Deck 3: Mortgage Law Foundation: The Time Value of Money Part Two Financing Residential Properties

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/24

Play

Full screen (f)

Deck 3: Mortgage Law Foundation: The Time Value of Money Part Two Financing Residential Properties

1

If you deposit $1,000 in an account that earns 5% per year,compounded annually,you will have $1,276 at the end of 5 years.What would be the balance in the account at the end of 5 years if interest compounds monthly?

A)$784

B)$1,000

C)$1,276

D)$1,283

A)$784

B)$1,000

C)$1,276

D)$1,283

$1,283

2

The internal rate of return is the good feeling you get inside when you earn a return on your investment

False

3

The future value of $800 deposited today would be greater if that deposit earned 8% rather than 7.75%

True

4

One way to calculate the present value of a single payment is with the following formula: PV = FV * 1+in

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

5

Your friend just won the lottery.He has a choice of receiving $50,000 a year for the next 20 years or a lump sum today.The lottery uses a 15% discount rate.What would be the lump sum your friend would receive?

A)$312,967

B)$316,426

C)$500,000

D)$1,000,000

A)$312,967

B)$316,426

C)$500,000

D)$1,000,000

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

6

Your friend has a trust fund that will pay him $100,000 at the end of 10 years.Your friend,however,wants his money today.He promises to sign his trust fund over to you if you give him some money today.You require a 20% interest rate on money you lend to friends.How much would you be willing to lend under these terms?

A)$16,151.

B)$50,000

C)$80,000

D)$0-it would be impossible to earn 20% interest on the loan.

A)$16,151.

B)$50,000

C)$80,000

D)$0-it would be impossible to earn 20% interest on the loan.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

7

You always see an ordinary annuity used in business and never see an annuity due used in business

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

8

The future value of a single deposit of $1,000 will be greater when this amount is compounded:

A)Annually

B)Semi-annually

C)Quarterly

D)Monthly

A)Annually

B)Semi-annually

C)Quarterly

D)Monthly

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is not a basic component of any compounding problem?

A)An initial deposit

B)An interest rate

C)A period of time

D)A net present value

A)An initial deposit

B)An interest rate

C)A period of time

D)A net present value

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

10

The future value of a $1 annuity compounded at 5% annually is greater than the future value of a $1 annuity compounded at 5% semi-annually

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

11

In order to solve a compounding problem,you must know all four of its basic parts

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

12

A deposit placed in an interest-earning account earning 8% a year will double in value in ___ years.

A)6

B)8

C)9

D)72

E)It will never double in value

A)6

B)8

C)9

D)72

E)It will never double in value

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

13

At the end of 8 years,your friend wants to have $50,000 saved for a down payment on a house.He expects to earn 8%-compounded monthly-on his investments over the next 8 years.How much would your friend have to put in his investment account each month to reach his goal?

A)$188

B)$374

C)$392

D)$521

A)$188

B)$374

C)$392

D)$521

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

14

Assume that an investment,with an single initial cost of $1,000 and a yield of $50 monthly for 10 years,had a 7% IRR in the 60th month and a 7.2% IRR five months later.The IRR can be 6.8% in the 62nd month

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

15

An investment may have more than one internal rate of return

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

16

Begin with a single sum of money at period 0.First,calculate a future value of that sum at 12.01%.Then discount that future value back to period 0 at 11.99%.In relation to the initial single sum,the discounted future value:

A)Is greater than the original amount

B)Is less than the original amount

C)Is the same as the original amount

D)Cannot be determined with the information given

A)Is greater than the original amount

B)Is less than the original amount

C)Is the same as the original amount

D)Cannot be determined with the information given

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

17

Ten years ago,you put $150,000 into an interest-earning account.Today it is worth $275,000.What is the effective annual interest earned on the account?

A)$225,000

B)6.00%

C)6.25%

D)8.33%

E)74.99%

A)$225,000

B)6.00%

C)6.25%

D)8.33%

E)74.99%

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

18

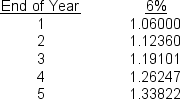

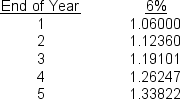

If you saw a table containing the following factors,what kind of interest factor would you be looking at?

A)Present value of a single amount

B)Future value of a single amount

C)Present value of an annuity

D)Future value of an annuity

A)Present value of a single amount

B)Future value of a single amount

C)Present value of an annuity

D)Future value of an annuity

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

19

At 6%,the present value of a $1 payment in 12 months is .941905.At 7%,the present value of a $1 payment in 12 months is .950342

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

20

The future value compound factor given for period n at 15%:

A)Would be less than the factor for period n+1 at 15%

B)Would be greater than the factor given for period n+1 at 15%

C)Would be the same as the factor given for period n+1 at 15%

D)Bears no relationship to the factor for period n+1 at 15%

A)Would be less than the factor for period n+1 at 15%

B)Would be greater than the factor given for period n+1 at 15%

C)Would be the same as the factor given for period n+1 at 15%

D)Bears no relationship to the factor for period n+1 at 15%

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

21

If an investment earns 12% annually:

A)An equivalent monthly investment would have to earn a higher equivalent nominal rate to yield the same return

B)An equivalent monthly investment would have to earn a lower equivalent nominal rate to yield the same return

C)An equivalent monthly investment would have to earn the same equivalent nominal rate to yield the same return

D)A relation cannot be determined between a monthly and annual investment

A)An equivalent monthly investment would have to earn a higher equivalent nominal rate to yield the same return

B)An equivalent monthly investment would have to earn a lower equivalent nominal rate to yield the same return

C)An equivalent monthly investment would have to earn the same equivalent nominal rate to yield the same return

D)A relation cannot be determined between a monthly and annual investment

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

22

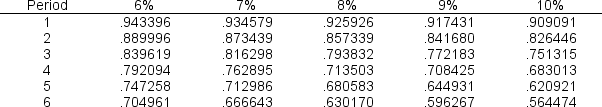

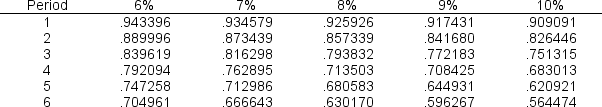

Using only the information in the table above,what would the IRR be for an investment that cost $500 in period 0 and was sold for $750 in period 5?

A)Between 6% and 7%

B)Between 7% and 8%

C)Between 8% and 9%

D)Between 9% and 10%

A)Between 6% and 7%

B)Between 7% and 8%

C)Between 8% and 9%

D)Between 9% and 10%

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

23

Using only the information in the table above,approximately how much would you pay today for an investment that pays $0 annual interest,but earns 8% interest over the next four years and has a face value at maturity of $13,500?

A)$8,000

B)$9,000

C)$10,000

D)$11,000

A)$8,000

B)$9,000

C)$10,000

D)$11,000

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

24

The internal rate of return:

A)Is also known as the investment of investor's yield

B)Represents a return on investment expressed as a compound rate of interest

C)Is calculated by setting the price of an investment equal to the stream of cash flows it generates and solve for the interest rate

D)Can be defined by all of the above

Present Value Factor for Reversion of $1

A)Is also known as the investment of investor's yield

B)Represents a return on investment expressed as a compound rate of interest

C)Is calculated by setting the price of an investment equal to the stream of cash flows it generates and solve for the interest rate

D)Can be defined by all of the above

Present Value Factor for Reversion of $1

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck