Deck 7: Decision Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/70

Play

Full screen (f)

Deck 7: Decision Analysis

1

Expected monetary value gives the long-run average payoff if a large number of identical decisions could be made.

True

2

The EVPI indicates an upper limit on the amount a decision-maker should be willing to spend to obtain perfect information.

True

3

The expected monetary value approach is most appropriate when the decision-maker is risk-neutral.

True

4

Expected monetary value gives the actual payoff one can expect in a given situation involving risk.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

5

Graphical sensitivity analysis is used when the payoffs and probabilities of decision alternatives are uncertain.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

6

In an influence diagram,the circles show chance events.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

7

A structured approach to decision making is important because the intuitive quick approach does not consider all the relevant information and possible alternatives,and can be biased.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

8

Graphical sensitivity analysis is limited to cases with no more than two alternatives.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

9

An advantage of decision trees compared to payoff tables is that they permit us to analyze situations involving sequential or multistage decisions.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

10

A utility is a quantification of a person's value for various payoffs.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

11

The probabilities assigned to each state of nature are taken from the appropriate probability distribution tables.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

12

Typically the choice to "do nothing" based on a preference to stick with the status quo is not considered in the list of possible alternatives for a decision.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

13

In order to use the expected value approach,one needs to determine the probabilities of future payoffs.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

14

Influence diagrams represent complex situations with many random variables,but only one decision variable.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

15

The expected value approach is used for major,non-recurring decisions involving several decision variables.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

16

In a decision tree,square nodes represent chance events,and circular nodes denote decision points.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

17

Decision trees are analyzed from left to right.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

18

In decision theory,states of nature refer to a set of possible values for a random variable.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

19

Decision trees are useful when there is more than one decision variable.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

20

Influence diagrams contain more detailed information than decision trees.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

21

Testing how a problem solution reacts to changes in one or more of the model parameters in a decision problem is called:

A)analysis of trade-offs.

B)sensitivity analysis.

C)priority recognition.

D)analysis of variance.

E)decision analysis.

A)analysis of trade-offs.

B)sensitivity analysis.

C)priority recognition.

D)analysis of variance.

E)decision analysis.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

22

An outcome over which the decision maker has no control is called:

A)Condition

B)Random variable

C)Alternative

D)State of nature

E)Consequence

A)Condition

B)Random variable

C)Alternative

D)State of nature

E)Consequence

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

23

The difference between expected payoff under certainty and expected payoff under risk is the:

A)expected monetary value.

B)expected value of perfect information.

C)expected net present value.

D)expected rate of return.

E)incremental rate of return

A)expected monetary value.

B)expected value of perfect information.

C)expected net present value.

D)expected rate of return.

E)incremental rate of return

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

24

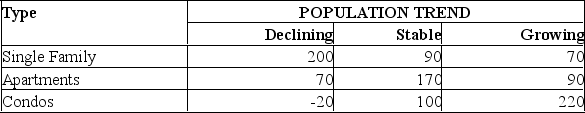

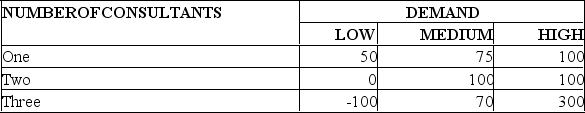

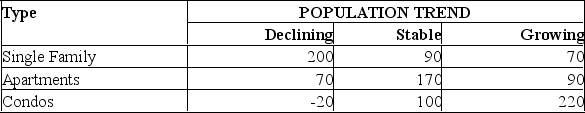

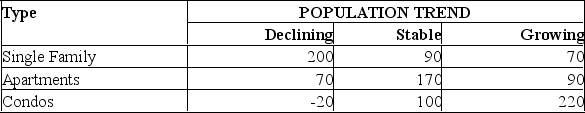

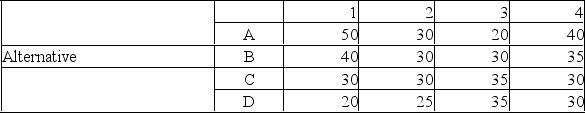

The construction manager for Acme Construction,Inc.must decide whether to build single-family homes,apartments,or condominiums.He estimates annual profits (in $000)will vary with the population trend as follows:  If he feels the chances of declining,stable,and growing population trends are 40%,50%,and 10%,respectively,what is his expected value of perfect information?

If he feels the chances of declining,stable,and growing population trends are 40%,50%,and 10%,respectively,what is his expected value of perfect information?

A)$187,000

B)$132,000

C)$123,000

D)$65,000

E)$55,000

If he feels the chances of declining,stable,and growing population trends are 40%,50%,and 10%,respectively,what is his expected value of perfect information?

If he feels the chances of declining,stable,and growing population trends are 40%,50%,and 10%,respectively,what is his expected value of perfect information?A)$187,000

B)$132,000

C)$123,000

D)$65,000

E)$55,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

25

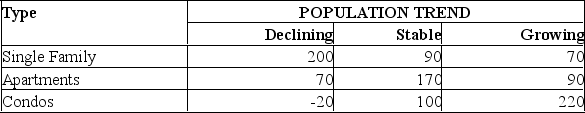

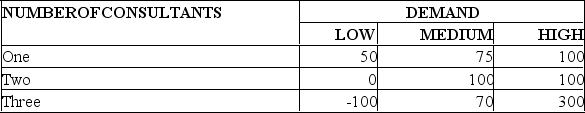

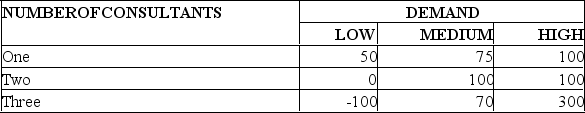

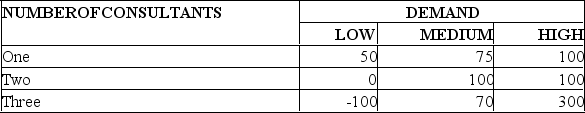

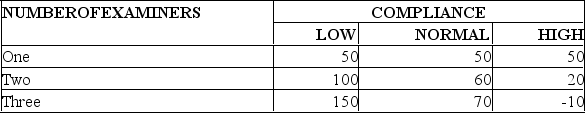

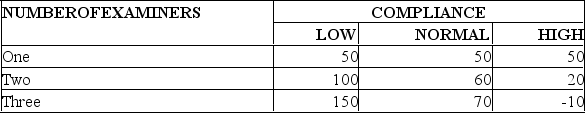

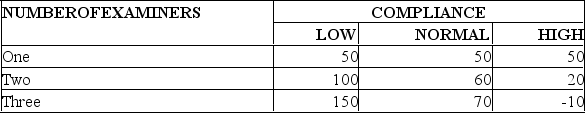

A former politician,who is now the owner of an Ottawa consulting firm,is trying to decide whether to hire one,two,or three consultants.He estimates that profits next year (in thousands of dollars)will vary with demand for his consulting services as follows:  If he feels the chances of low,medium,and high demand are 50%,20%,and 30%,respectively,what are the expected annual profits for the number of consultants he will decide to hire?

If he feels the chances of low,medium,and high demand are 50%,20%,and 30%,respectively,what are the expected annual profits for the number of consultants he will decide to hire?

A)$54,000

B)$55,000

C)$70,000

D)$80,000

E)$135,000

If he feels the chances of low,medium,and high demand are 50%,20%,and 30%,respectively,what are the expected annual profits for the number of consultants he will decide to hire?

If he feels the chances of low,medium,and high demand are 50%,20%,and 30%,respectively,what are the expected annual profits for the number of consultants he will decide to hire?A)$54,000

B)$55,000

C)$70,000

D)$80,000

E)$135,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

26

A sensitivity analysis graph:

A)provides the exact values of the range of probability for the optimal alternative.

B)is useful for a maximum of three alternatives.

C)is useful when the probabilities of payoffs are known.

D)provides a visual indication of the range of probability for the best alternative.

E)determines the average probability of a payoff.

A)provides the exact values of the range of probability for the optimal alternative.

B)is useful for a maximum of three alternatives.

C)is useful when the probabilities of payoffs are known.

D)provides a visual indication of the range of probability for the best alternative.

E)determines the average probability of a payoff.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

27

What is the method used for calculating EMVs in a decision tree and identifying the best alternative?

A)Expected monetary value

B)Expected value of perfect information

C)Folding back

D)Growing forward

E)Payoff

A)Expected monetary value

B)Expected value of perfect information

C)Folding back

D)Growing forward

E)Payoff

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

28

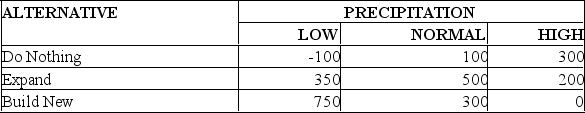

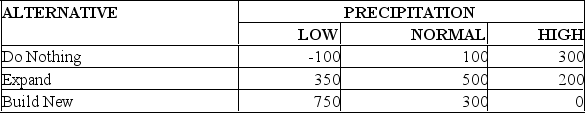

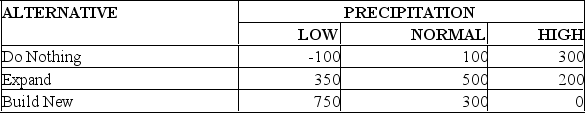

The operations manager for a well-drilling company must recommend whether to build a new facility,expand his existing one,or do nothing.He estimates that long-run profits (in $000)will vary with the amount of precipitation (rainfall)as follows:  If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what are expected long-run profits for the alternative he will select?

If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what are expected long-run profits for the alternative he will select?

A)$140,000

B)$170,000

C)$285,000

D)$305,000

E)$475,000

If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what are expected long-run profits for the alternative he will select?

If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what are expected long-run profits for the alternative he will select?A)$140,000

B)$170,000

C)$285,000

D)$305,000

E)$475,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

29

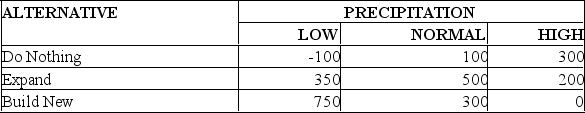

The operations manager for a well-drilling company must recommend whether to build a new facility,expand his existing one,or do nothing.He estimates that long-run profits (in $000)will vary with the amount of precipitation (rainfall)as follows:  If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what is his expected value of perfect information?

If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what is his expected value of perfect information?

A)$140,000

B)$170,000

C)$285,000

D)$305,000

E)$475,000

If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what is his expected value of perfect information?

If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what is his expected value of perfect information?A)$140,000

B)$170,000

C)$285,000

D)$305,000

E)$475,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

30

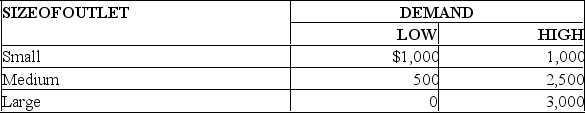

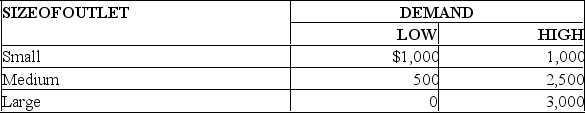

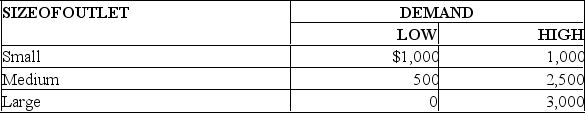

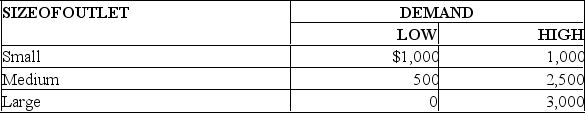

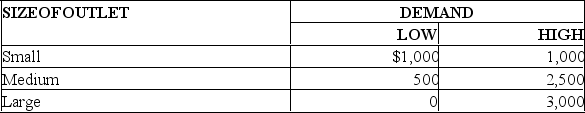

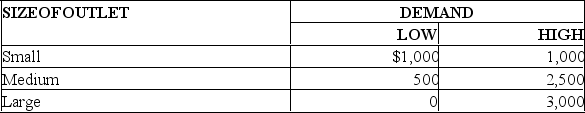

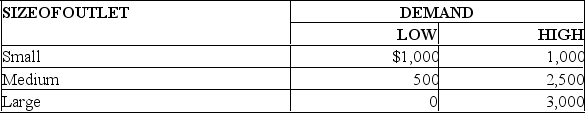

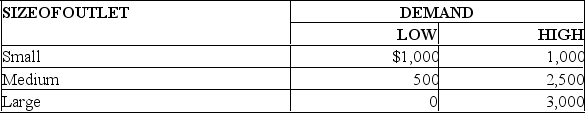

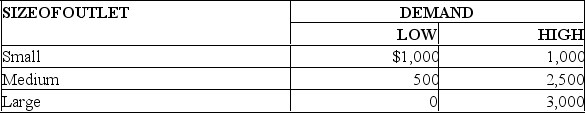

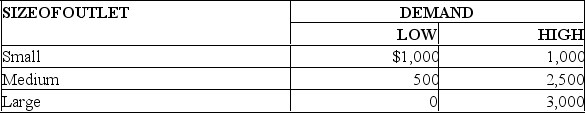

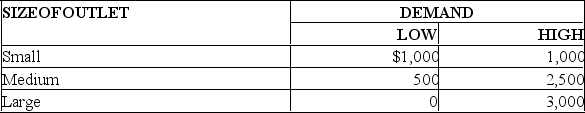

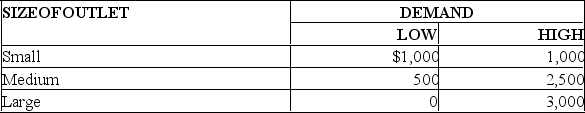

The owner of Tastee Cookies needs to decide whether to lease a small,medium,or large new retail outlet.She estimates that monthly profits will vary with demand for her cookies as follows:  If she feels there is a 30% chance that demand will be high,what are the expected monthly profits for the outlet she will decide to lease?

If she feels there is a 30% chance that demand will be high,what are the expected monthly profits for the outlet she will decide to lease?

A)$1,600

B)$1,100

C)$1,000

D)$900

E)$500

If she feels there is a 30% chance that demand will be high,what are the expected monthly profits for the outlet she will decide to lease?

If she feels there is a 30% chance that demand will be high,what are the expected monthly profits for the outlet she will decide to lease?A)$1,600

B)$1,100

C)$1,000

D)$900

E)$500

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

31

Decision maker's values,preferences and attitudes toward risk can be modelled.What is this called?

A)Risk profile

B)Sensitivity to a probability

C)Sensitivity to an input

D)Utility

E)Certainty equivalent

A)Risk profile

B)Sensitivity to a probability

C)Sensitivity to an input

D)Utility

E)Certainty equivalent

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

32

A decision tree is:

A)an algebraic representation of alternatives.

B)a behavioural representation of alternatives.

C)a matrix representation of alternatives.

D)a graphical representation of alternatives.

E)a horticultural representation of alternatives.

A)an algebraic representation of alternatives.

B)a behavioural representation of alternatives.

C)a matrix representation of alternatives.

D)a graphical representation of alternatives.

E)a horticultural representation of alternatives.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

33

A tabular presentation that shows the outcome for each decision alternative under the various possible states of nature is called:

A)a payoff table.

B)a feasible region.

C)an isoquant table.

D)a decision tree.

E)a payback period matrix.

A)a payoff table.

B)a feasible region.

C)an isoquant table.

D)a decision tree.

E)a payback period matrix.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

34

The sum over the states of nature of the payoff multiplied by probability of each state of nature is called what?

A)Payoff table

B)Expected monetary value

C)Decision tree

D)Expected value of perfect information

E)Bayes' rule

A)Payoff table

B)Expected monetary value

C)Decision tree

D)Expected value of perfect information

E)Bayes' rule

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

35

Determining the probability distribution which results in the best alternative is called:

A)Risk profile

B)Expected value of perfect information

C)Folding back

D)Expected probability value

A)Risk profile

B)Expected value of perfect information

C)Folding back

D)Expected probability value

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

36

A former politician,who is now the owner of an Ottawa consulting firm,is trying to decide whether to hire one,two,or three consultants.He estimates that profits next year (in thousands of dollars)will vary with demand for his consulting services as follows:  If he feels the chances of low,medium,and high demand are 50%,20%,and 30%,respectively,what is his expected value of perfect information?

If he feels the chances of low,medium,and high demand are 50%,20%,and 30%,respectively,what is his expected value of perfect information?

A)$54,000

B)$65,000

C)$70,000

D)$80,000

E)$135,000

If he feels the chances of low,medium,and high demand are 50%,20%,and 30%,respectively,what is his expected value of perfect information?

If he feels the chances of low,medium,and high demand are 50%,20%,and 30%,respectively,what is his expected value of perfect information?A)$54,000

B)$65,000

C)$70,000

D)$80,000

E)$135,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

37

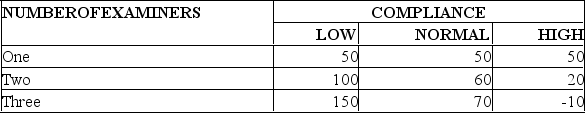

The local operations manager for the Canada Revenue Agency decides whether to hire one,two,or three temporary tax examiners for the upcoming tax season.She estimates that net revenues (in thousands of dollars)will vary with how well taxpayers comply with the new tax code just passed by Parliament,as follows:  If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what is her expected value of perfect information?

If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what is her expected value of perfect information?

A)$16,000

B)$26,000

C)$46,000

D)$48,000

E)$50,000

If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what is her expected value of perfect information?

If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what is her expected value of perfect information?A)$16,000

B)$26,000

C)$46,000

D)$48,000

E)$50,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is not true about influence diagrams?

A)They represent complex situations with many variables.

B)They show the alternatives at the decision nodes.

C)Chance events are shown in circles.

D)They are more concise than decision trees.

E)They are compact graphical representations.

A)They represent complex situations with many variables.

B)They show the alternatives at the decision nodes.

C)Chance events are shown in circles.

D)They are more concise than decision trees.

E)They are compact graphical representations.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

39

The construction manager for Acme Construction,Inc.must decide whether to build single-family homes,apartments,or condominiums.He estimates annual profits (in $000)will vary with the population trend as follows:  If he feels the chances of declining,stable,and growing population trends are 40%,50%,and 10%,respectively,which kind of houses will he decide to build?

If he feels the chances of declining,stable,and growing population trends are 40%,50%,and 10%,respectively,which kind of houses will he decide to build?

A)Single family

B)Apartments

C)Condos

D)Either single family or apartments

E)Either apartments or condos

If he feels the chances of declining,stable,and growing population trends are 40%,50%,and 10%,respectively,which kind of houses will he decide to build?

If he feels the chances of declining,stable,and growing population trends are 40%,50%,and 10%,respectively,which kind of houses will he decide to build?A)Single family

B)Apartments

C)Condos

D)Either single family or apartments

E)Either apartments or condos

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

40

The local operations manager for the Canada Revenue Agency must decide whether to hire one,two,or three temporary tax examiners for the upcoming tax season.She estimates that net revenues (in thousands of dollars)will vary with how well taxpayers comply with the new tax code just passed by Parliament,as follows:  If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what are the expected net revenues for the number of assistants she will decide to hire?

If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what are the expected net revenues for the number of assistants she will decide to hire?

A)$26,000

B)$46,000

C)$48,000

D)$50,000

E)$76,000

If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what are the expected net revenues for the number of assistants she will decide to hire?

If she feels the chances of low,medium,and high compliance are 20%,30%,and 50%,respectively,what are the expected net revenues for the number of assistants she will decide to hire?A)$26,000

B)$46,000

C)$48,000

D)$50,000

E)$76,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

41

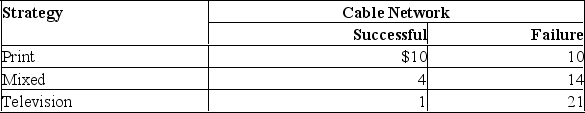

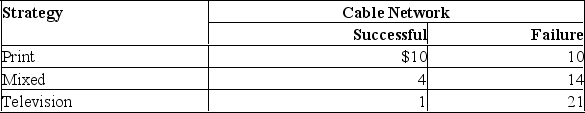

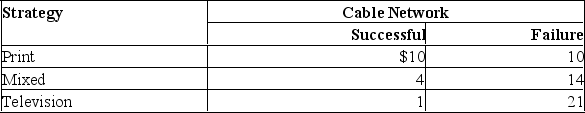

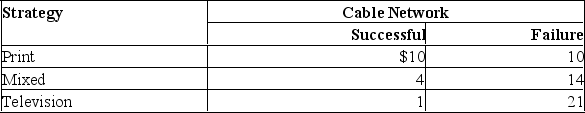

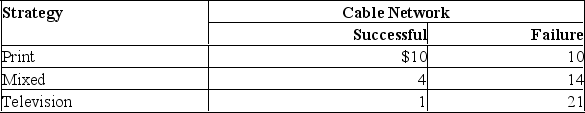

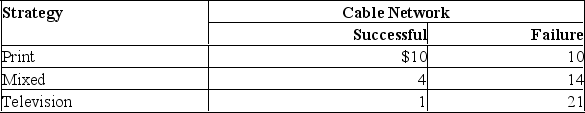

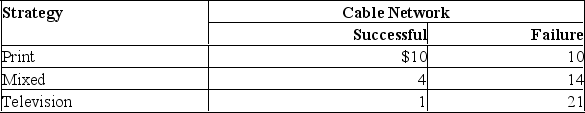

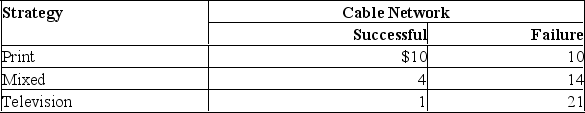

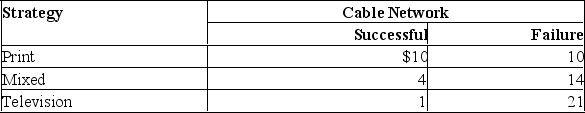

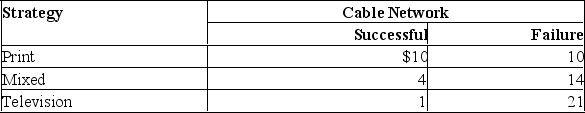

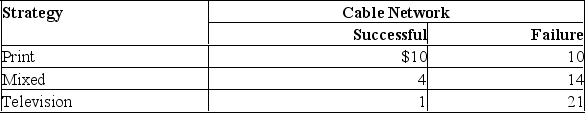

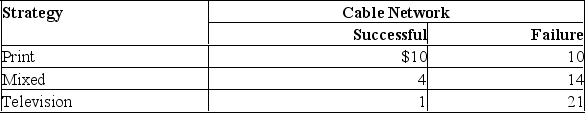

The advertising manager for Roadside Restaurants,Inc.needs to decide whether to spend this month's budget for advertising on print media,television,or a mixture of the two.Her goal is to minimize the costs associated with reaching her audience.She estimates that the cost per thousand "hits" (readers or viewers)will vary depending upon the success of the new cable television network she plans to use,as follows:  For what range of probability that the new cable network will be successful will she select the television media strategy?

For what range of probability that the new cable network will be successful will she select the television media strategy?

A)0 - .4

B)0 - .55

C).4 - .7

D).55 - 1

E).7 - 1

For what range of probability that the new cable network will be successful will she select the television media strategy?

For what range of probability that the new cable network will be successful will she select the television media strategy?A)0 - .4

B)0 - .55

C).4 - .7

D).55 - 1

E).7 - 1

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

42

The head of operations for a movie studio wants to determine which of two new scripts they should select for their next major production.(Due to budgeting constraints,only one new picture can be undertaken at this time.)She feels that script #1 has a 70 percent chance of earning about $10,000,000 over the long run,but a 30 percent chance of losing $2,000,000.If this movie is successful,then a sequel could also be produced,with an 80 percent chance of earning $5,000,000,but a 20 percent chance of losing $1,000,000.On the other hand,she feels that script #2 has a 60 percent chance of earning $12,000,000,but a 40 percent chance of losing $3,000,000.If successful,its sequel would have a 50 percent chance of earning $8,000,000,but a 50 percent chance of losing $4,000,000.Of course,in either case,if the original movie were a "flop",then no sequel would be produced.What is the expected value of selecting script #2?

A)$15,000,000

B)$9,060,000

C)$8,400,000

D)$7,200,000

E)$6,000,000

A)$15,000,000

B)$9,060,000

C)$8,400,000

D)$7,200,000

E)$6,000,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

43

One local hospital has just enough space and funds presently available to start either a cancer or heart research lab.If administration decides on the cancer lab,there is a 20 percent chance of getting $100,000 in outside funding from the American Cancer Society next year,and an 80 percent chance of getting nothing.If the cancer research lab is funded the first year,no additional outside funding will be available the second year.However,if it is not funded the first year,then management estimates the chances are 50 percent it will get $100,000 the following year,and 50 percent that it will get nothing again.If,however,the hospital's management decides to go with the heart lab,then there's a 50 percent chance of getting $50,000 in outside funding from the American Heart Association the first year,and a 50 percent chance of getting nothing.If the heart lab is funded the first year,management estimates a 40 percent chance of getting another $50,000,and a 60 percent chance of getting nothing additional the second year.If it is not funded the first year,then management estimates a 60 percent chance for getting $50,000,and a 40 percent chance of getting nothing in the following year.For both the cancer and heart research labs,no further possible funding is anticipated beyond the first two years.What is the expected value for the decision alternative to select the heart lab?

A)$100,000

B)$60,000

C)$50,000

D)$40,000

E)$20,000

A)$100,000

B)$60,000

C)$50,000

D)$40,000

E)$20,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

44

The owner of Tastee Cookies needs to decide whether to lease a small,medium,or large new retail outlet.She estimates that monthly profits will vary with demand for her cookies as follows:  For what range of probability that demand will be high,will she decide to lease the medium facility?

For what range of probability that demand will be high,will she decide to lease the medium facility?

A)0 - .25

B)0 - .33

C).25 - .5

D).33 - 1

E).5 - 1

For what range of probability that demand will be high,will she decide to lease the medium facility?

For what range of probability that demand will be high,will she decide to lease the medium facility?A)0 - .25

B)0 - .33

C).25 - .5

D).33 - 1

E).5 - 1

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

45

The head of operations for a movie studio wants to determine which of two new scripts they should select for their next major production.(Due to budgeting constraints,only one new picture can be undertaken at this time.)She feels that script #1 has a 70 percent chance of earning about $10,000,000 over the long run,but a 30 percent chance of losing $2,000,000.If this movie is successful,then a sequel could also be produced,with an 80 percent chance of earning $5,000,000,but a 20 percent chance of losing $1,000,000.On the other hand,she feels that script #2 has a 60 percent chance of earning $12,000,000,but a 40 percent chance of losing $3,000,000.If successful,its sequel would have a 50 percent chance of earning $8,000,000,but a 50 percent chance of losing $4,000,000.Of course,in either case,if the original movie were a "flop",then no sequel would be produced.What is the expected value of selecting script #1?

A)$15,000,000

B)$9,060,000

C)$8,400,000

D)$7,200,000

E)$6,000,000

A)$15,000,000

B)$9,060,000

C)$8,400,000

D)$7,200,000

E)$6,000,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

46

One local hospital has just enough space and funds presently available to start either a cancer or heart research lab.If administration decides on the cancer lab,there is a 20 percent chance of getting $100,000 in outside funding from the American Cancer Society next year,and an 80 percent chance of getting nothing.If the cancer research lab is funded the first year,no additional outside funding will be available the second year.However,if it is not funded the first year,then management estimates the chances are 50 percent it will get $100,000 the following year,and 50 percent that it will get nothing again.If,however,the hospital's management decides to go with the heart lab,then there's a 50 percent chance of getting $50,000 in outside funding from the American Heart Association the first year,and a 50 percent chance of getting nothing.If the heart lab is funded the first year,management estimates a 40 percent chance of getting another $50,000,and a 60 percent chance of getting nothing additional the second year.If it is not funded the first year,then management estimates a 60 percent chance for getting $50,000,and a 40 percent chance of getting nothing in the following year.For both the cancer and heart research labs,no further possible funding is anticipated beyond the first two years.What is the probability that the heart lab will be funded in both the first and second years?

A).4

B).3

C).2

D).1

E)0

A).4

B).3

C).2

D).1

E)0

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

47

The head of operations for a movie studio wants to determine which of two new scripts they should select for their next major production.(Due to budgeting constraints,only one new picture can be undertaken at this time.)She feels that script #1 has a 70 percent chance of earning about $10,000,000 over the long run,but a 30 percent chance of losing $2,000,000.If this movie is successful,then a sequel could also be produced,with an 80 percent chance of earning $5,000,000,but a 20 percent chance of losing $1,000,000.On the other hand,she feels that script #2 has a 60 percent chance of earning $12,000,000,but a 40 percent chance of losing $3,000,000.If successful,its sequel would have a 50 percent chance of earning $8,000,000,but a 50 percent chance of losing $4,000,000.Of course,in either case,if the original movie were a "flop",then no sequel would be produced.What would be the total payoff if script #1 was a success,but its sequel was not?

A)$15,000,000

B)$10,000,000

C)$9,000,000

D)$5,000,000

E)$-1,000,000

A)$15,000,000

B)$10,000,000

C)$9,000,000

D)$5,000,000

E)$-1,000,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

48

The advertising manager for Roadside Restaurants,Inc.needs to decide whether to spend this month's budget for advertising on print media,television,or a mixture of the two.Her goal is to minimize the costs associated with reaching her audience.She estimates that the cost per thousand "hits" (readers or viewers)will vary depending upon the success of the new cable television network she plans to use,as follows:  For what range of probability that the new cable network will be successful will she select the print media strategy?

For what range of probability that the new cable network will be successful will she select the print media strategy?

A)0 - .4

B)0 - .55

C).4 - .7

D).55 - 1

E).7 - 1

For what range of probability that the new cable network will be successful will she select the print media strategy?

For what range of probability that the new cable network will be successful will she select the print media strategy?A)0 - .4

B)0 - .55

C).4 - .7

D).55 - 1

E).7 - 1

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

49

One local hospital has just enough space and funds presently available to start either a cancer or heart research lab.If administration decides on the cancer lab,there is a 20 percent chance of getting $100,000 in outside funding from the American Cancer Society next year,and an 80 percent chance of getting nothing.If the cancer research lab is funded the first year,no additional outside funding will be available the second year.However,if it is not funded the first year,then management estimates the chances are 50 percent it will get $100,000 the following year,and 50 percent that it will get nothing again.If,however,the hospital's management decides to go with the heart lab,then there's a 50 percent chance of getting $50,000 in outside funding from the American Heart Association the first year,and a 50 percent chance of getting nothing.If the heart lab is funded the first year,management estimates a 40 percent chance of getting another $50,000,and a 60 percent chance of getting nothing additional the second year.If it is not funded the first year,then management estimates a 60 percent chance for getting $50,000,and a 40 percent chance of getting nothing in the following year.For both the cancer and heart research labs,no further possible funding is anticipated beyond the first two years.What is the expected value for the decision alternative to select the cancer lab?

A)$100,000

B)$60,000

C)$50,000

D)$40,000

E)$20,000

A)$100,000

B)$60,000

C)$50,000

D)$40,000

E)$20,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

50

The advertising manager for Roadside Restaurants,Inc.needs to decide whether to spend this month's budget for advertising on print media,television,or a mixture of the two.Her goal is to minimize the costs associated with reaching her audience.She estimates that the cost per thousand "hits" (readers or viewers)will vary depending upon the success of the new cable television network she plans to use,as follows:  If she feels that there is a 60% chance that the new cable network will be successful,what is her expected cost (per thousand "hits")under certainty?

If she feels that there is a 60% chance that the new cable network will be successful,what is her expected cost (per thousand "hits")under certainty?

A)$3.40

B)$14.40

C)$8.00

D)$9.00

E)$10.00

If she feels that there is a 60% chance that the new cable network will be successful,what is her expected cost (per thousand "hits")under certainty?

If she feels that there is a 60% chance that the new cable network will be successful,what is her expected cost (per thousand "hits")under certainty?A)$3.40

B)$14.40

C)$8.00

D)$9.00

E)$10.00

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

51

The advertising manager for Roadside Restaurants,Inc.needs to decide whether to spend this month's budget for advertising on print media,television,or a mixture of the two.Her goal is to minimize the costs associated with reaching her audience.She estimates that the cost per thousand "hits" (readers or viewers)will vary depending upon the success of the new cable television network she plans to use,as follows:  If she feels that there is a 60% chance that the new cable network will be successful,what is her expected cost (per thousand "hits")for the strategy she will be selecting?

If she feels that there is a 60% chance that the new cable network will be successful,what is her expected cost (per thousand "hits")for the strategy she will be selecting?

A)$3.40

B)$4.60

C)$8.00

D)$9.00

E)$10.00

If she feels that there is a 60% chance that the new cable network will be successful,what is her expected cost (per thousand "hits")for the strategy she will be selecting?

If she feels that there is a 60% chance that the new cable network will be successful,what is her expected cost (per thousand "hits")for the strategy she will be selecting?A)$3.40

B)$4.60

C)$8.00

D)$9.00

E)$10.00

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

52

The owner of Tastee Cookies needs to decide whether to lease a small,medium,or large new retail outlet.She estimates that monthly profits will vary with demand for her cookies as follows:  If she feels there is a 30% chance that demand will be high,what is her expected value of perfect information?

If she feels there is a 30% chance that demand will be high,what is her expected value of perfect information?

A)$1,600

B)$1,100

C)$1,000

D)$900

E)$500

If she feels there is a 30% chance that demand will be high,what is her expected value of perfect information?

If she feels there is a 30% chance that demand will be high,what is her expected value of perfect information?A)$1,600

B)$1,100

C)$1,000

D)$900

E)$500

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

53

The head of operations for a movie studio wants to determine which of two new scripts they should select for their next major production.(Due to budgeting constraints,only one new picture can be undertaken at this time.)She feels that script #1 has a 70 percent chance of earning about $10,000,000 over the long run,but a 30 percent chance of losing $2,000,000.If this movie is successful,then a sequel could also be produced,with an 80 percent chance of earning $5,000,000,but a 20 percent chance of losing $1,000,000.On the other hand,she feels that script #2 has a 60 percent chance of earning $12,000,000,but a 40 percent chance of losing $3,000,000.If successful,its sequel would have a 50 percent chance of earning $8,000,000,but a 50 percent chance of losing $4,000,000.Of course,in either case,if the original movie were a "flop",then no sequel would be produced.What is the probability that script #1 will be a success,but its sequel will not?

A).8

B).7

C).56

D).2

E).14

A).8

B).7

C).56

D).2

E).14

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

54

One local hospital has just enough space and funds presently available to start either a cancer or heart research lab.If administration decides on the cancer lab,there is a 20 percent chance of getting $100,000 in outside funding from the American Cancer Society next year,and an 80 percent chance of getting nothing.If the cancer research lab is funded the first year,no additional outside funding will be available the second year.However,if it is not funded the first year,then management estimates the chances are 50 percent it will get $100,000 the following year,and 50 percent that it will get nothing again.If,however,the hospital's management decides to go with the heart lab,then there's a 50 percent chance of getting $50,000 in outside funding from the American Heart Association the first year,and a 50 percent chance of getting nothing.If the heart lab is funded the first year,management estimates a 40 percent chance of getting another $50,000,and a 60 percent chance of getting nothing additional the second year.If it is not funded the first year,then management estimates a 60 percent chance for getting $50,000,and a 40 percent chance of getting nothing in the following year.For both the cancer and heart research labs,no further possible funding is anticipated beyond the first two years.What would be the total payoff if the heart lab were funded in both the first and second years?

A)$100,000

B)$60,000

C)$50,000

D)$40,000

E)$20,000

A)$100,000

B)$60,000

C)$50,000

D)$40,000

E)$20,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

55

The owner of Tastee Cookies needs to decide whether to lease a small,medium,or large new retail outlet.She estimates that monthly profits will vary with demand for her cookies as follows:  For what range of probability that demand will be high,will she decide to lease the small facility?

For what range of probability that demand will be high,will she decide to lease the small facility?

A)0 - .25

B)0 - .33

C).25 - .5

D).33 - 1

E).5 - 1

For what range of probability that demand will be high,will she decide to lease the small facility?

For what range of probability that demand will be high,will she decide to lease the small facility?A)0 - .25

B)0 - .33

C).25 - .5

D).33 - 1

E).5 - 1

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

56

The owner of Tastee Cookies needs to decide whether to lease a small,medium,or large new retail outlet.She estimates that monthly profits will vary with demand for her cookies as follows:  For what range of probability that demand will be high,will she decide to lease the large facility?

For what range of probability that demand will be high,will she decide to lease the large facility?

A)0 - .25

B)0 - .33

C).25 - .5

D).33 - 1

E).5 - 1

For what range of probability that demand will be high,will she decide to lease the large facility?

For what range of probability that demand will be high,will she decide to lease the large facility?A)0 - .25

B)0 - .33

C).25 - .5

D).33 - 1

E).5 - 1

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

57

The head of operations for a movie studio wants to determine which of two new scripts they should select for their next major production.(Due to budgeting constraints,only one new picture can be undertaken at this time.)She feels that script #1 has a 70 percent chance of earning about $10,000,000 over the long run,but a 30 percent chance of losing $2,000,000.If this movie is successful,then a sequel could also be produced,with an 80 percent chance of earning $5,000,000,but a 20 percent chance of losing $1,000,000.On the other hand,she feels that script #2 has a 60 percent chance of earning $12,000,000,but a 40 percent chance of losing $3,000,000.If successful,its sequel would have a 50 percent chance of earning $8,000,000,but a 50 percent chance of losing $4,000,000.Of course,in either case,if the original movie were a "flop",then no sequel would be produced.What is the expected value for the optimum decision alternative?

A)$15,000,000

B)$9,060,000

C)$8,400,000

D)$7,200,000

E)$6,000,000

A)$15,000,000

B)$9,060,000

C)$8,400,000

D)$7,200,000

E)$6,000,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

58

The advertising manager for Roadside Restaurants,Inc.needs to decide whether to spend this month's budget for advertising on print media,television,or a mixture of the two.Her goal is to minimize the costs associated with reaching her audience.She estimates that the cost per thousand "hits" (readers or viewers)will vary depending upon the success of the new cable television network she plans to use,as follows:  If she feels that there is a 60% chance that the new cable network will be successful,what is her expected value (per thousand "hits")of perfect information?

If she feels that there is a 60% chance that the new cable network will be successful,what is her expected value (per thousand "hits")of perfect information?

A)$4.40

B)$4.60

C)$8.00

D)$9.00

E)$10.00

If she feels that there is a 60% chance that the new cable network will be successful,what is her expected value (per thousand "hits")of perfect information?

If she feels that there is a 60% chance that the new cable network will be successful,what is her expected value (per thousand "hits")of perfect information?A)$4.40

B)$4.60

C)$8.00

D)$9.00

E)$10.00

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

59

The owner of Tastee Cookies needs to decide whether to lease a small,medium,or large new retail outlet.She estimates that monthly profits will vary with demand for her cookies as follows:  If she feels there is a 30% chance that demand will be high,what is her expected payoff with perfect information?

If she feels there is a 30% chance that demand will be high,what is her expected payoff with perfect information?

A)$1,600

B)$1,100

C)$1,000

D)$900

E)$500

If she feels there is a 30% chance that demand will be high,what is her expected payoff with perfect information?

If she feels there is a 30% chance that demand will be high,what is her expected payoff with perfect information?A)$1,600

B)$1,100

C)$1,000

D)$900

E)$500

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

60

The advertising manager for Roadside Restaurants,Inc.needs to decide whether to spend this month's budget for advertising on print media,television,or a mixture of the two.Her goal is to minimize the costs associated with reaching her audience.She estimates that the cost per thousand "hits" (readers or viewers)will vary depending upon the success of the new cable television network she plans to use,as follows:  For what range of probability that the new cable network will be successful will she select the mixed media strategy?

For what range of probability that the new cable network will be successful will she select the mixed media strategy?

A)0 - .4

B)0 - .55

C).4 - .7

D).55 - 1

E).7 - 1

For what range of probability that the new cable network will be successful will she select the mixed media strategy?

For what range of probability that the new cable network will be successful will she select the mixed media strategy?A)0 - .4

B)0 - .55

C).4 - .7

D).55 - 1

E).7 - 1

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

61

Two professors at a nearby university want to co-author a new textbook in either economics or statistics.They feel that if they write an economics book,they have a 50 percent chance of placing it with a major publisher,and it should ultimately sell about 40,000 copies.If they can't get a major publisher to take it,then they feel they have an 80 percent chance of placing it with a smaller publisher,with ultimate sales of 30,000 copies.On the other hand,if they write a statistics book,they feel they have a 40 percent chance of placing it with a major publisher,and it should result in ultimate sales of about 50,000 copies.If they can't get a major publisher to take it,they feel they have a 50 percent chance of placing it with a smaller publisher,with ultimate sales of 35,000 copies.What is the expected value for the optimum decision alternative?

A)50,000 copies

B)40,000 copies

C)32,000 copies

D)30,500 copies

E)10,500 copies

A)50,000 copies

B)40,000 copies

C)32,000 copies

D)30,500 copies

E)10,500 copies

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

62

Two professors at a nearby university want to co-author a new textbook in either economics or statistics.They feel that if they write an economics book,they have a 50 percent chance of placing it with a major publisher,and it should ultimately sell about 40,000 copies.If they can't get a major publisher to take it,then they feel they have an 80 percent chance of placing it with a smaller publisher,with ultimate sales of 30,000 copies.On the other hand,if they write a statistics book,they feel they have a 40 percent chance of placing it with a major publisher,and it should result in ultimate sales of about 50,000 copies.If they can't get a major publisher to take it,they feel they have a 50 percent chance of placing it with a smaller publisher,with ultimate sales of 35,000 copies.What is the probability that the economics book would wind up being placed with a smaller publisher?

A).8

B).5

C).4

D).2

E).1

A).8

B).5

C).4

D).2

E).1

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

63

A manager has developed a payoff table that indicates the profits associated with a set of alternatives under two possible states of nature.Answer the following questions.

(i)Determine the expected value of perfect information if P(S2)= .40.

(ii)Determine the range of P(S2)for which each alternative would be optimal.

11eab92b_c4a2_d7f1_99e6_e3e40ec631f6

(i)Determine the expected value of perfect information if P(S2)= .40.

(ii)Determine the range of P(S2)for which each alternative would be optimal.

11eab92b_c4a2_d7f1_99e6_e3e40ec631f6

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

64

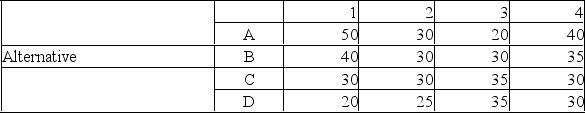

A manager's staff has compiled the information below which pertains to four capacity alternatives.Values in the matrix are present value in thousands of dollars.

If states of nature are equally likely and an expected value criterion of maximization is used,which alternative would be chosen?

If states of nature are equally likely and an expected value criterion of maximization is used,which alternative would be chosen?

A.

If states of nature are equally likely and an expected value criterion of maximization is used,which alternative would be chosen?

If states of nature are equally likely and an expected value criterion of maximization is used,which alternative would be chosen? A.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

65

Two professors at a nearby university want to co-author a new textbook in either economics or statistics.They feel that if they write an economics book,they have a 50 percent chance of placing it with a major publisher,and it should ultimately sell about 40,000 copies.If they can't get a major publisher to take it,then they feel they have an 80 percent chance of placing it with a smaller publisher,with ultimate sales of 30,000 copies.On the other hand,if they write a statistics book,they feel they have a 40 percent chance of placing it with a major publisher,and it should result in ultimate sales of about 50,000 copies.If they can't get a major publisher to take it,they feel they have a 50 percent chance of placing it with a smaller publisher,with ultimate sales of 35,000 copies.What is the expected value for the decision alternative to write the economics book?

A)50,000 copies

B)40,000 copies

C)32,000 copies

D)30,500 copies

E)10,500 copies

A)50,000 copies

B)40,000 copies

C)32,000 copies

D)30,500 copies

E)10,500 copies

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

66

A manager has learned that annual profits from four alternatives being considered for solving a capacity problem are projected to be $15,000 for A,$30,000 for B,$45,000 for C,and $60,000 for D if state of nature 1 occurs; and $60,000 for A,$80,000 for B,$90,000 for C,and $35,000 for D if state of nature 2 occurs. (i)If P(State of Nature 1)is .40,what alternative has the highest expected monetary value?

(ii)Determine the range of P(S2)for which each alternative would be optimal.

11eab92b_c4a2_ff03_99e6_71e1fe4a51ea (i)Max EMV is C ($72)

(ii)Refer to the diagram,above.

11eab92b_c4a2_ff04_99e6_8d97b5e50475 Ranges:

D is optimal from 0 < .214

C is optimal from > .214 to 1.00

(ii)Determine the range of P(S2)for which each alternative would be optimal.

11eab92b_c4a2_ff03_99e6_71e1fe4a51ea (i)Max EMV is C ($72)

(ii)Refer to the diagram,above.

11eab92b_c4a2_ff04_99e6_8d97b5e50475 Ranges:

D is optimal from 0 < .214

C is optimal from > .214 to 1.00

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

67

One local hospital has just enough space and funds presently available to start either a cancer or heart research lab.If administration decides on the cancer lab,there is a 20 percent chance of getting $100,000 in outside funding from the American Cancer Society next year,and an 80 percent chance of getting nothing.If the cancer research lab is funded the first year,no additional outside funding will be available the second year.However,if it is not funded the first year,then management estimates the chances are 50 percent it will get $100,000 the following year,and 50 percent that it will get nothing again.If,however,the hospital's management decides to go with the heart lab,then there's a 50 percent chance of getting $50,000 in outside funding from the American Heart Association the first year,and a 50 percent chance of getting nothing.If the heart lab is funded the first year,management estimates a 40 percent chance of getting another $50,000,and a 60 percent chance of getting nothing additional the second year.If it is not funded the first year,then management estimates a 60 percent chance for getting $50,000,and a 40 percent chance of getting nothing in the following year.For both the cancer and heart research labs,no further possible funding is anticipated beyond the first two years.What is the expected value for the optimum decision alternative?

A)$100,000

B)$60,000

C)$50,000

D)$40,000

E)$20,000

A)$100,000

B)$60,000

C)$50,000

D)$40,000

E)$20,000

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

68

A manager is quite concerned about the recent deterioration of a section of the roof on a building that houses her firm's computer operations.According to her assistant there are three options which merit consideration: A,B,and

C.

(i)Draw a decision tree for this problem.

(ii)Using expected monetary value,which alternative should be chosen?

EMV: A = $12,500,B = $18,400,C = $16,000 so choose B

C.If condition III materializes,the costs will be $10,000 for A,$15,000 for B,and $19,000 for

C.Moreover,there are three possible future conditions that must be included in the analysis: I,which has a probability of occurrence of .5; II,which has a probability of .3; and III,which has a probability of .2.If condition I materializes,A will cost $12,000,B will cost $20,000,and C will cost $16,000.If condition II materializes,the costs will be $15,000 for A,$18,000 for B,and $14,000 for

C.

(i)Draw a decision tree for this problem.

(ii)Using expected monetary value,which alternative should be chosen?

EMV: A = $12,500,B = $18,400,C = $16,000 so choose B

C.If condition III materializes,the costs will be $10,000 for A,$15,000 for B,and $19,000 for

C.Moreover,there are three possible future conditions that must be included in the analysis: I,which has a probability of occurrence of .5; II,which has a probability of .3; and III,which has a probability of .2.If condition I materializes,A will cost $12,000,B will cost $20,000,and C will cost $16,000.If condition II materializes,the costs will be $15,000 for A,$18,000 for B,and $14,000 for

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

69

Two professors at a nearby university want to co-author a new textbook in either economics or statistics.They feel that if they write an economics book,they have a 50 percent chance of placing it with a major publisher,and it should ultimately sell about 40,000 copies.If they can't get a major publisher to take it,then they feel they have an 80 percent chance of placing it with a smaller publisher,with ultimate sales of 30,000 copies.On the other hand,if they write a statistics book,they feel they have a 40 percent chance of placing it with a major publisher,and it should result in ultimate sales of about 50,000 copies.If they can't get a major publisher to take it,they feel they have a 50 percent chance of placing it with a smaller publisher,with ultimate sales of 35,000 copies.What is the probability that the statistics book would wind up being placed with a smaller publisher?

A).6

B).5

C).4

D).3

E)0

A).6

B).5

C).4

D).3

E)0

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

70

Two professors at a nearby university want to co-author a new textbook in either economics or statistics.They feel that if they write an economics book,they have a 50 percent chance of placing it with a major publisher,and it should ultimately sell about 40,000 copies.If they can't get a major publisher to take it,then they feel they have an 80 percent chance of placing it with a smaller publisher,with ultimate sales of 30,000 copies.On the other hand,if they write a statistics book,they feel they have a 40 percent chance of placing it with a major publisher,and it should result in ultimate sales of about 50,000 copies.If they can't get a major publisher to take it,they feel they have a 50 percent chance of placing it with a smaller publisher,with ultimate sales of 35,000 copies.What is the expected value for the decision alternative to write the statistics book?

A)50,000 copies

B)40,000 copies

C)32,000 copies

D)30,500 copies

E)10,500 copies

A)50,000 copies

B)40,000 copies

C)32,000 copies

D)30,500 copies

E)10,500 copies

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck