Deck 24: Standard Cost Systems

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/91

Play

Full screen (f)

Deck 24: Standard Cost Systems

1

In a standard cost system,actual costs are charged to work in process as they are incurred.

False

2

In setting standard costs,management's expectations are that the standard costs will always be met.

False

3

A materials price variance is arrived at by taking standard quantity times actual price,less standard price.

False

4

A materials quantity variance is the standard price times standard quantity,less actual quantity.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

5

Standard costs are established only for direct labor and direct materials.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

6

In most companies using standard cost procedures,the costs charged to Work in Process,Finished Goods,and Cost of Goods Sold are the actual costs,not the standard costs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

7

Standard costs actually are ideal costs per unit.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

8

In setting standards,management's level of performance expectation must be something less than ideal.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

9

In a standard cost system actual costs are recorded in Material,Direct Labor,and Overhead accounts,but standard costs are charged to Work in Process.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

10

The use of excessive quantities of material in manufacturing a product causes an unfavorable materials quantity variance.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

11

A favorable variance would be credited to a cost variance account.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

12

A standard cost is predetermined,that is,determined before actual costs of the current period have been computed.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

13

A favorable materials price variance indicates that actual prices paid in acquiring materials were more than standard prices.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

14

Standard cost systems are generally compatible with job cost systems or with process cost systems.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

15

Standard costs are typically reviewed once per year.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

16

A good standard cost system should always generate unfavorable variances.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

17

A standard cost is the per unit cost actually incurred under normal operating conditions.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

18

A labor efficiency variance relates to the number of hours actually worked,compared to the standard hours.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

19

The materials price variance is calculated by multiplying the difference between actual unit price and standard unit price,by the standard units purchased.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

20

The level of production plays an important role in determining cost standards.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

21

When standard costs are used in a cost accounting system:

A)A favorable cost variance results when standard amounts are less than actual costs.

B)Cost variances are shown in the year-end balance sheet as assets,if favorable,or as liabilities,if unfavorable.

C)Costs charged to the Work in Process Inventory,Finished Goods Inventory,and Cost of Goods Sold accounts are actual costs.

D)Costs charged to the Work in Process Inventory,Finished Goods Inventory,and Cost of Goods Sold accounts are at standard costs.

A)A favorable cost variance results when standard amounts are less than actual costs.

B)Cost variances are shown in the year-end balance sheet as assets,if favorable,or as liabilities,if unfavorable.

C)Costs charged to the Work in Process Inventory,Finished Goods Inventory,and Cost of Goods Sold accounts are actual costs.

D)Costs charged to the Work in Process Inventory,Finished Goods Inventory,and Cost of Goods Sold accounts are at standard costs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

22

An unfavorable cost variance will be debited to a cost variance account.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

23

In a system designed to measure cost variances,goods transferred from the Work in Process account to the Finished Goods Inventory are valued at:

A)Actual cost.

B)Market value.

C)Standard cost.

D)The lower of actual cost or market value.

A)Actual cost.

B)Market value.

C)Standard cost.

D)The lower of actual cost or market value.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is not an advantage of using a standard cost system?

A)It eliminates the need for analysis of variances.

B)It facilitates establishing an effective system of responsibility accounting.

C)It requires an analysis of all aspects of operations.

D)It helps management control costs.

A)It eliminates the need for analysis of variances.

B)It facilitates establishing an effective system of responsibility accounting.

C)It requires an analysis of all aspects of operations.

D)It helps management control costs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

25

The purchasing manager is often included in evaluating cost variances.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

26

A variance is said to be unfavorable when actual costs exceed standard costs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

27

External auditors are often called upon to evaluate cost variances.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

28

A difference between a standard cost and an actual cost would be recorded in the Work in Process account.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

29

The presence of fixed costs in manufacturing overhead causes the actual amount of manufacturing overhead per unit of output to vary,depending on the actual production volume attained.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

30

Standard costs:

A)May be used in job order cost systems but not in process cost accounting systems.

B)Should be revised upward when actual costs are higher than expected because of waste and inefficiency.

C)Are the same for all companies in a given industry.

D)Are the costs that should be incurred to produce a product under normal conditions.

A)May be used in job order cost systems but not in process cost accounting systems.

B)Should be revised upward when actual costs are higher than expected because of waste and inefficiency.

C)Are the same for all companies in a given industry.

D)Are the costs that should be incurred to produce a product under normal conditions.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

31

A favorable variance occurs when actual costs are less than standard costs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

32

Which statement is true regarding a standard cost system?

A)Both actual and standard costs are used.

B)Only standard costs are used.

C)If variances occur,then something negative in the operations has occurred.

D)Standards are used only when actual amounts are not available.

A)Both actual and standard costs are used.

B)Only standard costs are used.

C)If variances occur,then something negative in the operations has occurred.

D)Standards are used only when actual amounts are not available.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

33

It is possible for the overhead volume variance to be favorable and the overhead spending variance to be unfavorable.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

34

The company's CEO is the only person who analyzes costs variances.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

35

In evaluating cost variances,the accounting department determines whether variances are favorable or unfavorable.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

36

A spending variance results from incurring more overhead costs than allowed for the actual level of activity achieved.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

37

A standard cost is the per-unit cost incurred under:

A)Ideal operating conditions.

B)Perfect operating conditions.

C)Normal,but efficient operating conditions.

D)Minimally acceptable operating conditions.

A)Ideal operating conditions.

B)Perfect operating conditions.

C)Normal,but efficient operating conditions.

D)Minimally acceptable operating conditions.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

38

In establishing standard costs for labor,management must look at all of the following except:

A)Time allowed to produce each product.

B)Direct labor requirements for each product.

C)The wage rate of a direct laborer.

D)The quantity of materials for each product.

A)Time allowed to produce each product.

B)Direct labor requirements for each product.

C)The wage rate of a direct laborer.

D)The quantity of materials for each product.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

39

An important advantage of a standard cost system is that standard costs:

A)Cause financial statements to be more comparable because different companies cost their inventories in the same manner.

B)Can be determined with great precision so that inventories are valued with complete accuracy.

C)Cause a lower net income,resulting in lower income taxes.

D)Focus attention on trouble spots and facilitate prompt corrective action.

A)Cause financial statements to be more comparable because different companies cost their inventories in the same manner.

B)Can be determined with great precision so that inventories are valued with complete accuracy.

C)Cause a lower net income,resulting in lower income taxes.

D)Focus attention on trouble spots and facilitate prompt corrective action.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

40

A total cost variance for materials can be caused by differences in the quantity used,or in the price paid,but not by both.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

41

There will be a favorable materials price variance if:

A)The standard price per unit is less than the actual price per unit.

B)The standard price per unit is greater than the actual price per unit.

C)The actual quantity purchased is greater than expected.

D)The actual quantity purchased is less than expected.

A)The standard price per unit is less than the actual price per unit.

B)The standard price per unit is greater than the actual price per unit.

C)The actual quantity purchased is greater than expected.

D)The actual quantity purchased is less than expected.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

42

If the actual cost per pound of direct material is less than the standard cost per pound,there is:

A)A favorable materials price variance.

B)An unfavorable materials price variance.

C)A favorable materials quantity variance.

D)A favorable total materials variance.

A)A favorable materials price variance.

B)An unfavorable materials price variance.

C)A favorable materials quantity variance.

D)A favorable total materials variance.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

43

There is an unfavorable labor efficiency variance when:

A)Actual hours are greater than standard hours.

B)Actual hours are less than standard hours.

C)The standard rate per hour is greater than the actual rate per hour.

D)The standard rate per hour is less than the actual rate per hour.

A)Actual hours are greater than standard hours.

B)Actual hours are less than standard hours.

C)The standard rate per hour is greater than the actual rate per hour.

D)The standard rate per hour is less than the actual rate per hour.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

44

The calculation of the labor rate variance is:

A)Standard rate multiplied by (standard hours minus actual hours).

B)Standard hours multiplied by (standard rate minus actual rate).

C)Actual labor hours multiplied by (standard rate minus actual rate).

D)Actual rate multiplied by (standard hours minus actual hours).

A)Standard rate multiplied by (standard hours minus actual hours).

B)Standard hours multiplied by (standard rate minus actual rate).

C)Actual labor hours multiplied by (standard rate minus actual rate).

D)Actual rate multiplied by (standard hours minus actual hours).

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

45

If the hourly wage rate actually paid during January is higher than the standard rate,the result is:

A)An unfavorable labor rate variance.

B)A favorable labor rate variance.

C)An unfavorable labor efficiency variance.

D)A favorable total labor variance.

A)An unfavorable labor rate variance.

B)A favorable labor rate variance.

C)An unfavorable labor efficiency variance.

D)A favorable total labor variance.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

46

Controlling the materials quantity variance is usually the responsibility of:

A)The cost accountant.

B)The purchasing agent.

C)The marketing director.

D)The production supervisor.

A)The cost accountant.

B)The purchasing agent.

C)The marketing director.

D)The production supervisor.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

47

If the standard quantity of materials is 84,500 units @ $0.15 per unit and the actual quantity is 95,000 units @ $0.12 per unit,then the total materials cost variance is:

A)$2,850 Favorable.

B)$1,575 Unfavorable.

C)$1,275 Favorable.

D)$2,850 Unfavorable.

A)$2,850 Favorable.

B)$1,575 Unfavorable.

C)$1,275 Favorable.

D)$2,850 Unfavorable.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

48

Using more direct labor hours for units produced than the amount allowed by the standard results in:

A)An unfavorable total labor variance.

B)An unfavorable labor efficiency variance,regardless of the wage rate paid to employees.

C)An unfavorable labor efficiency variance only if the wage rate is higher than standard cost allowed.

D)A favorable labor rate variance,because the hourly wage rate is automatically reduced when workers operate less efficiently.

A)An unfavorable total labor variance.

B)An unfavorable labor efficiency variance,regardless of the wage rate paid to employees.

C)An unfavorable labor efficiency variance only if the wage rate is higher than standard cost allowed.

D)A favorable labor rate variance,because the hourly wage rate is automatically reduced when workers operate less efficiently.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

49

The calculation of the labor efficiency variance is:

A)Standard hourly rate multiplied by (standard hours minus actual hours).

B)Standard hours multiplied by (standard rate minus actual rate).

C)Actual labor hours multiplied by (standard rate minus actual rate).

D)Actual rate multiplied by (standard hours minus actual hours).

A)Standard hourly rate multiplied by (standard hours minus actual hours).

B)Standard hours multiplied by (standard rate minus actual rate).

C)Actual labor hours multiplied by (standard rate minus actual rate).

D)Actual rate multiplied by (standard hours minus actual hours).

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

50

The use of inexpensive,low quality,materials often results in:

A)A favorable materials quantity variance.

B)A favorable labor rate variance.

C)An unfavorable materials quantity variance.

D)An unfavorable materials price variance.

A)A favorable materials quantity variance.

B)A favorable labor rate variance.

C)An unfavorable materials quantity variance.

D)An unfavorable materials price variance.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

51

If the standard quantity of materials is 84,500 units @ $0.15 per unit and the actual quantity is 95,000 units @ $0.12 per unit,then the materials quantity variance is:

A)$2,850 Favorable.

B)$1,575 Unfavorable.

C)$1,275 Favorable.

D)$2,850 Unfavorable.

A)$2,850 Favorable.

B)$1,575 Unfavorable.

C)$1,275 Favorable.

D)$2,850 Unfavorable.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

52

Favorable standard cost variances are normally closed at the end of the period by:

A)Crediting the variance account and debiting Cost of Goods Sold.

B)Debiting the variance account and crediting Cost of Goods Sold.

C)Debiting the variance account and crediting Work in Process.

D)Crediting the variance account and debiting Work in Process.

A)Crediting the variance account and debiting Cost of Goods Sold.

B)Debiting the variance account and crediting Cost of Goods Sold.

C)Debiting the variance account and crediting Work in Process.

D)Crediting the variance account and debiting Work in Process.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

53

Excessive overtime hours worked by direct labor workers often results in:

A)An unfavorable labor rate variance.

B)A favorable labor rate variance.

C)A favorable materials price variance.

D)An unfavorable materials price variance.

A)An unfavorable labor rate variance.

B)A favorable labor rate variance.

C)A favorable materials price variance.

D)An unfavorable materials price variance.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

54

Unfavorable standard cost variances are normally closed at the end of the period by:

A)Debiting the variance account and crediting Cost of Goods Sold.

B)Crediting the variance account and debiting Cost of Goods Sold.

C)Debiting the variance account and crediting Work in Process.

D)Crediting the variance account and debiting Work in Process.

A)Debiting the variance account and crediting Cost of Goods Sold.

B)Crediting the variance account and debiting Cost of Goods Sold.

C)Debiting the variance account and crediting Work in Process.

D)Crediting the variance account and debiting Work in Process.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

55

If the standard quantity of materials is 84,500 units @ $0.15 per unit and the actual quantity is 95,000 units @ $0.12 per unit,then the journal entry to record the cost of materials used includes:

A)A debit to Work in Process Inventory of $11,400.

B)A debit to Work in Process Inventory of $12,675.

C)A debit to Materials Price variance of $2,850.

D)A credit to Materials Price variance of $1,575.

A)A debit to Work in Process Inventory of $11,400.

B)A debit to Work in Process Inventory of $12,675.

C)A debit to Materials Price variance of $2,850.

D)A credit to Materials Price variance of $1,575.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

56

If the standard quantity of materials is 84,500 units @ $0.15 per unit and the actual quantity is 95,000 units @ $0.12 per unit,then the materials price variance is:

A)$2,850 Favorable.

B)$1,575 Unfavorable.

C)$1,275 Favorable.

D)$2,850 Unfavorable.

A)$2,850 Favorable.

B)$1,575 Unfavorable.

C)$1,275 Favorable.

D)$2,850 Unfavorable.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

57

If actual direct labor cost was $7,560 and standard labor cost was $7,000,the journal entry to record this would include:

A)A credit to the labor rate variance account of $560 and a credit to Direct Labor of $7,000.

B)A debit to the labor rate variance account of $560 and a debit to Direct Labor of $7,000.

C)A credit to the labor rate variance account of $560 and a debit to Direct Labor of $7,560.

D)A debit to the labor rate variance account of $560 and a credit to Direct Labor of $7,560.

A)A credit to the labor rate variance account of $560 and a credit to Direct Labor of $7,000.

B)A debit to the labor rate variance account of $560 and a debit to Direct Labor of $7,000.

C)A credit to the labor rate variance account of $560 and a debit to Direct Labor of $7,560.

D)A debit to the labor rate variance account of $560 and a credit to Direct Labor of $7,560.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

58

Greenleaf's flexible budget for June,based on actual output,called for the use of 10,000 square feet of materials at a standard cost of $9.90 per square foot.Company records show that the actual price paid for the materials used in June was $9.70 per square foot,and that the direct materials price variance for the month was $2,090 favorable.The materials quantity variance for Greenleaf's June operations was:

A)$1,000 favorable.

B)$4,455 unfavorable.

C)$4,365 favorable.

D)Impossible to determine from the data given.

A)$1,000 favorable.

B)$4,455 unfavorable.

C)$4,365 favorable.

D)Impossible to determine from the data given.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

59

Controlling the materials price variance is usually the responsibility of:

A)The purchasing agent.

B)The marketing director.

C)The production supervisor.

D)The cost accountant.

A)The purchasing agent.

B)The marketing director.

C)The production supervisor.

D)The cost accountant.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

60

If the actual amount of direct materials used in production was less than the standard amount allowed for units produced,there was:

A)A favorable materials price variance.

B)A favorable total materials variance.

C)A favorable materials quantity variance.

D)An unfavorable materials quantity variance.

A)A favorable materials price variance.

B)A favorable total materials variance.

C)A favorable materials quantity variance.

D)An unfavorable materials quantity variance.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

61

An unfavorable overhead volume variance results from:

A)An unfavorable overhead spending variance.

B)Poor decisions made by the production manager.

C)Producing at levels of output which exceed normal output levels.

D)Producing at levels of output which fall short of normal output levels.

A)An unfavorable overhead spending variance.

B)Poor decisions made by the production manager.

C)Producing at levels of output which exceed normal output levels.

D)Producing at levels of output which fall short of normal output levels.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

62

A large favorable variance from standard costs at the end of the year should be:

A)Carried forward to the next fiscal year.

B)Shown as other income in the income statement.

C)Added to cost of goods sold in the income statement.

D)Allocated between ending inventories and cost of goods sold.

A)Carried forward to the next fiscal year.

B)Shown as other income in the income statement.

C)Added to cost of goods sold in the income statement.

D)Allocated between ending inventories and cost of goods sold.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

63

EJB Company used a "normal" production level of 10,000 units to determine the standard per-unit cost of manufacturing overhead.Which of the following is not true?

A)There is no overhead volume variance for a given month if actual production that month is 10,000 units.

B)When actual production exceeds 10,000 units,use of standard costs results in a favorable overhead volume variance.

C)When actual production is less than 10,000 units,use of standard costs results in an unfavorable total overhead variance.

D)Overhead variances arising as a result of producing more or less than 10,000 units do not indicate either strong or poor performance by the Production Department.

A)There is no overhead volume variance for a given month if actual production that month is 10,000 units.

B)When actual production exceeds 10,000 units,use of standard costs results in a favorable overhead volume variance.

C)When actual production is less than 10,000 units,use of standard costs results in an unfavorable total overhead variance.

D)Overhead variances arising as a result of producing more or less than 10,000 units do not indicate either strong or poor performance by the Production Department.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

64

Establishing standard cost amounts

Explain why the determination of standard cost amounts should not be the sole responsibility of a company's cost accountant.

Explain why the determination of standard cost amounts should not be the sole responsibility of a company's cost accountant.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

65

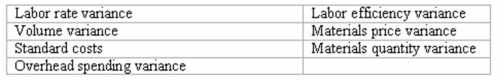

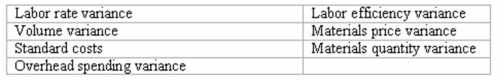

Accounting terminology

Listed below are seven technical accounting terms introduced or emphasized in this chapter: Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

____ (a)A materials variance which is the responsibility of the Purchasing Department.

____ (b)The variance which exists whenever actual production levels differ from normal levels.

____ (c)Unit costs expected to be incurred under normal conditions.

____ (d)A labor variance caused by a difference between standard and actual hours required to complete a task.

____ (e)The variance caused by incurring more overhead costs than allowed for at a given level of production.

Listed below are seven technical accounting terms introduced or emphasized in this chapter:

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.____ (a)A materials variance which is the responsibility of the Purchasing Department.

____ (b)The variance which exists whenever actual production levels differ from normal levels.

____ (c)Unit costs expected to be incurred under normal conditions.

____ (d)A labor variance caused by a difference between standard and actual hours required to complete a task.

____ (e)The variance caused by incurring more overhead costs than allowed for at a given level of production.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

66

The Victor Corporation has been incurring favorable overhead volume variances in each of the last several months.These persistent favorable variances indicate:

A)Victor's management is unusually efficient.

B)The overhead application rate should be revised upward.

C)Monthly output is consistently under budget.

D)Monthly output is consistently over that budgeted.

A)Victor's management is unusually efficient.

B)The overhead application rate should be revised upward.

C)Monthly output is consistently under budget.

D)Monthly output is consistently over that budgeted.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

67

Overhead volume variances indicate:

A)Efficient performance.

B)Inefficient performance.

C)Fluctuations in the level of production from month to month.

D)Inadequate budgeting.

A)Efficient performance.

B)Inefficient performance.

C)Fluctuations in the level of production from month to month.

D)Inadequate budgeting.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

68

Standard costs

Define standard costs.Under what conditions should previously established standard costs be revised?

Define standard costs.Under what conditions should previously established standard costs be revised?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

69

Standard cost system materials variances

Levron Corporation manufactures a line of cosmetics.The standard price of the ingredients in its beauty cream is $7 per ounce; the standard amount of material allowed per jar is 1.25 ounces.During December,5,300 jars were produced,requiring 6,784 ounces of ingredients at a total direct materials cost of $37,312.

(a)Calculate the materials price variance for December.Indicate whether it is favorable (F)or unfavorable (U).$__________

(b)Who is responsible for this variance? _________

(c)Calculate the materials quantity variance for December.Indicate whether it is favorable (F)or unfavorable (U).$__________

(d)What is Levron Corporation's total materials variance for December? Indicate whether it is favorable (F)or unfavorable (U).$__________

Levron Corporation manufactures a line of cosmetics.The standard price of the ingredients in its beauty cream is $7 per ounce; the standard amount of material allowed per jar is 1.25 ounces.During December,5,300 jars were produced,requiring 6,784 ounces of ingredients at a total direct materials cost of $37,312.

(a)Calculate the materials price variance for December.Indicate whether it is favorable (F)or unfavorable (U).$__________

(b)Who is responsible for this variance? _________

(c)Calculate the materials quantity variance for December.Indicate whether it is favorable (F)or unfavorable (U).$__________

(d)What is Levron Corporation's total materials variance for December? Indicate whether it is favorable (F)or unfavorable (U).$__________

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

70

Dawson Company has a union contract which calls for an 8% cost of living increase in the wages paid to all factory workers as of July 1 of the current year.This suggests that:

A)The labor rate variance for July will be unfavorable.

B)The labor rate variances during the first half of the current year have been favorable.

C)The standard labor cost per unit should be revised as of July 1.

D)The labor efficiency variance for July will be unfavorable.

A)The labor rate variance for July will be unfavorable.

B)The labor rate variances during the first half of the current year have been favorable.

C)The standard labor cost per unit should be revised as of July 1.

D)The labor efficiency variance for July will be unfavorable.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

71

A large unanticipated reduction in the property taxes on a company's factory would,all other things equal,most likely cause:

A)A favorable overhead spending variance.

B)An unfavorable overhead spending variance.

C)A favorable overhead volume variance.

D)An unfavorable overhead volume variance.

A)A favorable overhead spending variance.

B)An unfavorable overhead spending variance.

C)A favorable overhead volume variance.

D)An unfavorable overhead volume variance.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

72

The total overhead variance is the difference between:

A)Budgeted overhead and applied overhead.

B)Actual overhead and budgeted overhead.

C)Actual overhead and applied overhead.

D)Applied overhead and budgeted overhead.

A)Budgeted overhead and applied overhead.

B)Actual overhead and budgeted overhead.

C)Actual overhead and applied overhead.

D)Applied overhead and budgeted overhead.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

73

If fewer units are produced than had been estimated when standard unit costs were determined,there would normally be:

A)A favorable labor efficiency (usage)variance.

B)An unfavorable overhead volume variance.

C)A favorable materials quantity variance.

D)An unfavorable overhead spending variance.

A)A favorable labor efficiency (usage)variance.

B)An unfavorable overhead volume variance.

C)A favorable materials quantity variance.

D)An unfavorable overhead spending variance.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

74

An unfavorable volume variance in a factory is generally:

A)The responsibility of the production manager.

B)Viewed as an idle capacity loss.

C)The result of actual volume exceeding normal volume.

D)Treated as part of the controllable factory overhead variance.

A)The responsibility of the production manager.

B)Viewed as an idle capacity loss.

C)The result of actual volume exceeding normal volume.

D)Treated as part of the controllable factory overhead variance.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

75

An unfavorable labor efficiency variance is most likely to occur if:

A)Employees are paid at an overtime wage rate.

B)Employees are inefficient and units must be reworked.

C)Labor cost per unit exceeds materials costs per unit.

D)Employee turnover rates are low.

A)Employees are paid at an overtime wage rate.

B)Employees are inefficient and units must be reworked.

C)Labor cost per unit exceeds materials costs per unit.

D)Employee turnover rates are low.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

76

In a standard cost system,finished goods are reported in:

A)The balance sheet at standard cost.

B)The balance sheet at actual cost.

C)The income statement at standard cost.

D)The income statement at actual cost.

A)The balance sheet at standard cost.

B)The balance sheet at actual cost.

C)The income statement at standard cost.

D)The income statement at actual cost.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

77

Factory overhead variances are usually recorded when:

A)Overhead is applied to Work in Process.

B)Goods are finished and transferred to finished goods inventory.

C)Goods are sold.

D)Actual factory overhead costs are incurred.

A)Overhead is applied to Work in Process.

B)Goods are finished and transferred to finished goods inventory.

C)Goods are sold.

D)Actual factory overhead costs are incurred.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

78

A supervisor's salary is an example of:

A)Direct labor.

B)Variable factory overhead.

C)A standard cost.

D)Fixed manufacturing costs.

A)Direct labor.

B)Variable factory overhead.

C)A standard cost.

D)Fixed manufacturing costs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

79

An unfavorable labor rate variance could most likely result from all of the following except:

A)Producing at levels of output which exceed normal output levels.

B)Using highly skilled laborers to perform tasks normally performed by unskilled laborers.

C)Having laborers work excessive overtime hours.

D)Using outdated standard cost figures.

A)Producing at levels of output which exceed normal output levels.

B)Using highly skilled laborers to perform tasks normally performed by unskilled laborers.

C)Having laborers work excessive overtime hours.

D)Using outdated standard cost figures.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

80

The overhead spending variance:

A)Occurs automatically whenever actual production levels differ from the "normal" production level used to compute the standard overhead cost per unit.

B)Is the difference between amounts spent for actual manufacturing overhead costs and the amount applied to production.

C)Is computed as the difference between variable overhead per the flexible budget and actual variable overhead costs incurred.

D)Is the portion of the total overhead variance that is considered "controllable" by the production manager.

A)Occurs automatically whenever actual production levels differ from the "normal" production level used to compute the standard overhead cost per unit.

B)Is the difference between amounts spent for actual manufacturing overhead costs and the amount applied to production.

C)Is computed as the difference between variable overhead per the flexible budget and actual variable overhead costs incurred.

D)Is the portion of the total overhead variance that is considered "controllable" by the production manager.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck