Deck 23: Negotiation of Commercial Paper

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/38

Play

Full screen (f)

Deck 23: Negotiation of Commercial Paper

1

Makers and acceptors are secondary parties and are unconditionally liable to pay the instrument.

False

2

The Wisner Elevator Company, Inc. v. Richland State Bank case is about partial indorsements.

False

3

The fictitious payee rule puts the risk of loss on employers for the actions of their unscrupulous employees.

True

4

"For deposit" or "for collections" are effective trust indorsements.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

5

A collection indorsement attempts to limit payment to a particular person or otherwise prohibit further transfer or negotiation.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

6

A bearer instrument is like cash: it can be negotiated by mere possession.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

7

Under the Uniform Commercial Code Section 3-202(a), a forgery is an "unauthorized signature."

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

8

The "holder" of an instrument need not actually have possession of it.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

9

Only negotiable instruments can be transferred.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

10

A conditional indorsement is an indorsement that makes the instrument's payment dependent on the occurrence of some event specified in the indorsement; generally invalid.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

11

A blank indorsement consists of the indorser's signature alone.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

12

A blank indorsement converts order paper to bearer paper.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

13

An order paper is a negotiable instrument that by its term is payable to a specified person or his assignee.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

14

An indorsement that consists of the words "without recourse" is a conditional indorsement.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

15

A negotiation is ineffective when made by a person without the capacity to sign.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

16

An indorsement that operates to pay only part of the face value of an instrument is not an effective indorsement.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

17

A note or draft can be payable to two or more persons.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

18

Negotiation can occur only with an order paper.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

19

The transferor's contract liability is limited.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

20

A prior party who reacquires an instrument may reissue it or negotiate it further.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

21

Agency indorsements are _____.

A) conditional indorsements

B) qualified indorsements

C) special indorsements

D) trust indorsements

E) blank indorsements

A) conditional indorsements

B) qualified indorsements

C) special indorsements

D) trust indorsements

E) blank indorsements

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

22

A holder can convert a blank indorsement into a _____ indorsement by writing over the signature any terms consistent with the indorsement.

A) qualified

B) collection

C) restrictive

D) partial

E) special

A) qualified

B) collection

C) restrictive

D) partial

E) special

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

23

The dichotomy between _____ indorsements and _____ indorsements is the indorser's way of indicating how the instrument can be subsequently negotiated: with or without further indorsing.

A) qualified; conditional

B) restrictive; partial

C) conditional; agency

D) blank; special

E) trust; collection

A) qualified; conditional

B) restrictive; partial

C) conditional; agency

D) blank; special

E) trust; collection

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following indorsements converts the instrument into paper closely akin to cash?

A) A qualified indorsement

B) A trust indorsement

C) A blank indorsement

D) A special indorsement

E) A restrictive indorsement

A) A qualified indorsement

B) A trust indorsement

C) A blank indorsement

D) A special indorsement

E) A restrictive indorsement

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

25

Katie James indorses her paycheck "for deposit only, Katie James". This is an example of a _____.

A) restrictive indorsement

B) qualified indorsement

C) special indorsement

D) partial indorsement

E) conditional indorsement

A) restrictive indorsement

B) qualified indorsement

C) special indorsement

D) partial indorsement

E) conditional indorsement

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

26

_____, means that the indorser has no contract liability to subsequent holders if a maker or drawee defaults.

A) "Without recourse"

B) "For deposit only"

C) "For collection"

D) "Received payment"

E) "Indorsement in full"

A) "Without recourse"

B) "For deposit only"

C) "For collection"

D) "Received payment"

E) "Indorsement in full"

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

27

Under Article 3, the loss when a depository bank pays on an instrument to a fictitious payee falls exclusively on the account holder.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

28

What is a blank indorsement?

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

29

Uniform Commercial Code 3-201(a) defines _____ as a transfer of possession, whether voluntary or involuntary, of an instrument to a person who thereby becomes its holder if possession is obtained from a person other than the issuer of the instrument.

A) bailment

B) vertical privity

C) statute of repose

D) negotiation

E) implied warranty

A) bailment

B) vertical privity

C) statute of repose

D) negotiation

E) implied warranty

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following stands true for a special indorsement?

A) The payee of a check can indorse a special indorsement over to a third party by writing: "Pay to the order of" the third party and then signing her name.

B) It is known as an agency indorsement.

C) A special indorsement attempts to limit payment to a particular person or otherwise prohibit further transfer or negotiation.

D) Special indorsements such as "for deposit" or "for collection" are effective.

E) A special indorsement is known to create conditional contract liability in the indorser.

A) The payee of a check can indorse a special indorsement over to a third party by writing: "Pay to the order of" the third party and then signing her name.

B) It is known as an agency indorsement.

C) A special indorsement attempts to limit payment to a particular person or otherwise prohibit further transfer or negotiation.

D) Special indorsements such as "for deposit" or "for collection" are effective.

E) A special indorsement is known to create conditional contract liability in the indorser.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

31

A blank indorsement _____.

A) limits the indorser's contract liability

B) creates conditional contract liability in the indorser

C) names the transferee-holder

D) specifies the use to which instrument may be put

E) indorses to a person who is to hold or use the funds for the benefit of the indorser or a third party

A) limits the indorser's contract liability

B) creates conditional contract liability in the indorser

C) names the transferee-holder

D) specifies the use to which instrument may be put

E) indorses to a person who is to hold or use the funds for the benefit of the indorser or a third party

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

32

Collection indorsements and trust indorsements are types of a _____ indorsement.

A) special

B) restrictive

C) partial

D) conditional

E) qualified

A) special

B) restrictive

C) partial

D) conditional

E) qualified

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

33

The Victory Clothing Co., Inc. v. Wachovia Bank, N.A. case is about _____.

A) trust indorsements

B) partial indorsements

C) forged indorsements

D) qualified indorsements

E) restrictive indorsements

A) trust indorsements

B) partial indorsements

C) forged indorsements

D) qualified indorsements

E) restrictive indorsements

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

34

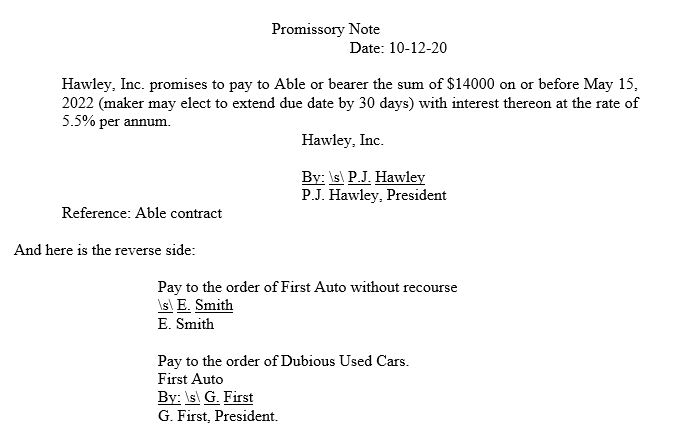

Dubious Used Cars received the promissory note shown below from First Auto, Inc., as security for payment of $14000 automo¬bile. When DUC accepted the note, it was aware that the maker of the note, Hawley, Inc., was claiming that the note was unenforceable because Able Co. (the original payee) had breach¬ed the contract for which Hawley had given the note. First Auto had acquired the note from Smith in exchange for repairing several cars owned by Smith. At the time First Auto received the note, First Auto was unaware of the dispute between Hawley and Able. Also, Smith, who paid Able $3500 for the note, was unaware of Hawley's allegations that Able had breached the agreement.

First Auto is now insolvent and unable to satisfy its obligation to Dubious. Therefore, Dubious has demanded that Hawley pay the $14000, but Hawley has refused, asserting:

First Auto is now insolvent and unable to satisfy its obligation to Dubious. Therefore, Dubious has demanded that Hawley pay the $14000, but Hawley has refused, asserting:

1. The note is nonnegotiable because it references the contract and is not payable at a definite time or on demand.

2. Dubious is not a holder in due course because it received the note as security for amounts owed by First Auto.

3. Dubious is not an hdc because it was aware of the dispute between Hawley and Able.

4. Hawley can raise the alleged breach by Able as a defense to payment.

5. Dubious has no right to the note because it was not endorsed by Able.

State whether the assertion is correct and give reasons for your conclusion (3 points each).

First Auto is now insolvent and unable to satisfy its obligation to Dubious. Therefore, Dubious has demanded that Hawley pay the $14000, but Hawley has refused, asserting:

First Auto is now insolvent and unable to satisfy its obligation to Dubious. Therefore, Dubious has demanded that Hawley pay the $14000, but Hawley has refused, asserting:1. The note is nonnegotiable because it references the contract and is not payable at a definite time or on demand.

2. Dubious is not a holder in due course because it received the note as security for amounts owed by First Auto.

3. Dubious is not an hdc because it was aware of the dispute between Hawley and Able.

4. Hawley can raise the alleged breach by Able as a defense to payment.

5. Dubious has no right to the note because it was not endorsed by Able.

State whether the assertion is correct and give reasons for your conclusion (3 points each).

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

35

A negotiation such as "Pay Tom Jacob if he finishes painting my house by July 15," is an example of a _____ indorsement.

A) trust

B) partial

C) restrictive

D) qualified

E) conditional

A) trust

B) partial

C) restrictive

D) qualified

E) conditional

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

36

An indorser can limit his liability by making a _____ indorsement.

A) special

B) qualified

C) conditional

D) partial

E) restrictive

A) special

B) qualified

C) conditional

D) partial

E) restrictive

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

37

A payee who has no existence or is intended to have no interest in the instrument is a(n) _____.

A) imposter

B) holder

C) carrier

D) fictitious payee

E) obligee

A) imposter

B) holder

C) carrier

D) fictitious payee

E) obligee

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

38

Who are primary and secondary parties?

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck