Deck 13: Cost Accounting and Reporting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/62

Play

Full screen (f)

Deck 13: Cost Accounting and Reporting

1

Costs may be allocated to a product or activity for many purposes, but care must be exercised when using allocated costs because:

A) direct costs identified with the product or activity may not be accurately assigned.

B) fixed costs will change in total if the volume of activity changes.

C) all costs may not have been allocated to the product or activity.

D)arbitrarily allocated costs may not behave in the way assumed in the allocation method.

A) direct costs identified with the product or activity may not be accurately assigned.

B) fixed costs will change in total if the volume of activity changes.

C) all costs may not have been allocated to the product or activity.

D)arbitrarily allocated costs may not behave in the way assumed in the allocation method.

D

2

Which of the following is more relevant to management accounting than to cost accounting?

A) accumulation and determination of product or service cost.

B) income measurement and inventory valuation.

C) generally accepted accounting principles.

D)providing managers information for planning and control purposes.

A) accumulation and determination of product or service cost.

B) income measurement and inventory valuation.

C) generally accepted accounting principles.

D)providing managers information for planning and control purposes.

D

3

Cost accounting is a subset of:

A) financial accounting.

B) process cost accounting.

C) job order cost accounting.

D)managerial accounting.

A) financial accounting.

B) process cost accounting.

C) job order cost accounting.

D)managerial accounting.

D

4

Product costs are inventoried and treated as assets until:

A) the next accounting period.

B) related liabilities no longer exist.

C) the period in which the products they relate to are sold.

D)none of the above.

A) the next accounting period.

B) related liabilities no longer exist.

C) the period in which the products they relate to are sold.

D)none of the above.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

5

The term "cost" means:

A) the price paid for a raw material.

B) the wage paid to a worker.

C) the price charged by an entity for its services.

D)all of the above.

A) the price paid for a raw material.

B) the wage paid to a worker.

C) the price charged by an entity for its services.

D)all of the above.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

6

An example of a cost likely to have an indirect relationship with products being manufactured is:

A) production labor costs.

B) raw material costs.

C) electricity costs for packaging equipment.

D)none of the above.

A) production labor costs.

B) raw material costs.

C) electricity costs for packaging equipment.

D)none of the above.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

7

For the partial value chain functions given below, which sequence is correct?

A) design, production, marketing.

B) marketing, production, distribution.

C) research and development, production, distribution.

D)customer service, marketing, distribution.

A) design, production, marketing.

B) marketing, production, distribution.

C) research and development, production, distribution.

D)customer service, marketing, distribution.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

8

Cost of Goods Manufactured can be computed as:

A) ending balance of work in process + raw materials used + direct labor costs incurred + manufacturing overhead costs applied - beginning balance of work in process.

B) beginning balance of work in process + raw materials purchased + direct labor costs incurred + manufacturing overhead costs applied - ending balance of work in process.

C) ending balance of work in process + raw materials purchased + direct labor costs incurred + manufacturing overhead costs applied - beginning balance of work in process.

D)beginning balance of work in process + raw materials used + direct labor costs incurred + manufacturing overhead costs applied - ending balance of work in process.

A) ending balance of work in process + raw materials used + direct labor costs incurred + manufacturing overhead costs applied - beginning balance of work in process.

B) beginning balance of work in process + raw materials purchased + direct labor costs incurred + manufacturing overhead costs applied - ending balance of work in process.

C) ending balance of work in process + raw materials purchased + direct labor costs incurred + manufacturing overhead costs applied - beginning balance of work in process.

D)beginning balance of work in process + raw materials used + direct labor costs incurred + manufacturing overhead costs applied - ending balance of work in process.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following costs would be classified as a period cost?

A) production line maintenance costs.

B) advertising expense for the product.

C) plant electricity.

D)indirect labor.

A) production line maintenance costs.

B) advertising expense for the product.

C) plant electricity.

D)indirect labor.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

10

The overhead component of product cost is:

A) the sum of the actual overhead costs incurred in the manufacture of the product.

B) likely to be the same amount for every product made by the company.

C) includes all manufacturing costs except those for raw materials and direct labor.

D)determined at the end of the year when actual costs and actual production are known.

A) the sum of the actual overhead costs incurred in the manufacture of the product.

B) likely to be the same amount for every product made by the company.

C) includes all manufacturing costs except those for raw materials and direct labor.

D)determined at the end of the year when actual costs and actual production are known.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following activities is not included in the organization's value chain?

A) marketing.

B) finance.

C) customer service.

D)research and development.

A) marketing.

B) finance.

C) customer service.

D)research and development.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

12

An example of a cost that is likely to have a direct relationship with products being manufactured is:

A) sales force salaries.

B) depreciation of production equipment.

C) salaries of production supervisors.

D)production labor costs.

A) sales force salaries.

B) depreciation of production equipment.

C) salaries of production supervisors.

D)production labor costs.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

13

Direct costs pertain to costs that:

A) are traceable to a cost object.

B) are not traceable to a cost object.

C) are commonly incurred.

D)are variable costs.

A) are traceable to a cost object.

B) are not traceable to a cost object.

C) are commonly incurred.

D)are variable costs.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

14

Cost accounting is concerned with:

A) accumulation and determination of product, process or service cost.

B) income measurement and inventory valuation.

C) generally accepted accounting principles.

D)all of the above.

A) accumulation and determination of product, process or service cost.

B) income measurement and inventory valuation.

C) generally accepted accounting principles.

D)all of the above.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

15

An example of a product cost is:

A) advertising expense for the product.

B) a portion of the president's travel expenses.

C) interest expense on a loan to finance inventory.

D)production line maintenance costs.

A) advertising expense for the product.

B) a portion of the president's travel expenses.

C) interest expense on a loan to finance inventory.

D)production line maintenance costs.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

16

The production cost of a single unit of a manufactured product is determined by:

A) dividing total direct materials and direct labor for a production run by the number of units made.

B) dividing total direct materials, direct labor, and manufacturing overhead for a production run by the number of units made.

C) dividing total direct materials, direct labor, manufacturing overhead and selling expenses for a production run by the number of units made.

D)dividing the selling price by the gross profit ratio.

A) dividing total direct materials and direct labor for a production run by the number of units made.

B) dividing total direct materials, direct labor, and manufacturing overhead for a production run by the number of units made.

C) dividing total direct materials, direct labor, manufacturing overhead and selling expenses for a production run by the number of units made.

D)dividing the selling price by the gross profit ratio.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

17

Common costs pertain to costs that:

A) are directly traceable to a cost object.

B) are not directly traceable to a cost object.

C) are commonly incurred.

D)are direct costs.

A) are directly traceable to a cost object.

B) are not directly traceable to a cost object.

C) are commonly incurred.

D)are direct costs.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

18

The sequence of activities that add value to the organization are:

A) the value processes.

B) the chain of production events.

C) the value chain.

D)the strategic cost initiatives.

A) the value processes.

B) the chain of production events.

C) the value chain.

D)the strategic cost initiatives.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

19

An organization's value chain refers to:

A) the process of using cost information to manage the activities of the organization.

B) the sequence of functions and related activities that add value for the customer.

C) the process of collecting and recording valuable information in the accounting information system.

D)None of the above.

A) the process of using cost information to manage the activities of the organization.

B) the sequence of functions and related activities that add value for the customer.

C) the process of collecting and recording valuable information in the accounting information system.

D)None of the above.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

20

In the T-account cost flow diagram of balance sheet inventory accounts and the income statement cost of goods sold account:

A) raw materials purchases are debited to work in process.

B) direct labor costs are credited to work in process.

C) cost of goods manufactured is debited to finished goods inventory.

D)cost of goods sold is debited to finished goods inventory.

A) raw materials purchases are debited to work in process.

B) direct labor costs are credited to work in process.

C) cost of goods manufactured is debited to finished goods inventory.

D)cost of goods sold is debited to finished goods inventory.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is NOT an inventory account for a manufacturing company?

A) Cost of goods sold.

B) Work-in-process.

C) Raw materials.

D)Finished goods.

A) Cost of goods sold.

B) Work-in-process.

C) Raw materials.

D)Finished goods.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

22

The three sections of a statement of cost of goods manufactured include:

A) raw material, direct labor, manufacturing overhead.

B) variable expenses, contribution margin, fixed expenses.

C) sales revenue, gross profit, selling and administrative expenses.

D)direct costs, indirect costs, operating profit.

A) raw material, direct labor, manufacturing overhead.

B) variable expenses, contribution margin, fixed expenses.

C) sales revenue, gross profit, selling and administrative expenses.

D)direct costs, indirect costs, operating profit.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following costs are included in the "for cost accounting purposes" classification?

A) Variable cost and fixed cost.

B) Direct cost and indirect cost.

C) Product cost and period cost.

D)Committed cost and discretionary cost.

A) Variable cost and fixed cost.

B) Direct cost and indirect cost.

C) Product cost and period cost.

D)Committed cost and discretionary cost.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

24

If all units produced during the month of September are sold, and no additional units are sold from the beginning finished goods inventory, then:

A) income determined with absorption costing will equal income determined with direct costing.

B) ending work in process inventory will increase.

C) income determined with absorption costing will be lower than income determined with direct costing.

D)ending finished goods inventory will decrease.

A) income determined with absorption costing will equal income determined with direct costing.

B) ending work in process inventory will increase.

C) income determined with absorption costing will be lower than income determined with direct costing.

D)ending finished goods inventory will decrease.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

25

An excess of cost of goods manufactured over cost of goods sold for the period represents:

A) an increase in gross profit.

B) a decrease in work in process inventory.

C) overapplied manufacturing overhead.

D)an increase in finished goods inventory.

A) an increase in gross profit.

B) a decrease in work in process inventory.

C) overapplied manufacturing overhead.

D)an increase in finished goods inventory.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is NOT an account that over/under applied overhead is transferred to at the end of an accounting period?

A) Cost of Goods Sold.

B) Work-in-Process.

C) Raw Materials.

D)Finished Goods.

A) Cost of Goods Sold.

B) Work-in-Process.

C) Raw Materials.

D)Finished Goods.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following items would not be reported on the statement of cost of goods manufactured?

A) beginning work in process inventory.

B) purchases of raw materials.

C) total manufacturing costs.

D)contribution margin.

A) beginning work in process inventory.

B) purchases of raw materials.

C) total manufacturing costs.

D)contribution margin.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following will cause income determined with absorption costing to be higher than income determined with direct costing?

A) units produced equal units sold.

B) units produced are greater than units sold.

C) units produced are less than units sold.

D)income determined with absorption costing will always equal income determined with direct costing.

A) units produced equal units sold.

B) units produced are greater than units sold.

C) units produced are less than units sold.

D)income determined with absorption costing will always equal income determined with direct costing.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

29

The shift in the amount of manufacturing overhead costs applied to the mix of products produced that occurs when using a single cost driver rate as compared to using activity-based costing rates is known as:

A) underapplied overhead.

B) overapplied overhead.

C) cost absorption.

D)cost distortion.

A) underapplied overhead.

B) overapplied overhead.

C) cost absorption.

D)cost distortion.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following describes the correct sequence of flow of costs for a manufacturing firm?

A) Raw materials, finished goods, work-in-process, cost of goods sold.

B) Work-in-process, raw materials, finished goods, cost of goods sold.

C) Raw materials, work-in-process, finished goods, cost of goods sold.

D)Raw materials, work-in-process, cost of goods sold, finished goods.

A) Raw materials, finished goods, work-in-process, cost of goods sold.

B) Work-in-process, raw materials, finished goods, cost of goods sold.

C) Raw materials, work-in-process, finished goods, cost of goods sold.

D)Raw materials, work-in-process, cost of goods sold, finished goods.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

31

Total manufacturing costs for the month on the statement of costs of goods manufactured equals:

A) variable costs + fixed costs + mixed costs.

B) work in process inventory - finished goods inventory.

C) cost of goods sold - cost of goods manufactured.

D)cost of raw material used + direct labor cost incurred + manufacturing overhead applied.

A) variable costs + fixed costs + mixed costs.

B) work in process inventory - finished goods inventory.

C) cost of goods sold - cost of goods manufactured.

D)cost of raw material used + direct labor cost incurred + manufacturing overhead applied.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

32

The primary difference between absorption costing and direct costing is the treatment of:

A) direct material costs.

B) variable manufacturing overhead.

C) fixed manufacturing overhead.

D)direct labor costs.

A) direct material costs.

B) variable manufacturing overhead.

C) fixed manufacturing overhead.

D)direct labor costs.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

33

A predetermined overhead rate is used to:

A) keep track of actual overhead costs as they are incurred.

B) assign indirect costs to cost objects.

C) establish prices for manufactured products.

D)allocate selling and administrative expenses to manufactured products.

A) keep track of actual overhead costs as they are incurred.

B) assign indirect costs to cost objects.

C) establish prices for manufactured products.

D)allocate selling and administrative expenses to manufactured products.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

34

In order to achieve higher quality cost information from the assignment of overhead costs to products manufactured, the use of a predetermined overhead rate is being replaced by:

A) absorption costing.

B) job order costing.

C) activity-based costing.

D)process costing.

A) absorption costing.

B) job order costing.

C) activity-based costing.

D)process costing.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

35

Direct costing may be used for:

A) internal reporting purposes.

B) external financial reporting purposes.

C) income tax reporting purposes.

D)all of the above.

A) internal reporting purposes.

B) external financial reporting purposes.

C) income tax reporting purposes.

D)all of the above.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

36

The predetermined overhead application rate based on direct labor hours is computed as:

A) actual total overhead costs divided by actual direct labor hours.

B) estimated total overhead costs divided by estimated direct labor hours.

C) actual total overhead costs divided by estimated direct labor hours.

D)estimated total overhead costs divided by actual direct labor hours.

A) actual total overhead costs divided by actual direct labor hours.

B) estimated total overhead costs divided by estimated direct labor hours.

C) actual total overhead costs divided by estimated direct labor hours.

D)estimated total overhead costs divided by actual direct labor hours.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is a true statement regarding absorption and/or direct costing?

A) A firm can choose to use either absorption or direct costing for income tax purposes.

B) A firm can choose to use either absorption or direct costing for financial reporting purposes.

C) Direct costing assigns only direct materials and direct labor to products.

D)Absorption costing includes fixed overhead in product costs whereas direct costing does not.

A) A firm can choose to use either absorption or direct costing for income tax purposes.

B) A firm can choose to use either absorption or direct costing for financial reporting purposes.

C) Direct costing assigns only direct materials and direct labor to products.

D)Absorption costing includes fixed overhead in product costs whereas direct costing does not.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

38

The three components of product costs are:

A) direct material, supervisor salaries, selling expenses.

B) direct labor, manufacturing overhead, indirect material.

C) direct material, direct labor, manufacturing overhead.

D)manufacturing overhead, indirect material, indirect labor.

A) direct material, supervisor salaries, selling expenses.

B) direct labor, manufacturing overhead, indirect material.

C) direct material, direct labor, manufacturing overhead.

D)manufacturing overhead, indirect material, indirect labor.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

39

An activity-based costing system involves identifying the activity that causes the incurrence of a cost; this activity is known as a:

A) cost driver.

B) cost applier.

C) direct cost.

D)cost object.

A) cost driver.

B) cost applier.

C) direct cost.

D)cost object.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

40

A debit balance in the manufacturing overhead account at the end of the period indicates that:

A) manufacturing overhead is overapplied.

B) manufacturing overhead is underapplied.

C) manufacturing overhead has been accurately applied.

D)None of the above.

A) manufacturing overhead is overapplied.

B) manufacturing overhead is underapplied.

C) manufacturing overhead has been accurately applied.

D)None of the above.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

41

The use of activity-based costing information to support the decision-making process is known as:

A) value chain analysis.

B) cost distortion analysis.

C) activity-based management.

D)cost-based management.

A) value chain analysis.

B) cost distortion analysis.

C) activity-based management.

D)cost-based management.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

42

For each of the following costs, check the columns that most likely apply.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

43

An example of a direct cost in the production of a computer is:

A) depreciation of production equipment.

B) production labor costs.

C) salary of the vice president of production.

D)material warehouse costs.

A) depreciation of production equipment.

B) production labor costs.

C) salary of the vice president of production.

D)material warehouse costs.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

44

Erber, Inc. produces men's neckties and dress socks. Manufacturing overhead is assigned to production using an application rate based on direct labor hours.(a.) For 2016, the company's cost accountant estimated that total overhead costs incurred would be $184,500, and that a total of 24,600 direct labor hours would be worked. Calculate the amount of overhead to be applied for each direct labor hour worked on a production run.(b.) A production run of 500 neckties required raw materials that cost $3,120, and 140 direct labor hours at a cost of $8.00 per hour. Calculate the cost of each necktie produced.(c.) At the end of February 2016, 420 neckties made in the above production run had been sold, and the rest were in ending inventory. Calculate the cost of the neckties sold that would have been reported in the income statement and the cost included in the February 28, 2016, finished goods inventory.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

45

ABC Company estimates total overhead costs to be $1,200,000 and will apply overhead to units produced based on 200,000 estimated machine hours. During the year ABC Company incurred actual overhead costs of $1,250,000 and achieved 250,000 machine hours. ABC Company's predetermined overhead rate is:

A) $4.80 per machine hour.

B) $5.00 per machine hour.

C) $6.00 per machine hour.

D)$6.25 per machine hour.

A) $4.80 per machine hour.

B) $5.00 per machine hour.

C) $6.00 per machine hour.

D)$6.25 per machine hour.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

46

Indirect costs pertain to costs that:

A) are traceable to a cost object.

B) are not traceable to a cost object.

C) are commonly incurred.

D)are variable costs.

A) are traceable to a cost object.

B) are not traceable to a cost object.

C) are commonly incurred.

D)are variable costs.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

47

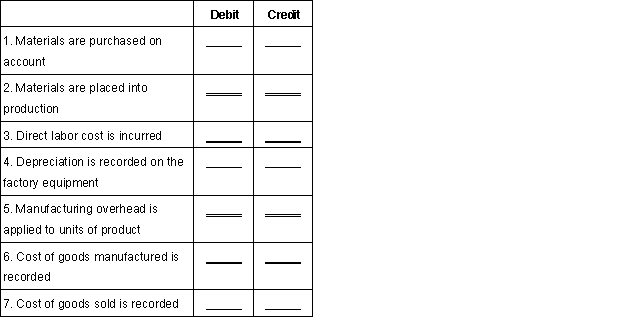

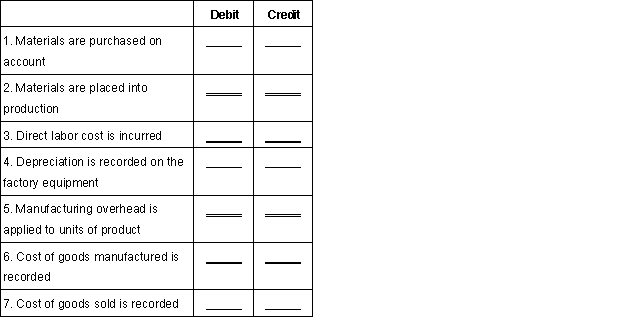

Webster World Products uses the following account titles:

A.

Accounts payable

F.

Depreciation expense

B.

Raw materials inventory

G.

Accumulated depreciation

C.

Work in process inventory

H.

Wages and salaries payable

D.Manufacturing overhead

E.

Cost of goods sold

J.

Finished goods inventory

For each transaction described below, indicate which accounts would be debited and credited under a job order cost system:

A.

Accounts payable

F.

Depreciation expense

B.

Raw materials inventory

G.

Accumulated depreciation

C.

Work in process inventory

H.

Wages and salaries payable

D.Manufacturing overhead

E.

Cost of goods sold

J.

Finished goods inventory

For each transaction described below, indicate which accounts would be debited and credited under a job order cost system:

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

48

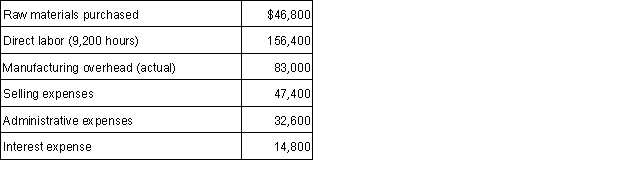

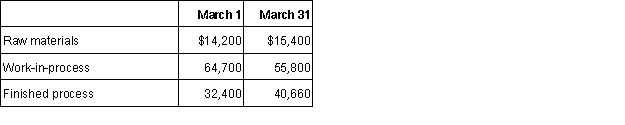

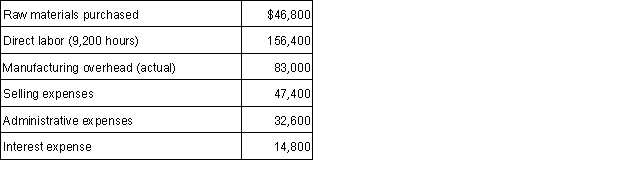

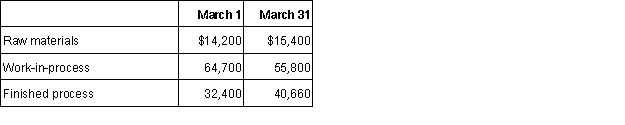

Partridge, Inc. incurred the following costs during March:

Manufacturing overhead is applied on the basis of $8.50 per direct labor hour. Assume that overapplied or underapplied overhead is transferred to cost of goods sold only at the end of the year. During the month, 3,500 units of product were manufactured and 3,400 units of product were sold. On March 1 and March 31, Partridge carried the following inventory balances:

(a.) Prepare a Statement of Cost of Goods Manufactured for the month of March, and calculate the average cost per unit produced.(b.) Calculate the cost of goods sold during March.(c.) Where in the financial statements will the difference between cost of goods manufactured and cost of goods sold be classified?

(a.) Prepare a Statement of Cost of Goods Manufactured for the month of March, and calculate the average cost per unit produced.(b.) Calculate the cost of goods sold during March.(c.) Where in the financial statements will the difference between cost of goods manufactured and cost of goods sold be classified?

Manufacturing overhead is applied on the basis of $8.50 per direct labor hour. Assume that overapplied or underapplied overhead is transferred to cost of goods sold only at the end of the year. During the month, 3,500 units of product were manufactured and 3,400 units of product were sold. On March 1 and March 31, Partridge carried the following inventory balances:

(a.) Prepare a Statement of Cost of Goods Manufactured for the month of March, and calculate the average cost per unit produced.(b.) Calculate the cost of goods sold during March.(c.) Where in the financial statements will the difference between cost of goods manufactured and cost of goods sold be classified?

(a.) Prepare a Statement of Cost of Goods Manufactured for the month of March, and calculate the average cost per unit produced.(b.) Calculate the cost of goods sold during March.(c.) Where in the financial statements will the difference between cost of goods manufactured and cost of goods sold be classified?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following best describes cost accounting?

A) cost accounting serves the needs of both financial and managerial accounting.

B) managerial accounting is a subset of cost accounting.

C) financial accounting is a subset of cost accounting.

D)cost accounting is an alternative to both financial and managerial accounting.

A) cost accounting serves the needs of both financial and managerial accounting.

B) managerial accounting is a subset of cost accounting.

C) financial accounting is a subset of cost accounting.

D)cost accounting is an alternative to both financial and managerial accounting.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

50

Activity-based costing minimizes the risk of cost distortion when applying overhead by:

A) using a single cost driver rate.

B) using multiple cost driver rates.

C) using actual activity cost rates.

D)using absorption cost rates.

A) using a single cost driver rate.

B) using multiple cost driver rates.

C) using actual activity cost rates.

D)using absorption cost rates.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

51

PlayCraft Co. manufactures toy boats. During 2016, total costs incurred in making 54,000 toy boats included $189,000 of fixed manufacturing overhead. The total absorption cost per toy boat was $28.50.(a.) Calculate the variable cost per toy boat.(b.) The ending inventory of toy boats was 11,600 units higher at the end of 2016 than at the beginning of the year. By how much and in what direction (higher or lower) would cost of goods sold for 2016 be different under direct costing than under variable costing?

(c.) Express the toy boat cost in a cost formula. What does this formula suggest the total cost of making an additional 5,800 toy boats would be?

(c.) Express the toy boat cost in a cost formula. What does this formula suggest the total cost of making an additional 5,800 toy boats would be?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

52

The following table summarizes the beginning and ending inventories of Ariel Co. for the month of October:

Raw materials purchased during the month of October totaled $112,300. Direct labor costs incurred totaled $234,800 for the month. Actual and applied manufacturing overhead costs for October totaled $145,100 and $149,400, respectively.(a) Calculate the cost of goods manufactured for October.(b) Calculate the cost of goods sold for October (Ignore under/overapplied overhead).(c) Given the fact that 25,000 units were produced, what is the cost per unit for October?

Raw materials purchased during the month of October totaled $112,300. Direct labor costs incurred totaled $234,800 for the month. Actual and applied manufacturing overhead costs for October totaled $145,100 and $149,400, respectively.(a) Calculate the cost of goods manufactured for October.(b) Calculate the cost of goods sold for October (Ignore under/overapplied overhead).(c) Given the fact that 25,000 units were produced, what is the cost per unit for October?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

53

The following information is from ABC Company's general ledger: Beginning and ending inventories, respectively, for raw materials were $16,000 and $20,000 and for work in process were $40,000 and $44,000. Raw material purchases and direct labor costs incurred were $72,000 each, and manufacturing overhead applied amounted to $40,000. Determine the total cost of goods manufactured during the period.

A) $176,000.

B) $180,000.

C) $184,000.

D)$220,000.

A) $176,000.

B) $180,000.

C) $184,000.

D)$220,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following items would be reported on the Statement of Cost of Goods Manufactured?

A) cost of goods sold.

B) beginning finished goods inventory.

C) ending work in process inventory.

D)contribution margin.

A) cost of goods sold.

B) beginning finished goods inventory.

C) ending work in process inventory.

D)contribution margin.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

55

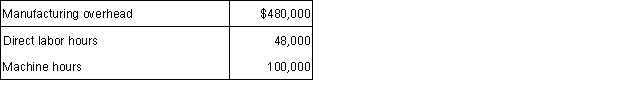

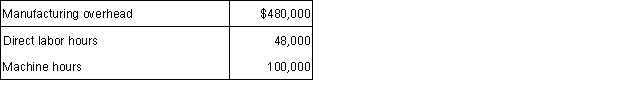

Eberlin Boats estimates the following for 2016:

During 2016 Eberlin incurs the following costs and activity:

Eberlin uses direct labor hours to calculate the predetermined overhead rate for the year.(a.) Calculate the predetermined overhead rate for 2016.(b.) Calculate the applied overhead for 2016.(c.) Calculate the amount of overapplied or underapplied overhead for 2016.

Eberlin uses direct labor hours to calculate the predetermined overhead rate for the year.(a.) Calculate the predetermined overhead rate for 2016.(b.) Calculate the applied overhead for 2016.(c.) Calculate the amount of overapplied or underapplied overhead for 2016.

During 2016 Eberlin incurs the following costs and activity:

Eberlin uses direct labor hours to calculate the predetermined overhead rate for the year.(a.) Calculate the predetermined overhead rate for 2016.(b.) Calculate the applied overhead for 2016.(c.) Calculate the amount of overapplied or underapplied overhead for 2016.

Eberlin uses direct labor hours to calculate the predetermined overhead rate for the year.(a.) Calculate the predetermined overhead rate for 2016.(b.) Calculate the applied overhead for 2016.(c.) Calculate the amount of overapplied or underapplied overhead for 2016.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

56

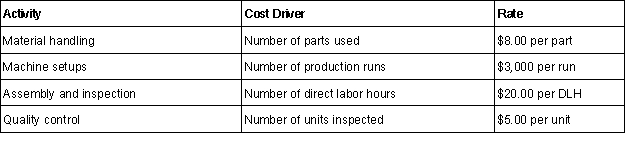

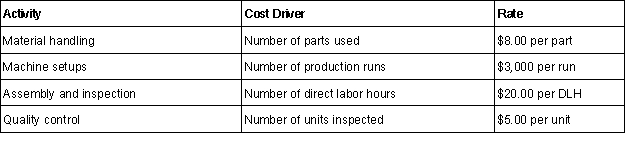

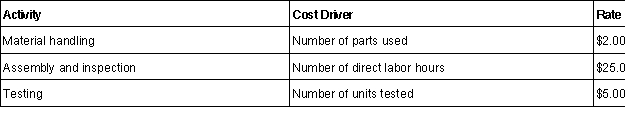

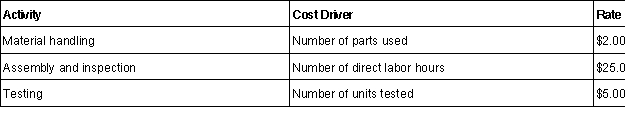

Envision Company uses activity-based costing (ABC) for allocating manufacturing overhead costs to jobs and it has established the following cost drivers and rates:

During July, Job #2005 produced 1,500 units and required the following activity: 1,800 parts, 2 production runs, and 325 direct labor hours.(a.) Calculate the amount of manufacturing overhead applied to Job #2005.(b.) Explain the advantage of using the ABC approach.

During July, Job #2005 produced 1,500 units and required the following activity: 1,800 parts, 2 production runs, and 325 direct labor hours.(a.) Calculate the amount of manufacturing overhead applied to Job #2005.(b.) Explain the advantage of using the ABC approach.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

57

AAA Plumbing Co. incurred the following costs during August:

During the month, 9,000 units of product were manufactured and 8,500 units of product were sold. On August 1, AAA Plumbing carried no inventories.(a.) Calculate the cost of goods manufactured during August and the average cost per unit of product manufactured.(b.) Calculate the cost of goods sold during August.(c.) Where in the financial statements will the difference between cost of goods manufactured and cost of goods sold be classified?

During the month, 9,000 units of product were manufactured and 8,500 units of product were sold. On August 1, AAA Plumbing carried no inventories.(a.) Calculate the cost of goods manufactured during August and the average cost per unit of product manufactured.(b.) Calculate the cost of goods sold during August.(c.) Where in the financial statements will the difference between cost of goods manufactured and cost of goods sold be classified?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

58

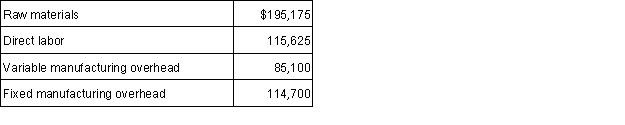

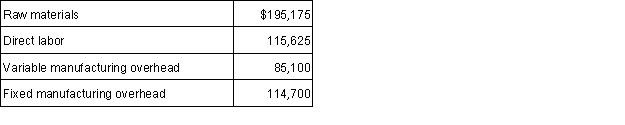

Great Bay Co. manufactures cordless telephones. During 2016, total costs associated with manufacturing 18,500 of the AB-2000 model (introduced this year) were as follows:

(a.) Calculate the cost per phone under both direct (or variable) costing and absorption costing.(b.) If 2,800 of these phones were in finished goods inventory at the end of 2016, by how much and in what direction (higher or lower) would 2016 operating income be different under direct (or variable) costing than under absorption costing?

(c.) Express the phone cost in a cost formula. What does this formula suggest the total cost of making an additional 1,600 phones would be?

(a.) Calculate the cost per phone under both direct (or variable) costing and absorption costing.(b.) If 2,800 of these phones were in finished goods inventory at the end of 2016, by how much and in what direction (higher or lower) would 2016 operating income be different under direct (or variable) costing than under absorption costing?

(c.) Express the phone cost in a cost formula. What does this formula suggest the total cost of making an additional 1,600 phones would be?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

59

Erca, Inc. produces automobile bumpers. Overhead is applied on the basis of machine hours required for cutting and fabricating. A predetermined overhead application rate of $15.00 per machine hour was established for 2016.(a.) If 9,000 machine hours were expected to be used during 2016, how much overhead was expected to be incurred?

(b.) Actual overhead incurred during 2016 totaled $135,000, and 9,200 machine hours were used during 2016. Calculate the amount of over- or underapplied overhead for 2016.(c.) Explain the accounting necessary for the over- or underapplied overhead for the year.

(b.) Actual overhead incurred during 2016 totaled $135,000, and 9,200 machine hours were used during 2016. Calculate the amount of over- or underapplied overhead for 2016.(c.) Explain the accounting necessary for the over- or underapplied overhead for the year.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

60

Cost management initiatives along an organization's value chain functions begins with __________ and concludes with __________.

A) marketing; production

B) research and development; customer service

C) design; production

D)production; distribution

A) marketing; production

B) research and development; customer service

C) design; production

D)production; distribution

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

61

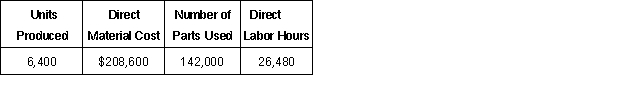

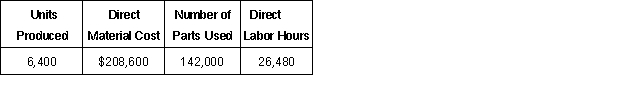

Baja Industries has recently switched its method of applying manufacturing overhead from a single predetermined overhead rate based on direct labor hours to activity-based costing (ABC). Assume that the direct labor rate is $18.00 per hour and that there were no beginning inventories. The following cost drivers and rates have been developed for allocating manufacturing overhead costs:

The following production, costs, and activities occurred during the month of August:

(a.) Calculate the total manufacturing cost and the cost per unit for the month of August.(b.) Assume instead that Baja Industries applies manufacturing overhead on the basis of $40.00 per direct labor hours (rather than the ABC method). Calculate the total manufacturing overhead cost applied for the month of August.(c.) Which method of applying overhead do you think provides better information for manufacturing managers?

(a.) Calculate the total manufacturing cost and the cost per unit for the month of August.(b.) Assume instead that Baja Industries applies manufacturing overhead on the basis of $40.00 per direct labor hours (rather than the ABC method). Calculate the total manufacturing overhead cost applied for the month of August.(c.) Which method of applying overhead do you think provides better information for manufacturing managers?

The following production, costs, and activities occurred during the month of August:

(a.) Calculate the total manufacturing cost and the cost per unit for the month of August.(b.) Assume instead that Baja Industries applies manufacturing overhead on the basis of $40.00 per direct labor hours (rather than the ABC method). Calculate the total manufacturing overhead cost applied for the month of August.(c.) Which method of applying overhead do you think provides better information for manufacturing managers?

(a.) Calculate the total manufacturing cost and the cost per unit for the month of August.(b.) Assume instead that Baja Industries applies manufacturing overhead on the basis of $40.00 per direct labor hours (rather than the ABC method). Calculate the total manufacturing overhead cost applied for the month of August.(c.) Which method of applying overhead do you think provides better information for manufacturing managers?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

62

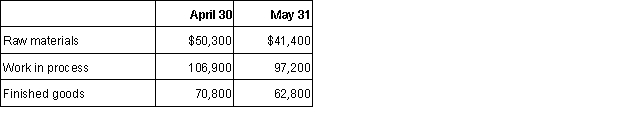

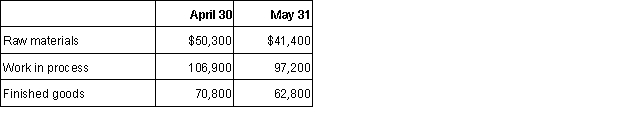

The following are beginning and ending inventories of ABC Company for the month of May:

Raw materials purchased during the month of May totaled $185,900. Direct labor costs incurred totaled $468,300 for the month. Actual and applied manufacturing overhead costs for May totaled $282,600 and $288,400, respectively. Over/underapplied overhead is written off to cost of goods sold at the end of the year in December.(a) Calculate the cost of goods manufactured for May.(b) Calculate the cost of goods sold for May.

Raw materials purchased during the month of May totaled $185,900. Direct labor costs incurred totaled $468,300 for the month. Actual and applied manufacturing overhead costs for May totaled $282,600 and $288,400, respectively. Over/underapplied overhead is written off to cost of goods sold at the end of the year in December.(a) Calculate the cost of goods manufactured for May.(b) Calculate the cost of goods sold for May.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck