Deck 18: Property, Plant, and Equipment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

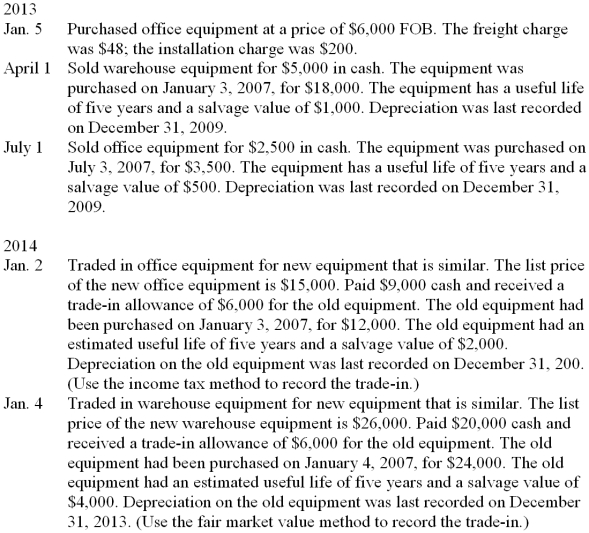

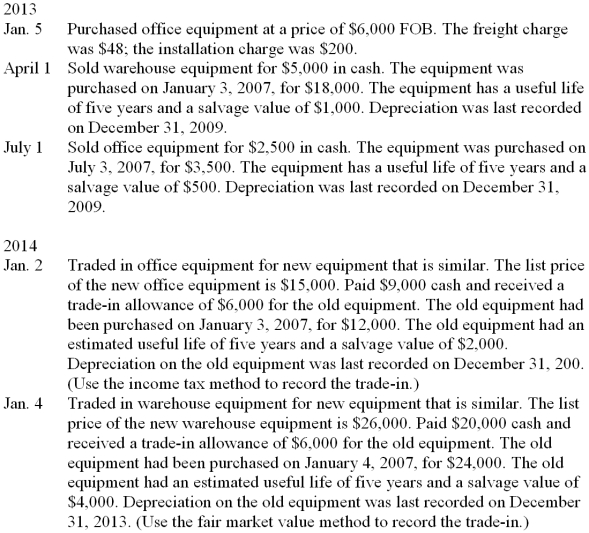

Question

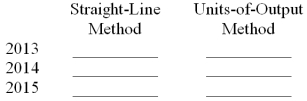

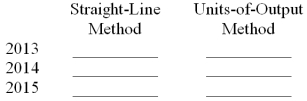

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/90

Play

Full screen (f)

Deck 18: Property, Plant, and Equipment

1

The salvage value is the value that the asset is expected to have at the end of its useful life.

True

2

Patents and copyrights are intangible assets.

True

3

The balance of an Accumulated Depletion account is subtracted from the related natural resource account to determine the book value of the natural resource.

True

4

Each year intangibles are assessed to estimate the value which is compared to the existing book value in order to determine if impairment must be recorded.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

5

For financial accounting purposes, when an asset is traded in for a similar asset, a gain is reported if the trade-in allowance exceeds the book value of the asset traded in.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

6

The entry to record the amortization of acquisition cost of an intangible asset includes a credit directly to the intangible asset account.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

7

The recorded cost of an asset should include both the net invoice price and all transportation and installation costs.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

8

The book value of an asset is usually the same as the fair market value of the asset.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

9

The sale of a depreciable asset for an amount less than its cost always requires the recognition of a loss in the financial records of the company.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

10

The cost of land is not depreciated.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

11

Use of the sum-of-the-years'-digits method of depreciation results in lower depreciation charges in the early years of an asset's life and higher charges in the later years.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

12

The acquisition cost of an intangible asset should be charged to expense over the shorter of its legal or useful life.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

13

Accumulated Depreciation is classified as a contra asset account.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

14

The modified accelerated cost recovery system (MACRS) is acceptable for financial accounting purposes because it matches the costs of assets with the revenues produced by those assets.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

15

When the units-of-output method is used to compute depreciation, the useful life of an asset is the number of units of work the asset will perform.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

16

The adjusting entry to record depletion for the period includes a credit to the Depletion Expense account.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

17

When an asset is traded for a similar asset, if the trade-in allowed is less than the book value of the asset, the loss is not recognized for financial accounting purposes.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

18

When an asset is sold, the first thing an accountant must do is record the depreciation to the date of sale.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

19

Depletion is the name given to the periodic allocation of the costs of assets created by human effort.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

20

Land purchased for a future building site or as an investment would not be shown in the Property, Plant, and Equipment section of the balance sheet.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

21

The Modified Accelerated Cost Recovery System (MACRS) is required for ______________ income tax purposes.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

22

The term used to describe the process of allocating the acquisition cost of an intangible asset to expense during its estimated useful life is ___________________.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

23

If a depreciable asset is sold for an amount that is lower than the asset's book value, a(n) ____________________ is recognized.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

24

A firm purchases an asset for $50,000 and estimates that it will have a useful life of five years and a salvage value of $5,000. Under the straight-line method, the balance in the accumulated deprecation account, after the second year, will be

A) $9,000.

B) $18,000.

C) $10,000.

D) $20,000. 18000 = 9000 x 2.

A) $9,000.

B) $18,000.

C) $10,000.

D) $20,000. 18000 = 9000 x 2.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

25

The term used to describe the periodic transfer of the acquisition cost to expense when minerals or other natural resources are physically removed during production is ___________________.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

26

In determining the impairment of a long-term asset, an accountant applies the _________________ test to compare the asset's net book value with estimated cash flows from the asset's future use.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

27

A company uses the units-of-output method of computing depreciation on its fleet of cars. A car that costs $26,000 is expected to have a useful life of 75,000 miles and an expected salvage value of $2,000 at the end of its useful life. The rate for each mile is ___________________.

(26000 - 2000)/75000

(26000 - 2000)/75000

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

28

Patents, trademarks, and copyrights are examples of ____________________ assets.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

29

When an asset is acquired by trading in an asset already owned in exchange for the new one, the amount received on the trade-in is called the ______________.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

30

The declining-balance method and the sum-of-the-years'-digits method are referred to as ____________________ methods of depreciation.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

31

A company uses the units-of-output method of computing depreciation on its fleet of cars. A car that costs $37,000 is expected to have a useful life of 120,000 miles and an expected salvage value of $1,000 at the end of its useful life. The rate for each mile is ___________________.

(37000 - 1000)/120000.

(37000 - 1000)/120000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

32

A firm purchases an asset for $50,000 and estimates that it will have a useful life of five years and a salvage value of $5,000. Under the double-declining-balance method, the depreciation expense for the first year of the asset's useful life is

A) $9,000.

B) $18,000.

C) $10,000.

D) $20,000. 20000 = (50000 x (2 x 20%))

A) $9,000.

B) $18,000.

C) $10,000.

D) $20,000. 20000 = (50000 x (2 x 20%))

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

33

The difference between the acquisition cost of an asset and its accumulated depreciation is called the ___________________.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

34

The acquisition cost of an intangible asset is amortized over the shorter of its legal life or ____________________ life.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

35

The normal balance of Accumulated Depreciation is a(n) ___________________.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

36

When the sum-of-the-years'-digits method is used to depreciate an asset with a four-year life, the depreciation expense for the fourth year is computed by multiplying the difference between the cost and the salvage value by the fraction ___________________.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

37

To calculate declining-balance depreciation, it is necessary to multiply the ____________________ of an asset by an appropriate rate.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

38

Which method of depreciation is seldom, if ever, used for financial accounting purposes?

A) the modified accelerated cost recovery system (MACRS)

B) the sum-of-the-years'-digits method

C) the declining-balance method

D) the straight-line method

A) the modified accelerated cost recovery system (MACRS)

B) the sum-of-the-years'-digits method

C) the declining-balance method

D) the straight-line method

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

39

If the property used in a business has physical substance and is not real estate it is _____________ property.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

40

A firm purchases an asset for $50,000 and estimates that it will have a useful life of five years and a salvage value of $5,000. Under the straight-line method, the depreciation expense for the first year of the asset's useful life is

A) $9,000.

B) $18,000.

C) $10,000.

D) $20,000. 9000 = (50000 - 5000)/5.

A) $9,000.

B) $18,000.

C) $10,000.

D) $20,000. 9000 = (50000 - 5000)/5.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

41

An example of real property is

A) machinery.

B) factory equipment.

C) computer equipment.

D) buildings.

A) machinery.

B) factory equipment.

C) computer equipment.

D) buildings.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

42

A company purchased equipment for $16,000 cash. In addition, the company paid $1,000 to have the equipment delivered and $500 to have it installed. The cost of this asset for financial accounting purposes is

A) $16,000.

B) $17,000.

C) $17,500.

D) $16,500.

A) $16,000.

B) $17,000.

C) $17,500.

D) $16,500.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

43

Under MACRS, the highest percent-resulting in the highest deprecation expense-occurs during which year?

A) first

B) second

C) third

D) fourth

A) first

B) second

C) third

D) fourth

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

44

The amount of a long-term asset's impairment is

A) the difference between the asset's current market value and historical cost.

B) the estimated net cash flows from the asset's future use less its accumulated depreciation.

C) the current market value of the asset.

D) the amount by which the asset's book value exceeds its market value.

A) the difference between the asset's current market value and historical cost.

B) the estimated net cash flows from the asset's future use less its accumulated depreciation.

C) the current market value of the asset.

D) the amount by which the asset's book value exceeds its market value.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

45

Assume that a business trades in an old cash register for a new one. Under the income tax method,

A) a gain may be recognized, but a loss cannot be recorded.

B) the cost of the new asset is recorded as the cash paid for the new asset.

C) the asset account is debited for the difference between the original cost of the old asset and the fair market value of the new asset.

D) the cost of the new asset is recorded as the book value of the old asset plus the cash amount paid or to be paid.

A) a gain may be recognized, but a loss cannot be recorded.

B) the cost of the new asset is recorded as the cash paid for the new asset.

C) the asset account is debited for the difference between the original cost of the old asset and the fair market value of the new asset.

D) the cost of the new asset is recorded as the book value of the old asset plus the cash amount paid or to be paid.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

46

Equipment that cost $20,000 was sold for $12,000 cash. Accumulated depreciation on the asset was $14,000. The entry to record the sale includes a credit to the Equipment account for

A) $6,000.

B) $12,000.

C) $20,000.

D) $14,000.

A) $6,000.

B) $12,000.

C) $20,000.

D) $14,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

47

Dom's Delivery purchased a van for $32,000. The transportation charges were $400, sales tax was $2,240, and the license cost $250. Special shelving was installed in the van for $4,300. In addition, Dom had the company name painted on the doors. This cost the company $1,250. The total cost of the van to record in the proper asset account is

A) $40,190.

B) $40,440.

C) $38,940.

D) $39,190.

A) $40,190.

B) $40,440.

C) $38,940.

D) $39,190.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

48

The cost of an intangible asset

A) should be immediately charged to expense if the cost was incurred to develop the intangible asset.

B) should be immediately charged to expense whether the intangible asset was developed internally or purchased.

C) should be recorded as an asset whose cost, like the cost of land, will not be allocated to expense.

D) should be charged to expense over the life of the intangible asset.

A) should be immediately charged to expense if the cost was incurred to develop the intangible asset.

B) should be immediately charged to expense whether the intangible asset was developed internally or purchased.

C) should be recorded as an asset whose cost, like the cost of land, will not be allocated to expense.

D) should be charged to expense over the life of the intangible asset.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following abides by the principle of conservatism regarding trade-ins?

A) recording only the loss

B) recording only the gain

C) recording both the loss and the gain

D) recording neither the loss nor the gain

A) recording only the loss

B) recording only the gain

C) recording both the loss and the gain

D) recording neither the loss nor the gain

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

50

An asset that cost $25,000 was sold for $8,000 cash. Accumulated depreciation on the asset was $16,000. The entry to record this transaction includes the recognition of

A) a gain of $8,000.

B) a loss of $1,000.

C) neither a gain nor a loss.

D) a gain of $1,000. 25000 - 16000 = 9000; 9000 - 8000 = 1000 loss.

A) a gain of $8,000.

B) a loss of $1,000.

C) neither a gain nor a loss.

D) a gain of $1,000. 25000 - 16000 = 9000; 9000 - 8000 = 1000 loss.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

51

For federal income tax purposes, the depletion expense deducted from income is the larger of cost depletion or ___________.

A) amount per table provided with forms

B) percentage depletion

C) units-of-production times the calculated rate per unit

D) number of units extracted times the calculated rate per unit

A) amount per table provided with forms

B) percentage depletion

C) units-of-production times the calculated rate per unit

D) number of units extracted times the calculated rate per unit

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

52

An asset that cost $14,000 was sold for $9,000 cash. Accumulated depreciation on the asset was $7,000. The entry to record this transaction includes the recognition of

A) a gain of $2,000.

B) a loss of $5,000.

C) neither a gain nor a loss.

D) a loss of $2,000. 14000 - 7000 = 7000; 9000 - 7000 = 2000 gain.

A) a gain of $2,000.

B) a loss of $5,000.

C) neither a gain nor a loss.

D) a loss of $2,000. 14000 - 7000 = 7000; 9000 - 7000 = 2000 gain.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

53

The entry to record the sale of equipment used in a business may include a debit to

A) the Equipment account.

B) the Gain on Sale of Equipment account.

C) the Accumulated Depreciation-Equipment account.

D) Depreciation Expense account.

A) the Equipment account.

B) the Gain on Sale of Equipment account.

C) the Accumulated Depreciation-Equipment account.

D) Depreciation Expense account.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

54

The allocation of the costs of natural resources, such as minerals, to the units produced is referred to as

A) depreciation.

B) depletion.

C) amortization.

D) salvage value.

A) depreciation.

B) depletion.

C) amortization.

D) salvage value.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

55

The process by which the cost of natural resources extracted are allocated is

A) depreciation.

B) amortization.

C) depletion.

D) evaluation.

A) depreciation.

B) amortization.

C) depletion.

D) evaluation.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

56

The book value of an asset is

A) the market value of the asset.

B) the portion of the asset's cost that has not yet been charged to expense.

C) the acquisition cost shown in the asset account less the estimated salvage value.

D) the replacement cost of the asset.

A) the market value of the asset.

B) the portion of the asset's cost that has not yet been charged to expense.

C) the acquisition cost shown in the asset account less the estimated salvage value.

D) the replacement cost of the asset.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

57

The method of depreciation that results in the same amount of depreciation expense each year is the

A) units-of-output method.

B) straight-line method.

C) sum-of-the-years'-digits method.

D) declining-balance method.

A) units-of-output method.

B) straight-line method.

C) sum-of-the-years'-digits method.

D) declining-balance method.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

58

When computing depreciation, the salvage value should be ignored if a company uses

A) the units-of-output method.

B) the sum-of-the-years'-digits method.

C) the declining-balance method.

D) the straight-line method.

A) the units-of-output method.

B) the sum-of-the-years'-digits method.

C) the declining-balance method.

D) the straight-line method.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

59

An asset that cost $25,000 was sold for $9,000 cash. Accumulated depreciation on the asset was $16,000. The entry to record this transaction includes the recognition of

A) a gain of $9,000.

B) a loss of $7,000.

C) neither a gain nor a loss.

D) a loss of $2,000. 25000 - 16000 - 9000 = 0; no gain and no loss.

A) a gain of $9,000.

B) a loss of $7,000.

C) neither a gain nor a loss.

D) a loss of $2,000. 25000 - 16000 - 9000 = 0; no gain and no loss.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following is NOT a class under MACRS for personal property?

A) 5 year class

B) 7 year class

C) 10 year class

D) 27.5 year class

A) 5 year class

B) 7 year class

C) 10 year class

D) 27.5 year class

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

61

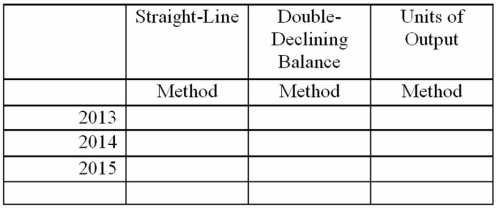

Using the information shown, calculate the depreciation for 2013, 2014, and 2015 if ARB Company uses the straight-line method. Complete the journal entry for the depreciation expense for 2013.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

62

Amortization is the periodic transfer of an intangible's cost to expense done on a

A) straight-line or unit-of-production basis.

B) straight-line or sum-of-the years basis.

C) declining basis or percentage depletion basis.

D) percentage depletion or straight-line basis.

A) straight-line or unit-of-production basis.

B) straight-line or sum-of-the years basis.

C) declining basis or percentage depletion basis.

D) percentage depletion or straight-line basis.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

63

In 2013 a mining company paid $150,000 for mining rights. It is estimated that a total of 200,000 tons of ore are available to be extracted. During 2013, 18,000 tons of ore were mined. What is the amount of Depletion Expense recorded in the adjusting entry for 2013?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

64

On January 2, 2013, the Hanover Company purchased some office equipment for $20,000. The equipment is expected to have a useful life of five years and a salvage value of $2,000. Prepare a schedule showing the annual depreciation for each of the first three years of the asset's life under the straight-line method, the double-declining-balance method, and the sum-of-the-years'-digits method.

Unlock Deck

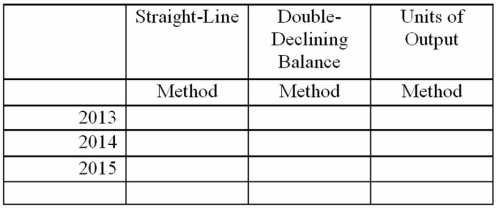

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

65

Using the information shown, calculate the depreciation for 2013, 2014, and 2015 using the Sum-of-the-Years'-Digits Method. (Round to the nearest whole dollar.)

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

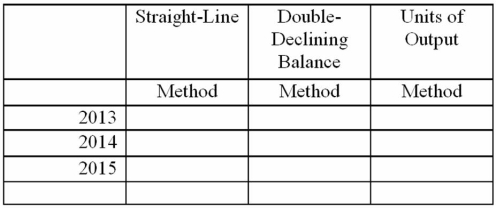

k this deck

66

On January 2, 2013, the Unit Manufacturing Company purchased manufacturing equipment for $62,000. The equipment is expected to have a useful life of six years and a salvage value of $2,000. Prepare a schedule showing the annual depreciation for each of the first three years of the asset's life under the straight-line method, the double-declining-balance method, and the sum-of-the-years'-digits method.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

67

On, January 2, 2013, Rubble Sand and Gravel Company purchased equipment for $77,000. The equipment was to be used for five years and had a $2,000 estimated residual value.

On January 2, 2013, equipment was sold for $35,000. Record the transactions on page 9 of a general journal. Omit descriptions.

On January 2, 2013, equipment was sold for $35,000. Record the transactions on page 9 of a general journal. Omit descriptions.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

68

Selected transactions of the Harrel Company are listed below. The company uses the straight-line method of depreciation. Record the transactions on page 9 of a general journal. Omit descriptions.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

69

On January 3, 2013, the Soloman Toy Company purchased a machine for $24,000. The machine is expected to produce 200,000 units during its useful life of five years and have a salvage value of $2,000 at the end of that period. The machine produced 41,000 units in 2013, 38,000 units in 2014, and 40,000 units in 2015. Prepare a schedule showing the annual depreciation for 2013, 2014, and 2015 under the straight-line method and the units-of-output method.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

70

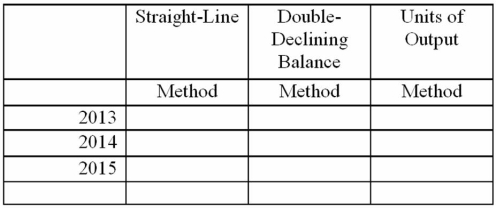

Modern Products Company purchased new packaging equipment for $245,000 on January 1, 2013. The equipment is expected to be used for 6 years, or 60,000 operating hours. It has an estimated salvage value of $5,000. The equipment was used for 10,000 hours in 2013, 15,000 hours in 2014, and 12,000 hours in 2015.

Compute annual depreciation expense for the first three years, using the straight-line method, the double-declining balance method, and the units of output method.

Compute annual depreciation expense for the first three years, using the straight-line method, the double-declining balance method, and the units of output method.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

71

All of the following refer to the handling of a decline in value of property, plant, and equipment except

A) depreciation.

B) impairment.

C) realization principle.

D) conservatism constraint.

A) depreciation.

B) impairment.

C) realization principle.

D) conservatism constraint.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

72

Modern Products Company purchased new packaging equipment for $245,000 on January 1, 2013. The equipment is expected to be used for 6 years, or 60,000 operating hours. It has an estimated salvage value of $5,000. The equipment was used for 10,000 hours in 2013, 15,000 hours in 2014, and 12,000 hours in 2015.

Compute annual depreciation expense for the first three years, using the straight-line method, the double-declining balance method, and the units of output method.

Compute annual depreciation expense for the first three years, using the straight-line method, the double-declining balance method, and the units of output method.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

73

Using the information shown, calculate the depreciation for 2013, 2014, and 2015 under the double-declining-balance method (DDB).

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

74

Intangible assets may be purchased or developed. If developed, they are categorized as Research and Development and

A) depreciated over their useful life.

B) amortized over their useful life.

C) depleted over their useful life.

D) expensed.

A) depreciated over their useful life.

B) amortized over their useful life.

C) depleted over their useful life.

D) expensed.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

75

Using the information shown, write the journal entry for the purchase of the Office Furniture assuming it was purchased on credit by signing a note and the journal entry for the Office Equipment purchase assuming that a check was written for it.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

76

MPG Industries purchased a new printing press on January 2, 2013 for a cost of $245,000. Transportation costs to have it delivered were $734. The floor had to have new supports because of the weight of the press. The new supports cost $2,540, which included installation. After the press was in place, two employees took training classes to learn how to use the press at a cost of $1,600. The Equipment account is debited for what amount?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

77

In 2013 Lucky Mining Company paid $800,000 for mining rights. It is estimated that a total of 400,000 kilograms of ore are available to be extracted. During 2013, 60,000 tons of ore were mined. What is the amount of Depletion Expense recorded in the adjusting entry for 2013?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

78

The steps in the process of determining an impairment loss in their proper order are

A) apply the recoverability test, review circumstances that suggest impairment, compute the amount of the impairment.

B) apply the recoverability test, review circumstances that suggest impairment, record the amount of the impairment.

C) review circumstances that suggest impairment, apply the recoverability test, and compute the amount of the impairment.

D) review circumstances that suggest impairment, apply the recoverability test, record the amount of the impairment.

A) apply the recoverability test, review circumstances that suggest impairment, compute the amount of the impairment.

B) apply the recoverability test, review circumstances that suggest impairment, record the amount of the impairment.

C) review circumstances that suggest impairment, apply the recoverability test, and compute the amount of the impairment.

D) review circumstances that suggest impairment, apply the recoverability test, record the amount of the impairment.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

79

On, January 2, 2013, Rubble Sand and Gravel Company purchased equipment for $77,000. The equipment was to be used for five years and had a $2,000 estimated residual value.

On January 2, 2013, equipment was sold for $30,000. Record the transactions on page 9 of a general journal. Omit descriptions.

On January 2, 2013, equipment was sold for $30,000. Record the transactions on page 9 of a general journal. Omit descriptions.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

80

DJG Corporation purchased land in order to build new corporate headquarters for a purchase price of $758,000. The lawyers charged $2,500 to handle the legal aspects of the purchase. Closing costs paid by DJG amounted to $15,160. There was an old factory and warehouse on the property that cost DJG $7,500 to have removed. In addition, CSB Construction charged the corporation $1,800 to grade the property to ensure proper drainage and an additional $15,800 build a drive, parking lot, and walkways. What amount should be recorded as land? What other account(s) should be increased and for what amount(s)?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck