Deck 21: The Balance of Payments, Exchange Rates, and Trade Deficits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/152

Play

Full screen (f)

Deck 21: The Balance of Payments, Exchange Rates, and Trade Deficits

1

U.S. imports:

A) Increase the foreign demand for foreign currencies

B) Increase the domestic demand for foreign currencies

C) Decrease the foreign supply of foreign currencies

D) Increase the domestic supply of foreign currencies

A) Increase the foreign demand for foreign currencies

B) Increase the domestic demand for foreign currencies

C) Decrease the foreign supply of foreign currencies

D) Increase the domestic supply of foreign currencies

Increase the domestic demand for foreign currencies

2

Which of the following transactions represents a credit on the financial account of the U.S. balance of payments?

A) Oil is imported from Venezuela

B) United States firms pay dividends to foreigners

C) United States citizens purchase foreign securities

D) A Canadian firm increases its direct investment in its U.S. branch

A) Oil is imported from Venezuela

B) United States firms pay dividends to foreigners

C) United States citizens purchase foreign securities

D) A Canadian firm increases its direct investment in its U.S. branch

A Canadian firm increases its direct investment in its U.S. branch

3

U.S. exports create a:

A) Supply of foreign currencies and a demand for dollars in the foreign exchange markets

B) Demand for foreign currencies and a supply of dollars in the foreign exchange markets

C) Supply of foreign currencies and a supply of dollars in the foreign exchange markets

D) Demand for foreign currencies and a demand for dollars in the foreign exchange markets

A) Supply of foreign currencies and a demand for dollars in the foreign exchange markets

B) Demand for foreign currencies and a supply of dollars in the foreign exchange markets

C) Supply of foreign currencies and a supply of dollars in the foreign exchange markets

D) Demand for foreign currencies and a demand for dollars in the foreign exchange markets

Supply of foreign currencies and a demand for dollars in the foreign exchange markets

4

When a U.S. company purchases a factory in Singapore, this will be a:

A) Credit on the current account of the U.S. balance of payments

B) Debit on the current account of the U.S. balance of payments

C) Credit on the financial account of the U.S. balance of payments

D) Debit on the financial account of the U.S. balance of payments

A) Credit on the current account of the U.S. balance of payments

B) Debit on the current account of the U.S. balance of payments

C) Credit on the financial account of the U.S. balance of payments

D) Debit on the financial account of the U.S. balance of payments

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

5

A nation's balance of trade on goods is equal to its exports of goods less its imports of:

A) Goods

B) Capital

C) Financial assets

D) Official reserves

A) Goods

B) Capital

C) Financial assets

D) Official reserves

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

6

The equilibrium exchange rate between two currencies is determined by the supply and demand in the:

A) Traded goods markets

B) Stock exchange markets

C) Foreign exchange markets

D) Money markets

A) Traded goods markets

B) Stock exchange markets

C) Foreign exchange markets

D) Money markets

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

7

French and German farmers wanting to buy equipment from an American manufacturer based in the U.S. will be:

A) Supplying dollars and also supplying euros in the foreign exchange market

B) Demanding dollars and also demanding euros in the foreign exchange market

C) Supplying dollars and demanding euros in the foreign exchange market

D) Supplying euros and demanding dollars in the foreign exchange market

A) Supplying dollars and also supplying euros in the foreign exchange market

B) Demanding dollars and also demanding euros in the foreign exchange market

C) Supplying dollars and demanding euros in the foreign exchange market

D) Supplying euros and demanding dollars in the foreign exchange market

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

8

When a U.S. agribusiness company sells 10,000 units of cow vaccine to a company in France, this transaction will represent a:

A) Credit on the current account of the U.S. balance of payments

B) Debit on the current account of the U.S. balance of payments

C) Credit on the financial account of the U.S. balance of payments

D) Debit on the financial account of the U.S. balance of payments

A) Credit on the current account of the U.S. balance of payments

B) Debit on the current account of the U.S. balance of payments

C) Credit on the financial account of the U.S. balance of payments

D) Debit on the financial account of the U.S. balance of payments

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

9

Which transaction represents a debit in the current account section of the U.S. balance of payments?

A) The Arab Capital Investment Corporation makes a loan to a U.S. firm

B) A U.S. subsidiary exports raw materials to the Canadian parent company

C) U.S. tourists in Great Britain purchase pounds with dollars in order to buy souvenirs

D) U.S. firms and individuals receive dividends from their investments in Latin America

A) The Arab Capital Investment Corporation makes a loan to a U.S. firm

B) A U.S. subsidiary exports raw materials to the Canadian parent company

C) U.S. tourists in Great Britain purchase pounds with dollars in order to buy souvenirs

D) U.S. firms and individuals receive dividends from their investments in Latin America

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

10

The current account on a nation's balance of payments statement includes all of the following except:

A) The nation's goods exports

B) The nation's goods imports

C) Net investment income

D) Net purchases of assets abroad

A) The nation's goods exports

B) The nation's goods imports

C) Net investment income

D) Net purchases of assets abroad

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

11

Which one of the following is part of the financial account on the U.S. balance of payments?

A) Net transfers

B) Net investment income

C) U.S. goods exports

D) U.S. purchases of assets abroad

A) Net transfers

B) Net investment income

C) U.S. goods exports

D) U.S. purchases of assets abroad

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

12

A nation's current account balance is equal to its exports less its imports of:

A) Goods and services

B) Goods and services, minus U.S. purchases of assets abroad

C) Goods and services, plus net investment income and net transfers

D) Goods and services, plus foreign purchases of assets in the United States

A) Goods and services

B) Goods and services, minus U.S. purchases of assets abroad

C) Goods and services, plus net investment income and net transfers

D) Goods and services, plus foreign purchases of assets in the United States

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

13

When a Japanese company buys a U.S. software company, this transaction will be a:

A) Credit on the current account of the U.S. balance of payments

B) Debit on the current account of the U.S. balance of payments

C) Credit on the financial account of the U.S. balance of payments

D) Debit on the financial account of the U.S. balance of payments

A) Credit on the current account of the U.S. balance of payments

B) Debit on the current account of the U.S. balance of payments

C) Credit on the financial account of the U.S. balance of payments

D) Debit on the financial account of the U.S. balance of payments

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements about the financing of international trade is correct?

A) International trade means the trading of financial assets for foreign exchange

B) Most international transactions are made with gold

C) Imports are more important than exports to the economy of a nation

D) Exports provide the foreign currencies needed to pay for imports

A) International trade means the trading of financial assets for foreign exchange

B) Most international transactions are made with gold

C) Imports are more important than exports to the economy of a nation

D) Exports provide the foreign currencies needed to pay for imports

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

15

When a U.S. importer buys 100,000 pairs of pants from a Hong Kong company, this transaction will represent a:

A) Credit on the current account of the U.S. balance of payments

B) Debit on the current account of the U.S. balance of payments

C) Credit on the financial account of the U.S. balance of payments

D) Debit on the financial account of the U.S. balance of payments

A) Credit on the current account of the U.S. balance of payments

B) Debit on the current account of the U.S. balance of payments

C) Credit on the financial account of the U.S. balance of payments

D) Debit on the financial account of the U.S. balance of payments

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

16

U.S. exports represent two flows:

A) An outflow of goods or services, and an outflow of payments

B) An inflow of goods or services, and an outflow of payments

C) An outflow of goods or services, and an inflow of payments

D) An inflow of goods or services, and an inflow of payments

A) An outflow of goods or services, and an outflow of payments

B) An inflow of goods or services, and an outflow of payments

C) An outflow of goods or services, and an inflow of payments

D) An inflow of goods or services, and an inflow of payments

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

17

The purchase of a British Rolls-Royce by a U.S. citizen would result in all of the following except a(n):

A) Supply of payments to England

B) Sale of dollars and the purchase of British pounds

C) Increase in imports to the United States

D) Gain of foreign exchange for the United States

A) Supply of payments to England

B) Sale of dollars and the purchase of British pounds

C) Increase in imports to the United States

D) Gain of foreign exchange for the United States

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

18

If a financial portfolio manager in the U.S. buys British company stocks in the London Stock Exchange, this would involve:

A) A demand for British pounds in the foreign exchange market

B) A supply of British pounds in the foreign exchange market

C) No effect on the demand for British pounds in the foreign exchange market

D) A demand for U.S. dollars in the foreign exchange market

A) A demand for British pounds in the foreign exchange market

B) A supply of British pounds in the foreign exchange market

C) No effect on the demand for British pounds in the foreign exchange market

D) A demand for U.S. dollars in the foreign exchange market

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

19

U.S. businesses are demanders of foreign currencies because they need them to:

A) Sell goods and services exported to foreign countries

B) Pay for goods and services imported from foreign countries

C) Receive interest payments from foreign governments

D) Receive interest payments from foreign businesses

A) Sell goods and services exported to foreign countries

B) Pay for goods and services imported from foreign countries

C) Receive interest payments from foreign governments

D) Receive interest payments from foreign businesses

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following shows the net difference between how much Americans forgave in debts owed to them by foreigners compared with how much foreigners forgave debts owed to them by Americans?

A) Current account

B) Capital account

C) Financial account

D) Net transfers

A) Current account

B) Capital account

C) Financial account

D) Net transfers

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

21

The following table contains hypothetical data for the U.S. balance of payments in a year. Answer the following question on the basis of these data. All figures are in billions of dollars. U.S.

Refer to the table above. The balance of trade in goods and services was:

A) $107 billion surplus

B) $82 billion deficit

C) $115 billion deficit

D) $55 billion surplus

Refer to the table above. The balance of trade in goods and services was:

A) $107 billion surplus

B) $82 billion deficit

C) $115 billion deficit

D) $55 billion surplus

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

22

The following table contains hypothetical data for the U.S. balance of payments in a year. Answer the following question on the basis of these data. All figures are in billions of dollars. U.S.

Refer to the table above. What does the figure for net investment income indicate?

A) Americans invested more abroad than the amount foreigners invested in the U.S.

B) The size of the net inflow of foreign investment to the United States in that year

C) The net amount Americans received as interest and dividends on existing American investments abroad

D) The net amount Americans paid as interest and dividends on existing foreign investments in the United States

Refer to the table above. What does the figure for net investment income indicate?

A) Americans invested more abroad than the amount foreigners invested in the U.S.

B) The size of the net inflow of foreign investment to the United States in that year

C) The net amount Americans received as interest and dividends on existing American investments abroad

D) The net amount Americans paid as interest and dividends on existing foreign investments in the United States

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

23

If there is a small surplus in the combined current account plus capital and financial account for a certain year, then to make the two accounts balance there will be:

A) An increase in the exchange rate

B) A decrease in the exchange rate

C) An increase in official reserve holdings

D) A decrease in official reserve holdings

A) An increase in the exchange rate

B) A decrease in the exchange rate

C) An increase in official reserve holdings

D) A decrease in official reserve holdings

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

24

The following table contains hypothetical data for the U.S. balance of payments in a year. Answer the following question on the basis of these data. All figures are in billions of dollars. U.S.

Refer to the table above. The figure for net transfers indicates that the United States:

A) Received a net public and private transfer of $22 billion from the rest of the world

B) Sent a net public and private transfer of $22 billion in remittances to the rest of the world

C) Sent a net private transfer of $22 billion to the rest of the world

D) Received a net private transfer of $22 billion from the rest of the world

Refer to the table above. The figure for net transfers indicates that the United States:

A) Received a net public and private transfer of $22 billion from the rest of the world

B) Sent a net public and private transfer of $22 billion in remittances to the rest of the world

C) Sent a net private transfer of $22 billion to the rest of the world

D) Received a net private transfer of $22 billion from the rest of the world

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

25

Remittances of Mexican workers in the U.S. to their families in Mexico are included in the U.S. balance of payments as a debit in the section on:

A) Trade in services

B) Net international transfers

C) Financial accounts

D) Capital accounts

A) Trade in services

B) Net international transfers

C) Financial accounts

D) Capital accounts

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

26

The following table contains hypothetical data for the U.S. balance of payments in a year. Answer the following question on the basis of these data. All figures are in billions of dollars. U.S.

Refer to the table above. The data indicate that there was a trade:

A) Deficit in goods and also a trade deficit in services

B) Surplus in goods and also a trade surplus in services

C) Deficit in goods and a trade surplus in services

D) Surplus in goods and a trade deficit in services

Refer to the table above. The data indicate that there was a trade:

A) Deficit in goods and also a trade deficit in services

B) Surplus in goods and also a trade surplus in services

C) Deficit in goods and a trade surplus in services

D) Surplus in goods and a trade deficit in services

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is an item in the current account balance of the United States? The purchase of:

A) A U.S. company by a foreign company

B) Stock in a foreign corporation by a U.S. company

C) Insurance in the United States by a foreign company

D) A United States Treasury bond by a wealthy foreigner

A) A U.S. company by a foreign company

B) Stock in a foreign corporation by a U.S. company

C) Insurance in the United States by a foreign company

D) A United States Treasury bond by a wealthy foreigner

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

28

Official reserves used to achieve a balance of payments between nations engaging in international trade are held by:

A) Private businesses engaging in trade

B) Central banks of the nations engaged in trade

C) Commercial banks which make loans to businesses engaging in trade

D) Commercial banks which make loans to governments which engage in trade

A) Private businesses engaging in trade

B) Central banks of the nations engaged in trade

C) Commercial banks which make loans to businesses engaging in trade

D) Commercial banks which make loans to governments which engage in trade

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

29

In one year the United States had a current account deficit of $461 billion. The balance on the capital account was -$8 billion. What was the balance on the financial account?

A) -$461 billion

B) +$469 billion

C) -$469 billion

D) +$453 billion

A) -$461 billion

B) +$469 billion

C) -$469 billion

D) +$453 billion

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

30

The following table contains hypothetical data for the U.S. balance of payments in a year. Answer the following question on the basis of these data. All figures are in billions of dollars. U.S.

Refer to the table above. If there was a net inflow of $7 billion in official reserves in the capital and financial account that year, the United States experienced a balance-of-payments:

A) Surplus of $7 billion

B) Deficit of $7 billion

C) Surplus of $99 billion

D) Deficit of $99 billion

Refer to the table above. If there was a net inflow of $7 billion in official reserves in the capital and financial account that year, the United States experienced a balance-of-payments:

A) Surplus of $7 billion

B) Deficit of $7 billion

C) Surplus of $99 billion

D) Deficit of $99 billion

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

31

A trade deficit means a net:

A) Inflow of payments for goods and services

B) Outflow of goods and services

C) Inflow of goods and services

D) Excess of exports over imports

A) Inflow of payments for goods and services

B) Outflow of goods and services

C) Inflow of goods and services

D) Excess of exports over imports

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following appears as a positive item on the balance of payments accounts for the United States?

A) U.S. government sending aid to natural-disaster victims in Asia

B) American tourists spending money in the other countries

C) The buying of U.S. Treasury bonds by a foreign bank

D) The payment of stock dividends by U.S. firms to foreign shareholders

A) U.S. government sending aid to natural-disaster victims in Asia

B) American tourists spending money in the other countries

C) The buying of U.S. Treasury bonds by a foreign bank

D) The payment of stock dividends by U.S. firms to foreign shareholders

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

33

The following table contains hypothetical data for the U.S. balance of payments in a year. Answer the following question on the basis of these data. All figures are in billions of dollars. U.S.

Refer to the table above. The balance on the current account was a:

A) $51 billion surplus

B) $92 billion deficit

C) $22 billion surplus

D) $82 billion deficit

Refer to the table above. The balance on the current account was a:

A) $51 billion surplus

B) $92 billion deficit

C) $22 billion surplus

D) $82 billion deficit

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

34

Answer the question on the basis of the following balance of payments data for the hypothetical nation of Econland. All figures are in billions of dollars. (1) Goods exports +$220

(2) Goods imports -328

(3) Exports of services +54

(4) Imports of services -55

(5) Net investment income +18

(6) Net transfers -11

(7) Capital account -1

(8) Foreign purchases of Econland assets +124

(9) Econland purchases of foreign assets -21

Refer to the table above. Econland's balance on the current account shows a:

A) Deficit of $91 billion

B) Deficit of $102 billion

C) Deficit of $109 billion

D) Surplus of $109 billion

(2) Goods imports -328

(3) Exports of services +54

(4) Imports of services -55

(5) Net investment income +18

(6) Net transfers -11

(7) Capital account -1

(8) Foreign purchases of Econland assets +124

(9) Econland purchases of foreign assets -21

Refer to the table above. Econland's balance on the current account shows a:

A) Deficit of $91 billion

B) Deficit of $102 billion

C) Deficit of $109 billion

D) Surplus of $109 billion

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

35

The settling of any net deficit in the combined current, and capital and financial accounts is done with:

A) Capital reserves

B) Official reserves

C) Net transfers

D) Net investment income

A) Capital reserves

B) Official reserves

C) Net transfers

D) Net investment income

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following would be an indication that a nation has a balance of payments deficit?

A) It is buying gold abroad

B) Its imports exceed its exports

C) Its holdings of official reserves are declining

D) It is borrowing abroad to finance capital investments

A) It is buying gold abroad

B) Its imports exceed its exports

C) Its holdings of official reserves are declining

D) It is borrowing abroad to finance capital investments

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

37

Answer the question on the basis of the following balance of payments data for the hypothetical nation of Econland. All figures are in billions of dollars. (1) Goods exports +$220

(2) Goods imports -328

(3) Exports of services +54

(4) Imports of services -55

(5) Net investment income +18

(6) Net transfers -11

(7) Capital account -1

(8) Foreign purchases of Econland assets +124

(9) Econland purchases of foreign assets -21

Refer to the table above. Econland's balance of trade in goods and services shows a:

A) Net inflow of payments of $109 billion

B) Net outflow of payments of $109 billion

C) Net inflow of payments of $108 billion

D) Net outflow of payments of $108 billion

(2) Goods imports -328

(3) Exports of services +54

(4) Imports of services -55

(5) Net investment income +18

(6) Net transfers -11

(7) Capital account -1

(8) Foreign purchases of Econland assets +124

(9) Econland purchases of foreign assets -21

Refer to the table above. Econland's balance of trade in goods and services shows a:

A) Net inflow of payments of $109 billion

B) Net outflow of payments of $109 billion

C) Net inflow of payments of $108 billion

D) Net outflow of payments of $108 billion

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

38

The following table contains hypothetical data for the U.S. balance of payments in a year. Answer the following question on the basis of these data. All figures are in billions of dollars. U.S.

Refer to the table above. The balance on the financial account was a:

A) $92 billion surplus

B) $97 billion surplus

C) $92 billion deficit

D) $97 billion deficit

Refer to the table above. The balance on the financial account was a:

A) $92 billion surplus

B) $97 billion surplus

C) $92 billion deficit

D) $97 billion deficit

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

39

In the Balance of Payments statement, a current account surplus will be matched by a:

A) Capital and financial accounts deficit

B) Capital and financial accounts surplus

C) Trade deficit

D) Trade surplus

A) Capital and financial accounts deficit

B) Capital and financial accounts surplus

C) Trade deficit

D) Trade surplus

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

40

A nation's annual balance of payments statement must always balance because:

A) A nation's imports are limited to the value of its exports

B) A nation's exports and imports are always paid with dollars

C) All international transactions must be settled in one way or another

D) A trade deficit must be matched by an equal surplus of investment income

A) A nation's imports are limited to the value of its exports

B) A nation's exports and imports are always paid with dollars

C) All international transactions must be settled in one way or another

D) A trade deficit must be matched by an equal surplus of investment income

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

41

If the exchange rate is $1 = 0.7841 euro, then a French DVD priced at 20 euros would cost to an American buyer (excluding taxes and other fees):

A) $15.68

B) $20.78

C) $25.51

D) $27.84

A) $15.68

B) $20.78

C) $25.51

D) $27.84

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

42

The exchange rate for the Mexican peso changes from $1 = 5 pesos to $1 = 6 pesos. This change will lead to:

A) U.S. goods becoming less expensive for Mexicans

B) Mexican goods becoming more expensive for Americans

C) An increase in U.S. exports to Mexico

D) A decrease in U.S. exports to Mexico

A) U.S. goods becoming less expensive for Mexicans

B) Mexican goods becoming more expensive for Americans

C) An increase in U.S. exports to Mexico

D) A decrease in U.S. exports to Mexico

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

43

The following table contains data for the U.S. balance of payments in a prior year. Answer the question on the basis of this information. All figures are in billions of dollars. U.S. goods exports +$793

U.S. goods imports -1573

U.S. exports of service +280

U.S. imports of services -222

Net investment income +5

Net transfers -81

Capital account -5

Foreign purchases of assets in the U.S. +1198

U.S. purchases of foreign assets -395

Refer to the table above. There was a:

A) Trade deficit, but a current account surplus

B) Trade surplus, but a current account deficit

C) Trade surplus, and a current account surplus

D) Trade deficit, and a current account deficit

U.S. goods imports -1573

U.S. exports of service +280

U.S. imports of services -222

Net investment income +5

Net transfers -81

Capital account -5

Foreign purchases of assets in the U.S. +1198

U.S. purchases of foreign assets -395

Refer to the table above. There was a:

A) Trade deficit, but a current account surplus

B) Trade surplus, but a current account deficit

C) Trade surplus, and a current account surplus

D) Trade deficit, and a current account deficit

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

44

Answer the question on the basis of the following balance of payments data for the hypothetical nation of Econland. All figures are in billions of dollars. (1) Goods exports +$220

(2) Goods imports -328

(3) Exports of services +54

(4) Imports of services -55

(5) Net investment income +18

(6) Net transfers -11

(7) Capital account -1

(8) Foreign purchases of Econland assets +124

(9) Econland purchases of foreign assets -21

Refer to the table above. Econland's balance on the capital and financial accounts is a:

A) Deficit of $110 billion

B) Surplus of $92 billion

C) Surplus of $102 billion

D) Surplus of $103 billion

(2) Goods imports -328

(3) Exports of services +54

(4) Imports of services -55

(5) Net investment income +18

(6) Net transfers -11

(7) Capital account -1

(8) Foreign purchases of Econland assets +124

(9) Econland purchases of foreign assets -21

Refer to the table above. Econland's balance on the capital and financial accounts is a:

A) Deficit of $110 billion

B) Surplus of $92 billion

C) Surplus of $102 billion

D) Surplus of $103 billion

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

45

In one year the dollar would buy 162 Japanese yen, but ten years later, it would buy only 123 yen. Relative to the yen, the value of the dollar:

A) Increased by about 32 percent

B) Decreased by about 24 percent

C) Decreased by about 32 percent

D) Increased by about 24 percent

A) Increased by about 32 percent

B) Decreased by about 24 percent

C) Decreased by about 32 percent

D) Increased by about 24 percent

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

46

In a graph showing the market supply and demand for British pounds in terms of U.S. dollars, the supply-of-pounds curve is upsloping because:

A) Fewer British pounds can be purchased per dollar if U.S. dollars become more expensive

B) Fewer U.S. dollars can be purchased per pound if the British pounds become less expensive

C) The British will purchase more U.S. goods or services when the dollar price of pounds rises

D) The British will purchase more U.S. goods or services when the dollar price of pounds falls

A) Fewer British pounds can be purchased per dollar if U.S. dollars become more expensive

B) Fewer U.S. dollars can be purchased per pound if the British pounds become less expensive

C) The British will purchase more U.S. goods or services when the dollar price of pounds rises

D) The British will purchase more U.S. goods or services when the dollar price of pounds falls

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

47

If the U.S. dollar appreciates relative to the British pound, then:

A) The pound will appreciate relative to the U.S. dollar

B) The pound will depreciate relative to the U.S. dollar

C) British goods will be more expensive for Americans

D) American goods will be less expensive for the British

A) The pound will appreciate relative to the U.S. dollar

B) The pound will depreciate relative to the U.S. dollar

C) British goods will be more expensive for Americans

D) American goods will be less expensive for the British

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

48

In a graph showing the market supply and demand for British pounds in terms of U.S. dollars, the demand-for-pounds curve is downsloping because:

A) Fewer British pounds can be purchased if pounds become less expensive

B) Fewer U.S. dollars can be purchased if British pounds become less expensive

C) More U.S. dollars can be purchased if British pounds become more expensive

D) More British pounds can be purchased if pounds become less expensive

A) Fewer British pounds can be purchased if pounds become less expensive

B) Fewer U.S. dollars can be purchased if British pounds become less expensive

C) More U.S. dollars can be purchased if British pounds become more expensive

D) More British pounds can be purchased if pounds become less expensive

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

49

Foreign exchange rates refer to the:

A) Price at which purchases and sales of foreign goods take place

B) Rate of exchange of goods and services between two trading nations

C) Price of one nation's currency in terms of another nation's currency

D) Difference between exports and imports of a particular nation with another

A) Price at which purchases and sales of foreign goods take place

B) Rate of exchange of goods and services between two trading nations

C) Price of one nation's currency in terms of another nation's currency

D) Difference between exports and imports of a particular nation with another

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

50

If an American can purchase 40,000 British pounds for $90,000, the dollar rate of exchange for the pound is:

A) $0.44

B) $0.23

C) $2.25

D) $2.00

A) $0.44

B) $0.23

C) $2.25

D) $2.00

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

51

Assume an exchange rate of $1 = .60 British pounds. A U.S. product sells in Britain for 18 pounds. By what percentage will dollar revenues change if the dollar price of a pound falls to .50 pounds?

A) -20 percent

B) -16 percent

C) +16 percent

D) +20 percent

A) -20 percent

B) -16 percent

C) +16 percent

D) +20 percent

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

52

All else being equal, increased U.S. exports to nations in the European Union create a:

A) Demand for euros

B) Supply of euros

C) Shortage of euros

D) Surplus of euros

A) Demand for euros

B) Supply of euros

C) Shortage of euros

D) Surplus of euros

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

53

If a European importer can buy $10,000 for 11,100 euros, the exchange rate for the euro is:

A) 1 euro = $0.80

B) 1 euro = $0.90

C) 1 euro = $0.95

D) 1 euro = $1.11

A) 1 euro = $0.80

B) 1 euro = $0.90

C) 1 euro = $0.95

D) 1 euro = $1.11

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

54

In equilibrium, if $1 = 0.5 pound sterling and 1 pound sterling = 40 Swiss francs, the exchange rate between dollar and franc will be:

A) 1 franc = $.10

B) 1 franc = $.20

C) $1 = 80 francs

D) $1 = 20 francs

A) 1 franc = $.10

B) 1 franc = $.20

C) $1 = 80 francs

D) $1 = 20 francs

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

55

An increase in the dollar price of the British pounds will:

A) Increase the pound price of dollars

B) Decrease the pound price of dollars

C) Leave the pound price of dollars unchanged

D) Cause Britain's terms of trade with the United States to deteriorate

A) Increase the pound price of dollars

B) Decrease the pound price of dollars

C) Leave the pound price of dollars unchanged

D) Cause Britain's terms of trade with the United States to deteriorate

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

56

To Americans buyers, there is a decrease in the relative prices of Japanese goods when the:

A) Yen appreciates

B) Dollar appreciates

C) Inflation rate in the United States is higher than the inflation rate in Japan, and there are flexible exchange rates

D) Inflation rate in Japan is higher than the inflation rate in the United States and there are fixed exchange rates

A) Yen appreciates

B) Dollar appreciates

C) Inflation rate in the United States is higher than the inflation rate in Japan, and there are flexible exchange rates

D) Inflation rate in Japan is higher than the inflation rate in the United States and there are fixed exchange rates

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

57

When the exchange rate between pounds and dollars moves from $2 = 1 pound to $1 = 1 pound, we say that the dollar has:

A) Depreciated

B) Appreciated

C) Inflated

D) Deflated

A) Depreciated

B) Appreciated

C) Inflated

D) Deflated

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

58

The following table contains data for the U.S. balance of payments in a prior year. Answer the question on the basis of this information. All figures are in billions of dollars. U.S. goods exports +$793

U.S. goods imports -1573

U.S. exports of service +280

U.S. imports of services -222

Net investment income +5

Net transfers -81

Capital account -5

Foreign purchases of assets in the U.S. +1198

U.S. purchases of foreign assets -395

Refer to the table above. The data indicate that Americans:

A) Bought foreign assets abroad more than foreigners bought assets in the U.S.

B) Invested abroad more than foreigners invested in America

C) Earned more from their investments abroad than foreigners earned from their investments in America

D) Sold more products to buyers abroad than what foreign producers sold to buyers in America

U.S. goods imports -1573

U.S. exports of service +280

U.S. imports of services -222

Net investment income +5

Net transfers -81

Capital account -5

Foreign purchases of assets in the U.S. +1198

U.S. purchases of foreign assets -395

Refer to the table above. The data indicate that Americans:

A) Bought foreign assets abroad more than foreigners bought assets in the U.S.

B) Invested abroad more than foreigners invested in America

C) Earned more from their investments abroad than foreigners earned from their investments in America

D) Sold more products to buyers abroad than what foreign producers sold to buyers in America

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

59

The following table contains data for the U.S. balance of payments in a prior year. Answer the question on the basis of this information. All figures are in billions of dollars. U.S. goods exports +$793

U.S. goods imports -1573

U.S. exports of service +280

U.S. imports of services -222

Net investment income +5

Net transfers -81

Capital account -5

Foreign purchases of assets in the U.S. +1198

U.S. purchases of foreign assets -395

By how much did Americans forgive debt owed to them by foreigners than foreigners forgave debt owed to them by Americans?

A) +$5 billion

B) -$5 billion

C) +$72 billion

D) -$72 billion

U.S. goods imports -1573

U.S. exports of service +280

U.S. imports of services -222

Net investment income +5

Net transfers -81

Capital account -5

Foreign purchases of assets in the U.S. +1198

U.S. purchases of foreign assets -395

By how much did Americans forgive debt owed to them by foreigners than foreigners forgave debt owed to them by Americans?

A) +$5 billion

B) -$5 billion

C) +$72 billion

D) -$72 billion

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

60

If the Canadian dollar price of United States dollars increases from C$.80 to C$1.00, it can be concluded that:

A) Both countries are on the international gold standard

B) The Canadian dollar has appreciated in value relative to the United States dollar

C) The United States dollar has depreciated in value relative to the Canadian dollar

D) The Canadian dollar has depreciated in value relative to the United States dollar

A) Both countries are on the international gold standard

B) The Canadian dollar has appreciated in value relative to the United States dollar

C) The United States dollar has depreciated in value relative to the Canadian dollar

D) The Canadian dollar has depreciated in value relative to the United States dollar

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

61

If there is a recession in the United Kingdom and a reduction in British imports, and an economic boom in the United States and an increase in U.S. imports, then these events are most likely to cause the British pound to:

A) Appreciate and the U.S. dollar to appreciate

B) Depreciate and the U.S. dollar to depreciate

C) Appreciate and the U.S. dollar to depreciate

D) Depreciate and the U.S. dollar to appreciate

A) Appreciate and the U.S. dollar to appreciate

B) Depreciate and the U.S. dollar to depreciate

C) Appreciate and the U.S. dollar to depreciate

D) Depreciate and the U.S. dollar to appreciate

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

62

All of the following would add to the demand for U.S. dollars except:

A) Long-term capital inflows

B) Foreign travel by United States citizens

C) Exports of commodities from the United States

D) Travel by foreigners on United States airlines

A) Long-term capital inflows

B) Foreign travel by United States citizens

C) Exports of commodities from the United States

D) Travel by foreigners on United States airlines

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

63

United States exports, international tourism in the United States, and foreign capital inflow into the United States all give rise to:

A) Depreciation of the U.S. dollar

B) A supply of foreign currencies to the United States

C) A demand for foreign currencies in the United States

D) Decreased foreign exchange reserves in the United States

A) Depreciation of the U.S. dollar

B) A supply of foreign currencies to the United States

C) A demand for foreign currencies in the United States

D) Decreased foreign exchange reserves in the United States

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following statements is correct?

A) Under the gold standard, exchange rates fluctuate without restraint and thereby correct any international balance of payment disequilibrium

B) If nations X and Y are on the international gold standard, and X's exports to Y exceed X's imports from Y, then gold will flow from X to Y

C) If the dollar price of pounds rises, then the pound price of dollars will also rise

D) American exports tend to increase, while American imports tend to decrease, the supplies of foreign monies owned by American banks

A) Under the gold standard, exchange rates fluctuate without restraint and thereby correct any international balance of payment disequilibrium

B) If nations X and Y are on the international gold standard, and X's exports to Y exceed X's imports from Y, then gold will flow from X to Y

C) If the dollar price of pounds rises, then the pound price of dollars will also rise

D) American exports tend to increase, while American imports tend to decrease, the supplies of foreign monies owned by American banks

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

65

If Japanese autos surge in popularity in the United States, then this event is most likely to cause the Japanese yen to:

A) Appreciate and the U.S. dollar to depreciate

B) Depreciate and the U.S. dollar to appreciate

C) Appreciate and the U.S. dollar to appreciate

D) Depreciate and the U.S. dollar to depreciate

A) Appreciate and the U.S. dollar to depreciate

B) Depreciate and the U.S. dollar to appreciate

C) Appreciate and the U.S. dollar to appreciate

D) Depreciate and the U.S. dollar to depreciate

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

66

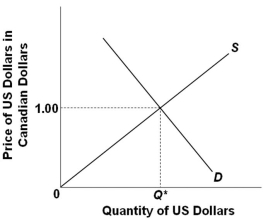

Refer to the graph above. If Canadian investors buy more U.S. financial and real assets, then:

Refer to the graph above. If Canadian investors buy more U.S. financial and real assets, then:A) The demand curve will shift left

B) The demand curve will shift right

C) The supply curve will shift left

D) The supply curve will shift right

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

67

When real interest rates in other countries rise relative to that in the U.S., other things being equal, we would expect the U.S. dollar to:

A) Appreciate

B) Depreciate

C) Inflate

D) Deflate

A) Appreciate

B) Depreciate

C) Inflate

D) Deflate

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

68

Consider the currency market for British pounds and U.S. dollars. A decrease in the supply of British pounds results in:

A) An appreciation of the pound and a depreciation of the dollar

B) A depreciation of the pound and a depreciation of the dollar

C) An appreciation of the pound and an appreciation of the dollar

D) A depreciation of the pound and an appreciation of the dollar

A) An appreciation of the pound and a depreciation of the dollar

B) A depreciation of the pound and a depreciation of the dollar

C) An appreciation of the pound and an appreciation of the dollar

D) A depreciation of the pound and an appreciation of the dollar

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

69

Other things being equal, the international value of foreign currencies will increase against the U.S. dollar if:

A) U.S. citizens reduce spending on imports

B) The U.S. Federal Reserve raises real interest rates

C) There is an increase in the number of foreign tourists in the United States

D) There are withdrawals of funds by foreigners from U.S. money markets

A) U.S. citizens reduce spending on imports

B) The U.S. Federal Reserve raises real interest rates

C) There is an increase in the number of foreign tourists in the United States

D) There are withdrawals of funds by foreigners from U.S. money markets

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

70

If currency speculators believe South Korea will have much lower inflation in the future than the United States, then this event is most likely to cause the South Korean won to:

A) Depreciate and the U.S. dollar to depreciate

B) Depreciate and the U.S. dollar to appreciate

C) Appreciate and the U.S. dollar to appreciate

D) Appreciate and the U.S. dollar to depreciate

A) Depreciate and the U.S. dollar to depreciate

B) Depreciate and the U.S. dollar to appreciate

C) Appreciate and the U.S. dollar to appreciate

D) Appreciate and the U.S. dollar to depreciate

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

71

Consider the currency market for British pounds and U.S. dollars. An increase in the supply of British pounds:

A) Results in an appreciation of the pound and a depreciation of the dollar

B) Results in a depreciation of the pound and a depreciation of the dollar

C) Is equivalent to an increase in the demand for the U.S. dollar

D) Is equivalent to a decrease in the demand for the U.S. dollar

A) Results in an appreciation of the pound and a depreciation of the dollar

B) Results in a depreciation of the pound and a depreciation of the dollar

C) Is equivalent to an increase in the demand for the U.S. dollar

D) Is equivalent to a decrease in the demand for the U.S. dollar

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

72

A currency depreciation in the foreign exchange market will:

A) Encourage imports into the country whose currency has depreciated

B) Discourage imports into the country whose currency has depreciated

C) Discourage exports from the country whose currency has depreciated

D) Encourage foreign travel by the citizens of the country whose currency has depreciated

A) Encourage imports into the country whose currency has depreciated

B) Discourage imports into the country whose currency has depreciated

C) Discourage exports from the country whose currency has depreciated

D) Encourage foreign travel by the citizens of the country whose currency has depreciated

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

73

When the U.S. dollar decreases in value relative to foreign currencies the:

A) Demand for U.S. exports will decrease

B) Supply of U.S. exports will decrease

C) Demand for U.S. exports will increase

D) Supply of U.S. exports will remain constant

A) Demand for U.S. exports will decrease

B) Supply of U.S. exports will decrease

C) Demand for U.S. exports will increase

D) Supply of U.S. exports will remain constant

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

74

Consider the currency market for British pounds and U.S. dollars. An increase in the demand for British pounds results in:

A) An appreciation of the pound and a depreciation of the dollar

B) A depreciation of the pound and a depreciation of the dollar

C) An appreciation of the pound and an appreciation of the dollar

D) A depreciation of the pound and an appreciation of the dollar

A) An appreciation of the pound and a depreciation of the dollar

B) A depreciation of the pound and a depreciation of the dollar

C) An appreciation of the pound and an appreciation of the dollar

D) A depreciation of the pound and an appreciation of the dollar

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

75

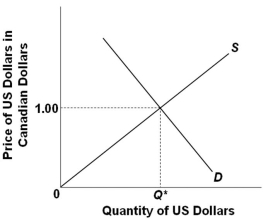

Refer to the graph above. Higher inflation in the United States relative to that in Canada, ceteris paribus, will cause a(n):

Refer to the graph above. Higher inflation in the United States relative to that in Canada, ceteris paribus, will cause a(n):A) Decrease in the supply of U.S. dollars

B) Increase in the demand for U.S. dollars

C) Decrease in the value of the U.S. dollar in terms of the Canadian dollar

D) Increase in the value of the U.S. dollar in terms of the Canadian dollar

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

76

If real interest rates rise in the United Kingdom relative to the United States, then this event is most likely to cause the British pound to:

A) Depreciate and the U.S. dollar to depreciate

B) Depreciate and the U.S. dollar to appreciate

C) Appreciate and the U.S. dollar to appreciate

D) Appreciate and the U.S. dollar to depreciate

A) Depreciate and the U.S. dollar to depreciate

B) Depreciate and the U.S. dollar to appreciate

C) Appreciate and the U.S. dollar to appreciate

D) Appreciate and the U.S. dollar to depreciate

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

77

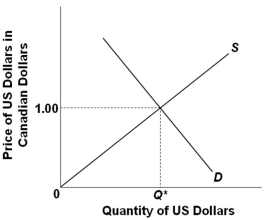

Refer to the graph above. If U.S. citizens flock to Canada for summer vacations and buy more Canadian goods and services, then the:

Refer to the graph above. If U.S. citizens flock to Canada for summer vacations and buy more Canadian goods and services, then the:A) The supply curve will shift left

B) The demand curve will shift right

C) The price of U.S. dollars in Canadian dollars will rise

D) The price of U.S. dollars in Canadian dollars will fall

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

78

Other things being equal, an increase in the U.S. rate of inflation is likely to cause an increase in the:

A) Quantity of U.S. exports

B) Quantity of U.S. imports

C) Demand for U.S. dollars

D) International value of the U.S. dollar

A) Quantity of U.S. exports

B) Quantity of U.S. imports

C) Demand for U.S. dollars

D) International value of the U.S. dollar

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

79

An increase in the income of country A relative to the income of country B will usually lead to an increase in country:

A) A's exports to country B

B) B's imports from country A

C) A's demand for the currency of country B

D) B's demand for the currency of country A

A) A's exports to country B

B) B's imports from country A

C) A's demand for the currency of country B

D) B's demand for the currency of country A

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

80

Other things being equal, which of the following is a necessary consequence of a depreciation of the U.S. dollar against other currencies?

A) The terms of trade will move in favor of the United States

B) The United States will experience an increase in the volume of imports

C) International speculators will buy U.S. dollars and sell other currencies

D) U.S. exports will become cheaper relative to other nations' products

A) The terms of trade will move in favor of the United States

B) The United States will experience an increase in the volume of imports

C) International speculators will buy U.S. dollars and sell other currencies

D) U.S. exports will become cheaper relative to other nations' products

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck