Deck 13: Property, Plant, and Equipment: Depreciation and Depletion

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/39

Play

Full screen (f)

Deck 13: Property, Plant, and Equipment: Depreciation and Depletion

1

Material purchases of assets from an affiliated company should be disclosed in the financial statements.

True

2

In the audit of depletion the auditors must often rely on the work of specialists.

True

3

When there are numerous property and equipment transactions during the year, an auditor who plans to assess control risk at a low level usually performs:

A) Tests of controls and extensive tests of property and equipment balances at the end of the year.

B) Analytical procedures for current year property and equipment transactions.

C) Tests of controls and limited tests of current year property and equipment transactions.

D) Analytical procedures for property and equipment balances at the end of the year.

A) Tests of controls and extensive tests of property and equipment balances at the end of the year.

B) Analytical procedures for current year property and equipment transactions.

C) Tests of controls and limited tests of current year property and equipment transactions.

D) Analytical procedures for property and equipment balances at the end of the year.

C

4

Idle equipment will generally need to be reclassified as a current asset.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

5

The primary purpose of internal control over plant and equipment is to safeguard the assets from theft.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

6

In testing for unrecorded retirements of equipment, an auditor might:

A) Select items of equipment from the accounting records and then attempt to locate them during the plant tour.

B) Compare depreciation expense with the prior year's depreciation expense.

C) Trace equipment items observed during the plant tour to the equipment subsidiary ledger.

D) Scan the general journal for unusual equipment retirements.

A) Select items of equipment from the accounting records and then attempt to locate them during the plant tour.

B) Compare depreciation expense with the prior year's depreciation expense.

C) Trace equipment items observed during the plant tour to the equipment subsidiary ledger.

D) Scan the general journal for unusual equipment retirements.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following best describes the auditors' typical observation of plant and equipment?

A) The auditors observe a physical inventory of plant and equipment, annually.

B) The auditors observe all additions to plant and equipment made during the year.

C) The auditors observe all major plant and equipment items in the clients' accounts each year.

D) The auditors observe major additions to plant and equipment made during the year.

A) The auditors observe a physical inventory of plant and equipment, annually.

B) The auditors observe all additions to plant and equipment made during the year.

C) The auditors observe all major plant and equipment items in the clients' accounts each year.

D) The auditors observe major additions to plant and equipment made during the year.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

8

Even when internal control is weak, a significant portion of the audit work on property, plant, and equipment may be performed at an interim date.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is not one of the auditors' objectives in auditing depreciation?

A) Establishing the reasonableness of the client's replacement policy.

B) Establishing that the methods used are appropriate.

C) Establishing that the methods are consistently applied.

D) Establishing the reasonableness of depreciation computations.

A) Establishing the reasonableness of the client's replacement policy.

B) Establishing that the methods used are appropriate.

C) Establishing that the methods are consistently applied.

D) Establishing the reasonableness of depreciation computations.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

10

A major control procedure related to plant and equipment is a budget for depreciation.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is the best evidence of continuous ownership of property?

A) Examination of the deed.

B) Examination of rent receipts from lessees of the property.

C) Examination of the title policy.

D) Examination of canceled check in payment for the property.

A) Examination of the deed.

B) Examination of rent receipts from lessees of the property.

C) Examination of the title policy.

D) Examination of canceled check in payment for the property.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

12

An auditor has identified numerous debits to accumulated depreciation of equipment. Which of the following is most likely?

A) The estimated remaining useful lives of equipment were increased.

B) Plant assets were retired during the year.

C) The prior year's depreciation expense was erroneously understated.

D) Overhead allocations were revised at year-end.

A) The estimated remaining useful lives of equipment were increased.

B) Plant assets were retired during the year.

C) The prior year's depreciation expense was erroneously understated.

D) Overhead allocations were revised at year-end.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following would be least likely to address control over the initiation and execution of equipment transactions?

A) Requests for major repairs are approved by a higher level than the department initiating the request.

B) Prenumbered purchase orders are used for equipment and periodically accounted for.

C) Requests for purchases of equipment are reviewed for consideration of soliciting competitive bids.

D) Procedures exist to restrict access to equipment.

A) Requests for major repairs are approved by a higher level than the department initiating the request.

B) Prenumbered purchase orders are used for equipment and periodically accounted for.

C) Requests for purchases of equipment are reviewed for consideration of soliciting competitive bids.

D) Procedures exist to restrict access to equipment.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

14

The auditors typically observe all major items of property, plant, and equipment every year.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following best describes the auditors' approach to the audit of the ending balance of property, plant, and equipment for a continuing nonpublic client?

A) Direct audit of the ending balance.

B) Agreement of the beginning balance to prior year's working papers and audit of significant changes in the accounts.

C) Audit of changes in the accounts since inception of the company.

D) Audit of selected purchases and retirements for the last few years.

A) Direct audit of the ending balance.

B) Agreement of the beginning balance to prior year's working papers and audit of significant changes in the accounts.

C) Audit of changes in the accounts since inception of the company.

D) Audit of selected purchases and retirements for the last few years.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not a control that should be established for purchases of equipment?

A) Establishing a budget for capital acquisitions.

B) Requiring that the department in need of the equipment order the equipment.

C) Requiring that the receiving department receive the equipment.

D) Establishing an accounting policy regarding the minimum dollar amount of purchase that will be considered for capitalization.

A) Establishing a budget for capital acquisitions.

B) Requiring that the department in need of the equipment order the equipment.

C) Requiring that the receiving department receive the equipment.

D) Establishing an accounting policy regarding the minimum dollar amount of purchase that will be considered for capitalization.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

17

A plant manager would be most likely to provide information on which of the following?

A) Adequacy of the provision for uncollectible accounts.

B) Appropriateness of physical inventory valuation techniques.

C) Existence of obsolete production equipment.

D) Deferral of certain purchases of office supplies.

A) Adequacy of the provision for uncollectible accounts.

B) Appropriateness of physical inventory valuation techniques.

C) Existence of obsolete production equipment.

D) Deferral of certain purchases of office supplies.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

18

A typical procedure in the audit of property is examination of public records to verify the ownership of the property.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

19

Evidence of continued ownership of property is obtained by vouching payments to a mortgage trustee.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

20

The auditors' approach to the audit of property, plant, and equipment largely results from the fact that relatively few transactions occur.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

21

The auditors may expect a proper debit to goodwill due to:

A) Purchase of a trademark.

B) Establishment of an extraordinarily profitable product.

C) A business combination.

D) Capitalization of human resources.

A) Purchase of a trademark.

B) Establishment of an extraordinarily profitable product.

C) A business combination.

D) Capitalization of human resources.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

22

When performing an audit of the property, plant, and equipment accounts, an auditor should expect which of the following to be most likely to indicate a departure from generally accepted accounting principles?

A) Repairs have been capitalized to repair equipment that had broken down.

B) Interest has been capitalized for self-constructed assets.

C) Assets have been acquired from affiliated corporations with the related transactions recorded and described in the financial statements.

D) The cost of freight-in on an acquisition has been capitalized.

A) Repairs have been capitalized to repair equipment that had broken down.

B) Interest has been capitalized for self-constructed assets.

C) Assets have been acquired from affiliated corporations with the related transactions recorded and described in the financial statements.

D) The cost of freight-in on an acquisition has been capitalized.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

23

In the examination of property, plant, and equipment, the auditor tries to determine all of the following except the:

A) Extent of the control risk.

B) Extent of property abandoned during the year.

C) Adequacy of replacement funds.

D) Reasonableness of the depreciation.

A) Extent of the control risk.

B) Extent of property abandoned during the year.

C) Adequacy of replacement funds.

D) Reasonableness of the depreciation.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following best describes the independent auditors' approach to obtaining satisfaction concerning depreciation expense in the income statement?

A) Verify the mathematical accuracy of the amounts charged to income as a result of depreciation expense.

B) Determine the method for computing depreciation expense and ascertain that is in accordance with generally accepted accounting principles.

C) Reconcile the amount of depreciation expense to those amounts credited to accumulated depreciation accounts.

D) Establish the basis for depreciable assets and verify the depreciation expense.

A) Verify the mathematical accuracy of the amounts charged to income as a result of depreciation expense.

B) Determine the method for computing depreciation expense and ascertain that is in accordance with generally accepted accounting principles.

C) Reconcile the amount of depreciation expense to those amounts credited to accumulated depreciation accounts.

D) Establish the basis for depreciable assets and verify the depreciation expense.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

25

A continuing audit client's property, plant, and equipment and accounts receivable accounts have approximately the same year-end balance. In this circumstance, when compared to property, plant and equipment, one would normally expect the audit of accounts receivable to require:

A) More audit time.

B) Less audit time.

C) Approximately the same amount of audit time.

D) Similar confirmation procedures.

A) More audit time.

B) Less audit time.

C) Approximately the same amount of audit time.

D) Similar confirmation procedures.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

26

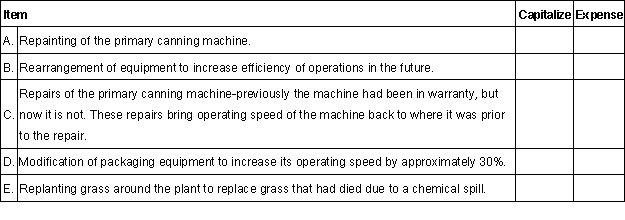

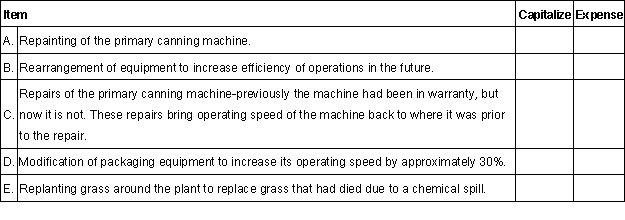

During the audit of Zing Company, Bill Jones, a staff member on the audit, identified a number of items that have been included as additions to property, plant, and equipment. Jones has indicated to you that he believes the following items should not be capitalized. Indicate with an "X" whether you believe the item should be capitalized or expensed.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is the most important control procedure over acquisitions of property, plant, and equipment?

A) Establishing a written company policy distinguishing between capital and revenue expenditures.

B) Using a budget to forecast and control acquisitions and retirements.

C) Analyzing monthly variances between authorized expenditures and actual costs.

D) Requiring acquisitions to be made by user departments.

A) Establishing a written company policy distinguishing between capital and revenue expenditures.

B) Using a budget to forecast and control acquisitions and retirements.

C) Analyzing monthly variances between authorized expenditures and actual costs.

D) Requiring acquisitions to be made by user departments.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is a customary audit procedure for the verification of the legal ownership of real property?

A) Examination of correspondence with the corporate counsel concerning acquisition matters.

B) Examination of ownership documents registered and on file at a public hall of records.

C) Examination of corporate minutes and resolutions concerning the approval to acquire property, plant, and equipment.

D) Examination of deeds and title guaranty policies on hand.

A) Examination of correspondence with the corporate counsel concerning acquisition matters.

B) Examination of ownership documents registered and on file at a public hall of records.

C) Examination of corporate minutes and resolutions concerning the approval to acquire property, plant, and equipment.

D) Examination of deeds and title guaranty policies on hand.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

29

For which of the following accounts is it most likely that most of the audit work can be performed in advance of the balance sheet date?

A) Accounts receivable.

B) Cash.

C) Current marketable securities.

D) Property, plant, and equipment.

A) Accounts receivable.

B) Cash.

C) Current marketable securities.

D) Property, plant, and equipment.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

30

For which of the following ledger accounts would the auditor be most likely to analyze the details to identify understatements of equipment acquisitions?

A) Service Revenue.

B) Sales.

C) Repairs and maintenance expense.

D) Sales salaries expense.

A) Service Revenue.

B) Sales.

C) Repairs and maintenance expense.

D) Sales salaries expense.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

31

Property acquisitions that are misclassified as maintenance expense would most likely be detected by an internal control system that provides for:

A) Investigation of variances within a formal budgeting system.

B) Review and approval of the monthly depreciation entry by the plant supervisor.

C) Segregation of duties of employees in the accounts payable department.

D) Examination by the internal auditors of vendor invoices and canceled checks for property acquisitions.

A) Investigation of variances within a formal budgeting system.

B) Review and approval of the monthly depreciation entry by the plant supervisor.

C) Segregation of duties of employees in the accounts payable department.

D) Examination by the internal auditors of vendor invoices and canceled checks for property acquisitions.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is used to obtain evidence that the client's equipment accounts are not understated?

A) Analyzing repairs and maintenance expense accounts.

B) Vouching purchases of plant and equipment.

C) Recomputing depreciation expense.

D) Analyzing the miscellaneous revenue account.

A) Analyzing repairs and maintenance expense accounts.

B) Vouching purchases of plant and equipment.

C) Recomputing depreciation expense.

D) Analyzing the miscellaneous revenue account.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

33

Auditors should obtain evidence that there are no significant amounts of unrecorded retirements of property, plant, and equipment.

a. Describe two ways that the auditors obtain evidence that there are no significant amounts of unrecorded retirements of property (land).

b. Describe three ways that the auditors obtain evidence that there are no significant amounts of unrecorded retirements of equipment.

a. Describe two ways that the auditors obtain evidence that there are no significant amounts of unrecorded retirements of property (land).

b. Describe three ways that the auditors obtain evidence that there are no significant amounts of unrecorded retirements of equipment.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

34

The most likely technique for the current year audit of goodwill which was acquired three years ago by a continuing audit client:

A) Confirmation.

B) Observation.

C) Recomputation.

D) Inquiry.

A) Confirmation.

B) Observation.

C) Recomputation.

D) Inquiry.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

35

The auditors are least likely to learn of retirements of equipment through which of the following?

A) Review of the purchase returns and allowances account.

B) Review of depreciation.

C) Analysis of the debits to the accumulated depreciation account.

D) Review of insurance policy riders.

A) Review of the purchase returns and allowances account.

B) Review of depreciation.

C) Analysis of the debits to the accumulated depreciation account.

D) Review of insurance policy riders.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

36

When comparing an initial audit with a subsequent year audit for a particular client, the scope of audit procedures for which of the following accounts would be expected to decrease the most?

A) Accounts receivable.

B) Cash.

C) Marketable securities.

D) Property, plant, and equipment.

A) Accounts receivable.

B) Cash.

C) Marketable securities.

D) Property, plant, and equipment.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is not a test primarily used to test property, plant and equipment accounts for overstatement?

A) Investigation of reductions in insurance coverage.

B) Review of property tax bills.

C) Examination of retirement work orders prepared during the year.

D) Vouching retirements of plant and equipment.

A) Investigation of reductions in insurance coverage.

B) Review of property tax bills.

C) Examination of retirement work orders prepared during the year.

D) Vouching retirements of plant and equipment.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

38

In violation of company policy, Lowell Company erroneously capitalized the cost of painting its warehouse. The auditors examining Lowell's financial statements would most likely detect this when:

A) Discussing capitalization policies with Lowell's controller.

B) Examining maintenance expense accounts.

C) Observing, during the physical inventory observation, that the warehouse had been painted.

D) Examining the construction work orders supporting items capitalized during the year.

A) Discussing capitalization policies with Lowell's controller.

B) Examining maintenance expense accounts.

C) Observing, during the physical inventory observation, that the warehouse had been painted.

D) Examining the construction work orders supporting items capitalized during the year.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

39

Plant and equipment are not as inherently risky as are other assets, such as inventories and accounts receivable. However, a company should still endeavor to maintain effective internal control over plant and equipment.

a. Describe the principal purpose of internal controls relating to plant and equipment.

b. List and describe four major controls applicable to plant and equipment.

a. Describe the principal purpose of internal controls relating to plant and equipment.

b. List and describe four major controls applicable to plant and equipment.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck