Deck 8: Long-Term Capital Investment Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/95

Play

Full screen (f)

Deck 8: Long-Term Capital Investment Decisions

1

If the net present value of an investment is negative, then:

A) the present value of the cash inflows is greater than the present value of the cash outflows.

B) the discount rate is negative.

C) the actual rate of return is less than the discount rate used.

D) increasing the cost of the investment will change the net present value to a positive number.

A) the present value of the cash inflows is greater than the present value of the cash outflows.

B) the discount rate is negative.

C) the actual rate of return is less than the discount rate used.

D) increasing the cost of the investment will change the net present value to a positive number.

C

2

Mid-Town Plumbers Inc. is considering the purchase of a machine costing approximately $6,000. Using a discount rate of 19%, the present value of future cash inflows are calculated to be $6,700. To yield at least an 19% return, the actual cost of the machine should not exceed the $6,000 estimate by more than:

A) $4,000

B) $6,000

C) $800

D) $700

A) $4,000

B) $6,000

C) $800

D) $700

D

3

Floyd Manufacturing purchased an asset costing $65,000. Annual operating cash inflows are expected to be $12,000 each year for ten years. No salvage value is expected at the end of the asset's life. Assuming Floyd's cost of capital is 11 percent, what is the asset's net present value? (ignore income taxes)

A) $4,443

B) $5,670

C) $4,560

D) $17,670

A) $4,443

B) $5,670

C) $4,560

D) $17,670

B

4

The time value of money concept focuses on:

A) revenues alone.

B) expenses alone.

C) cash flows.

D) net income.

A) revenues alone.

B) expenses alone.

C) cash flows.

D) net income.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

5

O'Malley Inc. purchased an asset costing $90,000. Annual operating cash inflows are expected to be $20,000 each year for six years. No salvage value is expected at the end of the asset's life. Assuming O'Malley's cost of capital is 16 percent, what is the asset's net present value? (ignore income taxes)

A) $(16,306)

B) $30,000

C) $(5,600)

D) $4,800

A) $(16,306)

B) $30,000

C) $(5,600)

D) $4,800

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

6

When using the NPV method for a particular investment decision, if the present value of all cash inflows is greater than the present value of all cash outflows, then:

A) the discount rate used was too high.

B) the investment provides an actual rate of return greater than the discount rate.

C) the investment provides an actual rate of return equal to the discount rate.

D) the discount rate was too low.

A) the discount rate used was too high.

B) the investment provides an actual rate of return greater than the discount rate.

C) the investment provides an actual rate of return equal to the discount rate.

D) the discount rate was too low.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

7

When using the NPV method for a particular investment decision, if the present value of the cash inflows is equal to the present value of the cash outflows, then:

A) the discount rate used was too high.

B) the investment should not be made.

C) the investment has an actual rate of return of zero percent.

D) the discount rate is equal to the internal rate of return.

A) the discount rate used was too high.

B) the investment should not be made.

C) the investment has an actual rate of return of zero percent.

D) the discount rate is equal to the internal rate of return.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is classified as a capital investment decision?

A) Purchase of a building

B) Purchase of inventory

C) Paying interest on bonds issued

D) Purchase of a 6-month treasury bill

A) Purchase of a building

B) Purchase of inventory

C) Paying interest on bonds issued

D) Purchase of a 6-month treasury bill

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

9

A quantitative analysis of capital investment decisions should consider:

A) accrued revenues.

B) accrued expenses.

C) accounting net income.

D) time value of money.

A) accrued revenues.

B) accrued expenses.

C) accounting net income.

D) time value of money.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

10

Big Al's is considering the purchase of a capital investment costing $33,000. Annual cash savings of $8,000, with a present value at 14 percent of $37,111, are expected for the next eight years. Given this information, which of the following statements is true?

A) This investment offers an actual rate of return of 14%.

B) This investment offers an actual rate of return of less than 14%.

C) This investment offers an actual rate of return of more than 14%.

D) This investment offers a negative rate of return.

A) This investment offers an actual rate of return of 14%.

B) This investment offers an actual rate of return of less than 14%.

C) This investment offers an actual rate of return of more than 14%.

D) This investment offers a negative rate of return.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is not a typical cash outflow associated with a capital investment?

A) Repairs and maintenance needed for purchased equipment

B) Additional operating costs resulting from the capital investment

C) Salvage value received when the newly purchased equipment is sold

D) Purchase price of new equipment

A) Repairs and maintenance needed for purchased equipment

B) Additional operating costs resulting from the capital investment

C) Salvage value received when the newly purchased equipment is sold

D) Purchase price of new equipment

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements is true regarding the concept of the time value of money?

A) A dollar paid today is worth the same as a dollar paid in the future.

B) A dollar received today is worth the same as a dollar received in the future.

C) A dollar received today is worth more than a dollar received in the future.

D) A dollar received today is worth less than a dollar received in the future.

A) A dollar paid today is worth the same as a dollar paid in the future.

B) A dollar received today is worth the same as a dollar received in the future.

C) A dollar received today is worth more than a dollar received in the future.

D) A dollar received today is worth less than a dollar received in the future.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

13

Cameo Inc., a local company specializing in home repairs, is considering replacing its older van with a new and larger one. The estimated cost of the new van will be $45,000. Using a discount rate of 16%, the company calculates a net present value for the new van of $(7,000). Based on this information, which of the following statements is true?

A) The actual rate of return on the new van is negative.

B) If the company purchases the van, they are guaranteed a rate of return of 16%.

C) Using a higher discount rate should cause the net present value to become positive.

D) If the actual cost of the new van ends up being less than $38,000, the net present value will become positive.

A) The actual rate of return on the new van is negative.

B) If the company purchases the van, they are guaranteed a rate of return of 16%.

C) Using a higher discount rate should cause the net present value to become positive.

D) If the actual cost of the new van ends up being less than $38,000, the net present value will become positive.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

14

If an investment's net present value is positive, then:

A) The investment provides a return greater than the discount rate.

B) The investment provides a return less than the discount rate.

C) The present value of the cash outflows must have been greater than the present value of the cash inflows.

D) The investment should be deemed as unacceptable.

A) The investment provides a return greater than the discount rate.

B) The investment provides a return less than the discount rate.

C) The present value of the cash outflows must have been greater than the present value of the cash inflows.

D) The investment should be deemed as unacceptable.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

15

When using the NPV method, the interest rate used to discount cash flows shouldnot be thought of as the:

A) hurdle rate.

B) internal rate of return.

C) minimum required rate of return.

D) discount rate.

A) hurdle rate.

B) internal rate of return.

C) minimum required rate of return.

D) discount rate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is false regarding the interest rate used in NPV calculations?

A) Some companies use their cost of capital as the discount rate.

B) The interest rate used may be adjusted for uncertainty.

C) It should be equal to the maximum required rate of return needed to make the investment profitable.

D) The interest rate used may be higher or lower than the investment's actual internal rate of return.

A) Some companies use their cost of capital as the discount rate.

B) The interest rate used may be adjusted for uncertainty.

C) It should be equal to the maximum required rate of return needed to make the investment profitable.

D) The interest rate used may be higher or lower than the investment's actual internal rate of return.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

17

Blossoms Inc., a local florist, is considering replacing its current refrigerator used for storing flowers with a larger one. The estimated cost of the new refrigerator will be $30,000. Using a discount rate of 15%, the company calculates a net present value for the new refrigerator of $6,000. Based on this information, which of the following statements is true?

A) If the actual cost of the new refrigerator ends up being greater than $36,000, the net present value will become negative.

B) If the actual cost of the new refrigerator ends up being less than $36,000, the net present value will become negative.

C) If the actual cost of the new refrigerator ends up being $30,000, the actual rate of return is equal to 15%.

D) If the actual cost of the new refrigerator ends up being less than $30,000, the company should not make the investment.

A) If the actual cost of the new refrigerator ends up being greater than $36,000, the net present value will become negative.

B) If the actual cost of the new refrigerator ends up being less than $36,000, the net present value will become negative.

C) If the actual cost of the new refrigerator ends up being $30,000, the actual rate of return is equal to 15%.

D) If the actual cost of the new refrigerator ends up being less than $30,000, the company should not make the investment.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

18

If the net present value of an investment is negative, then:

A) the actual rate of return is less than the discount rate.

B) the actual rate of return is more than the discount rate.

C) the actual rate of return is negative.

D) the discount rate is negative.

A) the actual rate of return is less than the discount rate.

B) the actual rate of return is more than the discount rate.

C) the actual rate of return is negative.

D) the discount rate is negative.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

19

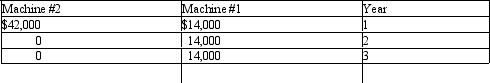

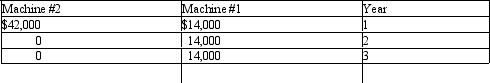

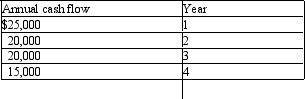

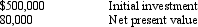

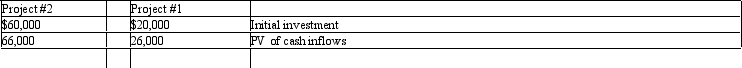

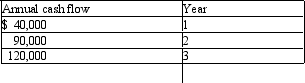

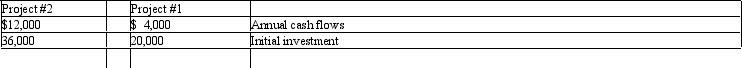

Woody Manufacturing Inc. is considering the purchase of a new machine. They have narrowed their choices down to two machines, Machine #1 and Machine #2, each having a cost of $35,000. The following information is available regarding the expected cash inflows from each machine:  When using net present value analysis, Woody uses the same cost of capital for both machines and both machines have a positive net present value.

When using net present value analysis, Woody uses the same cost of capital for both machines and both machines have a positive net present value.

Based on the above information, which of the following statements is true?

A) Machine #1 will have a higher net present value than Machine #2.

B) Machine #1 will have a lower net present value than Machine #2.

C) Machines #1 and #2 will have the same net present values.

D) Machines #1 and #2 will have the same internal rates of return.

When using net present value analysis, Woody uses the same cost of capital for both machines and both machines have a positive net present value.

When using net present value analysis, Woody uses the same cost of capital for both machines and both machines have a positive net present value.Based on the above information, which of the following statements is true?

A) Machine #1 will have a higher net present value than Machine #2.

B) Machine #1 will have a lower net present value than Machine #2.

C) Machines #1 and #2 will have the same net present values.

D) Machines #1 and #2 will have the same internal rates of return.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

20

Newman Auto Repair is considering the purchase of a hydraulic machine costing approximately $35,000. Using a discount rate of 18%, the present value of future cash inflows are calculated to be $42,000. To yield at least an 18% return, the actual cost of the machine should not exceed the $35,000 estimate by more than:

A) $28,000.

B) $49,000.

C) $7,000.

D) $6,300.

A) $28,000.

B) $49,000.

C) $7,000.

D) $6,300.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

21

The NPV method assumes that cash flows are reinvested at:

A) the government's prime rate.

B) the internal rate of return.

C) the company's discount rate.

D) an average of the internal rate of return and the discount rate.

A) the government's prime rate.

B) the internal rate of return.

C) the company's discount rate.

D) an average of the internal rate of return and the discount rate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

22

NPV calculations generally require which of the following simplifying assumptions?

A) All cash flows occur in the middle of the period.

B) All cash flows occur evenly during the period.

C) Cash flows occur equally at the beginning and end of the period.

D) All cash flows occur at the end of the period.

A) All cash flows occur in the middle of the period.

B) All cash flows occur evenly during the period.

C) Cash flows occur equally at the beginning and end of the period.

D) All cash flows occur at the end of the period.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

23

The IRR method assumes that cash inflows associated with a particular investment occur:

A) uniformly throughout the year.

B) only at the end of the year.

C) only at the beginning of the year.

D) only at the time of the initial investment.

A) uniformly throughout the year.

B) only at the end of the year.

C) only at the beginning of the year.

D) only at the time of the initial investment.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

24

If a project has an internal rate of return of 14% and a positive net present value, which of the following statements istrue regarding the discount rate used for the net present value computation?

A) The discount rate must have been greater than 14%.

B) The discount rate must have been less than 14%.

C) The discount rate must have been equal to 14%.

D) The discount rate must have been 0%.

A) The discount rate must have been greater than 14%.

B) The discount rate must have been less than 14%.

C) The discount rate must have been equal to 14%.

D) The discount rate must have been 0%.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

25

Mid-Town Products Inc. purchased equipment costing $150,000. Annual operating cash inflows are expected to be $26,000 each year for fifteen years. At the end of the equipment's life, the salvage value is expected to be $18,000. If Mid-Town's cost of capital is 14 percent, what is the asset's net present value? (ignore income taxes)

A) $4,245

B) $2,212

C) $18,000

D) $23,592

A) $4,245

B) $2,212

C) $18,000

D) $23,592

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

26

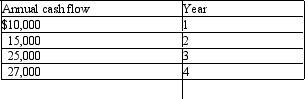

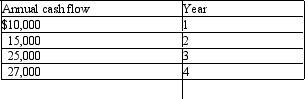

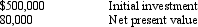

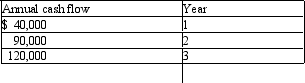

Pristine Products is considering the purchase of a new machine. The estimated cost of the machine is $45,000. The machine is expected to generate annual cash inflows for the next four years as follows:  The machine is not expected to have a residual value at the end of its useful life. If the company uses a discount rate of 15%, what is the expected net present value of the machine? (ignore taxes)

The machine is not expected to have a residual value at the end of its useful life. If the company uses a discount rate of 15%, what is the expected net present value of the machine? (ignore taxes)

A) $6,914

B) $6,253

C) $(2,757)

D) $4,200

The machine is not expected to have a residual value at the end of its useful life. If the company uses a discount rate of 15%, what is the expected net present value of the machine? (ignore taxes)

The machine is not expected to have a residual value at the end of its useful life. If the company uses a discount rate of 15%, what is the expected net present value of the machine? (ignore taxes)A) $6,914

B) $6,253

C) $(2,757)

D) $4,200

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

27

Finch Corporation purchased an asset costing $12,000. Annual operating cash inflows generated from the asset are expected to be $2,168 each year for eight years. No salvage value is expected at the end of the asset's life. Using time value of money tables, which of the following rates is closest to the internal rate of return on the project?

A) 8%

B) 9%

C) 10%

D) 16%

A) 8%

B) 9%

C) 10%

D) 16%

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

28

C & K Inc. purchased a delivery van costing $65,000. Annual operating cash inflows are expected to be $18,000 each year for six years. At the end of the asset's life, the salvage value is expected to be $5,000. Assuming C & K's cost of capital is 15 percent, what is the asset's net present value? (ignore income taxes)

A) $3,121

B) $22,044

C) $5,283

D) $959

A) $3,121

B) $22,044

C) $5,283

D) $959

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

29

The IRR method assumes that cash inflows associated with a particular capital investment decision are:

A) reinvested only at the beginning of the year.

B) never reinvested.

C) reinvested only in the last year of the investment's life.

D) immediately reinvested.

A) reinvested only at the beginning of the year.

B) never reinvested.

C) reinvested only in the last year of the investment's life.

D) immediately reinvested.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

30

Bluebird Inc. requires all capital investments to generate an internal rate of return of 14%. Bluebird is currently considering an investment that is expected to generate annual cash inflows of $12,000 for 5 years. The cost of the investment should not exceed:

A) $60,000.

B) $41,197.

C) $31,164.

D) $6,233.

A) $60,000.

B) $41,197.

C) $31,164.

D) $6,233.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

31

Oakwood Inc. requires all capital investments to generate an internal rate of return of 16%. Oakwood is currently considering an investment that is expected to generate annual cash inflows of $15,000 for 7 years. The cost of the investment should not exceed:

A) $16,800.

B) $37,149.

C) $60,579.

D) $105,000.

A) $16,800.

B) $37,149.

C) $60,579.

D) $105,000.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

32

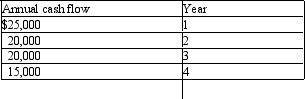

Palmetto Products is considering the purchase of a new industrial machine. The estimated cost of the machine is $50,000. The machine is expected to generate annual cash inflows for the next four years as follows:  The machine is not expected to have a residual value at the end of its useful life. If Palmetto uses a discount rate of 16%, what is the expected net present value of the machine? (ignore taxes)

The machine is not expected to have a residual value at the end of its useful life. If Palmetto uses a discount rate of 16%, what is the expected net present value of the machine? (ignore taxes)

A) $12,800

B) $18,969

C) $(5,816)

D) $7,515

The machine is not expected to have a residual value at the end of its useful life. If Palmetto uses a discount rate of 16%, what is the expected net present value of the machine? (ignore taxes)

The machine is not expected to have a residual value at the end of its useful life. If Palmetto uses a discount rate of 16%, what is the expected net present value of the machine? (ignore taxes)A) $12,800

B) $18,969

C) $(5,816)

D) $7,515

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

33

The NPV method assumes that cash inflows associated with a particular capital investment decision are:

A) reinvested only at the beginning of the year.

B) immediately reinvested.

C) reinvested only in the last year of the investment's life.

D) not reinvested.

A) reinvested only at the beginning of the year.

B) immediately reinvested.

C) reinvested only in the last year of the investment's life.

D) not reinvested.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

34

If a project has an internal rate of return of 12% and a negative net present value, which of the following statements is trueregarding the discount rate used for the net present value computation?

A) The discount rate must have been greater than 12%.

B) The discount rate must have been less than 12%.

C) The discount rate must have been equal to 12%.

D) The discount rate must have been 0%.

A) The discount rate must have been greater than 12%.

B) The discount rate must have been less than 12%.

C) The discount rate must have been equal to 12%.

D) The discount rate must have been 0%.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

35

Trenton Inc. is considering an equipment purchase that has a cost of $15,000. The equipment is expected to have a salvage value of $2,000 at the end of three years. In addition, the equipment is expected to generate cash flows over the next three years as follows:  If Trenton's cost of capital is equal to 14 percent, the net present value of the equipment is: (ignore income taxes)

If Trenton's cost of capital is equal to 14 percent, the net present value of the equipment is: (ignore income taxes)

A) $(1,340).

B) $10.

C) $(357).

D) $993.

If Trenton's cost of capital is equal to 14 percent, the net present value of the equipment is: (ignore income taxes)

If Trenton's cost of capital is equal to 14 percent, the net present value of the equipment is: (ignore income taxes)A) $(1,340).

B) $10.

C) $(357).

D) $993.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

36

Butner Inc. requires all capital investments to generate an internal rate of return of 14%. The company is considering an investment costing $100,000 that is expected to generate equal, annual cash inflows for ten years. The annual cash inflows are expected to be:

A) $19,171.

B) $16,000.

C) $38,088.

D) $12,800.

A) $19,171.

B) $16,000.

C) $38,088.

D) $12,800.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

37

Grant Inc. would like to replace an outdated piece of equipment with a newer model. Grant has determined that the new equipment needs to generate annual cash inflows of $10,000 for six years and have a salvage value at the end of year six of $4,000. Grant uses a cost of capital equal to 15 percent when making capital investment decisions. Given this information, which of the following statements is true regarding the cost of the new equipment if, using net present value analysis, Grant decides to purchase the new equipment because it has a positive net present value?

A) The cost of the equipment was $64,000 or less.

B) The cost of the equipment was $73,600 or less.

C) The cost of the equipment was $39,574 or less.

D) The cost of the equipment was $52,983 or less.

A) The cost of the equipment was $64,000 or less.

B) The cost of the equipment was $73,600 or less.

C) The cost of the equipment was $39,574 or less.

D) The cost of the equipment was $52,983 or less.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

38

The internal rate of return (IRR) of a project can be calculated using all of the following except:

A) a financial calculator.

B) present value tables.

C) a spreadsheet application, such as Excel.

D) the payback method.

A) a financial calculator.

B) present value tables.

C) a spreadsheet application, such as Excel.

D) the payback method.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

39

The IRR method assumes that cash flows are reinvested at:

A) the internal rate of return of the original investment.

B) the company's discount rate.

C) the lower of the company's discount rate or internal rate of return.

D) an average of the internal rate of return and the discount rate.

A) the internal rate of return of the original investment.

B) the company's discount rate.

C) the lower of the company's discount rate or internal rate of return.

D) an average of the internal rate of return and the discount rate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

40

If the net present value (NPV) of an investment is zero, then the internal rate of return (IRR) is:

A) less than the discount rate.

B) more than the discount rate.

C) equal to the discount rate.

D) negative.

A) less than the discount rate.

B) more than the discount rate.

C) equal to the discount rate.

D) negative.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements is false regarding the impact of taxes on net present value computations?

A) Most for-profit companies should take into account the impact of income taxes on capital investment decisions.

B) The disposal of a long-term asset may have tax consequences.

C) After-tax cash inflows will be less than before-tax cash inflows.

D) All tax-deductible expenses involve cash outflows.

A) Most for-profit companies should take into account the impact of income taxes on capital investment decisions.

B) The disposal of a long-term asset may have tax consequences.

C) After-tax cash inflows will be less than before-tax cash inflows.

D) All tax-deductible expenses involve cash outflows.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

42

Siddon Inc. is considering investing in equipment that costs $24,000. The equipment would be depreciated using the straight-line method with no half-year convention over five years and have no salvage value. If the company has a 35 percent income tax rate and desires an after-tax rate of return of 11 percent on investments, the total present value of the depreciation tax shield is:

A) $8,652.

B) $8,400.

C) $6,209.

D) $997.

A) $8,652.

B) $8,400.

C) $6,209.

D) $997.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

43

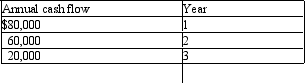

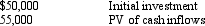

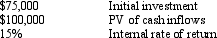

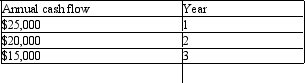

Adam's Manufacturing has the following information available regarding one of the projects it is considering:  The profitability index of this project is:

The profitability index of this project is:

A) 6.25.

B) 0.16.

C) 1.16.

D) 0.86.

The profitability index of this project is:

The profitability index of this project is:A) 6.25.

B) 0.16.

C) 1.16.

D) 0.86.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following expenses for accounting purposes generates an indirect after-tax cash inflow for purposes of net present value computations?

A) Repairs expense

B) Salaries expense

C) Depreciation expense

D) Tax expense

A) Repairs expense

B) Salaries expense

C) Depreciation expense

D) Tax expense

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

45

Cardinal Inc. purchased an asset costing $25,000. Annual operating cash inflows generated from the asset are expected to be $6,595 each year for five years. No salvage value is expected at the end of the asset's life. Using time value of money tables, which of the following rates is closest to the internal rate of return on the project?

A) 4%

B) 26%

C) 10%

D) 32%

A) 4%

B) 26%

C) 10%

D) 32%

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

46

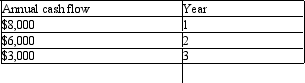

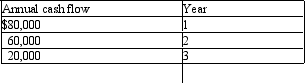

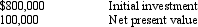

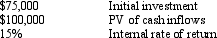

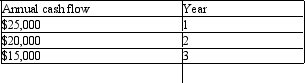

ABC Manufacturing has a project that requires an initial investment of $100,000 and has the following expected stream of cash flows:  Assuming the company's cost of capital is 12 percent, what is the profitability index for the project?

Assuming the company's cost of capital is 12 percent, what is the profitability index for the project?

A) 0.749

B) 1.335

C) 1.600

D) 2.985

Assuming the company's cost of capital is 12 percent, what is the profitability index for the project?

Assuming the company's cost of capital is 12 percent, what is the profitability index for the project?A) 0.749

B) 1.335

C) 1.600

D) 2.985

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

47

Deciding whether or not an investment meets a predetermined company standard is called a:

A) preference decision.

B) payback decision.

C) screening decision.

D) profitability decision.

A) preference decision.

B) payback decision.

C) screening decision.

D) profitability decision.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

48

Haven Inc. is in the 35 percent tax bracket and has a 12 percent rate of return. The after-tax rate of return is:

A) 12.0 percent.

B) 7.8 percent.

C) 4.2 percent.

D) 34.3 percent.

A) 12.0 percent.

B) 7.8 percent.

C) 4.2 percent.

D) 34.3 percent.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements comparing the NPV and IRR methods is false?

A) Both the NPV and IRR methods can be used for screening decisions.

B) Only the NPV method can be used to compare investments of various size or magnitude.

C) Both the NPV and IRR methods can take income tax effects into account.

D) Both the NPV and IRR methods are used for long-term decision making.

A) Both the NPV and IRR methods can be used for screening decisions.

B) Only the NPV method can be used to compare investments of various size or magnitude.

C) Both the NPV and IRR methods can take income tax effects into account.

D) Both the NPV and IRR methods are used for long-term decision making.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

50

A company choosing between two or more acceptable investment alternatives is called a:

A) profitability decision.

B) payback decision.

C) screening decision.

D) preference decision.

A) profitability decision.

B) payback decision.

C) screening decision.

D) preference decision.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

51

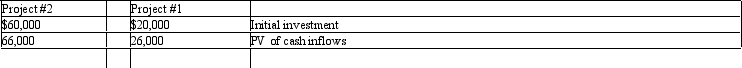

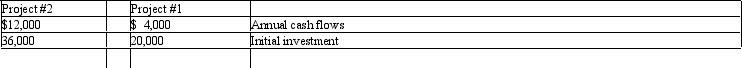

Vess Inc. is considering the following two projects:  Which of the following statements is true when comparing each of these projects?

Which of the following statements is true when comparing each of these projects?

A) Project #1 has a higher profitability index.

B) Project #2 has a higher net present value.

C) They both have the same profitability index.

D) They both have an unacceptable profitability index.

Which of the following statements is true when comparing each of these projects?

Which of the following statements is true when comparing each of these projects?A) Project #1 has a higher profitability index.

B) Project #2 has a higher net present value.

C) They both have the same profitability index.

D) They both have an unacceptable profitability index.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

52

The calculation of the profitability index (PI) is most helpful for which type of decisions?

A) Screening decisions

B) Preference decisions

C) Qualitative decisions

D) Short-term decisions

A) Screening decisions

B) Preference decisions

C) Qualitative decisions

D) Short-term decisions

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements regarding the profitability index is true?

A) A profitability index greater than 1.0 means that the investment will take longer than one year to pay for itself.

B) A profitability index greater than 1.0 means that the investment should not be made.

C) When comparing projects, the one with the highest profitability index will have a longer payback period.

D) When comparing projects, the one with the highest profitability index is preferred.

A) A profitability index greater than 1.0 means that the investment will take longer than one year to pay for itself.

B) A profitability index greater than 1.0 means that the investment should not be made.

C) When comparing projects, the one with the highest profitability index will have a longer payback period.

D) When comparing projects, the one with the highest profitability index is preferred.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

54

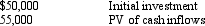

Charles Inc. has the following information available regarding one of the projects it is considering:  The profitability index of this project is:

The profitability index of this project is:

A) 5,000.

B) 0.9090.

C) 1.10.

D) 105,000.

The profitability index of this project is:

The profitability index of this project is:A) 5,000.

B) 0.9090.

C) 1.10.

D) 105,000.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

55

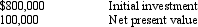

Talley Manufacturing has a project that requires an initial investment of $150,000 and has the following expected stream of cash flows:  Assuming the company's cost of capital is 14 percent, what is the profitability index for the project?

Assuming the company's cost of capital is 14 percent, what is the profitability index for the project?

A) 0.849

B) 1.320

C) 1.502

D) 1.405

Assuming the company's cost of capital is 14 percent, what is the profitability index for the project?

Assuming the company's cost of capital is 14 percent, what is the profitability index for the project?A) 0.849

B) 1.320

C) 1.502

D) 1.405

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

56

NC Products Inc. is considering investing in one of two projects. Both projects have a net present value of $25,000; however, Project #1 requires an initial investment of $300,000 while Project #2 requires an initial investment of $700,000. Based on this information, which of the following statements is true?

A) Project #2 will have a higher profitability index.

B) Project #1 will have a higher profitability index.

C) Both projects will have the same profitability index.

D) There is not enough information to determine the profitability index of either project.

A) Project #2 will have a higher profitability index.

B) Project #1 will have a higher profitability index.

C) Both projects will have the same profitability index.

D) There is not enough information to determine the profitability index of either project.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

57

RicChallengingson Corporation has the following information available regarding one of the projects it is considering:  The profitability index of this project is:

The profitability index of this project is:

A) 0.889.

B) 1.125.

C) 8.000.

D) 0.125.

The profitability index of this project is:

The profitability index of this project is:A) 0.889.

B) 1.125.

C) 8.000.

D) 0.125.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

58

Peterson Inc. has the following information available regarding one of the projects it is considering:  The profitability index of this project is:

The profitability index of this project is:

A) 1.33.

B) 0.75.

C) 0.15.

D) 0.33.

The profitability index of this project is:

The profitability index of this project is:A) 1.33.

B) 0.75.

C) 0.15.

D) 0.33.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

59

Assuming taxes are a consideration, which of the following would not have an overall positive effect on cash inflows when a company is computing the net present value of a potential capital investment?

A) The asset's salvage value

B) Cost savings per year

C) Depreciation expense

D) Initial capital investment

A) The asset's salvage value

B) Cost savings per year

C) Depreciation expense

D) Initial capital investment

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

60

Morris Manufacturing is in the 25 percent tax bracket and has a 10 percent rate of return. The after-tax rate of return is:

A) 7.5 percent.

B) 3.6 percent.

C) 36 percent.

D) 4.4 percent.

A) 7.5 percent.

B) 3.6 percent.

C) 36 percent.

D) 4.4 percent.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

61

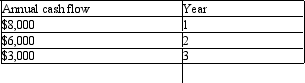

Mac Products Inc. is considering the purchase of a new machine. The estimated cost of the machine is $30,000. The machine is expected to generate annual cash inflows over the next three years as follows:  The machine will be depreciated with no half-year convention over its three-year life using the straight-line method and is not expected to have a residual value at the end of its useful life. The company considers income tax effects in all of its capital investment decisions. If the company's income tax rate is 35% and they desire an after-tax return of 14% on investments, the net present value of the new machine is:

The machine will be depreciated with no half-year convention over its three-year life using the straight-line method and is not expected to have a residual value at the end of its useful life. The company considers income tax effects in all of its capital investment decisions. If the company's income tax rate is 35% and they desire an after-tax return of 14% on investments, the net present value of the new machine is:

A) $8,965.

B) $24,056.

C) $12,338.

D) $840.

The machine will be depreciated with no half-year convention over its three-year life using the straight-line method and is not expected to have a residual value at the end of its useful life. The company considers income tax effects in all of its capital investment decisions. If the company's income tax rate is 35% and they desire an after-tax return of 14% on investments, the net present value of the new machine is:

The machine will be depreciated with no half-year convention over its three-year life using the straight-line method and is not expected to have a residual value at the end of its useful life. The company considers income tax effects in all of its capital investment decisions. If the company's income tax rate is 35% and they desire an after-tax return of 14% on investments, the net present value of the new machine is:A) $8,965.

B) $24,056.

C) $12,338.

D) $840.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

62

Buchanan Enterprises is considering investing in a machine that costs $400,000. The machine is expected to generate revenues of $175,000 per year for five years. The machine would be depreciated using the straight-line method with no half-year convention over five years and have no salvage value. The company considers the impact of income taxes in all of its capital investment decisions. The company has a 40 percent income tax rate and desires an after-tax rate of return of 10 percent on its investment. The net present value of the machine is:

A) $179,992.

B) $(13,338).

C) $119,337.

D) $(1,966).

A) $179,992.

B) $(13,338).

C) $119,337.

D) $(1,966).

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

63

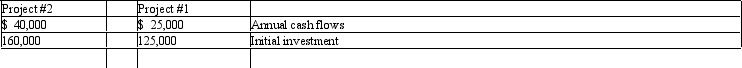

Hazir Products accepts capital investment projects with a payback period of four years or less. Under this condition, which of the following projects would be acceptable?

A) Project #1 only.

B) Project #2 only.

C) Both Project #1 and Project #2.

D) Neither Project #1 nor Project #2.

A) Project #1 only.

B) Project #2 only.

C) Both Project #1 and Project #2.

D) Neither Project #1 nor Project #2.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

64

Clinton Inc. is considering the purchase of a new equipment costing $200,000. The equipment is expected to reduce annual operating costs by $70,000 and will be depreciated using the straight-line method (with no half-year convention) over five years with no salvage value at the end of its useful life. Assuming a 40 percent income tax rate, the equipment's payback period is:

A) 2.44 years.

B) 2.86 years.

C) 3.45 years.

D) 4.76 years.

A) 2.44 years.

B) 2.86 years.

C) 3.45 years.

D) 4.76 years.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

65

Putter Inc. requires all capital investment projects to have a payback period of 4 years or less. Putter is currently considering an equipment purchase that has an initial cost of $80,000. The equipment is expected to have a six year life and a salvage value of $4,000. Assuming cash flows are equal, what does the annual cash flow generated by the equipment need to be in order to meet the payback period requirements?

A) $19,000

B) $13,333

C) $21,000

D) $20,000

A) $19,000

B) $13,333

C) $21,000

D) $20,000

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

66

What is the difference between the discount rate used for net present value computations and the internal rate of return? Explain your answer.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

67

Pauline's Products Inc. is considering investing in a new piece of equipment that costs $75,000. The equipment is expected to generate revenues of $25,000 per year for five years. The equipment would be depreciated using the straight-line method over its five year life and have a salvage value of $8,000. The company considers the impact of income taxes in all of its capital investment decisions. The company has a 35 percent income tax rate and desires an after-tax rate of return of 12 percent on its investment. The net present value of the equipment is:

A) $7,042.

B) $(13,472).

C) $21,248.

D) $5,453.

A) $7,042.

B) $(13,472).

C) $21,248.

D) $5,453.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

68

The length of time needed for a long-term project to recapture its initial investment amount is called the:

A) discount period.

B) internal rate of return.

C) present value.

D) payback period.

A) discount period.

B) internal rate of return.

C) present value.

D) payback period.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

69

Triangle Catering is considering investing in new equipment that costs $100,000. The equipment would be depreciated using the straight-line method with no half-year convention over five years and have no salvage value. If the company has a 35 percent income tax rate and desires an after-tax rate of return of 15 percent on investments, the total present value of the depreciation tax shield is:

A) $67,044.

B) $43,579.

C) $23,465.

D) $49,720.

A) $67,044.

B) $43,579.

C) $23,465.

D) $49,720.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

70

How is net present value (NPV) computed and interpreted?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

71

A local day spa is considering investing in a machine that costs $60,000. The machine is expected to generate revenues of $25,000 per year for five years. The machine would be depreciated using the straight-line method with no half-year convention over its five year life and have no salvage value. The company considers the impact of income taxes in all of its capital investment decisions. The company has a 35 percent income tax rate and desires an after-tax rate of return of 14 percent on its investment. The net present value of the machine is:

A) $36,985.

B) $10,207.

C) $25,828.

D) $22,566.

A) $36,985.

B) $10,207.

C) $25,828.

D) $22,566.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following does not consider the time value of money?

A) Net present value

B) Profitability index

C) Payback period

D) Internal rate of return

A) Net present value

B) Profitability index

C) Payback period

D) Internal rate of return

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

73

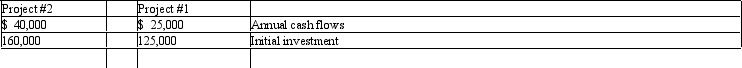

Lee Enterprises accepts capital investment projects with a payback period of five years or less. Under this condition, which of the following projects would be acceptable?

A) Project #1 only.

B) Project #2 only.

C) Both Project #1 and Project #2.

D) Neither Project #1 nor Project #2.

A) Project #1 only.

B) Project #2 only.

C) Both Project #1 and Project #2.

D) Neither Project #1 nor Project #2.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

74

Bluefield Inc. is considering a project that will require an initial investment of $75,000 and is expected to generate future cash flows of $15,000 for years 1 through 3 and $10,000 for years 4 through 8. The project's payback period is:

A) 6 years.

B) 5 years.

C) 4 years.

D) 2.67 years.

A) 6 years.

B) 5 years.

C) 4 years.

D) 2.67 years.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

75

Valeria Products is considering the purchase of a new machine costing $800,000. The machine is expected to reduce annual operating costs by $120,000 and will be depreciated using the straight-line method (with no half-year convention) over ten years with no salvage value at the end of its useful life. Assuming a 30 percent income tax rate, the machine's payback period is:

A) 5.56 years.

B) 6.76 years.

C) 9.26 years.

D) 3.57 years.

A) 5.56 years.

B) 6.76 years.

C) 9.26 years.

D) 3.57 years.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

76

Why do capital investment decisions require consideration of the time value of money?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

77

Chester Manufacturing is considering a project that will require an initial investment of $50,000 and is expected to generate future cash flows of $20,000 for years 1 through 3 and $10,000 for years 4 through 7. The project's payback period is:

A) 2.5 years.

B) 7 years.

C) 1.67 years.

D) 3.33 years.

A) 2.5 years.

B) 7 years.

C) 1.67 years.

D) 3.33 years.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

78

Vinson Manufacturing requires all capital investment projects to have a payback period of 5 years or less. Vinson is currently considering an equipment purchase that has an initial cost of $90,000. The equipment is expected to have a ten year life and a salvage value of $5,000. Assuming cash flows are equal, what does the annual cash flow generated by the equipment need to be in order to meet the payback period requirements?

A) $18,000

B) $19,000

C) $17,000

D) $9,000

A) $18,000

B) $19,000

C) $17,000

D) $9,000

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

79

Grant Manufacturing is considering investing in equipment that costs $70,000. The equipment would be depreciated using the straight-line method with no half-year convention over seven years and have no salvage value. If the company has a 40 percent income tax rate and desires an after-tax rate of return of 14 percent on investments, the total present value of the depreciation tax shield is:

A) $42,883.

B) $27,972.

C) $25,730.

D) $17,153.

A) $42,883.

B) $27,972.

C) $25,730.

D) $17,153.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

80

Tyson Enterprises is considering investing in a machine that costs $30,000. The machine is expected to generate revenues of $10,000 per year for six years. The machine would be depreciated using the straight-line method with no half-year convention over its six year life and have no salvage value. The company considers the impact of income taxes in all of its capital investment decisions. The company has a 40 percent income tax rate and desires an after-tax rate of return of 12 percent on its investment. The net present value of the machine is:

A) $2,891.

B) $(5,332).

C) $(13,555).

D) $15,225.

A) $2,891.

B) $(5,332).

C) $(13,555).

D) $15,225.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck