Deck 3: Financial Forecasting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/35

Play

Full screen (f)

Deck 3: Financial Forecasting

1

Scenario analysis involves changing one input to a financial forecast,whereas sensitivity analysis involves changing multiple inputs.

False

2

You are preparing pro forma financial statements for 2014 using the percent-of-sales method.Sales were $100,000 in 2013 and are projected to be $120,000 in 2014.Net income was $5,000 in 2013 and is projected to be $6,000 in 2014.Equity was $45,000 at year-end 2012 and $50,000 at year-end 2013.Assuming that this company never issues new equity,never repurchases equity,and never changes its dividend payout ratio,what would be projected for equity at year-end 2014?

A) $55,000

B) $56,000

C) $60,000

D) Insufficient information is provided to project equity in 2014.

All of net income was added to equity in 2013,so all of net income will be added to equity in 2014.$50,000 + $6,000 = $56,000.

A) $55,000

B) $56,000

C) $60,000

D) Insufficient information is provided to project equity in 2014.

All of net income was added to equity in 2013,so all of net income will be added to equity in 2014.$50,000 + $6,000 = $56,000.

$56,000

3

Cash budgets are less informative than pro forma financial statements.

True

4

Steve has estimated the cash inflows and outflows for his sporting goods store for next year.The report that he has prepared summarizing these cash flows is called a:

A) pro forma income statement.

B) sales projection.

C) cash budget.

D) receivables analysis.

E) credit analysis.

A) pro forma income statement.

B) sales projection.

C) cash budget.

D) receivables analysis.

E) credit analysis.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

5

Assume each month has 30 days and AmDocs has a 60-day accounts receivable period.During the second calendar quarter of the year (April,May,and June),AmDocs will collect payment for the sales it made during which of the months listed below?

A) October,November,and December

B) November,December,and January

C) December,January,and February

D) January,February,and March

E) February,March,and April

A) October,November,and December

B) November,December,and January

C) December,January,and February

D) January,February,and March

E) February,March,and April

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

6

On May 1,Vaya Corp.had a beginning cash balance of $175.Vaya's sales for April were $430 and May sales were $480.During May,the firm had cash expenses of $110 and made payments on accounts payable of $290.Vaya's accounts receivable period is 30 days.What is the firm's beginning cash balance on June 1?

A) $145

B) $155

C) $205

D) $215

E) $265

A) $145

B) $155

C) $205

D) $215

E) $265

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

7

Which one of the following statements is correct concerning the cash balance of a firm?

A) Most firms attempt to maintain a zero cash balance at all times.

B) The cumulative cash surplus shown on a cash budget is equal to the ending cash balance plus the minimum desired cash balance.

C) Most firms attempt to maximize the cash balance at all times.

D) A cumulative cash deficit on a cash budget indicates the need to acquire additional funds.

E) The ending cash balance must equal the minimum desired cash balancE.

A) Most firms attempt to maintain a zero cash balance at all times.

B) The cumulative cash surplus shown on a cash budget is equal to the ending cash balance plus the minimum desired cash balance.

C) Most firms attempt to maximize the cash balance at all times.

D) A cumulative cash deficit on a cash budget indicates the need to acquire additional funds.

E) The ending cash balance must equal the minimum desired cash balancE.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following are viable techniques to cope with the uncertainty inherent in realistic financial projections?

I.Simulation

II.Ad hoc adjustments

III.Scenario analysis

IV.Sensitivity analysis

A) II and IV only

B) III and IV only

C) II,III,and IV only

D) I,II,and III only

E) I,III,and IV only

I.Simulation

II.Ad hoc adjustments

III.Scenario analysis

IV.Sensitivity analysis

A) II and IV only

B) III and IV only

C) II,III,and IV only

D) I,II,and III only

E) I,III,and IV only

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

9

The Limited collects 25 percent of sales in the month of sale,60 percent of sales in the month following the month of sale,and 15 percent of sales in the second month following the month of sale.During the month of April,the firm will collect:

A) 60 percent of February sales.

B) 15 percent of April sales.

C) 60 percent of March sales.

D) 15 percent of March sales.

E) 25 percent of February sales.

A) 60 percent of February sales.

B) 15 percent of April sales.

C) 60 percent of March sales.

D) 15 percent of March sales.

E) 25 percent of February sales.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

10

All else equal,increasing the assumed payables period in a financial forecast will decrease external funding required.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

11

Oscar's Incredible Eatery (\$ thousands)

Income Statement for the year ending Dec. 31, 2014

-Please refer to Oscar's financial statements above.What was Oscar's increase in retained earnings during 2014?

A) $450

B) $1,380

C) $1,830

D) $2,280

E) None of the above.

Income Statement for the year ending Dec. 31, 2014

-Please refer to Oscar's financial statements above.What was Oscar's increase in retained earnings during 2014?

A) $450

B) $1,380

C) $1,830

D) $2,280

E) None of the above.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

12

An annual financial forecast for 2013 showing no external funding required assures a company that no cash shortfalls are likely to occur during 2013.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

13

You are developing a financial plan for a corporation.Which of the following questions will be considered as you develop this plan?

I.How much will our sales grow?

II.Will additional fixed assets be required?

III.Will dividends be paid to shareholders?

IV.How much new debt must be obtained?

A) I and IV only

B) II and III only

C) I,III,and IV only

D) II,III,and IV only

E) I,II,III,and IV

I.How much will our sales grow?

II.Will additional fixed assets be required?

III.Will dividends be paid to shareholders?

IV.How much new debt must be obtained?

A) I and IV only

B) II and III only

C) I,III,and IV only

D) II,III,and IV only

E) I,II,III,and IV

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

14

Ruff Wear expects sales of $560,$650,$670,and $610 for the months of May through August,respectively.The firm collects 20 percent of sales in the month of sale,70 percent in the month following the month of sale,and 8 percent in the second month following the month of sale.The remaining 2 percent of sales is never collected.How much money does the firm expect to collect in the month of August?

A) $621

B) $628

C) $633

D) $639

E) $643

A) $621

B) $628

C) $633

D) $639

E) $643

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

15

Given the same assumptions,cash flow forecasts and pro forma projections will yield the same need for external funding.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

16

You are estimating your company's external financing needs for the next year.At the end of the year you expect that owners' equity will be $80 million,total assets will amount to $170 million,and total liabilities will be $70 million.How much will your firm need to borrow,or otherwise acquire,from outside sources during the year?

A) $20 million

B) $70 million

C) $150 million

D) $160 million

E) $180 million

A) $20 million

B) $70 million

C) $150 million

D) $160 million

E) $180 million

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

17

To estimate Missed Places Inc.'s (MP)external financing needs,the CFO needs to figure out how much equity her firm will have at the end of next year.At the end of the most recent fiscal year,MP's retained earnings were $158,000.The Controller has estimated that over the next year,gross profits will be $360,700,earnings after tax will total $23,400,and MP will pay $12,400 in dividends.What are the estimated retained earnings at the end of next year?

A) $169,000

B) $170,400

C) $181,400

D) $506,300

E) $518,700

A) $169,000

B) $170,400

C) $181,400

D) $506,300

E) $518,700

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

18

Oscar's Incredible Eatery (\$ thousands)

Income Statement for the year ending Dec. 31, 2014

-Please refer to Oscar's financial statements above.Sales are projected to increase by 3 percent next year.The profit margin and the dividend payout ratio are projected to remain constant.What is the projected addition to retained earnings for next year?

A) $1,309.19

B) $1,421.40

C) $1,884.90

D) $2,667.78

E) $3,001.40

Income Statement for the year ending Dec. 31, 2014

-Please refer to Oscar's financial statements above.Sales are projected to increase by 3 percent next year.The profit margin and the dividend payout ratio are projected to remain constant.What is the projected addition to retained earnings for next year?

A) $1,309.19

B) $1,421.40

C) $1,884.90

D) $2,667.78

E) $3,001.40

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

19

A drawback of forecasting using spreadsheets is that typical spreadsheet programs are not equipped to deal with the circularity involving interest expense and debt.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

20

The most common approach to developing pro forma financial statements is called the:

A) cash budget method.

B) financial planning method.

C) seasonality approach.

D) percent-of-sales method.

E) market-oriented approach.

A) cash budget method.

B) financial planning method.

C) seasonality approach.

D) percent-of-sales method.

E) market-oriented approach.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

21

Oscar's Incredible Eatery (\$ thousands)

Income Statement for the year ending Dec. 31, 2014

-Please refer to Oscar's financial statements above.Assume a constant profit margin and dividend payout ratio,and further assume all of Oscar's assets and current liabilities vary directly with sales.Assume long-term debt and common stock remain unchanged.Sales are projected to increase by 10 percent.What is Oscar's external financing need for next year?

A) -$410

B) -$260

C) $235

D) $1,320

E) $7,240

Income Statement for the year ending Dec. 31, 2014

-Please refer to Oscar's financial statements above.Assume a constant profit margin and dividend payout ratio,and further assume all of Oscar's assets and current liabilities vary directly with sales.Assume long-term debt and common stock remain unchanged.Sales are projected to increase by 10 percent.What is Oscar's external financing need for next year?

A) -$410

B) -$260

C) $235

D) $1,320

E) $7,240

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

22

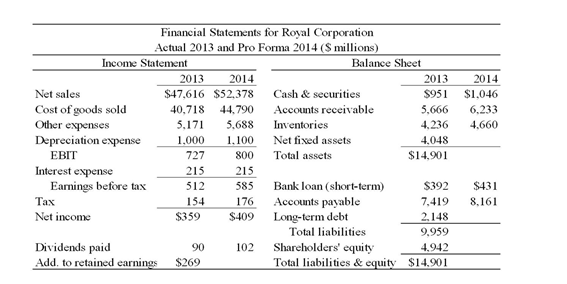

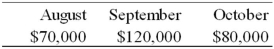

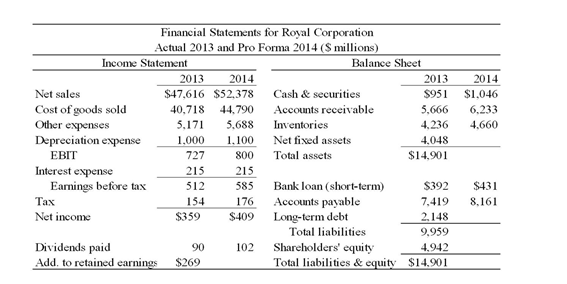

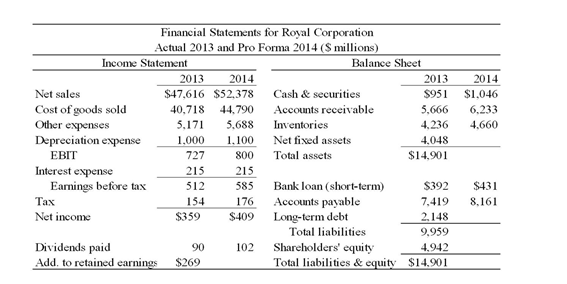

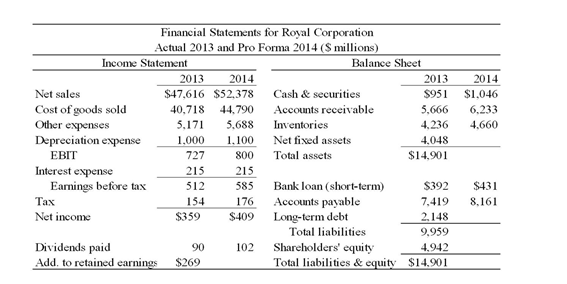

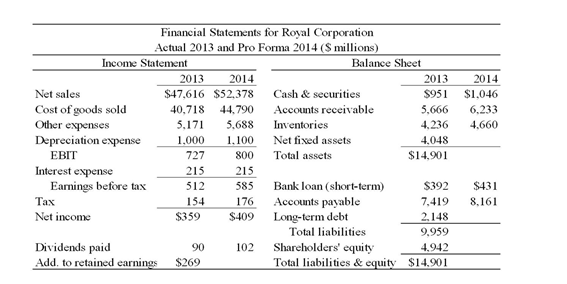

Please refer to the pro forma financial statements for Royal Corporation above.If Royal Corporation plans to issue $100 in new equity in 2014,what should be the projection for shareholders' equity for 2014?

A) $5,349

B) $5,436

C) $5,451

D) $5,536

4,942 + 307 + 100 = $5,349

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

23

Edna's Laundry Services just completed pro forma statements using the percentage of sales approach.The pro forma shows a projected external financing need of -$5,500.Interpret this figure.What are the firm's options in this case?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

24

Oscar's Incredible Eatery (\$ thousands)

Income Statement for the year ending Dec. 31, 2014

-Please refer to Oscar's financial statements above.All of Oscar's costs and current asset accounts vary directly with sales.Sales are projected to increase by 10 percent.What is the pro forma accounts receivable balance for next year?

A) $949

B) $1,034

C) $1,113

D) $1,730

E) $2,670

Income Statement for the year ending Dec. 31, 2014

-Please refer to Oscar's financial statements above.All of Oscar's costs and current asset accounts vary directly with sales.Sales are projected to increase by 10 percent.What is the pro forma accounts receivable balance for next year?

A) $949

B) $1,034

C) $1,113

D) $1,730

E) $2,670

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

25

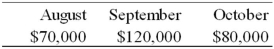

Preston Fencing Company's sales,half of which are for cash and the other half sold on credit,over the past three months were:

a.Estimate Preston's cash receipts in October if the company's collection period is 30 days.b.Estimate Preston's cash receipts in October if the company's collection period is 45 days.c.What would be Preston's accounts receivable balance at the end of October if the company's collection period is 30 days? 45 days?

a.Estimate Preston's cash receipts in October if the company's collection period is 30 days.b.Estimate Preston's cash receipts in October if the company's collection period is 45 days.c.What would be Preston's accounts receivable balance at the end of October if the company's collection period is 30 days? 45 days?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

26

Please refer to the spreadsheet above.Selected assumptions are given for preparing pro forma financial statements for 2015.When the pro formas are completed,which of the following formulas would correctly give the forecast for cost of goods sold in cell C9?

A) =B9*B3

B) =B9 + B9*B3

C) =B8*B3

D) =B9*B2

E) None of the abovE.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

27

Please refer to the pro forma financial statements for Royal Corporation above.Assume that net fixed assets are projected to be 5,000 for 2014 and that shareholders' equity is projected to be 5,500 for 2014.If long-term debt is the plug figure,what should be the projection for long-term debt for Royal Corporation in 2014?

A) $2,206

B) $2,363

C) $2,455

D) $2,847

Total assets would be 1,046 + 6,233 + 4,660 + 5,000 = $16,939

Total liabilities and equity,without long-term debt,would be 431 + 8,161 + 5,500 = $14,092

Long-term debt must make up the difference = 16,939 - 14,092 = $2,847

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

28

Complete the following pro forma financial statements for XYZ Corporation.Use the percent-of-sales method and use long-term debt as the plug figure (balancing item).Assume the following: 20% sales growth,capital expenditures of 200 in 2015,no equity issues or repurchases in 2015,no sale or disposal of fixed assets in 2015,and a 50% dividend payout ratio.Round figures to the nearest whole dollar.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements is correct if a firm's pro forma financial statements project net income of $12,000 and external financing required of $5,000?

A) Total assets cannot grow by more than $10,000.

B) Dividends cannot exceed $10,000.

C) Retained earnings cannot grow by more than $12,000.

D) Long-term debt cannot grow by more than $5,000.

A) Total assets cannot grow by more than $10,000.

B) Dividends cannot exceed $10,000.

C) Retained earnings cannot grow by more than $12,000.

D) Long-term debt cannot grow by more than $5,000.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

30

In the above financial statements,Royal Corporation has prepared (incomplete)pro forma financial statements for 2014,based on actual financial statements for 2013.Royal Corp.used the percent-of-sales method assuming a sales growth rate of 10% for 2014.If capital expenditures are planned to be $1,615 in 2014,then what would be the appropriate projection for net fixed assets in 2014?

A) $4,453

B) $4,563

C) $4,663

D) $5,663

4,048 + 1,615 - 1,100 = $4,563

A) $4,453

B) $4,563

C) $4,663

D) $5,663

4,048 + 1,615 - 1,100 = $4,563

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

31

Please refer to the spreadsheet above.Selected assumptions are given for preparing pro forma financial statements for 2015.Assume that no new equity will be issued in 2015.When the pro formas are completed,which of the following formulas would correctly give the forecast for shareholders' equity in cell G19?

A) =F19*B2

B) =F19*(1 + B2)

C) =F19 + (1 - B4)*C16

D) =F19 + B4*C16

E) None of the abovE.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose your colleague constructed a pro forma balance sheet and a cash budget for your company for the same time period,and the external financing required from the pro forma forecast exceeded the cash deficit estimated on the cash budget.How would you interpret this result?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

33

Pro forma financial statements,by definition,are predictions of a company's financial statements at a future point in time.So,why is it important to analyze the historical performance of the company before constructing pro forma financial statements?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

34

Oscar's Incredible Eatery (\$ thousands)

Income Statement for the year ending Dec. 31, 2014

-Please refer to Oscar's financial statements above.Assume a constant debt-equity ratio,net profit margin and dividend payout ratio,and further assume all of Oscar's expenses,assets and current liabilities vary directly with sales.What is the pro forma net fixed asset value for next year if sales are projected to increase by 7.5 percent?

A) $10,857.50

B) $10,931.38

C) $11,663.75

D) $15,587.50

E) $18,987.50

Income Statement for the year ending Dec. 31, 2014

-Please refer to Oscar's financial statements above.Assume a constant debt-equity ratio,net profit margin and dividend payout ratio,and further assume all of Oscar's expenses,assets and current liabilities vary directly with sales.What is the pro forma net fixed asset value for next year if sales are projected to increase by 7.5 percent?

A) $10,857.50

B) $10,931.38

C) $11,663.75

D) $15,587.50

E) $18,987.50

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

35

Please refer to the spreadsheet above.Selected assumptions are given for preparing pro forma financial statements for 2015.Which of the following formulas would correctly give the forecast for sales in cell C8?

A) =B8*B2

B) =B8 + B8*B2

C) =(1 + B8)*B2

D) =(1/B2)*B8

E) None of the abovE.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck