Deck 9: Capital Budgeting Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/36

Play

Full screen (f)

Deck 9: Capital Budgeting Decisions

1

In an equipment selection capital budgeting decision, which of the following will increase the present value of the tax savings from the annual depreciation deductions?

A)an increase in the cost of capital.

B)an increase in the tax rate.

C)an increase in the salvage value of the equipment.

D)a decrease in the cost of new equipment.

A)an increase in the cost of capital.

B)an increase in the tax rate.

C)an increase in the salvage value of the equipment.

D)a decrease in the cost of new equipment.

B

2

A company needs an increase in working capital of $10,000 in a project that will last 4 years. The company's tax rate is 30% and its discount rate is 8%. The present value of the release of the working capital at the end of the project is closest to:

A)$7,350

B)$3,000

C)$7,000

D)$5,145

A)$7,350

B)$3,000

C)$7,000

D)$5,145

A

3

Suppose a machine costs $20,000 now, has an expected life of eight years, and will require a $7,000 overhaul at the end of the third year. If the tax rate is 40%, then the after-tax cost of this overhaul would be:

A)$12,000

B)$4,200

C)$8,000

D)$2,800

A)$12,000

B)$4,200

C)$8,000

D)$2,800

B

4

Last year the sales at Jersey Company were $200,000 and were all cash sales. The expenses at Jersey were $125,000 and were all cash expenses. The tax rate was 30%. The after-tax net cash inflow at Jersey last year from these operations was:

A)$37,500

B)$60,000

C)$22,500

D)$52,500

A)$37,500

B)$60,000

C)$22,500

D)$52,500

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

5

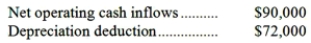

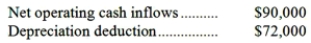

Ring Corporation uses a discount rate of 12% and has a tax rate of 30%. The following cash flows occur in the third year of an equipment selection investment project:  The total after-tax present value of the cash flows is closest to:

The total after-tax present value of the cash flows is closest to:

A)$10,152

B)$34,603

C)$60,235

D)$79,459

The total after-tax present value of the cash flows is closest to:

The total after-tax present value of the cash flows is closest to:A)$10,152

B)$34,603

C)$60,235

D)$79,459

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

6

Last year the sales at Seidelman Company were $700,000 and were all cash sales. The company's expenses were $450,000 and were all cash expenses. The tax rate was 35%. The after-tax net cash inflow at Seidelman last year was:

A)$700,000

B)$250,000

C)$162,500

D)$87,500

A)$700,000

B)$250,000

C)$162,500

D)$87,500

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

7

A company anticipates a taxable cash receipt of $30,000 in year 2 of a project. The company's tax rate is 30% and its discount rate is 10%. The present value of this future cash flow is closest to:

A)$17,355

B)$7,438

C)$9,000

D)$21,000

A)$17,355

B)$7,438

C)$9,000

D)$21,000

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

8

The Dill and Gherkin Law Firm is contemplating the decision to open up a branch office across town. The firm would sign a 5-year lease for a fully furnished office for $24,000 per year. The lease also requires a $30,000 security deposit upon signing. This deposit will be given back at the end of the 5-year lease term. No other amounts will need to be invested. However, additional operating costs are expected to be $65,000 per year for the 5 years. The firm expects to generate an additional $100,000 of revenue per year for the 5 years from the branch office. The firm's after-tax cost of capital is 16% and its tax rate is 30%. The net present value of this investment project is closest to:

A)$(509)

B)$5,206

C)$9,490

D)$14,206

A)$(509)

B)$5,206

C)$9,490

D)$14,206

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

9

A company anticipates a depreciation deduction of $20,000 in year 3 of a project. The company's tax rate is 30% and its discount rate is 14%. The present value of the annual depreciation deductions resulting from this deduction is closest to:

A)$9,450

B)$14,000

C)$6,000

D)$4,050

A)$9,450

B)$14,000

C)$6,000

D)$4,050

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

10

The reduction in taxes made possible by the annual depreciation deductions equals the depreciation deduction multiplied by the tax rate.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

11

When computing the net present value of the project, what are the annual after-tax cash receipts?

A)$338,000

B)$168,900

C)$394,100

D)$67,500

A)$338,000

B)$168,900

C)$394,100

D)$67,500

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

12

Depreciation expense reduces income taxes by an amount equal to:

A)one minus the tax rate times the amount of deprecation.

B)the tax rate times the amount of depreciation.

C)the amount of the depreciation.

D)one minus the amount of depreciation.

A)one minus the tax rate times the amount of deprecation.

B)the tax rate times the amount of depreciation.

C)the amount of the depreciation.

D)one minus the amount of depreciation.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

13

Not all cash inflows are taxable.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

14

The release of working capital at the end of an investment project is a taxable cash inflow.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

15

Superstrut is considering replacing an old press that cost $80,000 six years ago with a new one that would cost $245,000. The old press has a net book value of $15,000 and could be sold for $5,000. The increased production of the new press would require an investment in additional working capital of $6,000. The company's tax rate is 40%. Superstrut's net investment now in the project would be:

A)$256,000

B)$242,000

C)$250,000

D)$245,000

A)$256,000

B)$242,000

C)$250,000

D)$245,000

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

16

When a company invests in equipment, it gets to immediately expense the cost of the equipment on the company's tax reports.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

17

The after-tax cost of a deductible cash expense is:

A)The amount of the cash expense.

B)The amount of the cash expense times the tax rate.

C)The amount of the cash expense times 1 minus the tax rate.

D)Zero.

A)The amount of the cash expense.

B)The amount of the cash expense times the tax rate.

C)The amount of the cash expense times 1 minus the tax rate.

D)Zero.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

18

Last year the sales at Summit Company were $400,000 and were all cash sales. The expenses at Summit were $250,000 and were all cash expenses. The tax rate was 40%. The after-tax net cash inflow at Summit last year was:

A)$150,000

B)$60,000

C)$90,000

D)$400,000

A)$150,000

B)$60,000

C)$90,000

D)$400,000

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

19

Consider a machine which costs $115,000 now and which has a useful life of seven years. This machine will require a major overhaul at the end of the fourth year which will cost "X" dollars. If the tax rate is 40%, and if the after-tax cash outflow for this overhaul is $3,600, then the amount of "X" in dollars is:

A)$6,000

B)$9,000

C)$2,160

D)$1,440

A)$6,000

B)$9,000

C)$2,160

D)$1,440

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

20

A company anticipates a taxable cash expense of $80,000 in year 2 of a project. The company's tax rate is 30% and its discount rate is 10%. The present value of this future cash flow is closest to:

A)$(56,000)

B)$(19,835)

C)$(46,281)

D)$(24,000)

A)$(56,000)

B)$(19,835)

C)$(46,281)

D)$(24,000)

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

21

The net present value of the project is closest to:

A)$11,914

B)$37,601

C)$10,464

D)$34,151

A)$11,914

B)$37,601

C)$10,464

D)$34,151

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

22

By how much does the depreciation deduction reduce taxes each year in which the depreciation deduction is taken?

A)$6,500

B)$15,167

C)$18,200

D)$7,800

A)$6,500

B)$15,167

C)$18,200

D)$7,800

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

23

By how much does the depreciation deduction reduce taxes each year in which the depreciation deduction is taken?

A)$45,000

B)$75,000

C)$105,000

D)$32,143

A)$45,000

B)$75,000

C)$105,000

D)$32,143

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

24

A company is considering purchasing an asset for $50,000 that would have a useful life of 8 years and would have a salvage value of $5,000. For tax purposes, the entire original cost of the asset would be depreciated over 8 years using the straight-line method and the salvage value would be ignored. The asset would generate annual net cash inflows of $26,000 throughout its useful life. The project would require additional working capital of $8,000, which would be released at the end of the project. The company's tax rate is 40% and its discount rate is 13%.

Required:

What is the net present value of the asset?

Required:

What is the net present value of the asset?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

25

When computing the net present value of the project, what is the after-tax cash flow from the salvage value in the final year?

A)$9,100

B)$3,900

C)$13,000

D)$0

A)$9,100

B)$3,900

C)$13,000

D)$0

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

26

The net present value of the project is closest to:

A)$250,815

B)$84,495

C)$109,800

D)$276,120

A)$250,815

B)$84,495

C)$109,800

D)$276,120

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

27

When computing the net present value of the project, what are the annual after-tax cash expenses?

A)$12,900

B)$30,100

C)$55,900

D)$30,000

A)$12,900

B)$30,100

C)$55,900

D)$30,000

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

28

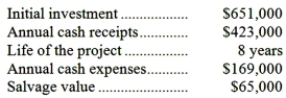

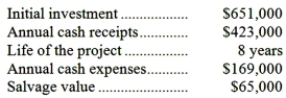

Eisenbeis Inc. has provided the following data concerning a proposed investment project:  The company's tax rate is 30%. For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 7 years. The company uses a discount rate of 13%.

The company's tax rate is 30%. For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 7 years. The company uses a discount rate of 13%.

Required:

Compute the net present value of the project.

The company's tax rate is 30%. For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 7 years. The company uses a discount rate of 13%.

The company's tax rate is 30%. For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 7 years. The company uses a discount rate of 13%.Required:

Compute the net present value of the project.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

29

When computing the net present value of the project, what is the after-tax cash flow from the salvage value in the final year?

A)$22,500

B)$75,000

C)$52,500

D)$0

A)$22,500

B)$75,000

C)$52,500

D)$0

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

30

When computing the net present value of the project, what are the annual after-tax cash receipts?

A)$39,000

B)$13,650

C)$54,600

D)$23,400

A)$39,000

B)$13,650

C)$54,600

D)$23,400

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

31

When computing the net present value of the project, what are the annual after-tax cash receipts?

A)$73,500

B)$77,000

C)$58,000

D)$31,500

A)$73,500

B)$77,000

C)$58,000

D)$31,500

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

32

Management is considering purchasing an asset for $30,000 that would have a useful life of 5 years and no salvage value. For tax purposes, the entire original cost of the asset would be depreciated over 5 years using the straight-line method. The asset would generate annual net cash inflows of $21,000 throughout its useful life. The project would require additional working capital of $4,000, which would be released at the end of the project. The company's tax rate is 40% and its discount rate is 8%.

Required:

What is the net present value of the asset?

Required:

What is the net present value of the asset?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

33

Sarafin Inc. is considering a project that would require an initial investment of $693,000 and would have a useful life of 7 years. The annual cash receipts would be $416,000 and the annual cash expenses would be $208,000. The salvage value of the assets used in the project would be $35,000. The company's tax rate is 30%. For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 15%.

Required:

Compute the net present value of the project.

Required:

Compute the net present value of the project.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

34

The net present value of the project is closest to:

A)$227,071

B)$58,113

C)$241,435

D)$43,749

A)$227,071

B)$58,113

C)$241,435

D)$43,749

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

35

When computing the net present value of the project, what is the after-tax cash flow from the salvage value in the final year?

A)$0

B)$31,500

C)$45,000

D)$13,500

A)$0

B)$31,500

C)$45,000

D)$13,500

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

36

When computing the net present value of the project, what are the annual after-tax cash expenses?

A)$235,000

B)$217,000

C)$93,000

D)$403,000

A)$235,000

B)$217,000

C)$93,000

D)$403,000

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck