Deck 7: Individual From Agi Deductions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/67

Play

Full screen (f)

Deck 7: Individual From Agi Deductions

1

Taxpayers are allowed to deduct mortgage interest on up to $1,000,000 of acquisition debt for their qualified residence and on up to $500,000 of home-equity debt.

False

Explanation: Interest is deductible on up to $100,000 of home-equity debt.

Explanation: Interest is deductible on up to $100,000 of home-equity debt.

2

Taxpayers are allowed to deduct all ordinary and necessary expenses incurred in connection with determining their tax obligations imposed by federal, state, municipal, or foreign authorities.

True

3

The deduction for medical expenses is limited to the amount of unreimbursed qualifying medical expenses paid during the year reduced by two percent of the taxpayer's AGI.

False

Explanation: 10% (7.5% for taxpayer or spouse age 65 or older) of AGI is the floor limit

Explanation: 10% (7.5% for taxpayer or spouse age 65 or older) of AGI is the floor limit

4

Which of the following is a true statement?

A) A taxpayer can deduct medical expenses incurred for members of his family who are dependents.

B) A taxpayer can deduct medical expenses incurred for a qualified relative even if the relative does not meet the gross income test.

C) A divorced taxpayer can deduct medical expenses incurred for a child even if the child is claimed as a dependent by the former spouse.

D) Deductible medical expenses include long-term care services for disabled spouses and dependents.

E) All of the above are true.

A) A taxpayer can deduct medical expenses incurred for members of his family who are dependents.

B) A taxpayer can deduct medical expenses incurred for a qualified relative even if the relative does not meet the gross income test.

C) A divorced taxpayer can deduct medical expenses incurred for a child even if the child is claimed as a dependent by the former spouse.

D) Deductible medical expenses include long-term care services for disabled spouses and dependents.

E) All of the above are true.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

5

The deduction to individual taxpayers for charitable contributions paid in cash made to public charities is limited to ten percent of the taxpayer's AGI whereas casualty losses on personal assets are only deductible to the extent the losses exceed ten percent of the taxpayer's AGI.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

6

Taxpayers traveling for the primary purpose of receiving essential and deductible medical care may deduct the cost of travel.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

7

The medical expense deduction is designed to provide relief for doctors and medical practitioners.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

8

The deduction for investment interest in excess of the net investment income carries forward to the subsequent year.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

9

Deductible medical expenses include payments to medical care providers such as doctors, dentists, and nurses and medical care facilities such as hospitals.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

10

Taxpayers filing single and taxpayers filing married separate have the same basic standard deduction amount.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

11

Taxpayers generally deduct the lesser of their standard deduction or their itemized deductions.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

12

To qualify as a charitable deduction the donation must be made by cash or by check.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

13

An individual who is eligible to be claimed as a dependent on another's return and has $1,000 of earned income may claim a standard deduction of $1,350.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

14

Unreimbursed employee business expenses, investment expenses, hobby expenses, and certain other expenses are classified as miscellaneous itemized deductions and are deductible only to the extent that their sum exceeds 2% of the taxpayer's AGI.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

15

In general, taxpayers are allowed to deduct the fair market value of long-term capital gain property on the date of the donation to a qualified charitable organization.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

16

The itemized deduction for taxes includes all types of state, local, and foreign taxes.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

17

Bunching itemized deductions is one form of tax evasion.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

18

Taxpayers may elect to deduct state and local sales taxes instead of deducting state and local income taxes.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

19

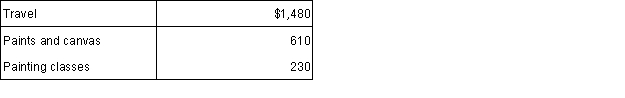

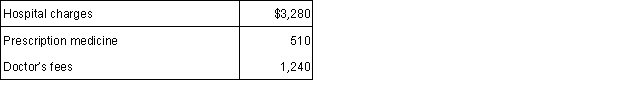

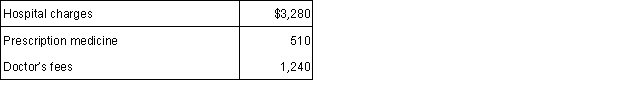

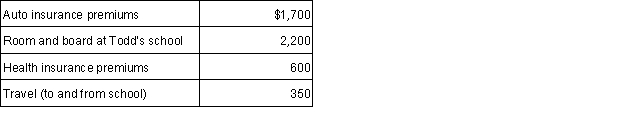

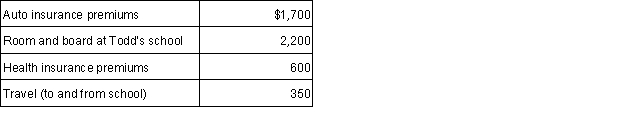

Ned is a head of household with a dependent son, Todd, who is a full-time student. This year Ned made the following expenditures related to Todd's support: What amount can Ned include in his itemized deductions?

A) $1,700 included in Ned's miscellaneous itemized deductions

B) $2,050 included in Ned's miscellaneous itemized deductions

C) $950 included in Ned's miscellaneous itemized deductions

D) $600 included in Ned's medical expenses

E) None of the above.

A) $1,700 included in Ned's miscellaneous itemized deductions

B) $2,050 included in Ned's miscellaneous itemized deductions

C) $950 included in Ned's miscellaneous itemized deductions

D) $600 included in Ned's medical expenses

E) None of the above.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

20

In 2016, personal and dependency exemptions are $6,300 for single taxpayers.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is a true statement?

A) Traveling from a personal residence to a place of business is deducted for AGI as a moving expense.

B) Traveling from a personal residence to a place of business is a miscellaneous itemized deduction subject to the 2 percent of AGI limitation.

C) The standard mileage rate can be used to calculate the deduction for traveling from a personal residence to a place of business.

D) Traveling from a personal residence to a place of business is deductible if reimbursed by an employer.

E) Traveling from a personal residence to a place of business is nondeductible.

A) Traveling from a personal residence to a place of business is deducted for AGI as a moving expense.

B) Traveling from a personal residence to a place of business is a miscellaneous itemized deduction subject to the 2 percent of AGI limitation.

C) The standard mileage rate can be used to calculate the deduction for traveling from a personal residence to a place of business.

D) Traveling from a personal residence to a place of business is deductible if reimbursed by an employer.

E) Traveling from a personal residence to a place of business is nondeductible.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is a true statement?

A) the deduction of cash contributions to public charities is limited to 30 percent of AGI.

B) the deduction of capital gain property to private nonoperating foundations is limited to 50 percent of AGI.

C) the deduction of capital gain property to public charities is limited to 20 percent of AGI.

D) the deduction of cash contributions to private nonoperating foundations is limited to 30 percent of AGI.

E) None of the above is true.

A) the deduction of cash contributions to public charities is limited to 30 percent of AGI.

B) the deduction of capital gain property to private nonoperating foundations is limited to 50 percent of AGI.

C) the deduction of capital gain property to public charities is limited to 20 percent of AGI.

D) the deduction of cash contributions to private nonoperating foundations is limited to 30 percent of AGI.

E) None of the above is true.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following taxes will not qualify as an itemized deduction?

A) personal property taxes assessed on the value of specific property.

B) state, local, and foreign income taxes.

C) real estate taxes on a residence.

D) gasoline taxes on personal travel.

E) None of the above qualifies as an itemized deduction.

A) personal property taxes assessed on the value of specific property.

B) state, local, and foreign income taxes.

C) real estate taxes on a residence.

D) gasoline taxes on personal travel.

E) None of the above qualifies as an itemized deduction.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

24

Madeoff donated stock (capital gain property) to a public charity. He purchased the stock 3 years ago for $100,000, and on the date of the gift, it had a fair market value of $200,000. What is his maximum charitable contribution deduction for the year related to this stock if his AGI is $500,000 (before considering the itemized deduction phase-out)?

A) $100,000

B) $200,000

C) $150,000

D) $250,000

E) None of the above

A) $100,000

B) $200,000

C) $150,000

D) $250,000

E) None of the above

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

25

Carly donated inventory (ordinary income property) to a church. She purchased the inventory last month for $100,000, and on the date of the gift, it had a fair market value of $92,000. What is her maximum charitable contribution deduction for the year related to this inventory if her AGI is $200,000?

A) $100,000

B) $92,000

C) $60,000

D) $46,000 if the church sells the inventory

E) None of the above

A) $100,000

B) $92,000

C) $60,000

D) $46,000 if the church sells the inventory

E) None of the above

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

26

This year Amanda paid $749 in Federal gift taxes on a gratuitous transfer to her nephew. Amanda lives in Texas and does not pay any state or local income taxes. Which of the following is a true statement?

A) Amanda cannot deduct Federal gift taxes.

B) Amanda can deduct Federal gift taxes for AGI.

C) Amanda can deduct Federal gift taxes paid as an itemized deduction.

D) Amanda must include Federal gift taxes with other miscellaneous itemized deductions.

E) None of the above is true.

A) Amanda cannot deduct Federal gift taxes.

B) Amanda can deduct Federal gift taxes for AGI.

C) Amanda can deduct Federal gift taxes paid as an itemized deduction.

D) Amanda must include Federal gift taxes with other miscellaneous itemized deductions.

E) None of the above is true.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

27

Jim was in an auto accident this year. Jim paid $2,450 to repair his personal-use car after the accident and his insurance only reimbursed him $400. Jim bought his car several years ago for $1,500. What is the amount of casualty loss from this accident before Jim applies any casualty loss floor limitations?

A) $2,450

B) $2,050

C) $1,500

D) $1,100

E) None of the above is correct.

A) $2,450

B) $2,050

C) $1,500

D) $1,100

E) None of the above is correct.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

28

This year Norma paid $1,200 of real estate taxes on her personal residence. Norma's other itemized deductions (state income taxes) only amount to $3,100. Which of the following is a true statement if Norma files single with one personal exemption?

A) Norma can deduct 4,300 for AGI.

B) Norma should deduct $1,200 even if her standard deduction is $6,300.

C) Norma should deduct $4,300 even if her standard deduction is $6,300.

D) Norma should deduct $3,100 even if her standard deduction is $6,300.

E) Norma should claim the standard deduction.

A) Norma can deduct 4,300 for AGI.

B) Norma should deduct $1,200 even if her standard deduction is $6,300.

C) Norma should deduct $4,300 even if her standard deduction is $6,300.

D) Norma should deduct $3,100 even if her standard deduction is $6,300.

E) Norma should claim the standard deduction.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is a true statement?

A) A casualty loss can only occur from storm damage.

B) Personal casualty losses can only be deducted to the extent that aggregate casualty losses exceed 10 percent of AGI after applying a $100 per incident deduction.

C) Individual casualty losses are only deductible if each individual loss exceeds $5,000.

D) Uninsured thefts of personal assets are not included with casualty losses.

E) All of the above are true.

A) A casualty loss can only occur from storm damage.

B) Personal casualty losses can only be deducted to the extent that aggregate casualty losses exceed 10 percent of AGI after applying a $100 per incident deduction.

C) Individual casualty losses are only deductible if each individual loss exceeds $5,000.

D) Uninsured thefts of personal assets are not included with casualty losses.

E) All of the above are true.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

30

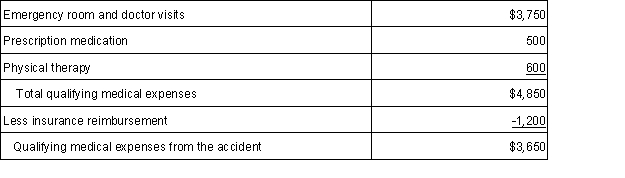

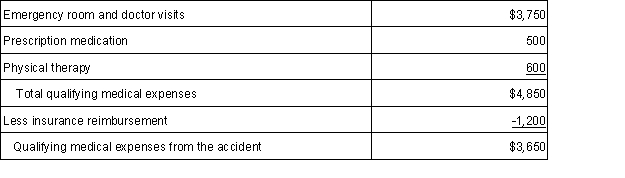

Opal fell on the ice and injured her hip this winter. As a result she paid $3,000 for a visit to the hospital emergency room and $750 for follow-up visits with her doctor. While she recuperated, Opal paid $500 for prescription medicine and $600 to a therapist for rehabilitation. Insurance reimbursed Opal $1,200 for these expenses. What is the amount of Opal's deductible medical expense before considering any AGI limitations?

A) $3,000

B) $3,750

C) $3,650

D) $4,850

E) All of the above

A) $3,000

B) $3,750

C) $3,650

D) $4,850

E) All of the above

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

31

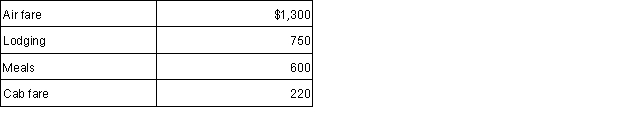

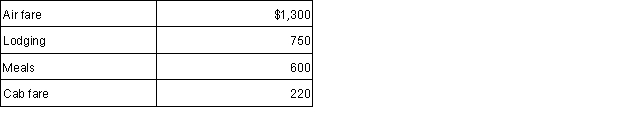

Fred's employer dispatched him on a business trip from the Dallas headquarters to New York this year. During the trip Fred incurred the following unreimbursed expenses: What is the amount of Fred's deduction before the application of any AGI limitations?

A) $2,870

B) $2,570

C) $2,050

D) $1,300

E) $0 - the expenses cannot be deducted unless Fred is reimbursed.

A) $2,870

B) $2,570

C) $2,050

D) $1,300

E) $0 - the expenses cannot be deducted unless Fred is reimbursed.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is a true statement?

A) Employees cannot claim business expense deductions.

B) Employees can claim business expense deductions for AGI.

C) Employees can claim business expense deductions as miscellaneous itemized deductions not subject to the 2 percent of AGI limitation.

D) Employees can claim business expense deductions as miscellaneous itemized deductions subject to the 2 percent of AGI limitation.

E) None of the above is true.

A) Employees cannot claim business expense deductions.

B) Employees can claim business expense deductions for AGI.

C) Employees can claim business expense deductions as miscellaneous itemized deductions not subject to the 2 percent of AGI limitation.

D) Employees can claim business expense deductions as miscellaneous itemized deductions subject to the 2 percent of AGI limitation.

E) None of the above is true.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following costs are deductible as an itemized medical expense?

A) The cost of prescription medicine and over-the-counter drugs.

B) Medical expenses incurred to prevent disease.

C) The cost of elective cosmetic surgery.

D) Medical expenses reimbursed by health insurance.

E) None of the above costs is deductible.

A) The cost of prescription medicine and over-the-counter drugs.

B) Medical expenses incurred to prevent disease.

C) The cost of elective cosmetic surgery.

D) Medical expenses reimbursed by health insurance.

E) None of the above costs is deductible.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

34

Larry recorded the following donations this year: $500 cash to a family in need

$2,400 to a church

$500 cash to a political campaign

To the Salvation Army household items that originally cost $1,200 but are worth $300.

What is Larry's maximum allowable charitable contribution if his AGI is $60,000?

A) $2,900

B) $1,000

C) $2,700

D) $4,600

E) None of the above

$2,400 to a church

$500 cash to a political campaign

To the Salvation Army household items that originally cost $1,200 but are worth $300.

What is Larry's maximum allowable charitable contribution if his AGI is $60,000?

A) $2,900

B) $1,000

C) $2,700

D) $4,600

E) None of the above

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

35

Simone donated a landscape painting (tangible capital gain property) to a library, a public charity. She purchased the painting five years ago for $50,000, and on the date of the gift, it had a fair market value of $200,000. What is her maximum charitable contribution deduction for the year if her AGI is $300,000 (before considering the itemized deduction phase-out)?

A) $100,000

B) $200,000

C) $90,000 if the library uses the painting in its charitable purpose

D) $150,000

E) None of the above

A) $100,000

B) $200,000

C) $90,000 if the library uses the painting in its charitable purpose

D) $150,000

E) None of the above

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

36

Margaret Lindley paid $15,000 of interest on her $300,000 acquisition debt for her home (fair market value of $500,000), $4,000 of interest on her $30,000 home-equity loan, $1,000 of credit card interest, and $3,000 of margin interest for the purchase of stock. Assume that Margaret Lindley has $10,000 of interest income this year and no investment expenses. How much of the interest expense may she deduct this year?

A) $23,000.

B) $22,000.

C) $19,000.

D) $18,000.

E) None of the above.

A) $23,000.

B) $22,000.

C) $19,000.

D) $18,000.

E) None of the above.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is a true statement?

A) Fees for investment advice are included in miscellaneous itemized deductions subject to the 2 percent of AGI limitation.

B) Unreimbursed employee business expenses are included in miscellaneous itemized deductions subject to the 2 percent of AGI limitation.

C) Fees for tax preparation are included in miscellaneous itemized deductions subject to the 2 percent of AGI limitation.

D) Reimbursed employee business expenses are included in miscellaneous itemized deductions subject to the 2 percent of AGI limitation unless the employer's reimbursement plan qualifies as an accountable plan.

E) All of the above are true.

A) Fees for investment advice are included in miscellaneous itemized deductions subject to the 2 percent of AGI limitation.

B) Unreimbursed employee business expenses are included in miscellaneous itemized deductions subject to the 2 percent of AGI limitation.

C) Fees for tax preparation are included in miscellaneous itemized deductions subject to the 2 percent of AGI limitation.

D) Reimbursed employee business expenses are included in miscellaneous itemized deductions subject to the 2 percent of AGI limitation unless the employer's reimbursement plan qualifies as an accountable plan.

E) All of the above are true.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is a true statement?

A) Taxpayers may only deduct interest on up to $1,500,000 of acquisition indebtedness.

B) Taxpayers may deduct interest on up to $1,000,000 of home-equity debt.

C) The deduction for investment interest expense is not subject to limitation.

D) Interest on home-equity debt up to $100,000 is deductible, even if the loan proceeds are used to buy a new car.

E) None of the above is true.

A) Taxpayers may only deduct interest on up to $1,500,000 of acquisition indebtedness.

B) Taxpayers may deduct interest on up to $1,000,000 of home-equity debt.

C) The deduction for investment interest expense is not subject to limitation.

D) Interest on home-equity debt up to $100,000 is deductible, even if the loan proceeds are used to buy a new car.

E) None of the above is true.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following costs are NOT deductible as an itemized medical expense?

A) The cost of eyeglasses.

B) Payments to a hospital.

C) Transportation for medical purposes.

D) The cost of insurance for long-term care services.

E) All of the above are deductible as medical expenses.

A) The cost of eyeglasses.

B) Payments to a hospital.

C) Transportation for medical purposes.

D) The cost of insurance for long-term care services.

E) All of the above are deductible as medical expenses.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

40

When taxpayers donate cash and capital gain property to a public charity, the AGI percentage limitation is applied in the following order:

A) a 30 percent of AGI limitation is applied to the aggregate donation.

B) a 50 percent of AGI limitation is applied to the cash donation and a 20 percent of AGI limitation is applied to the fair market value of the capital gain donation.

C) a 30 percent of AGI limitation is applied to the cash donation and a 20 percent of AGI limitation is applied to the fair market value of the capital gain donation.

D) a 50 percent of AGI limitation is applied to the cash donation and the fair market value of the capital gain donation is subject to the lesser of a 30 percent of AGI limitation or a 50 percent of AGI limitation after subtracting the cash contributions.

E) donations to public charities are not subject to AGI limitations.

A) a 30 percent of AGI limitation is applied to the aggregate donation.

B) a 50 percent of AGI limitation is applied to the cash donation and a 20 percent of AGI limitation is applied to the fair market value of the capital gain donation.

C) a 30 percent of AGI limitation is applied to the cash donation and a 20 percent of AGI limitation is applied to the fair market value of the capital gain donation.

D) a 50 percent of AGI limitation is applied to the cash donation and the fair market value of the capital gain donation is subject to the lesser of a 30 percent of AGI limitation or a 50 percent of AGI limitation after subtracting the cash contributions.

E) donations to public charities are not subject to AGI limitations.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

41

Colby is employed full-time as a food technician for a local restaurant chain. This year he has incurred the following expenses associated with his employment:  Colby was reimbursed $125 of the expenses from his employer's accountable plan. What amount can he include with his remaining itemized deductions if his AGI this year is $32,000?

Colby was reimbursed $125 of the expenses from his employer's accountable plan. What amount can he include with his remaining itemized deductions if his AGI this year is $32,000?

Colby was reimbursed $125 of the expenses from his employer's accountable plan. What amount can he include with his remaining itemized deductions if his AGI this year is $32,000?

Colby was reimbursed $125 of the expenses from his employer's accountable plan. What amount can he include with his remaining itemized deductions if his AGI this year is $32,000?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is a true statement?

A) Expenses associated with a "hobby" are never deductible.

B) The deductibility of an activity's expenses in excess of revenues depends upon whether the activity is primarily profit-motivated or a hobby as determined by facts and circumstances.

C) Taxpayers engaged in a "hobby" are always presumed to be motivated by profit.

D) The regulations do not provide any guidance for determining whether an activity is profit motivated.

E) All of the above are true.

A) Expenses associated with a "hobby" are never deductible.

B) The deductibility of an activity's expenses in excess of revenues depends upon whether the activity is primarily profit-motivated or a hobby as determined by facts and circumstances.

C) Taxpayers engaged in a "hobby" are always presumed to be motivated by profit.

D) The regulations do not provide any guidance for determining whether an activity is profit motivated.

E) All of the above are true.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

43

Frieda is 67 years old and deaf. If Frieda files as a head of household, what amount of standard deduction can she claim in 2016?

A) $10,850

B) $9,300

C) $10,400

D) $12,600

E) $1,550

A) $10,850

B) $9,300

C) $10,400

D) $12,600

E) $1,550

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

44

This year, Benjamin Hassell paid $20,000 of interest on a mortgage on his home (Benjamin borrowed $600,000 to buy the residence and it is currently worth $1,000,000), $12,000 on a $150,000 home equity loan on his home, and $10,000 of interest on a mortgage on his vacation home (loan of $300,000; home purchased for $400,000). How much interest expense can Benjamin deduct as an itemized deduction?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

45

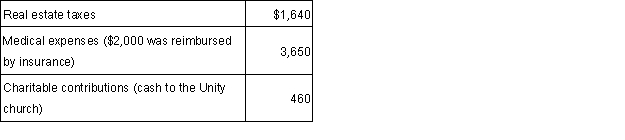

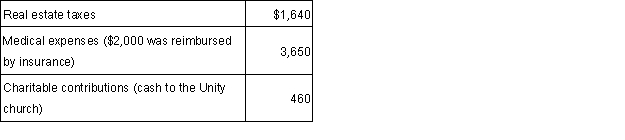

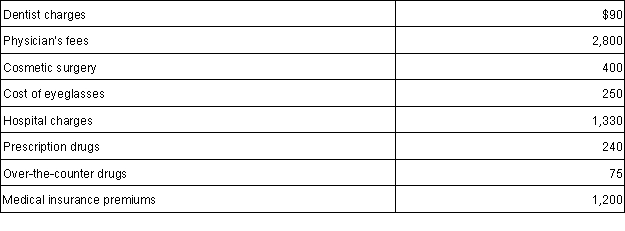

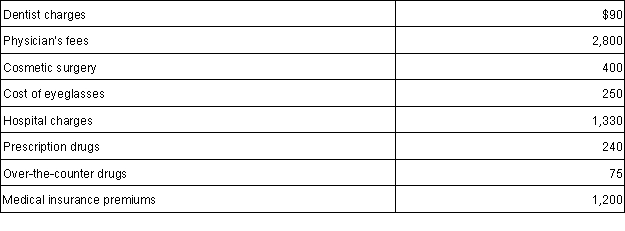

Jenna (age 50) files single and reports AGI of $40,000. This year she has incurred the following medical expenses:  Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

46

Claire donated 200 publicly-traded shares of stock (held for 5 years) to her father's nonoperating private foundation this year. The stock was worth $15,000 but Claire's basis was only $4,000. Determine the maximum amount of charitable deduction for the donation if Claire's AGI is $60,000 this year.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

47

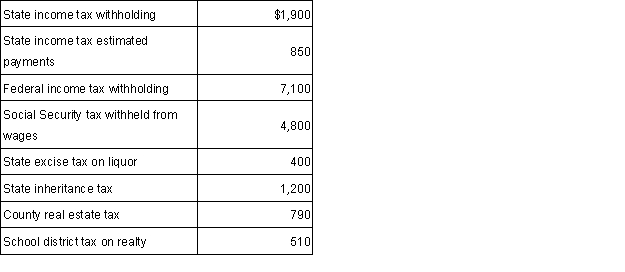

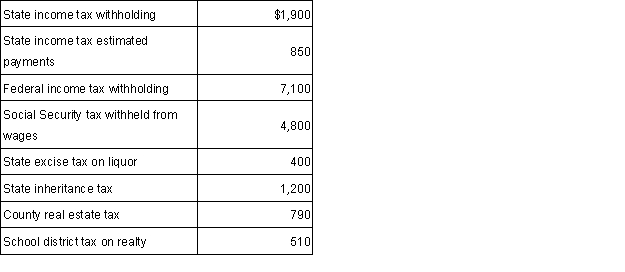

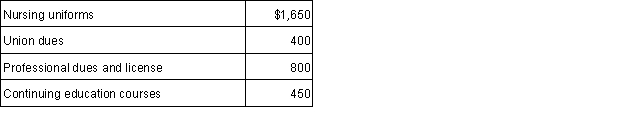

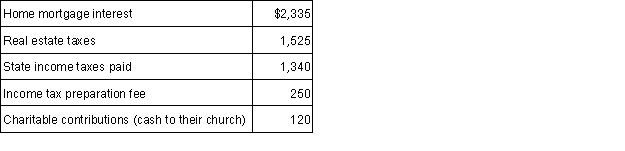

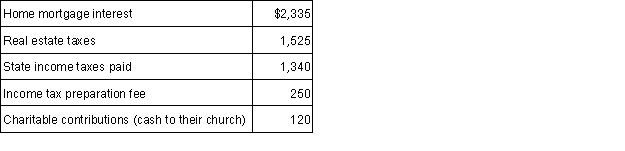

Chuck has AGI of $70,000 and has made the following payments:  Calculate the amount of taxes that Chuck can include with his itemized deductions.

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

48

Erika (age 67) was hospitalized with injuries from an auto accident this year. She incurred the following expenses from the accident:  In addition, Erika's auto was completely destroyed in the accident. She bought the car several years ago for $18,000 and it was worth $4,700 at the time of the accident. What are Erika's itemized deductions this year if she was uninsured and her AGI is $40,000?

In addition, Erika's auto was completely destroyed in the accident. She bought the car several years ago for $18,000 and it was worth $4,700 at the time of the accident. What are Erika's itemized deductions this year if she was uninsured and her AGI is $40,000?

In addition, Erika's auto was completely destroyed in the accident. She bought the car several years ago for $18,000 and it was worth $4,700 at the time of the accident. What are Erika's itemized deductions this year if she was uninsured and her AGI is $40,000?

In addition, Erika's auto was completely destroyed in the accident. She bought the car several years ago for $18,000 and it was worth $4,700 at the time of the accident. What are Erika's itemized deductions this year if she was uninsured and her AGI is $40,000?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

49

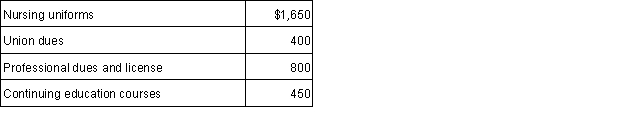

Clark is a registered nurse and full-time employee of the Hays Hospital. To maintain his nursing license Clark has incurred the following expenses:  Clark was reimbursed $1,250 of his expenses from his Hays Hospital accountable reimbursement plan. What amount can he include with his remaining itemized deductions if his AGI this year is $52,000?

Clark was reimbursed $1,250 of his expenses from his Hays Hospital accountable reimbursement plan. What amount can he include with his remaining itemized deductions if his AGI this year is $52,000?

Clark was reimbursed $1,250 of his expenses from his Hays Hospital accountable reimbursement plan. What amount can he include with his remaining itemized deductions if his AGI this year is $52,000?

Clark was reimbursed $1,250 of his expenses from his Hays Hospital accountable reimbursement plan. What amount can he include with his remaining itemized deductions if his AGI this year is $52,000?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

50

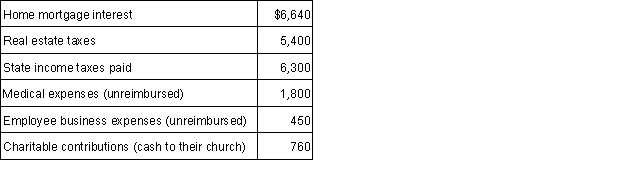

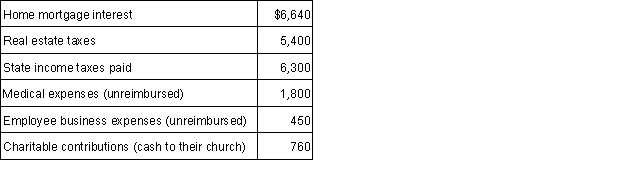

Karin and Chad (ages 30 and 31, respectively) are married and together have $110,000 of AGI. This year they have recorded the following expenses:  Karin and Chad will file married joint with two personal exemptions. Calculate their taxable income.

Karin and Chad will file married joint with two personal exemptions. Calculate their taxable income.

Karin and Chad will file married joint with two personal exemptions. Calculate their taxable income.

Karin and Chad will file married joint with two personal exemptions. Calculate their taxable income.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

51

Andres and Lakeisha are married and file joint. Andres is 72 years old and in good health. Lakeisha is 62 years old and blind. What amount of standard deduction can Andres and Lakeisha claim this year?

A) $15,100

B) $13,850

C) $9,300

D) $12,600

E) None of the above.

A) $15,100

B) $13,850

C) $9,300

D) $12,600

E) None of the above.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

52

Don's personal auto was damaged in a wind storm this year. Don purchased the auto several years ago for $32,000 and it was worth $18,000 at the time of the storm. The damage was superficial, so Don decided not to repair the car. Although Don collected $750 from his insurance company, the value of the car dropped after the storm to $15,000. What is the amount of casualty loss from the storm damage before Don applies any floor limitations?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

53

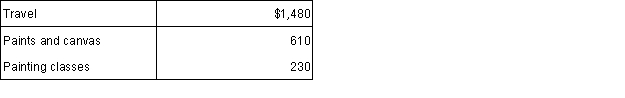

Homer is an executive who is paid a salary of $80,000. Homer also paints landscapes as a hobby. This year Homer expects to sell paintings for a total of $750 and incur the following expenses associated with his painting activities:  What is the effect of Homer's hobby on his taxable income? Assume his AGI does not reflect his painting activities and that he itemizes deductions but has no other miscellaneous itemized deductions.

What is the effect of Homer's hobby on his taxable income? Assume his AGI does not reflect his painting activities and that he itemizes deductions but has no other miscellaneous itemized deductions.

What is the effect of Homer's hobby on his taxable income? Assume his AGI does not reflect his painting activities and that he itemizes deductions but has no other miscellaneous itemized deductions.

What is the effect of Homer's hobby on his taxable income? Assume his AGI does not reflect his painting activities and that he itemizes deductions but has no other miscellaneous itemized deductions.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following is a miscellaneous itemized deduction that is not subject to the 2 percent of AGI floor?

A) gambling losses to the extent of gambling winnings

B) fees for investment advice

C) employee business expenses

D) tax preparation fees

E) All of the above are subject to the 2 percent of AGI floor limit

A) gambling losses to the extent of gambling winnings

B) fees for investment advice

C) employee business expenses

D) tax preparation fees

E) All of the above are subject to the 2 percent of AGI floor limit

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

55

Detmer is a successful doctor who earned $204,800 in fees this year, but he also competes in weekend golf tournaments. Detmer reported the following expenses associated with competing in almost a dozen tournaments:  This year Detmer won $5,200 from competing in various golf tournaments. Assuming that Detmer itemizes his deductions and that he did not have any other miscellaneous itemized deductions, what amount of the golfing expenses are deductible after considering all limitations if the tournament golfing is treated as a hobby activity?

This year Detmer won $5,200 from competing in various golf tournaments. Assuming that Detmer itemizes his deductions and that he did not have any other miscellaneous itemized deductions, what amount of the golfing expenses are deductible after considering all limitations if the tournament golfing is treated as a hobby activity?

This year Detmer won $5,200 from competing in various golf tournaments. Assuming that Detmer itemizes his deductions and that he did not have any other miscellaneous itemized deductions, what amount of the golfing expenses are deductible after considering all limitations if the tournament golfing is treated as a hobby activity?

This year Detmer won $5,200 from competing in various golf tournaments. Assuming that Detmer itemizes his deductions and that he did not have any other miscellaneous itemized deductions, what amount of the golfing expenses are deductible after considering all limitations if the tournament golfing is treated as a hobby activity?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

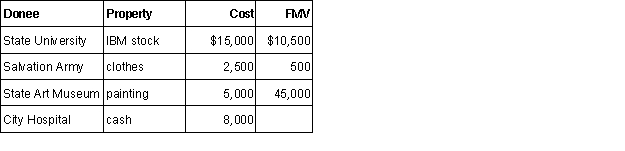

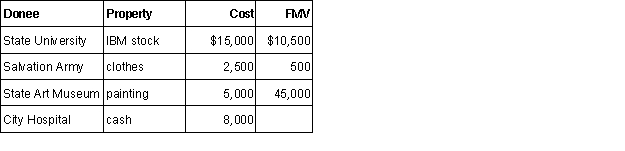

56

This year Darcy made the following charitable contributions:  Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and the painting is used in the State Art Museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and the painting is used in the State Art Museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and the painting is used in the State Art Museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and the painting is used in the State Art Museum's charitable purpose.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is a true statement?

A) The standard deduction is increased for taxpayers who are blind or deaf at year end.

B) A married couple is only entitled to one addition to their standard deduction even if both spouses are both over age 65.

C) Bunching itemized deductions is an illegal method of tax avoidance.

D) The deduction for personal and dependency exemptions is $4,050 times the number of exemptions.

E) All of the above are true.

A) The standard deduction is increased for taxpayers who are blind or deaf at year end.

B) A married couple is only entitled to one addition to their standard deduction even if both spouses are both over age 65.

C) Bunching itemized deductions is an illegal method of tax avoidance.

D) The deduction for personal and dependency exemptions is $4,050 times the number of exemptions.

E) All of the above are true.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is a true statement?

A) Personal exemptions, but not dependency exemptions, are subject to phase-out.

B) A married filing joint taxpayer with AGI of $500,000 would not be able to deduct personal and dependency exemptions.

C) At most, only 80% of exemptions are subject to phase-out.

D) Itemized deductions, but not exemptions, are subject to phase-out.

E) None of the above is true.

A) Personal exemptions, but not dependency exemptions, are subject to phase-out.

B) A married filing joint taxpayer with AGI of $500,000 would not be able to deduct personal and dependency exemptions.

C) At most, only 80% of exemptions are subject to phase-out.

D) Itemized deductions, but not exemptions, are subject to phase-out.

E) None of the above is true.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

59

Glenn is an accountant who races stock cars as a hobby. This year Glenn was paid a salary of $80,000 from his employer and won $2,000 in various races. What is the effect of the racing activities on Glenn's taxable income if Glenn has also incurred $4,200 of hobby expenses this year? Assume that Glenn itemizes his deductions but has no other miscellaneous itemized deductions.

A) increase in taxable income of $2,000

B) increase in taxable income of $1,640

C) no change in taxable income

D) decrease in taxable income of $560

E) decrease in taxable income of $2,200

A) increase in taxable income of $2,000

B) increase in taxable income of $1,640

C) no change in taxable income

D) decrease in taxable income of $560

E) decrease in taxable income of $2,200

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

60

Grace is employed as the manager of a sandwich shop. This year she earned a salary of $45,000 and incurred the following expenses associated with her employment: What amount of miscellaneous itemized deductions can Grace claim on Schedule A if these are her only miscellaneous itemized deductions?

A) $150

B) $1,050

C) $550

D) $200 if Grace was reimbursed $50 for her cooking class

E) None of the above.

A) $150

B) $1,050

C) $550

D) $200 if Grace was reimbursed $50 for her cooking class

E) None of the above.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

61

Misti purchased a residence this year. Misti is a single parent and lives with her 1-year old daughter. This year, Misti received a salary of $63,000 and made the following payments:  Misti files as a head of household and claims two exemptions. Calculate her taxable income this year.

Misti files as a head of household and claims two exemptions. Calculate her taxable income this year.

Misti files as a head of household and claims two exemptions. Calculate her taxable income this year.

Misti files as a head of household and claims two exemptions. Calculate her taxable income this year.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

62

Toshiomi works as a sales representative and travels extensively for his employer's business. This year Toshiomi was paid $75,000 in salary and made the following expenditures:  Toshiomi also made a number of trips to Las Vegas for gambling. This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420). Calculate Toshiomi's taxable income if he files single with one personal exemption.

Toshiomi also made a number of trips to Las Vegas for gambling. This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420). Calculate Toshiomi's taxable income if he files single with one personal exemption.

Toshiomi also made a number of trips to Las Vegas for gambling. This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420). Calculate Toshiomi's taxable income if he files single with one personal exemption.

Toshiomi also made a number of trips to Las Vegas for gambling. This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420). Calculate Toshiomi's taxable income if he files single with one personal exemption.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

63

Rochelle, a single taxpayer (age 47), has an AGI of $275,200. This year, she paid medical expenses of $30,000, state income taxes of $4,000, mortgage interest of $10,600, and charitable contributions of $6,000. What would be the amount of her total itemized deductions she may claim on her tax return?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

64

Justin and Georgia file married jointly with one dependent. This year, their AGI is $325,300. What dollar amount of personal and dependency exemptions would they be allowed to deduct this year?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

65

This year Kelly bought a new auto for $20,000 plus $1,650 in state and local sales taxes. Besides this sales tax, Kelly also paid $5,260 in state income taxes and had other itemized deductions (e.g., mortgage interest) of $3,500. If Kelly files single with AGI of $56,000, what amount of itemized deductions will she be eligible to claim?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

66

Jon and Holly are married and live in a retirement community. This year Jon celebrated his 65th birthday and Holly turned 68 years old. For their ages, both Jon and Holly are in good health. This year the only significant expense that they incurred was an unreimbursed medical expense of $3,200. If Jon and Holly together have AGI of $42,000, what is the amount of their standard deduction this year?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

67

Bryan is 67 years old and lives alone. This year he has received $25,000 in taxable interest and pension payments, and he has paid the following expenses:  If Bryan files single with one personal exemption, calculate his taxable income.

If Bryan files single with one personal exemption, calculate his taxable income.

If Bryan files single with one personal exemption, calculate his taxable income.

If Bryan files single with one personal exemption, calculate his taxable income.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck