Deck 17: Job Order Cost Systems and Overhead Allocations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/94

Play

Full screen (f)

Deck 17: Job Order Cost Systems and Overhead Allocations

1

Metalworks Incorporated purchased $54,500 worth of direct materials to be used in Job #222.During the accounting period,Job #222 used $45,600 of direct materials.The amount of direct materials that would be shown in Job #222 Job Cost Sheet at the end of the accounting period should be $54,500,since this is the amount of direct materials the company had purchased for this particular job.

False

2

A collection of job cost sheets would be similar to a subsidiary ledger and the work-in-process account would be similar to the controlling account.

True

3

A credit balance in the manufacturing overhead account at month end indicates that the actual overhead costs were less than the amount of overhead costs applied to jobs.

True

4

An overhead application rate is computed by dividing the actual overhead costs by the expected amount of units in the activity base.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

5

Overhead application rates allow overhead to be assigned as units are being produced throughout the accounting period.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

6

In a job order cost system,the costs of direct materials,direct labor,and manufacturing overhead are accumulated separately for each department for a given period of time.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

7

Since cost accounting systems provide managers with information necessary to manage operations,the information from cost accounting systems is not useful for external reporting purposes.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

8

An overhead application rate is a device used to assign overhead costs to units of product in proportion to some "activity base" that can be traced directly to the manufactured products.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

9

Management uses a cost accounting system to evaluate and reward employee performance.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

10

Job order costing is appropriate for businesses that produce mass quantities of identical units using the same amount of direct materials,direct labor,and manufacturing overhead.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

11

A principal objective of cost accounting systems is to ensure that cost reports to management are prepared in accordance with generally accepted accounting principles.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

12

Management can compute the per-unit cost of finished goods accurately only when a job order cost system is in use.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

13

A cost driver is an activity base that is highly correlated with manufacturing overhead costs.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

14

Metalworks employs 3 assembly workers that,on average,each work 40 hours per week and earn $9 per hour.During the current accounting period,Job #543 consumed 77 hours of direct labor totaling $693.

77 direct labor hours × $9 = $693.

77 direct labor hours × $9 = $693.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

15

When goods are sold,a journal entry is made transferring the goods from cost of goods sold to finished goods.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

16

Pepsi Cola would most likely use a job order costing system.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

17

Job order costing cannot be used for a service company.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

18

Metalworks applies manufacturing overhead on the basis of direct materials used in production.During the current period,direct materials used for job #123 amounted to $22,545.If Metalworks' overhead rate is 0.65 of direct materials used,the overhead applied to job #123 for the period was $15,000.

Correct answer would have been $22,545 × 0.65 = $14,654.25

Correct answer would have been $22,545 × 0.65 = $14,654.25

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

19

An activity-based costing system does not help managers make better product pricing decisions.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

20

A debit balance in the manufacturing overhead account at month end indicates overhead applied to jobs was greater than the actual overhead costs.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

21

In activity-based costing,only one cost driver should be used in applying overhead.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

22

The method used by managers when comparing unit costs with budgeted costs or other measures is broadly known as:

A)Sales management.

B)Cost control.

C)Employee evaluation.

D)Account reconciliation.

A)Sales management.

B)Cost control.

C)Employee evaluation.

D)Account reconciliation.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

23

Activity-based costing systems always result in more accurate measurements of unit costs.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

24

An effective cost accounting system should match processes that consume resources with the associated _____ in order to maintain competitive advantage.Select the best answer to complete the sentence.

A)Sales

B)Shareholders

C)Costs

D)Activities

A)Sales

B)Shareholders

C)Costs

D)Activities

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

25

A debit balance in the Manufacturing Overhead account at the end of the period indicates that overhead has been under-applied to jobs.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

26

A job order cost system would be appropriate in the manufacturing of:

A)Paints.

B)Custom-made furniture.

C)Breakfast cereal.

D)Standard-grade plywood.

A)Paints.

B)Custom-made furniture.

C)Breakfast cereal.

D)Standard-grade plywood.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

27

If actual overhead costs are less than the amount of overhead applied to production,this indicates that manufacturing overhead is over-applied.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

28

Under a job order cost system,costs are accumulated for:

A)Each department in the production cycle.

B)Each batch of production,known as a job or lot.

C)Each individual unit produced.

D)Each job supervisor.

A)Each department in the production cycle.

B)Each batch of production,known as a job or lot.

C)Each individual unit produced.

D)Each job supervisor.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

29

A job order cost system would be suitable for which of the following:

A)A manufacturer of laundry detergent.

B)A manufacturer of candy bars.

C)A sugar refinery.

D)A sailboat builder.

A)A manufacturer of laundry detergent.

B)A manufacturer of candy bars.

C)A sugar refinery.

D)A sailboat builder.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is not a commonly used cost accounting system?

A)Manufacturing yield costing.

B)Job order costing.

C)Process costing.

D)Activity-based costing.

A)Manufacturing yield costing.

B)Job order costing.

C)Process costing.

D)Activity-based costing.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

31

If the manufacturing overhead account at month end has a credit balance before adjustment,this indicates that overhead is under-applied.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is a characteristic of manufacturing overhead in a job order cost system?

A)It is directly traceable to specific jobs or units.

B)It includes the cost of all labor relating to manufacturing operations.

C)It is assigned to units produced by means of an overhead application rate.

D)It includes the cost of direct materials used and of indirect labor.

A)It is directly traceable to specific jobs or units.

B)It includes the cost of all labor relating to manufacturing operations.

C)It is assigned to units produced by means of an overhead application rate.

D)It includes the cost of direct materials used and of indirect labor.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

33

An increase in an activity base must cause an increase in actual overhead costs incurred for that base to be considered a cost driver.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

34

Activity-based costing uses multiple activity bases to assign overhead costs to units of production.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

35

The basic types of cost accounting systems are:

A)Job order cost systems,activity based cost systems,and process cost systems.

B)Direct cost systems and indirect cost systems.

C)Completed job cost systems and work in process cost systems.

D)Fixed cost systems and variable cost systems.

A)Job order cost systems,activity based cost systems,and process cost systems.

B)Direct cost systems and indirect cost systems.

C)Completed job cost systems and work in process cost systems.

D)Fixed cost systems and variable cost systems.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is an advantage of developing a predetermined overhead application rate?

A)Long-run fluctuations in volume of output are eliminated.

B)In a job order system,unit costs can be determined only at the end of the period.

C)The overhead application rate facilitates assigning overhead costs to the ending inventory of work in process.

D)Actual overhead will always be less than applied overhead.

A)Long-run fluctuations in volume of output are eliminated.

B)In a job order system,unit costs can be determined only at the end of the period.

C)The overhead application rate facilitates assigning overhead costs to the ending inventory of work in process.

D)Actual overhead will always be less than applied overhead.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

37

Activity-based costing tracks cost to the activities that consume resources.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

38

The advantage of using a predetermined overhead application rate is that:

A)Units produced are charged with a "normal" amount of manufacturing overhead regardless of whether they are produced in a high-volume month or a low-volume month.

B)Overhead costs will be limited to the predetermined amount.

C)Entries need not be made to record actual overhead costs incurred.

D)The unit cost of production will be lower than it would be if actual overhead costs were assigned to units produced.

A)Units produced are charged with a "normal" amount of manufacturing overhead regardless of whether they are produced in a high-volume month or a low-volume month.

B)Overhead costs will be limited to the predetermined amount.

C)Entries need not be made to record actual overhead costs incurred.

D)The unit cost of production will be lower than it would be if actual overhead costs were assigned to units produced.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

39

The type of cost accounting system best suited to a particular company depends on:

A)The nature of the company's manufacturing operations.

B)The requirements set forth by the FASB.

C)Government regulations.

D)The type of cost drivers available.

A)The nature of the company's manufacturing operations.

B)The requirements set forth by the FASB.

C)Government regulations.

D)The type of cost drivers available.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

40

The two steps required in activity-based costing are identifying separate activity cost pools and allocating each cost pool to the product using an appropriate cost driver.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

41

Manufacturing overhead is:

A)A direct cost that can traced to a specific job.

B)An indirect cost that can be traced to a specific joB.

C)A direct cost that cannot be traced to a specific job.

D)An indirect cost that cannot be traced to a specific job.

A)A direct cost that can traced to a specific job.

B)An indirect cost that can be traced to a specific joB.

C)A direct cost that cannot be traced to a specific job.

D)An indirect cost that cannot be traced to a specific job.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

42

The year-end balance in the Materials Inventory controlling account is equal to:

A)The total of the various materials subsidiary ledger accounts (the materials on hand at the end of the period.)

B)The total amount of materials requisitioned during the period.

C)The total amount of materials purchased during the period.

D)The amount of materials debited to the Work-in-Process Inventory account during the period.

A)The total of the various materials subsidiary ledger accounts (the materials on hand at the end of the period.)

B)The total amount of materials requisitioned during the period.

C)The total amount of materials purchased during the period.

D)The amount of materials debited to the Work-in-Process Inventory account during the period.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

43

A job cost sheet should:

A)Contain information that summarizes all jobs finished.

B)Contain information on each individual job in process.

C)Contain only the direct costs of a particular job.

D)Only be used for jobs that have been completed.

A)Contain information that summarizes all jobs finished.

B)Contain information on each individual job in process.

C)Contain only the direct costs of a particular job.

D)Only be used for jobs that have been completed.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

44

Moran Company uses a job order cost system and has established a predetermined overhead application rate for the current year of 150% of direct labor cost,based on budgeted overhead of $900,000 and budgeted direct labor cost of $600,000.Job no.1 was charged with direct materials of $36,000 and with overhead of $27,000.What is the total cost of job no.1?

A)$64,000.

B)$81,000.

C)$91,000.

D)Cannot be determined without additional information.

A)$64,000.

B)$81,000.

C)$91,000.

D)Cannot be determined without additional information.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

45

A job cost sheet usually contains a record of each of the following except:

A)The cost of direct materials charged to a particular job.

B)The overhead costs actually incurred on a particular joB.

C)The cost of direct labor charged to a particular job.

D)The overhead cost applied to a particular job.

A)The cost of direct materials charged to a particular job.

B)The overhead costs actually incurred on a particular joB.

C)The cost of direct labor charged to a particular job.

D)The overhead cost applied to a particular job.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

46

A job cost sheet will include:

A)All raw materials purchased.

B)Actual overhead.

C)Direct labor applied to production.

D)Selling costs.

A)All raw materials purchased.

B)Actual overhead.

C)Direct labor applied to production.

D)Selling costs.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

47

At the end of the accounting period,applied overhead was larger than actual overhead by a material amount.The over-applied overhead should be:

A)Treated as an extraordinary gain.

B)Treated as an extraordinary loss.

C)Apportioned among Work in Process Inventory,Finished Goods Inventory,and Cost of Goods Sold.

D)Ignored; actual overhead is determined only for internal control purposes.

A)Treated as an extraordinary gain.

B)Treated as an extraordinary loss.

C)Apportioned among Work in Process Inventory,Finished Goods Inventory,and Cost of Goods Sold.

D)Ignored; actual overhead is determined only for internal control purposes.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

48

The cost of salaries paid to employees who work in a factory maintaining the heating system is considered:

A)Direct labor.

B)Indirect materials.

C)Factory overhead.

D)General and administrative costs.

A)Direct labor.

B)Indirect materials.

C)Factory overhead.

D)General and administrative costs.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

49

Marty's Metal Shop uses a job order cost system.It applies overhead to jobs at a rate of 175% of direct labor costs.Job No.2617 required $800 in direct labor costs.The job was initially budgeted to require $850 in direct labor costs.Overhead applied to Job No.2617 during the period amounted to:

A)$850.

B)$1,400.

C)$1,275.

D)Some other amount.

A)$850.

B)$1,400.

C)$1,275.

D)Some other amount.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

50

When a job is completed:

A)Cost of goods sold is debited.

B)Work-in-process inventory is debited.

C)Materials inventory is credited.

D)Finished goods inventory is debited.

A)Cost of goods sold is debited.

B)Work-in-process inventory is debited.

C)Materials inventory is credited.

D)Finished goods inventory is debited.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following costing systems would always use job cost sheets?

A)Job order costing.

B)Process costing.

C)Activity-based costing.

D)All three systems.

A)Job order costing.

B)Process costing.

C)Activity-based costing.

D)All three systems.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

52

Overhead costs are assigned to production using an overhead application rate,whereas no such "application rate" is used to assign the costs of direct materials and direct labor to production.The reason for this difference in procedures is that:

A)Overhead is an indirect cost which cannot be traced easily and directly to specific units of product.

B)Overhead is always larger in dollar amount than either direct materials or direct labor.

C)The amounts of direct material and direct labor applicable to each unit of production cannot be determined as easily as the amount of overhead.

D)Overhead is always equal to a constant percentage of direct labor costs.

A)Overhead is an indirect cost which cannot be traced easily and directly to specific units of product.

B)Overhead is always larger in dollar amount than either direct materials or direct labor.

C)The amounts of direct material and direct labor applicable to each unit of production cannot be determined as easily as the amount of overhead.

D)Overhead is always equal to a constant percentage of direct labor costs.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

53

The employee time card for John Winter indicates that he spent last week performing routine maintenance on factory machinery.Payments made to Winter for last week's work should be:

A)Debited to Work in Process Inventory.

B)Credited to the Direct Labor account.

C)Debited to the Direct Labor account.

D)Debited to the Manufacturing Overhead account.

A)Debited to Work in Process Inventory.

B)Credited to the Direct Labor account.

C)Debited to the Direct Labor account.

D)Debited to the Manufacturing Overhead account.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

54

A predetermined overhead application rate:

A)Expresses an expected relationship between overhead costs and an activity base.

B)Can be determined by dividing budgeted direct labor cost by the budgeted factory overhead costs.

C)Is computed at the end of the period once actual overhead costs are known.

D)Applies the same amount of overhead to each product or service.

A)Expresses an expected relationship between overhead costs and an activity base.

B)Can be determined by dividing budgeted direct labor cost by the budgeted factory overhead costs.

C)Is computed at the end of the period once actual overhead costs are known.

D)Applies the same amount of overhead to each product or service.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

55

Manufacturing overhead is not:

A)A product cost.

B)An indirect cost.

C)A manufacturing cost.

D)A period cost.

A)A product cost.

B)An indirect cost.

C)A manufacturing cost.

D)A period cost.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

56

The document that provides information for the cost of goods manufactured is:

A)The job cost sheet.

B)Time cards.

C)Material requisition.

D)Payroll check.

A)The job cost sheet.

B)Time cards.

C)Material requisition.

D)Payroll check.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

57

In a job cost system,the Work-in-Process Inventory controlling account may be reconciled to the total of the:

A)Employee time cards.

B)Materials requisitions.

C)Work-in-Process Inventory records for each department or process.

D)Job cost sheets.

A)Employee time cards.

B)Materials requisitions.

C)Work-in-Process Inventory records for each department or process.

D)Job cost sheets.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

58

Doyle Co.uses a job order cost accounting system.At year-end the Work-in-Process Inventory controlling account showed a debit balance of $43,125.For the two jobs in process at year-end,one showed $6,000 in direct materials and $4,500 in direct labor.The job cost sheet for the second job showed $9,000 in direct materials and $6,750 in direct labor.If the company is using a predetermined overhead application rate based on direct labor cost,the rate is:

A)50%.

B)100%.

C)150%.

D)200%.

A)50%.

B)100%.

C)150%.

D)200%.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

59

Edwards Auto Body uses a job order cost system.Overhead is applied to jobs on the basis of direct labor hours.During the current period,Job No.337 was charged $425 in direct materials,$475 in direct labor,and $190 in overhead.If direct labor costs an average of $16 per hour,the company's overhead application rate is:

A)$7.27 per direct labor hour.

B)$6.40 per direct labor hour.

C)$17.50 per direct labor hour.

D)$40 per direct labor hour.

A)$7.27 per direct labor hour.

B)$6.40 per direct labor hour.

C)$17.50 per direct labor hour.

D)$40 per direct labor hour.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

60

A job order cost system traces direct materials cost to a particular job by means of:

A)Materials requisitions.

B)A production budget.

C)The Materials Inventory controlling account.

D)A debit to the job cost sheet for the job.

A)Materials requisitions.

B)A production budget.

C)The Materials Inventory controlling account.

D)A debit to the job cost sheet for the job.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

61

In an activity-based costing system,manufacturing overhead costs are divided into separate:

A)Cost drivers.

B)Activity cost pools.

C)Activity bases.

D)Indirect cost centers.

A)Cost drivers.

B)Activity cost pools.

C)Activity bases.

D)Indirect cost centers.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

62

An activity base is said to be a "driver" of overhead costs when the activity base:

A)Is independent of the amount of overhead cost incurred.

B)Results in an overhead application rate greater than 100%.

C)Is a causal factor in the amount of overhead cost incurred.

D)Is the largest of the various types of expenditures classified as manufacturing overhead.

A)Is independent of the amount of overhead cost incurred.

B)Results in an overhead application rate greater than 100%.

C)Is a causal factor in the amount of overhead cost incurred.

D)Is the largest of the various types of expenditures classified as manufacturing overhead.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

63

Objectives of a cost accounting system

What are the major objectives of a cost accounting system in a manufacturing company?

What are the major objectives of a cost accounting system in a manufacturing company?

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

64

The account Work in Process Inventory:

A)Consists of completed goods that have not yet been sold.

B)Consists of goods being manufactured that are incomplete.

C)Consists of materials to be used in the production process.

D)Consists of the cost of new materials used,labor but not overhead.

A)Consists of completed goods that have not yet been sold.

B)Consists of goods being manufactured that are incomplete.

C)Consists of materials to be used in the production process.

D)Consists of the cost of new materials used,labor but not overhead.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

65

What are the total manufacturing overhead costs allocated to the Baby Swings for the current month?

A)$69,837.

B)$102,873.

C)$37,290.

D)$210,000.

A)$69,837.

B)$102,873.

C)$37,290.

D)$210,000.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

66

What are the factory utilities costs allocated to Baby Swings during the current month?

A)$210,000.

B)$51,808.

C)$34,016.

D)$19,177.

A)$210,000.

B)$51,808.

C)$34,016.

D)$19,177.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

67

An activity-based costing system would probably not be appropriate if:

A)A company produces more than one product line.

B)A company produces only one product.

C)A company is highly automated.

D)A company has more than one production facility.

A)A company produces more than one product line.

B)A company produces only one product.

C)A company is highly automated.

D)A company has more than one production facility.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

68

If manufacturing overhead is materially over-applied,it is best to close it to:

A)Work-in-process inventory.

B)Finished goods inventory.

C)Cost of goods sold.

D)Apportioned among work-in-process,finished goods,and cost of goods sold.

A)Work-in-process inventory.

B)Finished goods inventory.

C)Cost of goods sold.

D)Apportioned among work-in-process,finished goods,and cost of goods sold.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

69

The Work in Process account in a job order cost accounting system will be debited for:

A)Only direct labor and direct materials.

B)Direct labor,direct materials,and applied overhead.

C)Direct labor,direct materials,and actual overhead.

D)Only direct materials and applied overhead.

A)Only direct labor and direct materials.

B)Direct labor,direct materials,and applied overhead.

C)Direct labor,direct materials,and actual overhead.

D)Only direct materials and applied overhead.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

70

What are the setup costs allocated to Strollers during the current month?

A)$9,036.

B)$6,502.

C)$14,458.

D)Cannot be determineD.$30,000 setup costs/83 total production runs × 40 production runs attributed to Strollers = $14,458 rounded

A)$9,036.

B)$6,502.

C)$14,458.

D)Cannot be determineD.$30,000 setup costs/83 total production runs × 40 production runs attributed to Strollers = $14,458 rounded

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

71

What are the total manufacturing overhead costs allocated to the Strollers for the current month?

A)$69,837.

B)$102,873.

C)$37,290.

D)$210,000.

A)$69,837.

B)$102,873.

C)$37,290.

D)$210,000.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

72

What are the factory foremen salaries allocated to Car Seats during the current month?

A)$11,607.

B)$26,786.

C)$36,607.

D)$75,000.

A)$11,607.

B)$26,786.

C)$36,607.

D)$75,000.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following statements is true about activity-based costing?

A)Only one activity should be used for a company.

B)Many different activity bases are used in applying overhead.

C)There can only be one cost driver.

D)Direct materials and direct labor are applied to work-in-process based upon cost drivers.

A)Only one activity should be used for a company.

B)Many different activity bases are used in applying overhead.

C)There can only be one cost driver.

D)Direct materials and direct labor are applied to work-in-process based upon cost drivers.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

74

Benefits of activity-based costing include all of the following except:

A)More accurate measures of product costs.

B)More accurate evaluations of product profitability.

C)A better understanding of what "drives" manufacturing overhead costs.

D)More subjective product pricing decisions.

A)More accurate measures of product costs.

B)More accurate evaluations of product profitability.

C)A better understanding of what "drives" manufacturing overhead costs.

D)More subjective product pricing decisions.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

75

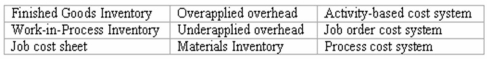

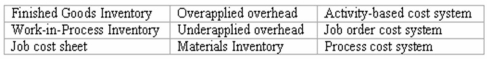

Accounting terminology

Listed below are nine technical accounting terms introduced or emphasized in this chapter: Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

_____ (a)The balance remaining in the Manufacturing Overhead account when the overhead application rate used during the period is too low.

_____ (b)The account credited as component parts are transferred into production.

_____ (c)A schedule used to accumulate manufacturing costs and to determine the unit costs associated with a specific customer's order.

_____ (d)The inventory account credited when the cost of goods sold is recorded.

_____ (e)The type of cost accounting system most likely used by an oil refinery engaged in the continuous production of petroleum products.

_____ (f)The inventory account debited when manufacturing cost accounts (such as Direct Labor or Materials Inventory)are credited.

_____ (g)The type of cost accounting system likely to be used by a machine shop that manufactures items to the specifications provided by its customers.

Listed below are nine technical accounting terms introduced or emphasized in this chapter:

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms._____ (a)The balance remaining in the Manufacturing Overhead account when the overhead application rate used during the period is too low.

_____ (b)The account credited as component parts are transferred into production.

_____ (c)A schedule used to accumulate manufacturing costs and to determine the unit costs associated with a specific customer's order.

_____ (d)The inventory account credited when the cost of goods sold is recorded.

_____ (e)The type of cost accounting system most likely used by an oil refinery engaged in the continuous production of petroleum products.

_____ (f)The inventory account debited when manufacturing cost accounts (such as Direct Labor or Materials Inventory)are credited.

_____ (g)The type of cost accounting system likely to be used by a machine shop that manufactures items to the specifications provided by its customers.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

76

Debits to the Manufacturing Overhead account record:

A)The actual amounts of overhead costs incurred during a period.

B)The amount of overhead applied to production during a period.

C)The amount of overhead incurred on a specific job.

D)All conversion costs of a period.

A)The actual amounts of overhead costs incurred during a period.

B)The amount of overhead applied to production during a period.

C)The amount of overhead incurred on a specific job.

D)All conversion costs of a period.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

77

What are the total manufacturing overhead costs allocated to the Car Seats for the current month?

A)$69,837.

B)$102,873.

C)$37,290.

D)$210,000.

A)$69,837.

B)$102,873.

C)$37,290.

D)$210,000.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following would likely be the most appropriate cost driver to allocate machinery set-up costs to products?

A)Machine hours.

B)Direct labor hours.

C)Number of production runs.

D)Repair work orders.

A)Machine hours.

B)Direct labor hours.

C)Number of production runs.

D)Repair work orders.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

79

Under-applied overhead at the end of a month:

A)Results when actual overhead costs are less than amounts applied to work in process.

B)Indicates a poorly designed cost accounting system.

C)Is represented by a debit balance remaining in the Manufacturing Overhead account.

D)Is represented by a credit balance remaining in the Work in Process Inventory account.

A)Results when actual overhead costs are less than amounts applied to work in process.

B)Indicates a poorly designed cost accounting system.

C)Is represented by a debit balance remaining in the Manufacturing Overhead account.

D)Is represented by a credit balance remaining in the Work in Process Inventory account.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

80

The account Finished Goods:

A)Consists of completed goods that have not yet been sold.

B)Consists of goods being manufactured that are incomplete.

C)Consists of materials to be used in the production process.

D)Consists of the cost of new materials used,labor but not overhead.

A)Consists of completed goods that have not yet been sold.

B)Consists of goods being manufactured that are incomplete.

C)Consists of materials to be used in the production process.

D)Consists of the cost of new materials used,labor but not overhead.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck