Deck 3: The Accounting Cycle: Capturing Economic Events

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/126

Play

Full screen (f)

Deck 3: The Accounting Cycle: Capturing Economic Events

1

Earning revenue increases owners' equity and expenses reduce owners' equity,therefore,revenues are recorded with debit entries and expenses are recorded with credit entries.

False

2

Decreases to owners' equity accounts are recorded using debits.

True

3

All liability accounts normally have a credit balance.

True

4

The ledger is a chronological,day-by-day,record of business transactions.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

5

Increases in owners' equity are recorded by credits; increases in assets and in liabilities are recorded by debits.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

6

When recording a journal entry,asset accounts are shown first,followed by liabilities,and finally owners' equity accounts.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

7

Every business transaction is recorded by a debit to a balance sheet account and a credit to an income statement account.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

8

Every transaction affects equal numbers of ledger accounts and is recorded by equal dollar amounts of debits and credits.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

9

If the number of debit entries in an account is greater than the number of credit entries,the account will have a debit balance.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

10

The left-hand side of an account is used for recording debits and the right-hand side for recording credits.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

11

Ledger accounts are updated through a process called posting.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

12

An increase in a liability is recorded by a credit; an increase in owners' equity by a debit.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

13

When making a general journal entry,there can only be one debit and one credit.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

14

In its simplest form an account has only three elements: a title,a left side (called debit),and a right side (called credit).

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

15

Ledger accounts are updated first,and then transactions are recorded in the journal.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

16

Liability accounts should only be debited and never credited.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

17

The credit side of an account is the right side,while the debit side is the left side.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

18

Dividends are an expense to a corporation and appear on the income statement.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

19

A credit to a ledger account refers to the entry of an amount on the right side of an account.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

20

When a company uses the double-entry method,the total dollar amount of debits recorded must equal the total dollar amount of credits recorded,but the number of debit and credit entries may differ.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

21

The purpose of accrual accounting is to measure the amounts of cash received and paid during the period.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

22

Since most companies update their Retained Earnings balances only once per year,the Retained Earnings balance will always have a $0 balance in the trial balance.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

23

A trial balance that balances provides proof that all transactions were correctly journalized and posted to the ledger.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is not true regarding the general ledger account for Cash?

A)The balance of the account indicates the amount of cash owned by the business on a particular date.

B)Each debit entry in the Cash account represents a cash receipt.

C)Debit entries are made before credit entries.

D)Credit entries in the Cash account represent cash payments.

A)The balance of the account indicates the amount of cash owned by the business on a particular date.

B)Each debit entry in the Cash account represents a cash receipt.

C)Debit entries are made before credit entries.

D)Credit entries in the Cash account represent cash payments.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

25

The sequence of accounting procedures used to record,classify,and summarize accounting information is called the:

A)Accounting cycle.

B)Accounting period.

C)Accrual accounting.

D)Double-entry bookkeeping.

A)Accounting cycle.

B)Accounting period.

C)Accrual accounting.

D)Double-entry bookkeeping.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

26

In the general ledger,a separate "account" is maintained for each:

A)Type of asset and liability and for each element of owners' equity.

B)Business transaction.

C)Business day.

D)Journal entry.

A)Type of asset and liability and for each element of owners' equity.

B)Business transaction.

C)Business day.

D)Journal entry.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

27

Steps in the accounting cycle include (1)prepare financial statements,(2)post each journal entry to the appropriate ledger account,and (3)journalize transactions.Which of the following reflects the correct order of these steps?

A)(1),(2),(3).

B)(3),(2),(1).

C)(2),(1),(3).

D)(3),(1),(2).

A)(1),(2),(3).

B)(3),(2),(1).

C)(2),(1),(3).

D)(3),(1),(2).

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

28

Every transaction which affects an income statement account also affects a balance sheet account.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

29

A trial balance includes only the balance sheet accounts,income statement accounts are not included on a trial balance.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

30

The accrual basis of accounting recognizes expenses only when they are paid.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

31

A trial balance proves that equal amounts of debits and credits were posted to the ledger.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

32

The matching principle refers to the relationship between revenues and expenses.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is not a step in the accounting cycle?

A)Prepare a trial balance.

B)Prepare a purchase order.

C)Prepare financial statements.

D)Prepare an adjusted trial balance.

A)Prepare a trial balance.

B)Prepare a purchase order.

C)Prepare financial statements.

D)Prepare an adjusted trial balance.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

34

The accounting cycle begins with the

A)Posting of journal entries to ledger accounts.

B)Formation of a business.

C)Initial recording of business transactions.

D)Preparation of a trial balance.

A)Posting of journal entries to ledger accounts.

B)Formation of a business.

C)Initial recording of business transactions.

D)Preparation of a trial balance.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

35

The cash account of Grande Home Improvement Store shows the following: a debit on June 1 for $25,000; a credit on June 5 for $10,000,a debit on June 16 for $14,000,and a credit on June 27 for $8,000.What is the balance in the cash account at the end of June?

A)$39,000 debit.

B)$21,000 debit.

C)$18,000 credit.

D)$21,000 credit.

A)$39,000 debit.

B)$21,000 debit.

C)$18,000 credit.

D)$21,000 credit.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

36

Revenues increase owners' equity and are,therefore,recorded by crediting the revenues account.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

37

"I was just following orders" is an acceptable defense if you committed an unethical action during an audit.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

38

The concept of applying the accounting treatment that results in the lowest,most conservative,estimate of net income for the period is called the matching principle.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

39

A CEO or CFO associated with fraudulent financial reporting could be fined but not imprisoned under the Sarbanes Oxley Act.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

40

A business that is profitable and liquid will have more accounts with credit balances than with debit balances.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

41

In accounting,the terms debit and credit indicate,respectively:

A)Increase and decrease.

B)Left and right.

C)Decrease and increase.

D)Right and left.

A)Increase and decrease.

B)Left and right.

C)Decrease and increase.

D)Right and left.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

42

Eagle News has a $6,000 account receivable from one of its advertisers,Allwood Floors.When Eagle receives $3,600 from Allwood as partial payment:

A)Eagle should debit Accounts Receivable for $3,600.

B)Eagle should credit Cash for $3,600.

C)Eagle should credit Accounts Receivable for $3,600.

D)Eagle makes no journal entry until the total of $6,000 is received from Allwood.

A)Eagle should debit Accounts Receivable for $3,600.

B)Eagle should credit Cash for $3,600.

C)Eagle should credit Accounts Receivable for $3,600.

D)Eagle makes no journal entry until the total of $6,000 is received from Allwood.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

43

Collection of an accounts receivable:

A)Increases the total assets of a company.

B)Decreases the total assets of a company.

C)Does not change the total assets of a company.

D)Reduces a company's total liabilities.

A)Increases the total assets of a company.

B)Decreases the total assets of a company.

C)Does not change the total assets of a company.

D)Reduces a company's total liabilities.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

44

On June 18,Baltic Arena paid $6,600 to Marvin Maintenance,Inc.for cleaning the arena following a monster truck show.Which of the following most likely occurred as a result of this transaction?

A)The accounts receivable account was debited.

B)Total assets increased.

C)The cash account was credited.

D)Total liabilities increased.

A)The accounts receivable account was debited.

B)Total assets increased.

C)The cash account was credited.

D)Total liabilities increased.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

45

If a company purchases equipment for cash:

A)Assets will increase and owners' equity will also increase.

B)Assets will increase and owners' equity will decrease.

C)Assets will increase and owners' equity will remain unchanged.

D)Total assets and owners' equity will remain unchanged.

A)Assets will increase and owners' equity will also increase.

B)Assets will increase and owners' equity will decrease.

C)Assets will increase and owners' equity will remain unchanged.

D)Total assets and owners' equity will remain unchanged.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following accounts normally contain a debit balance?

A)Asset.

B)Liability.

C)Owners' equity.

D)Revenue.

A)Asset.

B)Liability.

C)Owners' equity.

D)Revenue.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

47

If a company purchases equipment on account:

A)Assets will increase and owners' equity will also increase.

B)Assets will increase and owners' equity will decrease.

C)Assets will increase and owners' equity will remain unchanged.

D)Assets will increase and liabilities will decrease.

A)Assets will increase and owners' equity will also increase.

B)Assets will increase and owners' equity will decrease.

C)Assets will increase and owners' equity will remain unchanged.

D)Assets will increase and liabilities will decrease.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

48

Master Equipment has a $17,400 liability to Arrow Paint Co.When Master Equipment makes a partial payment of $7,600 on this liability,which of following occurs?

A)Retained earnings are debited $9,800.

B)The Accounts Payable account is credited $9,800.

C)The Cash account is debited $7,600.

D)The Accounts Payable account is debited $7,600.

A)Retained earnings are debited $9,800.

B)The Accounts Payable account is credited $9,800.

C)The Cash account is debited $7,600.

D)The Accounts Payable account is debited $7,600.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

49

Sue Costa,owner of A-1 Cleaning Services,invested an additional $75,000 in the company.Which of the following would be a part of the correct journal entry to record this transaction?

A)A debit to the Cash account.

B)A debit to the Equity account.

C)A debit to the Capital Stock account.

D)A debit to the Cash Received account.

A)A debit to the Cash account.

B)A debit to the Equity account.

C)A debit to the Capital Stock account.

D)A debit to the Cash Received account.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

50

Land is purchased by making a cash down payment of $40,000 and signing a note payable for the balance of $130,000.The journal entry to record this transaction in the accounting records of the purchaser includes:

A)A credit to Land for $40,000.

B)A debit to Cash for $40,000.

C)A debit to Land for $170,000.

D)A debit to Note Payable for $130,000.

A)A credit to Land for $40,000.

B)A debit to Cash for $40,000.

C)A debit to Land for $170,000.

D)A debit to Note Payable for $130,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

51

The collection of an account receivable is recorded by a debit to Cash and a credit to Accounts Payable.If this error is not corrected:

A)Total liabilities are understated.

B)Total assets are understated.

C)Total liabilities are overstated.

D)Owners' equity is overstated.

A)Total liabilities are understated.

B)Total assets are understated.

C)Total liabilities are overstated.

D)Owners' equity is overstated.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

52

The purchase of equipment on credit is recorded by a:

A)Debit to Equipment and a credit to Accounts Payable.

B)Debit to Accounts Payable and a credit to Equipment.

C)Debit to Equipment and a debit to Accounts Payable.

D)Credit to Equipment and a credit to Accounts Payable.

A)Debit to Equipment and a credit to Accounts Payable.

B)Debit to Accounts Payable and a credit to Equipment.

C)Debit to Equipment and a debit to Accounts Payable.

D)Credit to Equipment and a credit to Accounts Payable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

53

In a ledger,debit entries cause:

A)Increases in owners' equity,decreases in liabilities,and increases in assets.

B)Decreases in liabilities,increases in assets,and decreases in owners' equity.

C)Decreases in assets,decreases in liabilities,and increases in owners' equity.

D)Decreases in assets,increases in liabilities,and increases in owners' equity.

A)Increases in owners' equity,decreases in liabilities,and increases in assets.

B)Decreases in liabilities,increases in assets,and decreases in owners' equity.

C)Decreases in assets,decreases in liabilities,and increases in owners' equity.

D)Decreases in assets,increases in liabilities,and increases in owners' equity.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

54

The journal entry to record a particular business transaction includes a credit to the Cash account.This transaction is most likely also to include:

A)Issuance of new capital stock.

B)The purchase of an asset on account.

C)Payment of an outstanding note payable.

D)A credit to Accounts Receivable.

A)Issuance of new capital stock.

B)The purchase of an asset on account.

C)Payment of an outstanding note payable.

D)A credit to Accounts Receivable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

55

The journal entry to record a particular business transaction includes a credit to a liability account.This transaction is most likely also to include:

A)Issuance of new capital stock.

B)The purchase of an asset on account.

C)A cash payment.

D)A credit to Accounts Receivable.

A)Issuance of new capital stock.

B)The purchase of an asset on account.

C)A cash payment.

D)A credit to Accounts Receivable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

56

Bruno's Pizza Restaurant makes full payment of $8,300 on an account payable to Stella's Cheese Co.Stella's would record this transaction with a:

A)Debit to Accounts Payable for $8,300.

B)Credit to Cash for $8,300.

C)Credit to Accounts Receivable for $8,300.

D)Credit to Accounts Payable for $8,300.

A)Debit to Accounts Payable for $8,300.

B)Credit to Cash for $8,300.

C)Credit to Accounts Receivable for $8,300.

D)Credit to Accounts Payable for $8,300.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following accounts normally does not have a debit balance?

A)Accounts receivable.

B)Cash.

C)Building.

D)Capital Stock.

A)Accounts receivable.

B)Cash.

C)Building.

D)Capital Stock.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following accounts normally has a credit balance?

A)Cash.

B)Service revenue.

C)Accounts receivable.

D)Utilities expense.

A)Cash.

B)Service revenue.

C)Accounts receivable.

D)Utilities expense.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

59

The collection of accounts receivable is recorded by a:

A)Debit to Cash and a debit to Accounts Receivable.

B)Credit to Cash and a credit to Accounts Receivable.

C)Debit to Cash and a credit to Accounts Receivable.

D)Credit to Cash and a debit to Accounts Receivable.

A)Debit to Cash and a debit to Accounts Receivable.

B)Credit to Cash and a credit to Accounts Receivable.

C)Debit to Cash and a credit to Accounts Receivable.

D)Credit to Cash and a debit to Accounts Receivable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

60

The purchase of office equipment at a cost of $7,600 with an immediate payment of $4,200 and agreement to pay the balance within 60 days is recorded by:

A)A debit of $7,600 to Office Equipment,a debit of $4,200 to Accounts Receivable,and a credit of $3,400 to Accounts Payable.

B)A debit of $7,600 to Office Equipment,a credit of $4,200 to Cash,and a credit of $3,400 to Accounts Receivable.

C)A debit of $3,400 to Accounts Receivable,a debit of $4,200 to Cash,and a credit of $7,600 to Office Equipment.

D)A debit of $7,600 to Office Equipment,a credit of $4,200 to Cash,and a credit of $3,400 to Accounts Payable.

A)A debit of $7,600 to Office Equipment,a debit of $4,200 to Accounts Receivable,and a credit of $3,400 to Accounts Payable.

B)A debit of $7,600 to Office Equipment,a credit of $4,200 to Cash,and a credit of $3,400 to Accounts Receivable.

C)A debit of $3,400 to Accounts Receivable,a debit of $4,200 to Cash,and a credit of $7,600 to Office Equipment.

D)A debit of $7,600 to Office Equipment,a credit of $4,200 to Cash,and a credit of $3,400 to Accounts Payable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

61

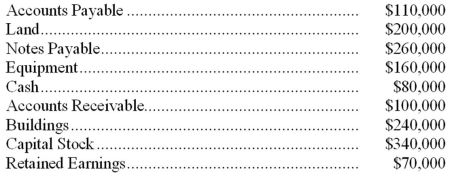

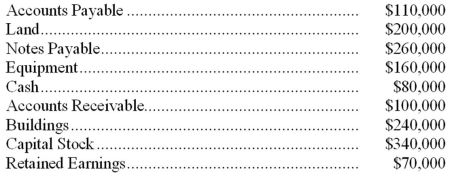

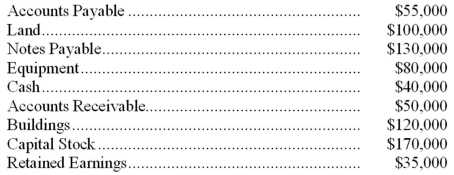

Montauk Oil Co.reports these account balances at December 31,2014  On January 2,2015,Montauk Oil collected $50,000 of its accounts receivable and paid $20,000 of its accounts payable.On January 3,2015,total liabilities are:

On January 2,2015,Montauk Oil collected $50,000 of its accounts receivable and paid $20,000 of its accounts payable.On January 3,2015,total liabilities are:

A)$370,000.

B)$350,000.

C)$300,000.

D)$70,000.

On January 2,2015,Montauk Oil collected $50,000 of its accounts receivable and paid $20,000 of its accounts payable.On January 3,2015,total liabilities are:

On January 2,2015,Montauk Oil collected $50,000 of its accounts receivable and paid $20,000 of its accounts payable.On January 3,2015,total liabilities are:A)$370,000.

B)$350,000.

C)$300,000.

D)$70,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

62

Ben Dryden,president of Jet Glass,Inc,noticed a $8,000 debit to Accounts Payable in the company's general ledger.This debit could correspond to:

A)A $8,000 sale to a customer.

B)A purchase of equipment costing $8,000 on credit.

C)A payment of $8,000 to a supplier to settle a balance due.

D)The failure to pay this month's $8,000 utility bill on time.

A)A $8,000 sale to a customer.

B)A purchase of equipment costing $8,000 on credit.

C)A payment of $8,000 to a supplier to settle a balance due.

D)The failure to pay this month's $8,000 utility bill on time.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

63

Transactions are recorded in the general journal in:

A)Numerical order.

B)Chronological order.

C)Account number order.

D)Financial statement order.

A)Numerical order.

B)Chronological order.

C)Account number order.

D)Financial statement order.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

64

Brett Tarek,a manager at D&J Landscaping,Inc.needs information regarding the amount of accounts payable currently owed by the company.This information would most easily be found in the:

A)General ledger.

B)General journal.

C)Income statement.

D)Notes to the financial statements.

A)General ledger.

B)General journal.

C)Income statement.

D)Notes to the financial statements.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

65

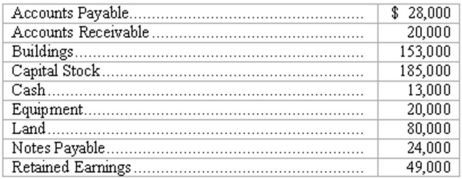

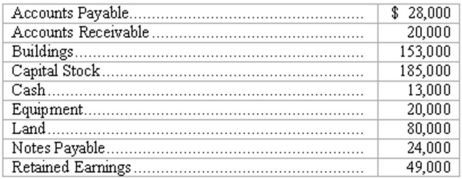

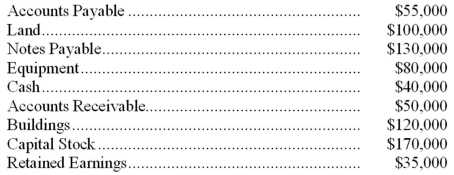

Ceramic Products,Inc.reports these account balances at January 1,2015 (shown in alphabetical order):  On January 5,Ceramic Products collected $12,000 of its accounts receivable and paid $11,000 on its note payable.On January 6,2015,total liabilities are:

On January 5,Ceramic Products collected $12,000 of its accounts receivable and paid $11,000 on its note payable.On January 6,2015,total liabilities are:

A)$0.

B)$30,000.

C)$56,000.

D)$41,000.

On January 5,Ceramic Products collected $12,000 of its accounts receivable and paid $11,000 on its note payable.On January 6,2015,total liabilities are:

On January 5,Ceramic Products collected $12,000 of its accounts receivable and paid $11,000 on its note payable.On January 6,2015,total liabilities are:A)$0.

B)$30,000.

C)$56,000.

D)$41,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

66

The price of the goods sold or services rendered during a given accounting period is called:

A)Net income.

B)Profit.

C)Revenue.

D)Equity.

A)Net income.

B)Profit.

C)Revenue.

D)Equity.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

67

All of the following statements are true of double-entry accounting except:

A)There is a need for both debit and credit entries for each and every transaction.

B)Double-entry accounting can only be used with computer-based accounting systems.

C)The total dollar amount of debit entries posted to the general ledger is equal to the dollar amount of the credit entries.

D)Double-entry accounting allows us to measure net income at the same time we record the effect of transactions on the balance sheet accounts.

A)There is a need for both debit and credit entries for each and every transaction.

B)Double-entry accounting can only be used with computer-based accounting systems.

C)The total dollar amount of debit entries posted to the general ledger is equal to the dollar amount of the credit entries.

D)Double-entry accounting allows us to measure net income at the same time we record the effect of transactions on the balance sheet accounts.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

68

Indirect Oil Co.reports these account balances at December 31,2014  On January 2,2015,Indirect Oil collected $25,000 of its accounts receivable and paid $20,000 of its accounts payable.On January 3,2015,total liabilities are:

On January 2,2015,Indirect Oil collected $25,000 of its accounts receivable and paid $20,000 of its accounts payable.On January 3,2015,total liabilities are:

A)$185,000.

B)$165,000.

C)$150,000.

D)$70,000.

On January 2,2015,Indirect Oil collected $25,000 of its accounts receivable and paid $20,000 of its accounts payable.On January 3,2015,total liabilities are:

On January 2,2015,Indirect Oil collected $25,000 of its accounts receivable and paid $20,000 of its accounts payable.On January 3,2015,total liabilities are:A)$185,000.

B)$165,000.

C)$150,000.

D)$70,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

69

A transaction is first recorded in which of the following accounting records?

A)Trial balance.

B)Ledger.

C)General journal.

D)Balance sheet.

A)Trial balance.

B)Ledger.

C)General journal.

D)Balance sheet.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

70

The rules of debit and credit may be summarized as follows:

A)Asset accounts are increased by debits,whereas,liabilities and owners' equity are increased by credits.

B)The balance of a ledger account is increased by debit entries and is decreased by credit entries.

C)Accounts on the left side of the balance sheet are increased by credits,whereas accounts on the right side of the balance sheet are increased by debits.

D)The balance of a ledger account is increased by credit entries and is decreased by debit entries.

A)Asset accounts are increased by debits,whereas,liabilities and owners' equity are increased by credits.

B)The balance of a ledger account is increased by debit entries and is decreased by credit entries.

C)Accounts on the left side of the balance sheet are increased by credits,whereas accounts on the right side of the balance sheet are increased by debits.

D)The balance of a ledger account is increased by credit entries and is decreased by debit entries.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

71

Preparing a journal entry in proper form involves all the following except:

A)Listing all accounts debited before any credits.

B)Computing the balances in accounts involved in the transaction.

C)Indicating the date of the transaction.

D)Providing a brief written explanation of the transaction.

A)Listing all accounts debited before any credits.

B)Computing the balances in accounts involved in the transaction.

C)Indicating the date of the transaction.

D)Providing a brief written explanation of the transaction.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

72

The essential point of a double-entry system of accounting is that every transaction:

A)Affects accounts on both sides of the balance sheet.

B)Is recorded in both the journal and the ledger.

C)Increases one ledger account and decreases another.

D)Affects two or more ledger accounts and is recorded by an equal dollar amount of debits and credits.

A)Affects accounts on both sides of the balance sheet.

B)Is recorded in both the journal and the ledger.

C)Increases one ledger account and decreases another.

D)Affects two or more ledger accounts and is recorded by an equal dollar amount of debits and credits.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

73

All of the following statements are true of an income statement except:

A)The period of time covered by an income statement is the company's accounting period.

B)A fiscal year is any accounting period less than 12 months in length.

C)The length of a company's accounting period may vary.

D)Every business prepares an annual income statement.

A)The period of time covered by an income statement is the company's accounting period.

B)A fiscal year is any accounting period less than 12 months in length.

C)The length of a company's accounting period may vary.

D)Every business prepares an annual income statement.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

74

Posting is the process of:

A)Transferring debit and credit entries from the journal into the appropriate ledger accounts.

B)Determining that the dollar amount of debit entries recorded in the ledger is equal to the dollar amount of credit entries.

C)Entering information into a computerized data base.

D)Preparing journal entries to describe each business transaction.

A)Transferring debit and credit entries from the journal into the appropriate ledger accounts.

B)Determining that the dollar amount of debit entries recorded in the ledger is equal to the dollar amount of credit entries.

C)Entering information into a computerized data base.

D)Preparing journal entries to describe each business transaction.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following would not appear on an income statement?

A)Repair service revenue.

B)Insurance expense.

C)Dividends.

D)Net income.

A)Repair service revenue.

B)Insurance expense.

C)Dividends.

D)Net income.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

76

Sally Smith had expenses of $800 in June which she paid in July.She reported these expenses on her June income statement.By doing this,she is following the accounting principle of:

A)Revenue realization.

B)Adequate disclosure.

C)Matching.

D)Conservatism.

A)Revenue realization.

B)Adequate disclosure.

C)Matching.

D)Conservatism.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

77

This transaction involves:

A)The sale of land and building for $286,000.

B)Payment of $221,000 on a note payable.

C)The receipt of $65,000 cash.

D)An increase in liabilities of $221,000.

A)The sale of land and building for $286,000.

B)Payment of $221,000 on a note payable.

C)The receipt of $65,000 cash.

D)An increase in liabilities of $221,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

78

The process of originally recording a business transaction in the accounting records is termed:

A)Journalizing.

B)Footing.

C)Posting.

D)Balancing.

A)Journalizing.

B)Footing.

C)Posting.

D)Balancing.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following accounts normally has a debit balance?

A)Accounts payable.

B)Retained earnings.

C)Accounts receivable.

D)Service revenue.

A)Accounts payable.

B)Retained earnings.

C)Accounts receivable.

D)Service revenue.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

80

Double-entry accounting is characterized by which of the following?

A)Every transaction affects both an asset account and either a liability account or an owners' equity account.

B)The number of general ledger accounts with debit balances is equal to the number with credit balances.

C)The total dollar amount of debit entries posted to the general ledger is equal to the dollar amount of the credit entries.

D)The number of debit entries posted to the general ledger equals the number of credit entries.

A)Every transaction affects both an asset account and either a liability account or an owners' equity account.

B)The number of general ledger accounts with debit balances is equal to the number with credit balances.

C)The total dollar amount of debit entries posted to the general ledger is equal to the dollar amount of the credit entries.

D)The number of debit entries posted to the general ledger equals the number of credit entries.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck