment in Investee Corporation by buying previously issued shares of Investee Corporation from other investors. Investee Corporation's other comprehensive income during the first period is as follows:

Unrealized Holding Gains from Marketable Securities...$ 3,000

Unrealized Losses from Cash Flow Hedges .......... (2,000)

Other Comprehensive Income.................... $ 1,000

Purchaser Corporation would make the following entry to recognize its share of the items of other comprehensive income of Investee Corporation:

A)Cash.......................................300 Realized Holding Losses from Cash Flow Hedges

(Other Comprehensive Income) ...................600

Realized Holding Gains from Marketable Securities

(Other Comprehensive Income) .......................900

B)Investment in Stock of Investee Corporation ..........300 Realized Holding Losses from Cash Flow Hedges

(Other Comprehensive Income) ...................600

Realized Holding Gains from Marketable Securities

(Other Comprehensive Income) .......................900

C)Cash.......................................300 Unrealized Holding Losses from Cash Flow Hedges

(Other Comprehensive Income) ...................600

Unrealized Holding Gains from Marketable Securities

(Other Comprehensive Income) .......................900

D)Investment in Stock of Investee Corporation ..........300 Unrealized Holding Losses from Cash Flow Hedges

(Other Comprehensive Income) ...................600

Unrealized Holding Gains from Marketable Securities

(Other Comprehensive Income) .......................900

E)none of the above

Unrealized Holding Gains from Marketable Securities...$ 3,000

Unrealized Losses from Cash Flow Hedges .......... (2,000)

Other Comprehensive Income.................... $ 1,000

Purchaser Corporation would make the following entry to recognize its share of the items of other comprehensive income of Investee Corporation:

A)Cash.......................................300 Realized Holding Losses from Cash Flow Hedges

(Other Comprehensive Income) ...................600

Realized Holding Gains from Marketable Securities

(Other Comprehensive Income) .......................900

B)Investment in Stock of Investee Corporation ..........300 Realized Holding Losses from Cash Flow Hedges

(Other Comprehensive Income) ...................600

Realized Holding Gains from Marketable Securities

(Other Comprehensive Income) .......................900

C)Cash.......................................300 Unrealized Holding Losses from Cash Flow Hedges

(Other Comprehensive Income) ...................600

Unrealized Holding Gains from Marketable Securities

(Other Comprehensive Income) .......................900

D)Investment in Stock of Investee Corporation ..........300 Unrealized Holding Losses from Cash Flow Hedges

(Other Comprehensive Income) ...................600

Unrealized Holding Gains from Marketable Securities

(Other Comprehensive Income) .......................900

E)none of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

30

U.S.GAAP and IFRS require firms to account for minority, active investments, using the _____ method.

A)cost

B)equity

C)fair market value

D)consolidation

E)lower of cost or market

A)cost

B)equity

C)fair market value

D)consolidation

E)lower of cost or market

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

31

U.S.GAAP view investments of less than 20 percent of the voting stock of another company as

A)minority, passive investments.

B)minority, active investments.

C)majority, passive investments.

D)majority, active investments.

E)a controlled entity.

A)minority, passive investments.

B)minority, active investments.

C)majority, passive investments.

D)majority, active investments.

E)a controlled entity.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

32

Purchaser Corporation acquires 30% of the outstanding voting common shares of the Investee Corporation for $600,000.Purchaser Corporation acquires the investment in Investee Corporation by buying previously issued shares of Investee Corporation from other investors. Which of the following is/are true?

A)On the balance sheet, an investment accounted for with the equity method appears among noncurrent assets.

B)On the balance sheet, the amount shown generally equals the acquisition cost of the shares, plus Purchaser Corporation's share of Investee Corporation's undistributed earnings (or losses) since the date Purchaser Corporation acquired the shares, plus or minus amortization of any excess cost at the date of acquisition attributable to assets with limited lives.

C)On the income statement, Purchaser Corporation reports each period its share of Investee Corporation's income (or loss) as revenue (or expense), as well as any amortization of excess cost.

D)Purchaser Corporation also recognizes its share of the investee's other comprehensive income.

E)all of the above

A)On the balance sheet, an investment accounted for with the equity method appears among noncurrent assets.

B)On the balance sheet, the amount shown generally equals the acquisition cost of the shares, plus Purchaser Corporation's share of Investee Corporation's undistributed earnings (or losses) since the date Purchaser Corporation acquired the shares, plus or minus amortization of any excess cost at the date of acquisition attributable to assets with limited lives.

C)On the income statement, Purchaser Corporation reports each period its share of Investee Corporation's income (or loss) as revenue (or expense), as well as any amortization of excess cost.

D)Purchaser Corporation also recognizes its share of the investee's other comprehensive income.

E)all of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

33

Power Corporation acquires 30% of the outstanding voting common shares of the Inroad Corporation for $600,000.Power Corporation acquires the investment in Inroad Corporation by buying previously issued shares of Inroad Corporation from other investors. Power Corporation records income earned by Inroad Corporation as a(n) _____, while the dividend _____, and _____ account.

A)increase in investment; returns part of the investment; decreases the Investment in Stock of Inroad Corporation

B)increase investment revenue; returns part of the investment; decreases the Investment in Stock of Inroad Corporation

C)increase investment revenue; decreases investment revenue; increases the Investment in Stock of Inroad Corporation

D)decrease in investment; returns part of the investment; increases the Investment in Stock of Inroad Corporation

E)decrease in investment; decreases investment revenue; increases the Investment in Stock of Inroad Corporation

A)increase in investment; returns part of the investment; decreases the Investment in Stock of Inroad Corporation

B)increase investment revenue; returns part of the investment; decreases the Investment in Stock of Inroad Corporation

C)increase investment revenue; decreases investment revenue; increases the Investment in Stock of Inroad Corporation

D)decrease in investment; returns part of the investment; increases the Investment in Stock of Inroad Corporation

E)decrease in investment; decreases investment revenue; increases the Investment in Stock of Inroad Corporation

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

34

Parton Corporation acquires 30% of the outstanding voting common shares of the Investee Corporation for $600,000.Parton Corporation acquires the investment in Import Corporation by buying previously issued shares of Import Corporation from other investors. When Parton Corporation acquired 30% of Import Corporation's common shares for $600,000, Import Corporation's total shareholders' equity was $1.5 million.Parton Corporation's cost exceeds the carrying value of the net assets acquired by $150,000 [ $600,000 - (0.30 x $1,500,000)].Parton Corporation may pay this premium because

A)the fair values of Import's net assets differ from their carrying values, only.

B)of unrecorded assets (for example, trade secrets), only.

C)the fair values of Import's net assets differ from their carrying values and/or unrecorded assets (for example, trade secrets).

D)the liquidation values of Import's net assets differ from their carrying values, only.

E)of unrecorded liabilities (for example, contingent liabilities), only.

A)the fair values of Import's net assets differ from their carrying values, only.

B)of unrecorded assets (for example, trade secrets), only.

C)the fair values of Import's net assets differ from their carrying values and/or unrecorded assets (for example, trade secrets).

D)the liquidation values of Import's net assets differ from their carrying values, only.

E)of unrecorded liabilities (for example, contingent liabilities), only.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

35

Purchaser Corporation acquires 30% of the outstanding voting common shares of the Investee Corporation for $600,000.Purchaser Corporation acquires the investment in Investee Corporation by buying previously issued shares of Investee Corporation from other investors. When Purchaser Corporation acquired 30% of Investee Corporation's common shares for $600,000, Investee Corporation's total shareholders' equity was $1.5 million.Purchaser Corporation's cost exceeds the carrying value of the net assets acquired by $150,000 [ $600,000 - (0.30 x $1,500,000)]. What is/are the accounting procedure(s) for this premium?

A)The investor's accounting for the excess purchase price embedded in the Investment in Stock of Investee Corporation account is similar to the treatment of an excess purchase price in a business combination.

B)The investor identifies any recorded assets and liabilities with fair values that differ from their carrying values, as well as any unrecorded assets and liabilities.

C)The investor attributes the excess purchase price to the assets and liabilities with fair values that differ from their carrying values, as well as any unrecorded assets and liabilities, based on the investor's proportionate ownership interest.

D)The investor attributes the excess purchase price to the assets and liabilities with fair values that differ from their carrying values, as well as any unrecorded assets and liabilities, based on the investor's proportionate ownership interest and any remaining excess purchase price to goodwill.

E)all of the above

A)The investor's accounting for the excess purchase price embedded in the Investment in Stock of Investee Corporation account is similar to the treatment of an excess purchase price in a business combination.

B)The investor identifies any recorded assets and liabilities with fair values that differ from their carrying values, as well as any unrecorded assets and liabilities.

C)The investor attributes the excess purchase price to the assets and liabilities with fair values that differ from their carrying values, as well as any unrecorded assets and liabilities, based on the investor's proportionate ownership interest.

D)The investor attributes the excess purchase price to the assets and liabilities with fair values that differ from their carrying values, as well as any unrecorded assets and liabilities, based on the investor's proportionate ownership interest and any remaining excess purchase price to goodwill.

E)all of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

36

Potion Corporation acquires 30% of the outstanding voting common shares of the Formula Corporation for $600,000.Potion Corporation acquires the investment in Formula Corporation by buying previously issued shares of Formula Corporation from other investors. Between the time of the acquisition and the end of Potion Corporation's next accounting period, Formula Corporation reports earnings of $80,000; and pays a dividend of $30,000 to holders of its common stock.

Formula Corporation reports earnings of $100,000 and pays dividends of $40,000 during the subsequent accounting period.

During the next accounting period, Potion Corporation sells one-fourth of its investment in Formula Corporation for $165,000.

After the sale, the balance in the Investment in Stock of Formula Corporation account is:

A)$462,750

B)$465,750

C)$474,750

D)$481,750

E)$486,750

Formula Corporation reports earnings of $100,000 and pays dividends of $40,000 during the subsequent accounting period.

During the next accounting period, Potion Corporation sells one-fourth of its investment in Formula Corporation for $165,000.

After the sale, the balance in the Investment in Stock of Formula Corporation account is:

A)$462,750

B)$465,750

C)$474,750

D)$481,750

E)$486,750

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

37

Pagoli Corporation acquires 30% of the outstanding voting common shares of the Inform Corporation for $600,000.Pagoli Corporation acquires the investment in Inform Corporation by buying previously issued shares of Inform Corporation from other investors. Between the time of the acquisition and the end of Pagoli Corporation's next accounting period, Inform Corporation reports earnings of $80,000; and pays a dividend of $30,000 to holders of its common stock.

Inform Corporation reports earnings of $100,000 and pays dividends of $40,000 during the subsequent accounting period.

Pagoli Corporation's Investment in Stock of Inform Corporation account now has a balance of:

A)$609,000

B)$621,000

C)$633,000

D)$642,000

E)$657,000

Inform Corporation reports earnings of $100,000 and pays dividends of $40,000 during the subsequent accounting period.

Pagoli Corporation's Investment in Stock of Inform Corporation account now has a balance of:

A)$609,000

B)$621,000

C)$633,000

D)$642,000

E)$657,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

38

Pager Corporation acquires 30% of the outstanding voting common shares of the Intercomm Corporation for $600,000.Pager Corporation acquires the investment in Intercomm Corporation by buying previously issued shares of Intercomm Corporation from other investors. Suppose that Intercomm Corporation reports earnings of $100,000 and pays dividends of $40,000, during the next accounting period.As a result, Pager Corporation's entries are:

A)Equity in Earnings of Affiliate ..........................30,000 Investment in Stock of Intercomm Corporation ............... . . .30,000

Investment in Stock of Intercomm Corporation................12,000

Cash.............................................. 12,000

B)Investment in Stock of Intercomm Corporation ...............30,000 Equity in Earnings of Affiliate ............................. 30,000

Cash.............................................. 12,000

Investment in Stock of Intercomm Corporation....................12,000

C)Equity in Earnings of Affiliate ..........................100,000 Investment in Stock of Intercomm Corporation ............... . . 100,000

Cash.............................................. 12,000

Investment in Stock of Intercomm Corporation....................12,000

D)Investment in Stock of Intercomm Corporation ...............100,000 Equity in Earnings of Affiliate ............................. 100,000

Cash.............................................. 12,000

Investment in Stock of Intercomm Corporation....................12,000

E)Investment in Stock of Intercomm Corporation ...............30,000 Investment Revenue..................................... 30,000

Cash.............................................. 12,000

Investment in Stock of Intercomm Corporation....................12,000

A)Equity in Earnings of Affiliate ..........................30,000 Investment in Stock of Intercomm Corporation ............... . . .30,000

Investment in Stock of Intercomm Corporation................12,000

Cash.............................................. 12,000

B)Investment in Stock of Intercomm Corporation ...............30,000 Equity in Earnings of Affiliate ............................. 30,000

Cash.............................................. 12,000

Investment in Stock of Intercomm Corporation....................12,000

C)Equity in Earnings of Affiliate ..........................100,000 Investment in Stock of Intercomm Corporation ............... . . 100,000

Cash.............................................. 12,000

Investment in Stock of Intercomm Corporation....................12,000

D)Investment in Stock of Intercomm Corporation ...............100,000 Equity in Earnings of Affiliate ............................. 100,000

Cash.............................................. 12,000

Investment in Stock of Intercomm Corporation....................12,000

E)Investment in Stock of Intercomm Corporation ...............30,000 Investment Revenue..................................... 30,000

Cash.............................................. 12,000

Investment in Stock of Intercomm Corporation....................12,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

39

acker Corporation acquires 30% of the outstanding voting common shares of the Insight Corporation for $600,000.Packer Corporation acquires the investment in Insight Corporation by buying previously issued shares of Insight Corporation from other investors. Between the time of the acquisition and the end of Packer Corporation's next accounting period, Insight Corporation reports earnings of $80,000; and pays a dividend of $30,000 to holders of its common stock.

Insight Corporation reports earnings of $100,000 and pays dividends of $40,000 during the subsequent accounting period.

Assume now that Packer Corporation sells one-fourth of its investment in Insight Corporation for $165,000.The entry is as follows:

A)Cash............................................. 165,000 Investment in Stock of Insight Corporation.....................158,250

Gain on Sale of Investment in Stock of Insight Corporation..........6,750

B)Investment in Stock of Insight Corporation...............158,250 Gain on Sale of Investment in Stock of Insight Corporation....6,750

Cash............................................... . ..165,000

C)Cash.................... ..................... 165,000 Investment in Stock of Insight Corporation.....................158,250

Equity in Earnings of Affiliate ............................... 6,750

D)Investment in Stock of Insight Corporation...............158,250 Equity in Earnings of Affiliate ......................... 6,750

Cash..................................................165,000

E)Investment in Stock of Insight Corporation...............158,250 Gain on Sale of Investment in Stock of Insight Corporation.... 6,750

Equity in Earnings of Affiliate .............................. 165,000

Insight Corporation reports earnings of $100,000 and pays dividends of $40,000 during the subsequent accounting period.

Assume now that Packer Corporation sells one-fourth of its investment in Insight Corporation for $165,000.The entry is as follows:

A)Cash............................................. 165,000 Investment in Stock of Insight Corporation.....................158,250

Gain on Sale of Investment in Stock of Insight Corporation..........6,750

B)Investment in Stock of Insight Corporation...............158,250 Gain on Sale of Investment in Stock of Insight Corporation....6,750

Cash............................................... . ..165,000

C)Cash.................... ..................... 165,000 Investment in Stock of Insight Corporation.....................158,250

Equity in Earnings of Affiliate ............................... 6,750

D)Investment in Stock of Insight Corporation...............158,250 Equity in Earnings of Affiliate ......................... 6,750

Cash..................................................165,000

E)Investment in Stock of Insight Corporation...............158,250 Gain on Sale of Investment in Stock of Insight Corporation.... 6,750

Equity in Earnings of Affiliate .............................. 165,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

40

Purchaser Corporation acquires 30% of the outstanding voting common shares of the Investee Corporation for $600,000.Purchaser Corporation acquires the investment in Investee Corporation by buying previously issued shares of Investee Corporation from other investors.When Purchaser Corporation acquired 30% of Investee Corporation's common shares for $600,000, Investee Corporation's total shareholders' equity was $1.5 million.Purchaser Corporation's cost exceeds the carrying value of the net assets acquired by $150,000 [ $600,000 - (0.30 x $1,500,000)]. Purchaser Corporation attributes the $150,000 excess purchase price as follows: $100,000 to remeasure buildings and equipment to fair value and $50,000 to goodwill. Which of the following is/are true?

A)Purchaser Corporation does not reclassify this excess out of its Investment in Stock of Investee Corporation account to Buildings and Equipment and to Goodwill.

B)Purchaser Corporation must amortize (or depreciate) any amount attributed to assets with limited lives.

C)Purchaser Corporation must depreciate the $100,000 attributed to buildings and equipment over their remaining useful lives.

D)U.S.GAAP and IFRS do not permit the investor to amortize the excess purchase price attributed to goodwill and other assets with indefinite lives.Instead, the investor must test the investment account annually for possible impairment.

E)all of the above

A)Purchaser Corporation does not reclassify this excess out of its Investment in Stock of Investee Corporation account to Buildings and Equipment and to Goodwill.

B)Purchaser Corporation must amortize (or depreciate) any amount attributed to assets with limited lives.

C)Purchaser Corporation must depreciate the $100,000 attributed to buildings and equipment over their remaining useful lives.

D)U.S.GAAP and IFRS do not permit the investor to amortize the excess purchase price attributed to goodwill and other assets with indefinite lives.Instead, the investor must test the investment account annually for possible impairment.

E)all of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

41

Consolidated financial statements provide more helpful information than does the equity method, because

A)they include all the assets, liabilities, revenues, and expenses of the controlled subsidiaries, not just the investment account that represents the parent's investment in the subsidiary's common shareholders' equity and not just the parent's share of the subsidiary's net income.

B)the parent, because of its voting interest, can control the use of all of the subsidiary's assets.

C)the parent needs to own only a majority of the voting stock, not necessarily 100%, to control the use of 100% of the subsidiary's assets.

D)consolidation of the individual assets, liabilities, revenues, and expenses of both the parent and the subsidiary provides a more realistic picture of the operations and financial position of the single economic entity.

E)all of the above

A)they include all the assets, liabilities, revenues, and expenses of the controlled subsidiaries, not just the investment account that represents the parent's investment in the subsidiary's common shareholders' equity and not just the parent's share of the subsidiary's net income.

B)the parent, because of its voting interest, can control the use of all of the subsidiary's assets.

C)the parent needs to own only a majority of the voting stock, not necessarily 100%, to control the use of 100% of the subsidiary's assets.

D)consolidation of the individual assets, liabilities, revenues, and expenses of both the parent and the subsidiary provides a more realistic picture of the operations and financial position of the single economic entity.

E)all of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

42

InvestCo purchases 30% of NewCo's stock on January 1, Year 1, for $100,000.In Year 1, NewCo paid total dividends of $30,000 and had a net income of $70,000.In Year 2, NewCo suffered a loss of $20,000 and paid no dividends.On January 1, Year 3, InvestCo sells its investment in NewCo for $105,000.How is the sale recorded?

A)Cash 105,000 Loss on Sale 1,000

Investment in NewCo 106,000

B)Cash 105,000 Loss on Sale 4,000

Investment in NewCo 109,000

C)Cash 105,000 Loss on Sale 10,000

Investment in NewCo 115,000

D)Cash 105,000 Gain on Sale 14,000

Investment in NewCo 91,000

E)Cash 105,000 Treasury Stock 14,000

Investment in NewCo 91,000

A)Cash 105,000 Loss on Sale 1,000

Investment in NewCo 106,000

B)Cash 105,000 Loss on Sale 4,000

Investment in NewCo 109,000

C)Cash 105,000 Loss on Sale 10,000

Investment in NewCo 115,000

D)Cash 105,000 Gain on Sale 14,000

Investment in NewCo 91,000

E)Cash 105,000 Treasury Stock 14,000

Investment in NewCo 91,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

43

If Barton Company purchases a minority active interest in Laramie Company for $150,000, Barton will make which of the following entries to record the purchase using the equity method?

A)Equity in Laramie Company 150,000 Cash 150,000

B)Investment in Laramie Company 150,000 Cash 150,000

C)Deferred Revenue--Laramie Company 150,000 Cash 150,000

D)Common Stock--Laramie Company 150,000 Cash 150,000

E)Paid-in-Capital--Laramie Company 150,000 Cash 150,000

A)Equity in Laramie Company 150,000 Cash 150,000

B)Investment in Laramie Company 150,000 Cash 150,000

C)Deferred Revenue--Laramie Company 150,000 Cash 150,000

D)Common Stock--Laramie Company 150,000 Cash 150,000

E)Paid-in-Capital--Laramie Company 150,000 Cash 150,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

44

Park Inc.owns 35 percent of Exeter Corporation.During the calendar year 2013, Exeter had net earnings of $300,000 and paid dividends of $36,000.Park mistakenly accounted for the investment in Exeter using the cost method rather than the equity method of accounting.What effect would this have on the investment account and net income, respectively?

A)Understate, overstate

B)Overstate, understate

C)Overstate, overstate

D)Understate, understate

E)None of these answer choices is correct.

A)Understate, overstate

B)Overstate, understate

C)Overstate, overstate

D)Understate, understate

E)None of these answer choices is correct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

45

When an investor uses the equity method to account for investments in common stock, cash dividends received by the investor from the investee should be recorded as

A)an increase in the investment account.

B)a deduction from the investment account.

C)dividend revenue.

D)a deduction from the investor's share of the investee's profits.

E)None of these answer choices is correct.

A)an increase in the investment account.

B)a deduction from the investment account.

C)dividend revenue.

D)a deduction from the investor's share of the investee's profits.

E)None of these answer choices is correct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

46

A minority, active investment is generally

A)an investment in another company's stock of less than 15%.

B)an investment in another company's stock of between 15% and 60%.

C)an investment in another company's stock of between 20% and 50%.

D)dependent upon management's intent.

E)dependent upon the expected holding period.

A)an investment in another company's stock of less than 15%.

B)an investment in another company's stock of between 15% and 60%.

C)an investment in another company's stock of between 20% and 50%.

D)dependent upon management's intent.

E)dependent upon the expected holding period.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

47

Minority, passive investments are initially recorded at the

A)acquisition cost.

B)fair market value of the net assets.

C)lower of cost or market.

D)present value of future cash flows.

E)future value of present cash flows.

A)acquisition cost.

B)fair market value of the net assets.

C)lower of cost or market.

D)present value of future cash flows.

E)future value of present cash flows.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

48

The equity method of accounting for an investment in the common stock of another company should be used when the investment

A)is composed of common stock and it is the investor's intent to vote the common stock.

B)ensures a source of supply such as raw materials.

C)enables the investor to exercise significant influence over the investee.

D)gives the investor voting control over the investee.

E)None of these answer choices is correct.

A)is composed of common stock and it is the investor's intent to vote the common stock.

B)ensures a source of supply such as raw materials.

C)enables the investor to exercise significant influence over the investee.

D)gives the investor voting control over the investee.

E)None of these answer choices is correct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is/are true?

A)When one firm, P, owns more than 50% of the voting stock of another company, S, P can control the activities of S in terms of broad policy making.

B)When one firm, P, owns more than 50% of the voting stock of another company, S, P can control the activities of S in terms of day-to-day operations.

C)When one firm, P, owns more than 50% of the voting stock of another company, S, common usage refers to the majority investor as the parent and to the majority-owned company as the subsidiary.

D)U.S.GAAP and IFRS require the parent to combine the financial statements of majority-owned companies with those of the parent in consolidated financial statements.

E)all of the above

A)When one firm, P, owns more than 50% of the voting stock of another company, S, P can control the activities of S in terms of broad policy making.

B)When one firm, P, owns more than 50% of the voting stock of another company, S, P can control the activities of S in terms of day-to-day operations.

C)When one firm, P, owns more than 50% of the voting stock of another company, S, common usage refers to the majority investor as the parent and to the majority-owned company as the subsidiary.

D)U.S.GAAP and IFRS require the parent to combine the financial statements of majority-owned companies with those of the parent in consolidated financial statements.

E)all of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

50

For various reasons, a single economic entity may exist in the form of a parent and several legally separate subsidiaries, often referred to as an affiliated group. Which of the following is/are true?

A)A consolidation of the financial statements of the parent and each of its subsidiaries presents the results of operations, financial position, and cash flows of an affiliated group of companies under the control of a parent as if the group of companies composed a single entity.

B)The parent and each subsidiary are legally separate entities that operate as one centrally controlled economic entity.

C)Consolidated financial statements generally provide more useful information to the shareholders of the parent corporation than do separate financial statements for the parent and each subsidiary.

D)all of the above

E)none of the above

A)A consolidation of the financial statements of the parent and each of its subsidiaries presents the results of operations, financial position, and cash flows of an affiliated group of companies under the control of a parent as if the group of companies composed a single entity.

B)The parent and each subsidiary are legally separate entities that operate as one centrally controlled economic entity.

C)Consolidated financial statements generally provide more useful information to the shareholders of the parent corporation than do separate financial statements for the parent and each subsidiary.

D)all of the above

E)none of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is/are true regarding the acquisition method for a business combination?

A)Measure the identifiable tangible and intangible assets and liabilities of the acquired company at their fair values.

B)The acquirer compares the fair value of the cash, common stock, or other consideration given with the fair value of the identifiable assets less liabilities acquired.

C)The excess of the fair value of the consideration over the fair value of the acquired firm's identifiable assets net of identifiable liabilities is goodwill.

D)If the fair value of the identifiable assets less liabilities exceeds the fair value of the consideration, the excess is a gain from a bargain purchase, which the purchaser immediately includes in net income.

E)all of the above

A)Measure the identifiable tangible and intangible assets and liabilities of the acquired company at their fair values.

B)The acquirer compares the fair value of the cash, common stock, or other consideration given with the fair value of the identifiable assets less liabilities acquired.

C)The excess of the fair value of the consideration over the fair value of the acquired firm's identifiable assets net of identifiable liabilities is goodwill.

D)If the fair value of the identifiable assets less liabilities exceeds the fair value of the consideration, the excess is a gain from a bargain purchase, which the purchaser immediately includes in net income.

E)all of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

52

For which type of investments would unrealized increases and decreases be recorded directly in an owners' equity account?

A)Equity method securities

B)Available-for-sale securities

C)Trading securities

D)Held-to-maturity securities

E)None of these answer choices is correct.

A)Equity method securities

B)Available-for-sale securities

C)Trading securities

D)Held-to-maturity securities

E)None of these answer choices is correct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

53

U.S.GAAP and IFRS require firms to account for business combinations using the _____ method.

A)purchase

B)pooling-of-interests

C)uniting-of-interests

D)equity

E)cost

A)purchase

B)pooling-of-interests

C)uniting-of-interests

D)equity

E)cost

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

54

Dividends and interest from Minority, Passive Investments become income when the

A)dividends and interest are received.

B)dividends and interest are earned.

C)dividends are earned and the interest is declared.

D)dividends are declared and the interest is earned.

E)dividends are declared and the interest is received.

A)dividends and interest are received.

B)dividends and interest are earned.

C)dividends are earned and the interest is declared.

D)dividends are declared and the interest is earned.

E)dividends are declared and the interest is received.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

55

Pareto Corporation owns 40% of Spring Corporation.During Year 3, Spring has net income of $60,000.What entry should Pareto record related to its investment in Spring during Year 3?

A)Investment in Spring Corp. 24,000 Equity in Earnings of Affiliate 24,000

B)Dividend Receivable 24,000 Dividend Income 24,000

C)Investment Receivable 24,000 Investment Income 24,000

D)Investment in Spring Corp. 24,000 Investment Income 24,000

E)Investment in Spring Corp. 24,000 Cash 24,000

A)Investment in Spring Corp. 24,000 Equity in Earnings of Affiliate 24,000

B)Dividend Receivable 24,000 Dividend Income 24,000

C)Investment Receivable 24,000 Investment Income 24,000

D)Investment in Spring Corp. 24,000 Investment Income 24,000

E)Investment in Spring Corp. 24,000 Cash 24,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

56

U.S.GAAP view investments of between 20 and 50 percent of the voting stock of another company (unless evidence indicates that significant influence cannot be exercised) as

A)minority, passive investments.

B)minority, active investments.

C)majority, passive investments.

D)majority, active investments.

E)marketable securities.

A)minority, passive investments.

B)minority, active investments.

C)majority, passive investments.

D)majority, active investments.

E)marketable securities.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

57

Business firms have several reasons for preferring to operate as a group of legally separate corporations, rather than as a single entity.From the standpoint of the parent company, the more important reasons for maintaining legally separate subsidiary companies include which of the following?

A)To reduce the parent's legal or operational risk.

B)To reduce the costs of dealing with jurisdiction-specific differences in corporate laws and tax rules.

C)To expand or diversify.

D)To reduce the costs of divesting assets.

E)all of the above

A)To reduce the parent's legal or operational risk.

B)To reduce the costs of dealing with jurisdiction-specific differences in corporate laws and tax rules.

C)To expand or diversify.

D)To reduce the costs of divesting assets.

E)all of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

58

If Wabasso Company pays $55,000 in dividends to its corporate investor Lament Corporation (Lament owns 35% of The Wabasso Company), what entry should Lament Corporation record when it receives the dividends?

A)Cash 55,000 Dividend Income 55,000

B)Cash 55,000 Investment Income 55,000

C)Cash 55,000 Investment in Wabasso Company 55,000

D)Cash 55,000 Additional Paid-in Capital 55,000

E)Cash 55,000 Common Stock- Wabasso Company 55,000

A)Cash 55,000 Dividend Income 55,000

B)Cash 55,000 Investment Income 55,000

C)Cash 55,000 Investment in Wabasso Company 55,000

D)Cash 55,000 Additional Paid-in Capital 55,000

E)Cash 55,000 Common Stock- Wabasso Company 55,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

59

Pense Co.purchased 40% of the stock of Stretch Co.in Year 1 for $100,000.Stretch had net income in Year 1 of $50,000 and net income in Year 2 of $30,000.Stretch also paid total dividends of $20,000 in Year 2.On January 1, Year 3, Pense Co.sold its investment in Stretch Co.to GE Capital Corporation (GE) for $130,000.What entry would Pense Co.make to record the sale of Stretch Co.?

A)Cash 130,000 Gain on Sale 6,000

Investment in Stretch 124,000

B)Cash 130,000 Loss on Sale 2,000

Investment in Stretch 132,000

C)Cash 130,000 Loss on Sale 10,000

Investment in Stretch 140,000

D)Cash 130,000 Loss on Sale 30,000

Investment in Stretch 160,000

E)Cash 130,000 Loss on Sale 20,000

Investment in Stretch 150,000

A)Cash 130,000 Gain on Sale 6,000

Investment in Stretch 124,000

B)Cash 130,000 Loss on Sale 2,000

Investment in Stretch 132,000

C)Cash 130,000 Loss on Sale 10,000

Investment in Stretch 140,000

D)Cash 130,000 Loss on Sale 30,000

Investment in Stretch 160,000

E)Cash 130,000 Loss on Sale 20,000

Investment in Stretch 150,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

60

In Year 2, ABC Corp.acquired a 15% interest in XYZ, Inc., for $50,000.During the year, XYZ paid dividends of $10,000 and had net income of $30,000.ABC sold the shares of XYZ for $65,000 cash.What entry will ABC make to record the sale?

A)Cash 65,000 Gain on Sale 12,000

Investment in XYZ 53,000

B)Cash 65,000 Gain on Sale 9,000

Investment in XYZ 56,000

C)Cash 65,000 Additional Paid-in Capital 15,000

Investment in XYZ 50,000

D)Cash 65,000 Gain on Sale 15,000

Investment in XYZ 50,000

E)Cash 65,000 Treasury Stock 15,000

Investment in XYZ 50,000

A)Cash 65,000 Gain on Sale 12,000

Investment in XYZ 53,000

B)Cash 65,000 Gain on Sale 9,000

Investment in XYZ 56,000

C)Cash 65,000 Additional Paid-in Capital 15,000

Investment in XYZ 50,000

D)Cash 65,000 Gain on Sale 15,000

Investment in XYZ 50,000

E)Cash 65,000 Treasury Stock 15,000

Investment in XYZ 50,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

61

Accountants sometimes refer to the equity method as a one-line consolidation because

A)the revenues less the expenses of the subsidiary appear in the one account, Equity in Earnings of Subsidiary.

B)the assets and liabilities of the subsidiary appear on one line, Investment in Subsidiary.

C)the application of the equity method therefore rests on the guiding principle to treat the items in such a way that the parent's net income equals the same amount that it would report if it consolidated the investee firm instead of using the equity method.

D)all of the above

E)none of the above

A)the revenues less the expenses of the subsidiary appear in the one account, Equity in Earnings of Subsidiary.

B)the assets and liabilities of the subsidiary appear on one line, Investment in Subsidiary.

C)the application of the equity method therefore rests on the guiding principle to treat the items in such a way that the parent's net income equals the same amount that it would report if it consolidated the investee firm instead of using the equity method.

D)all of the above

E)none of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

62

Accountants sometimes refer to the equity method as a(n)

A)one-line consolidation.

B)pooling-of-interests.

C)unity-of-interests.

D)purchase.

E)tricky combination.

A)one-line consolidation.

B)pooling-of-interests.

C)unity-of-interests.

D)purchase.

E)tricky combination.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

63

When preparing consolidated financial statements, the result of the elimination process generally is the

A)restatement of the cash balance of each company due to intercompany transactions.

B)presentation of only the transactions between the consolidated entity and others outside the entity.

C)replacement of the investment account and the subsidiary's shareholders' equity with only the parent's share of the individual assets and liabilities of the subsidiary.

D)posting the eliminations to both parent and subsidiary's accounts.

E)posting the eliminations to the subsidiary's accounts, only.

A)restatement of the cash balance of each company due to intercompany transactions.

B)presentation of only the transactions between the consolidated entity and others outside the entity.

C)replacement of the investment account and the subsidiary's shareholders' equity with only the parent's share of the individual assets and liabilities of the subsidiary.

D)posting the eliminations to both parent and subsidiary's accounts.

E)posting the eliminations to the subsidiary's accounts, only.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

64

Assume that P uses the equity method of accounting for its investment in S.Solve for the unknown in each of the following independent cases:

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

65

What role does management intent play in the accounting treatment of marketable equity securities?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

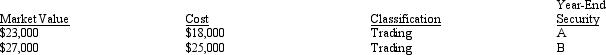

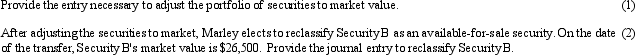

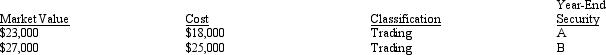

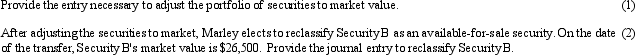

66

Marley Company had the following portfolio of securities at the end of its first year of operations:

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

67

Often, the parent does not own 100% of the voting stock of a consolidated subsidiary.The parent refers to the owners of the remaining shares of voting stock as a

A)noncontrolling interest.

B)nonconsolidated group.

C)consolidated subsidiary.

D)noninfluential interest.

E)nonvoting interest.

A)noncontrolling interest.

B)nonconsolidated group.

C)consolidated subsidiary.

D)noninfluential interest.

E)nonvoting interest.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

68

The consolidated income statement shows

A)all of the parent's and the subsidiary's revenues less all of the parent's and the subsidiary's expenses, plus or minus intercompany sales, expenses, gains, and losses, which equals consolidated income.

B)The consolidated income statement shows the portion of this consolidated income to which the noncontrolling shareholders have a claim, typically an amount equal to the subsidiary's net income multiplied by the noncontrolling shareholders' ownership percentage.

C)The consolidated income statement shows the portion of this consolidated income to which the parent company shareholders have a claim.

D)all of the above

E)none of the above

A)all of the parent's and the subsidiary's revenues less all of the parent's and the subsidiary's expenses, plus or minus intercompany sales, expenses, gains, and losses, which equals consolidated income.

B)The consolidated income statement shows the portion of this consolidated income to which the noncontrolling shareholders have a claim, typically an amount equal to the subsidiary's net income multiplied by the noncontrolling shareholders' ownership percentage.

C)The consolidated income statement shows the portion of this consolidated income to which the parent company shareholders have a claim.

D)all of the above

E)none of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

69

An intercompany transaction is a transaction between

A)two subsidiary corporations only.

B)the subsidiaries and the parent company only.

C)any two members of a consolidated entity.

D)any two members of a consolidated entity, conducted at arm's-length.

E)any three members of a consolidated entity.

A)two subsidiary corporations only.

B)the subsidiaries and the parent company only.

C)any two members of a consolidated entity.

D)any two members of a consolidated entity, conducted at arm's-length.

E)any three members of a consolidated entity.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

70

(CMA adapted, Dec 92 #9) In a business combination that is accounted for as a purchase and does not create negative goodwill, the assets of the acquired company are to be recorded on the books of the acquiring company at

A)original cost.

B)original cost less accumulated depreciation.

C)fair market value.

D)book value.

E)liquidation value.

A)original cost.

B)original cost less accumulated depreciation.

C)fair market value.

D)book value.

E)liquidation value.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

71

The usual criterion for preparing consolidated financial statements is voting control in the form of majority ownership of common stock.However, for some entities common stock ownership does not indicate control because the common stock of the entity lacks one or more of the economic characteristics associated with equity.U.S.GAAP refers to such entities as a _____ entity.

A)variable interest

B)special interest

C)thinly capitalized

D)securitized financial

E)nonsecuritized financial

A)variable interest

B)special interest

C)thinly capitalized

D)securitized financial

E)nonsecuritized financial

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

72

Why would a firm choose to acquire less than 50 percent of an organization yet not desire to exercise significant influence within the organization?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

73

Consolidated financial statements are typically prepared when one company has

A)accounted for its investment in another company by the equity method.

B)significant influence over the operating and financial policies of another company.

C)the controlling financial interest in another company.

D)a substantial equity interest in the net assets of another company.

E)All of these answer choices are correct.

A)accounted for its investment in another company by the equity method.

B)significant influence over the operating and financial policies of another company.

C)the controlling financial interest in another company.

D)a substantial equity interest in the net assets of another company.

E)All of these answer choices are correct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

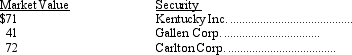

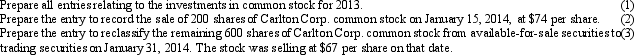

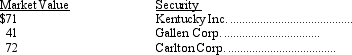

74

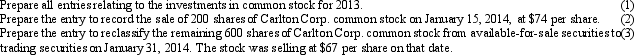

In 2013, Kentucky Inc.purchased stock as follows:

At December 31, 2013, the market values of the securities were as follows:

At December 31, 2013, the market values of the securities were as follows: